Europe Medical Cannabis Market Size, Share, Trends and Forecast by Species, Derivative, Application, End Use, Route of Administration, and Country, 2025-2033

Europe Medical Cannabis Market Size and Share:

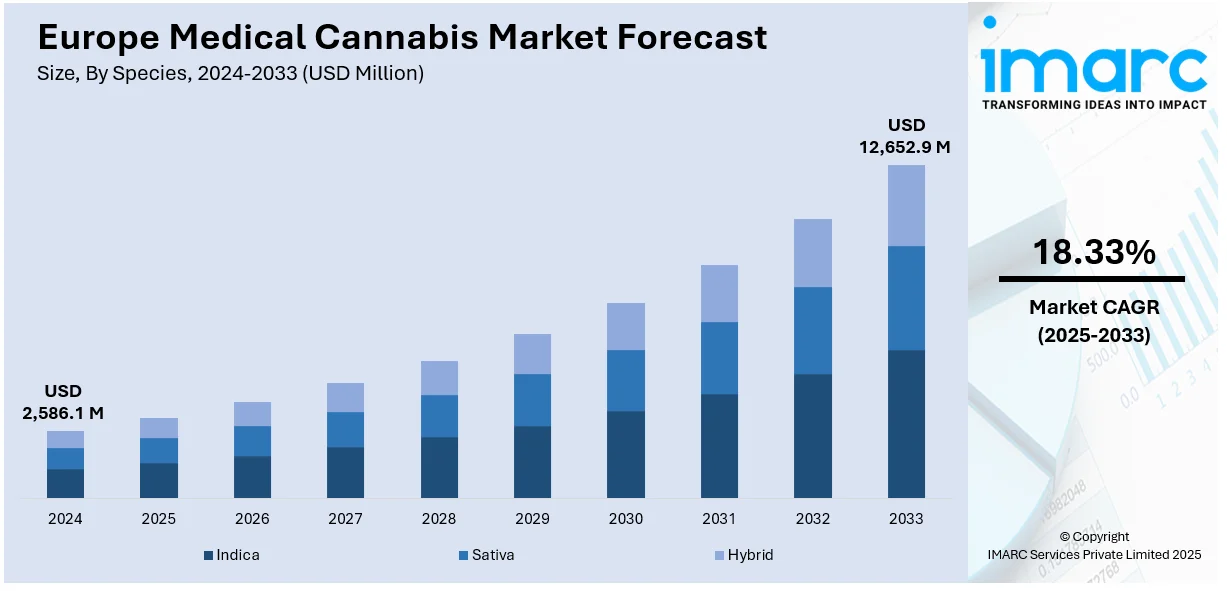

The Europe medical cannabis market size was valued at USD 2,586.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 12,652.9 Million by 2033, exhibiting a CAGR of 18.33% during 2025-2033. Germany currently dominates the market, holding a significant market share of 26.7% in 2024. The market is experiencing significant growth due to increasing legalization, expanding therapeutic applications of the product and the rising patient demand for cannabis. Technological advancements in cultivation and extraction technologies, strategic partnerships and growing investment in research and development (R&D) are also contributing positively to the Europe medical cannabis market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,586.1 Million |

|

Market Forecast in 2033

|

USD 12,652.9 Million |

| Market Growth Rate 2025-2033 | 18.33% |

The increasing legalization and evolving regulatory frameworks across European nations are making medical cannabis accessible to a larger patient population, which is driving the market growth. Countries like Germany, the UK, Italy, and Spain are progressively adapting their laws, fostering market expansion. For instance, in January 2025, Aurora Cannabis Inc., a publicly traded cannabis firm with headquarters in Canada, announced that its first line of medical cannabis products made in Germany available from January 27. Products under Aurora's IndiMed brand, which are made in Leuna, Germany, were the company's first to employ German-grown cannabis. Moreover, there's a growing acceptance of medical cannabis among patients and healthcare professionals as a therapeutic option for various conditions, such as epilepsy, chronic pain, multiple sclerosis, and anxiety disorders. This is further supported by increasing patient education initiatives that aim to address knowledge gaps and dispel misconceptions.

