Ethyl Vinyl Alcohol Copolymer Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Ethyl Vinyl Alcohol Copolymer Price Trend and Forecast

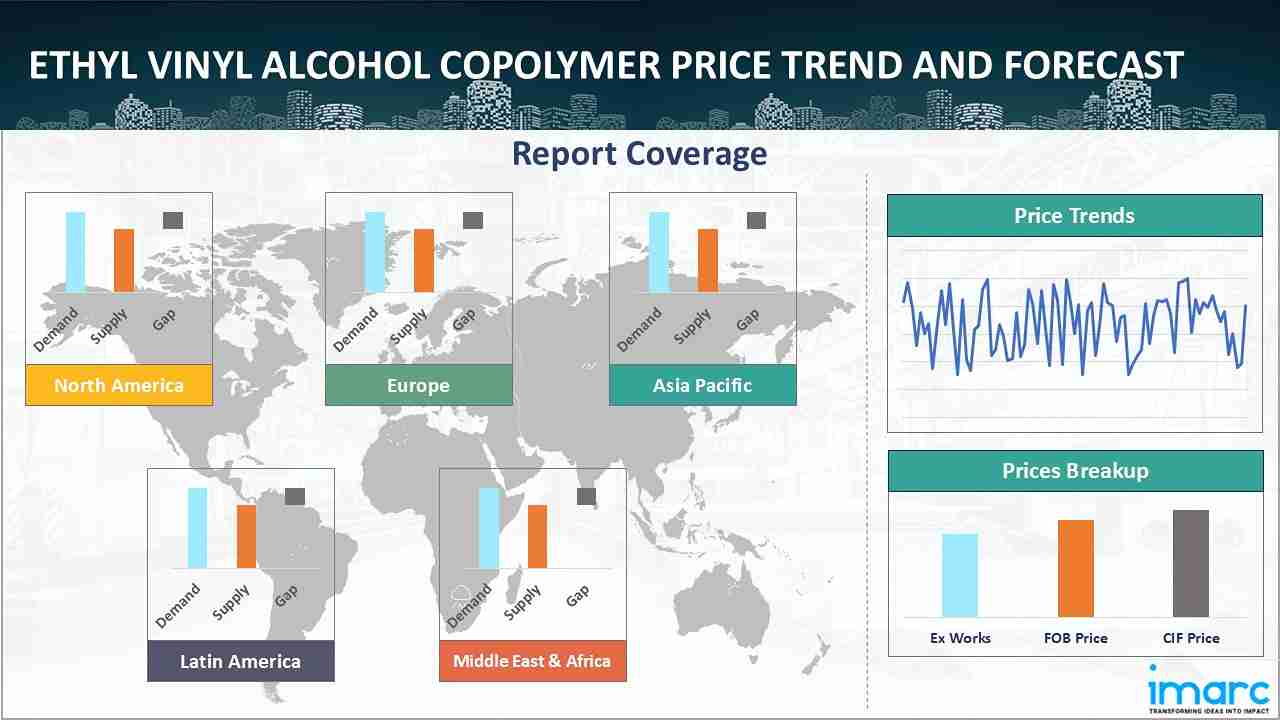

Track the latest insights on ethyl vinyl alcohol copolymer price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Ethyl Vinyl Alcohol Copolymer Prices Outlook Q2 2025

- USA: US$ 8320/MT

- Japan: US$ 8650/MT

- Belgium: US$ 8455/MT

- Indonesia: US$ 8638/MT

- United Kingdom: US$ 8715/MT

Ethyl Vinyl Alcohol Copolymer Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the ethyl vinyl alcohol copolymer prices in the USA reached 8320 USD/MT in June. As per the ethyl vinyl alcohol copolymer price chart, packaging and automotive demand remained underwhelming. Beverage companies were already holding excess stock, discouraging new procurement, while the auto sector saw a contraction in sales, particularly in import-heavy segments. This weakness at the consumer end filtered back through the chain, keeping converters cautious and reliant on short-term buying. Container shortages at Gulf Coast ports and ongoing anti-dumping concerns also compounded the slowdown.

