Ethylene Glycol Market Size, Share, Trends and Forecast by Product, Manufacturing Process, Application, End-Use Industry, and Region, 2025-2033

Ethylene Glycol Market Size and Share:

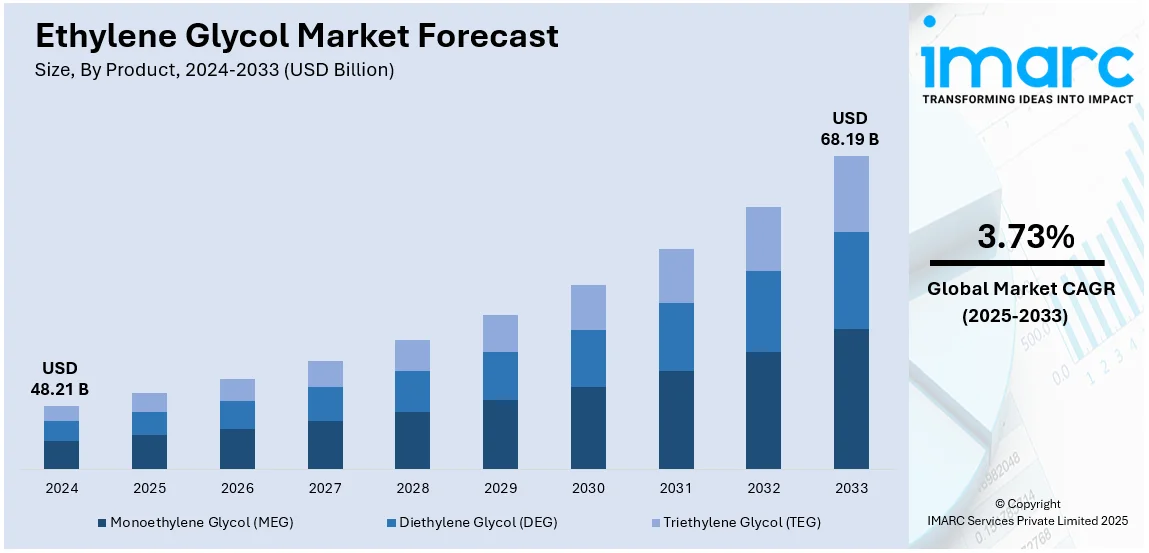

The global ethylene glycol market size was valued at USD 48.21 Billion in 2024. The market is projected to reach USD 68.19 Billion by 2033, exhibiting a CAGR of 3.73% from 2025-2033. The market growth is attributed to growing urbanization, rising disposable incomes, significant investments in infrastructure development, and the region's role as a global manufacturing hub for polyester and plastics.

Market Insights:

- Asia Pacific dominated the ethylene glycol with around 40% market share in 2024.

- Based on the product, monoethylene glycol leads the market with around 40.0% of the market share in 2024.

- On the basis of the manufacturing process, the market is divided into ethylene oxide, coal, and biological route.

