Europe Air Purifier Market Size, Share, Trends and Forecast by Filter Technology, Product Type, Mounting Type, Application, Distribution Channel, and Country 2025-2033

Europe Air Purifier Market Size and Share:

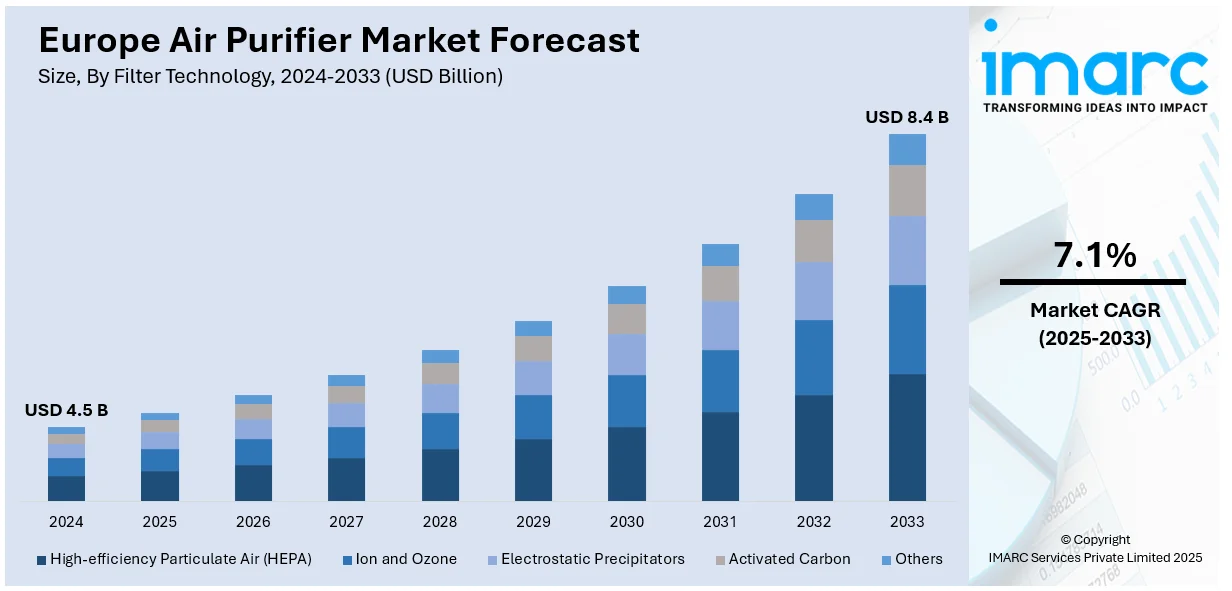

The Europe air purifier market size was valued at USD 4.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.4 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033. The market is experiencing significant growth due to increasing air pollution, stringent environmental regulations, and rising awareness about health impacts associated with poor air quality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.5 Billion |

|

Market Forecast in 2033

|

USD 8.4 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The growth of the Europe air purifier market is attributed to escalating air pollution caused by vehicular exhaust, urban development and industrial emissions. Raised concerns over the health implications of prolonged exposure to pollutants, such as fine particulate matter, allergens, and volatile organic compounds, have spurred demand for air purification solutions. Governments across Europe are implementing strict environmental regulations to improve air quality, encouraging the adoption of air purifiers in industrial residential, and commercial settings. Technological advancements, including high-efficiency particulate air (HEPA) filters and activated carbon filters, have enhanced product efficiency and consumer appeal. For instance, in January 2024, Airthings launched two products Renew, its first smart air purifier, and Wave Enhance, a compact air quality monitor. Renew features a 4-stage HEPA filter and integrates with the Airthings app, while Wave Enhance provides sleep quality insights with its CO2 and volatile organic compounds (VOC) sensors. Moreover, escalating awareness campaigns about the benefits of maintaining clean indoor air have further driven market growth, especially among urban populations. Additionally, innovations in design and technology, such as portable air purifiers and aesthetically appealing devices, cater to consumer preferences, expanding the market's reach across various segments.

