Europe Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Country, 2026-2034

Europe Cybersecurity Market Summary:

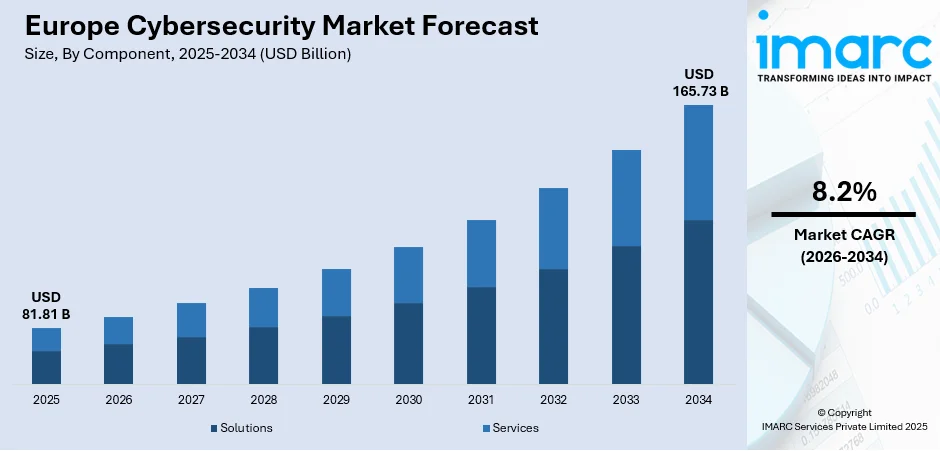

The Europe cybersecurity market size was valued at USD 81.81 Billion in 2025 and is projected to reach USD 165.73 Billion by 2034, growing at a compound annual growth rate of 8.2% from 2026-2034.

Escalating cyber threats coupled with stringent regulatory frameworks are fundamentally reshaping the cybersecurity landscape across Europe. The implementation of the NIS2 Directive has transformed cybersecurity from discretionary spending into compulsory investment. Organizations face mounting pressure from sophisticated ransomware operations that are increasing, while regulatory mandates like DORA enforce comprehensive ICT-risk requirements across financial institutions. This convergence of regulatory imperatives and advanced persistent threats expand the Europe cybersecurity market share growth.

Key Takeaways and Insights:

-

By Component: Services dominate the market with a share of 54.08% in 2025, driven by widespread reliance on managed security providers and professional consulting expertise.

-

By Deployment Type: On-premises leads the market with a share of 58.12% in 2025, reflecting data sovereignty requirements and regulatory compliance priorities.

-

By User Type: Large enterprises represent the largest segment with a market share of 70.1% in 2025, supported by substantial cybersecurity budgets and comprehensive regulatory obligations.

-

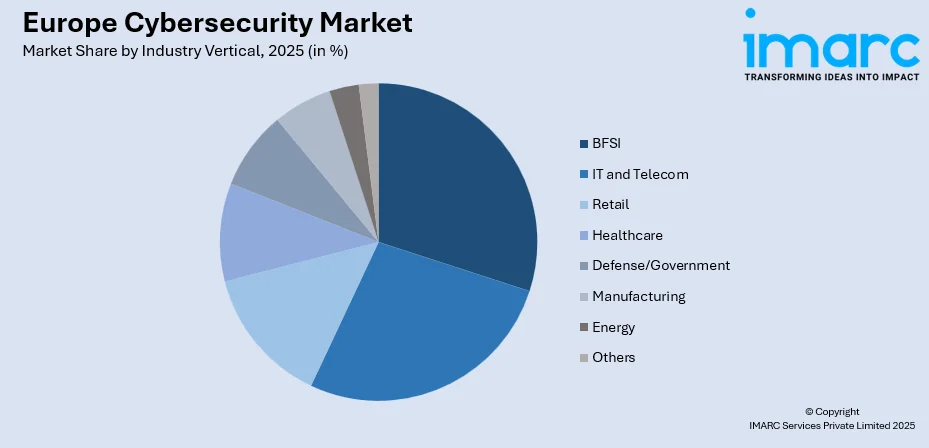

By Industry Vertical: BFSI leads the market with a share of 24.15% in 2025, driven by stringent financial regulations and critical infrastructure protection requirements.

-

By Country: Germany represents the largest segment with a market share of 22% in 2025, propelled by the presence of a robust industrial base and proactive security adoption.

-

Key Players: The Europe cybersecurity market exhibits intense competitive activity with multinational technology corporations competing alongside specialized regional providers across enterprise and SME segments.

