Europe 3D Printing Market Size, Share, Trends and Forecast by Technology, Process, Material, Offering, Application, and End User, and Country, 2026-2034

Europe 3D Printing Market Summary:

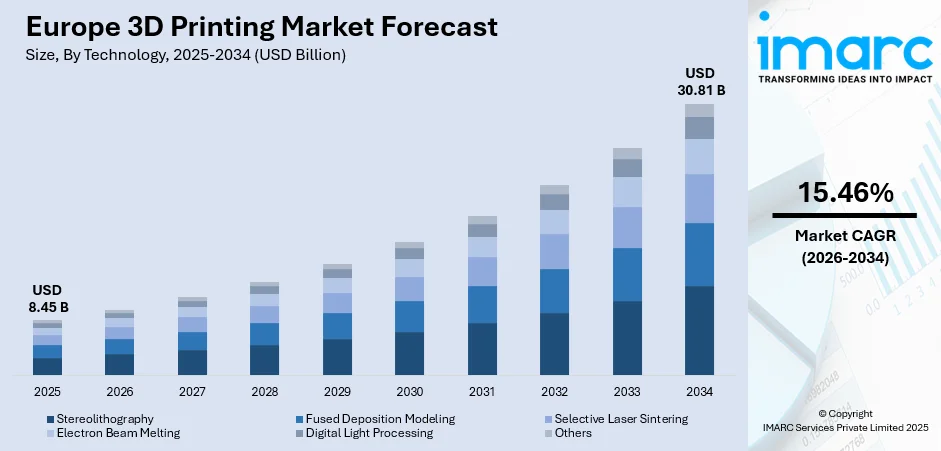

The Europe 3D printing market size was valued at USD 8.45 Billion in 2025 and is projected to reach USD 30.81 Billion by 2034, growing at a compound annual growth rate of 15.46% from 2026-2034.

The market is fueled by the growing adoption rate of additive manufacturing in industries such as the automotive, aerospace, and healthcare industries, looking for rapid prototyping and custom manufacturing services. A rising focus on shortening production cycles and minimizing material waste has led to rapid development in the industry. Investments in R&D and supporting governmental initiatives in Europe have enhanced the Europe 3D printing market share.

Key Takeaways and Insights:

-

By Technology: Fused deposition modeling dominates the market with a share of 28.03% in 2025, driven by its cost-effectiveness, ease of operation, and widespread adoption among small and medium enterprises for functional prototyping applications.

-

By Process: Material extrusion leads the market with a share of 28.12% in 2025, owing to its versatility in handling diverse thermoplastic materials, lower equipment costs, and suitability for producing durable end-use parts.

-

By Material: Plastics represents the largest segment with a market share of 38.10% in 2025, driven by their lightweight properties, design flexibility, availability in various grades, and compatibility with multiple printing technologies.

-

By Offering: Printer dominates the market with a share of 75.04% in 2025, owing to continuous technological advancements, increasing industrial applications, and expanding desktop printer adoption among educational institutions.

-

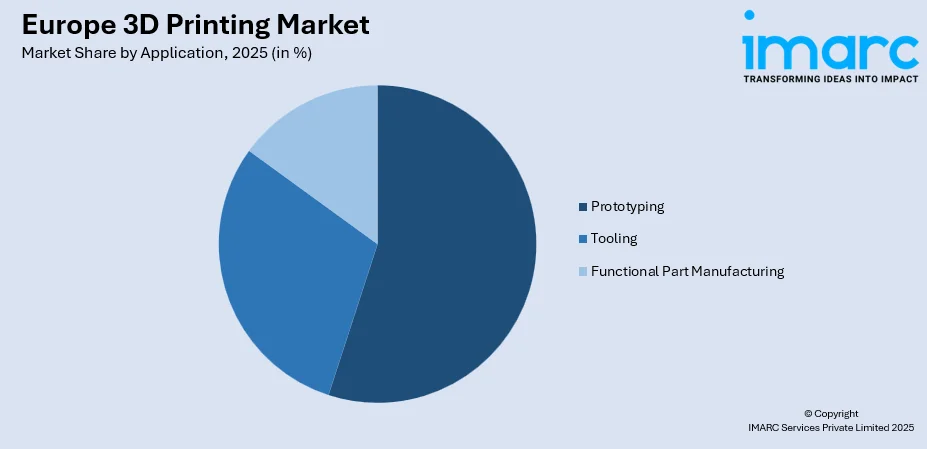

By Application: Prototyping represents the largest segment with a market share of 53.76% in 2025, driven by the growing need for rapid design validation, reduced time-to-market cycles, and cost-efficient product development processes.

