Europe Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Country 2026-2034

Europe Cosmetics Market Size:

The Europe cosmetics market size reached USD 111.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 138.7 Billion by 2034, exhibiting a growth rate (CAGR) of 2.50% during 2026-2034. The market is experiencing significant growth, driven by the rising consumer demand for natural and organic products, the emergence of e-commerce and digital marketing platforms, increasing focus on sustainability and ethical practices, rapid advancements in cosmetic technology and innovation, and an expanding male grooming market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 111.3 Billion |

| Market Forecast in 2034 | USD 138.7 Billion |

| Market Growth Rate (2026-2034) | 2.50% |

Access the full market insights report Request Sample

Europe Cosmetics Market Analysis:

- Major Market Drivers: The major drivers include the increasing demand from consumers for natural and organic goods as more people are looking for cosmetics free from artificial components and dangerous chemicals. Additionally, new developments in cosmetic formulations, such as augmented reality (AR) and artificial intelligence (AI) technologies, which are improving product efficacy and consumer experience, is driving the expansion of this industry. Besides this, growth is also being aided by the expanding male grooming sector, as more men are spending money on professional skincare, haircare, and grooming products.

- Key Market Trends: The ongoing shift towards sustainability and ethical practices is marked by a strong emphasis on cruelty-free manufacturing, sustainable ingredient sourcing, and eco-friendly packaging. In addition, significant developments in digital marketing and e-commerce platforms, helping online retailers take the lead in the distribution of these products, is acting as a growth-promoting factor. Furthermore, there is a growing demand for cosmetics that give both aesthetic and well-being advantages, owing to the increasing emphasis on clean beauty and health-conscious products.

- Geographical Trends: Country-wise the market is expanding rapidly due to a strong preference for high-quality, innovative, and sustainable cosmetics, which is driven by consumer awareness and the imposition of strict regulatory standards.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry. Some of the key players include L'Oréal Group, Procter & Gamble, Unilever, Beiersdorf AG, Coty Inc., Shiseido Co., Ltd., Kao Corporation, and Johnson & Johnson.

- Challenges and Opportunities: The high cost of natural and sustainable ingredients is one of the primary obstacles as it raises product costs and affect certain consumers' capacity to purchase them. However, the rising demand for unisex cosmetics and male grooming goods is providing considerable opportunities for the brands to capitalize on these trends.

Europe Cosmetics Market Trends:

Rising Consumer Demand for Natural and Organic Products

The increasing knowledge of European consumers and demand for natural and organic products is propelling the market. Consumers are becoming more conscious of the ingredients in the products they buy and are more informed about the harm they may cause. Furthermore, they tend to avoid products with synthetic chemicals, parabens, sulfates, and other harmful substances, favoring those with natural, organic, and cruelty-free labels. Additionally, Europe is among the largest markets for natural and organic cosmetics, as it accounts for 38% of the natural and organic cosmetics market value globally. In the year 2020, the European market for natural and organic cosmetics was valued at €3.89 billion, which is up from €3.64 billion in 2018. This shift in consumer preference has compelled cosmetic companies to innovate and reformulate their products to meet these demands.

Emergence of E-commerce and Digital Marketing Platforms

The surge in the use of e-commerce and digital marketing platforms is transforming the landscape of the cosmetics market in Europe. In 2022, 91% of people aged 16 to 74 in the European Union (EU) had used the internet, 75% of whom had bought or ordered goods or services for private use. The percentage of e-shoppers expanded dramatically from 55% in 2012 to 75% in the year 2022. Cosmetics was among the top categories that were purchased by consumers online, which reached 17% of total purchases. These platforms give consumers the convenience of shopping from the comfort of their homes in combination with the extensive reach of digital marketing. They are known to provide detailed product descriptions, customer reviews, and personalized recommendations, enhancing the shopping experience and encouraging higher purchase rates.

Increasing Focus on Sustainability and Ethical Practices

Consumers are increasingly prioritizing sustainability and ethical standards, seeing products aligned with their beliefs as they become more aware of the effects of their purchases. This has heightened the demand for items that are created by using sustainable ingredients and packaging. Additionally, consumers are also becoming more receptive to brands that have been paying attention to cruelty-free testing, fair trade sourcing, and lowering carbon emissions. Companies are also investing in sustainable technologies and practices, such as biodegradable packaging, refillable containers, and the reduction of plastic waste, to meet consumer expectations and comply with regulations. For instance, Cosmopak develops and supplies luxury cosmetics to the hotel and amenities sectors. The company has modified its products to make them more sustainable and to get them awarded the EU Ecolabel certification. This allowed the company to grow and enabled its partners to provide an eco-friendly service.

