Europe Mobile Gaming Market Size, Share, Trends and Forecast by Type, Device Type, Platform, Business Model, and Country, 2025-2033

Europe Mobile Gaming Market Size and Share:

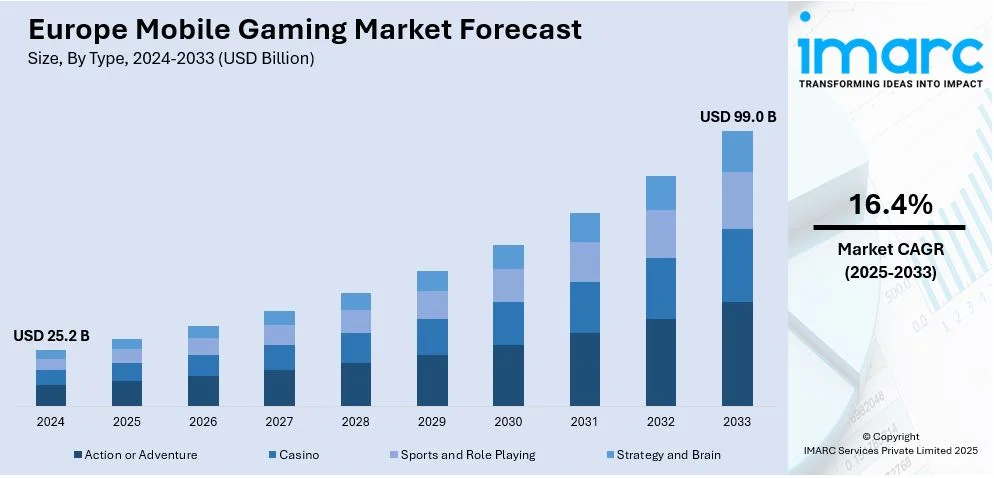

The Europe mobile gaming market size was valued at USD 25.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 99.0 Billion by 2033, exhibiting a CAGR of 16.4% from 2025-2033. The market is witnessing substantial expansion, fueled by the growing adoption of smartphones, a broad array of competitors, and an increase in disposable income levels. Strong demand for casual and multiplayer games, along with significant advancements in mobile technology, is fueling the Europe mobile gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.2 Billion |

|

Market Forecast in 2033

|

USD 99.0 Billion |

| Market Growth Rate 2025-2033 | 16.4% |

The rise of the European mobile gaming market is mainly due to the increasing penetration of smartphones and the widespread availability of high-speed network connections. As more consumers adopt mobile devices with advanced capabilities, the demand for mobile gaming continues to rise. The expansion of 4G and 5G networks improves the gaming experience by delivering quicker and more dependable connectivity, encouraging deeper player interaction. For instance, in August 2024, Deutsche Telekom, in partnership with ALSO and Ludium Lab, announced 5G+ Gaming at Gamescom, offering smooth cloud gaming via network slicing. Additionally, the popularity of casual and free-to-play games has broadened the audience, attracting players from various demographics.

Another significant driver is the rapid development of innovative mobile game content and the integration of advanced technologies. The increasing use of augmented reality (AR), virtual reality (VR), and cloud gaming platforms offers unique and immersive experiences, drawing more players into the mobile gaming ecosystem. Strategic partnerships and collaborations among game developers and tech companies are accelerating innovation, ensuring a continuous flow of fresh content that appeals to a wide range of consumers across Europe. For instance, in August 2024, Fortnite returned to iPhones in the EU and Android devices worldwide after being unavailable for four years. Epic Games, in partnership with Tencent, leveraged the EU’s Digital Markets Act to relaunch the game, ensuring compliance and enabling broader access for mobile users.