Urbanization and industrialization in Europe have also intensified indoor air pollution, exacerbated by the use of synthetic building materials and furnishings that emit harmful chemicals. This has heightened demand for air purifiers in households, schools, offices, and healthcare facilities. Rising health awareness, particularly regarding respiratory illnesses and allergies, has spurred greater adoption of air purifiers, with an emphasis on ensuring healthy indoor environments. For instance, Blueair's new ComfortPure 3-in-1 Air Purifier, launched in December 2024, combines heating, cooling, and purification to remove 99.97% of airborne particles, backed by TripleFlow™ technology and sleek scandinavian design. Furthermore, affordability and accessibility have improved with the introduction of energy-efficient and competitively priced models, making air purifiers a feasible choice for middle-income households. Additionally, the growing trend of eco-friendly and energy-efficient appliances aligns with consumer preferences for sustainable living, driving innovation and growth in the market. Manufacturers are actively investing in research and development to meet evolving consumer demands, fostering competitive advancements in the sector.

Europe Air Purifier Market Trends:

Growth of Smart and IoT-Enabled Air Purifiers

Smart and IoT-enabled air purifiers are one of the most important trends driving Europe's air purifier market. They allow for real-time monitoring of air quality and automatic adjustment according to the levels of pollutants. They are also remote-controllable with mobile apps or voice assistants, appealing to tech-conscious consumers. Smart air purifiers are intensely integrated with smart home ecosystems, providing smooth functionality along with other connected devices. For example, Coway's Airmega ProX and Mighty air purifiers introduced in 2023 and hailed by the world for applying AI and IoT technologies through the real-time monitoring of the quality of air, far and near control, as well as filtration tailored specifically for individual needs. Additionally, the benefits include the tracking of air quality data and automatic alert services for maintenance. Leading manufacturers are investing in cutting-edge features, such as advanced sensors for specific pollutants, AI-powered air quality predictions, and energy optimization. This trend aligns with consumer demand for automation and personalization, encouraging greater adoption among urban households and commercial users seeking efficient, hassle-free air purification solutions.

Demand for Energy-Efficient and Sustainable Air Purifiers

The escalating trend of energy efficiency and environmental sustainability is transforming the European air purifier market. Consumers are seeking products that consume less energy and also provide efficient air purification. This is the reason for the popularity of Energy Star-certified products. The biodegradable material used to make air purifiers, ozone-free technologies, and reusable filters attract eco-friendly buyers as they strictly abide by the European environmental rules. Operational costs are also lowered, making it an attractive proposition for residential and commercial consumers, while the governments of Europe are providing subsidies, tax benefits, and running campaigns to increase awareness, further driving this trend. Innovations by manufacturers will also focus on amplifying efficiency and reducing environmental impact, thereby making sustainability a core part of the market's evolution.

Increasing Utilization in Commercial and Public Spaces

Air purifiers in commercial and public premises are gaining momentum as growing indoor air quality recognition impacts one's well-being and productivity. Offices, retail stores, schools, and industries are placing amplifying emphasis on air purification systems to improve the healthy environment of their employees, customers, and visitors. Europe Union's strict regulations on the issue of air quality are also compelling businesses to include air purification solutions within their facilities. Customized solutions to a specific commercial need are becoming very popular, such as industrial-grade air purifiers for manufacturing units or quiet systems for office usage. Businesses are also waking up to the economic benefit of improved indoor air quality as absenteeism is reduced and the customers are happier, therefore the adoption rate of air purifiers in non-residential sectors is impelling.

Europe Air Purifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe air purifier market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on filter technology, product type, mounting type, application,and distribution channel.

Analysis by Filter Technology:

- High-efficiency Particulate Air (HEPA)

- Ion and Ozone

- Electrostatic Precipitators

- Activated Carbon

- Others

High-Efficiency Particulate Air (HEPA) lead in the Europe air purifier market as they capture particles down to 0.3 microns with up to 99.97% efficiency. They are great at eliminating allergens, dust, mold, and other airborne impurities, hence widely applied in residential and healthcare applications. Rising awareness of respiratory health issues and strict indoor air quality regulations add to their wide use. Moreover, HEPA filters are known for their durability and ease of maintenance, which attracts cost-conscious consumers and businesses looking for long-term air purification solutions.