The Europe medical cannabis market growth is also driven by substantial investments in research and development, which are fueling innovation in cannabis-based therapies and product formulations. This focus on scientific validation enhances the credibility of medical cannabis and paves the way for new treatment options. For instance, in January 2025, the world-renowned cannabis ag-tech and genetics leader Segra International announced a strategic alliance with GreenBe Pharma, a leading European manufacturer of medicinal cannabis. Through a regional European hub, this partnership allows European growers to effectively access Segra's well-known tissue culture cannabis clones, greatly lowering the logistical and legal challenges frequently connected with imports from other countries. Additionally, a rising geriatric population across Europe, susceptible to chronic illnesses, contributes to the demand for medical cannabis as a potential treatment. The increasing prevalence of diseases that may benefit from cannabis treatment, such as chronic pain and neurological disorders, further propels market growth.

Europe Medical Cannabis Market Trends:

Increase in Legalization and Regulation

The medical cannabis market dynamics in Europe have shifted significantly due to its increased legalization across the region. More countries in the region are enacting laws to permit its use, leading to a regulatory evolution that ensures stringent quality control, safety standards, and patient accessibility. Nations like Germany, the UK, and Italy have implemented comprehensive frameworks that include licensing systems for cultivation, production, and distribution. These measures not only protect patients by guaranteeing the efficacy and safety of medical cannabis products but also encourage investment and innovation within the industry. As a result, the market is witnessing robust growth, greater patient acceptance, and enhanced therapeutic options across Europe. For instance, in April 2024, Germany legalized limited adult-use cannabis, allowing personal possession of up to 25 grams and home cultivation of up to three plants per household. The new law also simplifies access to medical cannabis and introduces "cultivation social clubs" for recreational use. Germany aims to explore commercial supply chains through regional pilot projects before the 2025 elections.

Technological Advancements

Technological advancements are revolutionizing the market by improving cultivation, extraction, and product formulations. Innovations like precision agriculture, hydroponics, and advanced greenhouse technologies enhance the quality and yield of cannabis plants. In extraction processes, supercritical CO2 and other cutting-edge methods increase the purity and potency of cannabinoids, ensuring consistent and effective products. According to the Europe medical cannabis market forecast, these technological advancements in cultivation and extraction are broadening the market scope by enhancing product quality and variety. For instance, in July 2024, Cannatrol announced its partnership with Paralab Green to introduce its patented Vaportrol® Technology to Europe. This collaboration brought Cannatrol's advanced dry, cure, and storage system to European cannabis producers, promising elevated product quality, increased yields, and GMP regulatory compliance. Paralab Green, a prominent distributor in the region, will facilitate the distribution.

Rising Demand for Cannabidiol (CBD) Products

The rising demand for cannabidiol (CBD) products is driven by their therapeutic benefits without the psychoactive effects of THC, resulting in broader acceptance and usage. CBD is recognized for its potential in managing anxiety, chronic pain, epilepsy, and inflammation, appealing to a diverse consumer base seeking natural remedies. Its legal status in many European countries further creating a positive impact on the Europe medical cannabis market outlook. As awareness of CBD's health benefits increases, consumers are increasingly incorporating CBD-infused products into their wellness routines. This trend is fostering innovation and expansion in the market, with a growing variety of CBD products available. For instance, in February 2024, Zerion Pharma A/S partnered with dsm-firmenich to enhance cannabinoid bioavailability for medical and nutritional use. Their collaboration aims to develop high-quality Cannabidiol formulations with improved solubility and bioavailability, expected to be effective for treating conditions such as severe pain, inflammation disorders, depression, and anxiety. Clinical studies on the improved CBD formulations are scheduled for 2024.

Europe Medical Cannabis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe medical cannabis market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on species, derivative, application, end use, and route of administration.

Analysis by Species:

- Indica

- Sativa

- Hybrid

According to Europe medical cannabis market research report, Indica holds the majority of the share mainly due to its therapeutic benefits and widespread use in treating various medical conditions. Known for its calming and sedative effects, Indica strains are highly effective in managing chronic pain, anxiety, insomnia, and muscle spasms, which are prevalent issues among patients in Europe. Additionally, Indica's shorter growth cycle and higher yields make it a preferred choice for cultivators, ensuring a steady supply. The increasing acceptance and legalization of medical cannabis across European countries further boost the dominance of Indica in the market.

Analysis by Derivative:

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

Tetrahydrocannabinol (THC) holds the largest share of the Europe medical cannabis market by derivative due to its potent therapeutic properties and effectiveness in treating various medical conditions. THC is known for its analgesic, anti-inflammatory, and muscle relaxant effects, making it a key component in managing chronic pain, nausea, appetite loss, and certain neurological disorders. In addition to this, advancements in medical cannabis research and product development are enhancing the availability and variety of THC formulations, catering to diverse patient needs.

