Europe Mattress Market Size, Share, Trends and Forecast by Product, Distribution Channel, Size, Application, and Country, 2026-2034

Europe Mattress Market Size and Share:

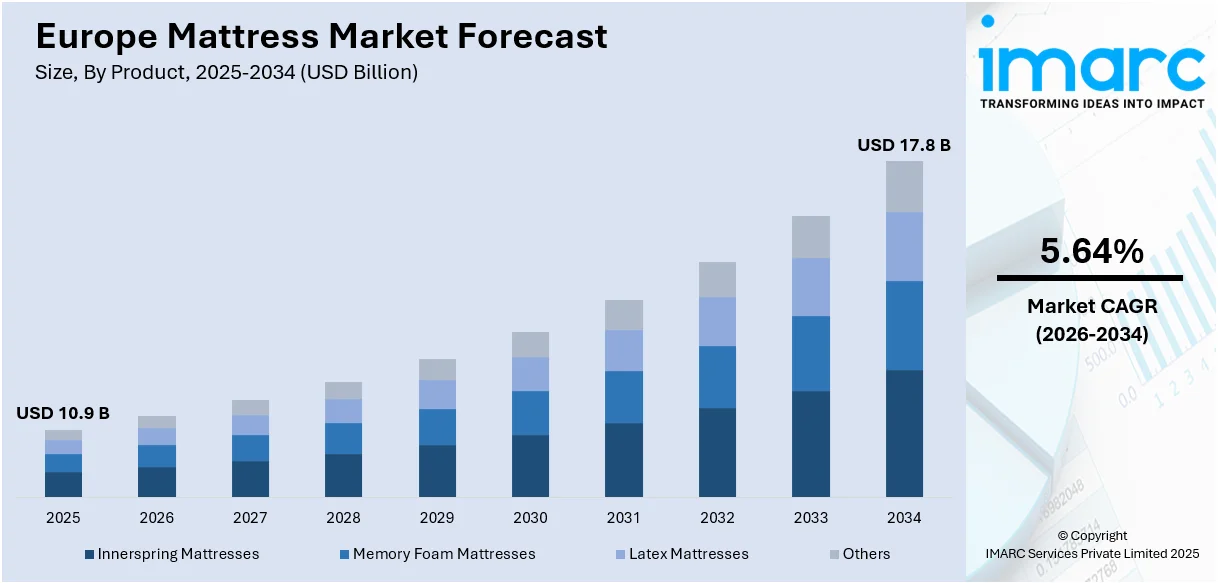

The Europe mattress market size was valued at USD 10.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 17.8 Billion by 2034, exhibiting a CAGR of 5.64% from 2026-2034. Germany currently dominates the market, due to the increasing emphasis on quality sleep solutions, strong manufacturing capabilities, rising disposable incomes, and rapid urbanization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.9 Billion |

|

Market Forecast in 2034

|

USD 17.8 Billion |

| Market Growth Rate (2026-2034) | 5.64% |

The European mattress market is growing steadily, driven by an increasing consumer emphasis on quality sleep and wellness. High awareness regarding the health benefits associated with quality mattresses leads to a growing demand for orthopedic and memory foam alternatives. Apart from this, environment-friendly, and personalized designs are gaining popularity due to the rise in disposable incomes in regions such as Germany and France, which is promoting investments in high-end mattresses. Tourism recovery in the hotel segment is also positively affecting the demand for quality mattresses in hotels and lodging.

To get more information on this market Request Sample

Concurring with this, is the technological innovation that continues to shape the mattress market as demand remains at a high level from savvy tech-savvy individuals who require smart mattresses with sleep and temperature tracking abilities. Furthermore, sales over e-commerce channels significantly affect the market due to increasing customer interest in the ease of buying on the internet, with its added advantages of price comparisons and reviews. Consumers in Nordic countries, including Denmark, Finland, Iceland, Norway, and Sweden, demand biodegradable or recycled-based mattress materials because of their strong cultural and environmental values, which is driving the market growth. Other than this, the rising number of brands offering trial periods and easy return provisions is helping increase customer confidence, thus boosting the market growth.

