Environment, Health, and Safety Market Size, Share, Trends and Forecast by Component, Deployment Type, Vertical, and Region, 2025-2033

Environment, Health and Safety Market Size and Share:

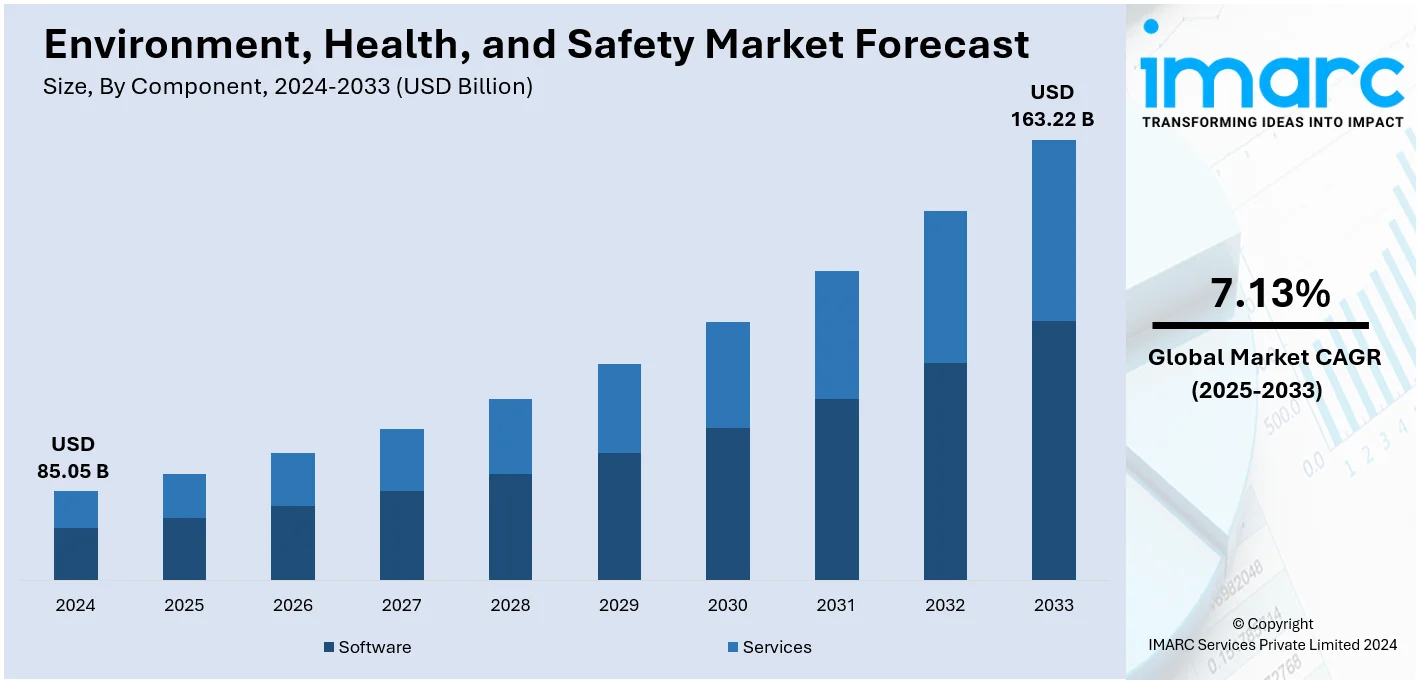

The global environment, health and safety market size was valued at USD 85.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 163.22 Billion by 2033, exhibiting a CAGR of 7.13% from 2025-2033. North America currently dominates the environment, health and safety market share by holding 37.5% in 2024. The growth of the environment, health, and safety (EHS) market in the region is fueled by stringent government regulations, heightened concerns regarding industrial safety, and the increasing demand for sustainable practices and corporate responsibility across different sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 85.08 Billion |

|

Market Forecast in 2033

|

USD 163.22 Billion |

| Market Growth Rate 2025-2033 | 7.13% |

On a global scale, environment, health, and safety market growth is largely driven by the need for regulatory compliance and adherence to industry-specific standards. These policies encourage the companies to adopt EHS solutions, which is aiding the market growth. In addition, the growing environmental awareness among consumers and businesses drives the need for sustainable practices, driving the market demand Moreover, the increasing focus on workplace safety and employee health, particularly in high-risk industries, is contributing to the market expansion. Besides this, ongoing advancements in technology, including artificial intelligence (AI) and Internet of Things (IoT), enable more efficient EHS management, providing an impetus to the market. For instance, Ideagen a UK based software provider firm declared about its plan to acquire Damstra Technology an EHS software firm based in Australia. This strategic acquisition highlights the industry's focus on regional expansion and technological integration to meet growing demands. Also, the rise in corporate social responsibility (CSR) initiatives encourages organizations to invest in EHS solutions, impelling the market growth.