-

By End User: Automobile dominates the market with a share of 21.08% in 2025, owing to increasing demand for lightweight components, rapid prototyping of vehicle parts, and customized tooling solutions.

-

Key Players: The Europe 3D printing market exhibits a fragmented competitive landscape, with established technology providers competing alongside emerging startups across various industry verticals. Market participants are focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market positioning.

To get more information on this market Request Sample

The Europe 3D printing market is witnessing strong expansion as additive manufacturing becomes increasingly embedded across a wide range of industrial processes. The growing need for rapid prototyping, design flexibility, and low-volume customized production is encouraging adoption among automotive, aerospace, healthcare, and industrial equipment manufacturers aiming to shorten development cycles and improve cost efficiency. Sustainability considerations are also playing a significant role, as additive manufacturing supports material optimization, reduced waste generation, and energy-efficient production compared to conventional methods. Substantial investments by governments and private enterprises in advanced manufacturing ecosystems, research facilities, and innovation hubs are further strengthening market growth. In July 2025, CECIMO launched the Manifesto for a Competitive European Additive Manufacturing Sector, co-signed by ten national associations, aiming to position Europe as a global leader in additive manufacturing. Moreover, continuous advancements in printer speed, precision, and reliability, along with the widening availability of metals, polymers, and composite materials, are expanding the scope of applications across diverse end-use sectors throughout Europe.

Europe 3D Printing Market Trends:

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) algorithms into additive manufacturing workflows is transforming production capabilities across the European market. These technologies enable real-time process monitoring, predictive quality control, and automated design optimization, significantly enhancing printing precision and reducing defect rates. In November 2025, Icelandic startup Euler secured €2 Million to scale its AI-powered 3D printing software, enabling real-time defect detection and improved reliability for industrial additive manufacturing processes. Further, manufacturers are increasingly adopting intelligent systems that automatically adjust printing parameters based on material behavior and environmental conditions. This technological convergence is enabling the development of self-correcting printing processes that maintain consistent output quality while minimizing human intervention requirements throughout production cycles.

Expansion of Multi-Material and Hybrid Printing Technologies

Multi-material and hybrid printing technologies are gaining significant traction across European manufacturing sectors, enabling the production of complex components with varied mechanical properties within single builds. This advancement allows manufacturers to combine different materials strategically, creating parts with localized characteristics such as varying rigidity, conductivity, or thermal resistance. The development of advanced printer systems capable of seamlessly transitioning between material types during production has opened new design possibilities. As per sources, AMAREA Technology delivered its MMJ ProX multi-material 3D printer to Fraunhofer IKTS, enabling precise, scalable production of complex components with up to six materials in a single build. Furthermore, these capabilities are particularly valuable in aerospace and medical device manufacturing where component functionality demands precise material placement and property optimization.

Growing Emphasis on Sustainable and Circular Manufacturing

Sustainability considerations are increasingly influencing additive manufacturing adoption decisions across European industries, with organizations prioritizing circular economy principles in their production strategies. The inherent material efficiency of additive processes, which typically generate minimal waste compared to subtractive methods, aligns with stringent regional environmental regulations. Manufacturers are investing in material recycling systems that enable reprocessing of unused powder and failed prints. The development of bio-based and recyclable printing materials is further supporting environmental objectives while maintaining production quality standards throughout various industrial applications. As per sources, in 2025, Dutch company Concr3de launched wood-based and water-soluble ceramic 3D printing materials, enabling fully bio-based, biodegradable, and circular additive manufacturing for industrial and design applications.

Market Outlook 2026-2034:

The Europe 3D printing market is positioned for sustained revenue growth throughout the forecast period, supported by expanding industrial adoption and continuous technological advancements. Increasing investments in research facilities and manufacturing infrastructure are expected to drive market expansion across key economies. The automotive and aerospace sectors will remain primary revenue contributors as manufacturers increasingly integrate additive technologies into production workflows. Healthcare applications, particularly medical device manufacturing and bioprinting initiatives, represent significant growth opportunities driving future market revenue development across the region. The market generated a revenue of USD 8.45 Billion in 2025 and is projected to reach a revenue of USD 30.81 Billion by 2034, growing at a compound annual growth rate of 15.46% from 2026-2034.

