Europe Ethnic Foods Market Size, Share, Trends and Forecast by Cuisine Type, Food Type, Distribution Channel, and Country, 2025-2033

Europe Ethnic Foods Market Size and Share:

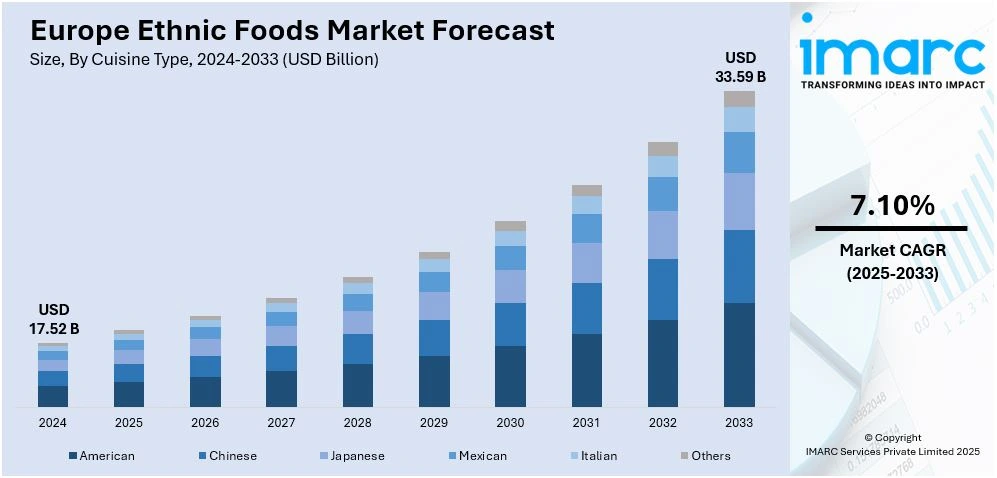

The Europe ethnic foods market size was valued at USD 17.52 Billion in 2024. Looking forward, the market is expected to reach USD 33.59 Billion by 2033, exhibiting a CAGR of 7.10% from 2025-2033. The expanding multicultural population in the region, rising consumer interest in diverse cuisines, significant growth in the hospitality sector, emerging health and wellness trends, and rapid technological advancements are some of the factors boosting the industry’s revenue and driving the Europe ethnic foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.52 Billion |

| Market Forecast in 2033 | USD 33.59 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

Europe ethnic foods market demand is experiencing notable growth, largely attributed to its increasing multicultural population. As of January 1, 2024, the European Union (EU) recorded a population of approximately 449.2 million, marking an increase of 1.65 million from the previous year. This growth is predominantly due to net migration, which accounted for an influx of 2.8 million people in 2023, effectively offsetting the natural population decline caused by more deaths than births. The demographic shift is further highlighted by the rising share of foreign-born residents. Between 2014 and 2022, the proportion of third-country nationals—individuals not originating from EU countries, EU candidate states as of 2015, or European Free Trade Association countries—more than doubled in nations such as Bulgaria, Hungary, Ireland, and Malta. Significant increases were also observed in Finland, Germany, Poland, and Slovakia. This growing diversity has led to a heightened demand for ethnic foods, as immigrant communities seek familiar culinary experiences and local populations become more exposed to and interested in diverse cuisines.

The rising consumer interest in diverse cuisines is a significant driver of the Europe ethnic foods market growth. The European Commission identifies the food and beverage industry as the EU's largest manufacturing sector, playing a significant role in driving economic growth. This robust industry supports a wide array of culinary options, catering to the evolving tastes of European consumers. Additionally, Eurostat's 2024 report highlights that, on average, each person in the EU spent €3,980 on food, beverages, and catering services in 2022, indicating a significant portion of consumer expenditure dedicated to exploring various food options. The expansion of the hospitality sector, including specialty restaurants and food services offering ethnic menus, has made diverse cuisines more accessible, further fueling market expansion. Moreover, the European Commission's data reveals that the EU produced 272 million tonnes of cereals in 2023, reflecting the region's capacity to support a diverse food supply chain. These factors collectively contribute to the increasing consumer interest in diverse cuisines, propelling the growth of the ethnic food market in Europe.

