Europe Courier, Express and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End Use Sector, and Country, 2025-2033

Europe Courier, Express and Parcel (CEP) Market Size and Share:

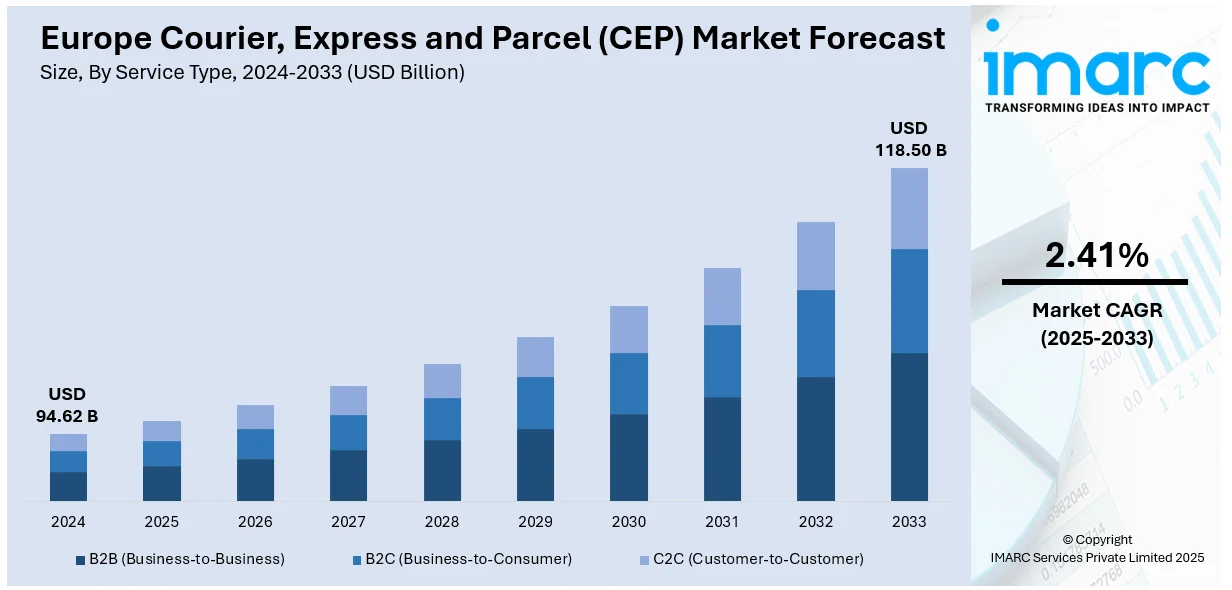

The Europe courier, express and parcel (CEP) market size was valued at USD 94.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 118.50 Billion by 2033, exhibiting a CAGR of 2.41% from 2025-2033. The courier, express, and parcel (CEP) market share in Europe is growing due to the rising e-commerce demand, cross-border trade expansion, and increasing same-day and next-day delivery expectations. Technological advancements, improved last-mile logistics, and the growing number of shipments are also boosting the market growth. Additionally, sustainability initiatives and urban logistics innovations are shaping service models and driving operational efficiencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 94.62 Billion |

|

Market Forecast in 2033

|

USD 118.50 Billion |

| Market Growth Rate (2025-2033) | 2.41% |

The expansion of online shopping is increasing the number of parcels managed throughout Europe. Higher individual reliance on digital platforms is expanding delivery demands, particularly for last-mile services. This sustained rise in e-commerce activity continues to be a primary contributor to the market expansion across both domestic and cross-border segments. Moreover, individual demands for quicker and scheduled deliveries are encouraging CEP providers to concentrate on improving efficiency and boosting service dependability. This entails investment in sophisticated logistics solutions designed to enhance delivery speed, operational flexibility, and responsiveness to immediate client delivery preferences and timelines.