Analysis by Product Type:

- Standalone

- In-Duct

- Others

Standalone air purifiers are leading the market in terms of versatility and easy installation. They are more convenient for small commercial and residential buildings, offering portability and affordability over in-duct systems. The standalone segment continues to gain from technology as it becomes integrated with features such as HEPA filters, activated carbon, and smart devices that provide real-time monitoring of the air quality. These air purifiers are specifically catering to the boosting demand for personalized air purification solutions, particularly in urban areas with rising levels of pollution. The compact design and ability to target specific rooms or zones make them a convenient choice for consumers seeking localized air cleaning.

Analysis by Mounting Type:

- Fixed

- Portable

The mounting type category remains dominated by portable air purifiers that are flexible in gaining popularity by consumer demand for mobility. As they can be easily moved between rooms or locations, portable devices provide personal air purification on demand. Portable is popular among residential users and smaller businesses as it provides the solution to a specific environment without requiring installation. Boosting demand toward compact and lightweight design, coupled with advanced filtration technologies as well as energy-efficient operation has increased the demand. In addition, affordability and ease of operation also help in widespread usage by various segments.

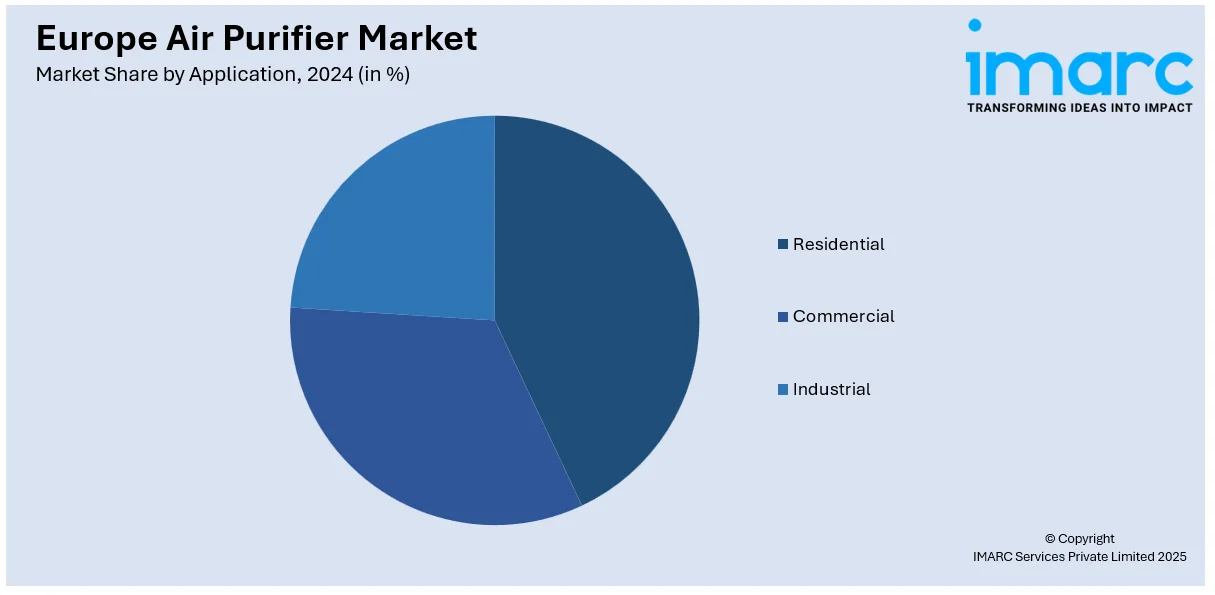

Analysis by Application:

- Residential

- Commercial

- Industrial

The residential segment dominates the Europe air purifier market, as amplifying health awareness about indoor air pollution and its impact on respiratory health is the key driver of this market. Urbanization and smaller living spaces result in poor indoor air quality, making homeowners invest in air purification devices. With accelerating health benefits such as reduced allergens and better sleep quality associated with clean air, consumers are turning to air purifiers for their homes. Residential air purifiers with innovative features such as HEPA filtration, noise control, and smart controls become highly popular. These features make the product affordable to most households, especially the densely populated urban areas that require compact and energy-saving devices.

