Europe Edge Computing Market Size, Share, Trends and Forecast by Component, Organization Size, Vertical, and Country, 2026-2034

Europe Edge Computing Market Size and Share:

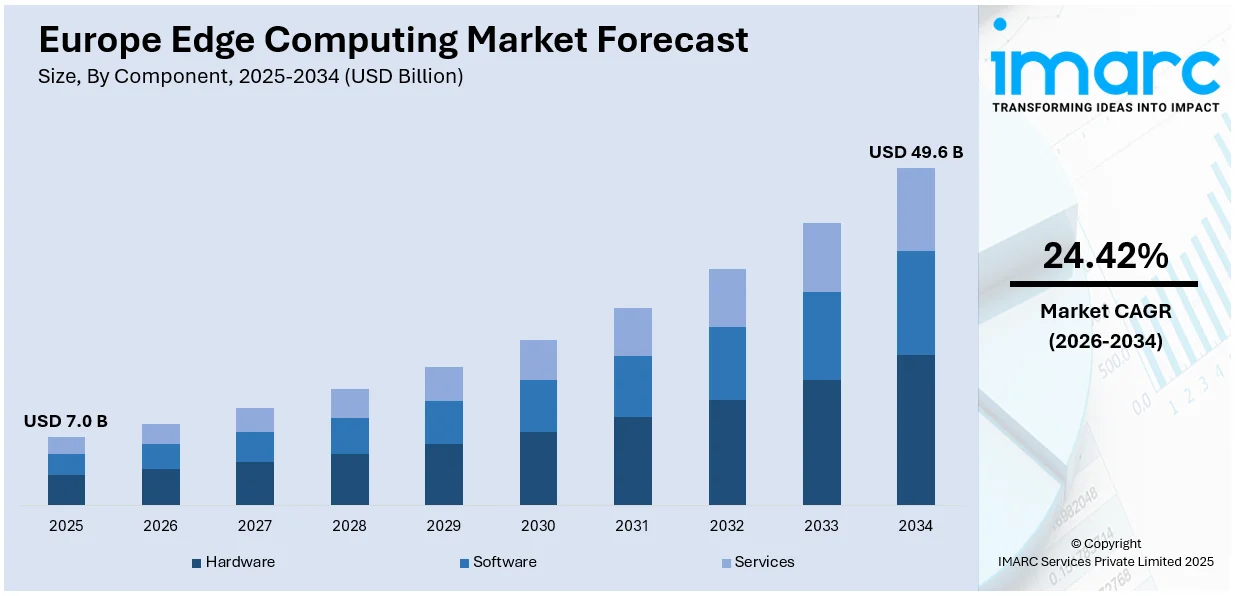

The Europe edge computing market size was valued at USD 7.0 Billion in 2025. and is expected to reach USD 49.6 Billion by 2034, exhibiting a CAGR of 24.42% from 2026-2034. The market is witnessing significant growth due to the rising demand for real-time data processing and increasing focus on data sovereignty and privacy regulations. Additionally, the expansion of IoT and smart devices integration, rising focus on energy efficiency and sustainability, and growth in 5G-enabled edge applications are expanding the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.0 Billion |

| Market Forecast in 2034 | USD 49.6 Billion |

| Market Growth Rate (2026-2034) | 24.42% |

The Europe edge computing market is highly driven by the growing need for real-time data processing across industries. Low-latency responses, improvement in operational efficiency, and decision-making in manufacturing, healthcare, and telecommunication sectors can be achieved by processing data at the edge. Industrial automation relies on edge computing to analyze data from sensors and devices instantly, thus enabling predictive maintenance and reducing downtime. Similarly, in the healthcare domain, edge solutions help applications such as remote patient monitoring and diagnostics where quick data processing is crucial. In addition, increasing investments also contribute to this demand. For instance, in July 2024, Microsoft invested USD 40 million in Edge startup Armada, which offers services across Europe, boosting its total funding to around USD 100 million, and facilitating integration of AI solutions with the Edge, highlighting the growing demand for real-time data processing in today's digital landscape. This investment allows Armada to develop further and scale its technology, enabling faster, more efficient data processing closer to the source of generation.

To get more information on this market Request Sample

The growing focus on data sovereignty and strong privacy laws in Europe is one of the most important factors increasing the edge computing market share. European regulations, such as the General Data Protection Regulation (GDPR), compel businesses to process and store sensitive data locally so that privacy standards are met effectively. Edge computing tackle these issues by localizing data processing and decreasing the use of central cloud systems, which could involve cross-border data transfers. For instance, in March 2024, Bosch Research began advancing the CUBE-C — Cyber-Physical Systems (CPS) Cloud Continuum initiative under IPCEI-CIS to develop energy-efficient, real-time-critical software solutions using edge computing. Collaborating with over 100 EU entities, the project targets decentralized, low-latency infrastructures to reduce dependency, enhance IoT, and enable localized, sustainable data-driven business models. This attribute is especially crucial for key sectors, including government, healthcare, and finance, where data safety is critical. The trend toward enhanced privacy protections is fostering the adoption of edge solutions, ensuring regulatory compliance while maintaining operational efficiency.

