Europe Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End-Use, and Country, 2026-2034

Europe Furniture Market Size and Share:

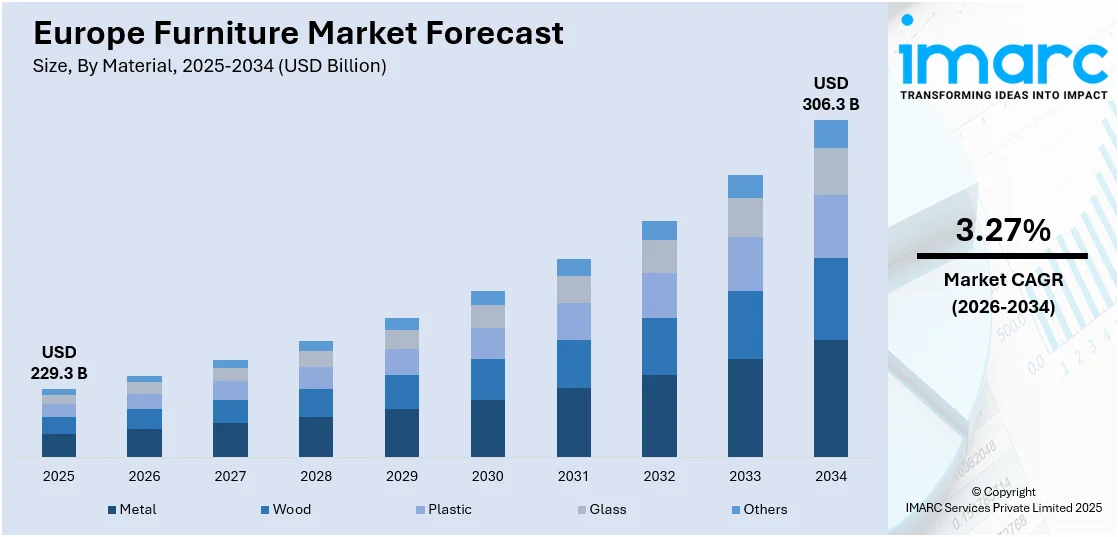

The Europe furniture market size was valued at USD 229.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 306.3 Billion by 2034, exhibiting a CAGR of 3.27% from 2026-2034. The market is witnessing significant growth due to the bolstering need for sustainable and eco-friendly furniture and the expansion of e-commerce and digitalization in furniture retail. Moreover, the escalating demand for modular and multifunctional furniture, rising demand for luxury and premium furniture, and Scandinavian and minimalist design are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 229.3 Billion |

| Market Forecast in 2034 | USD 306.3 Billion |

| Market Growth Rate (2026-2034) | 3.27% |

The European furniture market is witnessing substantial expansion fueled by magnifying customer shift towards sustainable and environmentally friendly products. Stringent policies, like the European Green Deal and Circular Economy Action Plan, are pushing manufacturers to adopt eco-conscious practices, including the use of non-toxic finishes, approved sustainable wood, and recycled materials. Consumers are increasingly prioritizing furniture made from responsibly sourced raw materials, coupled with energy-efficient manufacturing processes. The rising adoption of circular economy principles, including furniture refurbishing, rental models, and recycling initiatives, is further shaping market dynamics. Companies investing in sustainability certifications, like FSC (Forest Stewardship Council) and PEFC (Program for the Endorsement of Forest Certification), are gaining a competitive advantage as environmental awareness continues to influence purchasing decisions. For instance, in Jan

To get more information on this market Request Sample

The rapid expansion of online furniture retail platforms is transforming the European market by enhancing accessibility and consumer convenience. E-commerce players are leveraging virtual reality (VR) and augmented reality (AR) technologies to provide immersive shopping experiences, enabling consumers to visualize furniture placement in real time. For instance, in October 2024, Ikea reported increased foot traffic, with in-store visits rising 3% and online visits up 28% from the previous year. It also expanded its presence by opening 43 new stores. Moreover, AI-driven personalization, improved supply chain logistics, and direct-to-consumer (DTC) models are streamlining purchasing processes, reducing costs, and increasing product variety. The shift toward omnichannel retail strategies, including seamless online-to-offline integration, is further strengthening customer engagement. With rising internet penetration and digital adoption, furniture brands investing in digital transformation are witnessing stronger sales growth and brand loyalty.