Apart from this, retailers are increasingly embracing omnichannel strategies that combine online and offline sales channels. This change is creating intricate logistical needs for inventory transportation, delivery, and returns handling. CEP providers are modifying their services to facilitate multichannel fulfillment, guaranteeing uniformity and speed across various retail touchpoints and distribution systems. In addition, environmental factors are shaping the strategic focus of logistics firms in Europe. Regulatory requirements and stakeholder demands are driving investment in low-emission delivery methods and eco-friendly operational practices. Firms are also embracing energy-saving transport and packaging solutions to conform with wider climate objectives and minimize ecological effects in parcel logistics

Europe Courier, Express and Parcel (CEP) Market Trends:

E-Commerce Expansion and User Demand

One of the main factors propelling the CEP market in Europe is the swift expansion of e-commerce. With more people opting for online shopping because of its convenience, assortment, and competitive prices, the need for quick and dependable delivery services is growing. This change in user habits demands sophisticated logistics networks that can handle large quantities of packages, especially in metropolitan and suburban regions. As demand for same-day and next-day deliveries increases, CEP providers face pressure to create agile, effective last-mile solutions. Seasonal highs, like holiday shopping and sales occasions, additionally increase parcel quantities. A recent report from FedExunderscores this growth, predicting that parcel carriers will deliver 6.2 billion shipments throughout Europe from October to December 2024, marking a 9% rise compared to 2023. Significantly, almost 70% of these packages (4.2 billion) will be sent directly to clients, highlighting the ongoing prevalence of B2C deliveries in fueling growth within the CEP industry and transforming how logistics companies strategize, oversee, and carry out deliveries.

Increased Investment in Infrastructure and Network Expansion

To meet the growing demand and performance expectations, CEP companies are investing in expanding their logistical infrastructure across Europe. This includes new fulfillment centers, automated sorting facilities, regional hubs, and advanced fleet capabilities. These investments are critical for maintaining speed, reliability, and geographic reach as parcel volumes grow. Strategic placement of logistics centers helps optimize delivery routes and reduce last-mile delivery times, particularly in underserved or rural areas. Additionally, companies are enhancing their digital infrastructure to support real-time tracking, data analytics, and dynamic route planning. Partnerships with local delivery networks and third-party logistics (3PL) providers also form part of this expansion strategy. These investments reflect a long-term commitment to scalability, efficiency, and resilience, allowing CEP players to better absorb demand surges and adapt to geopolitical or supply chain disruptions. For instance, in 2024, CIRRO Fulfillment opened its 21st fulfillment center, Ergo Fradley 354, in Lichfield, UK, spanning 33,000 sqm. The facility supports efficient, sustainable operations with advanced features and strategic location near major transport routes. This expansion boosts CIRRO’s total fulfillment capacity to over 500,000 sqm across 14 European countries.

Entry of International Players Enhancing Competition and Coverage

The arrival of new international courier and logistics companies in European markets is boosting the CEP sector by enhancing competition, broadening service options, and increasing delivery reach. These newcomers frequently offer specialized cross-border skills, digital-centric platforms, and strategic collaborations with established local entities. Their entry encourages current providers to enhance service quality, implement flexible pricing, and invest in technology that engages clients. It also enhances connectivity between Europe and non-EU areas, which is particularly vital for communities with significant diaspora connections or thriving trade relationships. By creating networks in major urban areas, these companies enhance last-mile delivery alternatives and strengthen the overall resilience of the parcel system. In 2024, Nova Post, a Ukrainian logistics operator, launched its services in the UK with branches in London and a courier app. The company allows users to send and receive parcels to/from Ukraine and within the UK, with delivery to Ukraine taking as little as 5 days. The service includes partnerships with InPost and DPD for parcel lockers and nationwide delivery.

Europe Courier, Express and Parcel (CEP) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe courier, express and parcel (CEP) market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service type, destination, type, and end use sector.

