Europe CBD Oil Market Size, Share, Trends and Forecast by Source, Product Type, Product Category, Application, Distribution Channel, and Country, 2025-2033

Europe CBD Oil Market Size and Share:

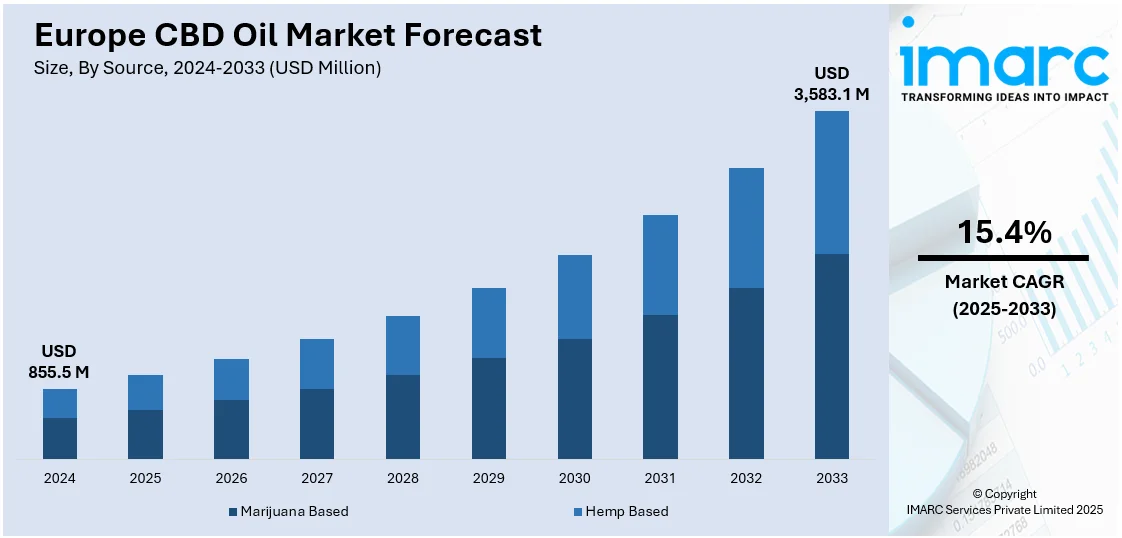

The Europe CBD oil market size was valued at USD 855.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,583.1 Million by 2033, exhibiting a CAGR of 15.4% from 2025-2033. The growing user awareness about the therapeutic benefits of CBD, including pain relief, anxiety reduction, and skin health. Legal reforms and regulatory clarity around CBD products are also increasing market confidence. Additionally, a rise in the demand for natural wellness products, coupled with increased product availability in various forms like oils, creams, and capsules, is contributing to the Europe CBD oil market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 855.5 Million |

|

Market Forecast in 2033

|

USD 3,583.1 Million |

| Market Growth Rate 2025-2033 | 15.4% |

As more people learn about the benefits of CBD oil through media, social influencers, and word-of-mouth, there is a significant increase in user interest. People are becoming more aware about its potential benefits for conditions like stress, anxiety, chronic pain, and sleep disorders. As a result, the stigma associated with CBD is diminishing, and it is progressively recognized as a valid wellness item. In addition, in several European nations, legislation surrounding CBD are evolving to be more accommodating, fostering a more nurturing atmosphere for the industry. As a result, businesses can function under a reliable legal structure, and shoppers feel more assured when buying items. The steady regulatory strategy guarantees product safety, which enhances user confidence and supports Europe CBD oil market growth.

Apart from this, businesses are producing CBD oils in various forms, including tinctures, capsules, creams, edibles, and vaping products. The existence of these products in diverse formats addresses various user preferences, whether they seek a fast-acting oil or a gradually-released edible. With the increasing variety of products, more people are attracted to the ease and adaptability of integrating CBD into their daily routines. Additionally, the growth of online shopping is enhancing the availability of CBD products. Shoppers can effortlessly search, compare, and buy CBD oil from different brands online, free from location limitations. The ease of online shopping, combined with the availability of reviews and informative materials is resulting in higher user trust.