Europe Mobile Gaming Market Trends:

Shift Toward Cloud Gaming

Cloud gaming is swiftly becoming a prominent trend in the European mobile gaming industry, offering gamers the ability to enjoy premium-quality titles without relying on high-performance hardware. These services allow users to stream games directly onto their smartphones and other devices, significantly improving accessibility and convenience. For instance, in January 2024, Ludium Lab, ACCESS Europe, and XPENG unveiled the first cloud gaming platform for in-car entertainment in Europe. The service, integrated with XPENG vehicles, delivers high-quality games in Full HD, offering a seamless gaming experience for passengers. Moreover, this trend is driven by improvements in 5G network infrastructure, which provide the necessary speed and stability for smooth cloud gaming experiences. As a result, mobile gamers can enjoy console-quality titles on their devices, expanding the reach of mobile gaming beyond traditional genres.

Incorporation of Virtual Reality (VR) and Augmented Reality (AR)

Augmented reality (AR) and virtual reality (VR) technologies are revolutionizing the Europe mobile gaming market by providing immersive gaming experiences. AR-based mobile games integrate real-world elements with virtual gameplay, creating interactive and engaging experiences for players. While VR is more common in dedicated headsets, its applications are expanding into mobile gaming through apps that enable users to engage in virtual environments using their smartphones. As mobile devices continue to advance in processing power and sensor capabilities, the integration of AR and VR technologies is expected to grow, further enhancing mobile gaming and providing users with innovative, immersive experiences. For instance, in March 2023, Flying Sheep Studios, based in Cologne, secured USD1.2 million from the German government to develop its VR metaverse game, Star Life, focusing on user cooperation, social interaction, and blockchain integration.

Focus on Social and Multiplayer Gaming

Social and multiplayer gaming has become a prominent trend in the European mobile gaming market as players seek more interactive and collaborative experiences. Many mobile games now feature real-time multiplayer modes, cross-platform play, and social integration, allowing users to connect with others globally. For instance, in August 2024, Saber Interactive and 3D Realms Entertainment introduced Tempest Rising’s PvP multiplayer mode at Gamescom in Cologne, Germany. The teaser showcased dynamic game modes, customizable match settings, and two factions: Global Defense Forces and Tempest Dynasty. These elements elevate the gaming experience by promoting rivalry, teamwork, and community engagement. Furthermore, this trend is expected to continue as the demand for more immersive and social gaming experiences grows.

Europe Mobile Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe mobile gaming market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, device type, platform, and business model.

Analysis by Type:

- Action or Adventure

- Casino

- Sports and Role Playing

- Strategy and Brain

One of the most popular mobile gaming categories in Europe is action and adventure. The fast development and explosive action are integral parts of this area, where gameplay is so immersive. These games are generally designed for a sizable demographic and are thus appealing to the casual and the hardcore player. By the emergence of more modern technologies on mobile devices, developers have generated more sophisticated graphical experiences they've been making, appealing to an ever-growing user base. Furthermore, storytelling, intricate missions, and open-world designs are considered the success and dominance among casual players in Europe.

The casino part of the mobile gambling market in Europe is expanding due to the flourishing online gambling consumer and mobile play. These games connect the players to the functionalities and facilities of the conventional casino games-poker, blackjack, roulette-anytime, anyplace. This industry is facilitated through each jurisdiction's legal requirements to regulate the market level of entry for online gaming, with some countries being more lenient on the online gaming procedure. The integration of live dealer options, enhanced graphics, and secure payment systems has helped this segment attract both seasoned players and newcomers, leading to substantial revenue growth in recent years.

The sports and role-playing game (RPG) segment in Europe blends competitive sports simulations with immersive storytelling and character development. Sports games, ranging from football to basketball, attract a dedicated fan base that seeks realistic gameplay and team management features. RPGs, on the other hand, focus on quest-driven narratives where players assume roles in fictional worlds. Both segments are enhanced by multiplayer functionality, offering social interaction and competitive play. With increasing mobile device capabilities and high-speed internet, these genres continue to grow in popularity, appealing to a diverse audience across Europe.