Analysis by Service Type:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

B2B (business-to-business) stand as the largest component in 2024, holding 55.9% of the market. B2B leads the market owing to the constant movement of goods among manufacturers, wholesalers, and retailers in various industries. Ongoing demand for large shipments, service contracts for logistics, and urgent delivery timelines sustain steady volume in this sector. Numerous sectors depend on trustworthy and effective courier services for parts, machinery, and inventory oversight, rendering B2B logistics a crucial element of the supply chain. Moreover, the expansion of pan-European commerce and regional distribution centers is catalyzing the demand for cohesive B2B delivery solutions. Sophisticated tracking technologies, collaboration with warehouses, and customized logistics solutions are further supporting B2B dominance. Businesses emphasize choosing courier partners that guarantee prompt and safe delivery internationally, maintaining reliable schedules and efficient routing. The capacity of B2B CEP services to deliver scalability, dependability, and cost-effectiveness makes them essential for preserving business continuity and fulfilling operational needs.

Analysis by Destination:

- Domestic

- International

Domestic leads the market with 69.5% of market share in 2024 because of the rising number of intra-country shipments fueled by robust regional supply chains and client demand for rapid deliveries. Domestic is crucial for local retailers, e-commerce platforms, and subscription services to efficiently meet order fulfillment. Preferences for same-day and next-day delivery, particularly in urban and semi-urban regions, is encouraging courier companies to enhance local networks, hubs, and last-mile delivery systems. Companies also favor local suppliers for reduced transit times, easier regulations, and lower shipping expenses in comparison to overseas logistics. Additionally, state funding for national transportation infrastructure and digital logistics networks facilitates smooth internal parcel delivery. The simplicity of combining courier services with national postal systems and local warehousing centers boosts delivery speed and reach. All these elements together make domestic as the favored option for various B2B and B2C deliveries.

Analysis by Type:

- Air

- Ship

- Subway

- Road

Air is a crucial segment in the market owing to the growing demand for time-sensitive and high-value shipments requiring rapid transit across long distances. Businesses often use air delivery for urgent documents, medical supplies, or electronics where speed outweighs cost considerations. Air freight enables efficient cross-border trade and supports international e-commerce growth, especially in premium and express service categories.

Ship supports bulk and heavy parcel deliveries over longer transit periods, primarily across intercontinental or intra-European routes. It is cost-effective for large-volume B2B shipments, especially in industrial and manufacturing sectors. Ports across Europe are well-equipped with cargo handling and intermodal transport facilities, allowing seamless integration with road and rail logistics.

The subway segment is growing relevance in highly urbanized cities where traffic congestion challenges last-mile delivery. It is primarily used in pilot programs or niche markets to enable quick intra-city transport of lightweight parcels through metro systems. Subway-based logistics offer low-emission, high-frequency delivery alternatives and are increasingly explored in sustainability-driven initiatives.

Road remains a vital segment attributed to its flexibility, coverage, and cost-effectiveness. It supports both B2B and B2C deliveries across urban, suburban, and rural regions. Road-based CEP services are integral to last-mile delivery networks and are often paired with other transport modes for multimodal solutions.

