Erythropoietin Drugs Market Size, Share, Trends and Forecast by Drug Class, Product Type, Application, End User, and Region, 2025-2033

Erythropoietin Drugs Market Size and Share:

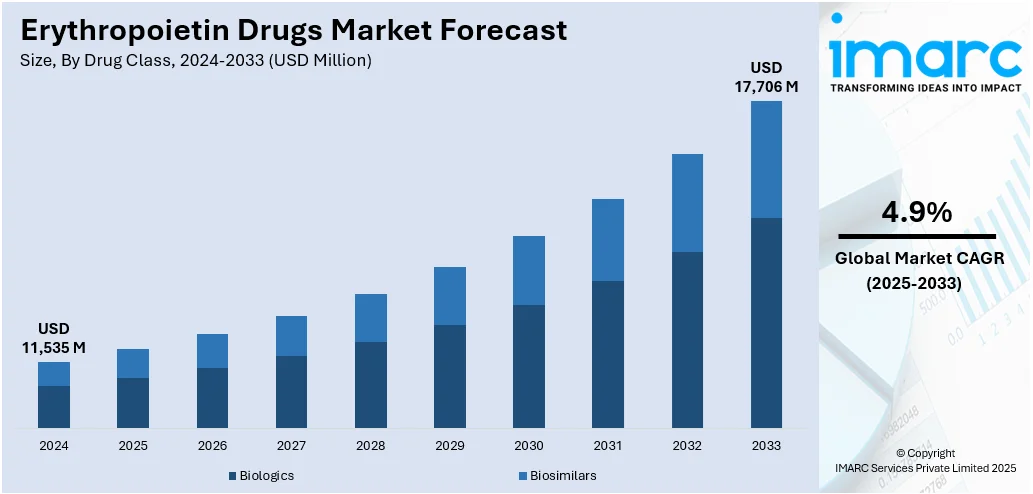

The global erythropoietin drugs market size was valued at USD 11,535 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 17,706 Million by 2033, exhibiting a CAGR of 4.9% from 2025-2033. North America currently dominates the market, holding a market share of 40.5% in 2024. The growing incidence of chronic diseases like cancer and kidney diseases is driving the demand for erythropoietin medication. Moreover, continuous advances in biopharmaceutical research are promoting the development of the next generation of erythropoietin drugs. Apart from this, the use of biosimilars due to mounting cost pressures in healthcare sector is expanding the erythropoietin drugs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11,535 Million |

|

Market Forecast in 2033

|

USD 17,706 Million |

| Market Growth Rate 2025-2033 | 4.9% |

The erythropoietin (EPO) drugs market is growing extensively due to the increasing attention of healthcare providers toward managing anemia of chronic kidney disease, cancer chemotherapy, and treatment of human immunodeficiency virus (HIV). Pharmaceutical companies are creating sophisticated formulations that enhance patient compliance and therapeutic effects. The market is growing with the increasing incidence of chronic diseases and the rising population of geriatric patients, which is driving the demand for efficacious erythropoiesis-stimulating agents. Health care systems across the globe are switching to biosimilar forms of erythropoietin medicines to cut costs of treatment, hence spurring competition and expanding patient access. Research organizations and biotechnology companies are investing in new delivery strategies and innovative biologics that are improving efficacy and safety profiles of EPO products, thereby offering a favorable erythropoietin drugs market outlook.

To get more information on this market, Request Sample

The United States EPO drugs market is continuously growing as healthcare professionals are giving increasing emphasis to the treatment of anemia in chronic kidney ailments and chemotherapy treatments. Hospitals and clinics nationwide are increasingly utilizing erythropoiesis-stimulating agents for better patient outcomes and improving the quality of life in patients receiving dialysis or chemotherapy. Pharmaceutical firms are investing in research and development (R&D) to bring enhanced formulations as well as biosimilars that are enhancing treatment options. Manufacturers and healthcare systems are promoting the utilization of more cost-effective biosimilars to lower the overall economic burden of anemia care, which is driving wider access to erythropoietin therapies. Regulatory agencies are simplifying approval procedures for biosimilars and new indications, which is allowing quicker market entry and driving competition among industry participants. Moreover, IMARC predicts that the United States biosimilar market is projected to attain USD 30.2 Billion by 2033.

