Europe LED Lighting Market Report by Product Type (LED Lamps and Modules, LED Fixtures), Installation (New Installation, Replacement), Application (Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, and Others), and Country 2025-2033

Europe LED Lighting Market Size:

The Europe LED lighting market size reached USD 24.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 55.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.87% during 2025-2033. Growth is driven by rising environmental awareness, energy-efficient LED adoption, and smart lighting demand in residential and automotive sectors. Germany leads with strong regulations and smart tech integration. Improved energy data access and intelligent controls further support sustainability, boosting the Europe LED lighting market forecast for continued expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.7 Billion |

| Market Forecast in 2033 | USD 55.1 Billion |

| Market Growth Rate 2025-2033 | 8.87% |

Europe LED Lighting Market Analysis:

- Market Growth and Size: The European LED lighting scene is vibrant, energized by an increasing embrace of energy-saving and green initiatives. The market is on the cusp of significant expansion, with projections signaling a substantial elevation in its worth. This upward trajectory is fueled by a robust appetite for innovative lighting solutions and a steady stream of technological advancements, painting a bright future for LED applications.

- Major Market Drivers: The market's momentum is significantly influenced by strict regulatory standards on energy usage, a shift towards environmentally friendly lighting options, and the widespread adoption of intelligent lighting solutions. These elements are driving the transition from conventional lighting methods to advanced LED technologies, supported by policies favoring energy-saving products.

- Key Market Trends: Notable trends include the merging of IoT technology with lighting systems and a growing preference for intelligent lighting solutions in both residential and commercial settings. The market is also experiencing a boost in demand for LEDs, attributed to their extended durability, superior energy efficiency, and reducing costs.

- Geographical Trends: The forefront of LED lighting adoption is seen in Northern European countries, characterized by their high environmental consciousness and robust governmental backing. Meanwhile, Southern Europe is progressively embracing LED technology, fueled by rising investments in infrastructure enhancements and refurbishment initiatives that integrate LED solutions.

- Competitive Landscape: This sector is marked by intense competition, featuring a blend of international powerhouses and local firms, where innovation and brand strength are key differentiators. Firms are prioritizing strategic alliances, technological breakthroughs, and diversification of their product ranges to consolidate their positions in the market.

- Challenges and Opportunities: Despite facing hurdles such as substantial upfront costs and the necessity for consumer awareness regarding LED advantages, the sector is ripe with opportunities. The escalating demand for energy-conserving lighting and the potential synergy with smart urban initiatives present expansive possibilities for market growth.

Europe LED Lighting Market Trends:

Energy Efficiency and Environmental Concerns

Traditional incandescent and fluorescent lighting technologies are notorious for their inefficiency, with a significant portion of energy converted into heat rather than light. In contrast, LEDs operate on a fundamentally different principle, where electrons in a semiconductor material release energy in the form of photons, producing light with minimal wasted energy as heat. This inherent efficiency results in LED bulbs consuming significantly less electricity to produce the same level of illumination as their counterparts. The European Union has implemented strict EU regulations aimed at phasing out inefficient lighting technologies and promoting energy-saving alternatives. These regulations include minimum performance standards and energy labeling requirements to accelerate the shift toward sustainable lighting solutions. As a result, manufacturers are innovating rapidly, improving LED performance and reducing costs. This drive toward efficiency has significantly boosted the Europe LED lighting market share in both residential and commercial sectors, helping consumers achieve substantial energy savings and supporting broader environmental sustainability goals.

Continual Technological Advancements and Innovations

Presently, significant breakthroughs in LED design, manufacturing processes, and semiconductor materials have led to enhanced luminous efficacy, improved color rendering, and reduced costs of production. These advancements have not only elevated the overall quality and performance of LED lighting but have also widened its application scope. The introduction of smart lighting systems that allow users to control brightness, color, and scheduling through connected devices has revolutionized the way lighting is experienced and managed. Additionally, innovations such as organic LEDs (OLEDs) have unlocked new possibilities for flexible and transparent lighting solutions, enabling creative architectural and design applications. As research and development continue to push the boundaries of LED technology, the LED lighting market in Europe remains vibrant and dynamic, attracting investment and fostering a competitive landscape where manufacturers strive to deliver cutting-edge solutions that cater to evolving customer demands.