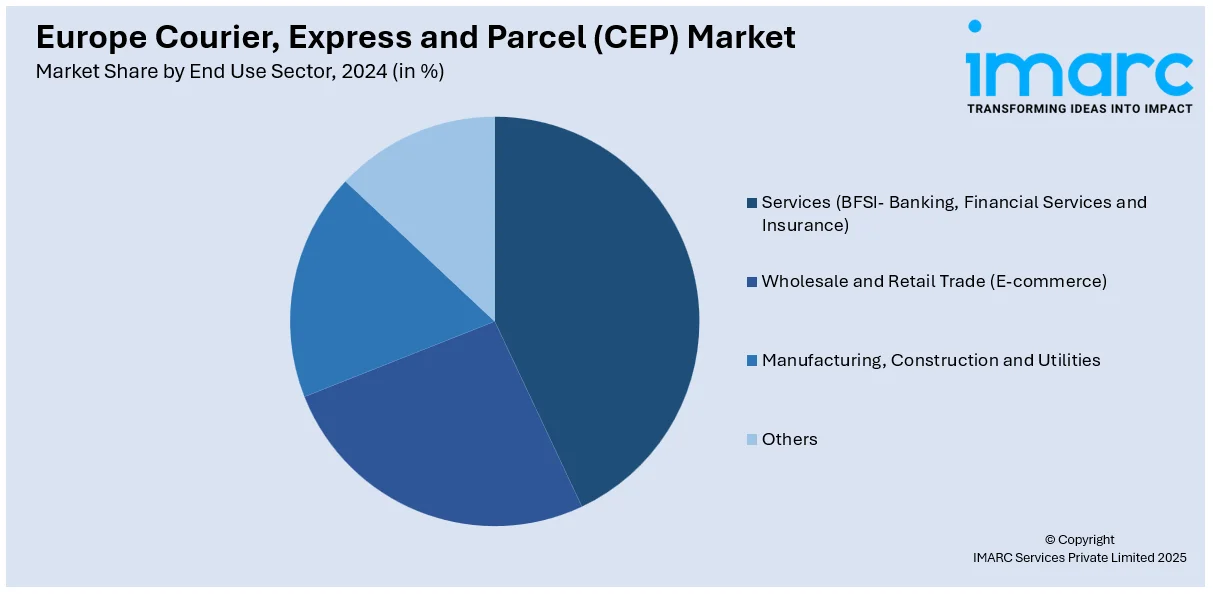

Analysis by End Use Sector:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

Services (BFSI – banking, financial services, and insurance) rely on CEP services for the secure and timely movement of documents, account materials, and sensitive communication. Financial institutions require trusted courier networks for delivering contracts, credit cards, and legal papers, often under strict timelines. High security, tracking capabilities, and compliance with regulatory handling procedures make CEP providers essential partners for the BFSI sector.

Wholesale and retail trade (e-commerce) is a major driver of parcel volumes across Europe. The rapid expansion of online shopping has accelerated demand for fast, reliable, and cost-effective delivery services. CEP providers cater to both large-scale retailers and small sellers, handling everything from order fulfillment to reverse logistics.

The manufacturing sector depends on CEP services for just-in-time delivery of parts, raw materials, and equipment between facilities, suppliers, and clients. Speed and reliability are critical to avoid production delays and manage inventory efficiently. This segment often requires scheduled pickups, tracking visibility, and specialized handling for components that are bulky, fragile, or high-value.

CEP services in the construction and utilities segment support the transport of tools, machinery parts, safety equipment, and documentation to and from project sites. Delivery reliability is crucial in this sector to maintain construction timelines and operational continuity. Couriers may handle urgent orders for replacement parts, technical manuals, or compliance documents, especially in remote or infrastructure-heavy areas.

Others include sectors like healthcare, education, public administration, and entertainment. In healthcare, CEP services transport lab samples, medical devices, and pharmaceutical products with speed and care. Educational institutions use courier services for distributing examination materials or administrative documents. Public sector organizations rely on secure document exchange, and media and entertainment companies require delivery of production equipment and time-sensitive content.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, United Kingdom accounted for the largest market share of 26.7% because of its sophisticated logistics system, extensive retail and e-commerce operations, and substantial parcel volume per person. As per the IMARC Group, the size of the UK e-commerce market hit USD 297.0 Billion in 2024. The nation gains from a developed delivery system backed by a robust presence of local and global CEP providers. The widespread use of the internet and user inclination towards online shopping is resulting in a rise in B2C deliveries, whereas a vibrant small and medium business sector guarantees consistent B2B parcel flow. The UK's advanced road, rail, and air freight systems facilitate effective distribution throughout various areas. Moreover, the extensive use of technology in warehousing, route optimization, and last-mile delivery enhances service speed and improves transparency. The nation's regulatory system also fosters a competitive market, promoting ongoing service improvements and investment.

