Europe Bottled Water Market Report by Product Type (Still, Carbonated, Flavored, Mineral), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, and Others), Packaging Type (PET Bottles, Metal Cans, and Others), and Country 2026-2034

Europe Bottled Water Market Size:

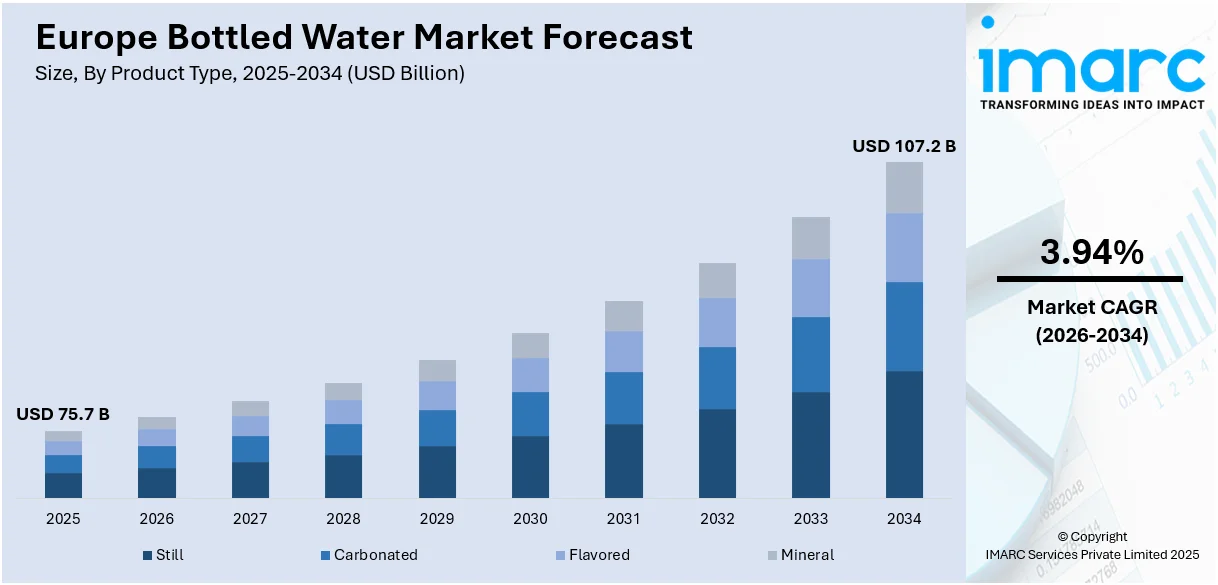

The Europe bottled water market size reached USD 75.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 107.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.94% during 2026-2034. The market is propelled by the increasing health awareness among consumers, rising demand for convenient hydration solutions, increasing tourism and hospitality sectors, preference for bottled water over tap water, eco-friendly packaging initiatives, expansion of premium and artisanal water brands, and increased consumer preference for sparking and mineral-enriched water. At present, Germany holds the largest market share, driven by increasing investments in sustainable production practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 75.7 Billion |

| Market Forecast in 2034 | USD 107.2 Billion |

| Market Growth Rate (2026-2034) | 3.94% |

Europe Bottled Water Market Analysis:

- Major Market Drivers: Increased health awareness among individuals, growing demand for convenient, on-the-go hydration solutions, and increasing tourism and hospitality sectors are some of the major market drivers.

- Key Market Trends: Increasing number of eco-friendly packaging initiatives, rapid expansion of premium and artisanal water brands, and partnerships with fitness and wellness sectors for brand positioning are some of the key market trends driving the market growth.

- Competitive Landscape: Several leading key players operating in the industry are involved in offering innovative products and expanding their portfolios to include functional waters enhanced with vitamins, minerals, and flavors to cater to health-conscious consumers. Significant efforts toward reducing their carbon footprint, expansion into untapped markets, and investment in marketing and branding strategies are some of the major initiatives taken by key players which are further propelling the market growth.

- Challenges and Opportunities: Some of the challenges include increasing concerns about plastic waste, stringent regulatory pressures on water sourcing and bottle recycling, and robust competition and price pressure from private brands. Whereas, rising demand for premium and value-added water products, rapid expansion into eco-friendly and biodegradable packaging solutions, and increasing consumer interest in health and wellness trends are some of the opportunities driving the market growth.