Europe Ethnic Foods Market Trends:

Expansion of the Hospitality Sector

The growth of the hospitality industry across Europe has greatly fueled the demand for ethnic foods, boosting this market segment. As highlighted by the European Commission, the food and beverage sector is the EU's leading manufacturing industry, both in terms of employment and its contribution to economic value. Over the past decade, EU food and drink exports have doubled, reaching over €182 billion and resulting in a positive trade balance of nearly €30 billion. This robust growth reflects a dynamic and expanding hospitality industry that increasingly incorporates diverse culinary offerings to cater to evolving consumer preferences. The rise of specialty restaurants and food services offering diverse ethnic menus has significantly increased the availability of international cuisines to consumers across Europe. Supporting this trend, Eurostat reports that in 2022, the average EU resident spent €3,980 on food, beverages, and catering services, highlighting the growing demand for varied culinary experiences. The combination of a thriving hospitality sector and rising consumer expenditure on diverse food experiences underscores the significant role of the hospitality industry in driving the ethnic foods market's expansion across Europe.

Emerging Health and Wellness Trends

The rising consumer interest in diverse cuisines is significantly propelling the growth of the European ethnic foods market share. This shift is driven by a blend of changing demographics and evolving consumer tastes. Europe's increasing multicultural population has introduced a variety of culinary traditions, fostering a rich tapestry of ethnic cuisines. As a result, there is a growing curiosity among native European consumers to explore these diverse food options. According to the European Food Safety Authority (EFSA), comprehensive food consumption data reveals a notable diversification in dietary habits across EU Member States, reflecting an openness to incorporating a wider range of food products into daily diets. This inclination towards varied culinary experiences is further supported by Eurostat's "Key figures on the European food chain – 2024 edition," which highlights an increase in the availability and consumption of international food products within the European Union. Such data underscores the expanding palate of European consumers, who are increasingly seeking out and embracing ethnic foods, thereby driving market growth. This shift not only reflects changing taste preferences but also signifies a broader cultural integration and acceptance within European societies.

Rapid Technological Advancement

Advancements in technology have greatly increased the availability and attractiveness of ethnic foods across Europe. Breakthroughs in food processing and packaging have extended product shelf life and ensured safety, making it easier to distribute a wide range of international cuisines across the region. The European Innovation Council's 2024 Tech Report highlights emerging technologies, such as plant-based biomanufacturing, which are transforming food production and expanding the variety of ethnic food products available to consumers. Additionally, the European Institute of Innovation and Technology's Food initiative (EIT Food) has supported over 350 companies and invested more than €3 million in business creation programmes over the past seven years, positioning Europe as a global leader in food innovation. These technological advancements, supported by substantial investments, have streamlined the production and distribution of ethnic foods, meeting the growing consumer demand for diverse culinary experiences across Europe.

Europe Ethnic Foods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe ethnic foods market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on cuisine type, food type, and distribution channel.

Analysis by Cuisine Type:

- American

- Chinese

- Japanese

- Mexican

- Italian

- Others

American cuisine is fast gaining popularity in Europe, driven primarily by associations with fast food and comfort foods, such as burgers, fried chicken, and barbecue. Many chains, particularly McDonald's and KFC, have led the market for these flavors. Premium American-style restaurants also continue to enjoy a growing demand for gourmet twists on traditional recipes. The overall convenience foods market, as well as indulgent dining experiences, supports the trend.

Due to the versatility in flavor, Chinese food has become a delicacy across Europe. These can go from sweet-and-sour dishes to spicy Sichuan options. Chinese takeaways and restaurants have been instrumental in promoting this cuisine. In addition, the market is giving way to healthier preferences such as dim sum and vegetable-based foods. With China's global cultural influence, authentic Chinese ingredients are now widely available in European supermarkets, contributing to a steady market expansion.

As per the latest Europe ethnic foods market outlook, Japanese cuisine, particularly sushi, ramen, and tempura, has gained immense popularity due to its health-focused appeal and unique flavors. Sushi consumption, for example, saw a 12% growth across key European cities in 2023, according to data from Eurostat. This segment also benefits from premium dining experiences and increased accessibility to Japanese products through online retailers. Innovations like plant-based sushi have further expanded the customer base, particularly among younger, eco-conscious demographics.

Mexican food is renowned for its rich flavors and diversity, with dishes such as tacos, burritos, and nachos becoming staples in many European countries. The market is expanding as a result of rising consumer demand for bold, spicy, and flavorful foods. Authenticity is a huge trend, where restaurants and brands are focusing on traditional ingredients such as avocados, tortillas, and Mexican spices. The European Free Trade Association reports that imports of avocados rose by 15% in 2024, reflecting the increasing popularity of Mexican dishes in home cooking.

