Europe Fumaric Acid Market Size, Share, Trends and Forecast by Application, End Use Industry, and Country, 2025-2033

Europe Fumaric Acid Market Size and Share:

The Europe fumaric acid market size was valued at USD 112.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 175.4 Million by 2033, exhibiting a CAGR of 5.1% from 2025-2033. The market is primarily driven by the increasing need for acidity regulators, the expanding focus on bio-based innovations, enhanced usage in skincare formulations, advancements in resin synthesis, and supportive regulatory policies promoting sustainable alternatives and chemical safety compliance, which are contributing to diverse applications across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 112.0 Million |

|

Market Forecast in 2033

|

USD 175.4 Million |

| Market Growth Rate (2025-2033) | 5.1% |

The market in Europe is majorly influenced by the growing demand for fumaric acid in the production of unsaturated polyester resins, which are used widely in construction and automotive applications. In addition to this, the robust growth of the European personal care and cosmetics industry increases the use of fumaric acid as an ingredient in skincare products. Fumaric acid is valued for its role in pH adjustment and as a stabilizing agent in skincare formulations. As of December 11, 2024, the COSMILE Europe database describes fumaric acid as a synthetic commodity used in cosmetics primarily as a buffering agent to balance pH levels. The database observes that fruit acids, in particular fumaric acid, are gaining popularity as cosmetics because they can create an even smoother skin texture and reduce small wrinkles and fine lines. It also indicates that while these acids can make the skin look better, their use should be tailored to individual skin types to avoid irritation.

The supportive regulatory policies, which encourage fumaric acid application as a food additive and industrial chemical, further strengthen the market position. Furthermore, the growing use of fumaric acid in animal feed as an acidifier for improving animal health and production has played a significant role in various applications. For example, on October 24, 2024, EFSA issued its statement on the assessment of fumaric acid as a feed additive. The report confirms that it is safe as a preservative, flavoring, and acidity regulator for terrestrial animals under authorized conditions, although it has irritant properties and may cause sensitization. Its safety for aquatic animals remains inconclusive under all conditions of use.

Europe Fumaric Acid Market Trends:

Rising Preference for Natural and Bio-Based Fumaric Acid

The European fumaric acid market is experiencing a natural and bio-based shift in production, driven by the need to produce sustainable and environmentally friendly products. The trend is due to the concern of reducing dependence on petrochemical-based raw materials and minimizing carbon footprints. Manufacturers are increasing their efforts in using fermentation-based methods for producing fumaric acid using renewable feedstocks such as glucose and other biomass. For instance, on April 22, 2024, a research paper by Boondaeng et al. highlighted on the production of fumaric acid from steam-exploded oil palm empty fruit bunches using fungal isolate K20. The study examined the effectiveness of immobilized and free cells in producing fumaric acid. The highest concentration that was obtained in free cells after 96 hours was 3.25 g/L. Scaling up the process in a 3-L air-lift fermenter afforded a concentration of 44 g/L fumaric acid, which clearly shows there is great potential for the industrial application of this. This makes the production process more sustainable and complies with tough European Union chemical safety and sustainability regulations, thus setting bio-based fumaric acid as a competitive alternative.

Increasing Application in Functional Food and Beverage Products

Expansion in the functional food and beverage sector is a significant factor contributing to the growth of the European fumaric acid market. As consumers seek products that offer health benefits beyond basic nutrition, fumaric acid is gaining popularity as an acidity regulator and preservative in various fortified and functional beverages. Its role in shelf-life extension and stabilization of pH has also made it a preferred additive in the production of sugar-free confectioneries and protein bars. This trend shows growing health-consciousness by the Europeans and increasing demand for convenient consumer goods that provide wellness benefits for fumaric acid application innovators.

Expanding Usage of Fumaric Acid in the Pharmaceutical Sector

The pharmaceutical sector in Europe is experiencing the increasing usage of fumaric acid in the treatment of skin diseases, such as psoriasis. Fumaric acid esters are increasingly used in oral and topical formulations. Due to the emphasis of health care systems on non-invasive, effective treatments, dermatology will be a significant area where fumaric acid finds application, thus increasing the size of the European fumaric acid market. Its antioxidant properties and ability to modulate immune responses make it a valuable component in the development of these medical products. As of October 10, 2024, proximal fumarate is approved for treating relapsing forms of multiple sclerosis (MS), such as relapsing-remitting disease, clinically isolated syndrome, and active secondary progressive disease. It metabolizes to the active metabolite of monomethyl fumarate, just like dimethyl fumarate, but with different efficacy in relation to GI tolerance. Administration requires an initial dose of 231 mg twice daily for seven days and maintains a dose of 462 mg twice daily while complete blood counts are monitored.

Europe Fumaric Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe fumaric acid market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, and end use industry.