During the second quarter of 2025, the ethyl vinyl alcohol copolymer prices in Japan reached 8650 USD/MT in June. The most decisive influence came from the muted performance of key consuming industries. Packaging, which usually absorbs large volumes of EVOH, faced a glut of finished goods and lacked fresh orders, pushing buyers to adopt cautious procurement. The automotive sector in Japan showed signs of recovery in sales, yet this did not feed through to polymer consumption, underlining the disconnection between end-use demand and material intake. Across Asia, subdued consumer activity and restrained international buying compounded the oversupply situation, leaving producers with high stock levels and fewer outlets.

During the second quarter of 2025, ethyl vinyl alcohol copolymer prices in Belgium reached 8455 USD/MT in June. Easing supply constraints from upstream feedstocks played a major role. Belgium, being a key trading and distribution hub, felt the benefits of this improved supply flow. However, these gains were partially offset by ongoing logistical challenges. Port congestion coupled with disruptions at Rotterdam, prolonged delivery times and kept distribution inefficient. Sellers in Belgium faced higher costs to move goods, which restricted their ability to fully capitalize on cheaper raw materials.

During the second quarter of 2025, the ethyl vinyl alcohol copolymer prices in Indonesia reached 8638 USD/MT in June. Indonesia showed signs of improved automotive sales, but this did not lead to stronger polymer consumption. The mismatch between downstream recovery in certain sectors and actual EVOH demand created a situation where sentiment stayed weak. Sellers struggled to stimulate additional orders, with most buyers relying on minimal purchasing strategies. In short, EVOH prices in Indonesia mirrored the broader Asian downtrend.

During the second quarter of 2025, the ethyl vinyl alcohol copolymer prices in United Kingdom reached 8715 USD/MT in June. The market felt the strain of weak downstream consumption, particularly from packaging and automotive buyers. Beverage packaging demand slowed as bottlers and distributors were already holding high inventories of soft drinks. In automotive, sluggish vehicle sales combined with a broader dip in consumer sentiment meant fewer new orders for barrier resins. This lack of urgency in procurement meant that buyers in the UK, like their European counterparts, limited their spot purchases and leaned on existing stocks.

Ethyl Vinyl Alcohol Copolymer Prices Outlook Q4 2024

- USA: US$ 8195/MT

During the fourth quarter of 2024, the ethyl vinyl alcohol copolymer prices in the United States reached 8195 USD/MT in December. The market in the region remained under pressure in Q4 2024 as ample domestic supply, weak seasonal demand, and reduced production costs limited any potential price hikes. While automotive industry demand provided temporary stability, declining ethylene vinyl acetate (EVA) costs and minimal spot activity kept market fundamentals weak, contributing to an oversupplied environment.

Ethyl Vinyl Alcohol Copolymer Prices Outlook Q3 2024

- USA: US$ 8910/MT

- Japan: US$ 8745/MT

The ethyl vinyl alcohol copolymer prices in the United States for Q3 2024 reached 8910 USD/MT in September. The region's market saw a notable drop in prices, mostly attributed to lower production charges, an overstock problem, and weaker packaging industry demand. Due to consistently weak market attitude, manufacturers were forced to further reduce prices in September when seasonal buying expectations failed to materialize.

The price trend for ethyl vinyl alcohol copolymer in Japan for Q3 2024, reached 8745 USD/MT in September. The market in Japan faced substantial pricing pressure in the quarter, largely due to an oversaturated supply, declining feedstock costs, and weak downstream demand. The combination of inexpensive ethylene vinyl acetate (EVA) and lackluster industrial activity sustained the bearish market trend, reinforcing the downward price movement throughout the quarter.

Ethyl Vinyl Alcohol Copolymer Prices Outlook Q1 2024

- USA: US$ 8695/MT

- Japan: US$ 8646/MT

- Belgium: US$ 8737/MT

During the first quarter of 2024, ethyl vinyl alcohol copolymer prices in the United States reached 8695 USD/MT in March. The market saw price swings. Initial demand for food packaging raised prices, but mid-quarter, cautious purchasing lowered global demand. With the approach of Easter, orders increased, leading merchants to increase rates to propel their revenue margins.

