Europe Decorative Laminates Market Size, Share, Trends and Forecast by Product Type, Application, End Use, Texture, Pricing, Sector, and Country, 2025-2033

Europe Decorative Laminates Market Size and Share:

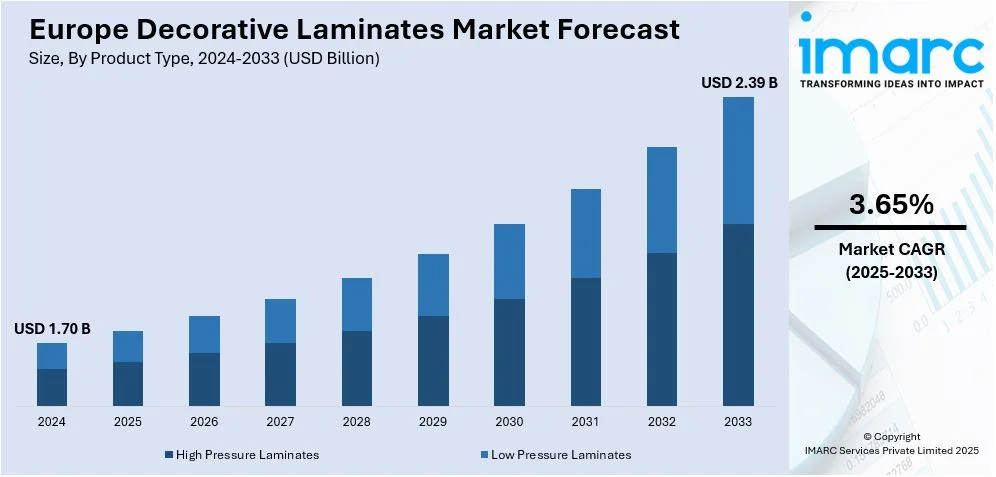

The Europe decorative laminates market size was valued at USD 1.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.39 Billion by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Germany currently dominates the market across Europe. The market is primarily driven by increasing demand for durable, cost-effective, and aesthetically pleasing materials in residential and commercial interiors. Urbanization, a growing preference for modern designs, and renovations of older properties further enhance adoption, and enhance the overall Europe decorative laminates market share. Additionally, the demand for lightweight, multifunctional furniture and the accessibility of laminates through e-commerce platforms further drive market revenue across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.70 Billion |

|

Market Forecast in 2033

|

USD 2.39 Billion |

| Market Growth Rate (2025-2033) | 3.65% |

The market in Europe is majorly driven by the growing demand for aesthetically appealing and durable surfaces in residential and commercial spaces. Also, rising urbanization and an increasing preference for modern interior designs are fueling the adoption of decorative laminates as a cost-effective alternative to wood, stone, or ceramic finishes. The market also benefits from advancements in manufacturing technologies, enabling the production of laminates with enhanced scratch, stain, and moisture resistance. On 1st October 2024, Guardian Glass launched six new Environmental Product Declarations for its flat, coated, and laminated glass products in Europe. These include the lower-carbon Guardian NEXA 6 and NEXA 9, which have reduced embodied carbon by over 40% and 20%, respectively. These EPDs will support architects in the calculation of Whole Life Carbon emissions and environmental certifications including LEED and BREEAM. A new function in Guardian's Performance Calculator also assists in estimation of embodied carbon for various glass combinations. Moreover, the rising trend of renovating older properties across Europe, combined with the easy availability of customizable and eco-friendly laminate options, is further enhancing Europe decorative laminates market share.

In addition, the increasing focus on sustainability and environmentally friendly materials within the construction and interior design industries is significantly supporting the market. Many European consumers and businesses are opting for laminates made from recycled or low-emission materials to meet stringent environmental regulations. On 17th June 2024, ExxonMobil and Hosokawa Alpine, along with Henkel, Nordmeccanica Group, and Univel, jointly created a recyclable MDO-PE/PE laminate specifically developed for food packaging. It contains high moisture and oxygen barrier properties to preserve product freshness. Balancing recyclability with performance, the laminate made of ExxonMobil's polyethylene resins and Henkel's LOCITITE Liofol coatings could easily replace PET and BOPP materials. According to the decorative laminates market outlook in Europe, the rising demand for compact and multi-functional furniture in urban apartments is creating opportunities for laminate manufacturers to offer lightweight and versatile solutions. Furthermore, the growing influence of e-commerce platforms has also facilitated easier access to decorative laminate products, expanding their reach to a broader customer base across the region.