To get more information on this market Request Sample

European organizations navigate an increasingly complex threat landscape where ransomware operations target nearly twenty-two percent of global extortion victims. The integration of artificial intelligence (AI) in both attack and defense mechanisms reshapes security operations, with AI-supported phishing campaigns representing over eighty percent of social engineering activity by early 2025. Germany spent EUR 11.2 billion on cybersecurity in 2024 with 13.8% annual growth, while the European market overall grew thirteen percent in the first half of 2025 driven by regulatory demands and AI-related threats. In June 2025, Microsoft launched its European Security Program across all twenty-seven EU member states, expanding government security initiatives and introducing joint research programs focused on AI-cybersecurity challenges with initial investment supporting critical infrastructure protection and agentic AI security development.

Europe Cybersecurity Market Trends:

Integration of AI in Threat Detection and Response

AI fundamentally transforms cybersecurity operations across Europe by enhancing detection capabilities and accelerating incident response. Machine learning (ML) technologies demonstrate proven capability in malware detection, while generative AI models contribute to vulnerability discovery and threat analysis. Organizations deploy AI-driven systems that achieve time savings in incident analyst output for detection and response efforts. Autonomous threat operations eliminate manual bottlenecks by continuously scanning for emerging threats and automatically correlating third-party intelligence feeds. The measures revealed in 2025 in a new Code of Practice of the United Kingdom will provide businesses and public services the assurance required to utilize AI’s transformative capabilities securely, aiding the government’s Plan for Change as the technology enhances public services, boosts productivity, and propels growth throughout the economy.

Shift Toward Cloud and Hybrid Security Architectures

European organizations increasingly adopt cloud and hybrid deployment models that balance operational flexibility with regulatory compliance requirements. Cloud deployments captured massive revenue in 2024 as enterprises embraced elasticity and continuous security updates. Hybrid architectures demonstrated the fastest growth trajectory driven by data sovereignty regulations compelling organizations to retain sensitive information within EU borders while leveraging global hyperscaler analytics capabilities. Financial institutions pilot quantum-secure metro networks maintaining encryption keys on premises while routing telemetry to analytics engines in sovereign clouds. This architectural evolution reflects broader industry recognition that uniform security policy enforcement across diverse deployment models provides superior protection compared to siloed security approaches. In 2024, Microsoft announced the expansion of its cloud infrastructure to support the high requirement for cloud services in Europe. The company invested in a significant expansion in specific European regions, which will make them its largest datacenter regions on the continent.

Consolidation and Strategic Acquisitions Reshape Competitive Landscape

The cybersecurity industry experiences accelerating merger and acquisition activity driven by platform consolidation strategies and market maturation pressures. Quarterly transaction volumes in Q4 2024 reached the highest levels, with security operations emerging as the largest subsector for acquisition activity. Strategic buyers dominated deal-making as organizations sought to integrate complementary capabilities spanning extended detection and response, identity management, and cloud security into unified platforms. In October 2024, Thoma Bravo completed a five point three billion dollar all-cash acquisition of Darktrace, the UK-based cybersecurity AI solutions provider, expanding its enterprise software portfolio. This consolidation trend reflects industry recognition that comprehensive security platforms delivering integrated visibility and automated response provide superior protection compared to point solutions requiring manual correlation across multiple vendors.

Market Outlook 2026-2034:

European cybersecurity investments will maintain robust momentum through 2033 as organizations confront escalating threats from both financially motivated criminals and state-sponsored adversaries. The market generated a revenue of USD 81.81 Billion in 2025 and is projected to reach a revenue of USD 165.73 Billion by 2034, growing at a compound annual growth rate of 8.2% from 2026-2034. Regulatory frameworks including NIS2 and DORA establish permanent security spending floors while expanding coverage to mid-market firms previously exempt from mandatory cybersecurity requirements.

Europe Cybersecurity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Services |

54.08% |

|

Deployment Type |

On-Premises |

58.12% |

|

User Type |

Large Enterprises |

70.1% |

|

Industry Vertical |

BFSI |

24.15% |

|

Country |

Germany |

22% |

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

Services dominate with a market share of 54.08% of the total Europe cybersecurity market in 2025.

Organizations across Europe increasingly rely on specialized service providers to address cybersecurity challenges that exceed internal capabilities. Managed security services deliver scalable protection mechanisms that reduce operational costs while enhancing threat visibility and response times according to industry analysis. Small and medium enterprises particularly depend on third-party expertise, with over seventy percent of UK small businesses utilizing external providers for threat detection and incident response. This service dominance reflects fundamental market dynamics where cybersecurity complexity outpaces in-house team capacity, compelling organizations to outsource security operations center functions, compliance audits, and penetration testing to specialized firms.