Europe Mattress Market Trends:

Growth in eco-friendly mattresses

The demand for eco-friendly mattresses in Europe is increasing due to the shifting consumer preference towards sustainable products. The manufacturers are incorporating organic materials in the mattresses, such as natural latex, bamboo fibers, and recycled foam, aligning with the ongoing trends. For instance, in April 2023, Recyc-Matelas Europe acquired Ecomatelas, supported by Weinberg Capital Partners and Bpifrance, to fully integrate its position within the circular economy, making it stronger in mattress recycling and reconditioning capabilities. Furthermore, the growth measures including sustainable production regulations and certifications such as OEKO-TEX and Global Organic Textile Standards (GOTS), are propelling the market forward.

Expansion of online mattress sales

The rise in e-commerce is transforming the European mattress market, due to the increasing convenience, ease of price comparison, and extensive product range. Moreover, the trend is driven by direct-to-consumer (DTC) brands offering low prices and flexible return policies. For example, in November 2024, I.T.S. GmbH launched its high-quality mattresses in the online e-commerce market for their consumers. Additionally, the advent of new delivery models, like the mattress-in-a-box, and augmented reality (AR) tools that recommend things based on an individual's preferences, allowing them to buy mattresses online and out of their homes, are supporting the market growth.

Rise in smart mattress adoption

The adoption of smart mattress market is rapidly growing in Europe, primarily driven by the health-conscious and technology-savvy consumer base. These mattresses are equipped with features like sleep monitoring, temperature adjustment, and pressure adjustment, offering a personalized and enhanced sleep experience. For example, the smart mattress maker, Eight Sleep, expanded its reach across Ireland, Portugal, and Poland, and to 28 other markets as international sales surged toward 20% of its revenue. This positioned the latest version of thermoregulating and health-tracking mattresses promoting innovation and expansion. Moreover, the increasing consciousness about sleep disorders and the integration of the Internet of Things (IoT) in appliances is driving the demand for smart and efficient sleep solutions, as several mattress brands are collaborating with health companies.

Europe Mattress Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe mattress market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, distribution channel, size, and application.

Analysis by Product:

- Innerspring Mattresses

- Memory Foam Mattresses

- Latex Mattresses

- Others

Innerspring mattresses are the most popular, as they are relatively inexpensive, durable, and easily accessible, hence in high demand by consumers. Continuous innovations within the segment also help in hybrid models, which include innerspring with latex or memory foam for support and enhanced comfort. Innerspring mattresses lead the market in countries like Germany and the United Kingdom, mainly because of their better breathability and firm support, thus satisfying a wide range of sleep preferences. Besides this, the continued demand from the hospitality sector for innerspring mattresses is working as a catalyst in promoting the growth of the market.

