Environmental Monitoring Market Size, Share, Trends and Forecast by Component, Product Type, Sampling Method, Application, and Region, 2025-2033

Environmental Monitoring Market Size and Share:

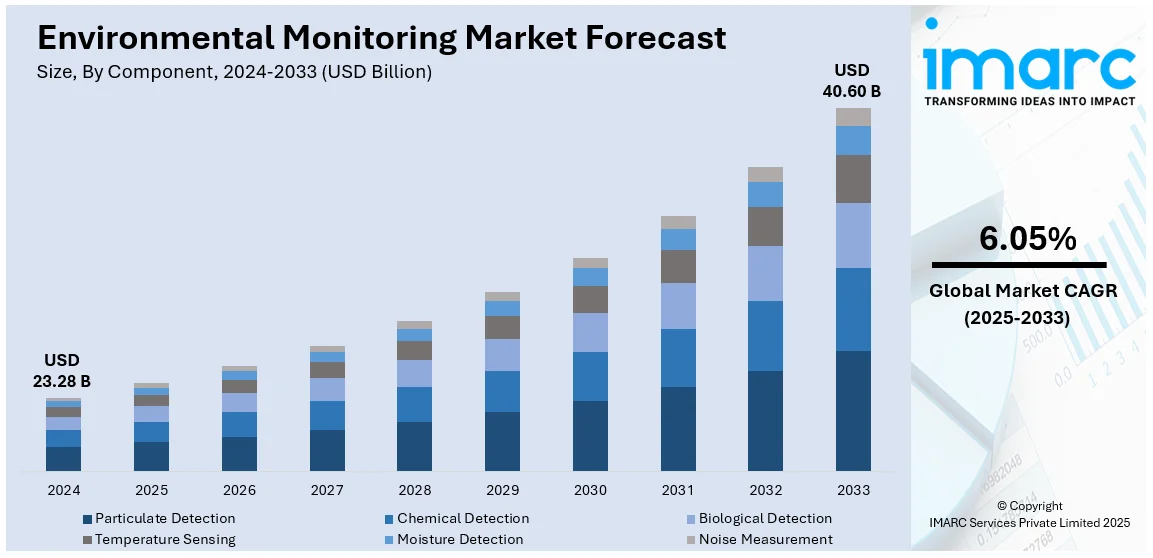

The global environmental monitoring market size reached USD 23.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.60 Billion by 2033, exhibiting a growth rate (CAGR) of 6.05% during 2025-2033. North America currently dominates the market, holding a market share of over 37.0% in 2024. The rising global awareness about environmental issues, significant technological advancements in monitoring equipment, the growing demand for sustainable resource management, increasing stringent government regulations for pollution control, and the rising efficient use of natural sources are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.28 Billion |

|

Market Forecast in 2033

|

USD 40.60 Billion |

| Market Growth Rate (2025-2033) | 6.05% |

The environmental monitoring market is influenced by increasing regulatory requirements for pollution control, heightened public awareness of environmental issues, and the increasing need for advanced monitoring technologies. Key drivers include rising industrial activities, urbanization, and the subsequent demand for monitoring air, water, and soil quality.. Government initiatives supporting sustainable development and enforcing stricter environmental standards are pivotal in driving market growth. Additionally, technological innovations, including the integration of IoT and AI in monitoring systems, enhance data precision and efficiency, contributing to increased adoption.For instance, in August 2024, CSIR-NPL launched a certification framework for Continuous Emission Monitoring Systems (CEMS) in India aimed at enhancing data quality for regulatory compliance. This initiative follows a five-year effort and addresses concerns over CEMS reliability marking a significant step towards improved environmental monitoring and adherence to pollution control standards. The growing focus on climate change and resource depletion further underscore the importance of robust environmental monitoring solutions.

Key drivers of the Unites States environmental monitoring market include stringent federal and state regulations, such as those enforced by the Environmental Protection Agency (EPA), aimed at controlling pollution and protecting natural resources. For instance, in February 2024, EPA strengthened the National Ambient Air Quality Standards for Particulate Matter (PM NAAQS) by setting the primary annual PM2.5 standard at 9.0 micrograms per cubic meter. The current 24-hour PM2.5 standards and PM10 standards remain unchanged, while the Air Quality Index and monitoring network are revised. Industrial expansion, particularly in sectors like manufacturing and energy, increases the demand for monitoring solutions to comply with these regulations. Significant technological advancements, including IoT-enabled devices and real-time analytics, strengthen the accuracy and efficiency of monitoring processes, thus facilitating adoption. The rising awareness of climate change, water scarcity, and air quality concerns also plays a significant role. Additionally, government funding and initiatives to promote environmental sustainability drive market growth.

