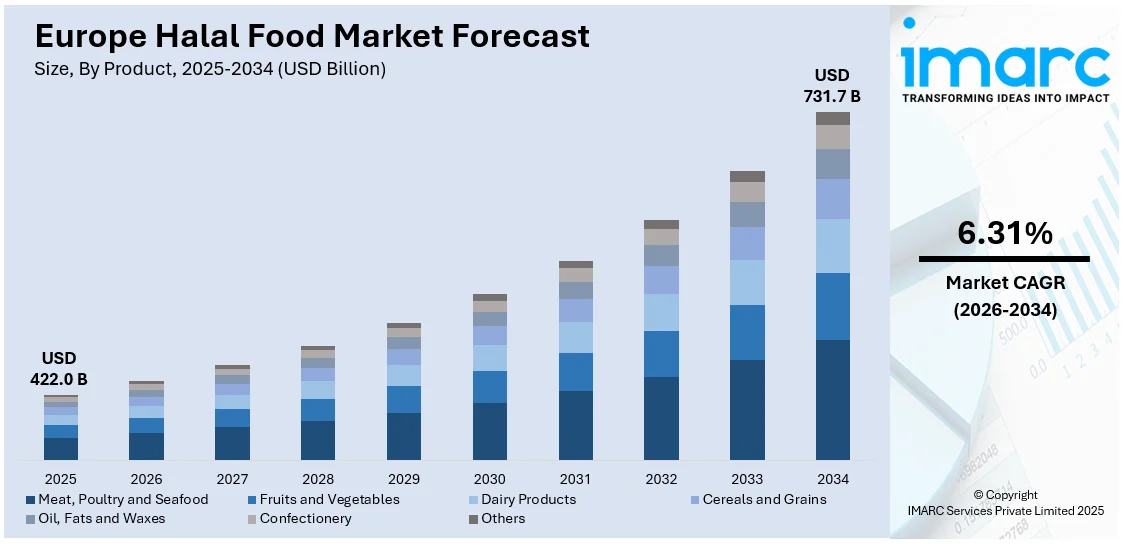

Europe Halal Food Market Report by Product (Meat, Poultry and Seafood, Fruits and Vegetables, Dairy Products, Cereals and Grains, Oil, Fats and Waxes, Confectionery, and Others), Distribution Channel (Traditional Retailers, Supermarkets and Hypermarkets, Online, and Others), and Country 2026-2034

Europe Halal Food Market Size:

The Europe halal food market size reached USD 422.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 731.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.31% during 2026-2034. The market is propelled by the growing Muslim population, increased halal certification, the rising demand for products that adhere to Islamic principles, and strong regulatory support to ensure compliance and uphold consumer faith in halal labeling.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 422.0 Billion |

|

Market Forecast in 2034

|

USD 731.7 Billion |

| Market Growth Rate 2026-2034 | 6.31% |

Europe Halal Food Market Analysis:

- Major Market Drivers: The demand for foods that follow Islamic dietary requirements is growing due to the growing number of Muslims population in Europe. Besides, the market is expanding owing to non-Muslim customers' increasing awareness and acceptance regarding halal cuisine owing to ethical and perceived health benefits.

- Key Market Trends: Halal food choices are growing beyond conventional categories to include a variety of goods including snacks, ready-to-eat meals, and organic options to reach a wider range of customers. Additionally, several developments in food processing and certification are improving the quality and accessibility of halal goods, which is driving the demand across the region.

- Competitive Landscape: The Europe halal food market is characterized by a mix of large multinational companies and smaller, specialized local producers, creating a competitive and diverse market environment. Moreover, companies are focusing on differentiating their brands through quality, authenticity, and adherence to halal standards to capture market share and build consumer trust across the region.

- Challenges and Opportunities: Challenges include navigating the complex regulatory landscape for halal certification across different European countries while potentially affecting market entry and expansion. On the other hand, the opportunity for growth in the halal food sector is due to the increasing number of halal-conscious consumers and the rising interest in halal products beyond traditional markets across the region.

