Europe Jewelry Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

Europe Jewelry Market Size and Share:

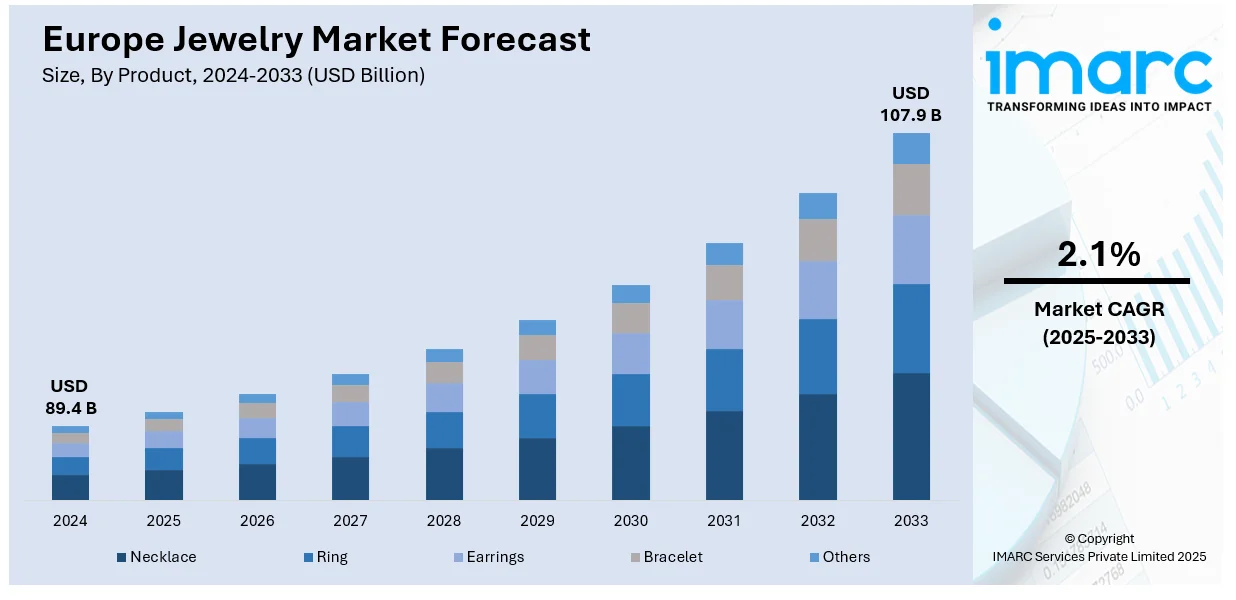

The Europe jewelry market size was valued at USD 89.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 107.9 Billion by 2033, exhibiting a CAGR of 2.1% from 2025-2033. The Europe jewelry market share is expanding, driven by the heightened requirement for lab-made diamonds that exhibit similar natural and chemical properties as original diamonds and are affordable, along with the expansion of online retail channels that allow people to easily browse and purchase jewelry from home, with features like virtual try-ons.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.4 Billion |

| Market Forecast in 2033 | USD 107.9 Billion |

| Market Growth Rate (2025-2033) | 2.1% |

Innovations in design are impelling the market growth. They attract a new generation of users who seek unique and personalized pieces. Modern designs, such as minimalist styles, geometric shapes, and asymmetrical pieces, have become highly popular, highlighting changing preferences. Additionally, jewelry designers experiment with unconventional materials, combining metals like gold with ceramics, wood, and 3D-printed components, offering fresh products. Customization options like engraving, birthstones, and mix-and-match pieces further enable people to create jewelry that feels personal and distinctive. These creative and functional designs appeal particularly to younger individuals who value both aesthetics and practicality. As people look for trendy pieces, innovation in design continues to be one of the major Europe jewelry market growth drivers.

Influencer and celebrity marketing assists in influencing user buying decisions in the region. Social media platforms are spaces where influencers and celebrities showcase their favorite jewelry pieces, making them highly desirable for their followers. When a famous personality wears a certain brand or style, it often leads to a rise in demand, as people want to replicate their looks. Jewelry brands partner with influencers to enhance popularity, using exclusive collections to tap into their large audiences. This marketing strategy helps jewelry brands to reach younger and more fashion aware users who value the opinions of influencers over traditional advertising. The visibility and aspirational appeal of celebrity endorsements, which is making jewelry more accessible and desirable, is fueling the Europe jewelry market growth.

