Europe Battery Market Size, Share, Trends and Forecast by Type, Product, Application, and Country, 2025-2033

Europe Battery Market Size and Share:

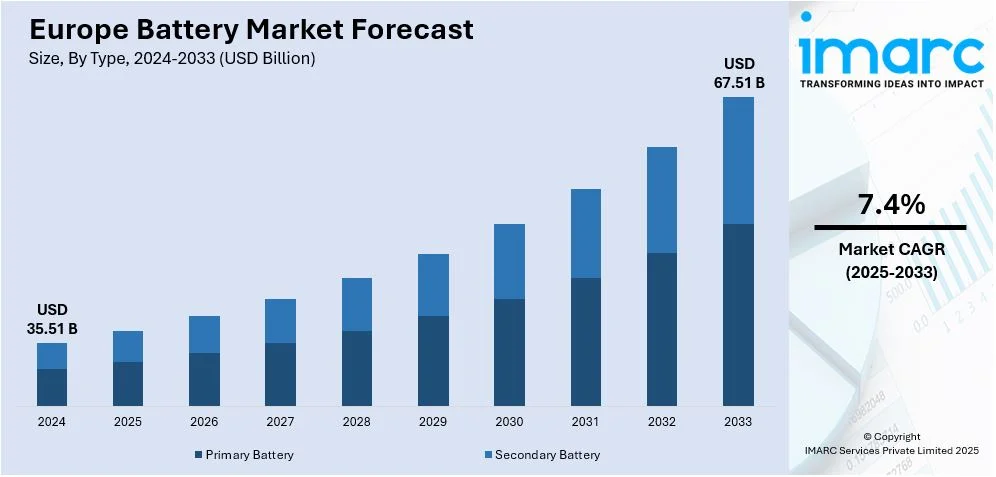

The Europe battery market size was valued at USD 35.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 67.51 Billion by 2033, exhibiting a CAGR of 7.4% from 2025-2033. The market is growing actively due to the increase in the usage of electric vehicles, integration of renewable energy resources, and rising measures against emissions. Moreover, technological advancements in battery performance, recycling initiatives, and increased investments in local production are enhancing the Europe battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.51 Billion |

| Market Forecast in 2033 | USD 67.51 Billion |

| Market Growth Rate (2025-2033) | 7.4% |

The market is fueled by the increase in adoption of renewable energy and the higher standards for decarbonization that companies are putting in place. The enhancing sales and usage of electric vehicles (EV) acts as another significant contributor, which is stimulated by government initiatives via purchase incentives and investments in charging stations. Energy storage solutions in industrial and residential sectors are also becoming popular to optimise grids and enhance energy use. Furthermore, growth in battery technologies like lithium-ion and solid-state batteries with better performance, life and safety aspects are contributing to the European battery market growth. For instance, in September 2024, AE Elemental opened a lithium-ion battery recycling facility in Zawiercie, Poland, with a 12,000-ton annual capacity. This facility supports EU recycling goals, contributing to EV battery supply chains and reducing environmental impact.

Another contributing factor is the implementation of favorable policies, such as the European Battery Alliance and dedicated research funding, aimed at boosting local battery production within the European Union. These initiatives seek to reduce reliance on imports and position Europe as a leader in battery manufacturing. Additionally, growing sustainability concerns have driven increased funding for recycling and second-life applications of batteries, aligning with circular economy principles. For instance, in October 2024, Mercedes-Benz opened Europe's first battery recycling plant in Kuppenheim, Germany, using a mechanical-hydrometallurgical process with a recovery rate exceeding 96%. The plant supports a circular economy, recycles valuable materials, and contributes to sustainable battery production for electric vehicles. Besides this, growth of smart devices and consumer electronics has created a need for compact, powerful batteries and taken the market into new directions across industry verticals.

Europe Battery Market Trends:

Shift Toward Electric Vehicles (EVs)

The European battery market size is experiencing significant growth due to the rapid adoption of electric vehicles. Governments around the region are introducing stricter requirements for emission and increasingly providing more incentives for the usage of electric vehicles, thus increasing the demand for lithium-ion batteries or lithium-metal solid-state batteries. For instance, in September 2024, Imec announced, in collaboration with 13 European partners in the H2020 SOLiDIFY project, the development of a lithium-metal solid-state battery with 1070 Wh/L energy density, offering improved performance and cost-effective manufacturing compatible with lithium-ion production lines. Moreover, automakers are investing heavily in local battery production to secure supply chains and reduce reliance on imports. The transition aligns with Europe’s broader green energy goals, aiming to phase out internal combustion engines in favor of sustainable mobility solutions. Furthermore, this trend is transforming the market into a global leader in EV battery technology.

