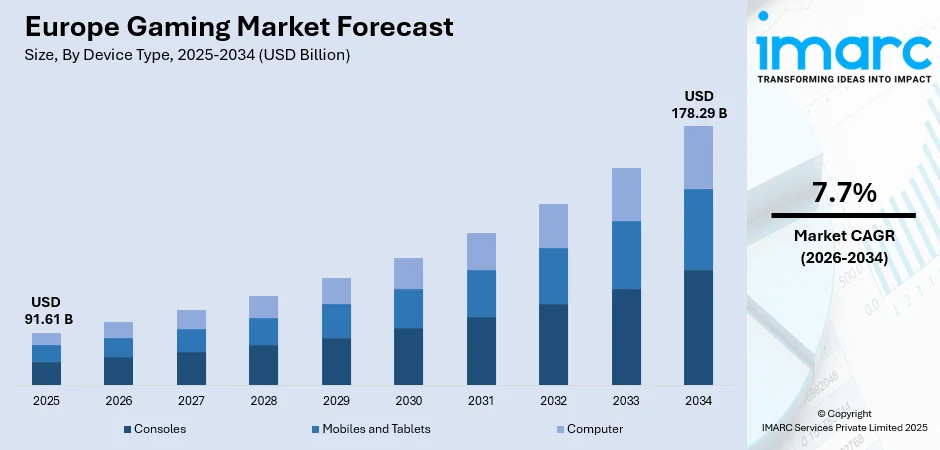

Europe Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Country, 2026-2034

Europe Gaming Market Summary:

The Europe gaming market size was valued at USD 91.61 Billion in 2025 and is projected to reach USD 178.29 Billion by 2034, growing at a compound annual growth rate of 7.7% from 2026-2034.

The market is driven by widespread smartphone adoption, enhanced internet connectivity, and rising consumer interest in interactive digital entertainment across diverse demographics. The proliferation of subscription-based gaming services and cloud gaming platforms has significantly expanded accessibility. Additionally, the growing esports ecosystem and increasing engagement with immersive technologies continue to accelerate market expansion. Europe represents a substantial portion of the global gaming market share.

Key Takeaways and Insights:

-

By Device Type: Mobiles and tablets dominate the market with a share of 51.45% in 2025, driven by affordable smartphones, improved internet infrastructure, and the convenience of gaming anywhere for on-the-go entertainment.

-

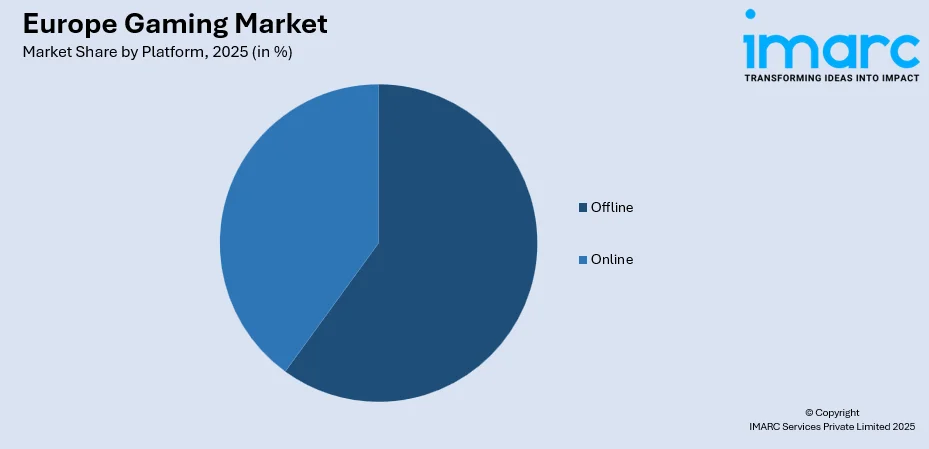

By Platform: Offline leads the market with a share of 53.62% in 2025, owing to preferences for downloadable content, single-player experiences, and gaming without internet dependency, especially in regions with inconsistent connectivity.

-

By Revenue Type: In-game purchase represents the largest segment with a market share of 63.47% in 2025, driven by free-to-play models monetizing through cosmetic items, virtual currencies, season passes, and expansions that encourage continuous player spending.

-

By Type: Adventure/role playing games dominate the market with a share of 41.18% in 2025, owing to European gamers’ preference for narrative-driven experiences, character progression, and expansive open-world environments offering immersive engagement.