Europe 3D Printing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Fused Deposition Modeling |

28.03% |

|

Process |

Material Extrusion |

28.12% |

|

Material |

Plastics |

38.10% |

|

Offering |

Printer |

75.04% |

|

Application |

Prototyping |

53.76% |

|

End User |

Automobile |

21.08% |

Technology Insights:

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Electron Beam Melting

- Digital Light Processing

- Others

Fused deposition modeling dominates with a market share of 28.03% of the total Europe 3D printing market in 2025.

Fused deposition modeling has emerged as the dominant technology segment in the Europe 3D printing market, commanding the largest revenue share among available printing methods. This technology's widespread adoption stems from its operational simplicity, requiring minimal technical expertise for effective utilization across various applications. The relatively lower equipment and material costs compared to alternative technologies have made FDM accessible to small and medium enterprises, educational institutions, and research facilities. According to sources, in February 2025, Shapeways expanded its European 3D printing services by adding Fused Deposition Modeling (FDM), enabling cost-effective, industrial-grade production of prototypes and end-use components. Further, its capability to process diverse thermoplastic materials including ABS, PLA, and engineering-grade polymers provides versatility for functional prototyping requirements.

The technology continues expanding as manufacturers develop enhanced printer systems offering improved precision, faster build speeds, and expanded build volumes suitable for industrial applications. Growing demand for customized components and short-run production has accelerated FDM adoption among automotive suppliers and consumer product manufacturers. The availability of high-performance materials specifically formulated for FDM processes has enabled production of end-use components meeting stringent mechanical requirements. Continuous improvements in printer reliability and process consistency are driving technology adoption across previously underserved market segments throughout Europe.

Process Insights:

- Binder Jetting

- Directed Energy Deposition

- Material Extrusion

- Material Jetting

- Power Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

Material extrusion leads with a share of 28.12% of the total Europe 3D printing market in 2025.

Material extrusion represents the leading process segment within the Europe 3D printing market, characterized by its versatility and cost-effectiveness across diverse applications. This process methodology involves depositing heated thermoplastic material through a nozzle in predetermined patterns to construct three-dimensional objects layer by layer. The process accommodates an extensive range of feedstock materials including standard polymers, engineering plastics, and composite filaments containing reinforcing fibers or metallic particles. Its straightforward operational requirements and relatively forgiving process parameters have made material extrusion particularly attractive for organizations new to additive manufacturing.

Industrial applications of material extrusion continue expanding as equipment manufacturers introduce systems capable of processing high-temperature materials and achieving tighter dimensional tolerances. In November 2025, HP unveiled the HP IF 600HT high-temperature filament 3D printer at Formnext held in Frankfurt, Germany, enhancing Europe’s material extrusion capabilities for industrial aerospace, automotive, and energy applications. Moreover, the process is increasingly utilized for producing functional prototypes, tooling fixtures, and end-use components across automotive, aerospace, and consumer goods sectors. Advancements in multi-material printing capabilities and improved surface finish quality have broadened application possibilities. The growing ecosystem of compatible materials and supporting software solutions continues strengthening the process segment's market position throughout the European region.

Material Insights:

- Photopolymers

- Plastics

- Metals and Ceramics

- Others

Plastics exhibits a clear dominance with a 38.10% share of the total Europe 3D printing market in 2025.

Plastics dominate the material segment within the Europe 3D printing market, driven by their versatility, processability, and favorable cost characteristics across numerous applications. The material category encompasses diverse polymer types ranging from standard thermoplastics suitable for concept modeling to engineering-grade materials meeting demanding mechanical and thermal requirements. Polylactic acid, acrylonitrile butadiene styrene, and polyamide variants represent commonly utilized plastic materials, each offering distinct property profiles suited to specific application requirements. The extensive availability of plastic materials in various formulations enables manufacturers to select optimal options matching their functional specifications.

Ongoing material development efforts are expanding the plastic segment's application scope through introduction of specialized formulations addressing previously unmet requirements. High-performance polymers exhibiting enhanced chemical resistance, flame retardancy, and mechanical durability are gaining traction in demanding industrial environments. Composite plastic materials incorporating carbon fiber, glass fiber, or mineral reinforcements provide improved structural properties while maintaining processing advantages. The development of sustainable plastic alternatives derived from renewable sources addresses growing environmental considerations influencing material selection decisions across European markets. As per sources, Evonik introduced its INFINAM® eCO PA12 biocircular 3D printing powder in Frankfurt, substituting fossil feedstock with renewable raw materials and advancing sustainable plastic use in European additive manufacturing.