The EVOH market in Japan demonstrated varied trends in Q1 2024. Initial price increases were led by heightened demand for packaging in preparation for regional festivals. Midway, supply chain disturbances eased, and regulatory updates to food contact materials were introduced. By the quarter’s end, prices stood at 8646 USD/MT.

In Q1 2024, Belgium's EVOH prices showed fluctuations. Early in the quarter, demand for food packaging led to a price increase, while geopolitical tensions and inflationary pressures strained supply. Demand increased again during the Easter period, with EU regulations favoring circular packaging. By the quarter’s end, prices closed at 8737 USD/MT.

Ethyl Vinyl Alcohol Copolymer Prices Outlook Q4 2023

- USA: US$ 8740/MT

- Japan: US$ 8670/MT

- Europe: US$ 8670/MT

Ethyl vinyl alcohol copolymer prices in the United States for Q4 2023 reached 8740 USD/MT in December. In Q4 2023, the EVOH market in the USA saw a drop due to weak demand in food packaging and a shift towards more sustainable materials. Although a temporary demand increase occurred around Thanksgiving, overall market conditions were pressured by reduced feedstock support and logistical challenges affecting supply through key routes.

The price trend for ethyl vinyl alcohol copolymer in Japan for Q4 2023 reached 8670 USD/MT in December. In Japan, the EVOH market experienced a decline in the final quarter of 2023, driven by abundant inventories and lower demand for petrochemical-based packaging materials. Supply challenges, worsened by feedstock issues following a plant shutdown and regional disruptions, further impacted the market, maintaining a downward pressure on prices throughout the quarter.

The price trend for ethyl vinyl alcohol copolymer in Europe for Q4 2023 reached 8670 USD/MT in December. Europe's EVOH market in Q4 2023 was marked by a significant downturn. The drop in need in the packaging sector, coupled with a shift in favor of recyclable materials and lower feedstock costs, pushed prices down. Despite steady orders from the food industry due to regulatory commitments, the overall market faced challenges from changing consumer preferences and economic factors.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the ethyl vinyl alcohol copolymer prices.

Global Ethyl Vinyl Alcohol Copolymer Price Trend

The report offers a holistic view of the global ethyl vinyl alcohol copolymer pricing trends in the form of ethyl vinyl alcohol copolymer price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of ethyl vinyl alcohol copolymer, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed ethyl vinyl alcohol copolymer demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Ethyl Vinyl Alcohol Copolymer Price Trend

Q2 2025:

The second quarter of 2025 in Europe highlighted a disconnect between supply-side relief and weak downstream demand, which kept prices under pressure despite an early-quarter rebound in the index. A notable influence came from upstream conditions. The restart of EVA facilities in France and Belgium reduced earlier feedstock tightness, lowering production costs. This meant that producers had less justification for holding firm on higher offers, especially as buyers were already hesitant. The more decisive factor was muted demand. Packaging demand was restrained, as beverage makers held high inventories and slowed procurement. The automotive sector added to the weakness, burdened by declining vehicle sales and broader economic pessimism. This double hit left converters reluctant to lock in large volumes, choosing instead to draw down existing stock. The seasonal lull compounded the problem. As activity slowed during the summer months, transactions shifted away from the spot market toward contract obligations. Even as feedstock availability improved, the market lacked the pull from end-use sectors to absorb material, leading to an overall easing in price momentum.

Q4 2024:

The market saw fluctuating pricing trends in Q4 2024, influenced by shifts in supply, freight costs, and consumer sentiment. While October remained comparatively steady in spite of a downturn in demand from the packaging sector, automotive recovery and supply chain delays prevented sharp declines. By November, downward pressure returned as ample inventory, lower ethylene vinyl acetate (EVA) feedstock costs, and subdued purchasing activity weakened the market. Spot transactions were minimal as most buyers relied on pre-existing contracts, leading to an oversupply scenario. Interestingly, December rates held unchanged as port jams brought on by severe weather and increased transportation costs balanced the ongoing bearish trend, briefly maintaining price stability before another decline.

