Europe Beer Market Size, Share, Trends and Forecast by Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel, and Country, 2025-2033

Europe Beer Market Size and Share:

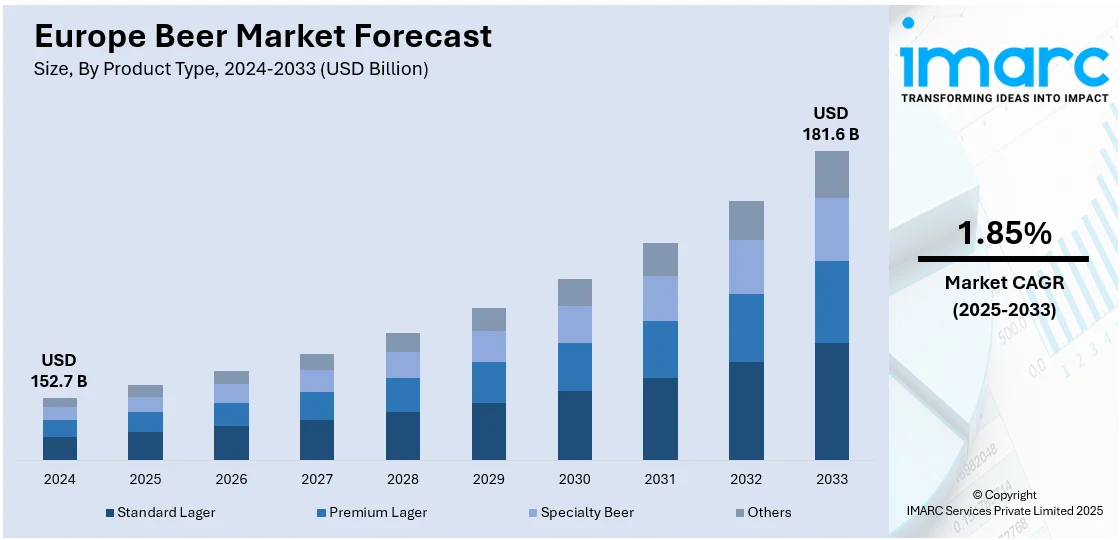

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033. The Europe beer market is driven by the growing demand for craft and low-alcohol beers, changing lifestyle choices, cultural traditions, sustainability initiatives, and innovations in brewing technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 152.7 Billion |

|

Market Forecast in 2033

|

USD 181.6 Billion |

| Market Growth Rate (2025-2033) | 1.85% |

One of the key factors driving the Europe beer market is the rising demand for craft brews, with growing consumer demand for unique and premium beer experiences. Consumers are increasingly eschewing mass-produced beers for local, artisanal brews that provide differentiation in taste and quality. This can be attributed to growing interest in authenticity, the need for innovation in flavor profiles, and the appeal of supporting small, independent breweries. Craft beers cater to the creativity, sustainability, and high-quality ingredients thereby catering to consumers who are more conscious of product origins and their environmental impact.

Another major factor driving the European beer market is the rising health-consciousness since consumers desire to have healthy lifestyle-conformable beverages. The trend in demand has shown increased consumption of lower-calorie, low-alcohol, gluten-free, and alcohol-free beers. The consumption of beer by more calorie-conscious consumers increases with consumer awareness of their beverages' nutrition content. The shift by consumers toward having enjoyable beverage choices that do not detract from their desired level of fitness is an encouragement to brew low-calorie beers. This trend is encouraging breweries to innovate with new formulations, creating healthier alternatives to traditional beer that still offer a satisfying taste.

Europe Beer Market Trends:

Rise in Premiumization

The European beer market is being increasingly driven by the trend of premiumization, where consumers are willing to spend more on high-quality and premium beer products. This is due to a rise in disposable incomes, the changing tastes of consumers, and the desire for an enhanced drinking experience. Premium beers usually focus on superior ingredients, craftsmanship, and unique branding to appeal to a sophisticated crowd. This trend has been highly pronounced in cities, where people are looking for specialty beers with high alcohol content, unique flavors, or specialty limited editions. Breweries are using this trend by releasing premium products and collaborating with luxury brands or renowned chefs to create one-of-a-kind experiences.

Growing Health and Wellness Trends

Consumers are becoming more health-conscious, and this is changing their lifestyle choices in terms of the beers they prefer. Low-alcohol, low-calorie, and gluten-free beers are gaining popularity. More breweries are now offering organic beers or beers with functional ingredients such as probiotics. The change is indicative of a larger trend in consumer behavior towards moderation, transparency, and healthier consumption, which is driving demand for these specific beer categories. Health-conscious consumers are increasingly growing an interest in the contents of their drinks, raising the pressure on breweries to transparently label their beers along with ingredients. In short, there is an extraordinary rise in demand for special beers that match such sentiments, which is a complete trend changer in the competition dynamics by brewers across Europe.

