Ethical Labels Market Size, Share, Trends and Forecast by Product Type, Label Type, Distribution Channel, and Region, 2025-2033

Ethical Labels Market Size and Share:

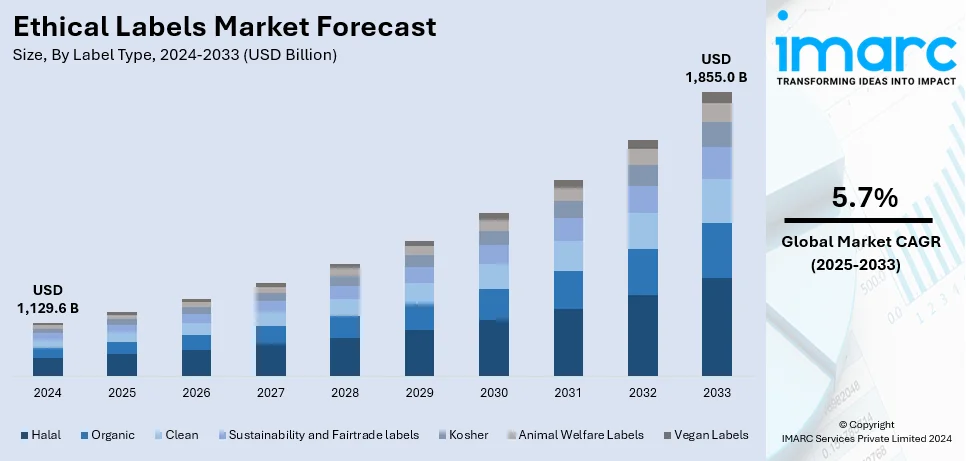

The global ethical labels market size was valued at USD 1,129.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,855.0 Billion by 2033, exhibiting a CAGR of 5.7% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The increasing preference for ready-to-eat (RTE) food products, integration of advanced technologies, and initiatives undertaken by governing agencies represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,129.6 Billion |

| Market Forecast in 2033 | USD 1,855.0 Billion |

| Market Growth Rate (2025-2033) | 5.7% |

The global ethical labels market is majorly driven by increasing consumer demand for sustainable and socially responsible products. Rising awareness about environmental impact and ethical sourcing is prompting businesses to adopt transparent labeling practices. Regulatory requirements for traceability and compliance with sustainability standards further fuel market growth. In addition, advanced technologies like blockchain, AI, and IoT enhance supply chain transparency, supporting the adoption of ethical labels. Furthermore, the growing popularity of certifications, such as organic and fair trade, along with government support for sustainable farming and production practices, bolsters the market's expansion across diverse industries and regions.

The United States plays a pivotal role in the global ethical labels market, driven by growing consumer demand for transparency and sustainability. Rising awareness of health, environmental, and social impacts influences purchasing decisions, encouraging brands to adopt ethical certifications like USDA Organic and Fair Trade. For instance, as per industry reports, to maintain the credibility of organic certification for consumers, the USDA introduced the Strengthening Organic Enforcement (SOE) rule, which took effect in 2023. Businesses and certifying bodies are required to achieve full compliance by March 19, 2024. The USDA estimates that approximately 4,000- 5,000 companies will require new certifications under this regulation. Moreover, technological advancements, such as blockchain and AI, are increasingly integrated into labeling to ensure traceability and authenticity. Regulatory support and initiatives promoting sustainable practices further bolster market growth. In addition, with a strong focus on innovation and meeting evolving consumer expectations, the U.S. remains a crucial market for the ethical labels industry.

Ethical Labels Market Trends:

Rising Demand for Ethical Labels Driven by Urbanization and Consumer Preferences

The increasing focus on food safety, hygiene, and reliability is a significant factor driving the global demand for ethical labels. Shifting consumer preferences toward ready-to-eat (RTE) food products, fueled by rapid urbanization, expanding purchasing power, and hectic schedules, are further catalyzing this growth. According to World Bank, 56% of the global population resides in cities, and this figure is projected to more than double by 2050, driven by rapid urbanization. Additionally, the rising consumption of halal food is positively influencing market demand. These factors reflect the growing emphasis on ethical practices and sustainability in consumer choices, bolstering the ethical labels market.

