Europe Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Country, 2025-2033

Europe Crane Market Size and Share:

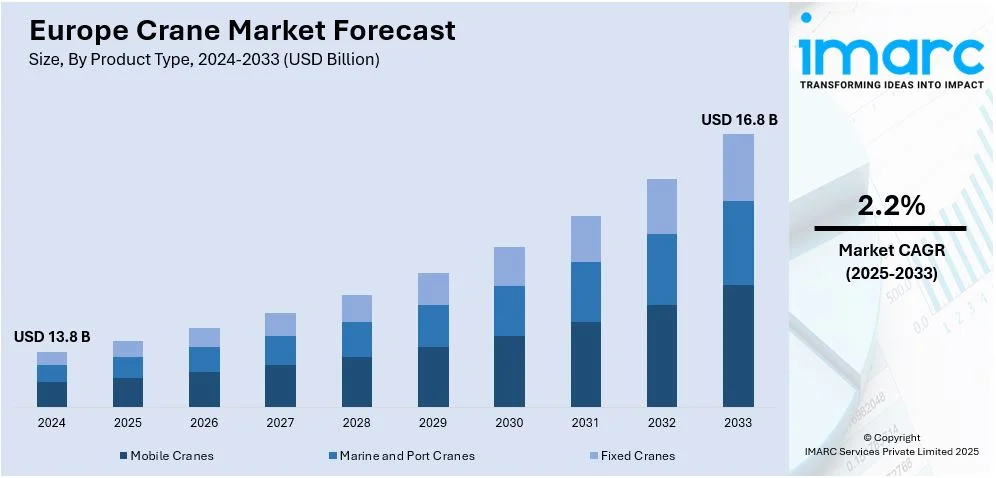

The Europe crane market size was valued at USD 13.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.8 Billion by 2033, exhibiting a CAGR of 2.2% from 2025-2033. The market is expanding due to increasing infrastructure investments, urbanization, and technological advancements. Demand for smart, energy-efficient cranes is rising, driven by construction, industrial automation, and renewable energy projects. Rental services and regulatory compliance further influence market growth, with manufacturers focusing on innovation and safety enhancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.8 Billion |

|

Market Forecast in 2033

|

USD 16.8 Billion |

| Market Growth Rate (2025-2033) | 2.2% |

The Europe crane market growth drivers include increasing infrastructure investments and rapid urbanization. For instance, as per the European Commission, by 2050, urbanization across the European Union is estimated to elevate to around 83.7%. Governments across the region are prioritizing the modernization of transportation networks, including roads, railways, and bridges, which require advanced lifting solutions. Additionally, growing urban construction projects, such as high-rise buildings and smart city developments, are driving demand for efficient and high-capacity cranes. The rise of renewable energy projects, particularly wind farms, further supports market growth. Stricter safety and environmental regulations are pushing manufacturers to develop more efficient, low-emission cranes, reinforcing adoption across various industries, thereby shaping a positive crane market outlook in Europe.

The adoption of advanced crane technologies, including automation, telematics, and remote monitoring, is shaping market growth. These innovations enhance efficiency, safety, and operational control, attracting construction firms and industrial users. In addition, the increasing preference for rental services is influencing market dynamics, allowing businesses to access high-performance cranes without large capital investments. Rental providers are expanding their fleets with energy-efficient and technologically advanced models to meet regulatory and industry requirements. For instance, in October 2024, Klasco, a Europe-based company, employed a new e-crane at its scrap terminal. This leading-edge crane is highly energy-efficient with an electromotor of 45kW of capacity. Moreover, with the rise of digitalization and smart construction practices, demand for cranes with integrated control systems continues to grow, consequently expanding the Europe crane market share.

Europe Crane Market Trends:

Integration of Smart Technologies

The Europe crane market is witnessing increased adoption of smart technologies, including telematics, remote monitoring, and automation. These innovations enhance operational efficiency, safety, and predictive maintenance, reducing downtime and costs. Construction firms and industrial operators are prioritizing cranes equipped with real-time data analytics for improved load management and fleet optimization. Manufacturers are integrating IoT-enabled systems to ensure compliance with stringent safety regulations and enhance productivity. For instance, in May 2024, Konecranes, a Europe-based company, unveiled its latest line of industrial cranes X-series that is integrated with TRUCONNECT, a remote controlling software that facilitates wireless and secure upgrades. Furthermore, the demand for autonomous and semi-autonomous lifting solutions is also rising, driven by labor shortages and the need for precise, controlled operations in complex construction environments.

