Europe Mild Hybrid Vehicles Market Size, Share, Trends and Forecast by Battery Type, Vehicle Type, and Country, 2026-2034

Europe Mild Hybrid Vehicles Market Size and Share:

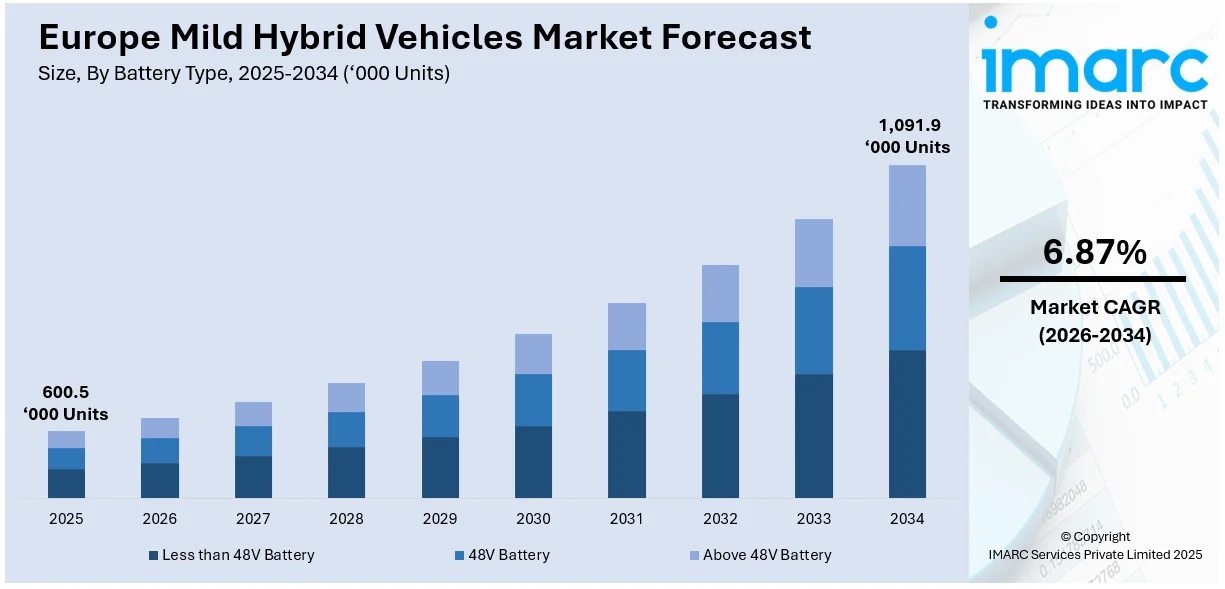

The Europe mild hybrid vehicles market size is estimated at 600.5 Thousand Units in 2025, and is expected to reach 1,091.9 Thousand Units by 2034, at a CAGR of 6.87% during the forecast period 2026-2034. The market is expanding rapidly, mainly impacted by key automakers actively opting for 48V hybrid systems to enhance fuel efficacy and lower emissions. Requirement is bolstered by stringent policies, customer shift toward affordable electrification, and magnifying deployment across SUVs, hatchbacks, and sedans.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 600.5 Thousand Units |

| Market Forecast in 2034 | 1,091.9 Thousand Units |

| Market Growth Rate (2026-2034) | 6.87% |

The Europe mild hybrid vehicles market growth drivers mainly include stringent emission policies implemented by the European Union, incentivizing automakers to adopt low-emission technologies. Mild hybrid systems, featuring 48V battery architecture, enhance fuel efficiency and reduce CO₂ emissions, making them a preferred choice for regulatory compliance. Government subsidies, tax incentives, and low-emission zones in major European cities further encourage adoption. Additionally, rising fuel prices and consumer preference for cost-effective electrification solutions are accelerating demand. For instance, as per industry reports, during November 2024, natural gas prices in Europe significantly boosted by 16%, reaching USD 49.22/MWh. Moreover, automakers are integrating mild hybrid technology into existing internal combustion engine platforms to achieve sustainability goals while maintaining vehicle performance.