Environmental Monitoring Market Trends:

Growing Regulatory Policies and Requirements

The rising strict government regulations regarding environmental protection and pollution control mandate the monitoring of water, soil, air, and other environmental elements. These regulations ensure industries comply with environmental standards, thereby preventing and minimizing pollution. For instance, the World Bank program is introducing tools for airshed management and planning to support state and regional air quality management approaches. These efforts aim to facilitate the creation of India's inaugural State-wide Air Quality Action Plans and the first extensive Regional Airship Action Plan for the Indo-Gangetic Plains (IGP), covering seven union territories and states. A study by the World Bank and International Institute for Applied Systems Analysis (IIASA) shows that focusing on air pollution through a clean air pathway out to 2030 could bring about significant climate change co-benefits for India. Such a pathway, for example, will reduce India's CO2 emissions by 23% by 2030 and 42% by 2040-50. This is further influencing the environmental monitoring market statistics significantly.

Significant Advances in Technology

The increasing innovations in technology, such as the development of artificial intelligence (AI), Internet of Things (IoT), and remote sensing technologies are significantly enhancing the effectiveness and efficiency of environmental monitoring. These technologies enable real-time data collection and analysis, improving the accuracy and timeliness of environmental assessments. For example, in October 2022, Agilent Technologies launched an enhanced version of its 8700 LDIR Chemical Imaging System, which has been further optimized for analyzing microplastics in environmental samples. The newly improved package includes Clarity 1.5 software, a significant upgrade that advances the speed of analysis, enhances spectral acquisition, transformation, and library matching, and provides automated workflows for direct analysis of microplastics on a filter substrate. An innovative, redesigned sample holder allows the on-filter sample to be presented to the instrument more easily and consistently. This is expected to fuel the environmental monitoring market revenue.

Rising Environmental Concerns and Public Awareness

The increasing public awareness about environmental issues including climate change, water and air quality, and biodiversity loss is driving the demand for environmental monitoring. This awareness influences government policies and corporate practices which is leading to greater investment in environmental monitoring infrastructure and technologies. For instance, in November 2022, 3M and the US Environmental Protection Agency (EPA) agreed on plans to address per- and polyfluoroalkyl substances (PFAS) in the Cordova region. Through the agreement, 3M will build on its work address past PFAS manufacturing in the area and install new and innovative technologies at its Cordova site that will enhance the quality of water used in its operations.

Environmental Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, product type, sampling method, and application.

Analysis by Component:

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

Particulate Detection leads the market with around 29.6% of market share in 2024. The demand for particulate detection components in the market is driven by the growing health concerns related to air quality and the associated risks of respiratory diseases. Strict regulatory standards for air pollution control necessitate precise monitoring of particulate matter. Industrialization and urbanization escalate air quality degradation, boosting the need for effective monitoring solutions. For instance, according to the Central Pollution Control Board (CPCB) report submitted to the National Green Tribunal on March 20, the central pollution control body has disbursed only rupees 156.33 of the total rupees 777.69 crore collected under the two heads- environmental Protection charge (EPC) and environmental compensation (EC).

Analysis by Product Type:

- Environmental Monitoring Sensors

- Environmental Monitors

- Environmental Monitoring Software

- Wearable Environmental Monitors

Environmental monitors leads the market with around 52.2% of market share in 2024. The demand for environmental monitors in the market is influenced by factors like the rising global environmental regulations, public awareness of health impacts related to pollution and advancements in technology. Industrialization and urbanization contribute to environmental degradation, escalating the need for comprehensive monitoring tools. The integration of IoT and big data analytics enhances the functionality and appeal of environmental monitoring products, facilitating real-time data collection and more accurate environmental assessment, which is further boosting the environmental monitoring market demand across the globe.

