Europe Heat Exchanger Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Country, 2025-2033

Europe Heat Exchanger Market Size and Share:

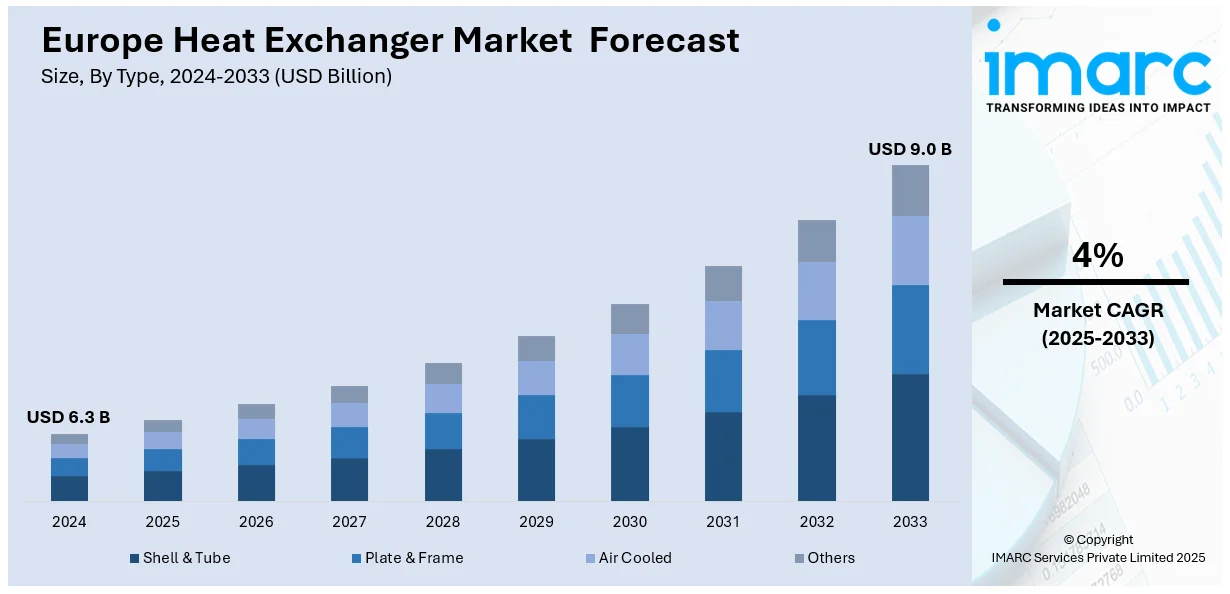

The Europe heat exchanger market size was valued at USD 6.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.0 Billion by 2033, exhibiting a CAGR of 4% from 2025-2033. The market is growing due to the rising demand for energy-efficient solutions, advancements in materials technology, and the increasing adoption of industrial applications that require optimized thermal management systems to improve performance, reduce costs, and meet sustainability goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.3 Billion |

|

Market Forecast in 2033

|

USD 9.0 Billion |

| Market Growth Rate 2025-2033 | 4% |

The amplifying demand for energy-efficient solutions in various industries is a significant growth driver for the Europe heat exchanger market. Industries, such as power generation, heating, ventilation, and air conditioning (HVAC), and chemical processing, are becoming highly energy-conscious, with a growing need for heat exchangers that optimize energy consumption and reduce operational costs. Other factors driving demand for more resilient and energy-efficient heat exchanger systems include technological advancement in material science, which further incorporates corrosion-resistant alloys and stainless steel. For example, the B285 frameless brazed plate heat exchanger, launched by SWEP in 2023, increases the energy efficiency while supporting the use of natural refrigerants, such as CO2, emphasizing SWEP's focus on innovative and sustainable heat transfer technologies. Additionally, tighter environmental regulations and the pressure of sustainable solutions call for a superior heat exchanger system that is more carbon-friendly, hence efficient.

Accelerating industrial activities and infrastructure development in Europe are also driving the heat exchanger market. The automotive, chemical, and food & beverage (F&B) industries are constantly expanding in Europe. For instance, in August 2024, Thermowave released gasketed plate heat exchangers, offering high thermal efficiency and reliability to HVAC, chemical, food, and power industries through compact design, scalable solutions, and easy maintenance. Moreover, the demand for efficient heat exchanger systems is escalating to meet the demands of new production processes that require efficient thermal management. The trend of urbanization and the amplifying adoption of district heating and cooling systems also contribute market growth, as these systems rely heavily on efficient heat exchanger solutions to maintain optimal temperatures across large-scale facilities. Additionally, the bolstering drive to reduce energy consumption in industries is driving investment in innovative technologies for heat exchangers that offer improved heat recovery with lower maintenance costs and longer lives.