Italian food remains an eternal favorite among people in Europe because of its simple nature and use of fresh ingredients. Pasta, pizza, and risotto hold the major share of the market, and it's the quality of authentic and superior Italian products that is expanding its growth. Italian Trade Agency reveals that Italy food exports increased 9% during 2023. With an increase in the number of high-end pizzerias and homemade pasta, there is increased demand among customers from traditional foodies to more experimental eaters.

Analysis by Food Type:

- Vegetarian

- Non-Vegetarian

The growth of the vegetarian segment in the ethnic food market in Europe is spectacularly rapid due to increasing adoption of plant-based diets and rising interest in sustainable food choices. Many ethnic cuisines, including Indian, Mediterranean, and Middle Eastern, provide a spectrum of varieties that are nutritious and full of flavors. Health-conscious consumers and innovation in plant-based substitutes for traditional ethnic dishes are driving this shift. Additional support of such sustainable food manufacturing comes through EU policies such as the European Green Deal. Consumers are persuaded through these strategies for consuming plant-based food and meals.

Meat-based, a non-vegetarian market sector, comprises of the ethnicity business in Europe primarily due to cuisine popularity including meat-based food delights like Chinese and Mexican cuisine among others as they are often spicy and delicious meat dishes served prepared with traditional flavorings including for lamb, chicken, or beef. Eurostat (2024) states that the demand for halal and kosher-certified non-vegetarian foods has increased by 20% annually, reflecting the growing multicultural population in the region. In addition, advancements in preservation and processing technologies ensure the availability of fresh and frozen non-vegetarian ethnic foods, meeting the expectations of a broader consumer base.

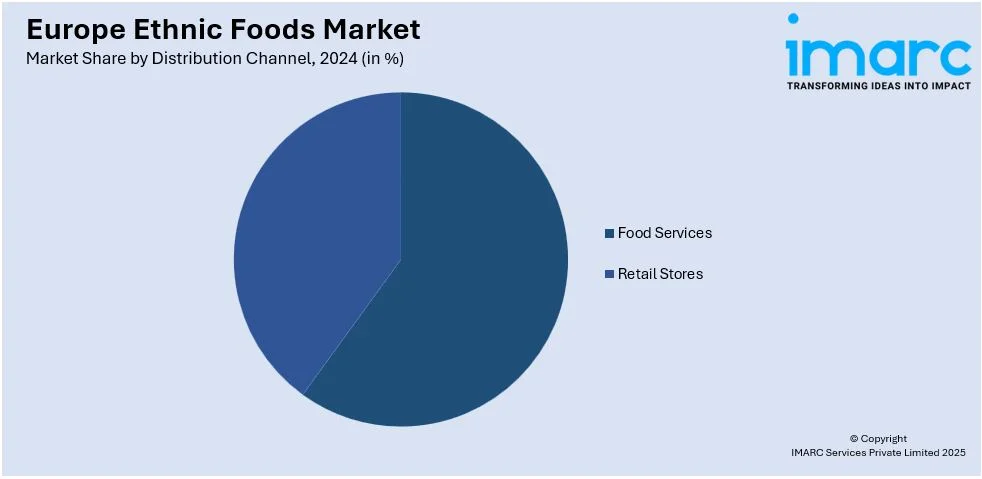

Analysis by Distribution Channel:

- Food Services

- Retail Stores

The food services sector, encompassing restaurants, cafes, and catering businesses, is a key driver of growth in the European ethnic foods industry. Increasing consumer preference for dining out and trying different cuisines has increased demand in this sector. The proliferation of specialty restaurants offering authentic ethnic foods has further fueled growth. As cultural fusion trends continue to shape dining preferences, food services remain pivotal in popularizing ethnic foods.

Retail food stores, consisting of supermarkets, hypermarkets, and specialty food stores, are important to ethnic food distribution. This space answers the call of increasing demand for convenient, ready-to-cook ethnic meal options for home consumption. Today, retailers continue to add more shelf space for international products and culturally diverse offerings supported by better packaging and longer shelf life. The European Retail Index shows that retail channel ethnic food product sales had increased by 8.3% in 2024. Large retail chains have reported expanding ethnic food offerings to meet the changing nature of consumer preferences and enhance access, thereby driving market growth.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Being among Europe's top consumers of ethnic foods, Germany takes an important place mainly due to a large number of immigrants and easy acceptance of multiple cuisines in the country. With over 13 million foreigners up to 2023, reported by Destatis, demand in authentic ethnic foods and their Turkish, Middle Eastern, as well as Asian counterparts remains rising. Germany is also witnessing flourishing restaurant and food delivery businesses where ethnic foods can be accessed very easily.