Offering Insights:

- Printer

- Material

- Software

- Service

Printer leads with a market share of 75.04% of the total Europe 3D printing market in 2025.

The printer commands the largest revenue share within the Europe 3D printing market offering category, reflecting substantial capital investments required for additive manufacturing equipment acquisition. According to sources, in January 2025, EOS installed its 5,000th industrial 3D printer at Keselowski Advanced Manufacturing, reinforcing its leadership in additive manufacturing and supporting industrial production across multiple sectors worldwide. Further, this segment encompasses diverse printer configurations ranging from entry-level desktop systems suitable for prototyping applications to industrial-scale production equipment capable of manufacturing large components. The continuous introduction of technologically advanced printer platforms featuring improved speed, precision, and automation capabilities drives ongoing equipment investments across various industry sectors. Growing recognition of additive manufacturing's strategic value has accelerated printer adoption among manufacturers seeking production flexibility.

Market dynamics within the printer are characterized by rapid technological evolution as manufacturers compete to deliver enhanced performance and expanded capabilities. Industrial printer systems incorporating multiple print heads, automated material handling, and integrated quality monitoring systems are gaining market acceptance among large-scale manufacturers. The desktop printer category continues growing as improved systems offer capabilities previously available only in industrial equipment. Educational institutions and research facilities represent significant demand sources as they establish additive manufacturing programs requiring diverse printer capabilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Prototyping

- Tooling

- Functional Part Manufacturing

Prototyping leads with a share of 53.76% of the total Europe 3D printing market in 2025.

Prototyping represents the dominant application segment within the Europe 3D printing market, accounting for the largest share of additive manufacturing utilization across industries. Furthermore, the capability to rapidly produce physical representations of digital designs enables accelerated product development cycles while reducing associated costs compared to traditional prototyping methods. Manufacturers leverage additive prototyping to evaluate form, fit, and function before committing to expensive tooling investments. The iterative design validation process facilitated by rapid prototyping capabilities improves final product quality while minimizing costly late-stage design modifications.

The prototyping continues evolving beyond basic concept visualization toward functional testing and performance validation applications. Advanced materials enabling production of prototypes exhibiting properties closely matching intended production materials expand testing possibilities. Automotive manufacturers extensively utilize prototyping capabilities for aerodynamic testing, interior component evaluation, and under-hood application assessment. Consumer product companies leverage rapid prototyping for user experience studies and ergonomic optimization, accelerating time-to-market while improving product acceptance rates.

End User Insights:

- Consumer Products

- Machinery

- Healthcare

- Aerospace

- Automobile

- Others

Automobile exhibits a clear dominance with a 21.08% share of the total Europe 3D printing market in 2025.

The automobile represents the leading end-user segment within the Europe 3D printing market, driven by intensive adoption across vehicle development and manufacturing processes. Automotive manufacturers utilize additive technologies throughout product development cycles from initial concept prototyping through production tooling and increasingly for end-use component manufacturing. The industry's continuous pursuit of weight reduction to improve fuel efficiency and vehicle performance has accelerated adoption of additive manufacturing for producing lightweight structural components. Customization requirements for luxury vehicles and motorsport applications further drive sector adoption.

Production applications within the automotive sector are expanding as manufacturers gain confidence in additive manufacturing's capability to meet demanding quality and consistency requirements. As per sources, in September 2025, Toyota Europe, with MacLean-Fogg and Fraunhofer ILT, produced the world’s largest 3D-printed 350-pound die casting insert for Yaris hybrid transmission, doubling lifespan versus conventional tooling. Furthermore, spare parts manufacturing represents a growing application area, enabling on-demand production of legacy components without maintaining extensive physical inventories. The transition toward electric vehicles is creating new opportunities for additive manufacturing in battery housing production and thermal management component fabrication. European automotive suppliers are establishing dedicated additive manufacturing facilities to serve original equipment manufacturers' expanding requirements.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany represents the largest national market for 3D printing in Europe, driven by its robust automotive and aerospace manufacturing sectors. The country's strong industrial base and emphasis on advanced manufacturing technologies have accelerated additive technology adoption. Significant investments in research institutions and manufacturing facilities support continued market expansion. Government initiatives promoting Industry 4.0 implementation have strengthened the ecosystem supporting additive manufacturing growth across diverse industrial applications.