The strategy and brain game segment of the mobile gaming market in Europe is attractive to those players who are in search of mind challenging games. This category encompasses puzzles, chess, card games, and real time strategy games where strategic decision making and solving features are dominant. Most of these games end up interesting the older players who enjoy a slow pace and thinking on the game strategy plan. The rise in multiplayer and competitive formats has further increased this segment where the players are making an attempt to challenge others worldwide. The simplicity and accessibility of these games on mobile devices have led to sustained engagement, making strategy and brain games a significant part of the European mobile gaming landscape.

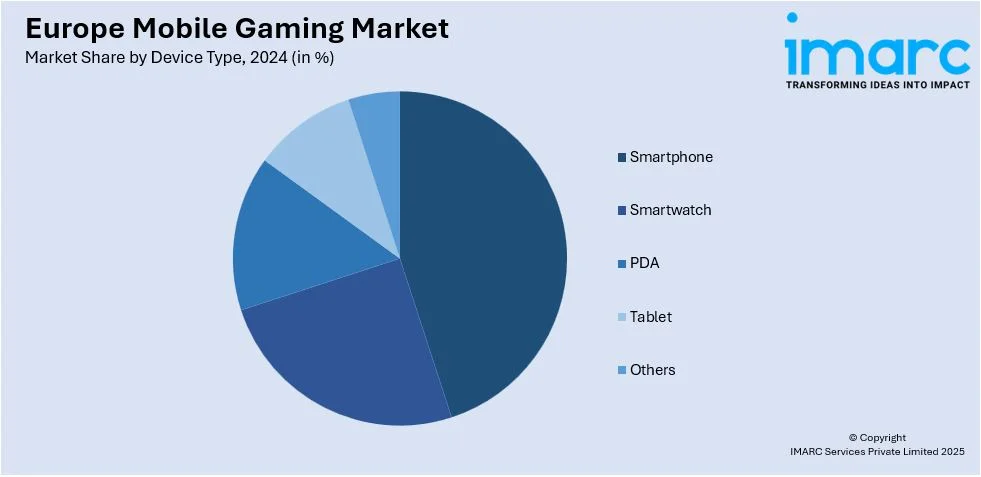

Analysis by Device Type:

- Smartphone

- Smartwatch

- PDA

- Tablet

- Others

Smartphones occupy a central position in the European mobile gaming market, accounting for the majority parts of gaming activities. They are powerful with high-resolution screens, useful touch control support, and multi-functional, providing a possibility for both casual and core gaming experiences. Additionally, smartphones have become immensely popular and widespread due to their high portability combined with network accessibility which can allow users much easier playing for any number of games they like. Swift technological innovation in smartphone gadgets, such as the integration of 5G, offers more engaging experience in gaming, thereby expanding the Europe mobile gaming market demand.

The smartwatch segment in the European mobile gaming market is niche but growing, with a focus on quick, casual gaming experiences. While not designed for complex games, smartwatches enable users to enjoy simple games such as puzzles, fitness challenges, and trivia. The small form factor of these gadgets, combined with their seamless compatibility with other smart technologies like smartphones, makes them perfect for quick gaming sessions and portable entertainment. As smartwatch technology advances, the potential for more interactive gaming experiences, including augmented reality (AR) games, may increase their appeal to a broader audience.

Although largely replaced by smartphones, PDAs still represent a small but distinct segment in the European mobile gaming market, particularly in professional and niche gaming circles. PDAs offered early mobile gaming experiences, with a focus on strategy and puzzle games that could be played offline. While their market presence has dwindled, a small group of users continues to engage with legacy PDA devices, especially in specialized areas such as educational games or corporate training tools. As mobile technology continues to evolve, PDAs remain largely obsolete in the gaming space.