Professional services encompassing consulting, implementation, and managed security operations capture substantial market share as regulatory frameworks mandate comprehensive risk assessments and continuous monitoring capabilities. Organizations engage security consultants to architect zero-trust reference models and develop post-quantum cryptography roadmaps that address emerging technological threats. The service segment benefits from recurring revenue models that align provider incentives with customer security outcomes, creating sustainable business relationships that evolve alongside threat landscapes. Integration-ready platforms and managed services providers that streamline multi-jurisdiction reporting requirements particularly thrive under NIS2 compliance mandates that introduced standardized security requirements across eighteen critical sectors.

Deployment Type Insights:

- Cloud-based

- On-premises

On-premises leads with a share of 58.12% of the total Europe cybersecurity market in 2025.

Data sovereignty requirements and regulatory compliance priorities sustain strong demand for on-premises cybersecurity deployments across European organizations. Defense and public-sector workloads mandate full hardware control to meet stringent security protocols that prohibit external data processing. Financial institutions maintain on-premises infrastructure for core banking systems while integrating cloud-based threat intelligence feeds, creating blended topologies that balance control requirements with advanced analytics capabilities. Germany demonstrates particularly strong on-premises adoption with over eighty percent of enterprises deploying firewalls and intrusion detection systems in controlled environments. This deployment preference reflects broader European emphasis on data residency and processing transparency that regulatory frameworks actively reinforce.

Organizations implementing on-premises solutions increasingly adopt hybrid architectures that retain sensitive data processing internally. This architectural evolution enables organizations to maintain compliance with General Data Protection Regulation and sector-specific mandates requiring EU-based data processing while accessing global threat intelligence networks that enhance detection capabilities. Vendors respond by packaging security platforms in appliance form factors that deliver identical policy engines and management interfaces across on-premises and cloud deployments, enabling unified security posture management regardless of workload location. On-premises deployments particularly dominate in industries handling personally identifiable information and classified government data where regulatory frameworks explicitly mandate local processing and storage.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 70.1% share of the total Europe cybersecurity market in 2025.

Large enterprises command dominant market share driven by substantial cybersecurity budgets and comprehensive regulatory compliance obligations. Organizations allocate funds annually to technology development with significant portions dedicated to cybersecurity protection and fraud prevention systems. These enterprises face sophisticated threat actors targeting intellectual property, customer data, and operational infrastructure, necessitating multi-layered defense mechanisms spanning network security, endpoint protection, and identity management. Regulatory frameworks including NIS2 and DORA impose direct accountability on management bodies for cybersecurity compliance, elevating security investments to boardroom priorities. Large enterprises typically maintain dedicated security operations centers staffed by specialized professionals while supplementing internal capabilities with managed security services for continuous threat monitoring.

Enterprise cybersecurity strategies increasingly emphasize zero-trust architectures that eliminate implicit trust assumptions and enforce continuous verification across users, devices, and applications. These organizations invest in advanced threat intelligence platforms that correlate security events across global operations, enabling rapid detection of coordinated attacks spanning multiple geographic regions. The complexity of enterprise IT environments encompassing legacy systems, cloud services, and operational technology networks requires sophisticated security orchestration and automation platforms that streamline incident response workflows. Large enterprises also drive innovation in emerging security domains including quantum-resistant cryptography, AI security, and supply chain risk management, establishing best practices that subsequently cascade to mid-market organizations through technology vendor offerings and regulatory requirements.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

BFSI leads with a share of 24.15% of the total Europe cybersecurity market in 2025.

Banking, financial services, and insurance organizations prioritize cybersecurity investments to protect critical infrastructure and maintain customer trust amid escalating cyber threats. European banks represented forty-six percent of cybersecurity incidents analyzed by ENISA, highlighting the sector's vulnerability to sophisticated attacks. Financial institutions face regulatory mandates including DORA that enforce comprehensive ICT-risk management frameworks and third-party oversight requirements. Banks increased cloud outsourcing spending, reaching average expenditures per significant institution, reflecting strategic infrastructure modernization to support advanced security capabilities.

BFSI cybersecurity strategies emphasize identity protection and access management as credential-centric attacks demonstrate success rates in simulated environments according to recent industry analysis. Financial organizations deploy behavioral analytics and multi-factor authentication systems to detect anomalous access patterns that signal account compromise. Ransomware incidents in financial services rank among the most costly cyberattacks. The sector invests heavily in continuous threat exposure management programs that simulate real-world attack scenarios, validate security control effectiveness, and prioritize remediation efforts based on business risk. Regulatory compliance programs evolve beyond checkbox exercises into strategic frameworks that drive operational discipline and justify security investments through quantified risk reduction.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany exhibits a clear dominance with a 22% share of the total Europe cybersecurity market in 2025.