Europe CBD Oil Market Trends:

Increasing Awareness and Demand for Natural Health Products

More individuals are acknowledging the possible health advantages of CBD oil for treating several issues, including chronic pain, anxiety, inflammation, and sleep disorders. As people gain more knowledge about the healing benefits of CBD, there is a significant increase in its application as a natural treatment. In May 2024, Madrid held the second edition of the Cannabis Breakfast, emphasizing the regulation of industrial hemp in Spain. This gathering, facilitated by CannabisHub and the 21st Century Drug Chair, sought to enhance awareness, responsible governance, and creativity in the cannabis field, focusing significantly on cultivating an ethical and sustainable industry. The growing significance of hemp regulation in Spain has been highlighted by positive comments from the President of the Community of Madrid concerning the sale of CBD products. The continuous regulatory changes are increasing the need for natural and alternative health products, including CBD oil, especially in wellness and self-care practices.

Rising Favorable Regulatory Changes

Recent changes in regulations across Europe, particularly the legalization and reclassification of CBD as a non-narcotic substance in several countries, are fostering a more favorable environment for the sale and distribution of CBD oil. This shift in policy is opening new doors for the cannabis industry, providing a solid foundation for growth. For instance, in April 2024, Germany became the largest EU nation to legalize recreational cannabis, despite strong resistance from opposition lawmakers and medical organizations. Under this new legislation, individuals aged 18 and older are now permitted to possess up to 25 grams of dried cannabis and grow up to three marijuana plants in their homes. Such progressive legislative changes are not only expanding the user base but also stimulating investment from both domestic and international companies, further accelerating the growth and development of the CBD oil market across the region. These evolving regulations are paving the way for broader market opportunities.

Expansion of Product Offerings and Distribution Channels

The growing accessibility of diverse CBD oil products, such as tinctures, edibles, capsules, and skincare products, is offering a favorable Europe CBD oil market outlook. For example, Dr. Hemp Me in Germany offers dependable and effective delivery of high-quality CBD products. Any orders made before 2:30 pm on a working day are sent out on the same day via their courier associates, with delivery within Germany generally taking no more than three business days. Additionally, industry reports show that Barcelona's historic area has experienced an increase in cannabis shops that are circumventing strict zoning regulations by posing as florists. Furthermore, an increasing number of cannabis shops are available throughout the city, especially in Ciutat Vella, the oldest and most tourist-populated area. Moreover, the growth of e-commerce sites and dedicated retail stores are considerably increasing the accessibility of CBD oil, thus enhancing the market's expansion in Europe.

Europe CBD Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe CBD oil market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on source, product type, product category, application, and distribution channel.

Analysis by Source:

- Marijuana Based

- Hemp Based

Hemp based account for the largest share, holding 56.8% in 2024, owing to its elevated CBD concentration and low THC content, making it the favored option for individuals looking for therapeutic advantages without psychoactive effects. Hemp, known for being a natural and sustainable resource, is acknowledged for its adaptability and capacity to flourish in various climates while having a low environmental footprint. CBD oil derived from hemp is preferred due to its high quality and consistency, as hemp plants are grown particularly for CBD extraction. Moreover, the growing user inclination toward plant-based and organic goods enhances hemp's position as the main source. Hemp contains a wealth of advantageous CBDs, terpenes, and various compounds that aid the entourage effect, improving the overall therapeutic experience. Additionally, the widespread legality of hemp throughout Europe enhances accessibility, ensuring that individuals can consistently obtain high-quality, hemp-based CBD products.

Analysis by Product Type:

- Inorganic

- Organic

Organic stand as the largest component in 2024, holding 62.8% of the market, driven by increasing user demand for sustainable, clean, and pesticide-free options. With the growing awareness about CBD's possible health advantages, individuals are more frequently looking for products that reflect their wellness principles, such as sustainability and purity. Organic CBD oil, commonly sourced from hemp cultivated without synthetic fertilizers or pesticides, attracts individuals who value natural, environment-friendly options. The organic certification guarantees that the product complies with rigorous quality standards, offering people increased assurance of its safety and efficacy. Moreover, the growing need for organic items in diverse sectors, including skincare, supplements, and food, is leading to the popularity of organic CBD oil. Shoppers are attracted to the notion that organic items are stronger and offer a purer, more efficient experience. The organic CBD oil industry gains from this extensive movement towards healthier, more conscientious product selections.

Analysis by Product Category:

- Flavored

- Unflavored

Unflavored dominates the market because of its adaptability and organic attractiveness. Numerous individuals choose unflavored CBD oil as it provides a pure and natural choice without the artificial flavors or sweeteners present in flavored versions. This inclination is in harmony with the increasing trend for clean, minimalistic items in the wellness sector. Unflavored CBD oil enables users to tailor their usage, whether by mixing it into drinks, food, or applying it topically for health benefits. Moreover, unflavored choices are frequently viewed as stronger as they usually have fewer additives, which instills confidence in user regarding the quality and efficacy of the product. The rising interest in organic, plant-derived, and natural formulations further reinforces the prevalence of unflavored CBD oils. This trend positions the Europe CBD oil market forecast for continued growth, driven by the increasing reliance on direct channels for user purchases.

