Europe Cement Market Report Size, Share, Trends and Forecast by Type, End Use, and Country, 2025-2033

Europe Cement Market Size and Share:

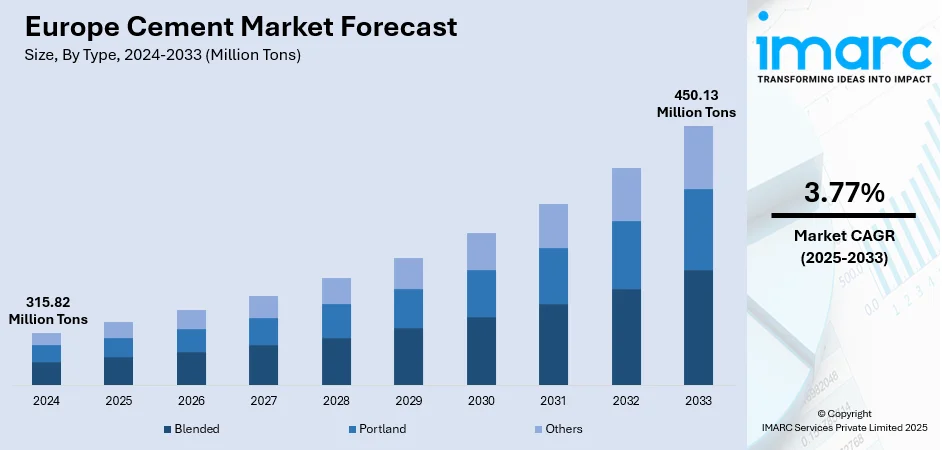

The Europe cement market size reached a volume of 315.82 Million Tons in 2024. The market is projected to reach a volume of 450.13 Million Tons by 2033, exhibiting a CAGR of 3.77% during 2025-2033. Germany currently dominates the market, holding a significant market share of around 30.0% in 2024. The market is fueled by rising construction activity, particularly in residential projects and infrastructure development. In addition to this, consistent improvement in production technologies and rising need for sustainable and environmentally friendly cement products are driving market dynamics. Along with this, strict environmental regulations compel the manufacturers to employ low-carbon technologies and improve production efficiency, further augmenting the Europe cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 315.82 Million Tons |

| Market Forecast in 2033 | 450.13 Million Tons |

| Market Growth Rate (2025-2033) | 3.77% |

The market is majorly driven by the high rates of urbanization and population concentrations in city centers, which is raising the level of construction activity and heavily contributing to cement usage. According to industry reports, over two-thirds of the population of the European Union lives in urban centers in the region. Furthermore, the region is experiencing a boost in infrastructure development projects to modernize transportation networks, public utilities, and energy infrastructure, further increasing the demand for cement-based materials. In addition, the shift toward sustainable and low-energy buildings is encouraging the application of advanced cement forms like blended and low-carbon cement in line with the decarbonization ambitions of the EU. Apart from this, EU-financed investments under programs such as the Green Deal and Recovery and Resilience Facility are pouring money into massive public infrastructure construction.

To get more information on this market, Request Sample

In addition to this, EU-backed investments under initiatives like the Green Deal and Recovery and Resilience Facility are injecting capital into large-scale public infrastructure development. For instance, the majority of the Next Generation EU funding, which is an economic recovery plan (2021 to 2026)), is allocated to the Recovery and Resilience Facility (RRF), with EUR 650 Billion designated for this program. Besides this, one of the emerging Europe cement market trends is the growing public and private sector collaboration in the development of green infrastructure and circular economy frameworks. Apart from this, regulatory mandates for durability, energy performance, and carbon footprint reduction are prompting industry participants to adopt advanced cement technologies. In addition, digitalization and automation in cement manufacturing processes are enhancing production efficiency and quality control. Also, cross-border trade and regional integration are facilitating the distribution of cement products, thereby strengthening market competitiveness and supply chain resilience across Europe.

Europe Cement Market Trends:

Increased Construction Activity Across Residential and Commercial Sectors

The market is dominated by the recovery of the real estate segment and rising demand for cement in residential and commercial segments. As per an industry report, seasonally adjusted output in construction rose by 1.7% in the euro area and by 1.4% in the EU during April 2025, compared to the month before, which reflects a positive trend in construction activity and cement use. Furthermore, recovery strategies following the pandemic have stimulated investments in public infrastructure, thus fueling cement consumption. Major countries such as Germany, France, and the UK are witnessing an upsurge in mixed-use developments, office buildings, and intelligent housing projects. At the same time, tourism-driven infrastructure, including hotels and recreational facilities, is also being built in high-traffic areas. Furthermore, government-supported social housing projects and low-cost housing initiatives have also added to a stable pipeline of construction. Cement, being a major building material, is still essential for concrete manufacturing and structure construction, causing constant demand.