Europe Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, category, gender, and distribution channel.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin and sun care products, hair care products, deodorants and fragrances, makeup and color cosmetics, and others.

As per the European cosmetics market trends, the skin and sun care segment is driven by the consumers' increasing awareness of skin health and the importance of sun protection. It includes products like moisturizers, anti-aging creams, sunscreens, and body lotions. The rising prevalence of skin-related issues, such as dryness, acne, and premature aging, is boosting the market growth.

The hair care products segment encompasses shampoos, conditioners, hair oils, styling products, and treatments for various hair concerns such as dandruff, hair fall, and damage repair. The increasing consumer focus on hair health and aesthetics is catalyzing the market growth. Besides this, rapid innovations, such as sulfate-free shampoos, hair serums infused with natural oils, and color-protecting treatments, are favoring the market growth.

The segment for deodorants and fragrances is driven by the consumer's desire for personal hygiene and pleasant scents. It includes a wide range of products, such as everyday deodorants, antiperspirants, luxury perfumes, and colognes. The rising demand for long-lasting and effective deodorants due to the growing awareness of personal hygiene and the need for odor control is boosting the Europe cosmetics market share.

The makeup and color cosmetics category include foundation, concealer, eyeshadow, mascara, lipsticks, and more, catering to the diverse beauty needs of consumers. The rising influence of fashion trends, celebrity endorsements, and social media, where makeup tutorials and influencer recommendations drive product popularity, is catalyzing the market growth. Besides this, the rising focus on long-wear formulations, inclusive shade ranges, and multifunctional products that offer skincare benefits alongside cosmetic enhancements is fueling the market growth.

Breakup by Category:

- Conventional

- Organic

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes conventional and organic.

Based on the European cosmetic market overview, the conventional cosmetics segment encompasses a wide range of products formulated with synthetic ingredients, which include preservatives, fragrances, and colorants. These products are known for their affordability, extensive shelf life, and widespread availability. Conventional cosmetics are backed by significant research and development (R&D), leading to continuous innovations in formulations and packaging.

The organic cosmetics segment is driven by increasing consumer awareness and demand for products formulated with natural and sustainably sourced ingredients. Organic cosmetics are perceived as safer and more environmentally friendly, appealing to health-conscious consumers. It includes a variety of products such as skincare, hair care, makeup, and personal hygiene items that are certified organic by regulatory bodies.

Breakup by Gender:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes men, women, and unisex.

The male cosmetics segment includes a wide range of products specifically formulated for men's skin and hair care needs, such as beard oils, shaving creams, moisturizers, anti-aging products, and hair styling gels. The increasing number of men seeking high-quality and effective products to enhance their appearance and maintain personal hygiene is catalyzing the market growth.

The female cosmetics segment encompasses a wide array of products that are designed for skincare, haircare, makeup, and personal hygiene. It includes moisturizers, anti-aging creams, sunscreens, shampoos, conditioners, lipsticks, foundations, and more. The continuous innovation and the latest beauty trends, influenced by fashion, social media, and celebrity endorsements, are driving the market growth.

The unisex cosmetics segment is reflecting a growing trend towards inclusivity and the breaking down of traditional gender barriers in beauty and personal care. Unisex products are designed to be universally appealing and effective, regardless of gender, and include items such as moisturizers, cleansers, shampoos, conditioners, and fragrances. The widespread adoption of unisex cosmetics among consumers who prefer simplicity and convenience in their beauty routines, as well as those who support gender-neutral branding and marketing, is promoting the market growth.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, pharmacies, online stores, and others.

Supermarkets and hypermarkets offer consumers the convenience of purchasing a wide range of beauty and personal care products during their regular grocery shopping trips. These large retail outlets provide extensive product assortments, such as everyday essentials and premium brands, at competitive prices. Moreover, the ability to physically see, touch, and test products before purchase is a significant advantage, contributing to the popularity of this channel.

