Europe Home Healthcare Market Size, Share, Trends, and Forecast by Product, Service, Indication, and Country, 2026-2034

Europe Home Healthcare Market Size and Share:

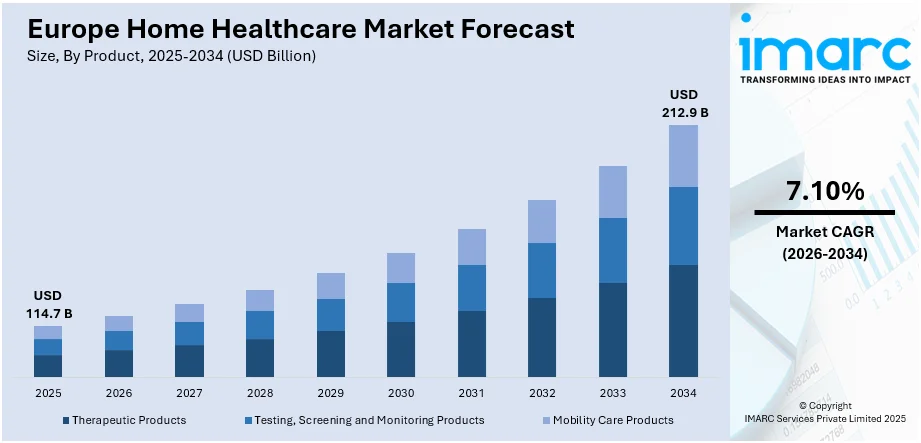

The Europe home healthcare market size was valued at USD 114.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 212.9 Billion by 2034, exhibiting a CAGR of 7.10% from 2026-2034. The market is driven by the aging population, increasing prevalence of chronic diseases, advancements in telehealth and medical devices, and the demand for cost-effective, patient-centered care. Government initiatives supporting home-based services and the integration of technology to improve accessibility and efficiency are also significant contributors, addressing diverse healthcare needs across Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 114.7 Billion |

| Market Forecast in 2034 | USD 212.9 Billion |

| Market Growth Rate (2026-2034) | 7.10% |

The growing geriatric population in Europe is driving the demand for home healthcare services, as elderly individuals often face mobility challenges and require continuous care for age-related health conditions, such as arthritis, dementia, and cardiovascular diseases. Additionally, the rising incidence of chronic diseases, including diabetes, hypertension, and chronic obstructive pulmonary disease (COPD), is creating a pressing need for long-term medical care. Home healthcare services are preferred for managing these conditions, providing regular monitoring, medication administration, and support with lifestyle changes. Besides this, continuous innovations in medical technology are positioning home healthcare as more accessible and efficient Devices such as portable oxygen concentrators, blood glucose monitors, and wearable health trackers enable patients to receive quality care in their homes. Telemedicine platforms and remote monitoring tools are further improving the capability of healthcare professionals to assist and monitor patients remotely.

To get more information on this market Request Sample

In addition, home healthcare is a cost-efficient substitute for prolonged nursing home care or hospital stays. It reduces the financial burden on both families and patients while helping healthcare systems allocate resources more effectively. This affordability drives adoption across various socioeconomic groups. Besides this, the increasing focus on preventive healthcare is leading to a shift toward home-based wellness programs. Regular health monitoring and early intervention for potential issues are becoming integral parts of care plans, which home healthcare services are well-equipped to support. Moreover, home-based mental health services, including therapy and counseling, are witnessing a significant growth in Europe. This trend aligns with the growing recognition of mental health's importance and the preference for discreet, private care options.

Europe Home Healthcare Market Trends:

Growing Geriatric Population

With a significant proportion of the population aged 65 and older, there is a rise in demand for services that allow older adults to receive care in familiar environments. Chronic diseases such as diabetes, hypertension, and cardiovascular disorders are prevalent among this demographic, further driving the need for long-term care and monitoring solutions. As per the “Ageing Europe-statistics on population developments” report published by Eurostat in November 2023, the population of people aged 65 years or more will elevate notably in the EU-2, increasing from 90.5 million in the beginning of 2019 to reach 129.8 million by the year 2050. The number of people in the Europe aged 75-84 years are projected to expand by 56.1%, while the number aged 65-74 years is projected to increase by 16.6%. This considerable growth is projected to drive the demand for home healthcare services, as more people will need home-based care and support.