Expansion of Renewable Energy Storage

The growing adoption of renewable energy systems, especially solar and wind power, is driving the need for advanced large-scale energy storage solutions across Europe. Cutting-edge technologies like lithium-ion and solid-state batteries are leading the way, providing efficient and reliable options to meet the increasing demand for extended-duration energy storage. Moreover, countries like the UK and Spain are integrating battery systems into their energy grids to stabilize supply and store surplus power during peak generation. For instance, in December 2024, Stellantis and CATL announced an agreement to invest up to €4.1 billion in a joint venture to build a carbon-neutral LFP battery plant in Zaragoza, Spain. This shift is opening avenues for battery producers to expand their offerings beyond the automotive industry and capitalize on the expanding renewable energy sector.

Emphasis on Circular Economy and Sustainability

Sustainability is a key focus in Europe’s battery market, with an increasing emphasis on recycling and ethical sourcing of raw materials. Organizations are allocating resources to develop technologies aimed at extracting essential metals such as lithium, cobalt, and nickel from spent batteries. This approach helps minimize environmental harm while decreasing reliance on non-European suppliers. European Union policies emphasize increasing recycling rates and encouraging the integration of recycled components in the production of new batteries. The circular economy approach is not only helping reduce waste but also supporting the region’s goal of achieving carbon neutrality. For instance, according to industry reports, the European Commission's new Battery Act regulations aim to enhance battery sustainability by requiring Battery Management Systems, digital passports, and stricter recycling targets. By 2030, manufacturers must achieve a 70% recycling efficiency, optimizing battery lifecycles, and promoting environmental responsibility across the industry. This trend is reshaping business strategies and fostering innovation in sustainable battery production.

Europe Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe battery market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Primary Battery

- Secondary Battery

Primary batteries are the non-rechargeable form of energy supply widely used across consumer electronics, medical sectors and remote sensing equipment. These batteries are usually preferred for their high dependability, longer storage period and ease of use. In Europe, primary batteries continue to provide power for portable applications in compact, low-value power solutions. Battery production in Europe has played a key role in meeting the demand for these essential power sources. Despite competition from rechargeable batteries, primary batteries remain vital in sectors requiring long-term, low-maintenance power supply. Zinc carbonate, alkaline, and lithium primary batteries can be categorized as being most frequently used kinds of batteries in the European market.

Secondary batteries, which are also called rechargeable batteries, are extensively used in EVs, energy storage, portable electronic devices, and others. These batteries are best suited for alternating charging and discharging processes as they have more advantages than the initial costs and durability. The increasing electric vehicle and renewable energy storage demand in Europe has been a major factor driving the secondary battery market, where lithium-ion technology is the most popular due to energy density, durability and efficiency. Furthermore, environmental issues are on the increase which has also served as a catalyst for a growing Europe battery market demand for secondary batteries on account of their ability to be recycled and thus their contribution to circular economy.

Analysis by Product:

- Lithium-Ion

- Lead Acid

- Nickel Metal Hydride

- Nickel Cadmium

- Others

Lithium-ion batteries hold a prominence in technology across the European battery market, utilized in electric cars, portable gadgets, and energy storage systems. One of the most popular types of batteries are lithium-ion, as they have high density energy storage capacity, long cycle life, and comparatively low weight. The magnifying demand for EVs and renewable energy storage systems in Europe has significantly facilitated the market for lithium-ion batteries. Ongoing advancements in battery chemistry are focused on enhancing performance, reducing costs, and improving sustainability, further cementing lithium-ion batteries as the leading solution in the market.

Lead acid batteries, despite being one of the oldest battery technologies, remain a significant segment in the European market due to their affordability, reliability, and long history of use in automotive applications, especially for starting, lighting, and ignition (SLI) purposes. They are also employed in backup power solutions and some industrial applications. However, their use is declining in favor of more advanced technologies like lithium-ion, driven by environmental concerns and the push for cleaner energy solutions. Nevertheless, lead acid batteries continue to be relevant due to their established infrastructure, recyclability, and cost-effectiveness in certain segments.

Nickel metal hydride (NiMH) batteries are widely used in hybrid electric vehicles (HEVs), power tools, and consumer electronics. Although not as commonly used in the rapidly expanding electric vehicle market as lithium-ion, NiMH batteries remain a viable option for certain applications due to their greater safety profile and competence to deal with a wide range of temperatures. In Europe, NiMH batteries are often favored in specific vehicle segments, such as HEVs, where high energy density and fast charging are not as critical. The demand for NiMH batteries is stable but growing slowly as the market increasingly shifts to lithium-ion solutions.