Europe Halal Food Market Trends:

Growing Muslim Population and Market Demand

The Pew Research Center projects that the number of Muslims in Europe will increase from 6% in 2010 to 8% by 2030, which is a substantial shift with a significant impact on the economy. There will likely be an increase of about one-third in the Muslim population over the next 20 years. It is projected that the number of Muslims in Europe will increase from 44.1 million in 2010 to 58.2 million by 2030. This increase, especially in the food industry, indicates a growing market niche with distinct customer demands. As the Muslim population grows, the demand for halal products increases, which has to follow Islamic dietary regulations. This rising demand is catalyzing changes in the food industry, prompting more supermarkets, restaurants, and manufacturers to offer halal options. Hence, businesses are recognizing the profitability of integrating halal into their product lines, leading to a diversification in food offerings and a broader cultural acceptance of these products across Europe.

Government Regulations and Support

Various European nations implemented strong regulatory systems to ensure compliance and uphold consumer faith in halal labeling due to the increased demand for halal products. According to the Halal Accreditation Agency (HAK), France has the largest Muslim population in Western Europe, with an estimated 5.5 million Muslims or over 8% of the 66 million people living in the nation. Furthermore, the French halal market is projected to be valued at 5.5 billion euros, of which 4.5 billion are attributable to the halal food industry. Furthermore, France leads the world in halal certification with multiple organizations overseeing the rigorous inspection and certification of halal goods. These regulations ensure that the halal items on the market comply with Islamic law and strict quality standards, which is vital for fostering customer confidence. Furthermore, the halal market is officially recognized and supported, as evidenced by the existence of government-backed organizations such as the UK's Halal Monitoring Committee (HMC). Hence, this helps to standardize halal standards and fosters the expansion of the halal food business by guaranteeing that the goods are truly compliant improving local consumption and export opportunities.

The Growing Demand for Halal Food in Germany

Germany's halal food market is experiencing significant growth due to a combination of demographic changes, increased economic integration, and greater cultural diversity. The country's Muslim population has been expanding due to higher birth rates within these communities and the migration of people from predominantly Muslim countries. This demographic shift has led to a rising demand for products that comply with Islamic dietary laws. The study carried out in conjunction with the Halal Council, the halal certification body, and Lufthansa Cargo, surveyed 772 Muslims in Germany regarding the willingness of Muslims to pay higher prices for halal food. The findings indicated that almost all participants (88%), thought that halal cuisine was important or somewhat important (9%). Furthermore, 94% of respondents said they preferred halal-certified goods, and 59% said they would be willing to pay extra for food that complies with halal requirements. Additionally, German companies are expanding the range of halal-certified goods they sell due to realizing the financial potential this market presents. Therefore, this is facilitated by enhanced certification procedures and increased awareness regarding halal standards, which support customer confidence and guarantee adherence to international dietary regulations.

Europe Halal Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Breakup by Product:

To get more information on this market Request Sample

- Meat, Poultry and Seafood

- Fruits and Vegetables

- Dairy Products

- Cereals and Grains

- Oil, Fats and Waxes

- Confectionery

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes meat, poultry and seafood, fruits and vegetables, dairy products, cereals and grains, oil, fats and waxes, confectionery, and others.

Halal meat, poultry, and seafood the core products of the Europe halal food. It closely abides by Islamic law, with animal slaughter conducted in accordance with Sharia law. Additionally, the demand is mostly driven by Muslims and is popular among non-Muslims due to its perceived safety and health benefits. Some of the leading European nations with high consumption are the UK, Germany, and France. According to the Halal Monitoring Committee (HMC) the introduction of fresh meat counters, mostly certified by the HMC, in supermarkets located in UK regions with sizable Muslim populations attracts halal customers and thus contributes significantly to the growth of the halal food market in Europe.