Human-Centric Lighting

Human-centric lighting (HCL) is emerging as a key trend in the Europe LED lighting market growth, focusing on enhancing health, comfort, and productivity by aligning lighting conditions with the human circadian rhythm. LED technologies allow for tunable white lighting that can mimic natural daylight variations, supporting concentration during the day and relaxation in the evening. This is particularly gaining traction in healthcare, education, and workplace environments. Germany, as the leading country in Europe, is at the forefront of adopting HCL solutions, supported by its advanced building standards, strong demand for wellness-focused designs, and regulatory incentives that promote energy-efficient and human-friendly lighting systems. The growing emphasis on occupant wellbeing is accelerating the demand for HCL across public and private sectors.

IoT Integration

The integration of Internet of Things (IoT) technology into LED lighting systems is transforming the European market, allowing for smart, data-driven, and automated lighting environments. Smart LED lighting in Europe is gaining traction as IoT-enabled solutions offer real-time monitoring, adaptive lighting control, predictive maintenance, and energy optimization, which are increasingly adopted in commercial, industrial, and residential settings. Germany, Europe’s leading market, is driving this trend through smart city initiatives and advanced infrastructure development. The country’s strong manufacturing base and commitment to digital transformation support widespread deployment of IoT-connected lighting. These systems are often paired with sensors and cloud platforms to deliver scalable lighting solutions that align with sustainability goals and EU energy efficiency directives, positioning IoT as a central feature of Europe’s lighting evolution.

Europe LED Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional, and country levels for 2025-2033. Our report has categorized the market based on product type, installation and application.

Breakup by Product Type:

- LED Lamps and Modules

- LED Fixtures

LED lamps and modules holds the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes LED lamps and modules, and LED fixtures. According to the report, LED lamps and modules represented the largest segment.

LED lamps and modules including bulbs designed to replace traditional incandescent, halogen, and compact fluorescent lamps, have gained immense popularity due to their exceptional energy efficiency, longevity, and versatility. These lamps are available in an assortment of shapes, sizes, and color temperatures, offering consumers a wide range of options to suit their lighting needs, whether for residential, commercial, or industrial spaces. Additionally, LED modules, which consist of integrated LED light sources often used in downlights, track lighting, and fixtures, contribute significantly to this product type's dominance. LED modules offer advantages such as precise light distribution, reduced glare, and seamless integration into luminaires, making them an ideal choice for professional lighting applications. The appeal of LED lamps and modules lies not only in their energy-saving attributes but also in their compatibility with emerging smart lighting technologies.

Breakup by Installation:

- New Installation

- Replacement

New installation holds the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the installation. This includes new installation and replacement. According to the report, new installation represented the largest segment.

New installation refers to the implementation of LED lighting solutions in entirely new buildings or structures, whether they are residential, commercial, or industrial in nature. The increasing recognition of LED lighting's numerous benefits, from its energy-saving potential to its longer lifespan and reduced maintenance requirements, LED lighting aligns with the demands of modern construction practices that prioritize sustainability and operational cost efficiency. As regulations and building codes evolve to mandate energy-efficient solutions, architects, developers, and contractors are inclined to incorporate LED lighting systems from the outset. Furthermore, the integration of LED lighting technology with architectural designs has transformed lighting into an artistic expression, where light fixtures are considered integral elements in shaping a space's ambiance. This fusion of technology and design has led to collaborations between lighting designers, architects, and interior decorators to create captivating visual effects and personalized lighting environments.

Breakup by Application:

- Residential

- Outdoor

- Retail and Hospitality

- Offices

- Industrial

- Architectural

- Others

Residential holds the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, outdoor, retail and hospitality, offices, industrial, architectural, and others. According to the report, residential represented the largest segment.

