Europe Luxury Watch Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Country, 2026-2034

Europe Luxury Watch Market Size and Share:

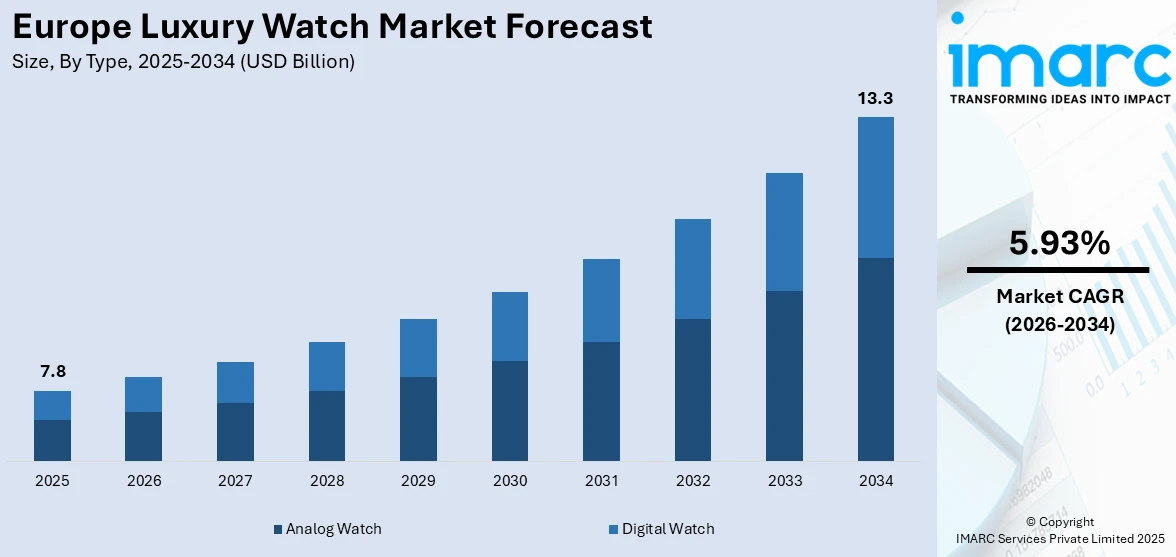

The Europe luxury watch market size was valued at USD 7.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.3 Billion by 2033, exhibiting a CAGR of 5.93% from 2025-2033. This market maintains a prominent position due to its established heritage in crafting high-quality products with stringent standards and continuous innovation. Furthermore, the increasing preference for digital shopping, growing interest in luxury goods, and robust tourist activity, driven by affluent buyers seeking exclusive and high-value timepieces, are significantly boosting the European luxury watch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.8 Billion |

| Market Forecast in 2034 | USD 13.3 Billion |

| Market Growth Rate (2026-2034) | 5.93% |

To get more information on this market Request Sample

The luxury watch market thrives from historical roots in watchmaking, coupled with worldwide demand for well-made timepieces. European countries are categorized for their expertise in horology and are dominating the industry with high-quality timepieces which symbolizes status and timeless elegance. For instance, in 2023, Rolex, a leading Switzerland-based luxury watchmaking company, reported record revenues of USD 11.5 billion, reflecting an 11% growth compared to the prior year. Rising disposable incomes among affluent consumers, coupled with their inclination toward exclusive handcrafted timepieces, are driving market expansion. Additionally, luxury watch enthusiasts and investors increasingly view these items as valuable assets, spurring accelerated growth in European markets.

Another key factor is the fusion of technology with design, as luxury watchmakers blend heritage craftsmanship with gold incorporation and contemporary innovation. Exclusive editions, customized elements, and progress in hybrid watch technologies resonate with consumers pursuing sophisticated and cutting-edge timepieces. For instance, in January 2024, Longines, a Swiss luxury watchmaker, introduced two limited-edition Master Collection GMT watches with 18k gold cases in yellow and rose gold. Each features a 39mm frosted silver dial, GMT complication, alligator strap, and a USD 14,750 USD price tag. The expansion of e-commerce platforms is further supporting the market by increasing accessibility while preserving a sense of exclusivity. Furthermore, Europe’s strong luxury tourism sector has driven retail sales, particularly in flagship stores and duty-free outlets. Sustainability and ethical sourcing are also becoming essential aspects of the market, aligning with evolving consumer preferences and contributing to its long-term growth.