The halal fruits and vegetables segment comprises products packaged and processed per halal standards, preventing cross-contamination with non-halal items, and are included in the halal fruits and vegetables section. Additionally, fruits and vegetables are naturally halal, still, the growing emphasis is on using pesticides and processing techniques that have received halal certification. It appeals to those who value ecological and ethical eating practices besides Muslims. Besides, fruits and vegetables with halal certification are becoming common in European supermarkets, indicating a developing market niche and favorable acceptance across the region.

Halal-certified dairy goods, such as butter, cheese, yogurt, and milk, are certified halal. These goods must be drained of non-halal additives and enzymes, which are frequently used in producing cheese. The growing demand for certified goods that ensure ethical processing and purity has led to an expansion of the halal dairy product sector in Europe. The well-established dairy sectors in nations like the Netherlands and France, which are modifying their product lines to incorporate halal-certified choices are benefiting from this market area.

Cereals and grains in the halal market involve ensuring that the products, including breads, pastas, and other grain-based foods, are free from alcohol and animal-based enzymes, which are often used in processing. This segment has seen innovative growth with the introduction of halal-certified breakfast cereals and health-focused grain products, catering to both traditional and contemporary dietary habits. The segment is growing in popularity in urban European centers, where there's a higher concentration of health-conscious consumers.

In the halal food sector, oils, fats, and waxes need certification to ensure they contain no pork-derived substances and are processed on clean, contamination-free lines. This segment caters to a niche but essential market, focusing on products like cooking oils, ghee, and margarine. Manufacturers are increasingly transparent about their processing and sourcing, helping to drive growth in regions with significant Muslim populations, such as the Balkans and parts of Eastern Europe.

The confectionery segment within the halal market includes sweets, chocolates, and other treats that are free from haram (prohibited) ingredients like gelatin from non-halal sources and certain types of emulsifiers. This market is particularly sensitive to consumer demands for ingredient transparency. The popularity of halal confectionery is rising rapidly, particularly in cosmopolitan areas with diverse populations, reflecting broader trends toward inclusive product offerings.

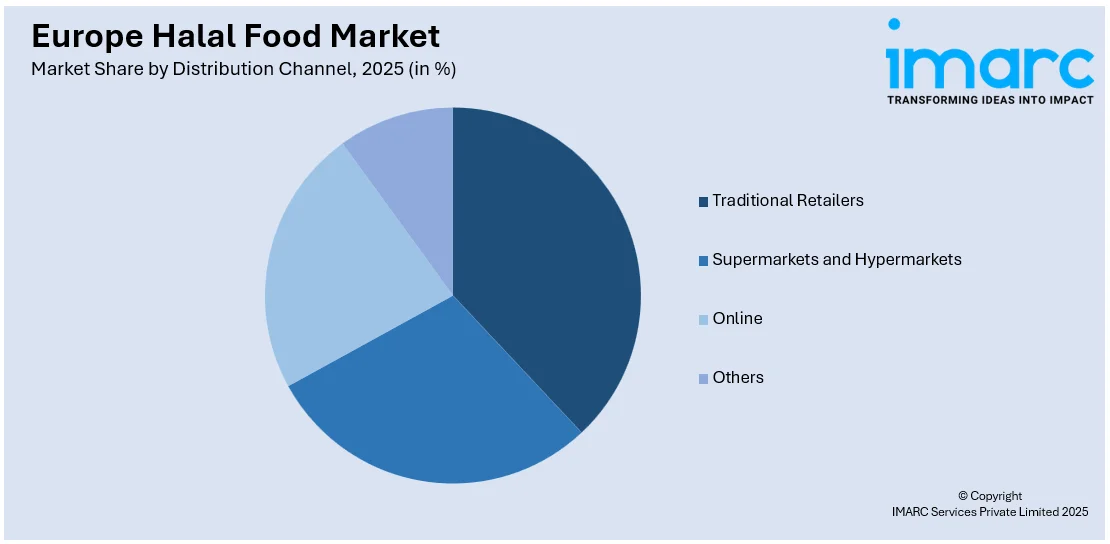

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Traditional Retailers

- Supermarkets and Hypermarkets

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes traditional retailers, supermarkets and hypermarkets, online, and others.