According to the ethnic foods market outlook in Europe, France is known to have a lively ethnic food market because of its colonial background and immigration population, especially from North Africa and Southeast Asia. Among the popular cuisines are Moroccan and Vietnamese. According to INSEE, more than 6 million immigrants in France have greatly impacted food culture, and ethnic foods are staples in urban cities and elsewhere.

Ethnic food is a huge market in the UK, with Indian, Chinese, and Caribbean food dominating the market. The Office for National Statistics states that the diverse population and established immigrant communities drive a thriving ethnic food scene. In addition, the popularity of ready-to-eat ethnic meals and a strong takeaway culture contribute to market growth.

Ethnic food is gaining popularity in Italy, particularly among the youth who want variety in their dining. Italian food remains the favorite, but Asian and Latin American cuisines are making their mark. Data from ISTAT reveals a growing presence of ethnic restaurants in urban areas, reflecting increasing consumer interest in diverse culinary experiences.

As per the Europe ethnic foods market forecast, Spain's ethnic food market is booming, mainly due to its ethnically diverse population and the tourism sector. Latin American and North African cuisines are the most popular among these cuisines. The ministry of Spanish Industry, Trade, and Tourism further claims that the high tourist numbers visiting the cities, such as Madrid and Barcelona, in pursuit of multicultural foods increases demand in the ethnic food market.

Competitive Landscape:

Based on the emerging Europe ethnic foods market trends, innovation, partnerships, and successful marketing strategies help leading players capitalize on increasing consumer interest in diverse cuisines. These days, most companies are investing in product development and are introducing a wide range of authentic ready-to-eat meals and cooking ingredients that can suit consumer preferences for convenience and flavor authenticity. Today, such collaborations with ethnic chefs and suppliers create cultural authenticity to build consumer confidence. Another effective strategy to widen the consumer reach is by integrating into online retailers and food delivery platforms. Now, the need for clean and sustainable labels gains importance because it caters to the ever-rising demands for ethical and health-conscious food offerings. For example, the adoption of biodegradable packaging and the sourcing of organic ingredients are becoming increasingly common.

The report provides a comprehensive analysis of the competitive landscape in the Europe ethnic foods market with detailed profiles of all major companies, including:

- Asli Fine Foods

- Premier Foods PLC

- Paulig

- Aryzta AG

- Orkla ASA

- Ajinomoto Co Inc

- McCormick & Co Inc

- General Mills Inc

- Nestle S.A.

Latest News and Developments:

- In September 2024, Turkey applied to the European Commission for "traditional specialty guaranteed" status for döner kebab. If approved, this designation would enforce specific preparation methods and ingredients, potentially impacting the diverse döner kebab variations popular in Germany and across Europe.

- In October 2024, Sysco acquired Campbell Prime’s Meat, a specialist meat supplier. This strategy will enable the company to broaden its product portfolio and reach a wider customer base.

- In January 2025, Lviv Croissants opened 12 new shops in Poland in a move to geographically expand its business and reach diverse consumer base.

- In November 2024, Studenac, a Croatian food retailer launched an IPO to list on Zagreb and Warsaw stock exchanges. The company aims to raise around 80 million euros to finance growth initiatives like new store rollouts and fresh acquisitions.

Europe Ethnic Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisine Types Covered | American, Chinese, Japanese, Mexican, Italian, Others |

| Food Types Covered | Vegetarian, Non-Vegetarian |

| Distribution Channels Covered | Food Services, Retail Stores |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Asli Fine Foods, Premier Foods PLC, Paulig, Aryzta AG, Orkla ASA, Ajinomoto Co Inc, McCormick & Co Inc, General Mills Inc, Nestle S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe ethnic foods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe ethnic foods market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe ethnic foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe ethnic foods market was valued at USD 17.52 Billion in 2024.

The expanding multicultural population in the region, rising consumer interest in diverse cuisines, significant growth in the hospitality sector, emerging health and wellness trends, and rapid technological advancements are some of the factors driving the Europe ethnic foods market share.

IMARC estimates the Europe ethnic foods market to exhibit a CAGR of 7.10% during 2025-2033, reaching USD 33.59 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)