Erythropoietin Drugs Market Trends:

Growing Incidence of Chronic Diseases

The growing incidence of chronic diseases like cancer and kidney diseases is driving the demand for erythropoietin medication. These illnesses usually cause anemia, in which erythropoietin treatment is critical in regulating low red blood cell count. The growing incidence of cancer worldwide, especially among older patients, also fuels the demand for supportive care like erythropoietin to treat anemia caused by chemotherapy. As per the Cancer Statistics 2025 by

American Cancer Society, A total of 2,041,910 new cases of cancer are projected for 2025, which translates to around 5,600 cases daily. In 2025, the projected total of new cancer cases for men across all sites is 1,053,250, with prostate, lung/bronchus, and colorectal cancers making up almost half (48%) of all identified cases. In 2025, the overall projected figure of new cancer cases for women across all types is 988,660, with breast, lung, and colorectal cancers making up 51% of these cases. Furthermore, the increased cases of chronic kidney disease (CKD) are contributing to the erythropoietin drugs market growth, given that these drugs are still essential in treating CKD-associated anemia.

Continual Advances in Drug Development

Continuous advances in biopharmaceutical research are promoting the development of the next generation of erythropoietin drugs, greatly improving efficacy and patient outcomes. In accordance with an industry report by AlphaSense, by 2025, 30% of novel drugs will be developed using artificial intelligence (AI). This is favorable for the introduction of long-acting erythropoietin formulations that minimize the dosing frequency and enhance patient compliance by providing more convenient dosing regimens. Apart from this, biotech firms are trying to develop biosimilars and new erythropoiesis-stimulating agents (ESAs) with fewer side effects, aimed at overcoming concerns related to safety. Such advancements not only present better therapeutic options but also have more cost-competitive prices, rendering them available in countries with limited healthcare budgets, thus fulfilling the demand of the erythropoietin drugs market and facilitating growth worldwide.

Emergence of Biosimilars

One of the major erythropoietin drugs market trends include the uptick in the use of biosimilars due to mounting cost pressures in healthcare sector and patent expirations of reference biologics. PwC anticipates an 8% annual medical cost trend for the Group market and 7.5% for the Individual market in 2025, influenced by inflation, prescription medication expenses, and the use of behavioral health services. Biosimilars provide an equally effective but less expensive option without sacrificing efficacy or safety, a reason for their widespread appeal across both emerging and developed markets. Governments and healthcare systems are encouraging the use of biosimilars to decrease treatment expenditures, especially in countries with limited healthcare budgets. This trend is also substantially increasing the market share of erythropoietin drugs as more biotechnology firms begin developing and releasing erythropoietin biosimilars, further increasing access to these vital treatments worldwide.

Erythropoietin Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global erythropoietin drugs market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug class, product type, application, and end user.

Analysis by Drug Class:

- Biologics

- Biosimilars

Biologics stand as the largest component in 2024, holding 55.2% of the market. They are providing dramatic advantages in managing a number of chronic and complex conditions, revolutionizing the field of contemporary medicine. Biologics are increasingly being prescribed by physicians to treat diseases like autoimmune diseases, cancers, and orphan diseases because of their mechanism of action and superior efficacy over conventional therapies. Pharmaceutical companies are designing innovative biologics that are meeting unmet medical needs, enhancing patient outcomes, and slowing disease progression rates. Patients are having better quality of life as biologics are delivering more targeted treatment with less side effect, which is facilitating long-term health outcomes and treatment compliance. Scientists are constantly finding new biologic agents that are better modulating the immune system and delivering tailored therapeutic strategies.

