Europe Compound Feed Market Size, Share, Trends and Forecast by Ingredient Type, Animal Type, and Region, 2026-2034

Europe Compound Feed Market Overview:

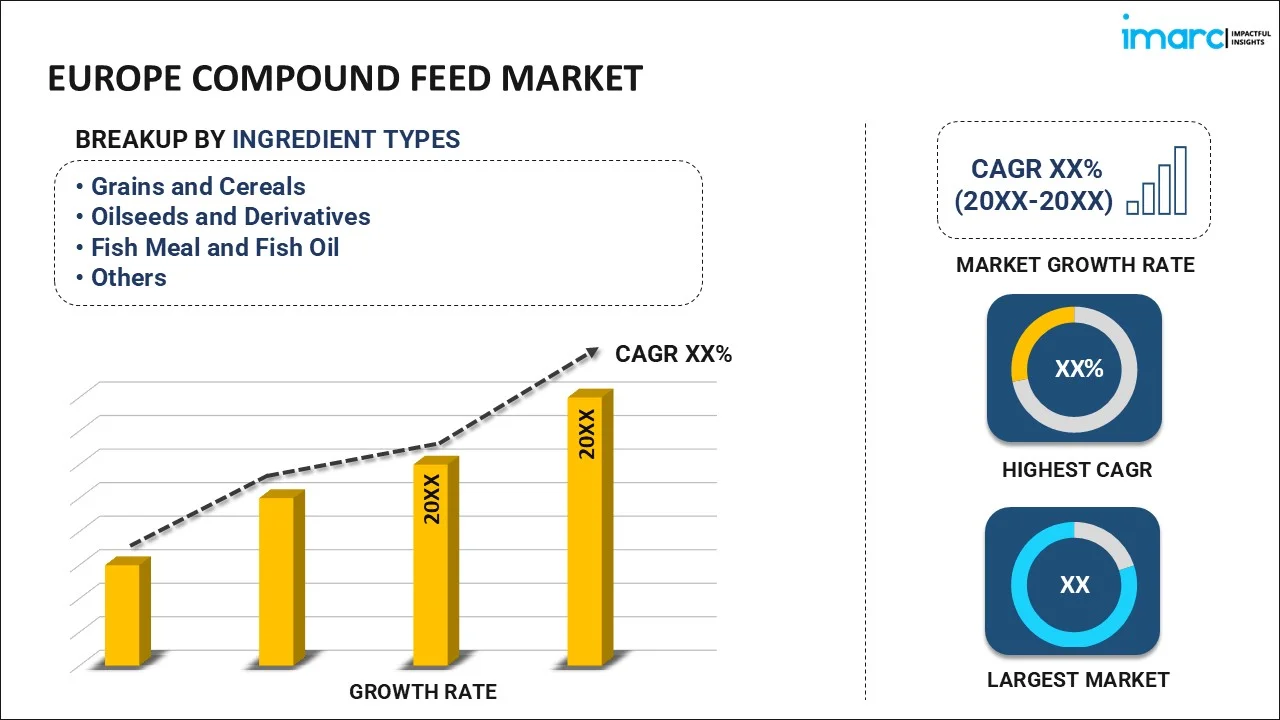

The Europe compound feed market size reached USD 121.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 180.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. The market is witnessing significant growth, driven by the shift towards sustainable and plant-based feed ingredients and the integration of technology for feed efficiency and traceability. This, along with significant research and development (R&D) is contributing to the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 121.7 Billion |

| Market Forecast in 2034 | USD 180.4 Billion |

| Market Growth Rate (2026-2034) | 4.47% |

Access the full market insights report Request Sample

Europe Compound Feed Market Trends:

Shift Towards Sustainable and Plant-Based Feed Ingredients

One of the most significant trends in the European compound feed market is that the demand for sustainable and plant-based feed ingredients is growing. With the increase in environmental awareness and consumer preferences changing toward eco-friendly and ethical practices, there has been pressure for demand for alternative proteins, especially plant proteins. For example, EU feed production reached a total of 147 million tons in December 2024. According to FEFAC, industrial compound feed output will rise by 0.50%, considering the economic, regulatory, environmental, and animal health factors across livestock sectors. Integral protein sources are being increasingly examined both as alternatives to fishmeal and meat-and-bone meal and for replacing them altogether. This shift is being fueled by regulatory pressure and consumer demand for sustainability in food production. Subsequently, Europe is invited to consider a host of regulatory frameworks to ensure the promotion of the sustainability objective, such as the European Green Deal and the Farm to Fork strategy, with the respective aim of reducing carbon emissions and enhancement of biodiversity. Such regulations are compelling feed companies to venture away from the conventional animal protein sources toward innovation in plant protein technologies and other sustainable alternatives like insect protein or algae-derived ingredients. This marked the rise in the use of by-products from the food and agricultural industries, like pulp from fruit or brewers' grains, which would help prevent food waste while offering an alternative to animal feed. As European consumers become ever more demanding of sustainable goods, the compound feed industry is expected to further inject investment in these alternative ingredients for the sake of both environmental and economic objectives.