Technological Advancements Enhancing Transparency and Sustainability

The integration of advanced technologies such as blockchain, RFID chips, GPS, AI, and ML is transforming ethical labels by improving transparency and traceability in supply chains. According to reports, global spending on Industrial IoT (IIoT) platforms is projected to grow from USD 1.67 Billion in 2018 at a 40% CAGR, driven by AI's role in accelerating supply chain decision-making. These technologies create tamper-proof records and track goods from origin to sale, providing insights into production conditions, such as temperature and humidity, to verify sustainability claims. Coupled with government support for sustainable farming practices, these advancements are creating a robust foundation for ethical label market growth.

Growing Consumer Awareness of Sustainability and Ethical Practices

The global ethical labels market is witnessing growth due to increasing consumer awareness of sustainability and ethical production practices. Shoppers are rapidly becoming more informed about the environmental and social impact of their purchases, driving demand for products with certifications like Carbon Neutral, Fair Trade, and Organic. For instance, as per industry reports, approximately 90% of Americans are aware or partially aware of organic claims when selecting food products. In line with this, certified organic items represented 5.7% of all food sales in U.S. retail channels in the year 2024. Resultantly, businesses are actively responding to this growing trend by adopting transparent practices and showcasing compliance through ethical labeling. Enhanced marketing efforts and the proliferation of eco-conscious brands further accelerate this trend. As consumers increasingly prioritize environmentally friendly and socially responsible choices, the demand for ethical labels continues to rise, positioning them as a key differentiator in competitive markets.

Ethical Labels Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ethical labels market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, label type, and distribution channel.

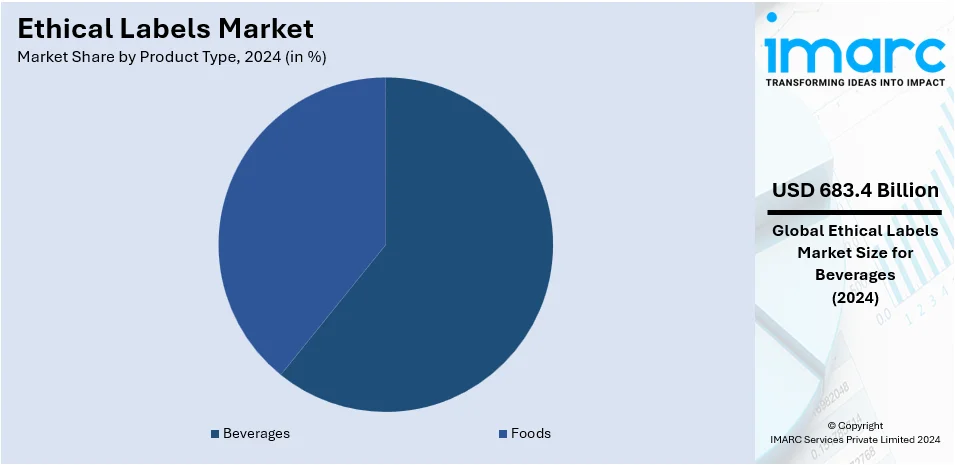

Analysis by Product Type:

- Foods

- Beverages

Beverages stand as the largest product type in 2024, holding around 60.5% of the market. This dominance is driven by magnifying consumer demand for transparency, sustainability, and health-conscious options. Ethical labels, such as Rainforest Alliance certifications, are widely adopted in the beverage sector, particularly for products like coffee, tea, bottled water, and juices. This prominence is attributed to heightened awareness of environmental sustainability and social responsibility, with consumers actively seeking ethically sourced and produced beverages. Additionally, the rising preference for organic and natural ingredients has boosted the adoption of ethical certifications to validate product claims. Major players in the beverage industry are leveraging these labels to differentiate their offerings, enhance brand reputation, and meet regulatory standards, further solidifying the segment's leadership in the ethical labels market.