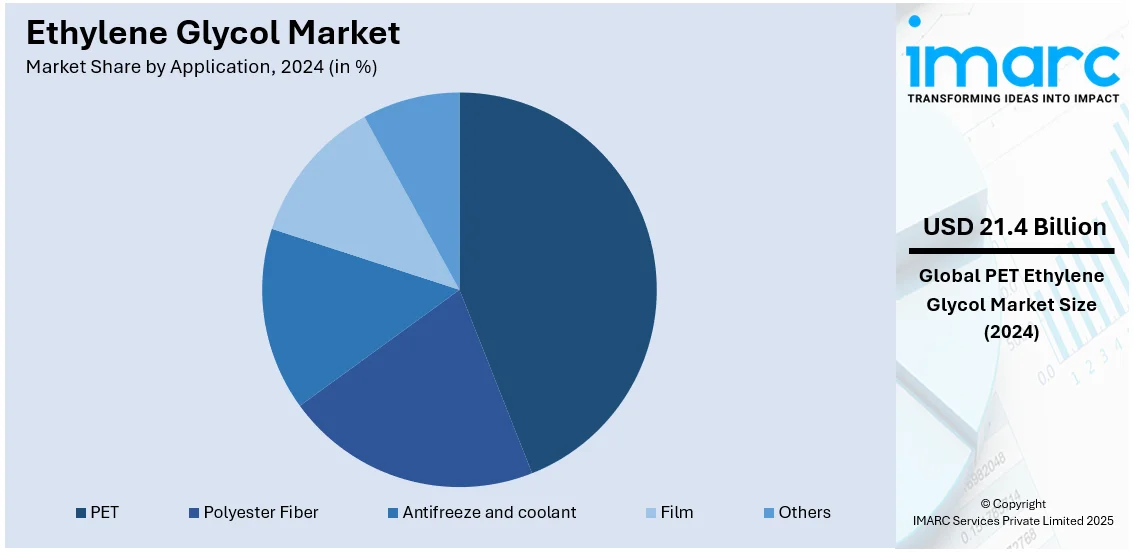

- Based on application, PET leads the market with around 44.4% of the market share in 2024.

- On the basis of the end-use industry, the market is divided into the oil and gas industry, plastic industry, transportation industry, medical industry, and textile industry.

Market Size & Forecast:

- 2024 Market Size: USD 48.21 Billion

- 2033 Projected Market Size: USD 68.19 Billion

- CAGR (2025-2033): 3.73%

- Asia Pacific: Largest market in 2024

The global ethylene glycol market growth is driven by the rising demand for polyester fibers in the textile industry, particularly in emerging economies. In addition, the expanding packaging industry, driven by the need for polyethylene terephthalate (PET) bottles and containers are contributing to the market expansion. For instance, in April 2024, Coca-Cola announced a USD100 million investment in PET bottle recycling plants in the U.S., significantly increasing ethylene glycol consumption. Moreover, the automotive sector's reliance on ethylene glycol for antifreeze and coolant applications is impelling the market growth. Besides this, the increasing urbanization and infrastructure development drive the demand for plastics and resins, providing an impetus to the market. Also, ongoing technological advancements in production processes enhance efficiency and output, fueling the market demand. Furthermore, the growing pharmaceutical industry's use of ethylene glycol in medical applications creates steady demand, supporting the market expansion.

To get more information on this market, Request Sample

The United States ethylene glycol market demand is primarily driven by the shale gas boom, which has significantly reduced raw material costs and enhanced production efficiency. In line with this, the growing adoption of bio-based ethylene glycol, driven by sustainability initiatives, is strengthening the market share. For example, in 2024, New Energy Chemicals partnered with Dow to supply biobased ethylene for sustainable plastics production, highlighting the shift toward eco-friendly solutions. Concurrently, the robust aerospace industry utilizes ethylene glycol in de-icing fluids, boosting the market growth. Additionally, the expanding e-commerce sector increases demand for PET packaging, which is providing an impetus to the market. Also, the rise in construction activities drives the need for resins and plastics, aiding the market growth. Apart from this, continuous advancements in renewable energy (RE) technologies, such as solar panels, which use ethylene glycol in heat transfer fluids, are thereby propelling the market forward.

The market is majorly influenced by the continual technological advancements in production methods, strategic partnerships, and the shift toward bio-based ethylene glycol. There are several developments in the sector. For instance, on June 27, 2024, Technip Energies announced the acquisition of glycol purification technology from Shell Catalysts & Technologies to accelerate its Bio‑2‑Glycols™ platform for bio‑based mono ethylene glycol (MEG) production. The agreement combines Shell's research and development (R&D) advancements with Technip Energies' proprietary bio‑MEG process to enhance efficiency and offer a lower‑carbon alternative to fossil‑based MEG in polyester manufacturing. Technip Energies expects to commercialize the upgraded technology by 2025, supporting its strategic objective to contribute to net‑zero carbon goals. Furthermore, there are a few challenges in the market, including fluctuating raw material prices and environmental concerns over petrochemical production. To overcome these, companies are investing in more efficient production techniques and sustainable sourcing of raw materials. Also, significant opportunities arise in expanding renewable-based ethylene glycol production, which can help address both supply chain challenges and environmental regulations.