Integration of Technology for Feed Efficiency and Traceability

Another important trend in the European compound feed market is the application of advanced technologies directed towards feed efficiency improvement and traceability. Due to the rising pressure to optimize production cost with animal health and productivity, the feed manufacturers are keen on digital tools and innovations like online precision feeding, automatic feeding systems, and data-fed formulations to feed. These technologies allow viewing of nutrient intake in a more accurate manner so that the animals can have the proper balance of nutrients without excess waste. Moreover, there is also an increasing emphasis on feed ingredient traceability. Manufacturers implement the use of blockchain and other traceability systems to track the origin and quality of feed ingredients with increasing consumer interest in food safety, transparency, and ethical sourcing. This gives proof for consumers and all stakeholders that the feed used for animal production meets requirements of sustainability and ethics. For instance, in August 2024, IACA's Secretary General stated that Portugal's feed market is significant, producing 4.2 million tons and has always been a proponent for sustainable agriculture and innovations, such as FeedInov and InsectERA. Furthermore, the interventions of sensors and IoT devices in livestock management enable real-time monitoring of animal health and performance, which in turn enhance feed efficiency and overall productivity. Indications show that as these technologies continue to evolve, the European compound feed market will continue to grow on both automation and transparency initiatives that will fuel increased demand for smart solutions and their data integration in the industry.

Europe Compound Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on ingredient type and animal type.

Ingredient Type Insights:

To get detailed segment analysis of this market Request Sample

- Grains and Cereals

- Oilseeds and Derivatives

- Fish Meal and Fish Oil

- Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes grains and cereals, oilseeds and derivatives, fish meal and fish oil, supplements, and others.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Aquaculture

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes ruminants, swine, poultry, aquaculture, and others.

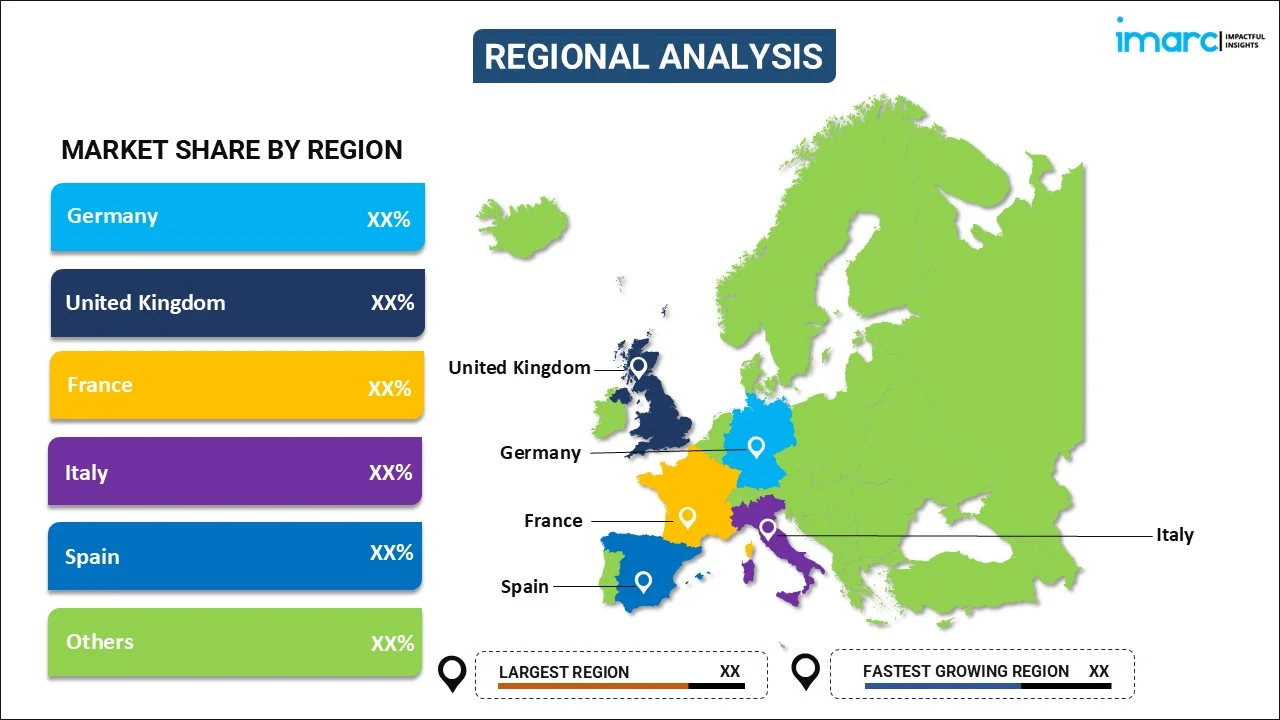

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Compound Feed Market News:

- In February 2025, FEED announced the launch of Feedentity, an automated system enhancing agri-food supply chain traceability. Combining blockchain and AI, it monitors environmental factors like temperature and humidity, ensuring product quality. The system helps prevent waste, improves sustainability, and offers insights to optimize agricultural and logistical practices.

- In December 2024, EU Member States announced an endorsement of an updated Code for Green Labelling for Feed, promoting sustainable animal feed production. The upgraded code provides detailed guidelines on environmental performance, addressing climate change, emissions, and biodiversity, supporting the feed sector’s efforts to reduce its environmental footprint and meet Scope 3 emissions requirements.

Europe Compound Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredient Types Covered | Grains and Cereals, Oilseeds and Derivatives, Fish Meal and Fish Oil, Supplements, Others |

| Animal Types Covered | Ruminants, Swine, Poultry, Aquaculture, Others |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe compound feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Europe compound feed market on the basis of ingredient type?

- What is the breakup of the Europe compound feed market on the basis of animal type?

- What is the breakup of the Europe compound feed market on the basis of region?

- What are the various stages in the value chain of the Europe compound feed market?

- What are the key driving factors and challenges in the Europe compound feed?

- What is the structure of the Europe compound feed market and who are the key players?

- What is the degree of competition in the Europe compound feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe compound feed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe compound feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe compound feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)