Analysis by Sampling Method:

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

Continuous Monitoring lead the market with around 57.9% of market share in 2024. The demand for continuous monitoring sampling methods in the market is major influenced by the demand for real-time data collection and analysis to swiftly detect and respond to environmental hazards. Continuous monitoring allows for the ongoing assessments of water, air, and soil quality, crucial for compliance with shrink environmental regulations. The rising industrial activity necessitates constant surveillance to ensure operational safety and Environmental Protection. Significant advancements in sensor technology and IoT integration enable more reliable and efficient continuous monitoring systems.

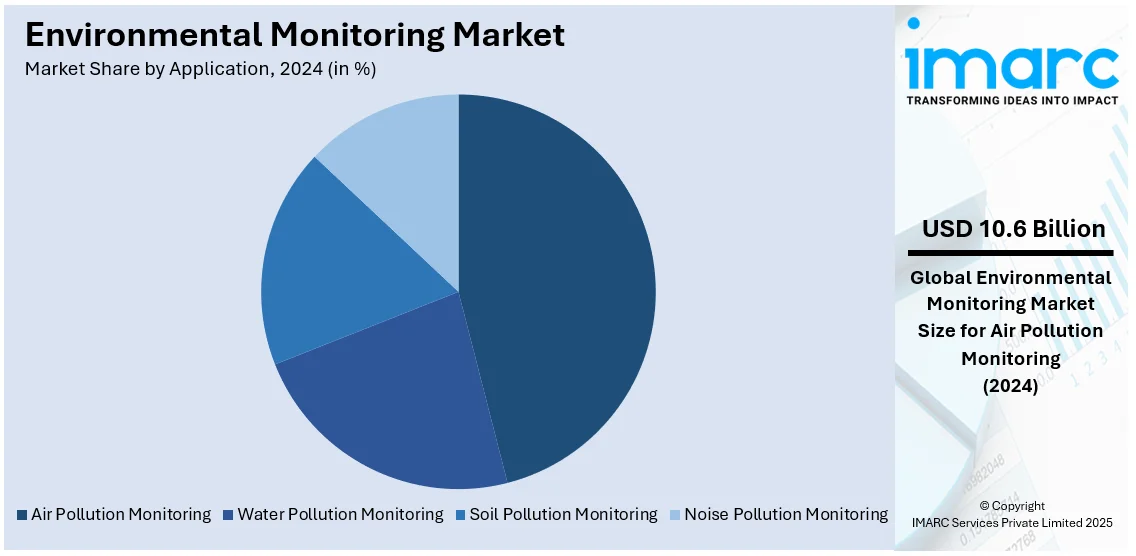

Analysis by Application:

- Air Pollution Monitoring

- Water Pollution Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

Air pollution monitoring leads the market with around 45.5% of market share in 2024. The role of air pollution monitoring applications in the market is fueled by various factors including increasing awareness of air quality issues and their impact on health and the environment which necessitates robust monitoring solutions. Strict regulatory standards for air quality around the world require effective enforcement tools, thus making air pollution monitoring essential. Significant technological advancements are enhancing the precision and efficiency of monitoring devices which is supporting more comprehensive air quality management. The growing urban population and increased industrial activity contribute to air pollution, raising the demand for continuous and accurate air quality assessment to guide policy-making and health advisories.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.0%. The increasing public awareness about environmental issues, strict environmental regulations, and significant advanced technological infrastructure are driving the growth of the market across the region. Technological innovations in IoT and remote sensing are enabling more precise and real-time environmental data collection. Initiatives to combat climate change and improve air and water quality further stimulate investment and development in the environmental monitoring sector in this region. For instance, in April 2024, the BAE System’s Weather System Follow-on-Microwave (WSF-M) satellite successfully launched from Vandenberg Space Force Base in California. The US Space Forces Space Systems Command's next-generation operational environmental satellite system will provide valuable data to help ensure the safety and success of warfighters as they carry out their missions around the world.