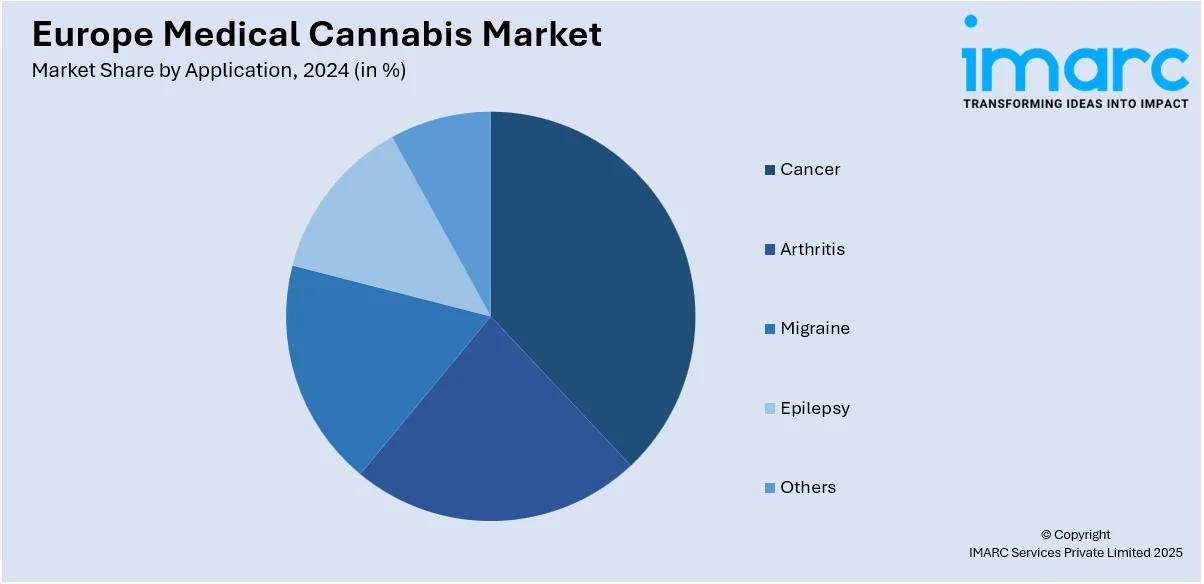

Analysis by Application:

- Cancer

- Arthritis

- Migraine

- Epilepsy

- Others

Cancer represents the leading segment in the medical cannabis market in Europe by application due to the substantial benefits cannabis offers to cancer patients. Medical cannabis, particularly strains high in Tetrahydrocannabinol (THC) and Cannabidiol (CBD), is widely used to alleviate symptoms associated with cancer and its treatments, such as chronic pain, nausea, and loss of appetite. The rising incidence of cancer across Europe and the increasing endorsement by medical professionals are driving the dominance of this application segment in the market.

Analysis by End Use:

- Pharmaceutical Industry

- Research and Development Centers

- Others

Pharmaceutical industry leads the market in Europe due to its established infrastructure, regulatory compliance, and extensive research and development capabilities. Leading pharmaceutical companies are actively involved in developing cannabis-based medications, ensuring high-quality and standardized products. Their ability to conduct rigorous clinical trials and secure regulatory approvals gives them a competitive edge. Additionally, partnerships and collaborations with biotech firms and research institutions further strengthen their market position. The industry's focus on innovation and patient-centric solutions drives the adoption of medical cannabis for various therapeutic applications, reinforcing its dominance in the market.

Analysis by Route of Administration:

- Oral Solutions and Capsules

- Smoking

- Vaporizers

- Topicals

- Others

Oral solutions and capsules represent the largest segment, holding 55.2% of the market share in the Europe due to their convenience, precise dosing, and ease of administration. These forms are preferred by both patients and healthcare providers for their reliability and consistent therapeutic effects. The oral solutions and capsules are particularly popular among patients with chronic conditions, such as pain and epilepsy, where controlled and sustained release of cannabinoids is crucial. Additionally, the familiarity of these formats to traditional pharmaceutical products boosts patient compliance and acceptance, driving their dominance in the market.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany dominates the market, accounting for 26.7% of the market share due to its progressive regulatory framework, robust healthcare system, and high patient acceptance. The country was one of the first in Europe to legalize medical cannabis, establishing a comprehensive medical cannabis program that ensures accessibility and affordability for patients. Germany's stringent quality standards and reimbursement policies have fostered a trusted market environment, attracting significant investments from domestic and international players. Additionally, the strong collaboration between healthcare providers and cannabis producers has facilitated widespread adoption, making Germany a dominant force in the market. For instance, in 2023, Germany imported a record 34.6 tons of cannabis for medical and scientific use, a 26.2% increase from the previous year's 27.4 tons. The increase is attributed to the end of the quota system, allowing companies to apply for permits to cultivate medical marijuana. Canada remained the top supplier, shipping approximately 15,600 kilograms to Germany in 2023, representing around 50% of Germany's total imports, up from less than 40% in 2022.