Traditional retailers form a foundational pillar in the distribution of halal food across Europe, catering primarily to local populations in specific neighborhoods. These outlets, often small, independently owned shops or butcheries, have a longstanding presence in communities with significant Muslim populations. They are deeply trusted by consumers for providing halal-certified products adhering strictly to Islamic dietary laws. These retailers benefit from direct and personal relationships with their customers, offering tailored services and understanding unique consumer needs, which is often lacking in larger retail formats. At present, traditional retailers remain crucial, especially in areas where supermarkets and hypermarkets are less prevalent, ensuring the availability of halal products tailored to meet localized consumer preferences.

Supermarkets and hypermarkets hold significant position in the European halal food market, reflecting broader trends in retail consolidation and consumer preference for one-stop shopping solutions. These larger retailers are expanding their halal offerings to cater to the diverse, multicultural European consumer base. These entities address a dual objective, satisfying the needs of Muslim consumers and attracting non-Muslim customers curious about halal products by incorporating dedicated halal sections or even entire aisles. Moreover, the scale of supermarkets and hypermarkets allows them to leverage economies of scale, thus reducing prices and making halal food more accessible to a broader audience. Furthermore, these retailers often have more resources to invest in marketing and in-store promotions, further increasing the visibility of their halal product ranges. For instance, Tahira Foods Limited is the leading producer and distributor of Halal foods in Europe which is composed of depots, cold stores, and a fleet of delivery vans across Europe. Tahira products are also distributed through independent wholesalers and can be predominantly found in nationwide supermarkets named on their stock lists and local ethnic stores.

The online distribution channel for halal food in Europe is witnessing rapid growth, driven by the broader global trend towards e-commerce that has been accelerated by the COVID-19 pandemic. It offers consumers unparalleled convenience, a wider selection, and often more competitive pricing. Online platforms range from large e-commerce sites offering various products to specialized online stores focused solely on halal foods. These platforms cater to tech-savvy, younger consumers who value the ease of browsing and purchasing products from the comfort of their homes. Moreover, the key opportunities include building and maintaining trust regarding the halal certification and quality of food products, as consumers cannot physically inspect products before purchase. It is likely to continue growing as logistics and delivery systems improve and as consumer confidence in online shopping strengthens, thus contributing to Europe halal food market growth.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major markets in the region, which include Germany, France, the United Kingdom, Italy, Spain, and others.

According to the Europe halal food market forecast, Germany has emerged as a significant market for halal food, driven by its substantial Muslim population, which includes both permanent residents and a growing number of immigrants. The country’s halal market is not only bolstered by consumer demand but also supported by a well-structured distribution network that includes halal-certified butchers, supermarkets, and restaurants. German consumers exhibit a high level of awareness and acceptance of halal products, partly due to the country’s strong emphasis on consumer rights and food safety. This has encouraged more manufacturers to consider halal certification to cater to this segment, aligning with global food trends. Additionally, Germany's central location in Europe makes it an important hub for the distribution of halal products throughout the continent.

In France, the halal food market is among the largest in Europe, reflective of France's having the highest Muslim population in Western Europe. The French halal market is characterized by a high demand for halal meat and poultry, underpinned by strong cultural preferences for fresh, quality food. Despite some public and political controversy around halal certification, the market has grown consistently, spurred by both domestic consumption and export opportunities. French supermarkets and hypermarkets increasingly stock halal products, which highlights the mainstream acceptance of these items. Moreover, France’s culinary reputation offers a unique position for the development and export of premium halal products, including gourmet offerings.