-

By Age Group: Adult represents the largest segment with a market share of 75.15% in 2025, driven by higher disposable income, mature gaming preferences, and mainstream acceptance of gaming among working professionals seeking entertainment and social engagement

-

By Country: Germany leads the market with a share of 31% in 2025, owing to its large population, strong digital infrastructure, high consumer spending, and vibrant gaming culture supported by events, conventions, and active community engagement.

-

Key Players: The Europe gaming market shows a moderately consolidated landscape, where established publishers and emerging independent studios compete, actively pursuing strategic partnerships, content diversification, and technological innovations to enhance market position and expand their consumer base across platforms. Some of the key players operating in the market include CD Projekt S.A., Embracer Group, Enad Global 7 AB (publ), Focus Entertainment, Gameloft SE, Keywords Studios Plc, Nacon, Paradox Interactive AB, Thunderful Group AB, and Ubisoft Entertainment SA.

To get more information on this market Request Sample

The Europe gaming market is experiencing robust growth driven by multiple interconnected factors that collectively enhance the gaming ecosystem across the region. The widespread penetration of high-speed internet infrastructure, including extensive fiber optic networks and advanced mobile connectivity, has created an optimal environment for seamless gaming experiences. Additionally, the cultural shift towards recognizing gaming as a legitimate form of entertainment and social interaction has expanded the demographic appeal beyond traditional gaming audiences. The emergence of cloud gaming services has democratized access to premium gaming experiences, eliminating the need for expensive hardware investments. As per sources, in August 2025, Samsung expanded its mobile cloud gaming platform to Europe, starting with the UK and Germany, giving Galaxy users instant access to premium mobile games without downloads. Furthermore, the region's strong developer community continues to produce innovative content that resonates with diverse consumer preferences, while supportive government policies and cultural recognition programs have elevated the industry's standing and attracted sustained investment.

Europe Gaming Market Trends:

Rise of Cloud Gaming and Subscription Services

The Europe gaming market is witnessing a significant transformation with the proliferation of cloud gaming platforms and subscription-based services that offer instant access to extensive game libraries. This trend is fundamentally changing how consumers access and consume gaming content by eliminating traditional barriers such as expensive hardware requirements and large storage needs. In March 2025, Amazon Luna expanded its cloud gaming service to Sweden, Portugal, Belgium, and Luxembourg, partnering with Electronic Arts to bring EA games to European players across multiple devices. Moreover, gamers can now stream high-quality titles across multiple devices including smartphones, tablets, and smart televisions, enabling seamless cross-platform experiences.

Growth of Esports and Competitive Gaming

Competitive gaming and esports have emerged as powerful cultural phenomena across Europe, transforming video games from casual entertainment into professional sporting events with dedicated infrastructure and passionate fan communities. Major cities across the continent now host prestigious tournaments that attract substantial viewership both online and in dedicated arenas, creating new career pathways for professional players, coaches, and content creators. The integration of esports into mainstream entertainment has attracted significant investment in training facilities, broadcasting infrastructure, and collegiate programs.

Integration of Immersive Technologies

European gaming is increasingly incorporating immersive technologies such as virtual reality, augmented reality, and mixed reality experiences that fundamentally transform player engagement and interaction paradigms. These technologies enable unprecedented levels of immersion by placing players directly within game environments and creating interactive experiences that blur the boundaries between digital and physical worlds. Hardware advancements have made these technologies more accessible and comfortable for extended gaming sessions, while developers continue creating compelling content specifically designed for immersive platforms. According to sources, AWE and Stereopsia announced United XR Europe, in Brussels, uniting Europe’s XR industry and showcasing next-generation immersive gaming innovations.

Market Outlook 2026-2034:

The Europe gaming market is poised for substantial revenue growth throughout the forecast period, driven by continuous technological innovation and expanding consumer engagement across all demographics. Revenue expansion will be supported by increasing monetization through in-game purchases, subscription services, and advertising integrations within gaming platforms. The market will benefit from ongoing infrastructure investments that enhance connectivity and accessibility while the cultural normalization of gaming drives adoption among previously underrepresented demographic segments. The market generated a revenue of USD 91.61 Billion in 2025 and is projected to reach a revenue of USD 178.29 Billion by 2034, growing at a compound annual growth rate of 7.7% from 2026-2034.

