Europe Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, End Use, Packaging, Distribution Channel, and Country, 2025-2033

Europe Hot Sauce Market Size and Share:

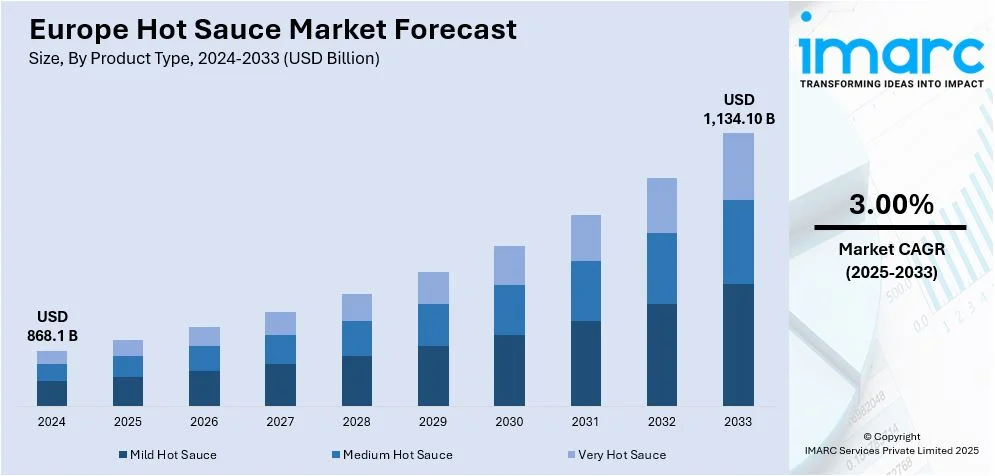

The Europe hot sauce market size was valued at USD 868.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,134.10 Billion by 2033, exhibiting a CAGR of 3.00% from 2025-2033. The market is growing due to rising demand for bold flavors, increased adoption of international cuisines, and growing consumer interest in spicy condiments, driven by both household usage and foodservice establishments incorporating diverse, flavorful options into their offerings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 868.1 Billion |

|

Market Forecast in 2033

|

USD 1,134.10 Billion |

| Market Growth Rate (2025-2033) | 3.00% |

Europe's hot sauce market growth is driving significantly forward due to the reshaping consumer preferences, driving demand through spicy condiments. Accelerating preferences for bold flavorful foods cut across the audiences, especially with younger consumers tend to prefer stronger, and more adventurous flavor profiles often associated with newer, hot sauces. For instance, in February 2023, Hunter & Gather launched its Unsweetened Sauces in 100% recyclable squeezy bottles, adding a new Unsweetened Sriracha Hot Sauce to the line-up, expanding its retail presence. Moreover, the amplified popularity of international cuisines, including Mexican, Asian, and Caribbean are driving the market. Hot sauces are a mainstay in all these cuisines, and as consumers try international flavors, they are finding hot sauces increasingly in both home cooking and dining out. In addition, heightening health awareness from certain ingredients found in hot sauces, like capsaicin which continues to drive up demand. Many consumers look at hot sauce as an additive for food to taste better, rather than boosting calories or unhealthy ingredients.

Furthermore, the amplifying number of foodservice establishments offering spicy menu items is one of the factors favoring to the growth in hot sauce consumption. The trend of customization in the foodservice industry also contributes to the market, with restaurants and fast-food chains offering a range of hot sauce options to cater to diverse consumer preferences. E-commerce growth is another relevant factor that enables consumers access to a wide variety of the most diversified hot sauces from companies in different regions. Moreover, raised incidence of home cooking demand is bolstered due to experimentation with new flavors prepared in the kitchen. Additionally, the aforementioned factors aids growing disposable income which works synergistically in driving the European market of hot sauce.