Europe Heat Exchanger Market Trends:

Technological Advancements in Heat Exchanger Design

The main driver for the European market is improvements in heat exchanger technology to refined energy efficiency, reduction in operational costs, and performance. Manufacturers are using advanced materials, including corrosion-resistant alloys and stainless steel, for improved durability and longer service lives. New designs of compact heat exchangers and modular systems have improved industries' ability to apply heat exchange solutions within their business operations. Smart technology integration, including temperature sensors and automated control systems, is becoming common in heat exchanger designs to optimize performance and real-time monitoring. These technological improvements are driving the market as they enable industries to meet the intensely stringent energy efficiency standards and carbon footprint reduction, which are making advanced heat exchangers highly attractive for both new and existing installations.

Growing Adoption of Sustainable and Renewable Energy Solutions

The accelerating shift toward renewable sources of energy, including solar, geothermal, and wind, is promoting the growth of the European heat exchanger market. In these renewable systems, proper heat exchange is necessary for performance and minimizing losses with efficient solutions like advanced heat exchangers which are in huge demand. For example, geothermal power systems require heat exchangers to regulate the heat transfer between the natural warmth of the earth and fluid circuits within the system. The European Union (EU) continues to strengthen its assurance to sustainability and decarbonization where industries continue to invest in renewable energy infrastructure. To fulfill this demand, advancement in heat exchange systems is being introduced to achieve maximum energy transfer efficiency with minimal environmental impact. With government incentives for green technologies and the transition to sustainable energy, the adoption of heat exchangers in renewable energy applications is picking up speed.

Rising Industrialization and Demand for Energy Efficiency

The advanced industrial activities and infrastructural development in Europe have been driving the heat exchanger market, especially within the automotive, chemical, and food processing sectors. As these industries expand, there is accelerating demand for systems that manage heat in complex industrial processes. In chemical manufacturing, maintaining specific temperatures during reactions is important for the quality and safety of the product where heat exchangers are critical in such an industry. The automotive industry also demands efficient cooling systems in electric vehicles, which are helping to fuel the heat exchanger market. Emphasis on energy efficiency in industrial operations is forcing companies to switch to advanced heat exchange technologies, such as those that have reduced energy consumption, amplified thermal performance, and cut down on maintenance costs, and is therefore driving the demand for high-efficiency heat exchangers across Europe. For example, in February 2024, Alfa Laval introduced the T25 semi-welded plate heat exchanger, optimizing energy efficiency for green hydrogen production, renewable energy storage, and industrial heat pumps with a compact, high-performance design.

Europe Heat Exchanger Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe heat exchanger market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, material, and end use industry.

Analysis by Type:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

The shell & tube heat exchanger segment accounts for the highest market share as it is highly versatile and has high thermal efficiency along with the capacity to resist extreme pressure and temperature conditions. It finds widespread usage in oil & gas, power generation, and chemical processing industries, where high performance is necessary. The effectiveness of shell & tube heat exchangers in exchanging heat between two fluids makes it ideal for applications requiring a continuous heat exchange in compact, durable designs. A significant factor in their ability to dominate the market lies in their handling of fluid volumes and high-pressure conditions.

Analysis by Material:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

The dominance of stainless steel in the heat exchanger market is attributed to its outstanding corrosion resistance, mechanical strength, and tolerance to high temperatures. This makes it suitable for operation in challenging industrial conditions such as chemical processing, power generation, and HVAC systems. It is also resistant to oxidation and chemical corrosion, meaning that the longevity of heat exchangers in aggressive environments will be assured. Its durability and the low maintenance cost add up to its popularity among the industries, further securing a place as the favorite material. The material's thermal fatigue resistance also provides performance throughout long operational periods.