Europe Gaming Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Device Type |

Mobiles and Tablets |

51.45% |

|

Platform |

Offline |

53.62% |

|

Revenue Type |

In-Game Purchase |

63.47% |

|

Type |

Adventure/Role Playing Games |

41.18% |

|

Age Group |

Adult |

75.15% |

|

Country |

Germany |

31% |

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computer

Mobiles and tablets dominate with a market share of 51.45% of the total Europe gaming market in 2025.

The mobile and tablets maintain its dominant position in the Europe gaming market, driven by the ubiquitous presence of smartphones across all demographic groups and the continuous improvement in mobile processing capabilities. As per sources, in December 2025, AviaGames established a new mobile gaming subsidiary in Hamburg, Germany, to expand its mobile titles and strengthen presence across European smartphones and tablets. Moreover, modern smartphones deliver gaming experiences that rival traditional gaming platforms, featuring high-resolution displays, powerful processors, and extended battery life. The convenience of mobile gaming allows consumers to engage with entertainment content during commutes, breaks, and leisure moments, maximizing engagement opportunities throughout daily routines.

The proliferation of free-to-play titles with an optional in-game purchases has significantly lowered the entry barriers, attracting casual gamers who might otherwise avoid traditional gaming platforms. Mobile games increasingly feature social integration, multiplayer functionality, and cross-platform compatibility that enhance community building and sustained engagement. App store ecosystems provide efficient discovery and distribution mechanisms that benefit both established publishers and independent developers seeking to reach European audiences with innovative gaming concepts.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 53.62% of the total Europe gaming market in 2025.

Offline dominates the Europe gaming market, reflecting consumer preferences for downloadable content and gaming experiences that do not require continuous internet connectivity. As per sources, EA Sports FC 25 led physical game sales across Europe, followed by Assassin’s Creed Shadows and Minecraft, with Nintendo games topping charts in Germany and Austria, based on GfK Entertainment data. Moreover, this segment encompasses single-player campaigns, story-driven adventures, and games designed for immersive solo experiences that remain popular among European gamers seeking meaningful narrative engagement. The offline model provides reliability and consistency, allowing players to enjoy uninterrupted gaming sessions regardless of network conditions.

Purchasing games offline and downloading patterns continue to dominate the consumer behavior, particularly for premium titles that offer substantial single-player content and replay the ability value. Players appreciate the ability to access their gaming libraries without dependency on server availability or internet bandwidth, ensuring consistent experiences across varying connectivity environments. The segment benefits from consumer trust in ownership models where purchased content remains permanently accessible regardless of external service conditions.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

In-game purchase exhibits a clear dominance with a 63.47% share of the total Europe gaming market in 2025.

In-game purchase represents the dominant revenue generation mechanism in the Europe gaming market, driven by the widespread adoption of free-to-play business models across mobile, console, and computer platforms. According to sources, in Q3 2025, Europe’s leading free-to-play games generated significant in-game purchase revenue, with Clash Royale peaking at $7.8M weekly, Coin Master at $9.7M, and Royal Match at $7.1M. Further, this monetization approach allows players to access core gaming experiences without upfront costs while offering optional purchases for cosmetic items, virtual currencies, expansion content, and gameplay enhancements. The model has proven highly effective in maximizing player acquisition while generating sustained revenue through engaged communities.

Publishers are continuously optimizing in-game purchase strategies to enhance player value while preserving fair and competitive gameplay experiences. By avoiding pay-to-win mechanics, developers maintain player trust and long-term engagement. Monetization tools such as season passes, battle passes, and limited-time content releases help sustain ongoing interaction and generate recurring revenue streams. Additionally, extensive personalization and customization options enable players to express individual identities within gaming communities, encouraging voluntary spending among highly engaged users and strengthening overall monetization efficiency.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure/role playing games lead with a market share of 41.18% of the total Europe gaming market in 2025.

Adventure/role-playing games dominates the Europe gaming market due to strong player interest in narrative-driven content, character progression systems, and expansive game worlds. European gamers favor story-rich experiences offering meaningful choices, emotional engagement, and prolonged gameplay spanning dozens of hours. The genre’s emphasis on exploration, discovery, and progression mechanics aligns with regional appreciation for complexity, depth, and immersive storytelling, making these games highly popular across diverse demographics and driving their dominant market share in Europe’s gaming ecosystem.