To get more information on this market Request Sample

Technological advancements in battery management systems, regenerative braking, and powertrain electrification are further driving market growth. Major automakers, including Volkswagen, BMW, and Mercedes-Benz, are expanding their mild hybrid vehicle portfolios, offering a balance between efficiency and affordability. Moreover, the increasing shift toward electrified powertrains without requiring significant charging infrastructure makes mild hybrids an attractive alternative to full battery-electric vehicles. For instance, as per industry reports, in 2024, powertrain trends are actively boosting in crucial European markets, with French market accounting for 16.7% new car sales in hybrid EV segment during February. Furthermore, growing investments in research and development and supply chain development for hybrid components are strengthening mild hybrid vehicles market outlook in Europe.

Europe Mild Hybrid Vehicles Market Trends:

Increasing Integration of 48V Mild Hybrid Systems

The utilization of 48V mild hybrid systems is significantly escalating across Europe as automakers are actively navigating for cost-efficient solutions to address the stringent emission frameworks. Such systems notably lower carbon emissions and improve fuel efficiency without demanding any substantial transformations to vehicle platforms. In addition, prominent manufacturers such as Volvo, BMW, and Mercedes-Benz are currently incorporating 48V technology into their existing internal combustion engine models, offering buyers with reduced running expenditures and enhanced fuel economy. For instance, as per industry reports, in June 2024, BMW introduced its new X3, a plug-in hybrid powertrain, integrated with 48V mild-hybrid system. Furthermore, this trend is driven by regulatory compliance, rising fuel prices, and consumer demand for environmentally friendly vehicles, making mild hybrids a key transition technology before full electrification.

Rising Consumer Preference for Hybrid Powertrains

European consumers are increasingly favoring mild hybrid vehicles due to their affordability, lower fuel consumption, and reduced environmental impact compared to conventional gasoline and diesel models. With growing awareness of sustainability and financial incentives offered by governments, demand for hybrid powertrains is rising. For instance, according to the European Parliament, the region is actively targeting to attain an emission reduction of 90% of greenhouse gases from transportation by 2050. Automakers are responding to this sustainable shift by expanding their mild hybrid vehicle portfolios, offering hybrid versions of popular models. The combination of enhanced driving performance, fuel efficiency, and extended range compared to plug-in hybrids and battery-electric vehicles is making mild hybrid technology a preferred option for many European buyers.

Automakers Expanding Mild Hybrid Offerings Across Segments

Major automakers are rapidly expanding mild hybrid technology across various vehicle segments, including compact cars, SUVs, and luxury sedans. For instance, in October 2024, Volkswagen launched its new SUV range Tayron for Europe market. This new range encompasses two next-gen plug-in hybrid EVs, offering a mild hybrid drive with 110kW capacity. Moreover, this diversification is driven by the need to comply with EU fleet-wide CO₂ targets while maintaining competitive pricing. In addition to this, premium brands are introducing mild hybrid systems in high-performance models to improve efficiency without compromising power. Simultaneously, mainstream brands are incorporating the technology into affordable vehicles to appeal to a broader consumer base. This trend is expected to continue as manufacturers seek scalable electrification strategies with minimal impact on vehicle cost and infrastructure.

Europe Mild Hybrid Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe mild hybrid vehicles market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on battery type and vehicle type.

Analysis by Battery Type:

- Less than 48V Battery

- 48V Battery

- Above 48V Battery

The less than 48V battery segment holds a niche share in the Europe mild hybrid vehicles market, primarily catering to entry-level hybrid systems with minimal electrification. These batteries are integrated into basic start-stop systems and mild hybrid architectures that provide limited fuel savings and emission reductions. While cost-effective, their lower voltage restricts regenerative braking efficiency and electric-assisted power delivery. Automakers focusing on budget-friendly hybrid solutions in compact and city cars continue to utilize these lower-voltage systems.

Europe mild hybrid vehicles market analysis indicates that the 48V battery segment is highly prominent type, driven by its ability to significantly enhance fuel efficiency and reduce CO₂ emissions without requiring extensive infrastructure modifications. Automakers such as Mercedes-Benz, Volkswagen, and BMW are increasingly adopting 48V technology across multiple vehicle segments, including compact, SUV, and luxury models. This battery type supports key hybrid functions such as regenerative braking, electric torque assist, and smoother start-stop operations. Additionally, the affordability of 48V systems compared to plug-in and full hybrid solutions makes them an attractive option for both manufacturers and consumers. As emission regulations tighten, the 48V segment is expected to maintain its leadership position, expanding across a broader range of vehicles.