Tablets play an important role in the European scene for mobile gaming, as they tend to have a larger screen and usually give an extended experience compared to smartphones. Their versatility and high functionality make them suitable and attractive to those who game a lot and are looking for good experiences without needing to carry a significantly heavy gaming console. Tablets are considered well-suited for family-type games, multiplayer experiences, and media-intense games with more viewing pleasure. With advances in generations of tablet as well as advances in their graphics and processing power, tablets are proliferating as gadgets most preferred among casual and mid-core gamers in Europe.

Analysis by Platform:

- Android

- iOS

- Others

Android commands a substantial portion of the European mobile gaming market, fueled by its extensive usage across a wide variety of devices and affordability levels. The platform’s open-source nature allows developers greater flexibility in creating games for various hardware specifications, contributing to a wide variety of gaming experiences. With access to the Google Play Store, Android users enjoy a broad selection of both free-to-play and premium titles. Additionally, the integration of Google services, such as Google Play Games, enhances the overall gaming experience through features like achievements, leaderboards, and cloud saving.

iOS remains a major player in the European mobile gaming market, renowned for its smooth performance, high-quality graphics, and secure ecosystem. The platform is particularly favored by developers for its consistent hardware and software integration, ensuring optimized gaming experiences across all Apple devices. The Apple App Store offers a curated selection of games, with a strong emphasis on premium titles, in-app purchases, and subscription models. iOS users benefit from exclusive games and early access releases, while Apple’s strong security and payment systems create a trusted environment for mobile gaming.

Analysis by Business Model:

- Freemium

- Paid

- Free

- Paymium

The freemium model is widely adopted in the European mobile gaming market, offering games for free while generating revenue through in-app purchases. Users can enjoy the main game for free but have the option to buy virtual goods, enhancements, or extra content if they wish. This model encourages a large player base, with the potential for significant revenue through microtransactions. It appeals to casual gamers who are hesitant to make an upfront investment, while also providing developers with the opportunity to monetize user engagement over time through optional paid content and features.

The paid model in the European mobile gaming market requires users to purchase the game upfront before playing. This model is commonly associated with high-quality, premium games that offer a complete, ad-free experience. Players make a one-time payment to download the game, which typically provides full access to content without additional costs. While the paid model may result in fewer downloads compared to freemium games, it attracts dedicated players willing to invest in a more polished and immersive gaming experience. It continues to appeal to dedicated gamers who prioritize a simple, commitment-free gaming experience.

The free model is prevalent in the European mobile gaming market, where users can download and play games without any upfront cost. While these games may generate revenue through ads or in-app purchases, they provide an entry point for a wide audience, encouraging higher download rates. The free model is especially effective for casual games, targeting players who are reluctant to spend money initially. Developers often monetize these games through ad-based revenue or offer optional paid features, creating a flexible approach to engage a broad user base while generating ongoing revenue.

The paymium model blends both paid and freemium approaches, offering a game that is initially purchased for a fixed price, but also includes in-app purchases for additional content or features. This hybrid business model is gaining popularity in the European mobile gaming market, as it allows developers to earn revenue upfront while still providing ongoing monetization opportunities through microtransactions. Players who enjoy the base game can enhance their experience by purchasing extra content or premium features. The paymium model appeals to gamers who appreciate a premium experience with the option for further customization or expansion.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is one of the largest markets for mobile gaming in Europe, driven by its strong economy and high smartphone penetration. The German mobile gaming market is characterized by a diverse player base, with strong interest in both casual and core gaming experiences. Germans tend to favor high-quality, immersive games with a focus on strategy, puzzle-solving, and role-playing. The country also has a well-established gaming industry, with many developers and publishers contributing to both the domestic and international mobile gaming markets. Germany's stable infrastructure and tech-savvy population further support the growth of mobile gaming.

France holds a prominent position in the European mobile gaming market, with a growing number of players across all age groups. French gamers are highly engaged with both casual games and more complex titles, such as role-playing games (RPGs) and strategy games. Mobile gaming in France benefits from strong broadband and 4G/5G penetration, enhancing the overall gaming experience. The French market is also notable for its adoption of in-app purchases and freemium models, allowing developers to monetize games effectively. France's rich cultural heritage and preference for creative, narrative-driven content influence the types of games that thrive.