Adventure/role-playing games are sustained by active modding communities that extend gameplay longevity and provide personalized experiences for players. The genre supports both immersive single-player campaigns and collaborative multiplayer modes, accommodating varied preferences. European developers have earned strong reputations by producing critically acclaimed titles that appeal to global audiences while resonating with regional players. Their innovative mechanics, richly designed worlds, and interactive content foster engagement, enhance replay value, and contribute to the enduring popularity of adventure and role-playing games.

Age Group Insights:

- Adult

- Children

Adult exhibits a clear dominance with 75.15% share of the total Europe gaming market in 2025.

Adult dominates the Europe gaming market, reflecting the maturation of gaming demographics as early adopters have carried their gaming habits into adulthood while new adult consumers increasingly embrace gaming as primary entertainment. According to reports, adults accounted for 75% of video game players in Europe, with an average age of 31.4, highlighting the dominance of mature demographics in the gaming market. Moreover, adult gamers possess higher disposable incomes enabling premium purchases, subscription services, and in-game spending that drives market revenue. Professional responsibilities and limited leisure time have shaped preferences for accessible, flexible gaming experiences.

Gaming among adults is widely recognized as legitimate entertainment, comparable to film, television, and music. This demographic’s diverse interests drive preferences across genres, from casual mobile games to complex strategy and competitive multiplayer titles. Social gaming features allow adults to stay connected with friends and family across distances, enhancing social interaction. These elements provide added value, supporting engagement and reinforcing gaming as a meaningful leisure activity within busy professional and personal lifestyles.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany dominates with a market share of 31% of the total Europe gaming market in 2025.

Germany is leading in Europe gaming market, driven by a large population, robust economic conditions, and a deeply ingrained gaming culture. The country’s advanced digital infrastructure ensures widespread high-speed internet access, supporting online gaming, content downloads, and streaming services. German consumers exhibit sophisticated gaming preferences across multiple platforms and genres while maintaining high spending levels. These factors collectively reinforce Germany’s dominant position in Europe’s gaming market and contribute to sustained industry growth.

Germany gaming ecosystem thrives through numerous industry events, conventions, and community gatherings that enhance engagement and foster development. Strong domestic studios contribute to both local content creation and global gaming production, while employment opportunities attract international talent. Government recognition of gaming’s cultural and economic importance has led to supportive policies that encourage innovation, investment, and market expansion. These combined efforts strengthen Germany’s position as a hub for gaming, nurturing both industry growth and sustained consumer interest.

Market Dynamics:

Growth Drivers:

Why is the Europe Gaming Market Growing?

Expansion of Digital Infrastructure and Connectivity

The continuous expansion and improvement of digital infrastructure across Europe serves as a fundamental driver of gaming market growth by enabling seamless access to online gaming services, cloud platforms, and digital distribution channels. Investment in fiber optic networks and advanced mobile connectivity has dramatically increased internet speeds and reduced latency, creating optimal conditions for multiplayer gaming and streaming services. As per sources, in April 2025, ING and UniCredit provided EUR 200 mln financing to expand and modernize Digi Group’s fiber-optic networks in Spain, Portugal, and Belgium, enhancing broadband infrastructure across Europe. Furthermore, this infrastructure development extends beyond major urban centers to reach suburban and rural populations, expanding the addressable market for gaming services. Enhanced connectivity supports the proliferation of cloud gaming platforms that deliver premium experiences without expensive hardware requirements. The reliability and consistency of modern networks encourage adoption of always-connected gaming experiences that maintain engagement through social features and live content updates.

Cultural Acceptance and Mainstream Recognition

The progressive recognition of gaming as legitimate cultural expression and mainstream entertainment has significantly expanded the European gaming audience beyond traditional demographics. According to reports, the Council of the European Union approved conclusions to enhance the cultural and creative dimension of the European video games sector, recognizing gaming as integral to European culture and creativity. Further, institutional acknowledgment through cultural programs, educational initiatives, and media coverage has elevated gaming's status alongside established entertainment forms. This cultural shift has removed social stigmas that previously limited gaming adoption among certain demographic segments, enabling broader market penetration. Gaming has become an accepted social activity that facilitates connection and community building across age groups and backgrounds. The normalization of gaming careers, esports professionalism, and content creation has created aspirational pathways that sustain youth engagement while demonstrating gaming's economic and cultural value to skeptical observers.