Technological Innovations

The incorporation of leading-edge technology in healthcare is significantly expanding the capabilities of home care services. Portable medical devices, wearable sensors, and digital health platforms enable real-time monitoring and seamless communication between patients and healthcare providers. These advancements facilitate precise diagnoses, prompt interventions, and improved patient involvement. Enhanced analytics and artificial intelligence (AI) are elevating the efficiency of home care by examining patient data to detect possible health threats early and suggest individualized treatment strategies. Moreover, top healthcare and technology firms are collaborating to merge advanced innovations, developing more holistic and efficient care systems. These partnerships emphasize merging knowledge in fields like wearable biosensors, patient monitoring systems, and open ecosystems to improve the precision and availability of healthcare services. In 2024, Philips partnered with smartQare to integrate viQtor and Philips' patient monitoring platforms, enabling seamless continuous monitoring in hospitals and at home across Europe. The collaboration combines wearable biosensors with an open ecosystem to enhance data flow and care delivery. smartQare also acquired Philips' Healthdot to strengthen remote patient monitoring solutions.

Specialized Training Programs Enhancing Workforce Competency

The increasing focus on specialized training programs is greatly enhancing the quality and range of home healthcare services. These efforts seek to provide healthcare workers, such as nurses and caregivers, with the expertise and training required to meet intricate patient demands in community and residential environments. Training programs typically concentrate on hands-on, patient-focused care while highlighting essential aspects like chronic illness management, mental health assistance, and empathetic caregiving. These programs assist in closing skill gaps in the workforce by improving the capabilities of healthcare workers, thereby guaranteeing high-quality care that is customized to meet individual needs. Collaborations between healthcare providers and educational institutions enhance these initiatives by providing organized, accredited programs that equip professionals for the changing needs of home healthcare. These initiatives are crucial for enhancing care standards and boosting patient outcomes outside of hospital settings. In 2024, Southern Healthcare, collaborating with the University of Bolton, introduced a free Advanced Diploma (CPD) in Adult Social Care Nursing in Devon. This program provides targeted training for nurses, nursing associates, and assistant practitioners focused on nursing home settings, highlighting effective, empathetic, and holistic care. The first cohort begins in August 2024.

Europe Home Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe home healthcare market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, service, and indication.

Analysis by Product:

- Therapeutic Products

- Testing, Screening and Monitoring Products

- Mobility Care Products

Therapeutic products include items like respiratory devices, insulin pumps, and infusion pumps designed to provide active treatment at home. These products address various conditions, such as diabetes, respiratory disorders, and chronic pain, enabling effective disease management outside of clinical settings.

Testing, screening, and monitoring products covers devices like glucose monitors, blood pressure cuffs, and portable ECG machines. These tools help patients and caregivers track health metrics regularly, ensuring timely intervention and better overall health management.

Mobility care products, mainly including wheelchairs, walkers, and transfer equipment, are requisite for people with limited mobility due to injury, aging, or neurological conditions. These products enhance independence and improve accessibility within the home environment.

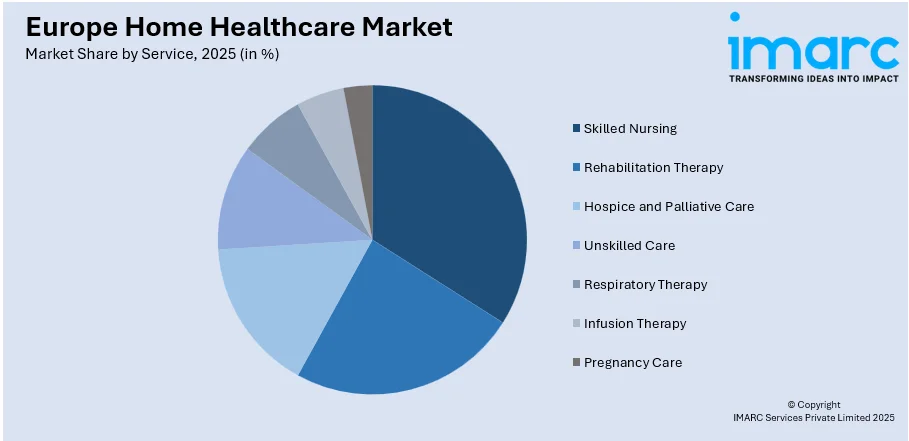

Analysis by Service:

Access the comprehensive market breakdown Request Sample

- Skilled Nursing

- Rehabilitation Therapy

- Hospice and Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

Skilled nursing includes medical care provided professionally by licensed nurses. This segment includes wound care, administering medications, post-operative care, and managing chronic conditions, ensuring patients receive high-quality medical attention at home.