The above 48V battery segment is emerging as a growing category in the Europe mild hybrid vehicles market, primarily driven by premium and high-performance vehicle applications. These batteries provide greater electrical power, enabling enhanced regenerative braking, extended electric drive capabilities, and improved fuel economy. Automakers such as Porsche, Audi, and Jaguar Land Rover are incorporating higher-voltage mild hybrid systems in performance-oriented models to optimize power output while meeting stricter emission standards. Despite their benefits, higher costs and more complex integration limit their adoption to premium vehicles. However, as battery technology advances and economies of scale improve, the above 48V segment is expected to gain traction, particularly in high-efficiency hybrid powertrains.

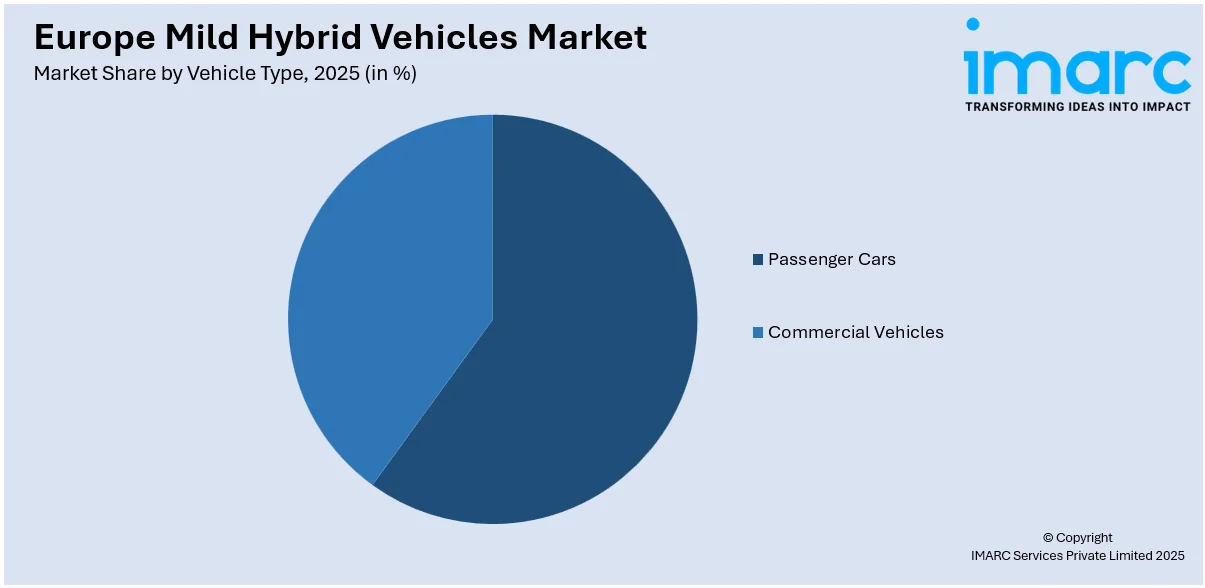

Analysis by Vehicle Type:

Access the comprehensive market breakdown Request Sample

- Passenger Cars

- Commercial Vehicles

Europe mild hybrid vehicles market research report indicates that the market for passenger cars is emerging as a prominent vehicle type due to escalating consumer need for fuel-efficiency, coupled with intense preference for environmentally friendly vehicles. Major car manufacturers like BMW, Mercedes-Benz and Volkswagen are increasing their mild hybrid offerings in various automobile categories to meet EU carbon emission standards. In addition to this, the affordability of 48v mild hybrid systems, their enhanced fuel efficiency as well as driving performance creates a desirable option against traditional electric vehicles, while additional government incentives strengthen adoption. Furthermore, mild hybrid technology integration by car manufacturers will sustain the passenger car segment's position as the market's primary sector.