Technological Innovation and Immersive Experiences

Continuous technological advancement drives gaming market growth by delivering increasingly sophisticated, engaging, and immersive experiences that attract new consumers and retain existing players. Hardware improvements across consoles, computers, and mobile devices enable visual fidelity, performance, and interactive capabilities that were previously impossible, creating compelling reasons for consumers to engage with modern gaming content. Innovation in virtual reality, augmented reality, and mixed reality technologies opens new experiential dimensions that differentiate gaming from traditional entertainment options. Artificial intelligence advancements enhance game design through improved non-player character behaviours, procedural content generation, and personalized experiences. These technological developments create cyclical upgrade patterns as consumers seek access to cutting-edge experiences, supporting sustained market investment and revenue growth.

Market Restraints:

What Challenges the Europe Gaming Market is Facing?

Regulatory Complexity and Compliance Requirements

The Europe gaming market faces significant restraints from complex and sometimes inconsistent regulatory frameworks across different national jurisdictions. Content rating systems, data protection requirements, and consumer protection regulations vary between countries, creating compliance burdens for publishers and developers seeking pan-European distribution. Age verification requirements, content restrictions, and monetization regulations add operational complexity that can delay releases and increase development costs.

Economic Pressures and Consumer Spending Constraints

Economic conditions including inflationary pressures and cost-of-living concerns impact discretionary spending on entertainment products including gaming hardware, software, and services. Premium gaming experiences requiring substantial hardware investments face sensitivity to economic conditions as consumers prioritize essential expenditures. Regional economic disparities create uneven market conditions across European territories with varying purchasing power and spending willingness.

Competition for Consumer Attention and Time

Gaming competes intensely with expanding entertainment options including streaming video services, social media platforms, and other digital content that vie for limited consumer attention and leisure time. The proliferation of entertainment choices creates fragmentation that can limit gaming engagement particularly among casual users with diverse entertainment preferences. Time constraints from professional and personal obligations restrict gaming sessions, favoring quick-play mobile experiences over extended console or computer gaming.

Competitive Landscape:

The Europe gaming market exhibits a dynamic competitive landscape characterized by diverse participants ranging from global publishers to regional studios and independent developers. Market participants compete across multiple dimensions including content quality, technological innovation, platform accessibility, and monetization strategies. Established publishers leverage extensive intellectual property portfolios and distribution networks while independent studios differentiate through creative innovation and niche market focus. The competitive environment encourages strategic partnerships, licensing agreements, and cross-platform publishing strategies that maximize content reach and revenue potential. Market participants increasingly emphasize service-based models with ongoing content updates and community engagement that sustain player retention.

Some of the key players include:

- CD Projekt S.A.

- Embracer Group

- Enad Global 7 AB (publ)

- Focus Entertainment

- Gameloft SE

- Keywords Studios Plc

- Nacon

- Paradox Interactive AB

- Thunderful Group AB

- Ubisoft Entertainment SA

Recent Developments:

-

In January 2025, Epic Games enhanced its mobile Epic Games Store by introducing nearly 20 third-party titles, launching a Free Games program on Android globally and iOS within the European Union, and adding new app features. This initiative strengthened mobile game distribution, developer participation, and consumer access across Europe’s gaming ecosystem.

Europe Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computer |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | CD Projekt S.A., Embracer Group, Enad Global 7 AB (publ), Focus Entertainment, Gameloft SE, Keywords Studios Plc, Nacon, Paradox Interactive AB, Thunderful Group AB, Ubisoft Entertainment SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe gaming market size was valued at USD 91.61 Billion in 2025.

The Europe gaming market is expected to grow at a compound annual growth rate of 7.7% from 2026-2034 to reach USD 178.29 Billion by 2034.

The mobiles and tablets held the largest Europe gaming market share, driven by widespread availability of affordable smartphones, improved mobile internet infrastructure, and the convenience of gaming on portable, on-the-go devices.

Key factors driving the Europe gaming market include expanding digital infrastructure and high-speed internet connectivity, growing cultural acceptance of gaming as mainstream entertainment, technological innovations in immersive experiences, and the proliferation of subscription-based and cloud gaming services.

Major challenges include complex regulatory frameworks across different jurisdictions, economic pressures impacting consumer discretionary spending, intense competition from alternative entertainment platforms, content compliance requirements, and talent acquisition competition from global technology sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)