Ethylene Glycol Market Trends:

The Increasing Product Utilization in Polyester and PET Resin Production

The expansion of ethylene glycol market stems primarily from rising polyester production requirements. The synthetic textile polyester is derived from the chemical combination of ethylene glycol with terephthalic acid. Additionally, textile manufacturers widely use ethylene glycol because of its long-term quality alongside its anti-wrinkling properties and competitive price. The market also expands because PET resins and films used as food and beverage packaging materials are extensively synthesized through polyethylene terephthalate chemistry. Besides this, PET demand experienced a notable increase due to two main factors, rising packaged goods consumption which results from both urbanization trends and shifting consumer life choices. For instance, the United Nations data suggests 68% of Earth's population will become urban residents by 2050 which will drive up packaged goods production and escalate PET-based packaging needs. As a result, the changing population structure drives an increased market expansion for ethylene glycol and derivative products.

Rapid Expansion of the Automotive Industry

Ethylene glycol is widely utilized in the automotive industry as an antifreeze and coolant, which is influencing the ethylene glycol market trends. As radiator coolants in manufacturing the automotive industry requires ethylene glycol because its high boiling point and low freezing point properties enable efficient engine operations across various temperatures. The growth of the automotive sector across emerging economies induces direct ethylene glycol market demand while supporting market expansion. According to European Automobile Manufacturers Association (ACEA) data from 2022 the world produced 85.4 million motor vehicles marking a 5.7% increase over 2021 figures. Concurrent to this, when the vehicle market expands then the entire automotive sector including ethylene glycol becomes more in demand. Furthermore, the increasing production of electric vehicles (EVs) is fostering the market growth, since ethylene glycol actively cools batteries and electronic components used in these vehicles. The market receives support from EV adoption because people choose sustainable transportation solutions.

Widespread Product Utilization in Various Industrial Applications

Ethylene glycol finds diverse applications in various industries, contributing significantly to the market growth. The chemical serves as a basic ingredient for producing antifreeze solutions and hydraulic fluids and operates as heat exchange medium in cooling equipment. The market grows through its utilization in paint and plastic industries as a solvent. The leather industry's extensive use of ethylene glycol for tanning processes and the electronics industry's use of ethylene glycol for capacitor manufacturing are fueling market growth thanks to its properties including low volatility and hygroscopic nature. A recent industry report indicates that China's ongoing urbanization push to reach a 70% urban population by 2030 has generated substantial demand for ethylene glycol which primarily serves residential and commercial building construction. The market expects urbanization to rise exponentially as construction material and cooling system requirements surge in the coming years. The market also shows growth due to both the continuous technological improvements and sector innovations which develop fresh applications for ethylene glycol.

Rapid Technological Advancements

Ongoing technological advancements in the application and production of ethylene glycol are playing a pivotal role in the market growth. The market growth is fueled by innovative production methods that enable cost-effective and environmentally friendly ethylene glycol synthesis. Recent advancements in catalysis techniques and process optimization have boosted market expansion by increasing yield while reducing energy consumption, resulting in more sustainable and economically viable production systems. The market expansion is further supported by new technological advances that allow producers to create ethylene glycol with renewable biomass materials. Braskem achieved a 30% boost in bio-based ethylene plant output at its Triunfo, Rio Grande do Sul, Brazil facility during June 2023. A USD 87 million capital injection aims to satisfy escalating global requirements for sustainable products. The market continues to expand due to environmental worries and official emission reduction requirements.

