Europe Dental Implants Market Size, Share, Trends and Forecast by Material, Product, End Use, and Country, 2025-2033

Europe Dental Implants Market Size and Share:

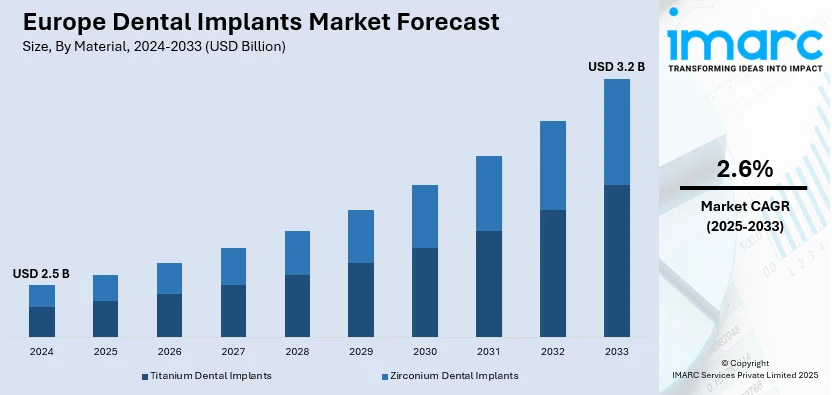

The Europe dental implants market size was valued at USD 2.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.2 Billion by 2033, exhibiting a CAGR of 2.6% from 2025-2033. The market is significantly driven by increasing demand for innovative oral health solutions, expansion of dental tourism, rising adoption of advanced dental implant technologies, enhanced regulatory compliance, continual technological advancements in implantology, aging population and increased tooth loss, and growing demand for aesthetic dentistry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.5 Billion |

|

Market Forecast in 2033

|

USD 3.2 Billion |

| Market Growth Rate (2025-2033) | 2.6% |

The European dental implants market is primarily driven by the growing movement toward digital dentistry. The integration of CAD, CAM, and 3D printing has transformed implantology by offering better precision and speed of treatment. This allows dental professionals to develop highly customized and accurate implant solutions for each particular patient's needs, further enhancing procedural efficiency and patient satisfaction. Furthermore, the transition to stricter medical device regulations is driving growth in the European dental implants market. Manufacturers obtaining MDR certification for their products demonstrate a commitment to meeting higher safety and quality standards, instilling greater confidence among dental professionals and patients. For instance, on August 30, 2024, Osstem implant announced the acquisition of MDR certification for 156 products, including surgical kits and tools. This transition from MDD to MDR certification encompasses both existing and new products. The achievement is expected to enhance trust among European dental professionals and support Osstem's growth in the region, with plans for further certifications through 2026.

In Europe, efficient optimization of distribution networks has driven the market for dental implants. Efficient partnerships and region-specific collaborations reduce the delivery time and logistical barrier to high-quality dental products. On September 8, 2024, dental solutions announced a new partnership with dental solutions EU, an independent distributor based in Belgium. This collaboration aims to enhance service efficiency and product delivery for Western European clients, offering shorter delivery times and eliminating customs fees for intra-European shipments. Apart from this, government efforts to improve access to dental care in underdeveloped regions are facilitating growth with subsidies and public health campaigns stimulating the adoption of dental implants.

Europe Dental Implants Market Trends:

Increasing Demand for Innovative Oral Health Solutions

Growing focus on advanced oral care technologies is pushing the demand for innovative dental treatments in Europe. For instance, On 10th October 2024, the Finnish health tech company Koite Health has partnered with Megagen Iberia to distribute its innovative Lumoral treatment in Spain's dental industry. This collaboration aims to elevate oral health care standards by providing a transformative tool for dental professionals and patients, particularly those with dental implants. Increased awareness of the importance of preventive dental care and the necessity for effective solutions for the maintenance of dental implants have increased interest in cutting-edge products. This trend corresponds to the growing adoption of advanced therapeutic tools by dental professionals to improve patient outcomes.

Rising Adoption of Advanced Dental Implant Technologies

The rising demand for dental implants with innovative designs and improved functionality is pushing the Europe dental implants market share. For example, On June 20, 2024, BioHorizons unveiled the Tapered Pro Conical, marking its debut dental implant featuring a deep conical connection. This innovation combines the Tapered Pro macro design with the CONELOG® connection, offering enhanced surgical efficiency for immediate implant procedures. The implant features Laser-Lok microchannels for improved tissue attachment and crestal bone retention, catering to single tooth and full arch treatments. The rising emphasis on surgical efficiency and long-term reliability has increased the demand for implants that can support immediate procedures. Besides this, the introduction of advanced technologies in implant design meets the growing demand for flexible solutions in single-tooth and full-arch restorations, thus encouraging its adoption across the dental industry.

Expansion of Dental Tourism

Significant growth has emerged in the Europe region in dental tourism as demand has surged for reasonably valued excellent facilities provided in countries like Hungary, Poland, and Romania among other countries. Moreover, the availability of highly professionalized staff, state-of-the-art clinics, and package deals in comprehensive dental care for international patients is propelling Europe's reputation in the field of dental tourism as patients traveling for dental care benefit from shorter waiting times, personalized treatment plans, and the opportunity to combine leisure travel and medical procedures. This trend has been contributing to an increased uptake of dental implants among international patients seeking affordable, high-tech solutions for tooth replacement. The increasing number of dental tourists is also compelling clinics to invest in innovative implant technologies and solutions, further pushing the Europe dental implants market growth.

Europe Dental Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe dental implants market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, product, and end use.