Competitive Landscape:

Major stakeholders in the market are improving service speed, broadening international logistics capabilities, and investing in digital infrastructure to optimize operations. They are concentrating on automating sorting and warehousing, incorporating AI-enabled route optimization, and enhancing real-time tracking systems. To achieve sustainability objectives, businesses are utilizing electric delivery vans and environment-friendly packaging. Collaborative strategies with e-commerce platforms and third-party logistics companies are enhancing distribution networks. Participants are also tailoring delivery solutions to meet changing user preferences, such as adaptable pickup options and safe drop-off spots. In 2024, DHL and Poste Italiane officially launched Locker Italia, a joint venture aimed at installing 10,000 parcel lockers across Italy. The initiative began with the installation of the first locker in Rome and was designed to offer a provider-independent, convenient delivery network.

The report provides a comprehensive analysis of the competitive landscape in the Europe courier, express and parcel (CEP) market with detailed profiles of all major companies, including:

- DHL Group

- FedEx

- GEODIS

- International Distributions Services

- La Poste Group

- Logista

- Otto GmbH & Co. KG

- Post NL

- Poste Italiane

- Sterne Group

- United Parcel Service of America, Inc.

Latest News and Developments:

- November 2024: InPost launched an international delivery service for eight European countries including Poland, France, Spain, Portugal, Italy, Belgium, Netherlands, and Luxembourg. The service targeted both businesses and individuals.

- October 2024: CacheFly launched a new Point of Presence (PoP) in Milan, Italy, enhancing content delivery performance and regulatory compliance across Europe. The Milan PoP supported GDPR adherence and boosted speed through anycast-based routing.

- October 2024: Ochama, JD.com’s European retail brand, launched a 27,000-square-meter automated warehouse in Poland to boost efficiency and customer experience. Located near the Polish-German border, the facility tripled picking efficiency and enabled 48-hour fulfillment in Poland.

- September 2024: Cainiao, Alibaba’s logistics arm, launched a next-day delivery service in Europe and announced plans to build new global logistics hubs. The EUR 2 service began in Spain and Portugal, with a three-day option available elsewhere in Europe.

- September 2024: Tata Consultancy Services (TCS) launched a new delivery center in Warsaw, Poland, aiming to expand operations and double its workforce to over 1,200 within a year. The center, part of TCS’ European delivery network, leveraged Poland’s growing ICT talent pool to deliver hyper-connected services across Europe.

Europe Courier, Express and Parcel (CEP) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End Use Sector Covered | Services (BFSI- Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | DHL Group, FedEx, GEODIS, International Distributions Services, La Poste Group, Logista, Otto GmbH & Co. KG, Post NL, Poste Italiane, Sterne Group, United Parcel Service of America, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe courier, express and parcel (CEP) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe courier, express and parcel (CEP) market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe courier, express and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe courier, express and parcel (CEP) market in the region was valued at USD 94.62 Billion in 2024.

The market in Europe is growing due to rising e-commerce demand, cross-border trade expansion, and increasing same-day and next-day delivery expectations. Technological advancements, improved last-mile logistics, and growing B2C shipments are also boosting market momentum. Additionally, sustainability initiatives and urban logistics innovations are shaping service models and driving operational efficiencies.

The Europe courier, express and parcel (CEP) market is projected to exhibit a CAGR of 2.41% during 2025-2033, reaching a value of USD 118.50 Billion by 2033.

B2B (business-to-business) leads the market in 2024, attributed to consistent shipment volumes, contractual logistics demand, and strong inter-industry supply chain requirements across Europe.

In 2024, domestic dominates the market owing to faster deliveries, lower costs, local e-commerce growth, and efficient national logistics networks.

In 2024, United Kingdom exhibits a clear dominance in the market because of advanced logistics, high parcel volume, strong e-commerce, and efficient infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)