Rising Demand for Non-Ionic Surfactants

Ethylene glycol functions as a fundamental component during non-ionic surfactant production for detergents and emulsifiers and wetting agents. Non-ionic surfactants are widely used in both industrial and consumer products due to their stability and non-reactive properties. Non-ionic surfactants find extensive use in household cleaning products and personal care products as well as industrial usage where they act as food industry emulsifiers and agrochemicals and textile processing agents. Furthermore, the market growth is fueled factors such as the rising consumer spending power, rapid urbanization and increased awareness about hygiene and cleanliness. The Food and Agriculture Organization projects the world population will exceed 9 billion by 2050. Future food demands will require agricultural systems to operate under unprecedented pressure. The growing population increases agricultural product requirements which leads to higher surfactant usage in agrochemical formulations. Apart from this, new breakthroughs in surfactant chemistry together with advanced chemical formulation development techniques are enhancing the ethylene glycol market outlook.

Ethylene Glycol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ethylene glycol market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, manufacturing process, application and end-use industry.

Analysis by Product:

- Monoethylene Glycol (MEG)

- Diethylene Glycol (DEG)

- Triethylene Glycol (TEG)

According to the report, monoethylene glycol (MEG) represented the largest segment with 40.0% of the ethylene glycol market share. Monoethylene glycol (MEG) holds the largest market share.

Monoethylene Glycol (MEG) finds the majority of its usage as a major raw material in producing polyethylene terephthalate (PET) resins, which are extensively applied in packaging, particularly in plastic bottles and food containers. Furthermore, MEG is also an important ingredient in the production of polyester fibers, which are widely used in the textile market. Its antifreeze and heat transfer fluid characteristics also render it indispensable for use in vehicles and HVAC applications. Growth in MEG demand is also fueled by the increasing use of PET in the beverage and apparel industries, especially in the developing economies of Asia Pacific. Continuing industrialization, mounting demand for consumer goods, and packaging industry growth support MEG's ongoing popularity in the ethylene glycol market to make it a crucial product segment worldwide.

Analysis by Manufacturing Process:

- Ethylene Oxide

- Coal

- Biological Route

- Others

The ethylene oxide process involves the reaction of ethylene oxide with water under high pressure and temperature, resulting in the production of ethylene glycol. The primary advantage of this method is its high efficiency and ability to produce ethylene glycol with a high purity level, which is crucial for applications in sensitive industries like food and pharmaceuticals.

The coal-based process for manufacturing ethylene glycol is an alternative method that has gained attention, especially in regions with abundant coal reserves and limited access to petrochemical feedstocks. This process involves the gasification of coal to produce syngas, which is then converted into ethylene glycol. Coal-based process offers a degree of energy independence and can be more cost-effective in coal-rich regions.

The biological route for producing ethylene glycol involves the use of bio-based feedstocks, such as sugars from biomass, to produce ethylene glycol through fermentation or other biological processes. It decreases reliance on fossil fuels and lowers the carbon footprint of ethylene glycol production. Additionally, recent innovations and technological advancements in biotechnology and biochemical engineering, making it easier to produce ethylene glycol, are fueling the market growth.

Analysis by Application:

To get more information on this market, Request Sample

- Polyester Fiber

- PET

- Antifreeze and coolant

- Film

- Others

According to the report, PET represented the largest segment by holding 44.4% of the market share. PET (polyethylene terephthalate) holds the largest market share.

Polyethylene Terephthalate (PET) is the largest application segment in the ethylene glycol market and captures a major share of global demand. Ethylene glycol, or more specifically monoethylene glycol (MEG), is a major raw material employed in the manufacture of PET that is extensively used to make plastic bottles, food and drink containers, and man-made fibers. Increased demand for lightweight, strong, and recyclable packaging materials has fueled the use of PET, particularly in the food and beverage sectors. Additionally, the growing trend toward sustainable packaging options and the growing usage of bottled drinks in emerging markets further increase demand for PET. Further, the usage of PET in the textile industry, particularly for polyester fiber production, aids in market growth. With the growing use of PET in various high-growth sectors, its share in the ethylene glycol market remains high and increasing.

