Ethnic Foods Market Report by Cuisine Type (American, Chinese, Japanese, Mexican, Italian, and Others), Food Type (Vegetarian, Non-Vegetarian), Distribution Channel (Food Services, Retail Stores), and Region 2025-2033

Ethnic Foods Market Size:

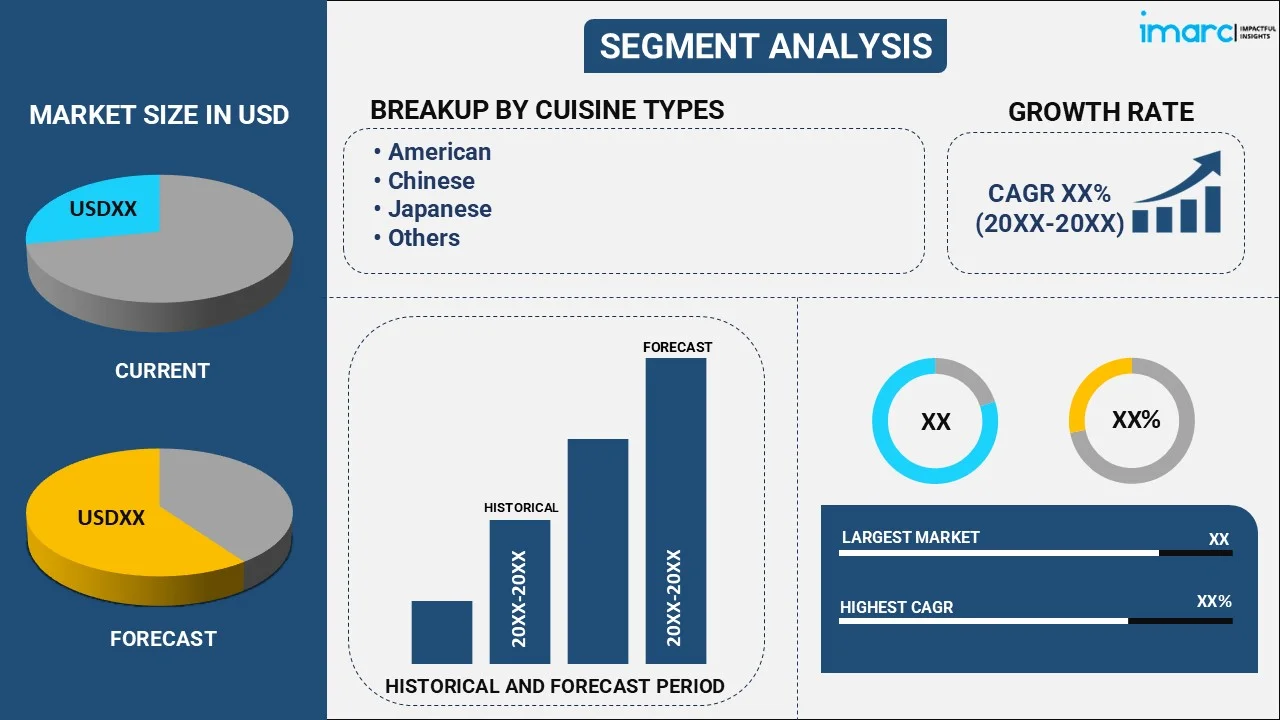

The global ethnic foods market size reached USD 58.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 113.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. The increasing popularity of ethnic cuisines, rapid urbanization, increasing population, advancements in food production technology, expanding global supply chains, and expanding immigrant populations, are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 58.4 Billion |

| Market Forecast in 2033 | USD 113.8 Billion |

| Market Growth Rate 2025-2033 | 7.7% |

Ethnic Foods Market Analysis:

- Major Market Drivers: The growing awareness and appreciation of health benefits associated with certain ethnic cuisines, such as Mediterranean and Japanese diets are driving the ethnic foods market growth. The rising disposable income, urbanization, increasing multiculturalism, and globalization are escalating the product demand.

- Key Market Trends: The rise of plant-based and vegan diets, the popularity of fusion cuisine, and the easy blending of elements from several ethnic backgrounds to create innovative dishes is acting as a primarily ethnic food industry trend.

- Geographical Trends: The Asia Pacific market is driven by the abundance of easily available culinary alternatives and the expansion of varied metropolitan regions due to the growing interest in global cuisines in this market. Additionally, ethnic meals are more widely accessible owing to online marketplaces and food delivery services, which eliminate geographic barriers and let customers sample a variety of cuisines from any location.

- Competitive Landscape: Some of the major ethnic foods companies include Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., among many others.