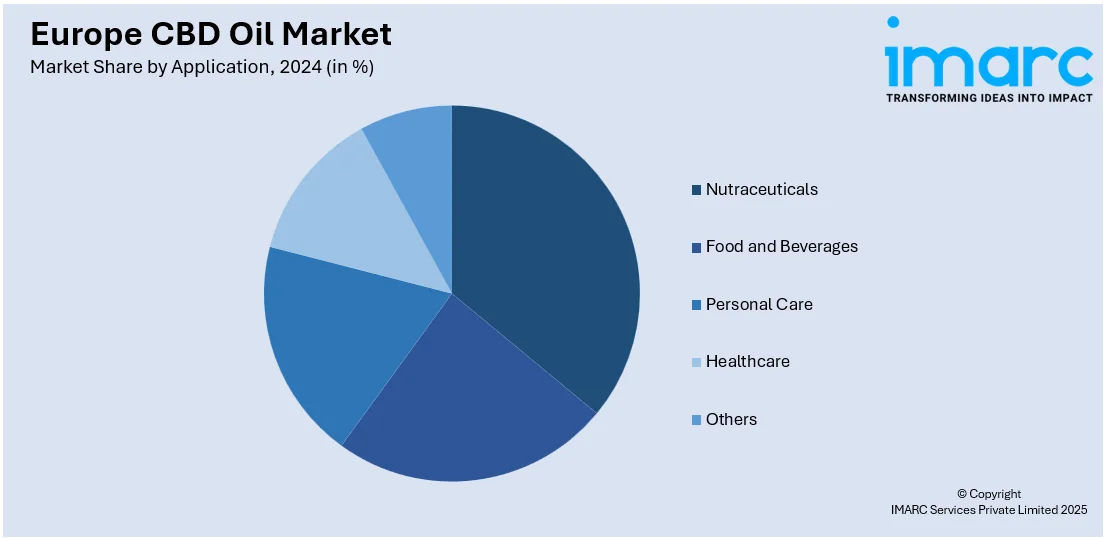

Analysis by Application:

- Food and Beverages

- Personal Care

- Healthcare

- Nutraceuticals

- Others

Nutraceuticals represent the largest segment with 74.9% of market share in 2024. The dominance of the segment is driven by the rising user demand for natural health products. As shoppers become more health-conscious, there is a rise in demand for plant-based items that provide health advantages without artificial ingredients. The incorporation of CBD oil into nutraceuticals is especially attractive attributed to its ability to promote wellness, ease pain, reduce anxiety, and enhance sleep quality. The adaptability of CBD enables it to be available in multiple formats like capsules, tinctures, gummies, and drinks, accommodating diverse user preferences. Furthermore, nutraceuticals typically offer a more organized, consistent dosage of CBD, simplifying its integration into the daily habits of individuals. The increasing understanding about the advantages of preventive health and the expanding acceptance of natural products are further enhancing the utilization of CBD in nutraceuticals.

Analysis by Distribution Channel:

- Direct

- Indirect

Direct leads the market with 57.8% of market share in 2024 because it provides user with more convenience and access to various products. Online platforms, especially, have an important function in connecting with a wider audience, enabling shoppers to buy CBD oil from the convenience of their homes. These platforms offer in-depth product details, user reviews, and simple comparisons, enhancing trust and clarity. Furthermore, direct-to-consumer (DTC) sales enable brands to cultivate deeper connections with their clients by providing tailored experiences and immediate feedback. This distribution model further guarantees improved control over pricing, quality, and client support, thereby enhancing the overall experience for buyers. Furthermore, numerous CBD brands are utilizing social media and digital marketing techniques to enhance brand awareness and draw in additional clients. The ease of access, affordability, and focus on customers of direct distribution channels are essential elements propelling their market leadership.

Country Analysis:

- Germany

- Spain

- Italy

- France

- United Kingdom

- Russia

- Rest of Europe

In 2024, France held the biggest market share of 23.8% because of its progressive regulatory framework and increasing user interest in natural health products. The country is establishing explicit regulations regarding CBD products, fostering a reliable and consistent market. For example, in 2025, France advanced its plan to legalize medical cannabis by submitting three key regulatory decrees to the European Union for approval. These documents outline the framework, technical standards, and conditions for cannabis use, maintaining it as a last-resort treatment. Besides this, France, being one of the largest wellness markets in Europe, is witnessing considerable user interest in CBD due to its possible therapeutic advantages, including pain relief, anxiety reduction, and skin health benefits. The growing retail avenues, such as pharmacies, e-commerce sites, and wellness stores, also offering a favorable market outlook. Furthermore, local producers are fostering innovation by providing a range of CBD-infused items, increasing user interest. The blend of clear regulations, greater user acceptance, and diverse products is establishing France as a key competitor in the European CBD oil market.