Europe Furniture Market Trends:

Growing Demand for Modular and Multifunctional Furniture

Rising urbanization and shrinking living spaces are fueling requirement for modular and multifunctional furniture across Europe. For instance, as per a research article published in July 2024, Europe is one of the intensely urbanized region globally, with approximately 5% of its land being allotted for urban utilization. As a result, consumers seek space-efficient solutions such as extendable dining tables, sofa beds, and stackable storage units to maximize functionality. Smart furniture, incorporating built-in technology like wireless charging and adjustable settings, is also gaining popularity. Manufacturers are prioritizing customizable and flexible designs to cater to changing lifestyle needs, particularly among young urban dwellers and remote workers. This trend is driving innovation in furniture design, positioning modular solutions as a key growth segment in the market.

Rising Demand for Luxury and Premium Furniture

The European furniture market is witnessing a growing demand for high-end, premium furniture driven by increasing disposable income, evolving lifestyle preferences, and a strong focus on aesthetics. For instance, as per European Commission, gross disposable incomes (household) elevated by 0.9% in the European Union during Q3 2024. Consumers are seeking high-quality, handcrafted, and designer furniture made from premium materials such as solid wood, leather, and marble. The demand is particularly strong in markets like Germany, France, and Italy, where heritage brands and luxury craftsmanship hold significant appeal. Additionally, the trend of personalization and bespoke furniture solutions is gaining momentum, with consumers willing to invest in custom-made pieces that reflect their unique tastes. Premium furniture brands are leveraging digital marketing, exclusive showrooms, and collaborations with interior designers to enhance their market positioning.

Influence of Scandinavian and Minimalist Design Aesthetics

Scandinavian and minimalist design principles continue to shape European furniture trends, emphasizing simplicity, functionality, and timeless appeal. Consumers prefer furniture with clean lines, neutral color palettes, and multifunctional features that complement modern and urban living spaces. The growing inclination toward decluttered, well-organized interiors is fueling demand for furniture that combines practicality with aesthetic minimalism. For instance, in 2024, B&B Italia expanded its outdoor collection for furniture with designs by Mario Bellini, Monica Armani, and Barber Osgerby, featuring new products and extensions, showcased at Solo House, Matarraña, Spain. Additionally, the preference for natural materials, such as oak, linen, and wool, aligns with this design philosophy, reinforcing a connection with sustainability. Leading brands are expanding product lines inspired by Scandinavian and Japandi styles, catering to consumers who prioritize both design and functionality in their furniture choices.

Europe Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe furniture market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on material, distribution channel, and end-use.

Analysis by Material:

- Metal

- Wood

- Plastic

- Glass

- Others

Metal furniture is a common choice for both commercial and residential settings in Europe because of its strength, modern appearance, and maintenance ease. Besides, metal is commonly used when designing contemporary furniture, encompassing minimalist frames for chairs and tables, and outdoor furniture due to its strength. Advancements in design and utility continue to fuel this industry: today's consumers require furniture that is both fashionable and utilitarian.

With durability, aesthetics, and versatility, wood continues to reign as a material of choice in the European interiors market. Increasing consumer interest in natural products and sustainability adds to the requirement for wooden furniture. Associated with this, an increasing market for the consumption of environmentally safe furniture amongst European customers has led to an increasing use of organic materials and wood that is sustainably grown. This market has benefitted from the long-standing traditions of European craftsmanship, which enhances the attractiveness of fine wooden furniture.

Plastic furniture is a great fit for customers who seek lightweight and affordable furniture that can easily be of their choice. Aside from plastics being affordable and easily moldable, the latest developments in plastics composites are: adding strength and good looks to plastic furniture; positively impacting market growth. With growing European environmental consciousness, the increasing focus on environmentally friendly and recyclable plastics is a valid point.