Evolving Consumer Preferences and Demographics

Demographics and changes in consumer preference are other key drivers for the beer market in Europe. Younger consumers, mainly millennials and Gen Z, tend to have different tastes and consumption behaviors compared to the older generations. This generation of consumers is likely to seek out new, innovative beer styles, such as flavored beers, low-alcohol options, and ready-to-drink beer cocktails. Alternative ingredients also have an emerging interest - fruit-infused beers or ones that incorporate spices and herbs. Increased attention to experience, rather than products, makes breweries adapt to demands for new taste profiles and unique drinking experiences.

Europe Beer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe beer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, packaging, production, alcohol content, flavor, and distribution channel.

Analysis by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Standard lager dominates the market due to its popularity, consistent taste, and affordability. This category appeals to a wide range of consumers, from casual drinkers to those who prefer more traditional beer. Standard lager is considered a staple for most social gatherings. Its mellow taste and ability to complement a variety of food products are the reasons for its popularity at various times. Also, mass production and availability worldwide have made the standard lager affordable and cheaper, which helps it stay in the market in a commanding position.

Analysis by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

The largest segment in the beer packaging market is glass, on account of its premium appeal, its ability to preserve the taste and quality of the beer, and sustainability advantages. Glass bottles are preferred for maintaining the carbonation of the beer, protecting it from UV light, and providing a longer shelf life, which results in a better drinking experience. Moreover, glass packaging is more environmentally friendly than most other materials since it has a high recyclability and can be reused several times.

Analysis by Production:

- Macro-Brewery

- Micro-Brewery

- Others

The macro-brewery segment is the largest in the beer market by production as it can produce beer on a large scale, thereby generating considerable economies of scale. They can produce huge quantities at relatively lower costs, which makes their products more affordable and accessible to many people. Macro-breweries also enjoy well-established distribution networks, enabling them to penetrate global markets and maintain robust brand recognition. Their extensive resources allow for consistent quality as well as the introduction of styles of beer that meet rather broad consumer preferences, thus assuring them of market domination.

Analysis by Alcohol Content:

- High

- Low

- Alcohol-Free

The high alcohol content category is the most extensive within the beer market due to its appeal to a wider market of consumers looking for stronger, more intense flavor profiles and higher alcohol by volume (ABV) options. Beers with a high alcohol content, such as IPAs, stouts, and Belgian-style ales, will generally be consumed by those who have an affinity for bolder, more complex taste profiles. Moreover, craft beers have become one of the major drivers for this category, as many craft brewers are producing innovative beers of high ABV to capture market share in this very competitive market. The high-ABV beers also find great usage in social and celebratory events.

Analysis by Flavor:

- Flavored

- Unflavored

The unflavored segment is the largest in beer market because of its broad acceptance and traditional nature. People love classic, unflavored beers like lagers and pilsners because it tastes familiar and versatile that goes well with a long list of foods. Besides, unflavored beers are the default choice of mass-market brews. These brews dominate beer sales in Europe. Such unflavored beers are an easily adopted option for casual drinking, while larger established brands still dominate the category.