To get more information on this market, Request Sample

The United States accounts for 86.80% of the total market share. The environment, health, and safety market demand is driven by the increased insurance premiums due to non-compliance and safety violations. For example, laws put in place by institutions like the Occupational Safety and Health Administration (OSHA) and Environmental Protection Agency (EPA) drive increase in company’s EH&S standards to evade penalties and fines for noncompliance. These regulations promote companies to adopt better EHS practices, supporting the market growth. In line with this, the rising demand for real-time data analytics enables improved monitoring and decision-making for EHS management, fostering the market growth. Concurrently, the growing emphasis on climate change and environmental protection drives the need for more effective waste management and pollution control, thus strengthening the environment, health, and safety market share. Furthermore, workforce diversity and inclusion initiatives require comprehensive health and safety protocols, catalyzing the market growth. Additionally, the shift towards remote work creates new challenges in ensuring employee safety, which is aiding in the market expansion. Apart from this, heightened investor focus on sustainability increases demand for EHS solutions, thereby propelling the market forward.

Environment, Health and Safety Market Trends:

Regulatory Compliance

The escalating need to maintain regulatory compliance is significantly enhancing the environment, health, and safety market outlook. In addition, governing agencies of several countries are imposing stringent environmental and safety regulations to protect public health and the environment. Apart from this, the increasing need for EHS solutions and services among organizations to meet these standards is impelling the market growth. Also, compliance entails to standards concerning emission, waste, and workers. In line with this, non-compliance leads to serious penalties and reputational loss of the company in terms of the law. Also, organizations are investing in EHS software and consulting services to be at par with the current regulations. In addition to this, EHS solutions assist in automating compliance reports, observing the changes in regulation and also in terms of the collection of data and reporting. This proactive approach not only saves organizations from penalties but also shows that the firm is environmentally and safety responsible which boosts the image of the company among the stakeholders.

Technological advancements

Ongoing technological advancements in EHS, including IoT, big data analytics, and AI, are strengthening the growth of the market. In line with this, IoT sensors can monitor air quality, equipment performance, and worker conditions in real time, providing valuable data for risk assessment and preventive actions. For instance, number of connected IoT devices rising between 13% and 18.8 billion in the year 2024. Furthermore, the large data analytics assists organizations in handling large volumes of market trends, future challenges and improvements in processes, which is driving the market demand. Besides this, the use of AI to predict the possibility of an equipment failure will help improve safety and minimize breakdowns. Moreover, with the use of the mobile apps and cloud systems in EHS reporting platforms, the process is made more convenient and can be monitored remotely for the different teams involved. In addition, wearables gain in increasing the safety of the workers by offering notifications and monitoring the exposure to risk factors. As a result, these technologies enhance the efficiency of the EHS measures while allowing the companies to make decisions based on information and increase the efficiency of the entire process and safety.

Industry-specific challenges

Different industries experience distinct EHS risks because of their procedures and activities. Moreover, the manufacturing industry is involved in working with dangerous substances, chemicals and emissions management among others while the construction industry encompasses working on safety, site and other legal concerns in the construction sites in different areas. In addition, EHS solutions must be tailored to address these specific challenges. It also fosters the specific adaptation of EHS services and software to industries, aligning with the individual needs of companies. In addition, solutions that are specific to an industry go beyond improving EHS performance and compliance and offer a positive impact to operational performance and sustainability. They assist organizations to address risks that are peculiar to their industries and reduce them by implementing safer and more responsible business strategy. Additionally, the market is experiencing significant growth due to the increasing focus on worker safety. According to reports, workplace injuries were recorded at 10,733 in FY23 from 9,889 cases in FY22. Also, the need for specific solutions integrated in healthcare organizations to advance patient safety, and reduce the rate of medical mistakes, is driving the market forward.

Environment, Health and Safety Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global environment, health and safety market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment type, and vertical.

Analysis by Component:

- Software

- Services

- Analytics

- Project Deployment and Implementation

- Business Consulting and Advisory

- Audit, Assessment and Regulatory Compliance

- Certification

- Training and Support

In 2024, services represent the largest segment, accounting for approximately 95.4% of the market. This segment comprises consultants who specialize in EHS compliance and risk assessment, sustainability strategy. They help organizations to follow up with the legal needs and put in place the right EHS management systems. Furthermore, there are training providers who provide courses and programs for EHS to aware employees, managers and executives of right safety procedures, legal requirements and proper practices. Besides this, EHS audits and assessments are performed by service providers in order to assess the EHS performance of an organization, to determine the EHS opportunities for improvement along with checking on the compliance aspect.