France demonstrates substantial 3D printing market growth, supported by its established aerospace and defense industries requiring advanced manufacturing capabilities. The country's healthcare sector increasingly adopts additive technologies for medical device production and surgical planning applications. French research institutions actively pursue additive manufacturing innovation, contributing to technology advancement. Government funding programs supporting manufacturing modernization initiatives have accelerated adoption across small and medium enterprises throughout various industrial sectors.

United Kingdom maintains a significant position in the Europe 3D printing market, characterized by strong aerospace, automotive, and healthcare sector adoption. British universities and research institutions contribute substantially to additive manufacturing technology development and application innovation. The motorsport industry clustered around central England drives advanced manufacturing technology adoption. Government initiatives supporting manufacturing innovation and skills development continue strengthening the national additive manufacturing ecosystem.

Italy exhibits growing 3D printing market development, driven by its prominent automotive, machinery, and fashion industries seeking customization capabilities. The country's luxury goods manufacturers increasingly leverage additive technologies for prototype development and limited production applications. Italian machine tool manufacturers are integrating additive capabilities into hybrid manufacturing systems. Regional industrial clusters throughout northern Italy demonstrate strong adoption patterns among specialized component manufacturers.

Spain represents an emerging 3D printing market within Europe, with growing adoption across automotive, aerospace, and healthcare sectors. The country's manufacturing modernization initiatives are accelerating additive technology integration among traditional producers. Spanish research centers actively develop additive manufacturing applications for construction and renewable energy sectors. Educational institutions are establishing additive manufacturing programs to develop workforce capabilities supporting expanded industry adoption.

Others in Europe including the Netherlands, Belgium, Switzerland, and Nordic nations demonstrate active 3D printing market participation across various sectors. These markets benefit from strong engineering traditions, advanced research capabilities, and supportive regulatory environments promoting manufacturing innovation. Specialized industrial clusters focusing on medical devices, precision engineering, and high-value manufacturing drive regional adoption patterns across these diverse national markets.

Market Dynamics:

Growth Drivers:

Why is the Europe 3D Printing Market Growing?

Increasing Demand for Mass Customization and Personalization

The growing consumer and industrial demand for customized products is significantly driving Europe 3D printing market expansion. Additive manufacturing uniquely enables economically viable production of individualized components without the tooling investments required for traditional manufacturing methods. In November 2024, Materialise enhanced its Magics 3D printing software and expanded collaborations, enabling manufacturers across Europe to create customized workflows, optimize production, and support mass personalization. Moreover, healthcare applications particularly benefit from customization capabilities, enabling production of patient-specific medical devices, surgical guides, and prosthetic components precisely matched to individual anatomical requirements. Consumer product manufacturers leverage customization capabilities to differentiate offerings and command premium pricing in competitive markets. The automotive sector increasingly utilizes additive technologies for producing bespoke components for luxury vehicles and limited-edition models requiring distinctive design elements.

Accelerating Digital Transformation Across Manufacturing Industries

The ongoing digital transformation of European manufacturing industries is creating favorable conditions for additive manufacturing adoption and market growth. Further, organizations pursuing Industry 4.0 implementation recognize additive manufacturing as a key enabling technology supporting flexible, data-driven production environments. Digital design workflows seamlessly integrate with additive manufacturing processes, enabling rapid translation of design concepts into physical components. Cloud-based design platforms and distributed manufacturing networks leverage additive capabilities to enable collaborative product development across geographically dispersed teams. According to sources, in, RWTH Aachen and Chinese partners launched ProCloud3D, a secure cloud platform enabling encrypted, real-time transmission of production data for decentralized Laser Powder Bed Fusion additive manufacturing. Further, the convergence of digital design tools, simulation capabilities, and additive production systems creates integrated workflows streamlining product development and manufacturing operations throughout various industrial sectors.