LED lighting's energy efficiency aligns perfectly with the growing societal emphasis on sustainability and energy conservation. In the residential sector, where lighting constitutes a significant portion of energy consumption, LEDs offer a compelling solution to reduce electricity bills and minimize environmental footprints. The long lifespan of LED bulbs further contributes to these advantages by reducing the need for frequent replacements, translating to both cost savings and reduced waste. Additionally, the versatility and adaptability of LED lighting play a pivotal role in its widespread adoption within residential spaces. LEDs are available in a spectrum of color temperatures and can be dimmed or brightened as needed, allowing homeowners to customize their environments to match different moods and activities. This flexibility extends beyond traditional lighting fixtures, with LED strips, under-cabinet lighting, and accent lighting offering creative ways to enhance interior aesthetics and create unique visual effects.

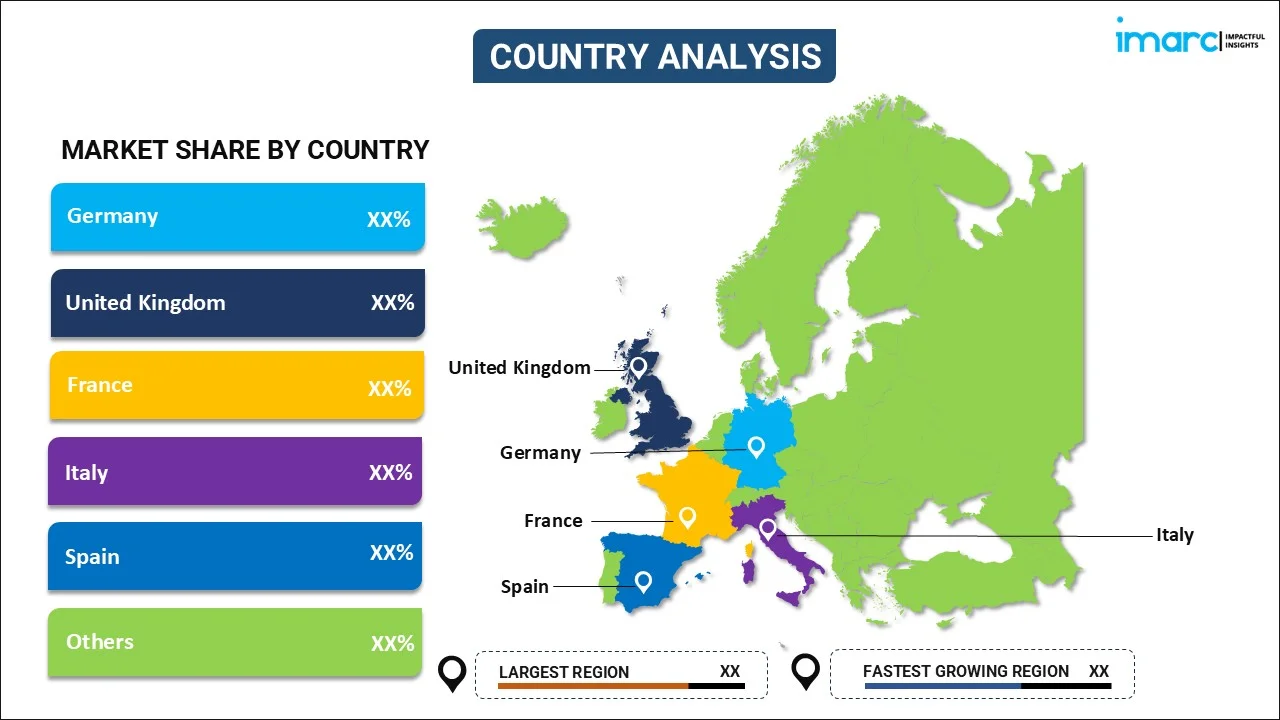

Breakup by Country:

- Germany

- United Kingdom

- France

- Italy

- Spain

- Others

Germany exhibits a clear dominance, accounting for the largest Europe LED lighting share

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, the United Kingdom, France, Italy, Spain, and others. According to the report, Germany accounted for the largest market share.