To get more information on this market Request Sample

Europe Bottled Water Market Trends:

Eco-friendly Packaging Initiatives

The drive toward eco-friendly packaging is a significant factor influencing the bottled water market in Europe. European consumers are increasingly environmentally conscious, and this awareness is reshaping purchasing behaviors. In response, bottled water companies across Europe are innovating with their packaging solutions to reduce environmental impact. This includes the introduction of bottles made from recycled plastics (rPET), plant-based plastics, and even entirely biodegradable materials. Such initiatives appeal to the environmentally aware consumer base and also align with stringent EU regulations aimed at reducing plastic waste. According to the EUROPEAN PARLIAMENT, EU aims to reduce packaging targets (5% by 2030, 10% by 2035, and 15% by 2040), particularly the plastic packaging waste.

Stringent Water Quality Regulations

Europe has some of the strictest regulations in the world regarding water quality, which significantly impacts the bottled water industry. For instance, the European Union's Drinking Water Directive mandates rigorous quality standards for water intended for human consumption, thus influencing both public water supplies and bottled water. The directive stipulates that bottled water must be of a higher standard than tap water, leading to increased consumer trust in bottled water products. This regulatory environment ensures the safety and quality of bottled water and also drives innovation in the industry, thus creating a positive Europe bottled water industry overview. Companies invest heavily in advanced filtration and purification technologies to comply with these standards and gain a competitive edge. For instance, reverse osmosis and UV filtration are commonly employed to ensure the purity of bottled water. These technological advancements help meet regulatory requirements and improve the overall product offering, enhancing consumer confidence in bottled water.

Rapid Growth in Tourism and Hospitality Industry

The growth of the tourism and hospitality industry in Europe significantly drives the bottled water market. Europe is a prime destination for international tourists, with countries, such as Spain, and Italy, ranking among the most visited globally. According to the WORLD TOURISM ORGANIZATION, Europe witnessed 91% of increase in tourism in the first seven months of 2023. This influx of tourists creates a substantial demand for bottled water, driven by tourists' needs for convenient and safe hydration options while traveling. Tourists often prefer bottled water due to concerns over the safety and taste of local tap water, especially in regions where the quality of tap water may vary or where language barriers make it difficult to verify safety standards. Moreover, the convenience of bottled water fits well with the on-the-go lifestyle of travelers who need quick and easy access to hydration as they explore various attractions, thereby leading to a positive Europe bottled water market growth.

Europe Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, distribution channel, and packaging type.

Breakup by Product Type:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

Still water is plain water without any carbonation or flavoring. This type of water appeals to consumers seeking hydration in its most natural form. Still water is popular due to its versatility and is often consumed in both home and office settings, as well as on-the-go. The preference for still water is driven by its perceived purity and health benefits, making it a staple in daily hydration habits.

Carbonated water, also known as sparkling water, is water that has been infused with carbon dioxide gas under pressure. This process creates effervescence or bubbles, making the water fizzy. Carbonated water is particularly popular in Western Europe, with countries such as Germany and Italy having a long-standing tradition of consuming sparkling water. This segment appeals to consumers looking for a refreshing alternative to sugary sodas without the added calories. Carbonated water often serves as a base for cocktails and other beverages in restaurants and bars, thereby catalyzing a positive Europe bottled water market share.

Flavored water is a segment that includes water enhanced with flavors such as lemon, berry, or mint without adding sugar or artificial sweeteners. This segment is growing as consumers increasingly seek products that offer a taste experience without compromising health. Flavored water is particularly popular among younger demographics and is often marketed as a healthy alternative to soft drinks. The innovation in natural and organic flavors is driving the growth of this segment, catering to the rising demand for clean-label products that are both tasty and healthy.

Mineral water is sourced from geologically and physically protected underground water sources. It is distinct from other types of bottled water due to its consistent level and relative proportions of minerals and trace elements at the point of emergence from the source. This type of water is highly regulated in Europe, with strict requirements on the mineral content that must be naturally present in the water. Mineral water is valued for its perceived health benefits due to its mineral content, which can include elements such as calcium, magnesium, and potassium.