Specialty stores, including dedicated beauty and cosmetic shops, play a crucial role in the distribution of cosmetics in Europe. These stores offer a curated selection of products and brands, focusing on high-end, niche, or specialized items that may not be available in larger retail chains. The personalized service, expert advice, and immersive shopping experience provided by specialty stores attract consumers seeking specific products or professional guidance.

Pharmacies are a trusted distribution channel, especially for products that are positioned at the intersection of beauty and health. This includes dermocosmetics, skincare treatments, and medically endorsed beauty products that require professional advice or have therapeutic benefits. Moreover, pharmacists' expertise and ability to recommend suitable products for specific skin conditions or concerns enhances their market appeal.

Online stores are driven by the convenience, variety, and accessibility they offer. E-commerce platforms provide consumers with the ability to browse and purchase a vast array of products from the comfort of their homes, with detailed descriptions, reviews, and personalized recommendations. Moreover, the rise of digital marketing, social media influencers, and virtual try-on technologies is further fueling their adoption among consumers.

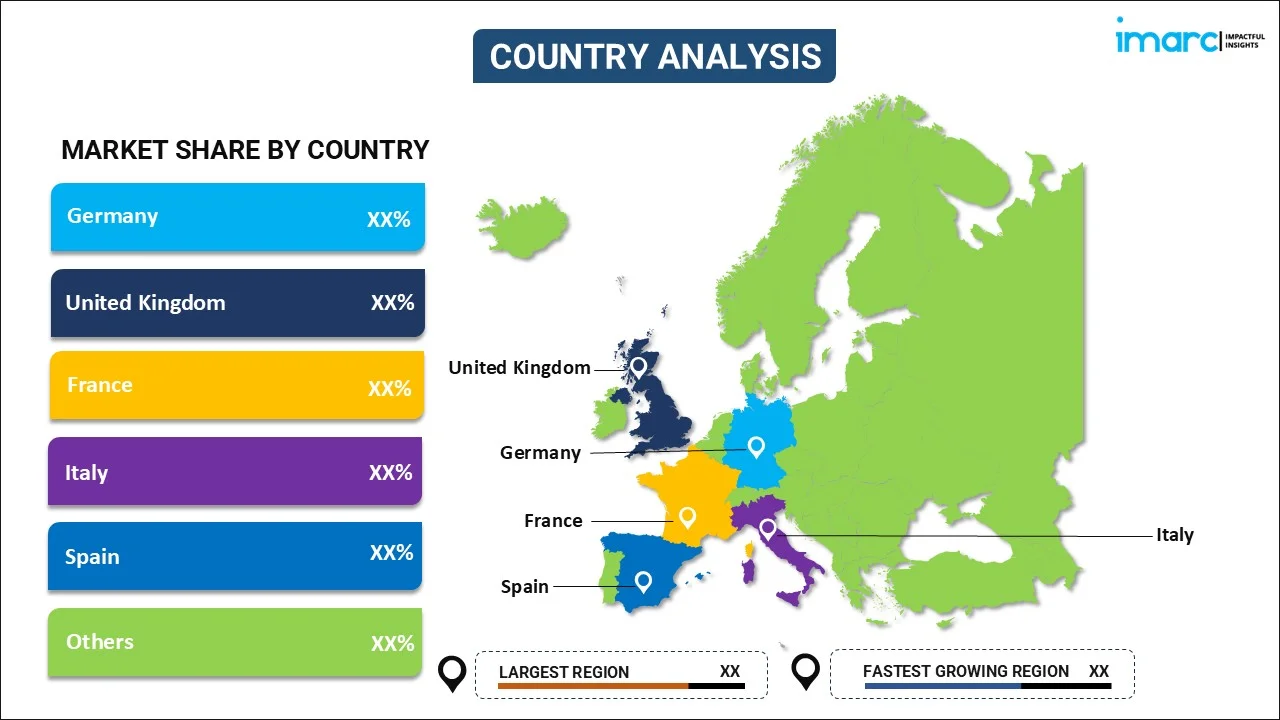

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others.

The market for cosmetics in Germany is driven by a robust economy and a high standard of living. German consumers are known for their preference for high-quality, innovative, and sustainable products. Along with this, the strong demand for natural and organic cosmetics, reflecting the country's environmental consciousness and stringent regulatory standards, is catalyzing the market growth.