Commercial vehicles are witnessing growing adoption of mild hybrid technology, primarily in light commercial vehicles (LCVs) and vans, as fleet operators seek to reduce fuel costs and emissions. European regulations mandating lower fleet-wide co₂ emissions are pushing manufacturers to introduce 48v hybrid systems in delivery vans and urban transport vehicles. companies such as ford and Renault are integrating mild hybrid solutions to improve fuel efficiency without compromising payload capacity. additionally, the increasing demand for sustainable last-mile delivery solutions is driving adoption among logistics providers. although mild hybrid penetration in heavy-duty vehicles remains limited, advancements in battery and powertrain technology could further expand hybrid adoption across commercial transport applications.

Country Analysis:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany holds the significant Europe mild hybrid vehicles market share, driven by the strong presence of leading automakers such as Volkswagen, BMW, and Mercedes-Benz. The country’s stringent CO₂ emission regulations and commitment to automotive electrification are accelerating mild hybrid adoption across multiple vehicle segments. Government incentives and tax benefits further encourage consumers to transition toward hybrid solutions. Additionally, advancements in 48V battery systems and integration of mild hybrid technology in premium and performance vehicles contribute to market growth. As Germany continues investing in sustainable mobility, the demand for mild hybrid vehicles is expected to remain strong.

The United Kingdom is a key market for mild hybrid vehicles, supported by government policies aimed at reducing emissions and promoting hybrid powertrains. Automakers such as Jaguar Land Rover, Ford, and Audi are expanding their mild hybrid offerings to meet growing consumer demand for fuel-efficient alternatives to traditional combustion engines. The implementation of low-emission zones in cities like London is further driving hybrid adoption. Additionally, rising fuel costs and consumer preference for cost-effective electrification solutions continue to push demand for mild hybrid vehicles across various vehicle segments.

France is experiencing significant growth in the mild hybrid vehicles market due to strict emission reduction targets and incentives promoting hybrid adoption. Leading automakers such as Renault, Peugeot, and Citroën are integrating 48V hybrid systems into their vehicle lineups to comply with regulatory requirements. Increasing environmental awareness among consumers, coupled with government-backed subsidies and tax reductions, is further accelerating demand. The expansion of urban low-emission zones and the transition away from diesel-powered vehicles are also key factors contributing to the growth of the mild hybrid segment in the French automotive market.

Italy is emerging as a strong market for mild hybrid vehicles, supported by rising consumer demand for fuel-efficient and eco-friendly mobility solutions. Domestic automakers such as Fiat and Alfa Romeo are actively incorporating mild hybrid technology into their models to align with evolving emission regulations. Government incentives, including tax reductions and purchase subsidies, are encouraging hybrid adoption across both urban and suburban markets. Additionally, Italy’s push toward sustainable transportation solutions, particularly in congested cities, is further accelerating the shift toward mild hybrid powertrains as a practical alternative to conventional internal combustion engines.

Russia’s mild hybrid vehicles market is steadily expanding as automakers introduce fuel-efficient solutions to meet evolving consumer demand. While full electrification remains limited due to infrastructure constraints, mild hybrids offer an accessible alternative with lower fuel consumption and emissions. Global brands such as Toyota, Volkswagen, and Hyundai are leading mild hybrid adoption in the country. Rising fuel prices and economic incentives supporting hybrid vehicle ownership are driving market growth. Additionally, growing environmental awareness and the increasing availability of hybrid models in both passenger and commercial segments are further strengthening Russia’s mild hybrid market.

Spain is witnessing increasing adoption of mild hybrid vehicles, supported by government policies aimed at reducing transport emissions and encouraging electrified mobility. Automakers such as SEAT, Renault, and Ford are expanding their hybrid vehicle portfolios to cater to rising consumer demand. Urban low-emission zones and incentives for hybrid vehicle purchases are accelerating adoption rates, particularly in metropolitan areas. Additionally, rising fuel costs and the push for sustainable urban mobility solutions are encouraging Spanish consumers to shift toward hybrid powertrains, strengthening the country’s position as a growing market for mild hybrid vehicles.