Europe Decorative Laminates Market Trends:

Growing Demand for High-Pressure Laminates (HPL)

High-pressure laminates (HPL) are witnessing rising demand due to their superior durability, versatility, and resistance to impact, heat, and moisture. On 9th May 2023, The Finnish company, The Warming Surfaces Ltd., in cooperation with the laminate producer Surforma and construction group Grupo Casais, revealed its first digital warming surface product - an intelligent warming wall - at the Interzum trade fair in Cologne, Germany. Equipped with ultra-thin Halia warming technology, this innovation promises to deliver energy-efficient, real-time radiant heating incorporated into building materials, such as walls and furniture. This solution addresses EU energy efficiency goals to reduce heating-related emissions and increase comfort in living spaces. As industries such as hospitality, healthcare, and retail require materials that can withstand heavy usage while maintaining visual appeal, HPL has become a preferred choice. Its availability in a wide range of textures, colors, and finishes has further increased its adoption for countertops, furniture, and wall panels. Additionally, the development of anti-bacterial and fire-resistant HPL has widened its application scope, aligning with stricter safety and hygiene standards across Europe.

Increasing Use of Digital Printing Technology

The adoption of digital printing technology in the market is acting as one of the significant Europe decorative laminates market trends. This technology enables manufacturers to create highly detailed, photorealistic designs, catering to customer-specific requirements for personalized interiors. Digital printing also allows for quicker production times and reduced waste, aligning with the region’s sustainability goals. As consumer preferences increase toward unique and visually striking designs, digital printing is being increasingly used to replicate natural materials such as wood, marble, and stone while offering greater design flexibility and cost-effectiveness.

Expansion of Compact Laminates in Furniture Manufacturing

Compact laminates are gaining traction in furniture manufacturing due to their robust properties, including impact resistance and high load-bearing capacity. These laminates are ideal for urban living spaces, where furniture must be lightweight, functional, and space-efficient. Compact laminates also support intricate design applications, making them a favorite for modular kitchens, office furniture, and shelving units. Their ability to combine durability with a sleek, minimalist look has positioned them as a trendy choice among manufacturers targeting contemporary interior styles in the European market. On 17th June 2024, EPF and Unilin announced driving circularity in the European flooring industry, through innovative recycling solutions for laminate, vinyl, and textile floor coverings as part of the EU-backed CISUFLO project. Unilin's breakthrough steam explosion technology recovers wood fibers from MDF/HDF-based laminate flooring, thus enabling their reuse in new products. The process has been demonstrated as economically viable and energy efficient at a pilot line in France and is scalable for large-scale recyclability.

Europe Decorative Laminates Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe decorative laminates market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, application, end use, texture, pricing, and sector.

Analysis by Product Type:

- High Pressure Laminates

- Low Pressure Laminates

High-pressure laminates (HPL) dominate the decorative laminates market as the largest product type segment due to their superior performance, versatility, and aesthetic appeal. Known for their exceptional durability, HPL is widely used in applications requiring resistance to impact, heat, moisture, and wear. Its extensive availability in various textures, patterns, and finishes makes it ideal for countertops, cabinetry, and wall panels in both residential and commercial settings. Additionally, advancements in HPL manufacturing, such as fire-resistant and anti-bacterial laminates, have expanded its applications in sectors including healthcare, hospitality, and retail. The combination of cost-efficiency, longevity, and adaptability to modern design trends has solidified HPL’s position as the most preferred choice among customers and industries across Europe.