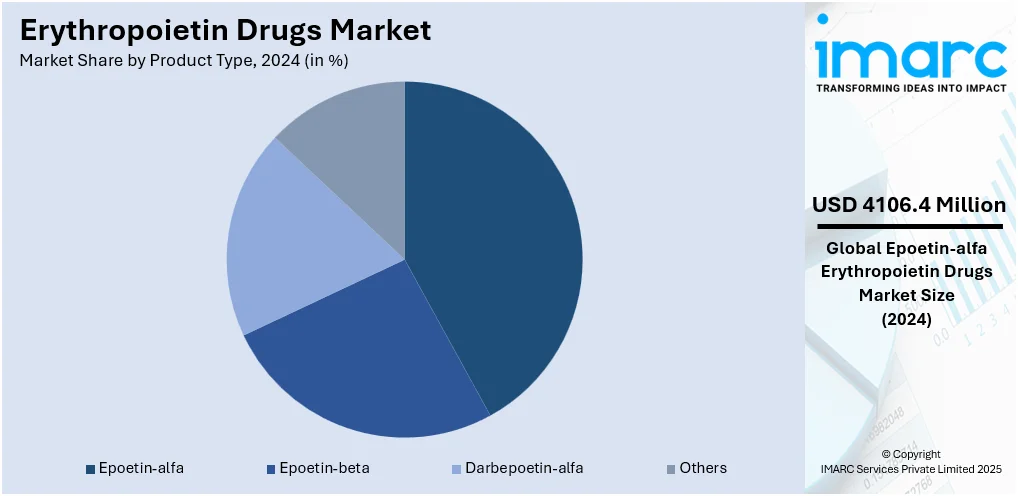

Analysis by Product Type:

- Epoetin-alfa

- Epoetin-beta

- Darbepoetin-alfa

- Others

Epoetin-alfa stands as the largest component in 2024, holding 35.6% of the market. It is acting as a critical erythropoiesis-stimulating agent that is assisting patients to cope with anemia related to chemotherapy, chronic kidney disease, and some HIV treatments. Doctors are prescribing epoetin-alfa to promote the manufacture of red blood cells, thereby limiting the frequency of repeated blood transfusions and enhancing the quality of life of patients. Hospitals and dialysis facilities are adopting epoetin-alfa as part of treatment regimens to help sustain hemoglobin levels and reduce side effects associated with severe anemia. Pharmaceutical manufacturers are making next-generation formulations of epoetin-alfa that are improving bioavailability and patient compliance with more flexible dosing regimens. Investigators are also conducting clinical trials to broaden its therapeutic applications and maximize dosing regimens, which is facilitating increased use across different clinical contexts. Governments are tracking the safety and efficacy profiles of epoetin-alfa while endorsing biosimilar versions for market entry and reducing treatment costs.

Analysis by Application:

- Hematology

- Kidney Disorder

- Cancer

- Others

Kidney disorder leads the market in 2024 as EPO drugs are taking a vital role in the treatment of anemia among patients suffering from chronic kidney diseases. Physicians are making wider use of EPO drugs to promote red blood cell production in patients whose kidneys have stopped making adequate amounts of natural erythropoietin because of their damaged function. Dialysis units and nephrology clinics are integrating EPO therapies into routine care regimens to prevent target hemoglobin levels from falling and minimize the reliance on repeated blood transfusions, which is decreasing related risks and complications. Pharmaceutical firms are creating sophisticated EPO formulations and biosimilars that are presenting improved dosing flexibility and enhancing compliance in patients. Researchers are investigating new delivery devices and dosing regimens that are optimizing treatment responses for patients with different stages of chronic kidney disease. Hospitals are educating healthcare professionals to monitor the response of patients to EPO therapy carefully, maintaining optimal dosing and reducing side effects like hypertension or thrombosis.