Analysis by Deployment Type:

- On-premises

- Cloud-based

Cloud-based leads the market with around 68.7% of market share in 2024. This segment based EHS solutions are hosted on remote servers and accessed via the internet. They also have several advantages including, availability, expansibility, cheaper and self-updating. Moreover, EHS data and tools are available on the internet, so the users can work remotely and in collaboration with other people. Cloud solutions can be easily expanded or contracted to meet the needs of the organization and are applicable to any size organization. They can be cheaper in the long run as well as in the beginning since as do not require major investments in equipment, cutting down the information technology (IT) costs for maintenance. Furthermore, cloud providers themselves manage both the updates of the software and their optimization, which allows users to use the latest options and improvements of security.

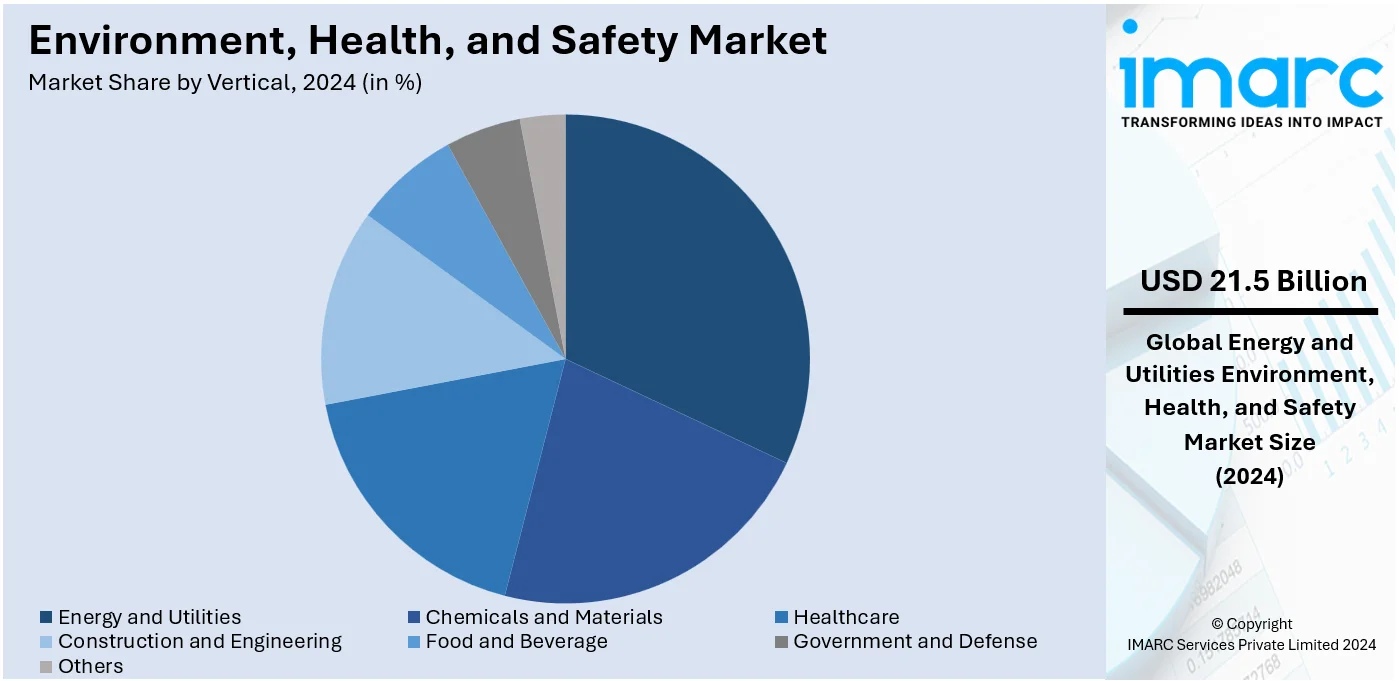

Analysis by Vertical:

- Energy and Utilities

- Chemicals and Materials

- Healthcare

- Construction and Engineering

- Food and Beverage

- Government and Defense

- Others

Energy and utilities lead the market with around 25.3% of the market share in 2024. This segment includes oil and gas, renewable energy (RE), and traditional utilities. EHS focuses on the safety of workers, emissions monitoring, and compliance with energy and environmental regulations. Apart from this, EHS solutions in this sector heavily emphasize protection of the workers in the risky sectors like the oil rig and power plants. They also have incorporated environmental issues, including emission and waste disposal. Additionally, controlling emissions, being compliant to the set laws and integrating the green and safe energy systems are essential for fulfilling both the government demand and the growing market demand from consumers and stakeholders.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5%. The growing demand in the region is driven by strict regulatory requirements and a heightened emphasis on workplace safety. The growth of the EHS market in this region is primarily driven by the increasing government regulations and compliance standards across industries like manufacturing, energy, and construction. Additionally, heightened public awareness and demand for environmental sustainability encourage companies to invest in robust EHS systems. Moreover, the integration of modern technologies including AI, IoT and cloud solutions in the region allows to monitor and take real-time decisions. In addition, there is an increasing concern of the health of workers, especially in the light of mental health and ergonomics in the workplace. Furthermore, trends created by CSR activities of companies to reduce their environmental impact and satisfy shareholders are significantly propelling the market forward.

Key Regional Takeaways:

United States Environment, Health and Safety Market Analysis

The adoption of environment, health, and safety (EHS) measures is surging alongside advancements in power generation and distribution. According to U.S. Energy Information Administration, the growing demand for electricity in the U.S., reaching 4.07 trillion kWh in 2022, 14 times higher than in 1950. With the integration of renewable resources and modernization of grids, there is a heightened focus on mitigating operational hazards and ensuring sustainable practices. The expansion of infrastructure necessitates rigorous compliance with workplace safety and emissions control standards to address risks associated with energy production and distribution. Additionally, the development of large-scale facilities prompts organizations to employ advanced EHS technologies to monitor air quality, manage hazardous materials, and enhance workforce safety. The increasing focus on energy efficiency and sustainability is fueling the demand for comprehensive monitoring systems, training programs, and emergency preparedness plans. These measures ensure environmental stewardship while maintaining operational continuity and safety, aligning with evolving industrial trends.

Europe Environment, Health and Safety Market Analysis

The food and beverage industry are advancing EHS measures to ensure product quality and safety across manufacturing and distribution processes. According to reports, there are approximately 445k businesses in the food & drink wholesaling industry in Europe. Rigorous hygiene protocols are being adopted to prevent contamination risks in production facilities. Enhanced traceability systems allow for effective monitoring of raw materials, aligning with strict environmental regulations. Automation of safety inspections has reduced workplace accidents, while real-time analytics identify and address operational inefficiencies. Water and energy conservation practices are being increasingly adopted to achieve sustainability objectives. Workers in this industry benefit from advanced safety training tailored to handling equipment and hazardous materials. Public demand for environmentally sustainable packaging and production processes further drives the adoption of EHS systems. Organizations are increasingly leveraging smart technologies to optimize operations, ensuring compliance with both environmental and safety standards while meeting consumer expectations for high-quality, safe products.

Asia Pacific Environment, Health and Safety Market Analysis

Expanding healthcare infrastructure has underscored the importance of EHS measures to ensure patient and staff well-being. Reports indicate that India's healthcare infrastructure has grown substantially since the pandemic, with the number of hospitals rising from 43,500 in 2019 to 54,000 in 2024. Private hospitals drove this growth, rising by 27% to 38,000 in 2024. The growing number of hospitals and clinics requires stringent protocols to manage biomedical waste, minimize contamination risks, and maintain air and water quality. The focus on infection control has led to the widespread adoption of advanced monitoring systems and the implementation of strict hygiene practices. The increasing complexity of healthcare operations, including advanced diagnostic and treatment technologies, necessitates regular safety audits and training programs to prevent occupational hazards. Furthermore, the integration of energy-efficient systems in healthcare facilities supports sustainable operations while complying with safety and environmental standards. These initiatives not only reduce environmental impact but also safeguard health outcomes by maintaining a safe and controlled environment across the sector.

Latin America Environment, Health and Safety Market Analysis

EHS adoption in the Chemicals and Materials sector is increasingly essential due to expanding mining activities. For instance, in 2023, nearly half (45.9%) of the global copper exploration budget targeted Latin America, with Chile leading as copper accounted for a staggering 82% of its mining sector investments. The handling of hazardous materials and the extraction of resources necessitate stringent safety protocols to mitigate workplace risks and environmental degradation. Industries are employing advanced monitoring systems to reduce emissions, manage waste, and ensure compliance with regulations. Improved training programs and the use of protective equipment are contributing to safer operations, while initiatives in resource recovery and recycling align with environmental goals. These initiatives demonstrate a rising commitment to sustainable practices and workforce safety within the sector.