Analysis by End-Use Industry:

- Oil and Gas Industry

- Plastic Industry

- Transportation Industry

- Medical Industry

- Textile Industry

- Others

Ethylene glycol is used in the oil and gas industry for natural gas dehydration, a process that removes water vapor from natural gas to prevent hydrate formation and pipeline corrosion, ensuring the safe and efficient transportation of gas. Additionally, ethylene glycol is utilized in hydraulic and drilling fluids within the industry.

The plastic industry relies on ethylene glycol as a key ingredient in producing polyethylene terephthalate (PET), a widely used plastic. PET is essential for various applications, including packaging materials like bottles and containers, as well as fibers for textiles. Furthermore, the increasing demand for sustainable and lightweight packaging solutions is driving market growth.

The transportation industry, encompassing the automotive and aviation sectors, is a vital end-use segment for ethylene glycol. In automotive applications, ethylene glycol is predominantly used as an antifreeze and coolant in vehicle cooling systems, which is essential for maintaining engine performance and longevity. Additionally, ethylene glycol is used in the aviation industry for producing deicing solutions for aircraft.

In the medical industry, ethylene glycol is used in various pharmaceutical products and medical processes. It serves as a solvent and stabilizer in pharmaceutical formulations and as a desiccant in packaging to protect medications from moisture. Additionally, ethylene glycol is involved in the production of medical devices and equipment, where its chemical stability and compatibility with other materials are advantageous.

The textile industry utilizes ethylene glycol in the production of polyester fibers. It is widely used in fabrics due to its durability, resistance to wrinkling, and ease of maintenance. Additionally, the growing demand for polyester fibers in the fashion industry, home furnishings, and industrial applications, is contributing to the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40%. The region boasts some of the world's most prominent textile and packaging industries, both of which are among the key end-users of ethylene glycol, specifically for the manufacturing of PET and polyester fibers. Other countries like China, India, South Korea, and Japan have undergone swift industrialization and urbanization, leading to high demand for ethylene glycol-based products in industries such as automotive, construction, and consumer goods. China leads the production and consumption of ethylene glycol, backed by an established petrochemical infrastructure and emerging export operations. Moreover, growth in disposable income and shifting lifestyles are driving demand for packaged clothing and drinks, further stimulating market expansion. Asia Pacific's robust manufacturing base and affordability make it a pivotal position in the world supply chain for ethylene glycol.

Key Regional Takeaways:

North America Ethylene Glycol Market Analysis

North America's ethylene glycol market is characterized by a well-established industrial sector and advanced technological infrastructure. Furthermore, the region's demand for ethylene glycol is primarily driven by its robust automotive, textile, and plastic industries. Additionally, the presence of a mature pharmaceutical industry in the region, creating a steady demand for ethylene glycol in medical applications, is favoring the market growth.

The region also benefits from significant investments in research and development (R&D), enhancing production efficiency and expanding application areas. For instance, Dow Inc. unveiled a new bio-based ethylene glycol production facility in Texas, aiming to reduce greenhouse gas emissions by 30%. Moreover, stringent environmental regulations are pushing the adoption of bio-based ethylene glycol, propelling the market growth in North America.

United States Ethylene Glycol Market Analysis

The ethylene glycol market expansion relies heavily on two primary factors from continuous crude oil production along with growing petrochemical industry needs. Industry data shows that U.S. crude oil production reached its highest levels at 13.3 million b/d during December 2023, and this boosts ethylene glycol demand along with other petrochemical products. Scattered throughout plastics and rubber manufacturing sectors ethylene glycol shipments exceeded USD 24.4 billion and then ascended to USD 24.9 billion in 2023. The steady growth of plastic manufacturing drives demand for ethylene glycol because it serves as a fundamental ingredient in polyester fibers and PET plastics production. The market expands intensively as environmental legislation and green consumer preferences drive sustainable bio-based ethylene glycol development that brings rapid market growth. Market expansion is supported by technological developments and the growing applications of PET plastics along with automotive and textile and medical sectors.