Europe Hot Sauce Market Trends:

Rising Demand for Bold Flavors

The rising demand for bold flavors in Europe is a significant driver of the hot sauce market's growth. Consumers, particularly millennials and Generation Z, are increasingly seeking stronger, spicier, and more intense flavors in their meals. As these audiences become adventurous in their culinary choices, hot sauces are gaining popularity due to their ability to add depth and excitement to everyday dishes. This trend is not only restricted to traditional spicy foods but is also influencing mainstream meals, where consumers are experimenting with hot sauces to create new flavor profiles. As people explore international cuisines like Mexican, Thai, and Indian, the use of hot sauces in cooking has expanded beyond their traditional applications, further driving their demand in the market. European hot sauce manufacturers are leveraging this demand by developing innovative products with diverse heat levels and unique flavor combinations, offering options that cater to the evolving tastes of adventurous consumers.

Health and Wellness Trends

Health and wellness trends are highly influencing the Europe hot sauce market, as consumers become more health-conscious and seek alternatives that complement their lifestyle. For instance, in December 2022, Spanish manufacturer Doctor Salsas launched the "Carolina Reaper Sauce" alongside three vegan-friendly varieties: Habanero, Chipotle, and Jalapeno, expanding its product range to cater to diverse consumer preferences. Moreover, various hot sauces contain capsaicin, a compound found in chili peppers that is believed to have various health benefits, such as boosting metabolism and aiding digestion. As consumers focus on maintaining healthy diets, they are turning to hot sauces as a way to add flavor without increasing calorie intake. This, coupled with many brands positioning their hot sauces as natural or organic products, which attract health-conscious consumers who like foods that are not highly processed, is part of the reason driving the hot sauce market forward with the general wellness trend.

Growth of Foodservice and E-commerce Channels

Foodservice establishments and e-commerce channels have influenced the development of the European hot sauce market. Restaurants and fast-food chains have begun to feature hot sauces as part of their offerings. Some restaurants go to the extent of having menus that specialize in offering various types of hot sauce in line with consumers' demands for a wide variety of spicy condiments. Further, in foodservice, the trend has been customization where consumers can order the degree of spiciness desired, allowed by hot sauces being a part of dining experience. On the contrary, e-commerce is simplifying consumers' access to many kinds of hot sauces that provide consumers with ample opportunities for discovering and buying from brands around the globe. This convenience, along with amplified sales of food online, has contributed to the growth of the hot sauces market in Europe.

Europe Hot Sauce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe hot sauce market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, application, end use, packaging, and distribution channel.

Analysis by Product Type:

- Mild Hot Sauce

- Medium Hot Sauce

- Very Hot Sauce

Mild hot sauce is currently the largest segment in the Europe hot sauce market. Its popularity lies in its balanced flavor profile, which appeals to a vast majority of consumers who enjoy spiciness but prefer not to have it too pungent. This appeal comes from the fact that such a product is ideal for a beginner in hot sauces or someone looking for something versatile for different dishes. As consumer preferences shift toward more accessible, yet flavor-friendly options, the mild hot sauce continues to dominate not only household and commercial applications but also drives the rising popularity of global cuisines and fusion dishes, thus retaining its leading status in the market.

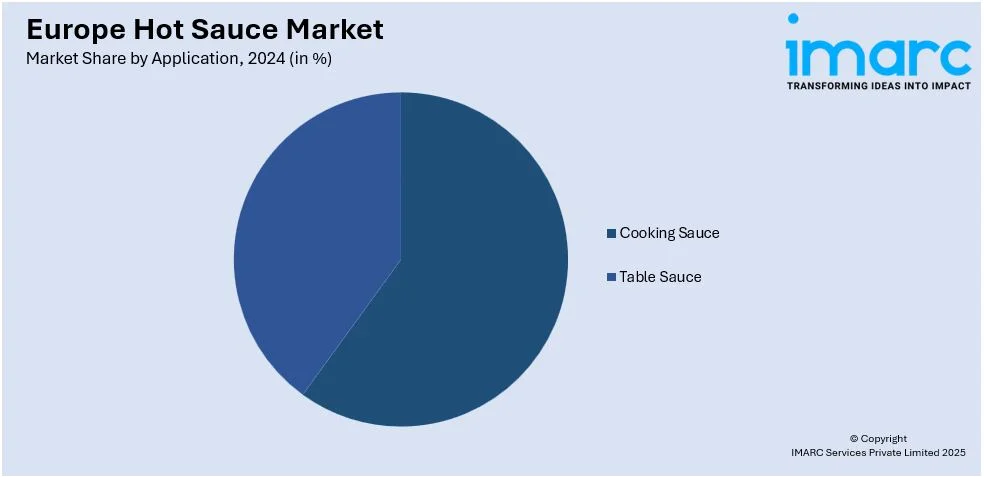

Analysis by Application:

- Cooking Sauce

- Table Sauce

Cooking sauce is the largest segment in the Europe hot sauce market, driven by its widespread use in preparing a variety of dishes. Consumers seek products that provide flavor enhancement, making them convenient to use in the kitchen. Cooking sauces are one of the most convenient means of adding depth and spice to meals and are also necessary in both home and professional kitchens. With home meal preparation becoming popular and international flavors on the rise, cooking sauces are in high demand within the foodservice industry and households. This segment remains to rise with the experimentation in new food cuisines and cooking technologies that are sure to grow this segment for the coming future.

Analysis by End Use:

- Commercial

- Household

Household use represents the largest segment in the Europe hot sauce market, reflecting the growing trend of spice and flavor integration in everyday home cooking. Consumers are nowadays experimenting with various hot sauces to spice up their cuisines, and homes accept hot sauces as staples. The ready-to-use format of hot sauces makes it an easy option for cooking at home, thus bringing hot sauces into common uses in preparing most meals. With the rise of spicy flavors and global cuisines, households are the greatest drivers of this segment that accounts for the largest market size in the hot sauce market.

Analysis by Packaging:

- Jars

- Bottles

- Others

Bottles are the largest packaging segment in the Europe hot sauce market due to their practicality and convenience. The bottle format allows the easy storage, pouring, and application of hot sauce which is consumer's preferred packaging choice. Bottles, especially with squeeze tops, are favored highly because they allow the control of the amount of sauce dispensed which ensure little wastage and a great user experience. Bottles come in different sizes, making them suitable for a range of consumers, from individual servings to family-sized portions. With heightening demand for hot sauces, bottle packaging leads due to its acceptability in larger quantities and also the utility functions it has.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

Supermarkets and hypermarkets are the largest distribution channels in the Europe hot sauce market, driven by their ability to offer a wide range of products to a large number of consumers. These retail outlets have easy access to several hot sauce brands which are offering consumers a chance to browse through the different flavors and types of products under one roof. Supermarkets and hypermarkets have a wide reach in Europe, that are meeting the demand of local as well as international brands in one location. The accessibility and diversity offered by these stores makes them the most dominant distribution channel for hot sauce, contributing to their market lead.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is experiencing growing demand for hot sauces, particularly as consumer preferences shift towards bold and exotic flavors. The rising trend of international cuisines and spice-rich dishes is contributing to the expansion of the hot sauce market. Consumers are increasingly incorporating hot sauces into everyday cooking, driving market growth.

France, known for its refined culinary culture, is witnessing a steady rise in hot sauce consumption, particularly in urban areas where global flavors are more popular. The younger generation is embracing spicier condiments, such as hot sauce, in their meals. This shift in taste preferences is fueling the growth of the hot sauce market.

The United Kingdom has a rapidly expanding hot sauce market, driven by the growing enthusiasm for bold, flavorful condiments. The rise of multicultural food trends, including spicy dishes, is influencing British consumers to incorporate more hot sauces in their meals. This shift towards spicier flavors is propelling the growth of the market.

Italy, traditionally known for its mild flavors, is experiencing a growing interest in hot sauces, especially among younger consumers and in urban areas. The adoption of international and fusion cuisines is driving demand for spicier condiments. This shift in consumer preferences is contributing to the steady growth of the hot sauce market in Italy.

In Spain, hot sauces are becoming more popular, especially in regions where bold, flavorful cuisine is a staple. Spanish consumers are embracing spicier foods, and hot sauces are intensely incorporated into both home cooking and dining out. This trend is contributing to the ongoing growth of the hot sauce market in the country.

Other European countries, such as the Netherlands, Belgium, and Sweden, are also witnessing a gradual rise in hot sauce consumption. The growing influence of global cuisines and the growing interest in spicy food options are driving market growth in these regions. As consumer tastes evolve, hot sauce demand is expanding across Europe.