Europe Jewelry Market Trends:

Rising demand for diamonds created in lab

The increasing demand for lab-made diamonds is positively influencing the market. People have become more aware about sustainability, making lab-grown diamonds a popular choice. These diamonds have the same physical and chemical assets as natural diamonds, but without the ethical and environmental issues related with mining. They offer a more affordable alternative to mined diamonds, allowing users to purchase larger and higher-quality stones at a lower price point. As a result, many jewelry brands incorporate lab-grown diamonds into their collections, appealing to eco-conscious buyers. For example, in June 2024, Pandora, a well-known jewelry brand, introduced its lab-made diamond jewelry in the EU for the first time, selecting Denmark, its home country, for the release. It launched its four lab-grown collections- Pandora Talisman, Pandora Infinite, Pandora Nova, and Pandora Era. The selection features necklaces, rings, and earrings, with prices beginning at DKK 1,899 (USD 275).

Increasing tourism activities

The rising tourism activities are offering a favorable jewelry market outlook in Europe. As per the UN’s World Tourism Organization (UNWTO) 2024 year-in-review data, Europe was the most frequented continent, attracting 747 Million visitors. Travelers like buying jewelry as souvenirs, gifts, or luxury keepsakes. Tourists visiting fashion capitals like Paris, Milan, and London seek high-end brands while others explore local artisan markets for unique handcrafted pieces. Duty-free shopping at airports and luxury shopping districts attracts international buyers looking for tax-free deals on fine jewelry. Cultural influences also play a role, with visitors drawn to traditional designs in countries like Italy and Spain. Jewelry brands cater to tourists by offering multilingual services, personalized shopping experiences, and exclusive collections. Seasonal tourism peaks, such as summer vacations and holiday travel, further enhance sales.

Expansion of retail platforms

One of the key jewelry trends in Europe market is the expansion of retail platforms. According to the data available on the Eurostat official website, in September 2024, the seasonally altered retail trade volume increased by 0.5% in the eurozone and by 0.3% in the EU, compared to August 2024, based on preliminary estimates from Eurostat, the EU's statistical agency. In August 2024, the volume of retail trade rose by 1.1% in the eurozone and by 0.9% in the EU. Both physical stores and online retailers are reaching more customers, offering a wider range of jewelry options. Additionally, luxury jewelry brands are opening new boutiques in major cities while smaller and independent designers are wagering on pop-up shops and local retail spaces. Online retail platforms allow customers to easily browse and buy jewelry from home, with features like virtual try-ons and customization options making it more interactive. Moreover, retailers provide better customer service with free shipping, easy returns, and personalized shopping experiences, making buying jewelry more convenient and appealing.

Europe Jewelry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe jewelry market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and material.

Analysis by Product:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

The necklace category features a range of designs, such as chokers, pendants, and bold statement pieces. Shoppers appreciate necklaces for their capacity to elevate any attire, whether it is casual or formal. Gold and silver continue to be favored due to the strong demand for sustainable and lab-created resources. High-end brands create innovative luxury products, while budget-friendly fashion jewelry companies serve cost-aware users in the area. Moreover, personalized and customizable necklaces like those featuring initials or birthstones are widely used.

A ring is among the most favored pieces of jewelry, representing love, dedication, and individual flair. The collection features engagement rings, wedding bands, and stylish rings. Diamonds continue to be a preferred option, while alternative stones, such as moissanite and colored gems are becoming more popular. Sleek designs draw in younger people whereas vintage and elaborate styles entice those who like traditional appearances.

Earrings are available in numerous styles, ranging from basic studs to striking hoops and pendant designs. The market sees a high requirement for fine jewelry and affordable fashion earrings. Gold and silver remain top materials while pearl and gemstone earrings add a touch of elegance. Ear stacking where multiple earrings are worn together is rising in demand. According to the Europe jewelry market research report, online retailers and influencers impact purchasing trends through styling tips and recommendations.

Bracelet is a part of versatile accessory, worn alone or stacked for a layered look. The range includes charm bracelets, bangles, cuffs, and beaded designs. People choose customizable options, such as bracelets with initials, charms, or symbolic elements. Luxury brands cater to affluent users while fashion brands offer trendy and budget-friendly styles. Leather and woven designs attract men’s jewelry buyers with delicate chain bracelets becoming popular among women.