Q3 2024:

In the third quarter of 2024, the European market saw a substantial decline, largely due to weak economic conditions, rising energy costs, and lower purchasing power. Surplus manufacturing of EVOH was a prevailing issue across global markets, particularly as excess ethylene vinyl acetate (EVA) availability drove down production costs. The packaging industry, one of the primary consumers of EVOH, faced weaker-than-expected demand, further impacting pricing trends. The summer holiday period also contributed to subdued market activity, with a slow recovery in September failing to meet earlier market projections. Additionally, despite supply network disruptions caused by storms and typhoons, import appetite remained low, as European producers were sufficiently stocked, reducing the need for imports from Asia. The overall market remained sluggish, with freight cost reductions offering some relief but failing to offset the weak pricing environment.

Q2 2024:

During the second quarter of 2024, the European ethyl vinyl alcohol copolymer market displayed diverse patterns, commencing robustly due to increased demand from the cosmetics industry, especially in France. Companies such as Beiersdorf experienced substantial revenue increases owing to the growing demand for packaging. At the same time, recent European laws focused on cutting down on packaging waste while encouraging a circular economy by implementing refill programs, setting reuse goals, and promoting higher utilization of recycled materials showed a promising future. Furthermore, an oversupply of inventory and reduced production expenses from cheaper EVA raw materials caused EVOH prices to diminish.

Q1 2024:

The market in Europe showed price variability throughout Q1 2024. Early in the quarter, prices edged up due to consistent demand for stockpiling. Geopolitical instabilities and trade conflicts strained supply chains, causing interruptions. By the middle of the quarter, the demand for food packaging materials softened, affected by rising food inflation. Concurrently, the draft of the EU's new packaging waste regulation (PPWR) moved closer to finalization, pushing demand for sustainable materials, such as polyethylene substitutes. By quarter’s end, increased demand for packaging, driven by the Easter holiday, led to a price uptick in the region.

Q4 2023:

The European EVOH market in the Q4 2023 was symbolized by a notable price decline. This bearish trend resulted from reduced demand in the packaging sector, driven by a preference for reusable materials over EVOH derived from petrochemicals. Additionally, lower cost aid from feedstock ethylene and a decrease in Vinyl Alcohol prices contributed to the downward pressure on production costs. Despite stable orders from the food sector toward the end of the quarter, aligned with the EU's dedication to minimizing plastic waste, the overall market remained sluggish, reflecting broader shifts in buyer preferences and regulatory pressures aiming for sustainability targets.

This analysis can be extended to include detailed ethyl vinyl alcohol copolymer price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Ethyl Vinyl Alcohol Copolymer Price Trend

Q2 2025:

As per the ethyl vinyl alcohol copolymer price index, production costs nudged upward as raw material EVA grew more expensive, yet this was complicated by weather shocks such as floods and wildfires. These events disrupted transport networks, delayed supplier deliveries, and added to insurance expenses. Packaging and automotive, the two key downstream sectors, provided little relief to producers. The packaging segment was slowed by already high beverage inventories, leaving converters to buy sparingly. The automotive market struggled with reduced sales, particularly among imported brands, cutting back on material requirements. This double drag on demand left producers without strong outlets for their product. International trade remained a weak spot for the US market. A brief improvement in shipments to South Korea was overshadowed by buyers elsewhere shifting toward Middle Eastern and Chinese alternatives. Tariff-related uncertainty compounded the problem, ensuring that US-origin EVOH remained on the defensive in global markets.

Q4 2024:

The North American market experienced a continued downward pricing trend in the fourth quarter of 2024, driven by ample domestic supply, weak seasonal demand, and reducing freight costs. While October saw stable prices due to limited spot market pressure, November brought renewed declines as excess inventory and reduced packaging sector demand created a market surplus. Despite uncertainty surrounding the Presidential Election, demand rebounded slightly in the automotive sector, helping maintain price stability early in the quarter. However, lower ethylene vinyl acetate (EVA) feedstock costs further reduced production expenses, avoiding any notable rise in cost. With most buyers emphasizing on contractual agreements, spot trading remained minimal, reinforcing the overstocking issue in the industry.