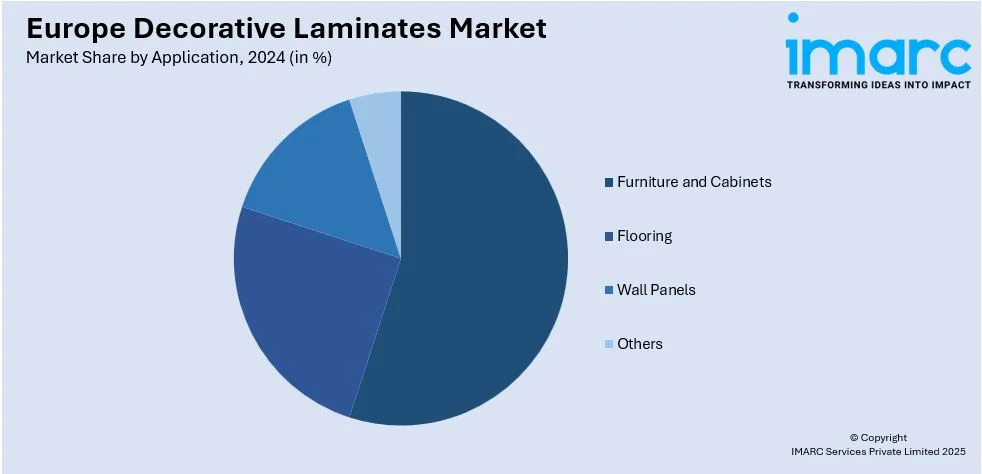

Analysis by Application:

- Furniture and Cabinets

- Flooring

- Wall Panels

- Others

Furniture and cabinets represent the largest application segment in the decorative laminates market, driven by their widespread use in both residential and commercial spaces. Decorative laminates are preferred for furniture and cabinetry due to their durability, cost-effectiveness, and ability to mimic high-end materials such as wood and stone. The growing demand for modular furniture, particularly in urban areas with limited space, has further increased the adoption of laminates for sleek, lightweight, and customizable designs. Laminates also offer enhanced resistance to scratches, stains, and moisture, making them ideal for cabinets in kitchens and bathrooms. With changing consumer preferences for visually appealing, functional, and budget-friendly interiors, furniture and cabinets remain the primary growth drivers for the decorative laminates market.

Analysis by End Use:

- Non-Residential

- Residential

- Transportation

The residential sector dominates the decorative laminates market as the largest end-use segment, fueled by rising urbanization, increasing housing construction, and home renovation activities across Europe. Decorative laminates are widely used in residential interiors for furniture, cabinets, countertops, and wall paneling due to their affordability, durability, and ability to replicate premium materials including wood, stone, and marble. Homeowners favor laminates for their resistance to stains, moisture, and scratches, as well as the extensive variety of colors, patterns, and finishes available to suit diverse interior styles. Additionally, the growing trend of personalized home decor has driven demand for customizable laminates. As homeowners seek stylish yet cost-effective design solutions, the residential sector remains a key driver of Europe decorative laminates market growth.

Analysis by Texture:

- Matte/Suede

- Glossy

Matte/suede finishes hold the largest share in the decorative laminates market’s texture segment, driven by their growing popularity in modern interior design. These finishes offer a sophisticated and understated aesthetic, making them ideal for furniture, cabinets, and wall paneling in both residential and commercial spaces. The matte/suede texture is favored for its smooth, non-reflective surface, which enhances the visibility of patterns and colors while creating a soft, elegant appearance. Additionally, these laminates are highly practical, as they resist fingerprints, scratches, and smudges, ensuring a clean and polished look over time. With the rising preference for minimalist and contemporary decor, matte/suede laminates continue to dominate the market as a versatile and stylish choice for interiors, which is creating a positive Europe decorative laminates market outlook.

Analysis by Pricing:

- Premium

- Mass

The premium pricing segment leads the market due to increasing consumer demand for high-quality, durable, and visually appealing materials. Premium laminates are preferred for their superior finish, enhanced resistance to wear and tear, and the ability to replicate luxurious materials such as exotic wood, natural stone, and metals. These laminates are widely used in upscale residential and commercial projects, including luxury homes, hotels, and office spaces, where aesthetics and performance are critical. Technological advancements have further enabled the production of premium laminates with features including anti-bacterial, fire-resistant, and moisture-proof properties, adding to their appeal. As consumers prioritize long-term value and sophisticated designs, the premium segment continues to dominate the market, particularly in Europe’s high-end interior sector.