Analysis by Label Type:

- Halal

- Organic

- Clean

- Sustainability and Fairtrade labels

- Kosher

- Animal Welfare Labels

- Vegan Labels

Halal leads the market under the label type segment. This domination is mainly supported by proliferating global Muslim populations and elevating awareness regarding halal standards among non-Muslim customers. Halal certifications guarantee that products adhere with religious, dietary, and ethical product policies, improving customer loyalty and confidence. In addition, heightening need demand for halal-certified cosmetics, food, and beverages is specifically prominent in regions including North America, the Middle East, and Asia Pacific. Furthermore, this segment profits from government programs endorsing cross-border certifications and halal trade to foster exports. With rapidly growing halal markets and its adherence to global ethical practices, this segment remains a key contributor to market expansion.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market by distribution channel. This leadership is primarily influenced by robust customer dependence on physical stores for procuring certified products. Specialty stores, supermarkets, and hypermarkets offer direct availability of labeled goods, allowing customers to verify certifications such as halal, organic, or fair trade, before purchase. Moreover, retailers generally provide dedicated sections for ethically labeled products, improving transparency and facilitating trust. The hands-on shopping experience, combined with promotional ventures, prompts customer loyalty and engagement. Despite the notable expansion of e-commerce, offline distribution remains dominant, particularly in regions with finite internet access, strengthening its crucial role in the ethical labels industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. This dominant region is principally propelled by magnified consumer awareness and demand for sustainable, socially responsible, and transparent products. Key factors include strong regulatory frameworks, such as the USDA Organic and Fair Trade certifications, which encourage ethical practices across industries. High disposable incomes and a growing preference for environmentally friendly products further fuel demand. Moreover, businesses in the region have actively embraced ethical labeling to meet consumer expectations and enhance brand loyalty. The rise of e-commerce platforms has also facilitated greater access to ethically labeled products, broadening their reach. For instance, according to the International Trade Administration, e-commerce sales in Canada are expected to reach approximately USD 40.3 billion by 2025, with e-commerce user penetration reaching 77.6% in the same year. Additionally, the region's robust retail infrastructure supports the adoption of ethical labels, positioning North America as a key player in shaping global standards and driving growth in this segment.

Key Regional Takeaways:

United States Ethical Labels Market Analysis

In 2024, United States accounted for the 85.40% of the market share in North America. Urbanization is pushing the demand for ethical labels in food and beverages. As cities expand, consumers seek transparency regarding sourcing, production, and environmental impact. For instance, urban population in the U.S. grew by 6.4% from 2010 to 2020, fostering increased consumer demand for ethical labels as urban populations prioritize sustainability and responsible consumption. Increasing health consciousness drives preferences for sustainably produced items with certifications like organic or fair trade. Urban dwellers value ethical claims, especially those highlighting animal welfare, waste reduction, or non-GMO verification, as these align with their sustainable lifestyle choices. The rise of modern retail formats enables greater access to products with such labels, emphasizing traceable supply chains. Additionally, shifting dietary habits, influenced by the demand for clean-label ingredients and ethical farming practices, further strengthen this market. The combination of eco-consciousness and changing consumption patterns supports a growing affinity for ethical food options.

Europe Ethical Labels Market Analysis

Consumers are increasingly adopting eco-friendly products as part of a broader sustainability movement. For instance, rising demand for eco-friendly food systems benefits ethical labels in food and beverages as the EU generates over 58 Million tonnes of food waste annually, valued at approximately USD 142 Billion, aligning with the farm-to-fork strategy to minimize environmental impact. Ethical labels such as carbon-neutral production, recyclable packaging, and organic certifications resonate with environmentally conscious buyers. Food traceability solutions are gaining traction as consumers demand information on ingredient origins, supply chain transparency, and reduced carbon footprints. Labels supporting biodiversity preservation and sustainable farming further align with the region's preference for green consumption. Increased government initiatives promoting climate-friendly food production are also driving brands to obtain ethical certifications. Additionally, ethical labeling complements plant-based diets, emphasizing eco-responsibility and boosting market traction in this region.