- Challenges and Opportunities: Challenges are for ethnic food manufacturers, especially smaller ones, preserving authenticity presents challenges in addition to maintaining regulatory requirements and scalability. The industry must use ethical sourcing methods and eco-friendly packaging due to growing concerns about food safety and sustainability. However, the ethnic food market recent opportunities lie in catering to niche dietary preferences, expanding untapped markets, and using digital platforms for marketing and distribution.

Ethnic Foods Market Trends:

Increasing Popularity of Ethnic Cuisines

The increased consumer interest in and acceptance of foreign cuisines has supported the rapid growth of the worldwide ethnic food sector. Authentic ethnic ingredients and recipes are in high demand as individuals from varied cultural origins travel and settle in new nations, bringing their culinary traditions with them. Additionally, this shift created a multicultural environment in the population, resulting in traditional dishes from all over the world becoming more well-known and well-liked. The U.S. Census Bureau recently released statistics that indicate the country's population is expected to surpass 400 million by 2060. According to the forecasts, the proportion of foreign-born persons in the population is expected to increase to almost 17% from 14% in 2020. Additionally, 83% of the population will continue to be native-born citizens, including immigrant children and the diverse cultural backgrounds have contributed significantly to this increase. These dietary preferences are further ingrained in the local market by the fact that immigrant children and the communities they build frequently cherish and preserve their ancestral cuisines. Hence, the local culinary scene is enhanced by this cultural blending, which also helps ethnic foods remain economically viable in the marketplace, thus increasing the ethnic foods demand.

Population Growth and Urbanization

The demographic shifts toward metropolitan areas globally have influenced ethnic food consumption. The amalgamation of many people in metropolitan areas leads to a melting pot of culinary traditions and increases demand for a wider variety of food. According to statistics from the U.S. Census Bureau, the multiracial population in the United States increased significantly from 9 million in 2010 to 33.8 million by 2020, a remarkable 276% rise. This increase is indicative of the country's rising diversity and its impact on dietary choices. The Asian alone or in combination increased by 24 million, the American Indian and Alaska Native alone or in combination with 9.7 million, and the 1.6 million Native Hawaiians and other Pacific Islanders alone or in combination. In addition, metropolitan environments frequently provide more exposure to ethnic experiences due to the diversity of the population and the concentration of restaurants serving a wide range of patrons. Thus, the increasing availability of ethnic cuisines is facilitated by this urban transition, which also fosters the ongoing expansion of the industry due to the persistent customer demand driven by demographic diversification, thus creating a positive ethnic food market outlook.

Advancements in Food Production Technologies

Technological advances in food production are increasing the popularity of ethnic food. The production of ethnic foods has been transformed by modern processing methods, which emphasize safety, flavor, and nutritional characteristics while maintaining batch-to-batch uniformity. Moreover, the integration of cutting-edge logistics and preservation technology guarantees that these delicacies retain their purity from manufacturing lines to the tables of the consumers. As a result, ethnic cuisines become more widely available and satisfy the expanding market demand, making them a staple of the global diet and fostering a lifelong interest in cultural gastronomy. For instance, in October 2023, Paulig launched a new 3D snack production line in Spain which expanded its product line and promoted innovation, sustainability, and customized snack alternatives by investing over €2 million and launching a new line of pellet snacks. This new range provides a wide variety of gluten-free 3D snacks with varying shapes, ingredients, and textures. It offers a daily production capacity surpassing 20,000 kg, the new line significantly increases Paulig's principal plant in Spain's capacity to produce pellets.

Ethnic Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on cuisine type, food type, and distribution channel.

Breakup by Cuisine Type:

- American

- Chinese

- Japanese

- Mexican

- Italian

- Others

Chinese accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the cuisine type. This includes American, Chinese, Japanese, Mexican, Italian, and others. According to the report, the Chinese represented the largest segment.

Chinese cuisine holds the largest share of the ethnic foods market driven by its widespread popularity across the globe. This cuisine is distinguished by its wide range of ingredients, cooking methods, and styles which come from different parts of China. Popular dishes like fried rice, stir-fries, and dumplings are becoming popular worldwide and are driving the industry's expansion. Furthermore, the authenticity of Chinese food and complex taste profiles are driving the business and attracting a wide range of customers who are looking for culinary diversity and adventure.

Breakup by Food Type:

- Vegetarian

- Non-Vegetarian

Non-vegetarian holds the largest share of the industry

A detailed breakup and analysis of the market based on the food type have also been provided in the report. This includes vegetarian and non-vegetarian. According to the report, non-vegetarian accounted for the largest market share.