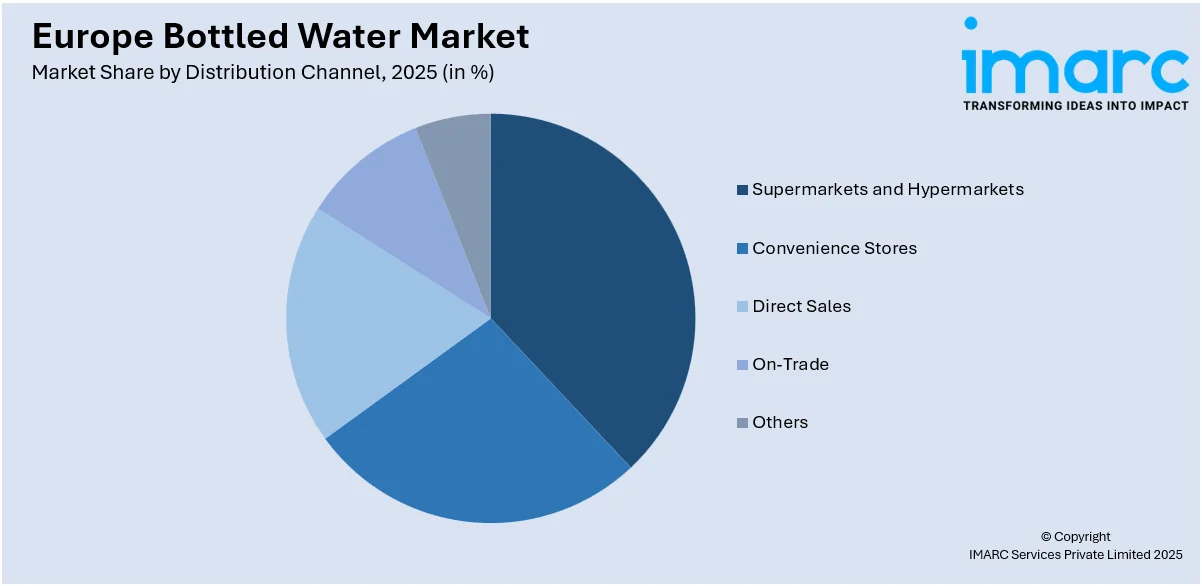

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others

Supermarkets and hypermarkets are among the most significant distribution channels for bottled water. These large retail spaces offer a variety of brands and types of bottled water, from premium artisanal waters to cost-effective multipacks. Consumers prefer this channel due to the convenience of finding multiple grocery items in one place, competitive pricing, and frequent promotions. Supermarkets and hypermarkets also benefit from high foot traffic, which increases the visibility and sales of bottled water. These outlets often feature different formats and sizes of bottled water, catering to both individual needs and family consumption.

Convenience stores represent a smaller, more accessible option for consumers looking to quickly purchase bottled water. These outlets are typically located in urban areas, transport hubs, and near workplaces, making them a popular choice for on-the-go consumers. The ease of access, extended opening hours, and the rapid shopping experience appeal to consumers who may not have the time or desire to visit larger supermarkets. Bottled water sold in convenience stores may carry a higher price per unit compared to supermarkets due to the premium placed on convenience.

Direct sales include sales made directly from the producer to the consumer without intermediaries. This can occur online through e-commerce platforms or through home delivery services offered by bottled water companies. This channel has grown with the rise of digital shopping platforms and the increasing comfort of consumers with online purchases. Direct sales allow companies to build direct relationships with their consumers, offer subscription services, and provide bulk purchase options that are often more cost-effective and convenient for home and office use.

On-trade channel refers to venues such as restaurants, cafés, hotels, and bars where bottled water is sold directly to consumers for immediate consumption. This segment allows bottled water brands to establish a premium image, especially in high-end dining settings where imported or specialty waters can be paired with meals to enhance the dining experience. On-trade sales often command higher prices due to the service and atmosphere provided by these establishments. The visibility in such settings also helps reinforce brand prestige and loyalty among consumers.