Q3 2024:

The North American ethyl vinyl alcohol copolymer (EVOH) market faced significant challenges in the third quarter of 2024, with persistent price declines driven by multiple factors. The primary reason for the downward trend was the combination of weak requirement from downstream sectors, especially packaging, and an overall oversupply in the global market. The sluggish economic conditions, high borrowing costs, and declining manufacturing expenses further pressured market pricing. Despite initial assumptions of a requirement resurgence in September due to seasonal purchasing for the winter holiday season, market activity remained subdued. This prolonged downturn prompted manufacturers to lower their price offerings to stimulate sales. The United States saw the steepest price drop in the region, with the market sentiment remaining largely negative throughout the quarter.

Q2 2024:

During the second quarter of 2024, the EVOH market in North America underwent changing trends, transitioning from growth to a decline. At first, the expanding cosmetic industry resulted in a higher requirement for beauty product packaging, with the help of growing beauty sales. Nevertheless, manufacturing was hindered by a lack of raw materials and consistent customer orders, causing producers to increase EVOH prices in April. In June, need from downstream sectors weakened, in spite of the usual increase in packaging needs. Surplus stock and lower consumer spending, impacted by inflation and continuous supply chain problems, resulted in decreased prices, and weakened market confidence.

Q1 2024:

Price fluctuations were observed in the market during the initial quarter of 2024. Prices experienced a slight increase at the start of the quarter, propelled by consistent demand for materials used in food packaging as food consumption continued to rise. Production levels stayed steady, yet weak global demand caused oversupply owing to careful purchasing habits. Global air cargo delays, driven by the increase in online shopping, also impacted shipping costs. At the conclusion of the quarter, increased orders for Easter packaging increased demand in the food industry, leading suppliers to increase prices in order to enhance revenue margins.

Q4 2023:

The market in North America experienced a downward to steady market behavior throughout the last quarter of 2023. Initially, demand remained weak for EVOH, primarily utilized in food packaging, due to restrained demand for boxed foods amidst rising food inflation. A move towards recyclable materials as well as decreased reliance on petrochemical derived EVOH further impacted demand. Mid-quarter saw a slight uptick in orders for packaged food around Thanksgiving, providing a temporary boost. However, cost support waned as feedstock ethylene prices declined due to increased refining activities and output levels locally. By the last quarter, demand continued to be moderate, affected by limited distribution across the Mississippi River.

Specific ethyl vinyl alcohol copolymer historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Ethyl Vinyl Alcohol Copolymer Price Trend

Q2 2025:

The report explores the ethyl vinyl alcohol copolymer trends and ethyl vinyl alcohol copolymer price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q4 2024:

The report explores the ethyl vinyl alcohol copolymer pricing trends in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on ethyl vinyl alcohol copolymer prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Ethyl Vinyl Alcohol Copolymer Price Trend

Q2 2025:

The market in Asia Pacific experienced mixed pricing conditions through the second quarter of 2025. Although the index showed a slight uptick by the end of the quarter, the overall tone was bearish. The weakness was tied to sluggish demand from core end-use sectors like packaging and automotive. Even though trade tensions eased and upstream costs remained steady, these positive factors were overshadowed by soft consumption patterns across the region. In Japan, the seasonal slowdown in July further weighed on sentiment. Procurement activity dropped after the Eid al-Adha and Dragon Boat Festival holidays, compounding the impact of an already oversupplied market. Buyers in the packaging industry avoided large purchases, choosing short-term strategies that kept inventories lean. This cautious behavior amplified the downward pull on pricing, preventing any meaningful recovery despite relatively balanced feedstock conditions.