The United Kingdom's halal food market is diverse, with a significant number of halal-certified dining establishments, food services, and retail options. This variety reflects the multicultural makeup of the UK, particularly in urban areas like London, Birmingham, and Manchester. Additionally, British consumers, Muslim and non-Muslim, are increasingly health-conscious and ethical in their food choices, which boosts the appeal of halal products. Moreover, the UK is also a leader in innovative halal services, such as online halal food delivery and e-commerce, which have expanded the reach and convenience of halal food shopping. For instance, Chicken Cottage, the popular UK-based chain known for its halal fried and grilled chicken, has unveiled a bold expansion strategy aimed at increasing its national presence. The company plans to open 20 new stores within the next two years, reinforcing its status as a prominent fast-food brand in Britain. This expansion follows the recent openings in Watford, Edmonton, Teddington, and Longsight, increasing the total number of locations to 51, including Orpington.

Italy’s halal food market is growing, driven primarily by the increasing Muslim tourist influx and Italy’s historic strength in food production and export. Italian manufacturers are beginning to see the value in obtaining halal certification to access not only domestic markets but also lucrative Middle Eastern and North African regions. The Italian market offers a unique segment of halal-certified Mediterranean products, including olive oil, pasta, and confectioneries, which appeal to health-conscious consumers seeking quality and authenticity. The challenge lies in integrating halal certification processes with traditional Italian food practices, ensuring that they meet both local culinary standards and international halal compliance.

Spain has a developing halal food market that benefits significantly from its historical and cultural ties to Islamic countries. The Spanish halal market is particularly noted for its meat products, with a strong emphasis on the export of halal-certified poultry and red meat to Muslim-majority countries. Spain's strategic geographic location serves as a gateway for halal products to both Europe and North Africa. Additionally, Spain is focusing on promoting halal tourism, which includes offering halal food options, thus broadening the market. The Spanish halal certification bodies are also gaining international recognition, which helps local producers penetrate foreign markets more effectively.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market.

- At present, key players in the market are actively strengthening market growth through several strategic initiatives. Additionally, companies are focusing on securing robust halal certification to ensure product authenticity and build consumer trust, a crucial aspect in attracting a discerning customer base. There is an emphasis on partnerships and collaborations with local distributors to enhance market reach and streamline supply chains. Moreover, several innovations in product development, particularly in creating diverse food offerings that appeal to both Muslim and non-Muslim consumers are also contributing to the market growth. Furthermore, businesses are investing in marketing and educational campaigns to raise awareness about the benefits of halal products, thereby broadening their consumer appeal and driving market expansion.

Europe Halal Food Market News:

- In November 2023, United Kingdom (UK) Halal Expo London 2023 announces partnership with Halal Products Development Company (HPDC). Halal Products Development Company (HPDC) is dedicated to establishing a robust ecosystem for halal products within Saudi Arabia and globally. It fosters the development of halal products through investments, equity capital, and halal certification advisory services, collaborating with local and international partners.

- In October 2023, World Halal Business Conference (WHBC Circuit) 2023, an esteemed industry event organized by Halal Development Corporation Berhad (HDC), is set to expand to the UK to boost halal industries. WHBC broadened its international reach following a successful event in Australia last year. WHBC debuted in London, United Kingdom, from October 27th to 28th, 2023. It was hosted by the Ministry of Investment, Trade, and Industry (MITI) and organized by HDC. WHBC Circuit 2023 London aims to stimulate the growth of halal industries in Malaysia, the United Kingdom, and the European Union.

Europe Halal Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Meat, Poultry and Seafood, Fruits and Vegetables, Dairy Products, Cereals and Grains, Oil, Fats and Waxes, Confectionery, Others |

| Distribution Channels Covered | Traditional Retailers, Supermarkets and Hypermarkets, Online, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe halal food market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Europe halal food market?

- What is the breakup of the Europe halal food market on the basis of product?

- What is the breakup of the Europe halal food market on the basis of distribution channel?

- What are the various stages in the value chain of the Europe halal food market?

- What are the key driving factors and challenges in the Europe halal food market?

- What is the structure of the Europe halal food market, and who are the key players?

- What is the degree of competition in the Europe halal food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe halal food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe halal food market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe halal food industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)