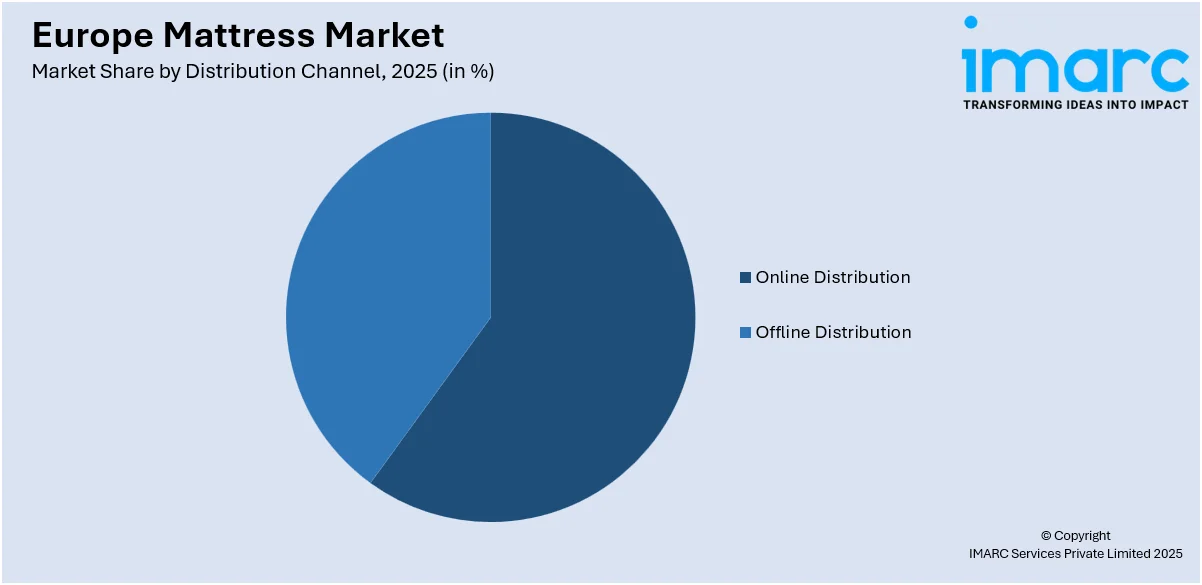

Analysis by Distribution channel:

Access the comprehensive market breakdown Request Sample

- Online Distribution

- Offline Distribution

Offline distribution holds the largest market share, owing to the physical stores, including specialty retailers and large furniture outlets, as they attract consumers who prefer testing the mattresses before purchase. Moreover, countries like Germany and France lead in offline sales, due to the well-established retail networks. In conjunction with this, the showroom experiences, expert guidance, and promotional discounts enhance the appeal of brick-and-mortar stores, instilling trust and tactile assurance in the consumers, especially for premium and customized mattresses, thereby propelling the market forward.

Analysis by Size:

- Twin or Single Size

- Twin XL Size

- Full or Double Size

- Queen Size

- King Size Mattress

- Others

Queen size mattresses lead the market, accounting for the majority of the share, driven by their versatility and suitability for couples and single sleepers seeking extra space. In line with this, this size is widely popular in urban areas, because compact and comfortable options are essential in their region. Besides this, countries like the UK and Germany exhibit high demand for queen-size mattresses due to their compatibility with standard bedroom dimensions. In addition to this, the availability of these mattresses across all price ranges and materials, from budget-friendly innerspring models to premium memory foam and hybrid options, is fueling the market demand.

Analysis by Application:

- Domestic

- Commercial

The domestic segment dominates the mattress market, due to the increasing focus on sleep health and the growing trend of home renovations. This trend has bolstered demand for mattresses in residential spaces in the region. Furthermore, the rising disposable incomes drive the purchases of these premium and customized options, driving the adoption of mattresses. Apart from this, the expansion of e-commerce, offers consumers convenient access to a wide variety of mattress types and sizes, reinforcing its position in the region, thus acting as another significant growth-inducing factor.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany has the largest mattress market in Europe, which is significantly driven by a strong preference for high-quality and innovative sleep solutions among consumers. Additionally, a robust manufacturing base and widespread adoption of eco-friendly products align with the country’s sustainability focus, which is continuously driving sales in the mattress market. Moreover, the rising disposable incomes and rapid urbanization fuel the demand, along with online sales of mattresses. Apart from this, the surging real estate sector, especially in residential housing, is contributing to the rising demand for new mattresses and creating a positive outlook for the market expansion.

Competitive Landscape:

The European mattress market is characterized by a blend of established players and emerging brands focusing on innovation and sustainability. The leading market players are increasingly investing in smart and eco-friendly mattresses to offer more advanced sleep solutions. Besides this, the market also witnesses an influx of smaller players that offer affordable, customized solutions to meet the diverse consumer needs across Europe. Besides this, the surging consumer demand for sustainable products and e-commerce expansion is driving innovation and competition, pushing brands to meet evolving customer expectations.

The report provides a comprehensive analysis of the competitive landscape in the Europe mattress market with detailed profiles of all major companies.

Latest News and Developments:

-

In August 2024, IKEA introduced a new mattress collection featuring six options, all priced under $600, including foam, spring, and hybrid mattresses specially designed to cater to various sleeping preferences.

Europe Mattress Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Sizes Covered | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe mattress market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe mattress market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe mattress industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mattress market in Europe was valued at USD 10.9 Billion in 2025.

The key factors driving the Europe mattress market include increasing health awareness, demand for premium and eco-friendly mattresses, and continual technological advancements in sleep solutions.

The mattress market in Europe is projected to exhibit a CAGR of 5.64% during 2026-2034, reaching a value of USD 17.8 Billion by 2034.

Innerspring mattresses dominate the market due to their affordability, durability, accessibility, and augmenting demand from both consumers and the hospitality sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)