Rehabilitation therapy covers physical, occupational, and speech therapies, helping patients recover from injuries, surgeries, or neurological conditions. This therapy aims to restore mobility, independence, and functional abilities in a familiar home environment.

Hospice and palliative care emphasize on enhancing the quality of life for such patients that are living with terminal illnesses or chronic conditions. It provides pain relief, assistance for daily tasks, and emotional support, while prioritizing comfort and dignity.

Unskilled care caters to non-medical needs, like meal preparation, personal hygiene, and companionship. It is essential for individuals who require daily assistance to restore their independence.

Respiratory therapy includes oxygen delivery, ventilator management, and pulmonary rehabilitation for patients with conditions like COPD, asthma, or other respiratory disorders, ensuring better respiratory function and overall well-being.

Infusion therapy encompasses administering nutrients, medications, or fluids intravenously at home. This service is commonly used for patients requiring antibiotics, chemotherapy, or nutritional support, offering convenience and continuity of care.

Pregnancy care provides prenatal monitoring, education, and postnatal support for newborns and mothers. This service ensures a safe and healthy experience throughout the pregnancy and recovery phases, addressing both routine and high-risk cases.

Analysis by Indication:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases and Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Others

Home healthcare for cancer emphasizes pain control, administration of chemotherapy, and palliative treatment. Services additionally encompass psychological assistance and dietary advice, focusing on both the physical and emotional requirements of patients receiving treatment or in later phases of the illness.

Respiratory diseases like COPD and asthma, requires services like pulmonary rehabilitation, oxygen therapy, and ventilator support. These interventions aim to improve breathing, lower hospital visits, and improve patients' quality of life for patients.

Movement disorders include treating patients with Parkinson’s disease, multiple sclerosis, and similar disorders with physical therapy, mobility aids, and occupational therapy in home healthcare settings. These services help maintain independence and manage disease progression effectively.

Cardiovascular diseases and hypertension require services that assist in recovery post-cardiac events and promote long-term heart health through regular monitoring and lifestyle adjustments.

Pregnancy includes prenatal monitoring, maternal health assessments, and postnatal care for mothers and newborns. Services often address high-risk pregnancies, ensuring continuous support for safe outcomes.

Wound care focus on managing pressure ulcers, surgical wounds, and diabetic foot ulcers. These services use advanced dressings and therapies to accelerate healing and prevent complications.

Diabetes home-based care encompasses blood sugar monitoring, insulin administration, dietary guidance, and education on disease management. Personalized plans help patients maintain stable glucose levels and reduce risks of complications.

Hearing disorders require home healthcare includes fitting and maintenance of hearing aids, auditory training, and therapy for speech improvement. These services support better communication and integration into daily life.

Others like dementia, kidney disorders, and infectious diseases are addressed through tailored home healthcare programs, including cognitive therapy, dialysis support, and infection control measures, designed to meet specific patient needs efficiently.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a crucial segment in the Europe home healthcare market share, driven by its advanced healthcare infrastructure and strong focus on integrating technology into patient care. The country’s emphasis on managing chronic diseases and supporting its aging population is fostering the development of home-based care services. Skilled nursing and telehealth applications are key contributors to growth in this segment.

In France, the market is supported by a well-established healthcare system and initiatives aimed at promoting care outside of hospitals. The focus on improving accessibility for elderly individuals and those with long-term illnesses has spurred demand for home nursing, physical therapy, and rehabilitation services, making home healthcare a critical component of the national healthcare framework.

The United Kingdom’s home healthcare segment benefits from public health policies encouraging care in community settings to reduce strain on hospitals. The rising use of telecare and remote monitoring technologies is encouraging the adoption of home healthcare services, particularly for patients with chronic conditions and post-surgical needs.

Italy's increasingly older population is fueling the need for home healthcare services, especially for addressing age-related issues and post-acute care. Localized services that emphasize mobility assistance, physical rehabilitation, and chronic illness management are crucial in addressing the healthcare requirements of patients in their residences.