Key Regional Takeaways:

United States Environmental Monitoring Market Analysis

In 2024, the United States captured 78.20% of the North American market. Stricter laws, new technology, and increased public awareness of environmental issues are driving the US environmental monitoring market. It is in this regard that the U.S. Environmental Protection Agency (EPA) plays a crucial role in upholding statutes like the Clean Air Act and Clean Water Act, which call for ongoing monitoring of air and water quality. The necessity for sophisticated monitoring systems is highlighted by the fact that about 100 million Americans reside in regions that do not fulfil federal air quality requirements, as per the data by U.S. Environmental Protection Agency. Furthermore, according to the data from the World Economic Forum, over 50% of lakes, rivers, and streams in the United States are estimated to be impaired, thus providing a motivation for investments in water quality monitoring systems. The industry is changing because of technological developments including real-time IoT-based monitoring tools. Expenses related to monitoring greenhouse gases also have drivers based on rising average U.S. temperatures over 1986-2016 by 1.2°F. Due to increased levels of pollution related to urbanisation and industrialisation, the industry, energy sector, and all types of enterprises adopt advanced technology in monitoring their environment. According to an industrial report, the significance of monitoring technologies is compounded by public health risks from the air, approximately an annual expense to the United States economy in the amount of USD 150 Billion.

Europe Environmental Monitoring Market Analysis

Europe's commitment to sustainability, robust laws, and technological advancement have a critical impact on the market of environmental monitoring. This need for monitoring systems is driven by the European Union's Green Deal and its "Fit for 55" package, where greenhouse gas emissions are targeted to be cut by 55% in 2030. Emphasis on air pollution control is underlined by over with more than 4,000 air quality monitoring stations across the EU and enhanced use of air quality modeling, according to the data of European Union. Since the EU's Water Framework Directive requires the member states to achieve "good" ecological and chemical status for water bodies, quality monitoring of water is also needed. The increasing trend of air pollution cases motivates the monitoring efforts also. For example, data from the European Environment Agency have recorded 275,000 premature deaths in 2022 due to poor air quality. Sustainable development includes investment in renewable energy and urban green projects including the smart cities of Netherlands and Germany. The European Environment Agency's push for the sharing of real-time data also promotes the use of IoT-based monitoring tools.

Asia Pacific Environmental Monitoring Market Analysis

Rapid urbanisation, industrialisation, and environmental deterioration have increased the need for environmental monitoring in the Asia-Pacific region. In addition, around 4 billion people or 92% of Asia and the Pacific population, are exposed to levels of air pollution that have serious harmful effects on health, reports the Climate and Clean Air Coalition. Government regulations are being enforced more frequently. In such programs, an example is National Clean Air Programme in India for reducing the concentration of 20-30% particles by 2024, and China's Blue Sky Action Plan for minimizing pollution. In the case of water pollution, 80% of Asia's wastage is released untreated. With real-time monitoring technologies as part of the Japan's Smart City projects, some end. Growing public awareness of the damage pollution causes to health is boosting the adoption of IoT and AI-based environmental monitoring technologies in the region.

Latin America Environmental Monitoring Market Analysis

Concerns about pollution, deforestation, and climate change are the main drivers of the environmental monitoring market in Latin America. Monitoring is required at the highest levels because more than 20% of the oxygen produced on earth comes from the Amazon rainforest, which witnesses alarming deforestation rates. Governments have already set up air quality monitors in many places because more than 150 million people in this area live in cities that don't comply with air quality standards, even PM10 (UNEP and CCAC 2018). According to the World Water Council, water scarcity and contamination are serious issues due to more than 77 million people lacking access to clean water. Initiatives such as Brazil's National Environment System (SISNAMA) aim to improve the monitoring infrastructure. Industrial emissions from industries such as mining and agriculture further point to the need for high-tech environmental monitoring equipment.

Middle East and Africa Environmental Monitoring Market Analysis

Climate change, pollution, and water shortages are the most significant drivers of environmental monitoring in the Middle East and Africa. Twelve of the world's most water-stressed nations are in this region, making advanced water quality monitoring systems a must. With PM2.5 levels over safe limits in places like Riyadh and Johannesburg, air pollution, associated with fast urbanisation and industrial activity, is becoming an increasingly big problem. For efficiency and compliance, renewable energy projects- such as the USD 50 Billion Saudi program on solar-include environmental monitoring. Governments are using IoT-based solutions to monitor the health of the ecosystems and desertification in places that risk it.