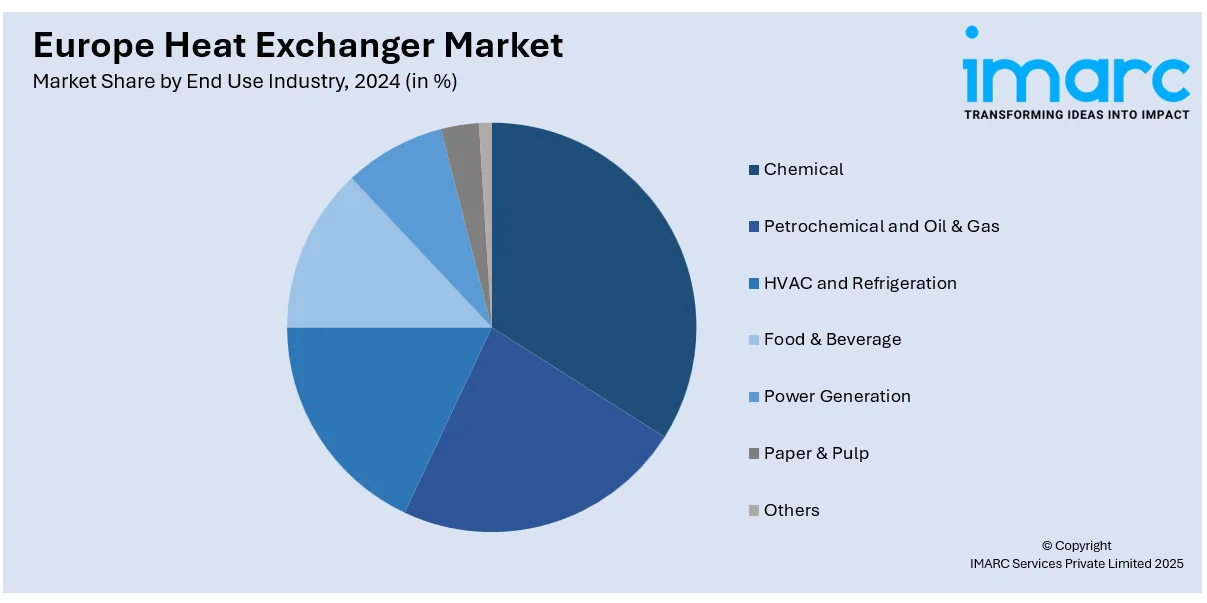

Analysis by End Use Industry:

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

The largest end-use sector for heat exchangers is the chemical industry, driven by the demand for efficient thermal management in chemical production, refining, and petrochemical processes. In this sector, heat exchangers assist in the regulation of temperatures in reactors, distillation columns, and other critical equipment, thereby ensuring optimum performance and energy efficiency. The amplifying demand for chemicals, especially in the area of pharmaceuticals, agrochemicals, and petrochemicals, requires advanced heat transfer solutions for energy efficiency standards with the objective of minimizing operating expenses. The heightened thrust in the area of sustainability within chemical manufacturing further enhances demand for high-performance heat exchangers to minimize energy use.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the largest heat exchanger market in Europe. Its advanced industrial infrastructure, especially in automotive, chemical, and manufacturing sectors, propels the demand for such heat exchangers. Its strong economy and emphasis on technological innovation result in high demand for efficient thermal management solutions. Growth in the German chemical and automotive industries, which require reliable and energy-efficient heat exchangers for their production processes, contributes to market growth. This has further fueled the adoption of heat exchangers that optimize energy consumption in the country. Germany's position as a leader in manufacturing and engineering has also placed it as a key consumer of high-quality heat exchangers.

Competitive Landscape:

The heat exchanger market's competitive landscape is characterized by various global and regional players concentrating on innovation, product differentiation, and cost efficiency for retaining market share. Global players are focusing on high-technology products, including designs with energy efficiency, materials with corrosion resistance, and customized solutions for different industry segments, such as chemical, power generation, and HVAC. Strategies like partnerships, mergers, and acquisitions allow companies to expand their product line and reach globally. Market players are also putting in significant investments for research and development (R&D) in terms of sustainable and high-performance heat exchange solutions across various applications.

The report provides a comprehensive analysis of the competitive landscape in the Europe heat exchanger market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Kelvion launched the GB 790 plate heat exchanger, designed for natural refrigerants to boost energy efficiency and sustainability. It serves data centers, heat pumps, and industrial cooling, thereby improving eco-friendly solutions.

- In October 2024, Danfoss introduced its microplate heat exchanger H62-CZ at Chillventa, designed for hydronic heat pumps and chillers, enhancing energy efficiency and supporting sustainable solutions for the European HVAC and refrigeration markets.

Europe Heat Exchanger Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Shell & Tube, Plate & Frame, Air Cooled, and Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, and Others |

| End Use Industries Covered | Chemical, Petrochemical and Oil & Gas, HVAC and Refrigeration, Food & Beverage, Power Generation, Paper & Pulp, and Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe heat exchanger market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe heat exchanger market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe heat exchanger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Heat transfer between two or more fluids without mixing them is facilitated by a device named as a heat exchanger. It is commonly used within heating, cooling, and refrigeration systems, within chemical processes. It is highly utilized in applications, such as automotive radiators, power plants, air conditioning, etc.

The Europe heat exchanger market was valued at USD 6.3 Billion in 2024.

IMARC estimates the Europe heat exchanger market to exhibit a CAGR of 4% during 2025-2033.

Key factors driving the Europe heat exchanger market include increasing demand for energy-efficient systems, stringent environmental regulations, growing industrial activities, advancements in heat recovery technologies, the shift towards renewable energy sources, and rising adoption in sectors like HVAC, automotive, and chemical processing, promoting energy conservation and cost reduction.

In 2024, shell & tube represented the largest segment by type, driven by its robust design and high thermal efficiency. This type is widely used in applications such as power generation, oil & gas, and chemical industries, where high pressure and temperature conditions are prevalent.

In 2024, shell & tube represented the largest segment by type, driven by its robust design and high thermal efficiency. This type is widely used in applications such as power generation, oil & gas, and chemical industries, where high pressure and temperature conditions are prevalent.

Stainless steel leads the market by material owing to its exceptional corrosion resistance, mechanical strength, and ability to withstand high temperatures. These properties make it the material of choice for heat exchangers used in harsh environments, such as chemical processing, power generation, and HVAC systems.

The chemical is the leading segment by end industry use, driven by the increasing demand for heat exchangers in chemical production, refining, and petrochemical processes. These industries require efficient thermal management solutions to maintain optimal operating conditions and ensure energy efficiency and cost savings.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, Others, wherein Germany currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)