Analysis by Distribution Channel:

- Offline

- Online

Offline distribution channels are the most preferred method of air purifier sales in Europe. The offline channels make it possible to use physical demonstration and provision of expert advice from retail stores, specialty electronics outlets, and showrooms that instill confidence in the buyer. Comparing models is possible with offline channels while making an informed decision. This segment enjoys promotional activities also, including in-store discounts and other offers that attract consumers. Many retailers also provide installment and maintenance services, giving value to customers. Offline channels dominate because they are considered truthful and more accessible, especially in areas with limited digital penetration.

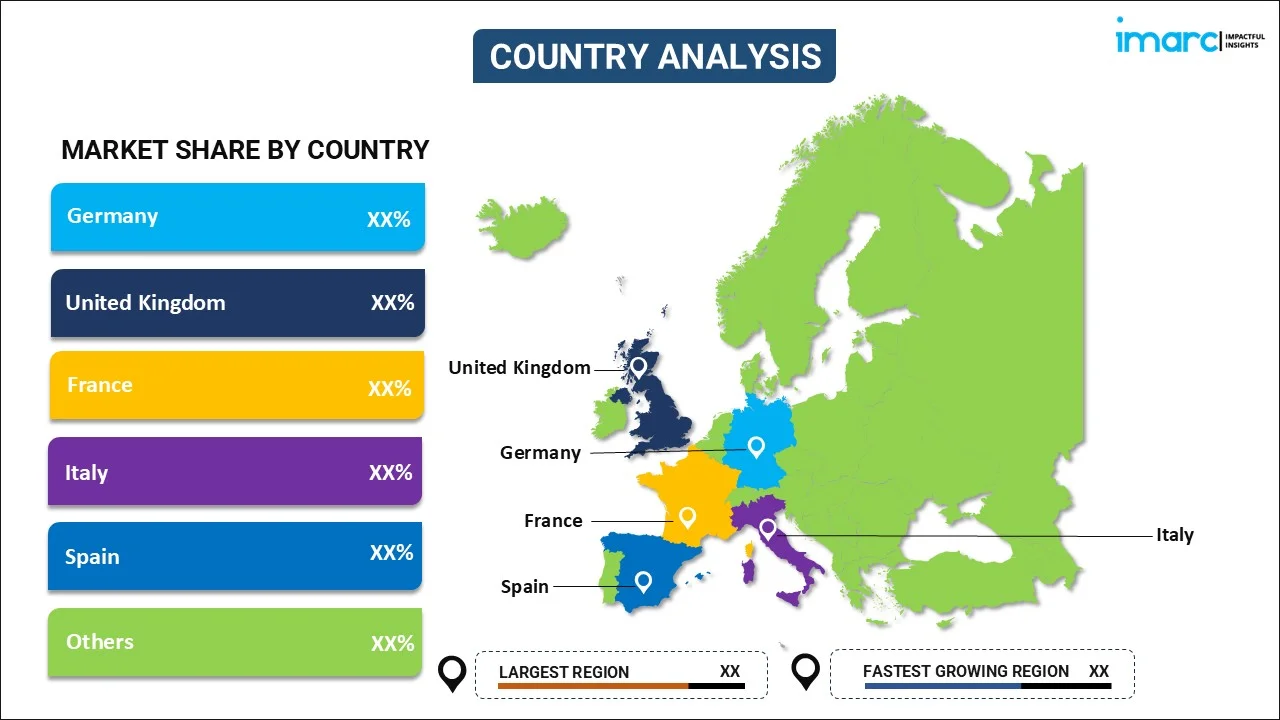

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the biggest market for air purifiers in Europe, mainly due to the strict environmental regulation in this country and high awareness among people of air quality problems. Germany's strong industrial basis also creates urban pollution that necessitates advanced air purification systems. German consumers are health-conscious and prefer products with efficiency proofed, such as HEPA filters. The government's emphasis on sustainability and energy-efficient products further encourages the use of ecologically friendly air purifiers. Germany's strong retail infrastructure as well as its position of leadership in technological innovation make accessible a wide range of items that cater to different demands. This solid foundation gives assurance of continued growth in the regional market.