France has a rich heritage in luxury cosmetics and perfumery, combined with its reputation for high-quality products. French consumers exhibit a strong preference for premium and luxury beauty products, with a particular emphasis on skincare and fragrances. Additionally, the robust distribution channels, including high-end boutiques, specialty stores, pharmacies, and an expanding e-commerce sector, ensuring widespread availability and accessibility of cosmetic products, are favoring the market growth.

The United Kingdom's market for cosmetics is characterized by a mix of high-end, mass-market, and niche brands. UK consumers are known for their openness to new trends and products, driving a high level of innovation and experimentation in the market. Moreover, the growing demand for ethical and sustainable beauty products, reflecting broader societal concerns about environmental impact and ethical sourcing, is fueling the market growth.

Italy's cosmetics market is known for its emphasis on luxury, quality, and style. Italian consumers place a high value on personal appearance and grooming, driving the demand for a wide range of beauty products, including skincare, haircare, makeup, and fragrances. The market is characterized by a blend of traditional artisanal brands and modern, innovative companies that leverage Italy's rich heritage in craftsmanship and design.

The cosmetics industry in Spain is driven by a youthful population and a strong cultural emphasis on beauty and personal care. Spanish consumers show a keen interest in skincare, makeup, and sun care products, reflecting the country's sunny climate and active outdoor lifestyle. Moreover, the rising demand for natural and organic cosmetics, influenced by increasing environmental awareness and a preference for healthier lifestyles, is catalyzing the market growth.

Competitive Landscape:

The major players in the market are focusing on innovation, sustainability, and digital transformation to maintain and enhance their market positions. They are investing in research and development (R&D) to create advanced formulations that cater to evolving consumer preferences, such as natural and organic ingredients and multifunctional products that combine skincare and makeup benefits. Moreover, some companies are adopting eco-friendly packaging, ethical sourcing of raw materials, and cruelty-free production processes. Besides this, they are leveraging e-commerce platforms, social media, and influencer partnerships to reach and engage with consumers. Furthermore, leading companies are expanding their presence through strategic acquisitions and partnerships, tapping into new markets and consumer segments.

The report provides a comprehensive analysis of the competitive landscape in the Europe cosmetics market with detailed profiles of all major companies, including:

- L'Oréal Group

- Procter & Gamble

- Unilever

- Beiersdorf AG

- Coty Inc.

- Shiseido Co., Ltd.

- Kao Corporation

- Johnson & Johnson

Europe Cosmetics Market News:

- In February 2024, Coty Inc. entered into a new licensing agreement with Marni, an Italian luxury fashion brand, to develop, manufacture, and distribute a wide range of fragrances and beauty care products beyond 2024. This new agreement solidifies Coty’s commitment to strengthening its presence in the luxury fragrance segment. The first offering under this licensing agreement is expected to launch in 2026. The collection will focus on translating Marni’s creative and fashion-forward identity into the realm of beauty.

- In June 2024, Unilever-owned Simple skincare brand launched its inaugural UK pop-up event in collaboration with Superdrug. This exclusive event was organized to provide visitors with an immersive skincare experience, emphasizing the transformative power of Simple’s products. The attendees had the opportunity to delve into the science behind Simple’s formulations and receive expert advice from renowned dermatologists. The event also featured exclusive panel talks with celebrity guests, personalized skincare consultations, express treatments, and artificial intelligence (AI)-powered skin analysis to offer bespoke product recommendations.

Europe Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | L'Oréal Group, Procter & Gamble, Unilever, Beiersdorf AG, Coty Inc., Shiseido Co., Ltd., Kao Corporation, Johnson & Johnson, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe cosmetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe cosmetics market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe cosmetics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetics market in Europe was valued at USD 111.3 Billion in 2025.

The Europe cosmetics market is projected to exhibit a CAGR of 2.50% during 2026-2034, reaching a value of USD 138.7 Billion by 2034.

Key factors driving the Europe cosmetics market include heightened need for natural and organic products, increasing awareness about personal grooming, advancements in product formulations, and influence of social media and lifestyle influencers. Additionally, sustainability concerns are encouraging the adoption of eco-friendly packaging and cruelty-free products.

Some of the major players in the Europe cosmetics market include L'Oréal Group, Procter & Gamble, Unilever, Beiersdorf AG, Coty Inc., Shiseido Co., Ltd., Kao Corporation, Johnson & Johnson, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)