Q4 2024:

In the EVOH market, Q4 2024 presented a mix of price stability and downward pressure, primarily due to seasonal slowdowns in packaging as well as automotive requirement. October remained steady as sufficient supply balanced market fundamentals, while a drop in freight prices further eased pricing worries. However, the impact of higher ethylene vinyl acetate (EVA) costs offset some of the downward movement by increasing manufacturing costs. In Japan, maintenance shutdowns at major production units helped moderate supply levels temporarily. By November, prices declined due to a rise in supply, lower EVA feedstock costs, and weak downstream demand. Buyers emphasized on long-term contractual agreements over spot purchases, intensifying the existing market oversupply and keeping pricing pressures subdued.

Q3 2024:

The Asia-Pacific market encountered a difficult quarter in Q3 2024, as prices faced a steady decline due to an oversaturated market and weakening demand across multiple sectors. Japan, in particular, experienced the most notable price reductions, bolstered by the continued availability of low-cost ethylene vinyl acetate (EVA) feedstock and limited buying activity from key downstream sectors. The correlation between falling production costs and sluggish demand led to a consistently bearish market sentiment, with oversupply exacerbating the pricing downturn. Despite occasional expectations for a price correction, the regional market continued its downward trend throughout the quarter, with industry players struggling to balance supply with existing demand.

Q2 2024:

In Q2 2024, the APAC market showed a variety of trends with an overall decrease in prices. The area saw initial advantages due to a strong cosmetics sector, leading to increased demand for beauty products packaging and higher sales for major companies such as L'Oréal. Production remained steady despite reduction in vinyl alcohol feedstock, guaranteeing a stable stock due to constant demand. During the middle of the quarter, producers raised prices due to inflation going up. Yet, in June, decreased need from packaging sectors, elevated levels of inventory, and continued disruptions in the supply chain resulted in reduced prices. Moreover, the market was additionally squeezed by decreased production expenses due to more affordable EVA raw material and supply chain difficulties.

Q1 2024:

The market in Asia-Pacific had a varied performance in the first quarter of 2024. Rising demand for food packaging before big festivals led to higher prices, aggravated by the growth in food expenses. Production levels were further influenced by the scarce stock of ethylene feedstock. Geopolitical tensions, such as a missile strike close to Yemen, have caused disruptions to the transportation of crude oil, putting strain on supply chains. By the middle of the quarter, there was a better supply of materials as the market slowed down, particularly in China owing to the Lunar New Year celebrations.

Q4 2023:

In Asia, the EVOH market saw a decline in Q4 2023, with prices falling in comparison to the last quarter. At the start of the period, ample inventories were available, but reduced support from feedstock ethylene, influenced by lower demand from the glycol sector, pressured prices. This downturn was further propelled by risen inventory levels and a shift away from petrochemical-based ethyl vinyl alcohol copolymer in packaging. During the mid-quarter, supply was constrained by limited feedstock availability owing to a plant closure at Eneos Corp. As the quarter drew to a close, demand remained subdued amid supply chain disruptions following the Red Sea strikes, affecting deliveries to buyers.

This ethyl vinyl alcohol copolymer price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Ethyl Vinyl Alcohol Copolymer Price Trend

Q2 2025:

Latin America's ethyl vinyl alcohol copolymer market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in ethyl vinyl alcohol copolymer prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the ethyl vinyl alcohol copolymer price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing ethyl vinyl alcohol copolymer pricing trends in this region.

Q4 2024:

The analysis of ethyl vinyl alcohol copolymer prices in Latin America provides a detailed overview, reflecting the unique market dynamics in the region influenced by economic policies, industrial growth, and trade frameworks.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Ethyl Vinyl Alcohol Copolymer Price Trend, Market Analysis, and News

IMARC's latest publication, “Ethyl Vinyl Alcohol Copolymer Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the ethyl vinyl alcohol copolymer market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of ethyl vinyl alcohol copolymer at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed ethyl vinyl alcohol copolymer prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting ethyl vinyl alcohol copolymer pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Ethyl Vinyl Alcohol Copolymer Industry Analysis

The global ethyl vinyl alcohol copolymer market size reached USD 951.05 Million in 2024. By 2033, IMARC Group expects the market to reach USD 1,488.09 Million, at a projected CAGR of 4.85% during 2025-2033.