Europe Ethylene Glycol Market Analysis

There are several key drivers of the growth of the ethylene glycol market in Europe. European plastics production stood at 57.2 million tons in 2021, as reported by Plastics Europe, with ethylene glycol playing a critical role in the production of polyethylene terephthalate (PET) plastics used in various applications, such as packaging, textiles, and consumer goods. The European textile industry, led by Germany, Spain, France, Italy, and Portugal, accounts for more than one-fifth of the global textile market. The production of polyester, which utilizes ethylene glycol, plays a significant role in this industry's growth. In addition, according to reports, the adoption of electric vehicles in Europe has grown by more than 65% year-on-year to 2.3 million units in 2021, which is having a positive impact on the ethylene glycol market. Ethylene glycol is used in electric vehicle battery cooling systems, increasing demand in the automotive industry. Generally, industrial growth, sustainable practices, and changes in consumer needs are driving the ethylene glycol market in Europe.

Asia Pacific Ethylene Glycol Market Analysis

The Asia Pacific market for ethylene glycol is growing strongly on the back of numerous factors in diverse industries. As per the ethylene glycol market research report, the market growth is mainly driven by the high levels of industrialization and urbanization in the region, particularly within the automotive, textile, and plastics industries. Electric vehicle demand is increasingly driving the sale of ethylene glycol since the Indian government aimed at 2030 to secure 30% new vehicle sales to be an electric vehicle in the automotive field, as per reports. In addition, Asia-Pacific countries, where the textile companies, such as China, India, and Bangladesh are mainly located; therefore, huge polyester and synthetic fabric production goes through ethylene glycol consumptions. The region also has an ever-growing plastics industry, especially the polyethylene terephthalate (PET) used in packaging, with significant demand for this commodity in food and beverages. Further, disposable income, combined with consumer awareness about hygiene, has increased demand for ethylene glycol in personal care products and cleaning agents, thus further fueling market growth.

Latin America Ethylene Glycol Market Analysis

The Latin America (LAC) ethylene glycol market experiences growth because agriculture stands as a prime economic driver throughout the region. The 2020 World Bank report demonstrates that agriculture generates 5-18% of GDP in 20 LAC countries which drives ethylene glycol consumption for agricultural chemicals including pesticides and fertilizers. Market growth receives additional momentum from packaging and textile industries which maintain high demand for plastics and synthetic fibers. Polyethylene terephthalate (PET) production begins with ethylene glycol as its fundamental starting material for making packaging products that mainly serve food and beverage consumption while experiencing growing demand from rising packaged food markets. The automotive sector in Brazil and Mexico serves as a primary market driver because ethylene glycol functions as antifreeze and coolant material. The demand for ethylene glycol in battery cooling applications receives additional support from rising electric vehicle production investments that result from government environmental initiatives and incentives.

Middle East and Africa Ethylene Glycol Market Analysis

The Middle East and Africa ethylene glycol market is significantly influenced by the region's dominance in the global energy landscape. With five of the world's top 10 oil producers and three of the top 20 gas producers, the region’s significant energy exports offer a strong foundation for sustained industrial growth. According to the International Energy Agency (IEA), in 2022, MEA region holds over 40 percent of global exports in oil which, in return, has expanded demand for ethylene glycol in petrochemical industries. Market growth was supported by significant use of this chemical in various applications such as antifreeze and lubricant by the petroleum and gas industry. In addition, the growth in plastic, textiles, and automobiles is creating huge demand for ethylene glycol from the manufacturing industry, especially from Saudi Arabia and the UAE. Increasing electric vehicles production and a new emphasis on sustainable living are increasing demand for ethylene glycol for battery cooling systems and other green products.

Competitive Landscape:

Major players are focusing on expanding their production capacity to meet the global demand for ethylene glycol. It involves upgrading existing facilities and building new plants, especially in regions with high demand. Additionally, they are focusing on developing advanced production technologies to increase yield and efficiency. Additionally, top ethylene glycol manufacturers are forming partnerships, joint ventures, and collaborations with other companies and organizations to exchange technological expertise, broaden market reach, and lower operational costs. According to the ethylene glycol market forecast, the market is expected to witness significant growth due to strategic partnerships between companies and research institutions to explore new production methods and applications.