Competitive Landscape:

The competitive landscape of the market represents a dynamic and shows a mix of emerging contenders and established players. Key players include major technology and industrial firms that specialize in analytical and monitoring equipment along with software solutions for data management and analysis. These companies compete on technological innovations, accuracy, reliability, and integration capabilities of their systems. Acquisitions and partnerships are common strategies to expand product offerings and geographic reach. For instances, in February 2024, Danaher Corporation announced that it has committed to set science-based greenhouse gas (GHG) emission reduction targets in line with the Science Based Targets initiative (SBTi), including a long-term target to reach net zero value chain emissions by no later than 2050.

The global environmental monitoring market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Company

- Agilent Technologies Inc.

- Danaher Corporation

- Emerson Electric Co.

- General Electric

- Honeywell International Inc.

- Horiba Ltd.

- Merck KGaA

- Siemens AG

- TE Connectivity

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- August 2024: Honeywell has launched a new advanced emissions monitoring system designed for offshore oil and gas operations. The goal of this system is to improve real-time emissions and air quality monitoring, assisting businesses in meeting legal obligations and enhancing their environmental performance. Advanced sensors and analytics are integrated into the technology to offer precise emissions data, guaranteeing sustainable and compliance operations.

- June 2024: Two new products from Agilent Technologies Inc. (NYSE: A) will be unveiled at the 72nd ASMS Conference on Mass Spectrometry and Related Topics. Designed for the food and environmental sectors, the Agilent 7010D Triple Quadrupole GC/MS System offers exceptional sensitivity and precision in gas chromatography-mass spectrometry.

- April 2023: GE announced additional options for enhanced emission reduction technologies now accessible for its LM25000XPRESS aeroderivative gas turbine fleet globally, following the successful installation of the gas turbine in Colorado. This announcement follows GR's introduction of the world’s first technical solution using four TM2500 aeroderivative gas turbines at the Department of Water Resources’ (DWR) facilities in Yuba City and Roseville, effectively reducing nitrogen oxide (NOx) and carbon monoxide (CO) emissions by more than 90%, exceeding the World Bank Emissions Standard.

- February 2023: Emerson combined its comprehensive power expertise and renewable energy capabilities into the Ovation Green portfolio to help power generation companies meet the needs of customers navigating the transition to green energy generation and storage. By uniting the recently acquired Mita-Teknik software and technology with its own industry-leading Ovation automation platform, deep renewable energy knowledge base, cybersecurity solution, and remote management capability, Emerson has created a new extension of its power-based control architecture.

- February 2022: Agilent Technologies acquired Virtual Control’s ACIES advanced artificial intelligence (AI) technology, which has been developed for innovative analysis solutions in lab testing.

Environmental Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, Noise Measurement |

| Product Types Covered | Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, Wearable Environmental Monitors |

| Sampling Methods Covered | Continuous Monitoring, Active Monitoring, Passive Monitoring, Intermittent Monitoring |

| Applications Covered | Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, Noise Pollution Monitoring |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Agilent Technologies Inc., Danaher Corporation, Emerson Electric Co., General Electric, Honeywell International Inc., Horiba Ltd., Merck KGaA, Siemens AG, TE Connectivity, Teledyne Technologies Incorporated, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, environmental monitoring market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global environmental monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the environmental monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Environmental monitoring involves the systematic collection and analysis of environmental data such as air, water, and soil quality to assess, manage, and mitigate pollution, ensuring compliance with environmental regulations and promoting sustainability.

The global environmental monitoring market was valued at USD 23.28 Billion in 2024.

IMARC estimates the global environmental monitoring market to exhibit a CAGR of 6.05% during 2025-2033.

The market is driven by rising environmental awareness, stringent regulations, technological advancements in monitoring tools, industrial expansion, and the demand for sustainable resource management solutions.

Particulate detection is the leading segment by component, driven by strict air pollution standards and rising health concerns.

In 2024, environmental monitors represented the largest segment by product type, driven by advancements in IoT and data analytics integration.

Continuous monitoring leads the market by sampling method owing to the demand for real-time environmental data collection.

Air pollution monitoring is the leading segment by application, driven by growing regulatory requirements and concerns over health impacts of air pollution.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global environmental monitoring market include 3M Company, Agilent Technologies Inc., Danaher Corporation, Emerson Electric Co., General Electric, Honeywell International Inc., Horiba Ltd., Merck KGaA, Siemens AG, TE Connectivity, Teledyne Technologies Incorporated, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)