Nickel cadmium (NiCd) batteries are primarily used in industrial and power tool applications, where durability and ability to perform under extreme conditions are essential. While their use in consumer electronics has declined due to environmental concerns and the emergence of newer technologies, NiCd batteries continue to serve specialized sectors requiring robust performance. They are recognized for their extended lifespan, ability to withstand deep discharge, and cost-efficiency. In Europe, the use of NiCd batteries is regulated under stringent environmental laws, leading to a decline in demand for new NiCd batteries, although they remain in use for specific industrial purposes.

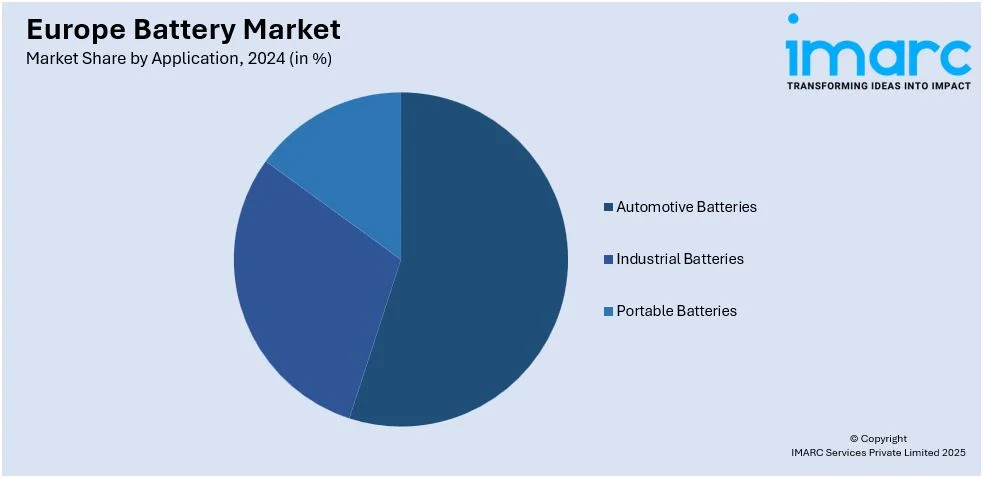

Analysis by Application:

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

The automotive battery segment in the European market is primarily driven by the growing demand for electric vehicles (EVs). As governments enforce stricter emission standards and promote sustainable mobility, automakers are shifting to electric powertrains, which significantly increases the need for high-performance automotive batteries. Lithium-ion batteries lead this market segment because of their high energy density, operational efficiency, and extended lifespan. The focus is on developing batteries with higher energy capacities, faster charging times, and improved durability to meet consumer expectations and regulatory requirements. The automotive battery segment is crucial in advancing Europe’s green transportation goals.

Industrial batteries play a crucial role in various sectors, supporting applications such as energy storage systems, backup power solutions, and equipment used in material handling. In Europe, the demand for industrial batteries is rising as industries focus on energy efficiency, sustainability, and reducing carbon footprints. These batteries are progressively being adopted in large-scale energy storage systems, including applications for grid stabilization and the incorporation of renewable energy sources. Industrial sectors are adopting advanced battery technologies like lithium-ion and solid-state batteries to improve performance, reduce downtime, and ensure reliable power supply in critical operations. This segment supports Europe’s shift toward energy transition and industrial automation.

Portable batteries are a crucial segment in the European market, powering a variety of consumer electronics, including smartphones, laptops, and wearables. As mobile technology and portable devices become increasingly essential, there is a steady rise in the demand for efficient, durable portable batteries capable of delivering extended performance. Lithium-ion batteries dominate this segment due to their light weight, high energy density, and rechargeability. Additionally, the increasing adoption of portable power banks and other mobile charging solutions drives further growth. The portable battery segment is also evolving with the development of more efficient, faster-charging, and environmentally friendly battery technologies to meet consumer expectations and sustainability goals.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

According to the Europe battery market forecast, Germany is expected to maintain its prominent position in the region, driven by strong demand for electric vehicles (EVs) and renewable energy storage. The country hosts major manufacturing hubs, supported by significant investments in local battery production. Government policies, such as incentives for clean energy and sustainability, further boost the market. Germany is also a leader in battery recycling, with advanced technologies and collaborations helping reduce environmental impact. The country’s automotive industry is a major driver, fostering innovation and growth in battery technology and manufacturing, making it a central market for Europe’s battery sector.