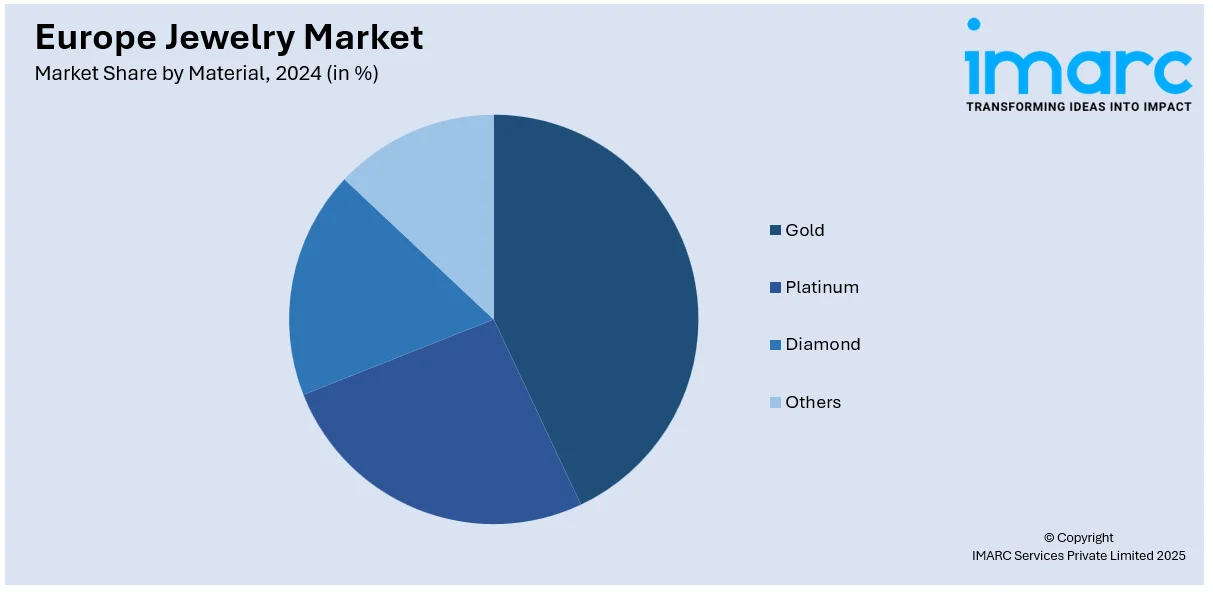

Analysis by Material:

- Gold

- Platinum

- Diamond

- Others

Gold jewelry remains a classic choice in Europe, favored for its elegance and worth. Individuals prefer yellow, white, and rose gold, with 18K and 14K being among the most popular options in the region. Gold jewelry is preferred for daily use, presents, and investment opportunities. Furthermore, eco-friendly and recycled gold products appeal to people, as they grow increasingly aware about environmental issues. Gold customization choices, including name necklaces and engraved items, are in high demand.

Platinum jewelry is appreciated for its strength, scarcity, and opulent charm. It is a preferred option for engagement rings and wedding bands because of its durability and hypoallergenic features. In contrast to gold, platinum offers a more subtle and contemporary appearance, which appeals to minimalists. It is particularly used by high-end users who value its uniqueness.

Diamond jewelry represents luxury, love, and status, with engagement rings being the primary sales driver. Traditional white diamonds continue to be favored while fancy-colored diamonds and alternative options, such as diamonds developed in labs, are becoming more accepted. Ethical sourcing and diamonds free from conflict are also crucial factors for purchasers. In addition to this, there is a strong demand for custom-designed diamond jewelry.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is well-known for its high-quality craftsmanship and preference for minimalist designs. In this country, people value durability and precision, favoring brands with a strong reputation. Gold and silver jewelry are popular here, along with a high interest in ethical and sustainable pieces. Engagement rings and wedding bands enhance sales, as Germans see jewelry as a long-term investment. Additionally, local brands and family-owned businesses compete with international luxury names.

France is a major hub for luxury jewelry and is noted for the presence of big brands. French users prefer elegant and sophisticated designs, often choosing high-end pieces. Paris remains the center of jewelry fashion, influencing worldwide trends. Diamonds, gold, and platinum jewelry are highly sought after here, especially for special occasions. Online shopping is growing with in-store experiences remaining important for luxury buyers. As per the Europe jewelry market analysis, proper sourcing and sustainability are becoming key factors in purchasing decisions.