Competitive Landscape:

The competition in the market is intense, with many local and global competitors competing for market share. Notable companies like Canopy Growth, Aurora Cannabis, and Elixinol stand out by utilizing their worldwide reach and broad range of products. Regional brands such as Cibdol and Love Hemp emphasize premium, full-spectrum offerings and target specialized markets. The competitive environment is influenced by strict regulatory requirements, driving firms to innovate and maintain product quality and transparency. New brands are increasingly focusing on distinct customer demands, like wellness and skincare, while long-established firms are broadening distribution methods through e-commerce and retail collaborations to improve market presence. For example, in May 2024, Curaleaf International declared its formal partnership as a founding member of an innovative task force designed to establish the UK as a worldwide pioneer in cannabis and cannabinoid research.

The report provides a comprehensive analysis of the competitive landscape in the Europe CBD oil market with detailed profiles of all major companies, including:

- Aurora Cannabis

- Diamond CBD Inc.

- ENDOCA

- APHRIA Inc.

- ConnOils LLC

- Elixinol Global Limited

- Emblem CANNABIS

- NuLeaf Naturals, LLC

- CBD Ultra Limited

- The Original Alternative Limited

Latest News and Developments:

- March 2025: Stenocare delivered the first consignment of its new CBD100 oil offering to the Danish market. The product aimed to meet the needs of patients requiring higher CBD dosages for conditions like chronic pain and epilepsy.

- February 2025: Canopy Growth Corporation formally introduced its Tweed brand to the medical cannabis market in Germany, which included four new Tweed strains cultivated in the European Union through a partnership with Gro-Vida S.A., a cultivator of medical-grade cannabis based in Portugal.

- February 2025: SOMAÍ Pharmaceuticals, an EU-GMP vertically integrated Multi-Country Operator (MCO) that specializes in CBD-based medications, which includes full-spectrum oils, officially entered the medical cannabis market in Switzerland. This was done via an alliance with Dascoli Pharma AG, a Swiss pharmaceutical business that specializes in the supply, distribution, and educational instruction of medical cannabis.

- January 2025: Tilray Medical, a branch of Tilray Brands, Inc., announced that Tilray Deutschland GmbH, its German subsidiary, was awarded a contract for supplying Luxembourg with its premium cannabis flower.

Europe CBD Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Marijuana Based, Hemp Based |

| Product Types Covered | Inorganic, Organic |

| Product Categories Covered | Flavored, Unflavored |

| Applications Covered | Food and Beverages, Personal Care, Healthcare, Nutraceuticals, Others |

| Distribution Channels Covered | Direct, Indirect |

| Countries Covered | Germany, Spain, Italy, France, United Kingdom, Russia, Rest of Europe |

| Companies Covered | Aurora Cannabis, Diamond CBD Inc., ENDOCA, APHRIA Inc., ConnOils LLC, Elixinol Global Limited, Emblem CANNABIS, NuLeaf Naturals, LLC, CBD Ultra Limited, The Original Alternative Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe CBD oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe CBD oil market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe CBD oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CBD oil market in the Europe was valued at USD 855.5 Million in 2024.

The growth of the Europe CBD oil market is attributed to the increasing user awareness about its health benefits, rising demand for natural wellness products, regulatory advancements, and expanding applications in skincare, pain relief, and mental health. Additionally, the growing acceptance and legal reforms is positively influencing the market.

The Europe CBD oil market is projected to exhibit a CAGR of 15.4% during 2025-2033, reaching a value of USD 3,583.1 Million by 2033.

Hemp based leads the market because of its high CBD content, low THC levels, sustainability, and consistent quality.

In 2024, France holds the biggest market share because of its favorable regulatory environment, high consumer demand for natural wellness products, and increasing awareness about CBD oil's therapeutic benefits.

Some of the major players in the Europe CBD oil market include Aurora Cannabis, Diamond CBD Inc., ENDOCA, APHRIA Inc., ConnOils LLC, Elixinol Global Limited, Emblem CANNABIS, NuLeaf Naturals, LLC, CBD Ultra Limited, The Original Alternative Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)