Breakup by Packaging Type:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

PET (Polyethylene Terephthalate) bottles are the most prevalent packaging type in the European bottled water market. This type of packaging is favored for its combination of lightweight, durability, and flexibility. PET bottles are designed to be resilient, shatterproof, and economically viable, which makes them particularly appealing to both manufacturers and consumers for bottled water. They are also highly recyclable, which adds to their appeal in environmentally conscious markets.

Metal cans in the bottled water market, while less common than PET bottles, offer unique benefits and appeal to specific market segments. Metal cans are typically made from aluminum or steel, known for their strength, impermeability, and excellent recyclability. One of the key advantages of metal cans is their sustainability profile; they can be recycled repeatedly without loss of quality, making them highly appealing in a circular economy.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others.

Germany represents the largest market for bottled water consumption by country. This trend is characterized by a highly health-conscious population and an established environmental ethos. German consumers tend to prioritize product quality and sustainability, influencing bottled water sales, particularly those that emphasize eco-friendly packaging and natural sourcing. Germany is known for its strict recycling regulations, which encourage companies to invest in sustainable practices. The market is diverse, with a strong preference for both sparkling and still water.

France is one of the largest markets for bottled water in Europe, deeply rooted in a culture that values gastronomy and fine dining, where bottled water is often considered an essential part of the dining experience. France is renowned for its naturally sourced mineral waters, with brands such as Evian and Vittel being popular both domestically and internationally. The French market is characterized by a high consumption rate of mineral-enriched waters, which are marketed for hydration and also for their health benefits, such as aiding digestion and providing essential minerals.

The bottled water market in the United Kingdom is driven by increasing health awareness and changing lifestyles, particularly in urban areas where consumers seek convenience and healthier beverage choices. The market has seen a significant shift toward flavored and functional waters, catering to a consumer base looking for variety and health benefits beyond hydration. The UK is also seeing a trend toward premiumization within the bottled water market, with consumers willing to pay higher prices for products that offer superior taste or health benefits.

Italy bottled water market benefits from the country's rich heritage of natural mineral springs, which are integral to both the local culture and the economy. Italians are among the highest consumers of bottled water in Europe, largely due to the prevalent belief in the health benefits of mineral-rich waters sourced from specific regions. Italian bottled water brands often emphasize the origin and unique properties of their waters, aligning with consumer preferences for natural and authentic products.

Spain bottled water market is largely influenced by the warm climate and the extensive tourism industry, which drives high consumption rates, particularly during the summer months. Spanish consumers are increasingly seeking hydration and health-oriented products, leading to growth in the segments of flavored and functional waters. Environmental concerns are gaining traction among Spanish consumers, pushing bottled water companies to adopt more sustainable practices and packaging solutions

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- Key players in the European bottled water market are actively engaging in several strategic efforts to drive growth and respond to evolving consumer preferences and regulatory environments. According to the Europe bottled water market research, sustainability is a central theme, with major companies investing heavily in eco-friendly packaging solutions such as biodegradable materials and recycled PET (rPET) to reduce environmental impact and align with stringent EU directives aimed at curbing plastic waste. For instance, leading brands have committed to increasing the content of rPET in their bottles to at least 50%, significantly reducing reliance on virgin plastics. Innovation in product offerings is another critical area, with companies expanding their portfolios to include functional waters enhanced with vitamins, minerals, and flavors to cater to health-conscious consumers seeking added value beyond hydration.

Europe Bottled Water Market News:

- December 2023: FIJI Water has transitioned its 500 mL and 330 mL bottles to 100% recycled plastic, reducing its plastic waste and environmental impact. The transition to 100% recycled plastic bottles replaces nearly 70% of FIJI® Water's bottle volume in the U.S. with recycled material, contributing to a lighter environmental footprint.

Europe Bottled Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global Europe bottled water market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global Europe bottled water market?

- What is the impact of each driver, restraint, and opportunity on the global Europe bottled water market?

- What are the key regional markets?

- Which countries represent the most attractive Europe bottled water market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the Europe bottled water market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the Europe bottled water market?

- What is the breakup of the market based on the packaging type?

- Which is the most attractive packaging type in the Europe bottled water market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global Europe bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe bottled water market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global Europe bottled water market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe bottled water industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)