Analysis by Sector:

- Organised

- Unorganised

The organized sector holds the largest share in the market, driven by the increasing consumer preference for branded, high-quality products and reliable customer service. Companies in the organized sector benefit from advanced manufacturing technologies, ensuring consistent quality, durability, and a wide range of innovative designs. These manufacturers also adhere to strict environmental and safety standards, aligning with the growing demand for eco-friendly and certified products in Europe. Furthermore, organized players leverage robust distribution networks and partnerships with retailers, ensuring easy availability across markets. With a focus on customer trust, product innovation, and brand recognition, the organized sector outpaces the unorganized segment, catering to both residential and commercial customers seeking long-lasting and premium decorative laminates.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany leads the market as the largest country segment, driven by its robust construction and interior design industries. With a strong focus on quality and innovation, German consumers and businesses prioritize premium and sustainable laminates for residential, commercial, and industrial applications. The country’s well-established housing market, coupled with increasing renovation activities in older properties, has significantly contributed to the Europe decorative laminates market demand. Moreover, Germany’s growing inclination toward eco-friendly materials and compliance with stringent environmental regulations has enhanced the adoption of laminates with recycled content and low emissions. The presence of major manufacturers and advanced production facilities in Germany further solidifies its position as the largest market, catering to both domestic and export demands across Europe.

Competitive Landscape:

The market is highly competitive, with key players focusing on product innovation, sustainability, and strategic expansion to strengthen their market presence. Manufacturers are investing in advanced technologies to produce laminates with enhanced durability, aesthetic appeal, and features such as anti-bacterial and fire-resistant properties. Many companies are also prioritizing eco-friendly practices by introducing laminates made from recycled materials or low-emission products to meet environmental regulations and growing consumer demand for sustainable solutions. Additionally, firms are expanding their distribution networks and forming partnerships with retailers and e-commerce platforms to improve product accessibility. Marketing efforts, such as showcasing diverse textures, finishes, and customizable options, are also being employed to capture a broader customer base across different market segments.

The report provides a comprehensive analysis of the competitive landscape in the Europe decorative laminates market with detailed profiles of all major companies.

Latest News and Developments:

- December 03, 2024: Worthington Steel announced acquiring a 52% stake in Italy-based Sitem Group, an electric motor lamination major for automotive and industrial sectors in Europe. The acquisition supports expansion plans in the European electric vehicle market and further lines up with Worthington's aspirations toward expansion of the laminations business and global presence in the space of electric vehicle manufacturing.

- September 30, 2024: Lampre, DuPont's European partner, launched Fortilam Decor: a laminate solution with the capabilities of Tedlar PVF film in transportation interior railway applications. This laminate has been put out in Berlin, Germany, during InnoTrans, and will demonstrate easy-to-clean chemical resistance for walls, panels, and areas that are subject to high contact.

- May 01, 2024: AGC Glass Europe inaugurated its new laminating line at the Osterweddingen, Germany facility, transforming it into a fully integrated plant for laminated glass that can be realized in Jumbo XXL sizes with high-performance coatings. In total, this investment matches the growing European demand for safety, acoustic comfort, and advanced glazing solutions while offering high potential growth that can be tapped through updated German market standards. In total, the Osterweddingen plant will produce for Germany and the wider European market together with increased production in Cuneo, Italy.

- January 9, 2025: Soyang Europe announced that it has extended its presence into Ireland with a new branch in Dublin, ensuring quicker delivery of its wide-format media solutions, including textile, PVC, and the newly launched SoStick self-adhesive vinyl laminates. The facility will reflect Soyang's UK offering and will have an in-house slitting service for custom sizes.

Europe Decorative Laminates Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminates, Low Pressure Laminates |

| Applications Covered | Furniture and Cabinets, Flooring, Wall Panels, Others |

| End Uses Covered | Non-Residential, Residential, Transportation |

| Textures Covered | Matte/Suede, Glossy |

| Pricings Covered | Premium, Mass |

| Sectors Covered | Organised, Unorganised |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain,Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe decorative laminates market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe decorative laminates market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe decorative laminates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe decorative laminates market was valued at USD 1.70 billion in 2024.

The market growth is driven by increasing demand for durable, cost-effective, and aesthetically appealing materials in residential and commercial interiors. Factors such as urbanization, a growing preference for modern designs, home renovations, and advancements in laminate manufacturing also contribute significantly to market expansion.

The Europe decorative laminates market is projected to exhibit a CAGR of 3.65% during 2025-2033, reaching a value of USD 2.39 billion by 2033.

The high-pressure laminates (HPL) segment accounted for the largest market share in Europe, driven by its superior durability, resistance to heat and moisture, and versatility across applications such as countertops, cabinetry, and wall panels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)