Glass furniture, valued for its aesthetic appeal, gives a sleek and modern feel to a room. This category offers decorative items, shelving units, and glass tabletops. It is, however, often combined with other materials to offer stability and style, such as metal or wood. In addition, glass furniture is transparent, thus offering a sense of space and airiness to all interiors, residential or commercial, which is an advantageous factor for the outlook of the Europe furniture market.

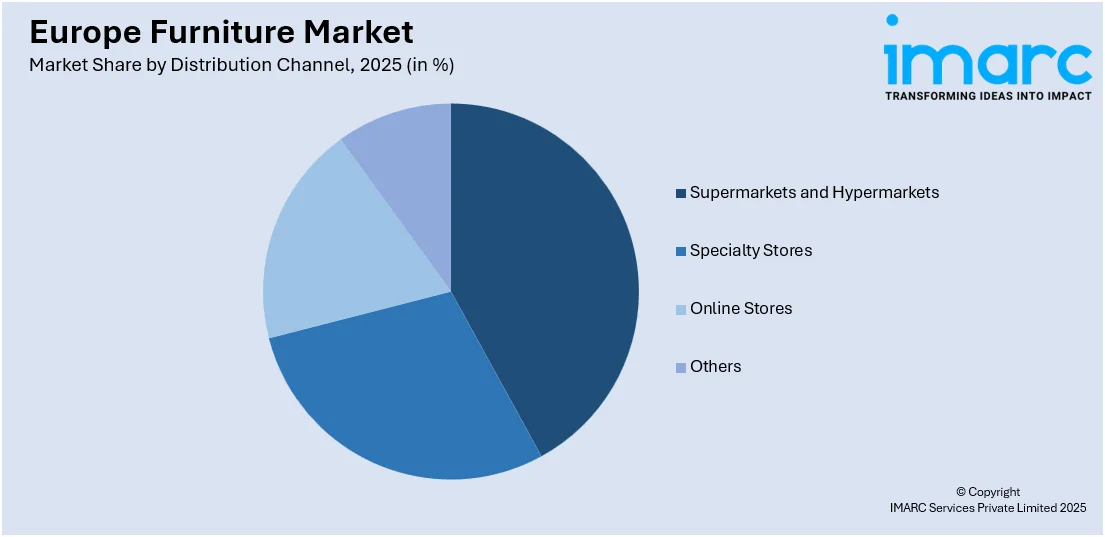

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets stock a limited range of furniture, mainly at affordable prices; most furniture pieces found are light and small. They are targeted at people who want good prices and convenience. The furniture range encompasses flat-pack, smaller furniture options, which fit with the usual patron purchasing patterns that frequent such stores for general purchases.

Specialty stores generally have products along the spectrum. The specialty furniture stores offer many highly tailored services: custom options, interior design advice, and possibly even home delivery and installation. Further, higher-end specialty stores seem to be targeted toward that customer seeking quality-grade furnishings or specific designs that might not be found in regular retail outlets; this serves to promote market growth.

Online retailers are generally offering easy direct home delivery, coupled with a large assortment of furniture, at cheaper prices. The platforms are targeted at the consumer base that is tech-savvy and places much value on variety, convenience, and home shopping. This segment's growth has also been facilitated by the expansion of digital payment systems, increased customer confidence in online purchasing, and improvements in logistics.

Analysis by End Use:

- Residential

- Commercial

The residential market for European home furniture is impacted by a very beautiful design tradition that has nourished strong desire into consumers for good-looking and quality furniture. The category ranges from couches to mattresses to storage options including cupboards and closets. With more people having smaller homes and hence urban living conditions the trend towards multipurpose and space-saving furniture is growing. Another big penetration in the industry is due to sustainability trends, with the demand for eco-friendly furniture on the rise.