Europe Edge Computing Market Trends:

Expansion of IoT and Smart Devices Integration

The increasing integration of Internet of Things (IoT) devices is a remarkable trend impacting the Europe edge computing market forecast. As businesses and consumers adopt IoT technology for applications ranging from smart homes to industrial automation, the demand for decentralized data processing at the edge continues to grow. Edge computing ensures real-time data analysis and seamless device communication, addressing latency and bandwidth challenges associated with cloud-based solutions. For instance, in October 2024, Edgee, a Paris-based edge computing platform, secured €2.66 million funds to advance its goal of optimizing data collection and application performance. By moving data processing closer to users, Edgee addresses latency issues and empowers developers to create faster, more accurate, and privacy-compliant applications, transforming modern data processing. Additionally, this trend is particularly evident in sectors such as manufacturing, healthcare, and transportation, where IoT adoption enhances operational efficiency and decision-making.

Rising Focus on Energy Efficiency and Sustainability

Sustainability is becoming a critical focus in Europe, driving the adoption of energy-efficient edge computing solutions. By processing data closer to the source, edge computing minimizes the requirement for energy-intensive data transfers to centralized cloud servers. This localized approach aligns with the European Union’s green initiatives and carbon reduction goals. Additionally, companies are exploring innovations like micro data centers and renewable energy-powered edge infrastructure, ensuring sustainable growth while meeting the region's stringent environmental regulations. For instance, in 2024, Schneider Electric unveiled smart grid solutions, including virtualized PowerLogic T300 RTU, to enhance grid resiliency, flexibility, and renewable energy adoption, supporting net-zero goals and advanced energy flow management.

Growth in 5G-Enabled Edge Applications

The rapid adoption of 5G networks in Europe is heightening the deployment of edge computing applications, which is providing a boost to Europe edge computing market growth. 5G’s high-speed connectivity and low-latency capabilities are unlocking new possibilities in areas such as augmented reality (AR), autonomous vehicles, telemedicine, and virtual reality (VR). Businesses are increasingly leveraging edge computing to optimize these 5G-enabled applications, enhancing user experiences and operational outcomes. For instance, in February 2024, NTT DATA and Schneider Electric announced the first private 5G-based launch of a data center EcoStruxure in Berlin's Marienpark, a 74-acre innovation park offering advanced connectivity and edge computing experiences for campus users. In addition, this trend is also driving investments in edge infrastructure, as several firms are striving to benefit from the opportunities presented by 5G to maintain a competitive edge in this rapidly transforming market. Together, these advancements are shaping the future of edge computing in Europe, fostering innovation and technological progress.

Europe Edge Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe edge computing market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on component, organization size, and vertical.

Analysis by Component:

- Hardware

- Software

- Services

In the component segment, hardware includes servers, storage devices, routers, and gateways essential for edge computing infrastructure. In Europe, it supports edge applications by enabling real-time data processing, reducing latency, and enhancing efficiency across industries like manufacturing, healthcare, and retail, aligning with increasing IoT adoption and 5G deployment.

Software primarily encompasses platforms, analytics tools, and management systems that facilitate data processing, orchestration, and decision-making at the edge. In Europe, it supports edge computing by optimizing real-time operations, enhancing IoT functionality, enabling AI integration, and ensuring compliance with stringent regional data privacy regulations.

In the component segment, services include deployment, integration, maintenance, and consulting solutions that support edge computing infrastructure. In Europe, these services facilitate seamless implementation, ensure system reliability, and optimize performance, enabling industries to leverage edge computing for real-time data processing, IoT applications, and compliance with regional data regulations.

Analysis by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Small and medium enterprises (SMEs) are prominent in the Europe edge computing market through scalable, cost-effective solutions that improve efficiency and competitiveness. SMEs extensively leverage edge computing for the real-time processing of data, IoT integration, and local services, addressing unique operational needs while promoting innovation in various industries, such as retail, manufacturing, and logistics, across Europe.

Large enterprises across Europe utilize edge computing services and advanced infrastructure to handle enormous data volumes for real-time analytics and decision-making. They incorporate edge solutions that are related to IoT, AI, and 5G applications so that operational efficiency increases with reduced latency, as well as regulatory compliance can be addressed in key industries including health, manufacturing, and telecommunication.