Analysis by Application:

- Food Additives

- Rosin-Sized Sheathing Paper

- Unsaturated Polyester Resins

- Alkyd Resins

- Others

Food additives play a vital role in the market due to the rising demand for processed and convenience foods. As a food additive, fumaric acid is extensively used for its applications as an acidity regulator, preservative, and flavour enhancer, thus allowing longer shelf life and improved flavour profiles. Also, the need for packaged and ready-to-eat meals increases the demand for food-grade fumaric acid. With growing health-conscious customers with increased interest in adopting natural and plant-based additives, the need to produce renewable-based fumaric acid has increased. Moreover, regulatory support toward food safety and quality standards in Europe aids the growth of the market. Expansion of the European food industry and a growing emphasis on clean-label products will continue to fuel demand for fumaric acid in food applications, thereby propelling market growth.

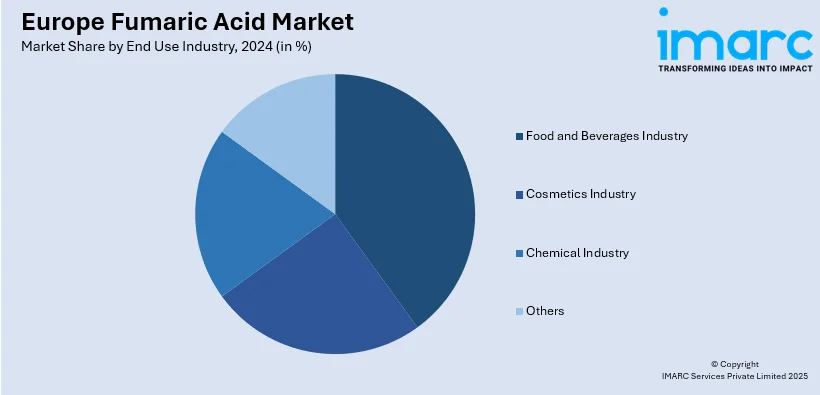

Analysis by End Use Industry:

- Food and Beverages Industry

- Cosmetics Industry

- Chemical Industry

- Others

The food and beverage industry is a major segment in the fumaric acid market in Europe. Its wide application as an acidulant, flavour enhancer, and preservative fuels its extensive demand in the industry. Fumaric acid finds significant applications in extending shelf life, improving product stability, and enhancing taste profiles, especially in bakery products, beverages, and confectioneries. Additionally, the increased demand for convenience and processed foods, driven by changing consumer lifestyles and preferences, further propels the market. Increasing clean-label and natural ingredients also promote the usage of fumaric acid as a cost-effective and versatile additive. Also, regulatory support for its safe usage in food products boosts market expansion. This synergy between the food and beverage industry and fumaric acid underlines its importance in maintaining quality and meeting the evolving consumer demands in Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is one of Europe's biggest economies and an established chemical manufacturing country with a substantial portion of demand in food and beverages, pharmaceuticals, and plastic sectors. The high consumer need for plant-based food products and natural food additives further increases the usage of fumaric acid, as it is an essential preservative and acidulant used in many foods. Additionally, Germany's robust automobile and industrial manufacturing industries promote the increased utilization of fumaric acid as an input in the synthesis of unsaturated polyester resins (UPR), an essential ingredient in automotive components and building materials. Moreover, with a solid manufacturing base and rising investments in green and sustainable technologies, Germany continues to be one of the most important regions shaping the European fumaric acid market's development, enabling the market to grow through demand as well as technological improvements.

Competitive Landscape:

The market is steadily growing due to its diverse applications in food and beverages, pharmaceuticals, and industrial sectors. Regional and international manufacturers are intensely competing in the market with innovative products and cost-effective manufacturing. Compliance with regulations of food safety and environmental standards plays a crucial role in deciding market strategies. The focus is set on sustainability, as observed in initiatives like the announcement of the ERA-B 6th Joint Call project in collaboration with EuroTransBio in November 2024. The project goal is to develop an effective fermentative process for fumaric acid production using glycerol, orange peels, and apple pomace as renewable feedstocks. This includes further optimization of fermentation processes as well as enzyme development advancements and a detailed life cycle assessment (LCA) to ensure environmental compatibility. The market also mirrors the emergence of new dynamics as raw material prices change and increasing consumer demand for clean-label, natural solutions push manufacturers to go beyond their traditional products with sustainable solutions.

The report provides a comprehensive analysis of the competitive landscape in the Europe fumaric acid market with detailed profiles of all major companies.

Europe Fumaric Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Food Additives, Rosin-Sized Sheathing Paper, Unsaturated Polyester Resins, Alkyd Resins, Others |

| End Use Industries Covered | Food and Beverages Industry, Cosmetics Industry, Chemical Industry, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe fumaric acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe fumaric acid market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe fumaric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fumaric acid is a naturally occurring dicarboxylic acid used in various industries. It is commonly used as a food additive to enhance flavor and preserve food. Fumaric acid serves as a raw material in the production of unsaturated polyester resins, and it is extensively utilized in pharmaceuticals and cosmetics.

The Europe fumaric acid market was valued at USD 112.0 Million in 2024.

IMARC estimates the Europe fumaric acid market to exhibit a CAGR of 5.1% during 2025-2033.

The key factors driving the market are the increasing demand for food preservatives, the growing popularity of plant-based products, and the rising usage of fumaric acid in the production of resins and plasticizers. Additionally, the expanding cosmetic and pharmaceutical industries, along with the push for sustainable alternatives, further fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)