Europe Luxury Watch Market Trends:

Growing Demand for Pre-Owned Luxury Watches

The pre-owned luxury watch market in Europe is expanding rapidly as consumers increasingly value both affordability and sustainability. Trusted online platforms and certified resale programs are driving this trend by offering authenticated second-hand pieces, often accompanied by warranties. For instance, in May 2023, Bucherer partnered with luxury e-commerce platform Mytheresa to offer over 300 certified pre-owned watches from 25 brands in Europe, ensuring authenticity, refurbishment, and premium customer service with a two-year guarantee. Iconic brands are offering pre-owned watches at lower prices, which are attracting young buyers, notably Millennials and Gen Z, further supporting in the Europe luxury watch market growth. The market's increased value of special watches makes these purchases attractive investments. Furthermore, this trend highlights a shift in consumer attitudes, with a growing emphasis on value retention and eco-conscious buying.

Shift Toward Online Retail Channels

European luxury watchmakers are integrating e-commerce features into their businesses in order to match today's digital age. Luxury watches brands create special online offerings and team up with exclusive dealers to deliver perfect online shopping access. Digital platforms provide detailed product information, virtual try-ons, and bespoke services, catering to tech-savvy consumers. Additionally, markets such as the UK, Germany, and France are at the forefront, with strong online sales growth reported. For instance, in October 2024, Watches of Switzerland Group acquired Hodinkee, an online platform for watch enthusiasts, to strengthen its e-commerce presence, enhance brand awareness, and expand market share, particularly in the U.S., aligning with its growth strategy. The shift reflects the importance of blending traditional craftsmanship with modern retail strategies to attract new customer segments.

Increased Interest in Smart Luxury Watches

Smart luxury watches are carving out a niche in the European market as brands blend traditional aesthetics with advanced technology. Leading luxury watchmakers are partnering with tech companies to create high-end connected timepieces that offer features like fitness tracking, notifications, and customization. These blended designs attract buyers prioritizing practicality while maintaining an emphasis on aesthetics and brand reputation. For instance, in November 2024, Withings, a French consumer electronics company, unveiled the ScanWatch Nova Brilliant at IFA Berlin, a premium smartwatch blending analog and digital features, offering health tracking, a titanium design, sapphire crystal, and a 30-day battery. Swiss brands, traditionally cautious about embracing technology, are now exploring this segment to attract younger demographics. Furthermore, this trend signifies a broader effort to modernize offerings while maintaining the craftsmanship and exclusivity that define the luxury watch industry.

Europe Luxury Watch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe luxury watch market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, end user, and distribution channel.

Analysis by Type:

- Analog Watch

- Digital Watch

Analog watches are a prominent segment in Europe's luxury watch market due to their classic design and masterful construction. Traditional analog timepieces come with dials that show hours, minutes, and seconds as a combination of beauty and exact measurement. In addition, the advanced timekeeping systems in analog luxury watches draw people who want rare timepieces that honor tradition and art. Limited-edition collections, and bespoke designs further enhance their demand among collectors and affluent buyers. Analog watches symbolize status and tradition, making them a cornerstone of the luxury market, especially in regions with a strong watchmaking legacy, such as Switzerland and Germany.

Digital watches are gaining traction in the Europe luxury watch market, appealing to tech-savvy and modern consumers. Equipped with features such as touchscreen displays, advanced health tracking, and connectivity, luxury digital watches blend innovation with premium aesthetics. Brands are increasingly adopting hybrid designs, combining digital functionalities with traditional craftsmanship to cater to evolving consumer preferences. As the demand for smart and connected wearables grows, luxury digital watches offer a unique proposition for individuals seeking functionality, style, and cutting-edge technology, positioning them as a rising segment in the luxury market.