The non-vegetarian category includes a diverse range of meats such as poultry, beef, lamb, and seafood, each prepared with traditional spices and cooking techniques that are characteristic of various cultures and regions. Additionally, the popularity of non-vegetarian ethnic foods is driven by their rich flavors, perceived authenticity, and the growing consumer interest in exploring new and traditional cuisines from around the world. This trend is further supported by the increasing availability of these foods in restaurants and supermarkets, catering to a broader audience seeking culinary diversity, thus generating positive ethnic foods market revenue. For instance, on 18 September 2023, National Meat and Provision Company (NATCO), a long-standing family-owned business known for supplying upscale Louisiana restaurants such as Brennan's and Commander's Palace, announced that it would be improving its production facility in St. John the Baptist Parish with an investment exceeding $437,600. It added 3,795 square feet to the building, mostly for freezer storage, to increase its ability to serve a wide range of customers, including retailers, offshore businesses, and the restaurant industry. While maintaining its current staff of 80, the expansion is expected to result in the creation of five additional positions.

Breakup by Distribution Channel:

- Food Services

- Retail Stores

Retail stores represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes food services and retail stores. According to the report, retail stores represented the largest segment.

According to the ethnic foods market overview, retail stores are leveraging their widespread presence and the ability to offer consumers tangible shopping experiences where they can physically assess product quality and authenticity. They benefit from consumer preferences for instant gratification and the convenience of one-stop shopping for diverse food products. Additionally, retail stores often feature a broader variety of ethnic foods, catering to an increasingly multicultural consumer base seeking authentic, exotic, and diverse culinary experiences. For instance, in April 2024, Gymkhana Fine Foods, the Indian restaurant retail venture associated with Gymkhana London that was formed between JKS Restaurants and former Mars executive Gulrez Arora, secured $3 million in seed funding. The investment, led by venture capital firm CAVU Consumer Partners, aims to expand the availability of premium Indian recipes in retail stores.

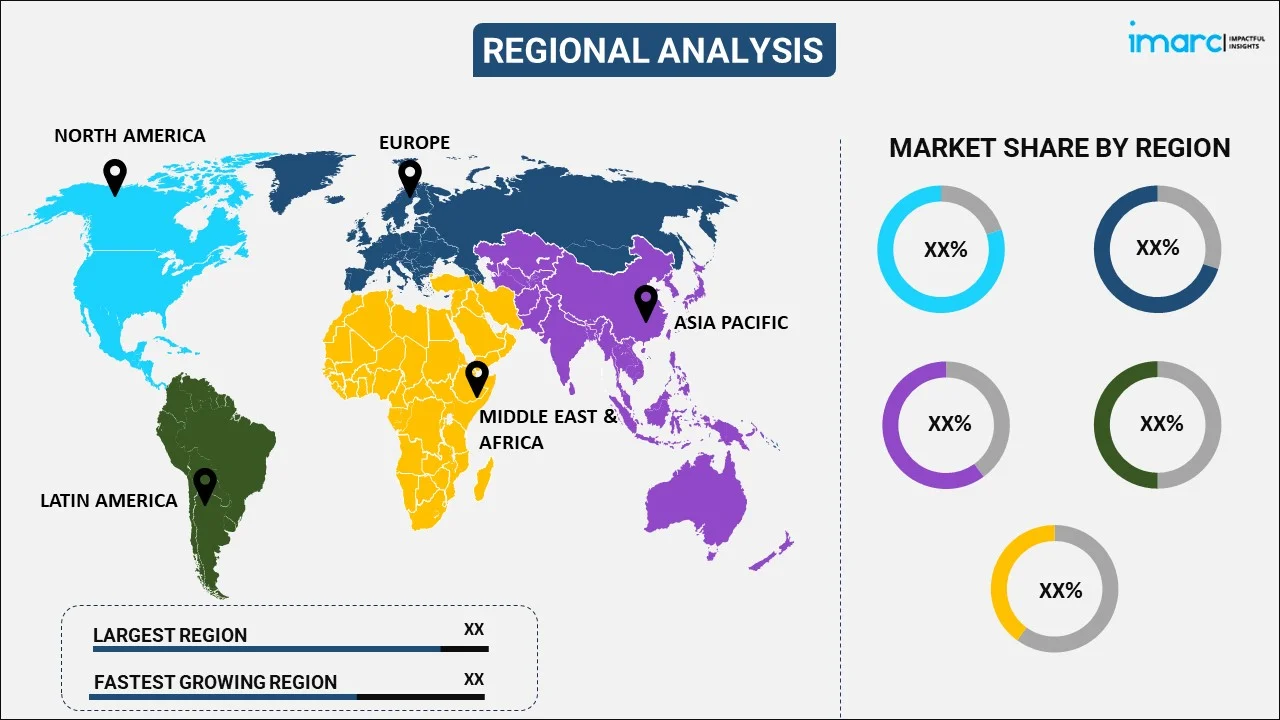

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest ethnic foods market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for ethnic foods.