Germany's rising emphasis on energy efficiency and environmental sustainability aligns seamlessly with the core attributes of LED lighting technology. The nation's proactive approach to addressing climate change and reducing energy consumption has led to a robust demand for energy-efficient lighting solutions. LED lighting's capacity to deliver substantial energy savings while maintaining superior illumination quality has resonated with both businesses and consumers seeking to align with Germany's stringent environmental standards and regulations. The country's thriving industrial and technological sectors play a pivotal role in driving LED innovation. With a robust ecosystem of research institutions, manufacturers, and designers, Germany remains at the forefront of developing cutting-edge LED products that cater to diverse applications and industries. This innovation is not limited to the commercial realm; it extends to the design and creation of advanced lighting systems for smart cities, transportation networks, and industrial facilities.

Leading Key Players in the Europe LED Lighting Industry:

Several companies are heavily investing significantly in R&D to develop cutting-edge LED lighting technologies. This includes advancements in LED chip design, thermal management, color accuracy, and efficiency. R&D efforts are also focused on integrating smart technology features, such as connectivity and controls, to offer consumers more sophisticated and customizable lighting solutions. Moreover, LED lighting manufacturers are expanding their product portfolios to cater to a wide range of applications. This includes developing LED lamps and fixtures tailored to different settings, such as residential, commercial, industrial, and outdoor lighting. Diversification helps companies address diverse customer needs and capture a larger market share. Also, companies are focusing on smart lighting solutions that can be integrated into home automation systems and controlled through smartphones or voice assistants. This includes the development of smart LED bulbs, lighting strips, and fixtures that offer features, including color changing, dimming, and scheduling.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Cree Inc.

- Dialight PLC

- Eaton Corporation Inc. (Cooper Industries LLC)

- Osram Licht AG

- Panasonic Corporation

- Seoul Semiconductor Co., Ltd.

- Signify N.V. (Philips Inc.)

- TRILUX GmbH & Co. KG

- Zumtobel Group AG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Europe LED Lighting Market News:

- In January 2025, Signify unveiled major AI-powered upgrades to Philips Hue smart lighting and security systems. Key innovations include a generative AI assistant for personalized lighting scenes, smoke alarm sound detection, and expanded camera control features under Hue Secure. The Hue Sync TV app now supports LG TVs, enhancing immersive entertainment. New product launches like outdoor lights and ceiling panels expand availability across global markets. These updates reflect Signify’s focus on energy-efficient, intuitive, and connected home lighting experiences driven by innovation and sustainability.

- In May 2024, Zumtobel launched the EXTONA luminaire, a moisture-proof and impact-resistant lighting solution designed for demanding industrial environments. Certified for ATEX 2/22 zones, EXTONA ensures high reliability, energy efficiency, and safety across industries such as automotive, power, textiles, and metalworking. Its robust build includes emergency lighting functions and adaptable installation options. By reducing power consumption and supporting sustainability goals, EXTONA enhances workplace safety and comfort. Zumtobel’s innovation reflects its commitment to delivering versatile, high-quality lighting for challenging industrial applications.

Europe LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | LED Lamps and Modules, LED Fixtures |

| Installations Covered | New Installation, Replacement |

| Applications Covered | Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Spain, Others |

| Companies Covered | Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, Zumtobel Group AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe LED lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe LED lighting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe LED lighting industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe LED lighting market was valued at USD 24.7 Billion in 2024.

We expect the Europe LED lighting market to exhibit a CAGR of 8.87% during 2025-2033.

The rising number of modern housing projects, along with the increasing demand for energy-efficient lighting systems, such as LED lights, are currently driving the Europe LED lighting market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several European countries resulting in temporary closure of numerous manufacturing units and supply chain disruptions of LED lights.

Based on the product type, the Europe LED lighting market can be segmented into LED lamps and modules and LED fixtures. Among these, LED lamps and modules currently hold the majority of the total market share.

Based on the installation, the Europe LED lighting market has been divided into new installation and replacement. Currently, new installation exhibits a clear dominance in the market.

Based on the application, the Europe LED lighting market can be categorized into residential, retail and hospitality, outdoor, offices, architectural, industrial, and others. Among these, the residential sector accounts for the largest market share.

On a regional level, the market has been classified into Germany, United Kingdom, France, Italy, Spain, and Others, where Germany currently dominates the Europe LED lighting market.

Some of the major players in the Europe LED lighting market include Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, Zumtobel Group AG., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)