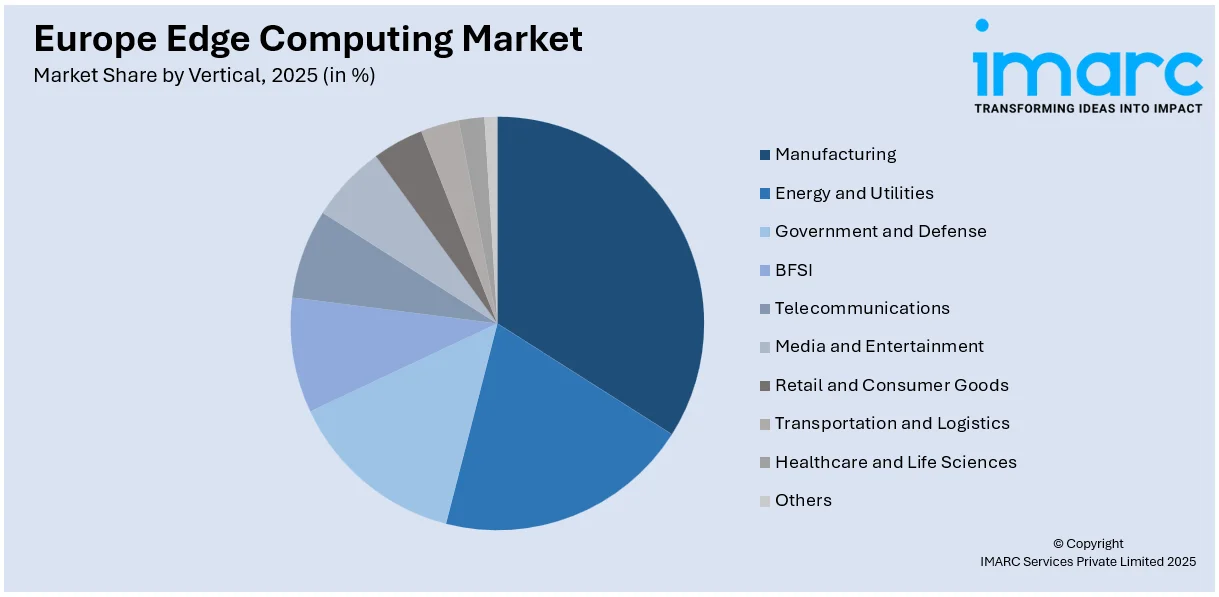

Analysis by Vertical:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Energy and Utilities

- Government and Defense

- BFSI

- Telecommunications

- Media and Entertainment

- Retail and Consumer Goods

- Transportation and Logistics

- Healthcare and Life Sciences

- Others

In the vertical segment, manufacturing uses edge computing to monitor and predict maintenance in real-time, automate processes, and other applications. In Europe, it boosts productivity, reduces downtime, and supports Industry 4.0 by allowing IoT integration and low-latency analytics, answering the need for efficient, smart manufacturing, and is in line with regional sustainability goals.

Energy and utilities employ edge computing for real-time grid monitoring, predictive maintenance, and renewable energy management. It supports smart grid initiatives, enhances energy efficiency, and ensures reliable operations to meet growing demands for sustainable energy solutions and compliance with stringent environmental and regulatory standards in Europe.

In the vertical segment, governments and defense organizations use edge computing to perform secure real-time processing of data related to surveillance, cybersecurity, and management of critical infrastructure. It improves decision-making processes in Europe while strengthening national security and supporting smart cities with efficient operation in accordance with severe data sovereignty and privacy regulation.

BFSI (Banking, Financial Services, and Insurance) segment uses edge computing to process transactions in real-time, detect fraud, and provide personalized customer services. In Europe, it helps in operational efficiency, supports compliance with strict financial regulations, and enhances customer experience, which has increased its adoption in digital banking and financial technology innovations.

In the vertical segment, telecommunications leverage edge computing to improve network performance, support 5G deployment, and enable applications such as IoT and AI. In Europe, it supports efficient data processing, increases connectivity, and supports complex services such as video streaming, augmented reality, and smart city initiatives, which fulfill the growing demands of the consumer.

In the vertical space, media, and entertainment capitalize on edge computing to deploy seamless streaming, immersive games, and real-time content, thereby improving user experiences by way of reducing latency for proper video streaming and AR/VR applications, as well as supporting local content distribution within Europe, in line with the increasing demand for media services.

Retail and consumer goods segment use edge computing for real-time inventory management, customized shopping experiences, and optimized supply chain operations. For Europe, it supports smart stores, enhances customer engagement, and optimizes e-commerce processes, addressing the growing demand for fast, data-driven, and seamless retail solutions.

Transportation and logistics improve the efficiency of the supply chain, support smart transportation systems, and provide deliveries on time in Europe while helping to meet the growing demand for reliable, data-driven logistics solutions in a very competitive market. It uses edge computing to monitor fleets in real-time, optimize routes, and prevent failures in the vertical segment.