Commercial furniture on the European market is furniture that is used for business landscapes such as retail, offices, or hospitality. Such market is exhibited by both functional and durable furniture to meet the requirements of contemporary business operations. In designing office furniture, much emphasis is given to ergonomic design and furniture comfort in enhancing productivity in the workplace. With its strong tourism sector, the hospitality industry demands exquisitely looking yet sturdy furniture for heavy use.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a major player in Europe's furniture trade with superior craftsmanship and design. German buyers favor practicality, long-lasting appeal, and up-to-date looks in their furniture. The vigorous manufacturing sector balances the consumption of the products by the end-user domestically as well as abroad. Thus, urban living is not as difficult as the elevation of new brands is lauded and their innovative alternatives offered. Sustainability is the new norm in furnishing today, so one finds the new theme of furniture with sustainable materials.

France's furniture business is a heterogeneous arena where an amalgam of classicism and modernism reminds one of the historical depth of France's design heritage. French consumers are inclined toward sophistication, quality, and workmanship in the selection of living-room furniture. Luxury and high-end design furniture is in high demand, sparking attention towards the growing green-oriented and sustainable products. France continues to be an important market for the spectrum of traditional and contemporary home furniture.

The United Kingdom furniture market is wide-ranging and offers a delicious selection of standard rungs between budget-friendly styles and luxury. British householders ask for comfort and fashion in their furniture. There is an increasing demand for custom-made and bespoke furniture too. Increased attention is given to sustainability: Many have been offering eco-friendly furniture and ethically sourced furniture options to meet gradually changing consumer tastes.

Italy, leading in high-end luxury decorative furnishing, originates from high design excellence and innovative imagination. Italian buyers look for a combination of aesthetics and functionality focusing substantially on quality materials. Italian furniture market bears a strong historical heritage of craftsmanship, which enjoys admiration both with the traditional as well as beauty.

Spain's furniture sector has a history with a unique combination of traditional craftsmanship and modern design. Spanish people have an insatiable taste for functional and stylish pieces of furniture for their bungalows with a growing emphasis on affordability combined with quality. The demand for furniture in contemporary, sleek, and minimalistic style is on the rise, while some people show a preference in sustainable furniture. The market in Spain benefits from local production as well as from international influences.

Competitive Landscape:

The Europe furniture market has big multinational brands, regional manufacturers, and newer direct-to-consumer players. The bigger companies dominate distribution, branding, and product innovation. For example, in April 2024, Herman Miller and Studio 7.5 added the Zeph Side Chair to the ergonomic Zeph collection with a flexible and playful design for workspaces that accommodates concentrated work, collaboration, education, and encourages natural recline. Moreover, sustainability brands have grown in popularity due to regulatory and consumer preferences. E-commerce players are upping competition with AI-driven personalization and digital-first strategies. Mergers and acquisitions and strategic partnerships are reshaping market dynamics, with companies investing in smart furniture, modular design, and circular economy initiatives to stay competitive in an ever-evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the Europe furniture market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Italian brand Pedrali unveils new upholstered collections blending comfort and elegance for homes, workspaces, and hospitality. Featuring soft, organic shapes and modular designs, these pieces offer a cozy, customizable experience, seamlessly fitting into modern living rooms, offices, and dynamic public spaces with style and sophistication.

- In February 2025, Italian modern furniture brand Rimadesio expands into textiles with a new rug collection, created in collaboration with multidisciplinary studio Juma. Featuring three designs, the collection highlights natural materials and handcrafted techniques, blending contemporary aesthetics with artisanal craftsmanship to offer elegant and sustainable home décor solutions.

- In February 2025, CASA Design Group partners with Cassina, a renowned Italian furniture brand, enhancing its luxury portfolio. Cassina’s craftsmanship and innovation align with CASA’s vision to offer premier modern design solutions, reinforcing its position as a leading destination for contemporary, high-end furnishings for discerning clients.

Europe Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe furniture market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe furniture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture market in Europe was valued at USD 229.3 Billion in 2025.

The Europe furniture market is growing due to rising demand for sustainable and multifunctional designs, urbanization, increasing disposable incomes, and e-commerce expansion. Technological advancements, smart furniture integration, and eco-friendly materials further drive growth. Government regulations promoting sustainability and the increasing popularity of home renovation projects also contribute significantly.

The Europe furniture market is projected to exhibit a CAGR of 3.27% during 2026-2034, reaching a value of USD 306.3 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)