Analysis by Material:

- Titanium Dental Implants

- Zirconium Dental Implants

Titanium dental implants are dominating the market on account of their high biocompatibility, corrosion resistance, and strength, ensuring durability and long-term functionality. Titanium is widely utilized by dentists due to its excellent osseointegration with the jawbone. Moreover, titanium can be customized in different shapes and sizes to cater to diverse patient needs. Its wide clinical acceptance and proven success in ensuring successful implant procedures have further cemented its position. In addition, with continuous developments in surface treatments to improve osseointegration, titanium implants continue to dominate the market in terms of both practitioner and patient preference for reliable, durable dental solutions.

Analysis by Product:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

The most commonly used implant type is endosteal, which leads the market, offering superior stability and a natural look. They are directly placed into the jawbone, providing a strong foundation for artificial teeth, making them a preferred option for numerous dental restoration procedures. Their high success rate and compatibility with diverse patient needs, including single-tooth replacements and full-arch restorations, contribute to their widespread adoption. Dental professionals prefer an endosteal implant on account of its flexibility and susceptibility to integration with advanced technological applications, such as surgery guidance. The growing demand for efficient, long-lasting, and aesthetically pleasing dental solutions further supports dominance in the market by this segment.

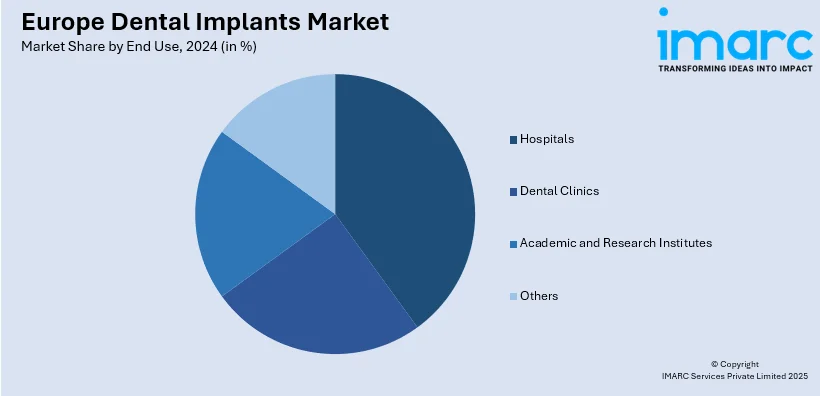

Analysis by End Use:

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

Dental clinics account for the most extensive share in the market due to their accessibility and specialization in ensuring customized dental implant treatments. Clinics are preferred by patients as they offer affordable treatment and a whole range of services, including consultation, imaging, and surgical procedures. Clinics hire the most experienced dental professionals and make use of the most advanced technologies and equipment for a high success rate for implants. Additionally, clinics cover a wide demographic range, from single-tooth replacement to complex full-arch restorations. This market is also gaining prominence from the trend of private dental practice and availability of flexible payment options in clinics.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a large share-gainer in the European market due to its strong health infrastructure, and its focus on advancement of technology in dentistry. The country houses several world-class dental implant producers and research centers, which promote innovation and high-quality implant solutions. A strong network of dental clinics and professionals ensures the widespread availability of advanced treatments. Moreover, Germany's aging population, combined with growing disposable incomes, increases the demand for dental restorations, such as implants. Public awareness campaigns promoting oral health and government support for healthcare services further strengthen its market position. Advanced infrastructure, coupled with the presence of professionals and growing patient demands, make Germany the largest segment in this region.

Competitive Landscape:

Major players in the European dental implants market are engaged in different strategic activities, such as developmental and marketing strategies, to maintain and create a market position that propels growth. These activities include the introduction of new, innovative products that incorporate advanced materials and technologies for improving patient outcomes and procedural efficiency. Strategic partnerships and alliances are also forged for the extension of product portfolios and geographical expansion, thus facilitating market penetration. Besides, various companies are focusing on mergers and acquisitions to consolidate their market position and integrate complementary technologies. Also, key players are also strengthening their distribution networks for better access to products and customer service in Europe.

The report provides a comprehensive analysis of the competitive landscape in the Europe dental implants market with detailed profiles of all major companies.

Latest News and Developments:

- On December 10, 2024, Swiss dental solutions AG (SDS) announced a partnership with Gilde Healthcare, wherein Gilde healthcare's private equity fund will acquire a majority stake in SDS. This strategic alliance aims to reinforce SDS's global leadership in ceramic dental implants and accelerate its growth in the European markets.

- On December 10, 2024, Osstem Implant announced its role as a diamond sponsor for the 2024 European Association for Osseointegration, Italian Academy of Osseointegration and Italian Society of Periodontology and Implantology (EAO–IAO–SIdP) joint meeting held in Milan, Italy, Europe from October 24-26. The company participated in workshops, industry forums, and hands-on lectures, showcasing innovations like the 122 Taper Kit, OneGuide Kit, and SOI surface technology. Osstem will also feature a comprehensive exhibition, including its T2 CBCT unit.

Europe Dental Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe dental implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe dental implants market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe dental implants market was valued at USD 2.5 Billion in 2024.

The Europe dental implants market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching a value of USD 3.2 Billion by 2033.

The market is driven by increasing demand for innovative oral health solutions, expansion of dental tourism, rising adoption of advanced dental implant technologies, enhanced regulatory compliance, continual technological advancements in implantology, aging population and increased tooth loss, and growing demand for aesthetic dentistry.

The endosteal implants segment accounted for the largest market share due to their superior stability and natural look.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)