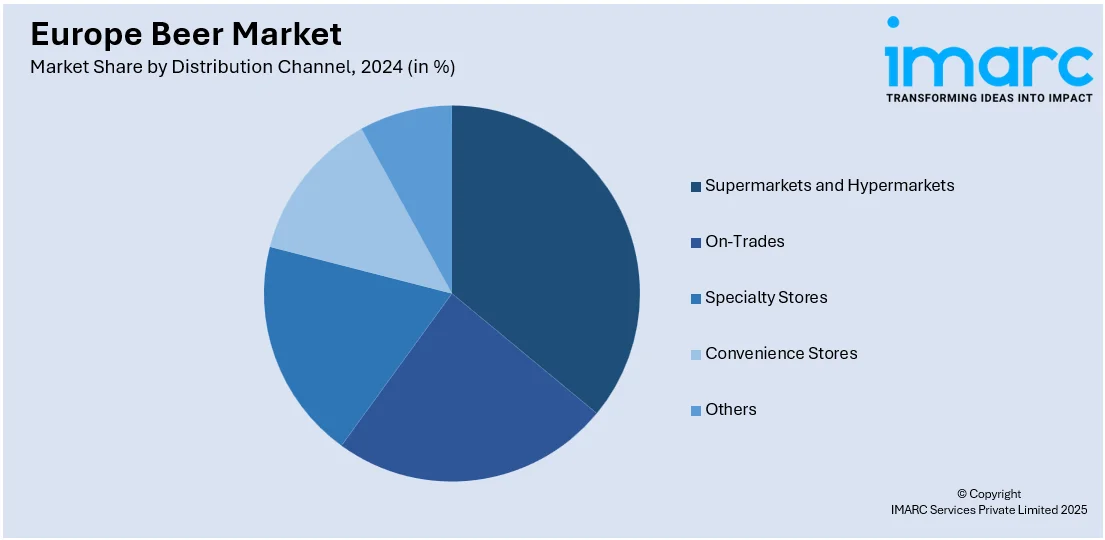

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

The biggest distribution channel segment in the beer market is that of supermarkets and hypermarkets because they have wide distribution, are convenient, and have extensive products. The advantage of such retail formats for consumers is a one-stop shop for various brands and types of beer within one outlet, thus facilitating an easy comparison of products and the final selection of items. Secondly, high foot traffic boosts sales. Their strong supply chain networks, promotional offers, and strategic placements also enhance visibility and accessibility, making them a dominant channel for beer distribution in many regions.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The largest segment in the European beer market is held by Germany because of its well-developed beer culture, long traditions of brewing, and demand from consumers. Iconic beer styles like Pilsner, Weissbier, and Bock are characteristic for Germany, where there are also numerous world-famous breweries, and events such as Oktoberfest-the world's largest beer festival-drive beer consumption and tourism. High per capita beer consumption, a relatively strong export market, as well as a well-developed network of distribution, place German beer market at the vanguard of Europe's beer-making industry.

Competitive Landscape:

Europe's largest players in the brewing beer sector engage themselves with all the activities to maintain their growth and meet changes brought forth by the consumer of these days. Top-tier breweries invest in product development as they introduce low-alcoholic and low-calorie brands. Sustainability is another thrust area: leading players have been embracing ecologically friendly packaging, have implemented water-saving practices and began the usage of renewable power within brewing. Strategic acquisition and collaborations have been rampant because breweries are looking to expand portfolios and enter new markets, especially in the craft beer and premium segments. Digital transformation is another area of focus, with brands leveraging e-commerce platforms and social media marketing to engage consumers and streamline distribution more effectively.

The report provides a comprehensive analysis of the competitive landscape in the Europe beer market with detailed profiles of all major companies, including:

- Asahi Group Holdings Ltd

- Carlsberg Group

- Oettinger Brewery

- Heineken NV

- Kirin Holdings Co. Ltd

- Bitburger Brewery

- Molson Coors Beverage Company

- Constellation Brands

- Anheuser Busch InBev

- Krombacher

- Pernod Ricard

Latest News and Developments:

- January 2024: Carlsberg bought 20% stakes in fellow Danish brewer Mikkeller. Under this deal, Carlsberg will distribute Mikkeller’s beers in their home market.

Europe Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packagings Covered | Glass, PET Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Contents Covered | High, Low, Alcohol-Free |

| Flavors Covered | Flavored, Unflavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Asahi Group Holdings Ltd, Carlsberg Group, Oettinger Brewery, Heineken NV, Kirin Holdings Co. Ltd, Bitburger Brewery, Molson Coors Beverage Company, Constellation Brands, Anheuser Busch InBev, Krombacher, Pernod Ricard, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe beer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe beer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Beer is an alcoholic drink prepared by fermenting malted grains, usually barley, along with water, hops, and yeast. The hop adds flavor and acts as a preservative; the yeast converts the sugars into alcohol and carbonation. It is one of the oldest and most popular drinks in the world, with its great variety and flavors.

The Europe beer market was valued at USD 152.7 Billion in 2024.

IMARC estimates the Europe beer market to exhibit a CAGR of 1.85% during 2025-2033.

Factors driving the Europe beer market include changing lifestyle choices, the craft beer revolution, cultural traditions, sustainability efforts, evolving consumer preferences, and technological innovations in brewing and marketing.

In 2024, standard lager represented the largest segment by product type, driven by its widespread popularity, affordability, balanced flavor profile, and availability, making it a preferred choice among a broad range of consumers across Europe.

Glass leads the market by packaging owing to its premium appeal, recyclability, and ability to preserve beer's taste and quality, aligning with consumer preferences for sustainable and high-quality packaging solutions.

The macro-brewery is the leading segment by production, driven by its ability to produce beer on a large scale, ensuring consistent quality, wide distribution, and affordability for mass-market consumption.

High alcohol content holds the maximum number of shares on account of its association with premium and specialty beers, which offer complex flavors, higher quality, and appeal to consumers seeking unique drinking experiences.

Unflavored represents the largest market segment by flavor, as it aligns with traditional consumer preferences, offering the classic taste profiles that dominate the European beer culture.

Supermarkets and hypermarkets lead the market on account of their widespread availability, diverse product offerings, and competitive pricing, making them convenient and cost-effective for consumers.

On a regional level, the market has been classified into Germany, France, the United Kingdom, Italy, Spain, and others wherein Germany currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)