Germany maintains regional market leadership through robust industrial base characteristics and proactive cybersecurity adoption across public and private sectors. The nation spend massive funds on cybersecurity as automotive and machinery manufacturers modernized operational technology defenses against escalating industrial espionage threats. German organizations reported robust growth in network security expenditures during Q1 2025, driven by GDPR implementation rigor and early NIS2 Directive adoption. Public and private sectors collaboratively invest in cybersecurity infrastructure responding to Germany's strategic positioning as Europe's largest economy and manufacturing powerhouse. The country's implementation law for NIS2 will affect approximately thirty thousand companies nationwide, further accelerating security spending across medium enterprises previously exempt from mandatory requirements.

Germany's cybersecurity ecosystem benefits from strong collaboration between government agencies, research institutions, and private industry that accelerates innovation and threat intelligence sharing. Organizations deploy advanced security frameworks emphasizing zero-trust principles and supply chain risk management that address sophisticated state-sponsored espionage campaigns targeting German intellectual property. The nation's focus on critical infrastructure protection extends beyond traditional sectors to encompass automotive suppliers, chemical manufacturers, and logistics providers that underpin European industrial supply chains.

Growth Drivers:

Why is the Europe Cybersecurity Market Growing?

Critical Infrastructure Protection and National Security Imperatives

European governments prioritize cybersecurity investments to protect critical infrastructure from escalating geopolitical tensions and state-sponsored cyber operations. Nation-state adversaries from Russia, China, Iran, and North Korea demonstrate growing scope and sophistication in targeting energy grids, transportation systems, telecommunications networks, and government services. Russia-nexus actors continue conducting destructive operations targeting infrastructure across Ukraine that create spillover risks for broader European networks, while Chinese state-sponsored adversaries targeted industries in eleven European countries exploiting cloud infrastructure and software supply chains. Governments allocate substantial budgets toward cybersecurity initiatives recognizing that infrastructure resilience directly impacts national security and economic stability. The European Commission will assign €1.3 billion for the implementation of essential technologies that are vital for Europe's future and the tech sovereignty of the continent through the Digital Europe Programme (DIGITAL) work plan for 2025 to 2027 approved in March 2025.

Expansion of Cybersecurity Insurance and Risk Quantification Frameworks

Organizations increasingly adopt cybersecurity insurance as risk transfer mechanisms while insurers mandate strict security protocols as coverage prerequisites. Cyber insurance markets experience significant growth with Paris-based insurer Stoïk securing EUR 25 million in Series B funding during 2024 to enhance its platform throughout Europe focusing especially on small and medium enterprises. Insurers frequently require comprehensive security assessments, incident response capabilities, and specific control implementations as conditions for coverage, compelling organizations to strengthen cybersecurity postures to obtain affordable premiums. The rising reliance on digital technologies renders cyber insurance increasingly vital as it provides financial safety nets helping businesses recover more quickly from incidents while transferring residual risks beyond organizational control.

Proliferation of Connected Devices and Internet of Things Ecosystems

The exponential growth of Internet of Things deployments across industrial, commercial, and consumer applications creates massive expansion in attack surfaces requiring specialized security solutions. Each connected device represents potential entry points for adversaries seeking to compromise networks, exfiltrate data, or disrupt operations. Manufacturing facilities deploy thousands of sensors and actuators within Industry 4.0 initiatives that optimize production efficiency yet introduce operational technology vulnerabilities requiring network segmentation and continuous monitoring. Healthcare providers integrate medical devices into hospital networks improving patient care while creating risks where device compromises could endanger lives. The deployment of 5G networks accelerates IoT adoption by providing enhanced connectivity supporting real-time data transmission and edge computing applications. In 2024, Virgin Media O2 revealed the launch of its 5G Standalone (SA) network in 14 cities throughout the UK. According to the carrier, the new network will be accessible to customers with compatible 5G SA SIMs and devices at no additional charge.

Market Restraints:

What Challenges the Europe Cybersecurity Market is Facing?