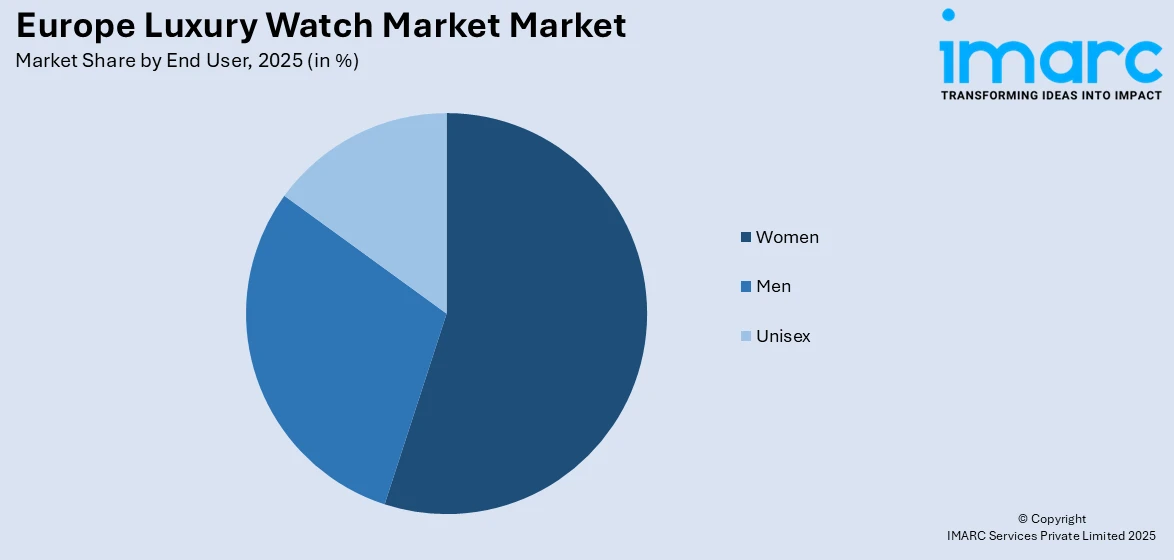

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Women

- Men

- Unisex

The women’s segment in the Europe luxury watch market thrives on demand for elegant, stylish, and personalized timepieces. Brands focus on intricate designs, premium materials, and embellishments like diamonds and mother-of-pearl to appeal to discerning female consumers. Smaller case sizes and versatile styles cater to both formal and casual wear, while innovations like hybrid smartwatches attract tech-conscious buyers. With growing disposable incomes and an increasing focus on self-purchasing, women’s luxury watches remain a vital and expanding segment in the market.

The men’s segment in the Europe luxury watch market is driven by demand for bold, sophisticated, and multifunctional timepieces. Renowned for craftsmanship, durability, and status symbolism, men’s luxury watches often feature complex movements, larger case sizes, and sporty or classic designs. Mechanical watches remain a top choice among male consumers, who appreciate the technical precision and exclusivity of high-end brands. Limited-edition collections and investment-worthy pieces also appeal to collectors, making this segment essential to the luxury watch industry.

The unisex segment is gaining prominence in the Europe luxury watch market as consumers embrace versatility and gender-neutral designs. These watches feature minimalist aesthetics, medium-sized cases, and adaptable styles that appeal to a wide audience. The trend aligns with shifting cultural norms and a growing preference for functional, inclusive timepieces. Luxury watch brands are expanding their unisex offerings, incorporating features like hybrid technology and sustainable materials to cater to modern consumer values. This segment reflects the market’s evolution toward broader inclusivity and adaptability.

Analysis by Distribution Channel:

- Online Stores

- Offline Stores

Online stores are transforming the Europe luxury watch market by offering convenience, wider reach, and personalized shopping experiences. Luxury watches brands increasingly utilize e-commerce platforms and exclusive digital boutiques to cater to tech-savvy consumers. Online channels provide detailed product information, virtual try-on features, and seamless purchasing options, appealing to younger buyers and international customers. The rise of authenticated resale platforms and brand-owned websites ensures trust and quality in online transactions. This channel is growing rapidly, complementing traditional retail by making luxury timepieces more accessible globally.

Offline stores remain a cornerstone of the Europe luxury watch market, offering personalized service and the opportunity to experience timepieces firsthand. Flagship boutiques, authorized retailers, and duty-free shops cater to affluent customers seeking exclusivity and expert guidance. These stores often showcase limited-edition collections and provide bespoke services, enhancing brand loyalty. The hands-on interaction with watches and the upscale atmosphere of physical stores play a crucial role in driving in-person purchases. Despite the growth of online channels, offline stores continue to play a vital role in maintaining the prestige and heritage of luxury watch brands.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a key market in Europe’s luxury watch industry, known for its precision engineering and high demand for premium timepieces. With a strong tradition of horology, Germany’s domestic brands contribute significantly to the market, alongside international players. Affluent consumers prioritize craftsmanship and innovation, driving sales of limited-edition and investment-worthy watches. The country’s robust economy, coupled with a growing luxury e-commerce sector, further fuels market expansion. Furthermore, prioritizing environmentally friendly practices resonates with the eco-aware preferences of German consumers.