Increasing Investments to Enhance Existing Infrastructure

The substantial investments aimed at modernizing and expanding existing infrastructure networks are propelling the Europe cement market growth. Aging infrastructures such as transport systems, highways, roadways, bridges, and rail corridors have necessitated massive rehabilitation and maintenance programs. Besides, the European Union has also set ambitious renovation goals, observing that by 2050, around 2 Billion square meters of current space in Europe will be destroyed and rebuilt or renovated, requiring a large amount of building materials, such as cement. Additionally, public-private partnerships are investing capital to enhance facilities for resilience, safety, and efficiency. At the same time, the transition in the energy sector has provoked infrastructure improvements for renewable energy facilities, grid upgrades, and energy-efficient construction. These improvements require cement for foundation constructions, retrofitting, and strengthening of structures. Furthermore, logistics infrastructure like ports, airports, and urban transport systems is being developed to serve trade and population growth needs.

Growing Environmental Concerns and Sustainability Efforts

Environmental regulations and growing sustainability concerns are significantly influencing the Europe cement market outlook. With the growing concerns regarding the environmental impact of cement production, manufacturers are introducing new production methods and formulations that help reduce energy use and utilize locally available raw materials. This shift is being strongly supported by consumer sentiment as well, according to the World Economic Forum, 86% of Europe’s population believes that more action is needed in sustainable construction, underscoring the demand for eco-friendly solutions such as green cement, which helps minimize CO₂ emissions during production. As a result, companies are increasingly integrating alternative fuels, reducing clinker content, and investing in carbon capture and storage (CCS) technologies. There is also a rise in the use of supplementary cementitious materials (SCMs) such as fly ash and slag to enhance eco-efficiency. The circular economy model is being promoted through material recycling and waste valorization in production processes. Green building certifications and sustainability-driven procurement practices are further encouraging the adoption of low-carbon cement solutions across infrastructure and real estate sectors in Europe.

Europe Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe cement market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end use.

Analysis by Type:

- Blended

- Portland

- Others

Portland leads the market with around 70.0% of market share in 2024. The segment is known for its versatility, strength, and durability. portland cement is heavily utilized for residential, commercial, and infrastructure building projects such as bridges, roads, and skyscrapers. It can set quickly and possess high early strength based on its chemical composition, thus being highly suitable for high-volume and time-critical usage. Even with growing focus on sustainable substitutes, Portland cement remains predominant with its well-established supply chain networks, competitive pricing, and adaptability to a wide range of admixtures and supplementary cementitious materials. In several European nations, portland cement is also mixed with fly ash, slag, or limestone to enhance the environmental performance without sacrificing quality. The long-term reliability and performance of portland cement make it a staple that will not lose its relevance in the region. It continues to be a foundation of construction activity, particularly in infrastructure upgrade and urban development markets.

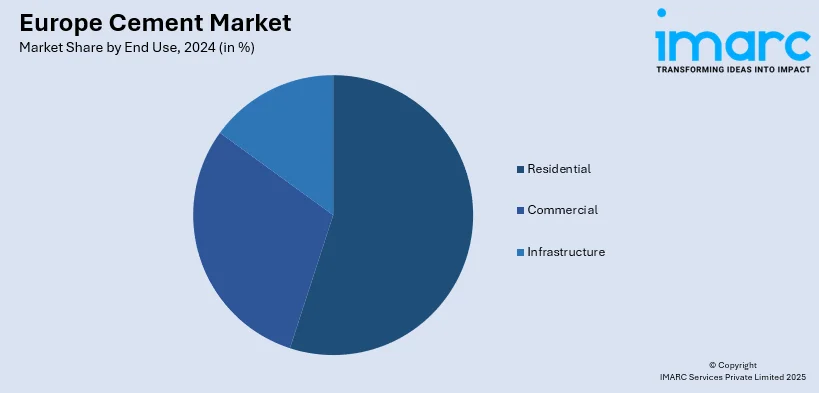

Analysis by End Use:

- Residential

- Commercial

- Infrastructure

Residential leads the market with around 33.8% of market share in 2024. The segment is driven by accelerating urban growth, increasing housing requirements, and government policies on affordable housing. Cement is widely utilized in the building of foundations, walls, floors, and roof structures owing to its durability, strength, and affordability. Moreover, maintenance and upgrading works in the aging housing stock in Western Europe also contribute towards persistent cement demand. Germany, France, and the UK are all seeing more residential development, specifically in suburban as well as semi-urban regions. Additionally, the increased focus on sustainable housing has the effect of inducing the use of low-carbon cement types in residential buildings. Also, cement producers are adapting product offerings to address changing residential offerings to meet evolving residential needs. Overall, the residential sector remains a critical end-use segment shaping the region's cement market dynamics.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share of over 30.0%. The nation's well-developed construction sector, fueled by its continued infrastructure growth, domestic housing needs, and industrial development, has a substantial impact on cement demand. Germany's focus on energy-saving and sustainable construction has also played a role in the transition towards low-carbon and blended cements. Increased government targets on climate change, such as CO₂ cuts in all industries, have placed further focus on green building materials, encouraging cement makers to invest in new fuels, carbon capture equipment, and new production processes. Moreover, rehabilitation and updating of deteriorating infrastructure—especially in the transport and public utilities sector—drive constant demand for cement. With its effective regulatory system and sophisticated technological capabilities, Germany is a model market in Europe that dictates regional cement-making patterns, innovation, and sustainability levels. Its strategic role continues to influence the larger market.

Competitive Landscape:

The market is characterized by a mix of established domestic players and multinational manufacturers that operate through vertically integrated production facilities and extensive distribution networks. Moreover, market participants are focusing on cost optimization, technological advancements, and product differentiation, particularly in low-carbon and blended cement formulations, to maintain a competitive edge. Stringent environmental regulations and decarbonization targets across Europe are pushing companies to invest in alternative fuels, carbon capture technologies, and energy-efficient production processes. Apart from that, the rise of sustainable construction practices has further intensified innovation and competition in green cement offerings. Furthermore, mergers, acquisitions, and strategic collaborations are also common, aimed at expanding geographic reach and enhancing operational capabilities. Besides this, competition is influenced by regional construction activity, infrastructure investments, and supply chain dynamics. According to the Europe cement market forecast, the growing demand for eco-friendly construction materials and sustainable infrastructure will likely reshape competition, favoring players that can adapt to regulatory pressures while delivering low-carbon, high-performance cement solutions.

The report provides a comprehensive analysis of the competitive landscape in the Europe cement market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Heidelberg Materials inaugurated the first carbon capture facility at a cement plant in Brevik, Norway, capturing 400,000 Tons of CO₂ annually. Backed by Norway’s Longship project, it liquefied and stored CO₂ under the seabed, setting a precedent for decarbonising cement production and launching Heidelberg’s carbon-neutral evoZero cement.

- May 2025: EMSTEEL launched a Green Finance Framework to fund low-carbon steel and cement projects, renewable energy initiatives, and energy efficiency upgrades. With a “Very Good” Moody’s rating, it enabled green bonds and loans to support emission reduction targets—40% for steel and 30% for cement by 2030.

- May 2025: Cimpor committed €155 Million to establish a sustainable construction R&D centre and modernise Kiln 7 at its Alhandra plant. The centre focused on carbon reduction technologies, low-clinker cement, alternative fuels, and digitalisation, while also functioning as a ‘living lab’ for real-time performance monitoring and academic collaboration.

- January 2025: In January 2025, S&P Global Commodity Insights launched weekly Platts price assessments for Turkish cement and clinker, including freight to Europe and North America. This initiative addressed rising decarbonization pressures and regulatory transparency demands, providing the first market benchmarks for one of the construction industry’s most carbon-intensive materials.

Europe Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe cement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe cement market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement market in Europe reached a volume of 315.82 Million Tons in 2024.

The Europe cement market is projected to exhibit a CAGR of 3.77% during 2025-2033, reaching a volume of 450.13 Million Tons by 2033.

The market is driven by increasing construction activities, urbanization, demand for infrastructure development, government investments in housing and transportation projects, eco-friendly construction trends, the growing need for sustainable building materials, technological advancements in cement production, rising demand for residential and commercial spaces, and robust growth in the renovation sector.

Portland dominates the type segment in the market with the market share of 70.0% in 2024. The dominance is due its widespread use in construction projects, its versatility in various applications, cost-effectiveness, high demand for infrastructure development, and the growing preference for durable and high-performance cement in both residential and commercial buildings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)