The UK has numerous luxury brands and businesses that provide budget-friendly fashion items. London serves as the hub for luxury jewelry, hosting various international brands. In the country, engagement rings and wedding jewelry are commonly used, with diamonds as the top preference. Customizable and retro-themed designs appeal to the younger demographic. Additionally, independent designers and custom jewelry have also gained popularity among those seeking distinctive items.

Italy is famous for its exquisite craftsmanship and artistic jewelry designs. Gold jewelry, especially 18K gold, is a staple, with many people choosing handmade and intricate pieces. Italian brands come up with bold and luxurious designs. In addition, fashion jewelry firms in the area offer a mix of modern and traditional styles. Local artisans and family-owned businesses are widely sought after alongside luxury houses.

Spain combines tradition with modern fashion trends. Gold jewelry is widely preferred, along with silver and gemstone pieces becoming highly popular, especially among younger buyers. Spaniards enjoy bold and statement designs influenced by cultural heritage. Additionally, handcrafted pieces attract both locals and tourists across the country. Affordable fashion jewelry also has strong demand, especially in urban areas.

Competitive Landscape:

Key players in the market work on developing innovative designs and products to meet the high Europe jewelry market demand. Luxury brands, catering to affluent buyers, offer exquisite designs and premium materials. Big brands focus on craftsmanship, exclusivity, and heritage to attract wealthy buyers. Additionally, mid-range and fashion jewelry firms make stylish pieces more accessible, appealing to younger and budget-conscious users. Sustainability is a growing focus, with key players promoting ethical sourcing, lab-grown diamonds, and recycled metals. Moreover, companies employ e-commerce portals for widening their market reach, making personalized and custom jewelry more popular. Local artisans and independent designers further add diversity, offering unique and handcrafted options. Through strong marketing, celebrity collaborations, and digital presence, these players influence user choices and entice people. For instance, in July 2024, Dolce & Gabbana, an Italian luxury fashion house, unveiled its latest Alta Gioielleria collection with the title “These Pieces Embody Italy”, in Sardinia. Within Alta Gioielleria resides the culture, folklore, and artistic heritage of specific Italian regions expressed through exquisitely crafted gold and gemstones.

The report provides a comprehensive analysis of the competitive landscape in the Europe jewelry market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: The Vicenzaoro Jewelry Show 2025 is set to launch and aims to welcome 1,300 top brands, displaying the newest in luxury jewelry, gemstones, and advanced technology in Italy. It is considered the biggest event in Europe for the gold, jewelry, and watch sectors.

- May 2024: SKYlink, a top travel retail distributor, teamed up with Eurotrade to introduce its new jewelry collection, Marlay, at Munich Airport Terminal 2, Germany. The new Marlay launch represents the brand's largest travel retail debut featuring a selection of 67 stock keeping units (SKUs).

- May 2024: Luxury jeweler Bulgari introduced its latest high-end collection Aeterna in Rome, celebrating its 140th anniversary. The collection features an exquisite selection of more than 500 pieces, including high jewelry, high jewelry watches, premium bags, and ultra-luxurious fragrances.

- September 2023: Cartier, a luxury goods conglomerate based in France, intended to launch its Jewelry Institute and make it accessible to the public during the European Heritage Days. On September 16th and 17th, around 200 attendees were expected to explore the realm of jewelry crafting and Cartier's exclusive skills.

- June 2023: Malabar Gold & Diamonds (MGD), a prominent jewelry brand, opened its new showroom in London, UK. This signified the brand's growth into its 11th operational country and its entry into the European region. The London showroom features an extensive range of gold, diamond, and precious gemstone jewelry, along with exclusive brands and collections thoughtfully selected by the company from more than 15 countries.

Europe Jewelry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Necklace, Ring, Earrings, Bracelet, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe jewelry market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe jewelry market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe jewelry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The jewelry market in Europe was valued at USD 89.4 Billion in 2024.

The growing adoption of online shopping is making jewelry items more accessible, offering better pricing and a wider selection. Besides this, the increasing trend of sustainability and ethical sourcing is driving the demand for lab-grown diamonds and recycled metals that attract eco-conscious buyers. Moreover, the rising need for personalization & customization, with people preferring unique pieces like engraved jewelry, birthstone rings, and bespoke designs, is impelling the market growth.

The Europe jewelry market is projected to exhibit a CAGR of 2.1% during 2025-2033, reaching a value of USD 107.9 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)