As per the ethnic foods market forecast, the Asia Pacific market is dominating the market due to diverse culinary traditions and rapid urbanization that increases consumer exposure to varied cuisines. The dominance is fueled by a large, growing population with increasing disposable income, which enhances spending on food products that offer novel flavors and dining experiences. Countries like China, India, and Japan are key contributors, as they embrace their rich, traditional cuisines and are quick to adopt other regional flavors, thereby broadening the market scope. For instance, on 29 February 2024, Conagra Brands, Inc. disclosed that one of its subsidiaries has reached a definite agreement with funds advised by Convergent Finance and Samara Capital to sell its 51.8% ownership interest in Agro Tech Foods Limited (ATFL), a Mumbai-based food company listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). It is anticipated that the transaction will be finalized by the conclusion of the 2024 calendar year.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the ethnic foods industry include Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The key players in the global market are focusing on product innovation, strategic partnerships, and expanding distribution networks to strengthen market growth. Companies are introducing authentic, region-specific options and healthier versions of traditional dishes to attract health-conscious consumers. They are also leveraging digital marketing and e-commerce platforms to reach a broader audience. Collaborations with local producers and chefs help ensure authenticity and freshness, while investment in supply chain improvements enhances product availability and variety. To cite another ethnic foods market recent developments, on 23 January 2024, McCormick brand unveiled its latest offering, Flavor Maker Seasonings, a new line designed to add inspiration and flavor to meals from preparation to serving. It offers 15 different blends, each seasoning offers a simple way to enhance the taste of various dishes, from ramen to rice, catering to cooks of all skill levels with minimal effort required. These versatile seasonings can be used as ingredients during cooking or as toppings, expertly crafted with McCormick spices and free from additives. Some of the available varieties include Chicken, Veggie, Pasta, Avocado, Egg, Sandwich, Pizza, Chili, Salmon, Potato, Asian-style Rice Bowl, Mac & Cheese, Mediterranean, Ramen, and Taco.

Ethnic Foods Market News:

- 29 January 2024: Ajinomoto Foods North America, Inc. (AFNA), a prominent frozen food producer, has reached an agreement to sell the business rights and associated equipment of its Italian frozen pasta division, which includes the Bernardi and Mona’s brands, to Seviroli Foods LLC (Seviroli), a leading manufacturer of frozen pasta and other food items, and an importer of specialty foods. The sale has been finalized, and AFNA will continue to co-manufacture Bernardi and Mona’s products at its Toluca, IL facility to ensure uninterrupted service to customers until Seviroli completes the transition of operations to its facilities.

- 21 May 2024: McCormick Grill Mates unveiled its latest innovation, the Max the Meat Guy seasoning blend including Max's All-Purpose Seasoning, Max's Xtra Coarse Seasoning, and Max's Chimichurri Seasoning. These three new spice blends are crafted to deliver maximum layered flavor for dedicated grill masters. It aims to cater to serious grillers by offering high-quality ingredients and versatile flavors. These blends can be used individually or layered to elevate the taste of grilled proteins, vegetables, and side dishes.

- 5 February 2024: General Mills introduced the New Old El Paso Cinnamon Toast Crunch Dessert Taco Shells. Fans are acting fast to secure limited-edition boxes of these tantalizing Cinnadust-infused shells. Additionally, commitment to innovation shines through in this fusion of flavors, as Cinnamon Toast Crunch and Old El Paso join forces to deliver a distinctive experience, blending the stalwarts of cereal and taco realms into an unparalleled creation that elevates taco nights to sweet victory.

Ethnic Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisine Types Covered | American, Chinese, Japanese, Mexican, Italian, Others |

| Food Types Covered | Vegetarian, Non-vegetarian |

| Distribution Channels Covered | Food Services, Retail Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ethnic foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global ethnic foods market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ethnic foods industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ethnic foods market was valued at USD 58.4 Billion in 2024.

We expect the global ethnic foods market to exhibit a CAGR of 7.7% during 2025-2033.

The rising consumer inclination towards experimenting, exploring, and experiencing diverse culinary traditions is primarily driving the global ethnic foods market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online platforms for the purchase of ethnic food items.

Based on the cuisine type, the global ethnic foods market can be categorized into American, Chinese, Japanese, Mexican, Italian, and others. Currently, Chinese accounts for the majority of the global market share.

Based on the food type, the global ethnic foods market has been segregated into vegetarian and non-vegetarian, where non-vegetarian currently holds the largest market share.

Based on the distribution channel, the global ethnic foods market can be bifurcated into food services and retail stores. Currently, retail stores exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global ethnic foods market include Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)