Asia Pacific Ethical Labels Market Analysis

Rising disposable incomes are driving consumer spending on premium and ethically labeled food and beverages. For instance, India's per capita disposable income is set to reach approximately USD 2,570 in FY24, growing 8%, benefiting ethical food and beverage labels as rising incomes drive demand for premium and sustainable products. Gross national disposable income is also projected to expand by 8.9%, reflecting greater consumer spending power. Growing awareness of healthier diets has encouraged demand for products certified as organic, sustainably sourced, or free from harmful additives. Labels emphasizing worker welfare, clean processes, and ethical farming resonate with a rapidly expanding middle class prioritizing food safety and product authenticity. Younger demographics are increasingly favouring responsibly produced options, particularly plant-based alternatives or cruelty-free items. Evolving preferences have fostered demand for labels supporting local farmers or environmentally conscious practices. This shift in purchasing habits, coupled with higher purchasing power, underpins the strong adoption of ethical certifications in the food and beverage industry.

Latin America Ethical Labels Market Analysis

The growth of e-commerce platforms and online grocery stores has improved access to ethical food and beverage options. According to reports, Brazil, the largest economy in Latin America, is witnessing rapid e-commerce growth at 14.3%, expected to surpass USD 200 Billion by 2026, presenting significant opportunities for ethical food and beverage labels. With 67% of consumers searching on Instagram and 41% influenced by digital recommendations, online platforms are driving demand for sustainable and transparent products. Digital marketplaces prominently feature products with sustainable labels, meeting consumer demand for clean, responsibly sourced food. Enhanced delivery networks and direct-to-consumer models promote visibility for items like organic or fair-trade offerings, fostering their adoption. Tech-enabled platforms allow detailed traceability and certification displays, building trust in ethical products.

Middle East and Africa Ethical Labels Market Analysis

The increasing popularity of ready-to-eat (RTE) food products, powered by GPS-enabled logistics and artificial intelligence (AI) applications, is supporting ethical labelling adoption. According to reports, The global ready-to-eat (RTE) food market, valued at USD 189.1 Billion in 2024, is projected to reach USD 269.4 Billion by 2033, growing at a 4.01% CAGR, driving demand for ethical food and beverage labels due to increasing consumer preference for transparency and sustainability. Intelligent inventory systems streamline supply chain tracking, enabling brands to showcase transparent, certified options. As RTE offerings expand, clean-label and ethically certified products remain preferred among discerning consumers seeking quality assurance and traceability.

Competitive Landscape:

The market demonstrates a competitive landscape underpinned by the robust presence of emerging innovators and established players endeavoring to cater to the escalating customer need for both transparency and sustainability. Major market participants are actively focusing on tactical partnerships, certification standards, and technology integration to improve their product lines offerings and distinguish themselves. In addition, several companies are rapidly utilizing leading-edge technologies such as artificial intelligence (AI) and blockchain to verify ethical claims and facilitate traceability, tackling accelerating customer as well as regulatory scrutiny. Besides, as per industry reports, 88% of German consumers pay attention to Nutri-Score, a color-based nutritional quality labeling, while 37% stated that this label plays a crucial role in their food purchasing activities. As a result, this growing consumer focus is magnifying competition and incentivizing brands to prioritize health-focused and transparent labeling. Moreover, niche and regional players are capitalizing on industry-specific demands and localized consumer needs, bolstering competition. Furthermore, the rapid emergence of eco-conscious brands and government aid for sustainable practices is constantly steering the competitive dynamics of the ethical labels industry.

The report provides a comprehensive analysis of the competitive landscape in the ethical labels market with detailed profiles of all major companies, including:

- Abbot's Butcher Inc.

- Archer-Daniels-Midland Company

- Cargill Inc.