France plays a pivotal role in the Europe luxury watch market due to its global reputation as a fashion and luxury hub. Renowned for high-end retail experiences, Paris attracts international tourists who contribute significantly to luxury watch sales. French consumers value exclusivity, timeless designs, and branded heritage, making limited editions and bespoke offerings highly desirable. The country’s expanding e-commerce presence complements its traditional retail, catering to tech-savvy buyers. France’s vibrant luxury tourism industry solidifies its position as a major market for luxury timepieces.

The United Kingdom is a prominent player in Europe’s luxury watch market, driven by high-income consumers and a thriving retail landscape. London’s flagship stores and exclusive boutiques attract both domestic buyers and international tourists. UK consumers are drawn to prestigious brands and investment-worthy timepieces, with increasing interest in pre-owned luxury watches. The e-commerce boom has further expanded accessibility, while duty-free shopping opportunities at airports bolster sales. The UK market’s resilience and adaptability make it a critical segment for luxury watchmakers.

Italy is a significant market for luxury watches, fueled by a strong appreciation for style, craftsmanship, and exclusivity. Italian consumers often view luxury timepieces as status symbols and investments, driving demand for premium designs and limited editions. The country’s high-end retail culture, supported by iconic shopping districts like Milan’s Quadrilatero della Moda, contributes to robust sales. Additionally, Italy’s growing luxury tourism sector attracts international buyers, while expanding online channels enhance accessibility and cater to younger, tech-savvy consumers.

Spain is a growing market for luxury watches, driven by increasing disposable incomes and a vibrant tourism industry. Key cities like Madrid and Barcelona host exclusive boutiques and flagship stores, attracting affluent domestic buyers and international visitors. Spanish consumers value sophisticated designs and timeless craftsmanship, making luxury timepieces a sought-after accessory. The expansion of online retail platforms has extended market accessibility, as interest in eco-friendly and exclusive designs highlights shifting consumer priorities. Spain’s dynamic luxury retail scene positions it as a key contributor to the Europe luxury watch market.

Competitive Landscape:

The competitive landscape of the Europe luxury watch market is shaped by the dominance of established European watchmakers known for their heritage, precision, and innovation. Swiss brands lead the market, leveraging advanced craftsmanship, high-quality materials, and exclusivity to maintain strong consumer demand. Growing competition comes from emerging luxury watchmakers focusing on modern designs and sustainable practices, appealing to younger, environmentally conscious buyers. For instance, in January 2025, Omega launched the Speedmaster Moonphase Meteorite, a 43mm hand-wound watch with lunar meteorite subdials, a double-moonphase indicator, and the Calibre 9914 movement. It is priced at USD 17,100 and offers exceptional craftsmanship. Moreover, e-commerce platforms and direct-to-consumer strategies are intensifying competition by broadening market access and enhancing customer engagement. Additionally, limited-edition collections and customization options are driving brand differentiation. The market remains highly competitive, driven by innovation, heritage, and evolving consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the Europe luxury watch market with detailed profiles of all major companies, including:

- Apple Inc.

- The Swatch Group Ltd

- Fossil Group

- Citizen

- Louis Vuitton

- Movado Group Inc.

- Ralph Lauren Media LLC

- Seiko Watch Corporation

- Girard Perregaux

- Breguet

Latest News and Developments:

- For instance, in July 2024, German luxury watch retailer Aigner Watches partnered with Titan Company to enter India, launching Swiss-made collections in 50 metro stores, focusing on the country’s expanding premium and accessible luxury watch market.

- In September 2024, Omega unveiled the Speedmaster Pilot, a 40.85mm chronograph inspired by its exclusive military version. Designed with a matte brushed finish and cockpit-style features, it includes a two-register layout, matte black dial, and discreet date window.

Europe Luxury Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Watch, Digital Watch |

| End Users Covered | Women, Men, Unisex |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe luxury watch market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe luxury watch market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe luxury watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury watch market was valued at USD 7.8 Billion in 2025.

The market is driven by its heritage of craftsmanship, rising demand for exclusivity, and growing consumer interest in investment-worthy timepieces. Factors such as sustainability, digital transformation, e-commerce expansion, and strong luxury tourism further boost the market, meeting evolving preferences for premium, personalized, and innovative designs.

IMARC estimates the Europe luxury watch market to reach USD 13.3 Billion in 2034, exhibiting a CAGR of 5.93% during 2026-2034.

Some of the major players in the Europe luxury watch market include Apple Inc., The Swatch Group Ltd, Fossil Group, Citizen, Louis Vuitton, Movado Group Inc., Ralph Lauren Media LLC, Seiko Watch Corporation, Girard Perregaux, Breguet, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)