France plays a pivotal role in the European battery market, with growing investments in EV production and sustainable energy solutions. The government's focus on lowering carbon emissions and supporting sustainable technologies has fast-tracked the establishment of battery manufacturing plants. France is also focused on creating a circular economy for battery materials, including recycling and reuse. The automotive sector, with a focus on electric mobility, continues to drive demand for advanced batteries. Additionally, France’s strategic location and infrastructure support its increasing involvement in the regional battery supply chain.

The United Kingdom is a rapidly developing market in Europe’s battery sector, particularly for electric vehicles and energy storage solutions. The government’s aggressive targets for net-zero emissions by 2050 have led to substantial investments in EV infrastructure and battery manufacturing. Battery manufacturers in Europe are also expanding operations, with the UK focusing on building local battery supply chains to reduce dependency on imports. With strong automotive industry support, the country is advancing in battery research, innovation, and recycling. Furthermore, the UK is strengthening its role in battery storage for renewable energy, aligning with broader sustainability goals in the region.

Italy is emerging as an important market for the European battery sector, fueled by the increasing adoption of electric vehicles and energy storage systems. The country’s automotive industry is transitioning towards electric mobility, creating a higher demand for efficient, high-performance batteries. Italy is also investing in local battery production and recycling initiatives, aligning with EU sustainability targets. The government is supporting this shift through incentives and policy frameworks to encourage clean energy innovation. Moreover, Italy’s strategic location within Europe offers opportunities for enhanced battery supply chain integration and regional collaboration.

Spain is becoming a significant player in the European battery market, driven by its expanding electric vehicle market and renewable energy projects. The government’s renewable energy initiatives and green policies have spurred investment in battery production and energy storage systems. Spain is actively developing battery manufacturing facilities and has strong potential in the area of battery recycling. The country’s growing demand for energy storage, particularly in the context of solar energy, is pushing the development of new battery technologies. With its supportive infrastructure and EU funding, Spain is positioning itself as a key contributor to Europe’s battery value chain.

Competitive Landscape:

The competition of the European market is increasing by the number of battery manufacturers and pioneer organizations due to the increasing popularity of electric vehicles (EVs) and other storage technologies. The current and prospective market players are increasing output capacity in order to meet the growing demand for supplies in the region. Simultaneously, rising concerns for sustainability are bolstering the interest in battery recycling and second-use applications. For instance, in May 2024, Cylib, a sustainable battery recycling firm, raised €55 million in Series A funding. Its innovative process recycles all lithium-ion battery components with over 90% efficiency, reducing environmental impact and supporting European EV supply chain resilience. In addition, strong government support, including regulatory measures and incentives for local production, is fueling market growth and technological advancements. Furthermore, these dynamics create an intensely competitive environment, as companies strive to enhance performance, reduce costs, and meet evolving consumer and regulatory demands.

The report provides a comprehensive analysis of the competitive landscape in the Europe battery market with detailed profiles of all major companies, including:

- Saft Groupe SAS

- FIAMM Energy Technology S.p.A.

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Limited.

- Tesla

- Duracell Inc.

- GS Yuasa International Ltd.

- LG Energy Solution

- Varta AG

- Panasonic Corporation

Latest News and Developments:

- In June 2024, BASF and WHW Recycling GmbH partnered to process cathode and anode waste from battery production in Europe, recovering valuable raw materials and enhancing sustainable battery recycling for electric vehicles.

- In September 2024, Impact Clean Power Technology launched a highly automated lithium-ion battery production line at GigafactoryX, doubling its capacity to 1.2 GWh in 2024, with plans to reach 4 GWh for large-scale orders.

- In December 2024, Bosch Ventures invested in Cylib, based in Germany, and Li Industries, to advance scalable, sustainable battery recycling solutions, addressing critical raw material recovery and environmental challenges.

Europe Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Primary Battery, Secondary Battery |

| Products Covered | Lithium-Ion, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, Others |

| Applications Covered | Automotive Batteries, Industrial Batteries, Portable Batteries |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe battery market was valued at USD 35.51 Billion in 2024.

The key factors driving the Europe battery market include the growing demand for electric vehicles (EVs), stringent environmental regulations, and increased investments in renewable energy storage solutions. Technological advancements in battery chemistry, government incentives, and the push towards sustainability are further accelerating market growth, making energy storage solutions more essential.

IMARC estimates the Europe battery market to reach USD 67.51 Billion in 2033, exhibiting a CAGR of 7.4% during 2025-2033.

Some of the major players in the Europe battery market include Saft Groupe SAS, FIAMM Energy Technology S.p.A., BYD Company Ltd., Contemporary Amperex Technology Co. Limited., Tesla, Duracell Inc., GS Yuasa International Ltd., LG Energy Solution, Varta AG, Panasonic Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)