Analysis by End User:

- Hospitals

- Homecare

- Specialty Clinics

- Others

Hospitals lead the market in 2024 since they are increasingly using EPO drugs to manage anemia in patients with cancer, chronic kidney disease, and other conditions that impair red blood cell production. Nephrology and oncology departments are integrating EPO therapies into their treatment protocols to address anemia, particularly in patients undergoing dialysis or chemotherapy. Healthcare providers are closely monitoring patient responses to ensure appropriate dosing and minimize potential side effects, such as hypertension or clotting risks. Medical teams are administering EPO drugs in both inpatient and outpatient settings, improving patients’ hemoglobin levels and reducing the need for blood transfusions. Hospitals are adopting advanced EPO formulations that offer enhanced stability and bioavailability, which are making treatment regimens more effective and convenient for patients. Additionally, the introduction of biosimilars is helping hospitals reduce treatment costs while maintaining therapeutic efficacy, allowing broader access for economically diverse patient populations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 40.5%. The region is witnessing significant growth as healthcare professionals are increasingly addressing anemia related to chronic kidney disease, cancer chemotherapy, and other such conditions. Hospitals, dialysis facilities, and oncology departments are turning to EPO therapies to sustain hemoglobin levels in patients receiving dialysis or chemotherapy, enhancing patient care and minimizing the requirement for blood transfusions. Pharmaceutical manufacturers are continually working on developing next-generation EPO drugs, such as long-acting and biosimilar versions, that enhance treatment convenience and affordability. The increasing incidence of chronic kidney disease and cancer in North America is fueling the need for efficient anemia control solutions. Healthcare systems are focusing on cost-containment treatment options, with biosimilars being increasingly adopted as a cheaper option compared to original EPO medications. Regulatory bodies in the region are approving new drugs and adding indications, further driving the utilization of EPO medications across different patient populations.

Key Regional Takeaways:

United States Erythropoietin Drugs Market Analysis

The United States holds 88.20% share in North America. The market in the country is primarily driven by the rising incidence of chronic kidney disease (CKD), particularly among the aging population. According to reports, CKD affects 14% of the U.S. population, largely due to T2DM, hypertension, and obesity. Data from the US Renal Data System revealed that in 2020, CKD affected 33.2% of individuals aged 65 and older, compared to just 9% among younger adults. In line with this, the growing prevalence of chemotherapy-induced anemia is expanding erythropoietin drug usage across oncology care. The increasing adoption of biosimilars is reducing treatment costs while improving access and competition within the market. Furthermore, strategic partnerships between dialysis providers and pharmaceutical companies are optimizing the distribution and utilization of drugs. The medical community’s ongoing shift toward reducing transfusion reliance is bolstering higher drug uptake. Similarly, enhanced physician awareness of clinical guidelines for anemia management is fostering broader therapeutic adoption in both nephrology and oncology settings. Moreover, various reimbursement programs, such as CMS’s TDAPA, facilitating the integration of newer erythropoiesis agents into clinical practice, are creating lucrative opportunities in the market.

Europe Erythropoietin Drugs Market Analysis

The market in Europe is witnessing growth driven by the increasing prevalence of chronic kidney disease and anemia among the aging population. In accordance with this, heightened awareness and early diagnosis of anemia in oncology patients are broadening the market scope. Similarly, supportive regulatory frameworks established by the European Medicines Agency (EMA) facilitate the faster approval and adoption of innovative biologics and biosimilars. The rising investments in healthcare infrastructure across the region, along with improved patient access to advanced anemia treatments, are propelling market growth. Additionally, favorable government initiatives encouraging the uptake of biosimilars are enhancing treatment affordability. The growing demand for personalized medicine is promoting the development of targeted erythropoietin therapies tailored to individual patient needs. An industry survey found that 73% of respondents in France, Germany, Italy, and the UK supported sharing healthcare data for personalized treatment plans, while 76% expressed excitement about technology-driven data enhancing medical and surgical training. Furthermore, various cross-border clinical trials and collaborations within the EU are accelerating product innovation and therapeutic effectiveness, thereby impacting market trends.