The United Kingdom is a key player in the European mobile gaming market, driven by high smartphone penetration and a diverse gaming audience. British players are known for their affinity for multiplayer, sports, and action-adventure games, with a growing interest in competitive eSports. The UK's mobile gaming market benefits from a strong digital economy and widespread access to high-speed internet, supporting the development of mobile games with advanced graphics and features. The adoption of the freemium business model is also prevalent, with many players engaging in in-app purchases to enhance their gaming experience.

Italy is a significant and growing market for mobile gaming in Europe, with a large percentage of the population engaging in casual and social gaming. Italian players prefer games that offer simple, accessible experiences, such as puzzle games, casual simulations, and social games. The mobile gaming market is primarily marked by its high coverage of people using smartphones as well as most of the consumer preferring games without the possibility to make in-game purchases. As internet connectivity improves and 5G technology expands, Italy’s mobile gaming market is expected to grow further, providing opportunities for both local and international game developers to cater to this dynamic audience.

Spain is an important market for mobile gaming in Europe, with a rapidly expanding player base and increasing revenue generation. The Spanish gaming community is highly diverse, with strong engagement in both casual and mid-core games, including puzzle, strategy, and role-playing genres. Spanish players are also keen on multiplayer and social games that allow for interaction and competition. Mobile gaming in Spain is supported by widespread smartphone usage, improving mobile internet infrastructure, and high demand for free-to-play titles with in-app purchases. As the market continues to grow, Spain offers significant opportunities for game developers to reach a broad, engaged audience.

Competitive Landscape:

The Europe mobile gaming market is marked by a diverse range of developers, publishers, and platforms. Leading players include major game development companies offering both casual and hardcore games, while a significant number of indie developers are gaining traction with unique, innovative titles. The market is highly fragmented, with competition driven by the introduction of new game genres, enhanced gaming experiences through AR and VR, and advancements in mobile technology. For instance, in December 2023, Sandbox VR partnered with Next Level Erlebnisse to expand its presence in Europe, opening ten new virtual reality locations across Germany by 2026. This follows the success of Sandbox VR’s recent experience, Squid Game Virtuals, which quickly surpassed USD 1 million in ticket sales. Furthermore, the increasing popularity of esports and cloud gaming platforms intensifies competition. As in-app purchases and subscription models grow, developers are focusing on user engagement, content innovation, and optimizing gaming experiences to attract and retain players.

The report provides a comprehensive analysis of the competitive landscape in the Europe mobile gaming market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Epic Games partnered with Telefónica to preinstall the Epic Games Store on compatible Android devices across Spain, the U.K., Germany, and Latin America, expanding its reach and offering more app marketplace options.

- In December 2024, SYNOT Games partnered with Luckia to expand in Spain, integrating its premium slot portfolio, including top titles, into Luckia’s platform to deliver engaging gaming experiences to Spanish players.

Europe Mobile Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Action or Adventure, Casino, Sports and Role Playing, Strategy and Brain |

| Device Types Covered | Smartphone, Smartwatch, PDA, Tablet, Others |

| Platforms Covered | Android, iOS, Others |

| Business Models Covered | Freemium, Paid, Free, Paymium |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe mobile gaming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe mobile gaming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe mobile gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe mobile gaming market was valued at USD 25.2 Billion in 2024.

The market is driven by factors such as the increasing smartphone penetration, advancements in mobile network technology like 5G, and the growing demand for interactive and immersive gaming experiences. Additionally, the rise of cloud gaming, in-app purchases, and the popularity of esports and social gaming further fuel market expansion.

IMARC estimates the Europe mobile gaming market to reach USD 99.0 Billion by 2033, exhibiting a CAGR of 16.4% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)