The Netherlands is a crucial adopter of hybrid and electrified mobility solutions, with mild hybrid vehicles gaining traction due to government incentives and tax benefits. The country’s well-developed charging infrastructure supports hybrid adoption, while automakers such as Volvo, BMW, and Audi continue to introduce mild hybrid models across multiple vehicle segments. Increasing corporate fleet electrification and stringent CO₂ reduction policies are further driving demand. Additionally, the Netherlands’ commitment to sustainable mobility and the transition to low-emission transport solutions are contributing to the growing market share of mild hybrid vehicles.

Switzerland’s mild hybrid vehicles market is growing steadily, driven by consumer demand for fuel-efficient and environmentally friendly mobility solutions. The country’s stringent emission regulations and high fuel prices are prompting automakers to expand their hybrid offerings. Premium brands such as Mercedes-Benz, Audi, and Porsche are integrating 48V hybrid technology into luxury and performance-oriented models. Government incentives and the increasing preference for hybrid powertrains over conventional combustion engines are further supporting market expansion. Additionally, Switzerland’s focus on sustainability and low-emission transport is expected to continue fueling hybrid vehicle adoption.

Poland is emerging as a key market for mild hybrid vehicles in Central Europe, driven by rising consumer interest in fuel-efficient and cost-effective mobility solutions. Automakers such as Toyota, Skoda, and Hyundai are expanding their mild hybrid vehicle offerings to cater to growing demand. Government-backed initiatives promoting hybrid adoption and tax benefits for eco-friendly vehicles are further supporting market growth. Additionally, Poland’s increasing urbanization and rising fuel prices are encouraging consumers to opt for hybrid alternatives. As the country strengthens its automotive electrification policies, the mild hybrid vehicle segment is expected to witness continued expansion.

Competitive Landscape:

The market is currently exhibiting intense competitive dynamic, with major automakers emphasizing on augmenting their hybrid product lines to cater to the stricter emission policies. Several leading firms are actively incorporating 48V battery systems across numerous vehicle segments to lower CO₂ emissions and improve fuel efficacy. Moreover, innovations in AI-based energy management, powertrain electrification, and regenerative braking are significantly boosting advancements. For instance, in July 2024, Stellantis announced expansion of its hybrid powertrains lineup across Europe, by unveiling 30 models in the same year and 6 others by the year 2026. Such hybrids offer a better driving experience with reduced emissions and greater cost-effectiveness in comparison to plug-in and EVs. Besides, magnifying customer need for cost-efficient hybrid solutions and government incentives further prompt market competition. In addition to this, partnerships with technology providers as well as battery suppliers are fortifying manufacturers' efficiency to scale manufacturing and advance vehicle performance.

The report provides a comprehensive analysis of the competitive landscape in the Europe mild hybrid vehicles market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Peugeot announced expansion of its 5008 and 3008 SUV lineup across Europe with new PHEV (52-mile EV-only), alongside existing mild-hybrid and standard EV models.

- In May 2024, Jeep, a Europe-based automobile company, launched Avenger 4xe, its smallest SUV with an all-wheel-drive hybrid powertrain. It features a 48V hybrid system developed to provide substantial torque to bolster vehicle's performance off-road.

- In April 2024, Mazda announced the launch of its new CX-80 SUV, incorporated with mild-hybrid 16 turbo diesel. The company announced that the vehicle would be commercially available for European market during September-November.

- In February 2024, Dacia, a Romania-based car company, showcased its revamped version of Duster SUV. This new version is powered by Renault-Nissan CMF-B platform and offers both mild-hybrid and full-hybrid powertrains.

Europe Mild Hybrid Vehicles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Less than 48V Battery, 48V Battery, Above 48V Battery |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe mild hybrid vehicles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe mild hybrid vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe mild hybrid vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe mild hybrid vehicles market size reched 600.5 Thousand Units in 2025.

Stringent emission regulations, rising demand for fuel-efficient vehicles, and government incentives for hybrid technology are driving Europe's mild hybrid vehicle market. Advancements in 48V battery systems, growing consumer preference for eco-friendly mobility, and expanding electrification efforts by automakers further accelerate adoption. Increasing fuel costs also contribute to market growth.

IMARC estimates the Europe mild hybrid vehicles market to reach 1,091.9 Thousand Units by 2034, exhibiting a CAGR of 6.87% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)