The report provides a comprehensive analysis of the competitive landscape in the ethylene glycol market with detailed profiles of all major companies, including:

- Akzo Nobel N.V.

- Ashland Global Specialty Chemicals Inc.

- BASF SE

- China Petrochemical Corporation (Sinopec Group)

- Dow Inc.

- Formosa Plastics Corporation

- Huntsman Corporation

- Ineos Oxide Limited (INEOS Holdings Limited)

- Lotte Chemical Corporation

- Lyondellbasell Industries Inc.

- Reliance Industries Limited

- SABIC

- Shell plc

Latest News and Developments:

- July 2024: China-based Sinopec announced that it would cut further ethylene output, after slashing production in June. The new cut seems to be strategic in favor of fuel production in order to meet the goals of efficiency and market positioning set by the company.

- May 2024: Japan's Asahi Kasei, Mitsui Chemicals, and Mitsubishi Chemical have agreed to jointly conduct a feasibility study on feedstock and fuel conversion at their ethylene production plants in Western Japan. The initiative is aimed at promoting carbon neutrality and contributing to the broader effort of societal decarbonization.

- February 2024: LyondellBasell gained one of Europe's major makers of ethane-1,2-diol in the recent moves of acquiring strategic entities in Europe with an aim for increased market product portfolios and stronghold of its ground.

- November 2023: The Path2Zero project's final investment decision was accepted by Dow's board of directors, allowing for the manufacture of sustainable ethylene and its derivatives.

- October 2023: At its Verbund facility in Antwerp, BASF SE initiated the expanded ethylene oxide and derivatives complex.

- April 2022: Sinopec Group and BASF began the expansion of their product capacity at Nanjing, which will produce ethyleneamines, ethylene oxides, and other chemicals.

Ethylene Glycol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Monoethylene Glycol (MEG), Diethylene Glycol (DEG), Triethylene Glycol (TEG) |

| Manufacturing Processes Covered | Ethylene Oxide, Coal, Biological Route, Others |

| Applications Covered | Polyester Fiber, PET, Antifreeze and Coolant, Film, Others |

| End-Use Industries Covered | Oil and Gas Industry, Plastic Industry, Transportation Industry, Medical Industry, Textile Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Ashland Global Specialty Chemicals Inc., BASF SE, China Petrochemical Corporation (Sinopec Group), Dow Inc., Formosa Plastics Corporation, Huntsman Corporation, Ineos Oxide Limited (INEOS Holdings Limited), Lotte Chemical Corporation, Lyondellbasell Industries Inc., Reliance Industries Limited, SABIC, Shell plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ethylene glycol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ethylene glycol market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ethylene glycol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ethylene glycol market was valued at USD 48.21 Billion in 2024.

IMARC estimates the ethylene glycol market to exhibit a CAGR of 3.73% during 2025-2033, expecting to reach USD 68.19 Billion by 2033.

Key factors driving the ethylene glycol market include rising demand for polyester fibers and PET packaging, growth in the automotive (antifreeze) and textile industries, and increasing urbanization. Additionally, expanding applications in plastics and resins, along with technological advancements in production, are significant market drivers.

Asia Pacific currently dominates the market, accounting for a share exceeding 40% in 2024. This dominance is fueled by rapid industrialization, growing textile and packaging industries, increasing automotive production, and rising urbanization, particularly in countries like China and India.

Some of the major players in the ethylene glycol market include Akzo Nobel N.V., Ashland Global Specialty Chemicals Inc., BASF SE, China Petrochemical Corporation (Sinopec Group), Dow Inc., Formosa Plastics Corporation, Huntsman Corporation, Ineos Oxide Limited (INEOS Holdings Limited), Lotte Chemical Corporation, Lyondellbasell Industries Inc., Reliance Industries Limited, SABIC, Shell plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)