Persistent Cybersecurity Skills Shortage Constrains Response Capabilities

Organizations across Europe struggle to recruit and retain qualified cybersecurity professionals amid widespread talent shortages that limit security program effectiveness. Major number of firms report new hiring needs under NIS2 compliance mandates, yet available talent pools prove insufficient to meet surging demand for security operations center analysts, penetration testers, and compliance specialists. The skills gap particularly impacts small and medium enterprises lacking resources to compete with large corporations and specialized security firms for limited expert personnel. Organizations increasingly rely on managed security service providers to supplement internal capabilities, yet this dependency creates concentration risks where provider capacity constraints and service quality variations affect multiple clients simultaneously.

Sophistication of AI-Enabled Cyber Attacks Outpaces Defensive Capabilities

Threat actors increasingly leverage artificial intelligence and machine learning technologies to automate reconnaissance, enhance social engineering campaigns, and evade traditional detection mechanisms. AI-supported phishing operations represented a significant portion of social engineering activity by early 2025, demonstrating widespread adversarial adoption of automation technologies. Organizations face challenges distinguishing between legitimate and malicious AI-generated content as deepfake technologies enable convincing impersonation of executives and trusted parties. Detection systems trained on historical attack patterns struggle to identify novel AI-generated threats that exploit previously unknown vulnerabilities or employ unique attack sequences.

Supply Chain and Third-Party Risk Management Complexity

Modern business operations rely on complex supplier networks and technology dependencies that expand organizational attack surfaces beyond direct control. European organizations face supply chain vulnerabilities where sixty-seven percent of outsourcing contracts involve sub-outsourcing to external service providers, creating multi-tier dependencies with limited visibility. Contracts average four subcontractors each, compounding risk management challenges as organizations struggle to enforce security requirements across extended supplier ecosystems. Third-party breaches demonstrated significant impacts with sixty-three percent of supplier incidents resulting in sensitive data exposure and sale on criminal marketplaces. Regulatory frameworks including NIS2 and DORA mandate supply chain risk management and third-party oversight, yet many organizations lack comprehensive inventories of external dependencies or standardized assessment methodologies for evaluating supplier security postures.

Competitive Landscape:

The Europe cybersecurity market demonstrates intense competitive dynamics characterized by both global technology corporations and specialized regional providers pursuing platform consolidation strategies. Multinational vendors compete across enterprise segments by offering integrated security platforms spanning network protection, cloud security, and identity management. These established players leverage extensive research and development resources to incorporate artificial intelligence and automation capabilities that differentiate offerings while creating switching barriers through ecosystem dependencies. Regional European providers and emerging startups focus on data sovereignty requirements and regulatory compliance expertise that resonate with organizations prioritizing local data processing and European Union alignment. Merger and acquisition (M&A) activity fundamentally reshapes competitive positioning as strategic buyers pursue capability consolidation and geographic expansion.

Recent Developments:

-

In December 2025, Capgemini announced that it has been chosen by the European Commission’s Directorate-General for Digital Services (DIGIT) to deliver extensive cybersecurity services to public entities throughout the European Union, in collaboration with Airbus Protect, PwC, and NVISO. The MC17 FREIA Cyber Framework Contract is a multi-million Euro deal lasting four years. In this effort, Capgemini will enhance cybersecurity measures and safeguard essential digital infrastructure for 71 European Institutions, Bodies, and Agencies (IBAs).

-

In September 2025, Atos, an international technology company driven by AI, declared that it received a major contract under Lot 1 (Technical Operations Services) of the European Commission’s CLOUD II Dynamic Purchasing System (DPS 2) Mini-Competition 17 (MC17) focused on Cybersecurity. Worth up to €326 million, this contract represents one of the most significant cybersecurity service deals in Europe.

Europe Cybersecurity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe cybersecurity market size was valued at USD 81.81 Billion in 2025.

The Europe cybersecurity market is expected to grow at a compound annual growth rate of 8.2% from 2026-2034 to reach USD 165.73 Billion by 2034.

Services dominated the market with 54.08% share in 2025, driven by widespread reliance on managed security providers delivering scalable protection that reduces operational costs by thirty percent while addressing cybersecurity complexity exceeding internal team capabilities across small and medium enterprises.

Key factors driving the Europe cybersecurity market include stringent regulatory frameworks such as NIS2 Directive covering entities with mandatory compliance requirements, escalating ransomware attacks targeting a major percent of global victims, and accelerating digital transformation initiatives expanding cloud adoption and IoT deployments creating new security requirements.

Major challenges include persistent cybersecurity skills shortages with firms reporting new hiring needs under compliance mandates, sophistication of AI-enabled cyber attacks with AI-supported phishing representing social engineering activity, and supply chain risk management complexity where a significant percent of outsourcing contracts involve sub-outsourcing creating multi-tier dependencies with limited visibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)