Competitive Landscape:

The Europe air purifier market is highly competitive and has many global and regional players who are looking to establish their presence in the market by making innovative and strategic moves. Leading companies include Philips, Dyson, and Blueair, all of which have wide-ranging product portfolios, superior technology, and strong brand presence. Players focus on integrating the most advanced features, including smart connectivity, energy efficiency, and filtration systems, to create distinctive offerings. Regional companies compete on prices and customized offerings that fulfill the specific needs of the locale. Strategic alliances, mergers, and acquisitions have become common due to efforts by companies to expand their geographic footprint and develop distribution networks. Finally, R&D investments facilitate market participants in responding to consumers' shifting needs for sustainable and energy-efficient air purification systems.

The report provides a comprehensive analysis of the competitive landscape in the Europe air purifier market with detailed profiles of all major companies, including:

- Blueair (Unilever)

- Camfil

- Coway Co. Ltd.

- Daikin Industries Ltd.

- Dyson

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Samsung

- Sharp Corporation

- Whirlpool Corporation

- Winix Inc.

Latest News and Developments:

- In June 2024, Coway launched the Airmega 100, an affordable cylindrical air purifier designed for small spaces. With 360° air intake, 3-stage HEPA filtration, and whisper-quiet sleep mode, it targets allergens and pollutants. Its energy-efficient design is ideal for apartments and bedrooms.

- In January 2024, Daikin Industries launched a new UV-LED air purifier that uses a combination of UV-LED and Streamer technology to suppress 99% of viruses within 30 minutes. The purifier’s design integrates UV light and filters for enhanced disinfection, addressing rising consumer demands for effective virus control.

Europe Air Purifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Filter Technology Covered | High-efficiency particulate air (HEPA), ion and ozone, electrostatic precipitators, activated carbon, and others |

| Product Type Covered | Standalone, in-duct, and others |

| Mounting Type Covered | Fixed and portable |

| Application Covered | Residential, commercial, and industrial |

| Distribution Channel Covered | Offline and online |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Blueair (Unilever), Camfil, Coway Co. Ltd., Daikin Industries Ltd., Dyson, Honeywell International Inc., Koninklijke Philips N.V., Panasonic Corporation, Samsung, Sharp Corporation, Whirlpool Corporation and Winix Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe air purifier market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe air purifier market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe air purifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An air purifier is a device that improves indoor air quality by eliminating pollutants, allergens, and contaminants. Utilizing filters, UV light, or ionization, it removes dust, pollen, smoke, and harmful particles. It is widely used in homes, offices, healthcare facilities, and industries to promote cleaner and healthier living environments.

The Europe air purifier market was valued at USD 4.5 Billion in 2024.

IMARC estimates the Europe air purifier market to exhibit a CAGR of 7.1% during 2025-2033.

The Europe air purifier market is driven by increasing air pollution, accelerating health awareness, stringent environmental regulations, urbanization, and technological advancements. Demand for energy-efficient and smart-enabled devices, coupled with growing adoption in residential and commercial spaces, further propels market growth. Consumers prioritize solutions addressing allergens, particulate matter, and indoor air quality concerns.

In 2024, High-efficiency Particulate Air (HEPA) represented the largest segment by filter technology, driven by by its ability to remove 99.97% of airborne particles, including allergens, dust, and pollutants, ensuring superior air purification and health benefits.

Standalone leads the market by product type owing to its affordability, easy installation, compact design, and suitability for localized air purification, making it a preferred choice among residential and small commercial users across Europe.

The portable is the leading segment by mounting type, driven by its flexibility, lightweight design, and convenience for users seeking mobility and efficient air purification across different rooms or spaces without permanent installations.

The residential is the leading segment by application, driven by heighteneing consumer awareness of health issues, rising urban air pollution, and the demand for effective air purification in homes to improve indoor air quality.

The offline is the leading segment by distribution channel, driven by consumer preference for physical product evaluation, in-store demonstrations, and expert guidance, which ensure confidence in purchase decisions and reliable post-sales support, particularly in regions with limited digital access.

On a regional level, the market has been classified into Germany, France, The United Kingdom, Italy, Spain, and others, wherein Germany currently dominates the market.

Some of the major players in the Europe air purifier market include Blueair (Unilever), Camfil, Coway Co. Ltd., Daikin Industries Ltd., Dyson, Honeywell International Inc., Koninklijke Philips N.V., Panasonic Corporation, Samsung, Sharp Corporation, Whirlpool Corporation and Winix Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)