Growing Focus on Supply Chain Resilience and Localized Production

European manufacturers are increasingly prioritizing supply chain resilience and localized production capabilities, driving expanded additive manufacturing adoption across diverse industries. The technology enables on-demand production of components traditionally sourced from distant suppliers, reducing dependency on extended supply networks vulnerable to disruption. Distributed manufacturing models utilizing additive technologies allow organizations to produce components closer to end-use locations, reducing logistics costs and delivery timeframes. Spare parts production represents a particularly compelling application, enabling manufacturers to eliminate extensive physical inventories while maintaining service capabilities for legacy products. Defense and aerospace sectors particularly value additive manufacturing's potential for establishing secure, domestic production capabilities for critical components. As per sources, in June 2025, 3YOURMIND was selected for the European Defence Innovation Scheme, enhancing on-demand, distributed 3D printing of spare parts to strengthen Europe’s defense supply chain.

Market Restraints:

What Challenges the Europe 3D Printing Market is Facing?

High Initial Investment and Operational Costs

The substantial capital investment required for industrial-grade additive manufacturing equipment presents a significant adoption barrier, particularly for small and medium enterprises with limited financial resources. Beyond equipment costs, organizations must invest in supporting infrastructure, specialized materials, and qualified personnel to effectively utilize additive technologies. Material costs for industrial applications often exceed those for traditional manufacturing processes, affecting production economics for high-volume applications.

Limited Production Speed and Scalability

Additive manufacturing processes generally exhibit slower production rates compared to established mass production methods, limiting applicability for high-volume manufacturing requirements. Build speed constraints inherent to layer-by-layer fabrication methodologies restrict throughput capabilities even with advanced equipment. Scaling production volumes typically requires proportional increases in equipment investments rather than incremental capacity additions achievable with traditional manufacturing approaches.

Material Property Limitations and Certification Requirements

Available additive manufacturing materials often exhibit different mechanical properties compared to traditionally processed counterparts, limiting applications requiring specific performance characteristics. Certification requirements for safety-critical applications in aerospace, medical, and automotive sectors impose lengthy qualification processes before additive-produced components receive approval. The lack of standardized testing protocols and material specifications across the industry creates uncertainty regarding component performance and reliability.

Competitive Landscape:

The Europe 3D printing market exhibits a dynamic competitive landscape characterized by the presence of established technology leaders alongside innovative emerging participants across various market segments. Competition occurs across multiple dimensions including technology platforms, material offerings, application expertise, and service capabilities. Market participants pursue diverse strategies including horizontal expansion across technology platforms and vertical integration spanning materials, equipment, and services. Strategic partnerships between equipment manufacturers, material suppliers, and end-users are becoming increasingly common as organizations seek to develop comprehensive solutions addressing specific application requirements. Mergers and acquisitions activity continues reshaping the competitive environment as organizations pursue scale advantages and technology portfolio expansion.

Recent Developments:

-

In January 2025, Stratasys launched TrueDentD™ resin in Europe, offering monolithic digital dentures for dental labs and clinicians. This expansion highlights growing adoption of 3D printing technology in Europe’s healthcare and dental sectors, enabling efficient, high-quality, and customizable denture production across the region.

Europe 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Stereolithography, Fused Deposition Modeling, Selective Laser Sintering, Electron Beam Melting, Digital Light Processing, Others |

| Processes Covered | Binder Jetting, Directed Energy Deposition, Material Extrusion, Material Jetting, Power Bed Fusion, Sheet Lamination, Vat Photopolymerization |

| Materials Covered | Photopolymers, Plastics, Metals and Ceramics, Others |

| Offerings Covered | Printer, Material, Software, Service |

| Applications Covered | Prototyping, Tooling, Functional Part Manufacturing |

| End Users Covered | Consumer Products, Machinery, Healthcare, Aerospace, Automobile, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe 3D printing market size was valued at USD 8.45 Billion in 2025.

The Europe 3D printing market is expected to grow at a compound annual growth rate of 15.46% from 2026-2034 to reach USD 30.81 Billion by 2034.

Fused deposition modeling held the largest share of the Europe 3D printing market, driven by its cost-effectiveness, ease of operation, and broad adoption across industries for functional prototyping, low-volume production, and design validation applications.

Key factors driving the Europe 3D printing market include increasing demand for mass customization, accelerating digital transformation across manufacturing industries, growing focus on supply chain resilience, expanding healthcare applications, and continuous technological advancements improving production capabilities.

Major challenges include high initial investment and operational costs, limited production speed and scalability compared to traditional manufacturing, material property limitations, lengthy certification requirements for critical applications, workforce skill gaps, and intellectual property protection concerns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)