- The increasing demand for EVOH in the packaging applications that require pharmaceuticals, cosmetics, and food to remain fresh and uncontaminated represents one of the key factors influencing the growth of the market across the globe. This is primarily due to the exceptional barrier property of EVOH to gases like oxygen is driving its demand in the packaging industry. According to Invest India, packaging is currently the 5th largest sector in the Indian economy. India is a net exporter of packaging products and the largest exporter of sub-segments- Biaxially-oriented Polyethylene Terephthalate (BOPET) & Flexible Intermediate Bulk Container (FIBC).

- The rising awareness regarding food safety and quality standards among consumers is leading to greater use of effective packaging materials such as EVOH to prevent spoilage and ensure normal shell stability of perishable goods. According to the general instruction of the Food Safety and Standards Authority of India (FSSAI), packaging materials shall be suitable for the type of product, the conditions provided for storage, and the equipment for filling, sealing, and packaging of food as well as transportation conditions. Packaging materials shall be able to withstand mechanical, chemical, or thermal stresses encountered during normal transportation. In the case of flexible semi-rigid containers, overall packaging may be necessary.

- Improvements in multiplayer film technology allow for the efficient integration of EVOH layers into several packaging structures, enhancing their protective qualities without significant cost increases, thereby facilitating the market growth. For instance, Maine and Oregon became the first two US states to introduce extended producer responsibility (EPR) legislation for plastic packaging in 2021. These laws shift the responsibility of packaging waste management to producers rather than municipalities or individuals.

- The growing stringent regulations for packaging safety and sustainability are encouraging the adoption of high-performance materials such as EVOH, which comply with these regulations while offering recyclability and minimal environmental impact.

- The increasing demand for EVOH in the pharmaceutical sector, along with the rising need for high-barrier packaging to protect sensitive medical products from moisture and gases is driving the demand for EVOH in drug packaging.

Ethyl Vinyl Alcohol Copolymer News

The report covers the latest developments, updates, and trends impacting the global ethyl vinyl alcohol copolymer industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in ethyl vinyl alcohol copolymer production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the ethyl vinyl alcohol copolymer price trend.

Latest developments in the ethyl vinyl alcohol copolymer industry:

- On 18th September 2023, Mitsubishi Chemical announced plans to double the production capacity of its SoarnoL-brand ethylene vinyl alcohol copolymer in the UK, from 18,000 t/y to 39,000 t/y by July 2025, anticipating increased demand for the material in packaging applications.

- On 12th April 2024, Kuraray announced plans to build a new ethylene vinyl alcohol copolymer (EVOH) plant in Singapore with a production capacity of 18,000 tons per year, aiming to start operations by 2026. This expansion is intended to meet growing demand in Asia and strengthen the company’s global supply chain. The estimated investment is around USD 410 Million, and it will enhance Kuraray’s service capabilities in the region.

Product Description

Ethyl vinyl alcohol copolymer also known as EVOH refers to a synthetic polymer known for its exceptional barrier properties against gases such as carbon dioxide, nitrogen, and oxygen. This makes it highly valuable in the packaging industry, especially for food, cosmetics, and pharmaceuticals to ensure product freshness and extend shelf life.

EVOH is a copolymer of ethylene and vinyl alcohol, which is produced by hydrolyzing polyvinyl acetate into polyvinyl alcohol, followed by copolymerization with ethylene.

It is characterized by its transparency, flexibility, and resistance to oils and hydrocarbons. These properties make EVOH especially effective in multiplayer packaging applications, where it is employed as a thin layer sandwiched between other materials to enhance the product the barrier against moisture and gases.

The use of EVOH can significantly improve the presentation of packaged goods while maintaining their safety and quality.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Ethyl Vinyl Alcohol Copolymer |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ethyl Vinyl Alcohol Copolymer Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States, Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of ethyl vinyl alcohol copolymer pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting ethyl vinyl alcohol copolymer price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The ethyl vinyl alcohol copolymer price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)