Growth in Crane Rental Services

The demand for crane rental services is rising across Europe, driven by cost efficiency, project-based requirements, and the need for advanced lifting solutions without heavy capital investment. Construction firms and industrial operators are increasingly opting for rental models to access modern, high-capacity cranes with minimal maintenance liabilities. In addition, rental providers are expanding their fleets with energy-efficient and technologically advanced models to meet evolving regulatory and project demands. The shift toward adaptable leasing choices, encompassing long-term and short-term rentals, is further driving market competition, prompting companies to offer customized service agreements and value-added solutions. For instance, in August 2024, Maeda MK3053-C spider crane was exported to Hird, a UK-based rental firm. This crane offers new abilities to the rental company by expanding the line of lifts they can deal with.

Rising Demand from Renewable Energy Projects

The expansion of renewable energy projects, particularly wind power, is fueling crane demand in Europe. For instance, in January 2025, Orsted announced construction of an offshore wind farm, with a capacity of 1.5GW, in the Baltic Sea, Europe. This is said to be the biggest venture for renewable energy. The installation of onshore and offshore wind farms requires specialized high-capacity cranes capable of handling large turbine components at considerable heights. Governments are investing in clean energy infrastructure, driving demand for lifting equipment suited for challenging environments. Crane manufacturers are developing customized solutions with enhanced lifting capacities and stability to support the growth of wind energy. The transition toward sustainable power generation is expected to sustain long-term demand for cranes across the European renewable energy sector.

Europe Crane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe crane market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

Mobile cranes stand as essential components in the Europe crane market since they combine their flexible use with mobile mobility and efficient operations. Mobile cranes support construction sites, logistics operations, and industrial projects due to their capability to lift heavy materials through different kinds of surfaces. The market continues to grow because modern technology offers increased lifting options and combines telemetry systems with efficient engines. Furthermore, the market is augmented by mobile cranes necessity in modern urban construction, infrastructure improvements, and renewable energy projects. The market growth of rental services enables contractors to obtain advanced crane models by avoiding major financial outlays. The purchasing process for mobile cranes is further shaped by safety-focused changes and regulatory updates and real-time monitoring and automated systems. Moreover, regional infrastructure modernization combined with industrial development across Europe is anticipated to sustain mobile crane demand because these machines have established themselves as fundamental equipment in the European crane market.

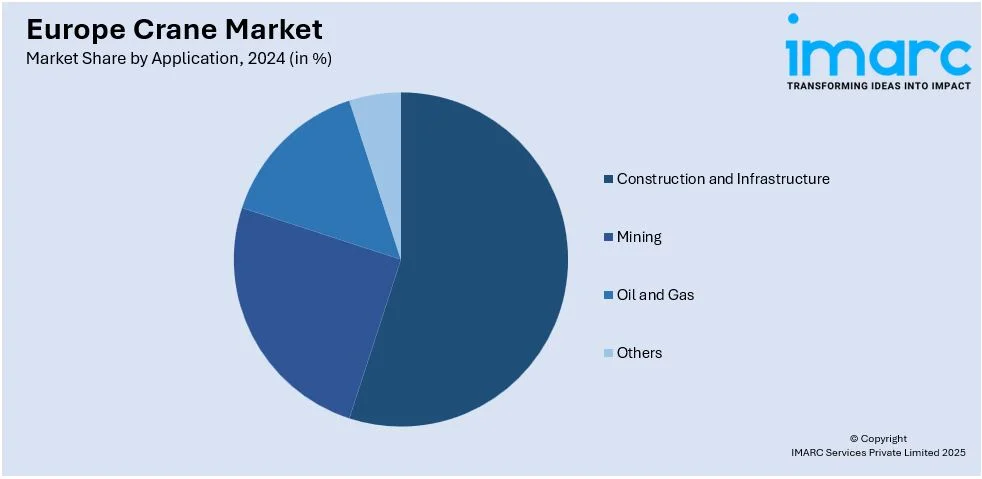

Analysis by Application:

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

Europe crane market research report indicates that the construction and infrastructure sector is the leading application segment, with large-scale urban projects and public works fueling market growth. Increasing investments in residential, commercial, and industrial construction are intensifying the need for high-capacity cranes to manage complex lifting operations. Governments across the region are prioritizing infrastructure modernization, including road networks, bridges, ports, and railway expansions, further supporting crane deployment. The shift toward green building initiatives and renewable energy projects, such as wind farms and solar installations, is also influencing market trends. Stricter safety and environmental regulations are prompting manufacturers to develop more efficient and technologically advanced cranes with enhanced control systems. Additionally, public-private partnerships and EU-backed infrastructure funding are reinforcing demand, ensuring a steady market outlook. The growing emphasis on sustainable construction and smart infrastructure solutions continues to shape crane utilization across the region.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Europe crane market analysis reveal that Germany holds the largest market share due to its strong construction sector, advanced manufacturing base, and significant infrastructure investments. Large-scale projects in transportation, renewable energy, and industrial expansion drive crane demand. For instance, as per industry reports, Germany witnessed a significant inclination toward renewable sources of energy in 2024, with this energy contributing to 59% of the nation's overall electricity production. This indicates the rapid adoption of solar or wind power which can significantly bolster cranes demand for infrastructure construction. Moreover, the country’s emphasis on automation and smart lifting solutions enhances efficiency and compliance with stringent safety regulations. Additionally, the presence of major crane manufacturers and rental service providers strengthens market growth. With continued investments in urban development, logistics, and energy infrastructure, Germany remains the leading market for crane deployment in Europe.

Competitive Landscape:

Crane market in Europe exhibits intense competition, impacted by the robust establishment of prominent manufacturers, regional players, and rental service providers. Companies focus on technological advancements, including automation, telematics, and energy-efficient designs, to enhance performance and regulatory compliance. Strategic partnerships, acquisitions, and geographic expansion drive market positioning. For instance, in May 2024, Petrolift announced expansion of its partnership with Manitowoc to proliferate its fleet by deploying Manitowoc's Grove all-terrain cranes. These cranes will foster installations of wind turbine, along with being employed in petrochemical ventures across Europe, significantly improving Petrolift's operational functionality. Moreover, increasing demand for rental solutions has intensified competition, with firms offering flexible leasing options and value-added services. Innovation in smart lifting solutions and safety enhancements remains a key differentiator. With rising infrastructure investments, market participants continue to strengthen their portfolios to meet evolving industry demands.

The report provides a comprehensive analysis of the competitive landscape in the Europe crane market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, SeaPort Manatee announced receival of new eco-effective cranes, manufactured by Konecranes, a Europe-based company. These cranes can carry 125 metric tons of weight and are anticipated to be deployed functionally in January 2025.

- In July 2024, Hydrauliska Industri AB, a Europe-based company, unveiled its latest product line for four new cranes that are highly energy-efficient and built for medium duty loading applications. The product line includes 192, 142, 162, and 232 crane.

- In March 2024, ABB and Kuenz announced securing Europe’s biggest single order for Automatic Stacking Cranes, supplying one Intermodal Yard Crane and 62 ASCs in Netherlands, doubling capacity of the container with advanced automation and electrical technology.

- In February 2024, NOV announced the successful selling of its first electric subsea crane to a customer in Europe. This innovative crane provides improved efficacy in comparison to electro-hydraulic cranes, aiding in reduction of emissions from vessel.

Europe Crane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Oil and Gas, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe crane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe crane market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe crane market was valued at USD 13.8 Billion in 2024.

The market is bolstering mainly because of magnifying infrastructure projects, urbanization, and industrial automation. Need for smart cranes, stringent safety policies, and increasing investments in energy further aid growth. Innovations in telematics, rental services, and government-backed construction ventures also contribute to market expansion.

IMARC estimates the Europe crane market to reach USD 16.8 Billion by 2033, exhibiting a CAGR of 2.2% from 2025-2033.

Germany accounted for the largest country market share due to its robust construction segment, comprehensive industrial base, and elevated infrastructure investments. The nation’s focus on automation, smart crane adoption, and renewable energy projects further bolsters requirement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)