Spain’s healthcare system promotes the rising demand for home care, placing greater emphasis on palliative care and rehabilitation services. Telemedicine and mobile healthcare units are also gaining traction, addressing the needs of patients in remote areas and enhancing access to specialized care.

Others include the Netherlands, Switzerland, and Scandinavian nations, are also contributing to the market growth. These regions emphasize innovative solutions like wearable devices, telehealth integration, and specialized care programs to cater to diverse patient needs while prioritizing accessibility and efficiency in healthcare delivery.

Competitive Landscape:

Major participants in the market are diligently working on broadening their service options and incorporating advanced technologies to satisfy the growing need for personalized care. They are putting money into telemedicine systems, remote monitoring tools, and AI-based solutions to improve efficiency and patient results. Collaborations with healthcare professionals and governmental bodies are being enhanced to meet the needs of various patient groups. Businesses are enhancing employee training initiatives to guarantee there are qualified caregivers and healthcare workers on hand. Leading companies are emphasizing creative approaches for managing chronic diseases, recovery after surgery, infant care, and elderly assistance, all while guaranteeing affordable choices. In 2024, Owlet Inc revealed that its Dream Sock, a baby monitoring gadget for pulse rate and oxygen saturation, obtained EU medical device certification. Intended for at-home use with healthy babies up to 18 months, it offers sleep insights through the Owlet Dream App. The product is scheduled to debut in Germany, France, and the UK, with additional expansion in Europe anticipated.

The report provides a comprehensive analysis of the competitive landscape in the Europe home healthcare market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Heim Health, located in London, secured €2.65 million in a seed funding round led by Heal Capital to improve its software platform for delivering healthcare at home. Founded by Sasha Tory, Kelly Klifa, and James Monico, , Heim Health collaborates with the NHS and private healthcare organizations to optimize community-based care and reduce hospital strain. The funding supports scaling services through digital infrastructure and logistics innovation.

- July 2024: The WHO launched the Strategic Partners’ Initiative for Data and Digital Health (SPI-DDH) to enhance digital health solutions across its 53 European Member States. This initiative aims to address challenges in digital health transformation, including financing, interoperability, and trust in digital solutions. Over 100 representatives from various sectors will collaborate in four specialized working groups focusing on capacity building, home healthcare, interoperability standards, and public health enhancement.

- March 2024: Birdie introduced Flock, a complimentary online and offline community catering to the UK's homecare, live-in, and complex care fields. Flock provides resources, forums, and specialized groups to support knowledge sharing, recruitment, compliance, and policy challenges.

- February 2024: London-based Samphire Neuroscience has raised a pre-seed investment of €2.1 million for its wearable neurostimulation device, Nettle. This is a gadget focused on the alleviation of menstrual discomfort and PMS, utilizing transcranial direct current stimulation (tDCS) to address issues with mood and pain as an innovative, non-invasive approach to women's health. The device seeks to offer a secure, home-based option to conventional therapies.

- January 2024: Rudolf Riester GmbH launched its telemedicine solution, which features the ri-sonic® E-Stethoscope that is integrated with eMurmur® AI for early heart murmur detection. Already used in Europe, the solution supports frontline healthcare, including the "hospital at home" model, to enhance diagnosis and care delivery.

Europe Home Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Therapeutic Products, Testing, Screening and Monitoring Products, Mobility Care Products |

| Services Covered | Skilled Nursing, Rehabilitation Therapy, Hospice and Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care |

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases and Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe home healthcare market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe home healthcare market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe home healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Home healthcare is a type of medical or supportive care offered to people in their homes. It is typically aimed at people managing chronic conditions, recovering from an illness or injury, or demanding assistance with daily tasks due to age or disability. It can include speech therapy, skilled nursing, occupational therapy, physical therapy, personal care, medication management, and assistance with activities like bathing, dressing, and meal preparation.

The Europe home healthcare market was valued at USD 114.7 Billion in 2025.

IMARC estimates the Europe home healthcare market to exhibit a CAGR of 7.10% during 2026-2034.

The Europe home healthcare market is driven by an aging population, the bolstering cases of chronic diseases, advancements in medical technology, and a shift toward cost-effective care solutions. Rising demand for personalized care, government initiatives promoting home-based care, and the magnifying availability of telehealth services further contribute to the market growth, emphasizing convenience and improved patient outcomes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)