Asia Pacific Erythropoietin Drugs Market Analysis

The Asia Pacific market for erythropoietin drugs is significantly influenced by rapid urbanization and the rising prevalence of chronic diseases. As per WHO, in South-East Asia, noncommunicable diseases (NCDs) account for 62% of all deaths, around 9 million, highlighting a significant burden of premature mortality before age 70. Similarly, supportive government initiatives aimed at enhancing healthcare infrastructure and expanding access to advanced biologics are improving treatment availability across the region. The growing awareness and improved diagnosis of anemia in rural and underserved populations are strengthening market demand. Furthermore, increased investments by pharmaceutical companies in local manufacturing and research & development are enhancing product accessibility and affordability. Additionally, the expansion of health insurance coverage in emerging economies, facilitating broader patient access to anemia treatments, is stimulating market appeal. Besides this, the growing geriatric population, accompanied by associated comorbidities, is driving demand for erythropoietin drugs, thereby sustaining the market’s robust presence.

Latin America Erythropoietin Drugs Market Analysis

In Latin America, the market is advancing due to the increasing prevalence of anemia associated with chronic kidney disease and chemotherapy. In addition to this, expanded access through government-subsidized healthcare programs in Brazil, Argentina, and Colombia is improving patient reach. Furthermore, increasing clinical trial activity and regulatory harmonization across LATAM markets, which are attracting global biopharma investments, are impelling growth in the market. According to data from ANVISA (Brazilian Health Regulatory Agency), Brazil ranks among the world’s top 20 countries for clinical research, leading Latin America. Between 2019 and 2024, the number of clinical studies conducted annually in Brazil increased from 300 to 500, as reported by the Brazilian Association of Representative Clinical Research Organizations (ABRACO). Moreover, growth in regional efforts to localize biologics manufacturing and distribution is bolstering supply chain resilience and affordability, which in turn is promoting industry advancement.

Middle East and Africa Erythropoietin Drugs Market Analysis

The market in the Middle East and Africa is gaining momentum due to a rising prevalence of chronic kidney disease and associated anemia, particularly across aging and diabetic populations. Furthermore, national health transformation plans, such as Saudi Arabia’s Vision 2030 and the UAE’s Health Strategy 2021–2031, are enhancing access to biologics and investing in infrastructure. Additionally, the growth of inbound medical tourism in hubs like Dubai and Cape Town, which facilitates the adoption of advanced anemia therapies, is enhancing market accessibility. A recent report by the Dubai Health Authority (DHA) revealed that in 2023, Dubai’s health tourism sector experienced notable growth, attracting over 691,000 international health tourists who spent more than AED 1.03 Billion on healthcare services, exceeding 2022 figures of 674,000 tourists and AED 992 Million in spending. Apart from this, increased localization efforts by global pharmaceutical firms through partnerships and technology transfer are accelerating regional drug availability and market expansion.

Competitive Landscape:

Market players are actively engaging in research activities to enhance the efficacy, safety, and accessibility of their products. Pharmaceutical companies are focusing on the development of innovative long-acting formulations and biosimilars to meet the growing demand for cost-effective anemia treatments. They are also forming strategic partnerships and collaborations with biotechnology firms to expand their product portfolios and improve distribution networks. Additionally, market players are increasing investments in clinical trials to gain regulatory approvals for new indications and formulations. As per the erythropoietin drugs market forecasts, companies are expected to focus on expanding their presence in emerging markets, where the demand for EPO drugs is rising due to the growing prevalence of chronic diseases and improving healthcare infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the erythropoietin drugs market with detailed profiles of all major companies, including:

- Amgen Inc.

- Biocon Limited

- Dr. Reddy’s Laboratories Ltd.

- F. Hoffmann-La Roche AG

- Intas Pharmaceuticals Ltd.