In the vertical segment, healthcare and life sciences leverage edge computing for real-time patient monitoring, advanced diagnostics, and efficient data management. In Europe, it supports telemedicine, IoT-enabled medical devices, and AI-driven research, thereby providing better patient care, efficient operations, and meeting stringent data privacy regulations in the healthcare ecosystem.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany drives the Europe edge computing market with its advanced industrial base, widespread adoption of Industry 4.0 technologies, and strong focus on IoT and automation. It fosters innovation through robust infrastructure, supports smart manufacturing, and leads in regulatory compliance, positioning itself as a key hub for edge computing advancements.

France supports the Europe edge computing market through its strong emphasis on digital transformation, smart city initiatives, and 5G deployment. With investments in IoT and AI technologies, it enhances real-time data processing capabilities across industries like transportation, retail, and energy, fostering innovation and driving the adoption of edge solutions.

The United Kingdom drives the Europe edge computing market through advanced digital infrastructure, strong 5G adoption, and a thriving tech ecosystem. With a focus on IoT integration and data sovereignty, it supports real-time applications in industries like finance, healthcare, and retail, fostering innovation and boosting edge computing adoption across sectors.

Italy supports the Europe edge computing market through its focus on industrial automation, smart manufacturing, and digital transformation initiatives. With growing 5G adoption and IoT integration, Italy enhances real-time data processing in sectors like automotive, energy, and healthcare, driving innovation and improving efficiency in a competitive European market.

Spain contributes to the Europe edge computing market through its robust investments in smart city projects, renewable energy initiatives, and IoT integration. With expanding 5G networks and a focus on real-time data processing, Spain drives advancements in industries like transportation, energy, and retail, fostering innovation and enhancing operational efficiency.

Competitive Landscape:

The Europe edge computing market is characterized by intense competition among established technology giants, innovative startups, and telecom providers. Leading players are striving to sustain their domination with comprehensive edge computing solutions, focusing on industrial automation, IoT integration, and data management. Moreover, telecom companies are leveraging 5G infrastructure to offer low-latency edge services, while niche firms introduce specialized solutions for sectors like healthcare and automotive. Strategic partnerships, mergers, and investments in research and development further shape the competitive dynamics, driving innovation and market growth across the region. For instance, in September 2024, Netradyne and Roos Fleetservice GmbH, announced a tactical partnership to offer Netradyne's Driver•i to Roos's customers across Europe. This product utilizes edge computing, ML, and AI to evaluate driving durations, manage fleet networks, and improve road safety.

The report provides a comprehensive analysis of the competitive landscape in the Europe edge computing market with detailed profiles of all major companies.

Latest News and Developments:

- December 21, 2023: The European Commission approved EUR 1.2 billion in public funding under the Important Project of Common European Interest (IPCEI) to advance edge and cloud computing infrastructure. Jointly submitted by seven EU nations, the initiative involves 19 companies and aims to create an open-source reference infrastructure by 2027. The funding complements EUR 1.4 billion in private investments to enhance digital innovation across various sectors.

- July 18, 2024: Barcelona-based Nearby Computing secured EUR 6.5 million in Series A funding to expand its edge computing solutions in industrial and telecom sectors. The round was led by Walter Ventures and JME Ventures, with participation from Telefónica, Akamai, and other investors, to support the company's NearbyOne platform and global growth efforts. The funding will enable the firm to enhance orchestration, automation, and network ecosystem management across industries like IoT and defense.

- October 2024: The EU Commission announced €865M investment to enhance digital infrastructure by 2027, focusing on 5G expansion, energy-efficient networks, cloud-edge computing integration, and submarine cables, connecting all citizens and businesses by 2030.

- December 2024: Wasabi Technologies expanded its data management services by integrating its storage regions with IBM Cloud’s London data center. Leveraging IBM’s Multizone Region (MZR), Wasabi enables joint customers to meet regulatory needs and adopt AI technologies on a secure enterprise cloud platform, while supporting edge computing use cases through real-time data processing and hybrid cloud integration.

Europe Edge Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Manufacturing, Energy and Utilities, Government and Defense, BFSI, Telecommunications, Media and Entertainment, Retail and Consumer Goods, Transportation and Logistics, Healthcare and Life Sciences, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe edge computing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe edge computing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe edge computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The edge computing market in Europe was valued at USD 7.0 Billion in 2025.

The edge computing market in Europe is projected to exhibit a CAGR of 24.42% during 2026-2034, reaching a value of USD 49.6 Billion by 2034.

The key factors driving the market include rising demand for real-time data processing, growth in IoT and 5G adoption, and stringent data privacy regulations. Industries like manufacturing, healthcare, and retail increasingly require low-latency solutions, while advancements in AI and cloud technologies further accelerate edge computing adoption across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)