Competitive Landscape:

The Europe medical cannabis market is highly competitive, with key players various key players dominating the market landscape. Companies nowadays are leveraging extensive research and development (R&D) capabilities, strategic partnerships, and robust distribution networks to maintain market leadership. Emerging local players are gaining traction by focusing on niche segments and adhering to stringent European regulations. Continuous innovation, advanced cultivation techniques, and novel product formulations are driving competition. Collaborations with pharmaceutical companies and healthcare providers further enhance product credibility and market penetration, fueling overall market growth.

The report provides a comprehensive analysis of the competitive landscape in the Europe medical cannabis market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Curaleaf International, in partnership with Jupiter Research LLC, obtained regulatory authorization for a portable liquid inhaler intended for accurate delivery of medical cannabis. This EU medical device approval will unlock opportunities for a new age technological advancement in medical cannabis administration, providing patients with better solutions.

- April 2025: Aurora Cannabis launched its first inhalable resin cartridges for medical patients in the UK, introducing two proprietary 1.2g strains - Sourdough (indica) and Electric Honeydew (sativa). These cartridges offer fast-acting, high-potency, and discreet delivery, manufactured in TGA-GMP certified facilities without additives.

- March 2025: Tilray medicinal announced the launch of Tilray Craft, a new brand addition to Tilray Medical's medical cannabis line, in Germany. With this launch, the company seeks to provide distinctive flower selections that are currently inaccessible in the market, primarily focusing on individuals who need medicinal cannabis flowers with higher THC and terpene content developed from innovative genetic lineages.

- February 2025: Canopy Growth Corporation launched its Tweed brand in the medical cannabis sector in Germany. This includes four new Tweed strains that are grown in the EU courtesy of a partnership with the Portuguese medicinal cannabis grower Gro-Vida S.A. (Gro-Vida).

- January 2025: Aurora Cannabis Inc. reported the release of its first medical cannabis product grown in Germany, under the company’s IndiMed brand. Developed at Aurora's EU-GMP plant in Leuna, the newly launched brand provides the nation's growing patient base with a source of premium, locally cultivated and distributed medical cannabis.

- February 2024: Tikun Olam Europe became the first company to offer medical cannabis products under prescription in Greece. The company plans to introduce new products soon and aims to set a benchmark for the industry. Tikun Olam Europe is leveraging Greece's advantages, such as lower costs, a favorable climate for cultivation, and skilled pharmaceutical experts.

Europe Medical Cannabis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Indica, Sativa, Hybrid |

| Derivatives Covered | Cannabidiol (CBD), Tetrahydrocannabinol (THC), Others |

| Applications Covered | Cancer, Arthritis, Migraine, Epilepsy, Others |

| End Uses Covered | Pharmaceutical Industry, Research and Development Centers, Others |

| Routes of Administration Covered | Oral Solutions and Capsules, Smoking, Vaporizers, Topicals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Canopy Growth Corporation, Aurora Cannabis Inc., Tilray, Inc., Demecan GmbH, Panaxia Pharmaceutical Industries Ltd, Little Green Pharma, Cannamedical Pharma GmbH, Sapphire Medical, Althea Group, Bedrocan International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe medical cannabis market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe medical cannabis market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe medical cannabis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical cannabis market in the Europe was valued at USD 2,586.1 Million in 2024.

The Europe medical cannabis market is projected to exhibit a CAGR of 18.33% during 2025-2033, reaching a value of USD 12,652.9 Million by 2033.

The key factors propelling the European medical cannabis market include increasing legalization and evolving regulatory frameworks across countries, growing acceptance of cannabis for therapeutic purposes by patients and healthcare professionals, and rising investments in research and development exploring its medicinal potential for various conditions like chronic pain and epilepsy.

Germany holds the largest share in the Europe medical cannabis market due to the removal of cannabis from the narcotics list, simplified prescription processes, increased patient access via telemedicine, and rising domestic production alongside significant import growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)