- Johnson & Johnson

- LG Chem Ltd.

- Pfizer Inc.

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

Latest News and Developments:

- March 2025: Julphar announced an exclusive licensing partnership with Dong-A ST to manufacture and commercialize Darbepoetin Alfa biosimilar, a long-acting erythropoietin formulation, in the MENA region. This collaboration aims to expand Julphar’s biologics portfolio, enhancing access to innovative treatments for patients with chronic kidney disease in the region.

- February 2025: AstraZeneca acquired full China rights to roxadustat from FibroGen for USD 160 Million. Roxadustat, a HIF-PH inhibitor that boosts erythropoietin production to treat CKD-related anemia, remains a top seller in China. FibroGen will use proceeds to fund prostate cancer drug trials and explore U.S. reentry for roxadustat.

- January 2025: Akebia began U.S. distribution of Vafseo (vadadustat), an oral HIF-PH inhibitor that boosts erythropoietin to treat CKD-related anemia in dialysis patients. With nearly 100% dialysis coverage secured, Akebia plans a Phase 3 trial in non-dialysis patients, aiming to expand access to this erythropoiesis-stimulating treatment.

- August 2024: RNA Therapeutics received FDA feedback on RNAT-89, the first mRNA-based therapeutic protein expressing darbepoetin for anemia. With FDA support on naming and streamlined testing, RNAT-89 aims to disrupt the USD 9.7 Billion erythropoietin market by reducing treatment costs from USD 1,000 to under USD 50.

- July 2024: Genexine merged with EPD Biotherapeutics to integrate mRNA-based bioPROTAC technology for targeting undruggable proteins. This complements Genexine’s pipeline, including GX-E4 for CKD-induced anemia linked to erythropoietin deficiency. EPD’s platform enables protein degradation via mRNA, enhancing drug development beyond small-molecule limitations. Merger finalization is expected by October.

- June 2024: Keros Therapeutics presented Phase 2 data showing elritercept’s durable transfusion independence in lower-risk MDS and anemia improvement in myelofibrosis. The therapy benefits patients with low erythropoietin levels, offering an alternative to ESAs, and showed quality-of-life improvements and reduced spleen size and symptoms, supporting Phase 3 advancement.

Erythropoietin Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

xploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Biologics, Biosimilars |

| Product Types Covered | Epoetin-alfa, Epoetin-beta, Darbepoetin-alfa, Others |

| Applications Covered | Hematology, Kidney Disorder, Cancer, Others |

| End Users Covered | Hospitals, Homecare, Specialty Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., Biocon Limited, Dr. Reddy’s Laboratories Ltd., F. Hoffmann-La Roche AG, Intas Pharmaceuticals Ltd., Johnson & Johnson, LG Chem Ltd., Pfizer Inc., Sun Pharmaceutical Industries Limited and Teva Pharmaceutical Industries Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the erythropoietin drugs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global erythropoietin drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the erythropoietin drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The erythropoietin drugs market was valued at USD 11,535 Million in 2024.

The erythropoietin drugs market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 17,706 Million by 2033.

Key factors driving the market include the rising incidence of chronic diseases like cancer and kidney disorders, advancements in biopharmaceutical research, and the growing adoption of cost-effective biosimilars. Additionally, the aging population and the increasing demand for effective anemia treatments are contributing to market growth.

North America currently dominates the erythropoietin drugs market, accounting for a share of 40.5% in 2024. The region benefits from high disease prevalence and advanced healthcare infrastructure.

Some of the major players in the erythropoietin drugs market include Amgen Inc., Biocon Limited, Dr. Reddy’s Laboratories Ltd., F. Hoffmann-La Roche AG, Intas Pharmaceuticals Ltd., Johnson & Johnson, LG Chem Ltd., Pfizer Inc., Sun Pharmaceutical Industries Limited, Teva Pharmaceutical Industries Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)