- Garden of Life (Nestlé S.A.)

- Go Macro LLC

- Kerry Group plc

- Koninklijke DSM N.V.

- Marks and Spencer Group plc

- The Hershey Company

Latest News and Developments:

- December 2024: The Simpson Centre, in collaboration with the Canadian Roundtable for Sustainable Beef, is advancing efforts to strengthen ethical beef labelling in Canada. Researchers aim to establish standardized accreditation systems to help consumers make informed choices. With growing demand for transparency, ethical labels like “organic” and “sustainable” need greater consistency. This initiative enhances consumer trust and promotes transparency in food production.

- December 2024: STÖK has launched Decaf Cold Brew in its two best-selling roasts: Unsweet and Not Too Sweet. The product features a new white label design to distinguish it from the original lineup. This move expands STÖK's offerings for caffeine-conscious consumers while maintaining its signature smooth taste. The updated packaging aligns with evolving market preferences for clarity and choice.

- August 2024: ADM and Farmers Business Network® (FBN) announced a joint venture, Gradable, to accelerate regenerative and sustainable agriculture practices. The expanded platform empowers farmers to track ethical labels and earn financial rewards while providing buyers with reliable farm-level data. Launched in 2020, Gradable supports rising demand for sustainably produced grain, ensuring transparency in ethical sourcing. This collaboration strengthens the adoption of sustainable farming and benefits both farmers and grain buyers.

- May 2024: Suma, has launched an online store (suma-store.coop) to cater to individual customers, offering ethically sourced products alongside popular brands. Partnering with Ethical Superstore, the site features a variety of plant-based, organic, and fairly traded options. Despite challenges like Brexit, Suma is seeing strong sales in wholesale and trending health products such as kombucha and organic pasta. Suma’s commitment to ethics is underscored by its products earning Ethical Consumer’s Best Buy label.

- March 2024: CuliNEX is revolutionizing clean label food product development, showcasing its expertise at Expo West. With a team of culinary and food science professionals bringing over 250 years of combined experience, CuliNEX is creating the future of food by innovating and enhancing culinary offerings. Their approach blends tradition and innovation, ensuring market success from concept to production.

Ethical Labels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Foods, Beverages |

| Label Types Covered | Halal, Organic, Clean, Sustainability and Fairtrade labels, Kosher, Animal Welfare Labels, Vegan Labels |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbot's Butcher Inc., Archer-Daniels-Midland Company, Cargill Inc., Garden of Life (Nestlé S.A.), Go Macro LLC, Kerry Group plc, Koninklijke DSM N.V., Marks and Spencer Group plc, The Hershey Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ethical labels market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ethical labels market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ethical labels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Ethical labels are certifications or markers on products that indicate compliance with specific ethical, environmental, or social standards. They help consumers make informed choices by highlighting attributes such as sustainability, fair trade, organic production, or animal welfare, promoting transparency and accountability in supply chains.

The Ethical Labels market was valued at USD 1,129.6 Billion in 2024.

IMARC estimates the global ethical labels market to exhibit a CAGR of 5.7% during 2025-2033.

The market is driven by rising consumer demand for transparency, sustainability, and socially responsible products. Increasing health and environmental awareness, regulatory support for ethical practices, advancements in traceability technologies, and the growing adoption of certifications like Fair Trade and Organic further propel market growth.

According to the report, beverages represented the largest segment by product type due to high demand for transparency, sustainability, and ethical sourcing certifications.

Halal leads the market by label type, driven by increasing demand for certified halal products among Muslim consumers and rising global halal food exports.

According to the report, offline represented the largest segment by distribution channel, driven by consumer preference for direct product verification and trust in traditional retail channels for ethical certifications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Ethical Labels market include Abbot's Butcher Inc., Archer-Daniels-Midland Company, Cargill Inc., Garden of Life (Nestlé S.A.), Go Macro LLC, Kerry Group plc, Koninklijke DSM N.V., Marks and Spencer Group plc, The Hershey Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)