Competitive Landscape:

The Europe hot sauce market is extremely dynamic in terms of competition with a large volume of both established brands as well as emerging players in the industry. Companies rely on differentiation of products along unique flavor profiles, using organic or natural ingredients, and specific spice levels for tailoring to differentiated consumer tastes. Packaging innovation, specifically in relation to eco-friendliness and convenient bottles, also plays a highly important role. The growing demand of consumers for premium and specialty hot sauces, including international and artisanal varieties, will spur intense competition. Digital marketing strategies, collaborations with influencers, and platforms to shop online are all contributing factors to the expanded reach and growth of online shopping. Brand loyalty and effective distribution networks are becoming essential for maintaining Europe hot sauce market share.

The report provides a comprehensive analysis of the competitive landscape in the Europe hot sauce market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Pringles officially announced the introduction of a new flavor, Blazin' Fried Chicken, inspired by Nashville Hot Chicken. It is scheduled for release in the UK on January 1, 2025, this bold snack taps into the increasing demand for spicy products in the market. The flavor blends cayenne spice with the essence of deep-fried chicken.

- In November 2024, Colman’s launched a limited-edition 150g ‘Hot & English’ Squeezy Mustard pack as part of a £2m campaign to highlight its fiery flavor, target younger consumers, and drive growth in the sauces and condiments category, featuring in-store sampling at Tesco, Sainsbury’s, and Asda.

- In November 2024, Tango, manufactured by Britvic, launched its first-ever hot sauce, the "Tang Reaper." Limited to only 200 bottles, the sauce combines Carolina Reaper and ghost chilies with a tangy orange twist. It is available at selected Nabzy’s chicken shops across Preston, Liverpool, and Manchester, offering a unique, fiery dining experience.

- In February 2024, Lion enhanced its Piri Piri range to lower salt content and simplify usage for restaurants. The popularity of hot sauces, driven by social media trends and thrill-seeking diners during the cost of living crisis, has led to increased demand. The updated Piri Piri range includes a new Garlic Piri Piri Sauce, alongside existing varieties like Hot, Medium, Original, and Lemon and Herb Piri Piri sauces, catering to diverse tastes.

Europe Hot Sauce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| End Uses Covered | Commercial, Household |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe hot sauce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe hot sauce market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Hot sauce is a condiment made from chili peppers, vinegar, and various spices, used to add heat and flavor to dishes. It is widely used in cooking and as a table sauce, enhancing meals like meats, seafood, and vegetables. Hot sauce is also highly popular in international cuisine, especially Mexican, Thai, and Caribbean dishes.

The Europe hot sauce market was valued at USD 868.1 Billion in 2024.

IMARC estimates the Europe hot sauce market to exhibit a CAGR of 3.00% during 2025-2033.

Key drivers of the Europe hot sauce market include increasing consumer preference for bold and exotic flavors, rising demand for international cuisines, growing health consciousness due to the benefits of capsaicin, and expanding foodservice offerings. Additionally, the rise of e-commerce and product innovation are fueling market growth.

In 2024, mild hot sauce represented the largest segment by product type, driven by consumer preference for flavors that provide a balanced spice level, catering to a broader audience who may not favor very hot or intense spice levels, allowing for its widespread adoption in everyday cooking.

Cooking sauce leads the market by application owing to its adaptability in a variety of dishes, from marinades and dressings to dips, making it essential for both amateur home cooks and professional chefs who seek to enhance flavor profiles in their recipes across different cuisines.

Household is the leading segment by end use, driven by consumers increasingly experimenting with flavors in their home kitchens, seeking to replicate restaurant-style spicy dishes and enhance meals like pizza, burgers, and grilled meats, making hot sauces a regular addition to everyday cooking.

Bottles leads the segment by packaging, driven by their ease of storage, portability, and convenience in controlled dispensing, allowing consumers to use precise amounts without waste, while also offering the ability to preserve the sauce’s freshness and flavor over time.

Supermarkets and hypermarkets are the leading segment by distribution channel, driven by their ability to offer a vast selection of hot sauce products, competitive pricing, and easy access to large numbers of customers, making them the preferred shopping destination for consumers looking for variety and convenience.

On a country level, the market has been classified into Germany, France, United Kingdom, Italy, Spain and Others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)