Middle East and Africa Environment, Health and Safety Market Analysis

The expansion of construction and engineering projects has driven the integration of EHS strategies to enhance operational safety and environmental sustainability. According to reports, Saudi Arabia is witnessing rapid growth in its construction sector, with over 5,200 projects underway, valued at USD 819 Billion. Infrastructure projects involve significant risk, prompting the adoption of advanced tools for hazard identification, resource management, and emissions monitoring. Enhanced workforce training programs ensure compliance with evolving standards, while sustainable construction materials and techniques reduce environmental impact. These efforts support the creation of safer and more resilient structures.

Competitive Landscape:

Market players in the global EHS sector are increasingly focusing on technology-driven solutions to enhance compliance, safety, and sustainability. One of the key trends is that AI and IoT are being implemented into EHS management systems to collect live data, make forecast, and generate reports automatically. They are also diversifying their products through mergers, acquisitions, and alliance to offer new services and to penetrate new markets. Another remarkable activity is the advancement of mobility and cloud solutions for EHS management, as these solutions offer more adaptable, expandable, and accessible EHS tools. Moreover, players are continuing to commit significant number of resources for sustainability activities to address increasing consumer and regulatory attention in sustainability. This pressure is also increasing with the market players concentrating on enhancing the training and safety measures for the workforce.

The report provides a comprehensive analysis of the competitive landscape in the environment, health and safety market with detailed profiles of all major companies, including:

- Alcumus Group Limited

- Dakota Software Corporation

- Enhesa

- ETQ (Hexagon AB)

- Ideagen

- Intelex Technologies, ULC

- Pro-Sapien Software

- SafetyCulture

- SAP SE

- Sphera

- UL LLC

- VelocityEHS

- Wolters Kluwer N.V.

Latest News and Developments:

- December 2024: Safe Security and Booz Allen Hamilton introduced a next-generation Integrated Risk Management-as-a-Service (IRMaaS) suite designed to assist organizations in managing cyber risk. Leveraging Safe Security's AI-powered CRQM platform and Booz Allen's cybersecurity expertise, the solution offers data-driven insights for continuous risk monitoring. The offering integrates EHS (Environmental, Health, and Safety) considerations to ensure a comprehensive approach to risk management.

- December 2024: RunSafe Security introduced a new software supply chain security platform aimed at providing comprehensive risk identification, protection, and monitoring. The platform integrates SBOM tooling with automated remediation and CI/CD tool integrations, improving resilience and cybersecurity. It also includes automated memory safety vulnerability remediation and enhanced runtime software monitoring for embedded systems.

- December 2024: Cority has launched two new solutions, SIF Essentials and Audit Essentials, aimed at enhancing EHS performance. These tools streamline safety workflows, improve compliance, and reduce operational risk for EHS teams. With quicker implementation and ease of use, they help organizations manage high-risk scenarios and improve audit program performance. Both solutions are integrated into CorityOne and work seamlessly with the Safety Cloud platform.

- October 2024: Benchmark Gensuite acquired Anvl, an AI-driven solution for frontline worker safety, strengthening its EHS and sustainability platform. This acquisition aims to operationalize safety programs across industries by integrating Anvl’s technology with Benchmark Gensuite’s enterprise-scale solutions. The partnership is anticipated to enhance organizational efficiency, boost safety performance, and lower costs. The move reinforces Benchmark Gensuite’s commitment to delivering innovative EHS solutions.

- May 2024: KPA has enhanced its Flex software platform with new features aimed at improving construction safety and compliance. The updates provide real-time visibility, advanced reporting, and mobile data capture for streamlined safety management. Tailored tools like training modules, safety forms, and incident management support contractors in maintaining a robust safety culture. Integration with existing construction systems enables efficient tracking of safety initiatives and equipment.

Environment, Health and Safety Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud-based |

| Verticals Covered | Energy and Utilities, Chemicals and Materials, Healthcare, Construction and Engineering, Food and Beverage, Government and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcumus Group Limited, Dakota Software Corporation, Enhesa, ETQ (Hexagon AB), Ideagen, Intelex Technologies, ULC, Pro-Sapien Software, SafetyCulture, SAP SE, Sphera, UL LLC, VelocityEHS, Wolters Kluwer N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the environment, health and safety market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global environment, health and safety market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the environment, health and safety industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The environment, health and safety (EHS) market was valued at USD 85.08 Billion in 2024.

IMARC estimates the environment, health and safety market to exhibit a CAGR of 7.13% during 2025-2033.

Key factors driving the EHS market include stringent government regulations, rising focus on workplace safety, growing environmental sustainability initiatives, advancements in technology like AI and IoT, increasing CSR efforts, and the need for effective risk management and compliance across industries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the environment, health and safety market include Alcumus Group Limited, Dakota Software Corporation, Enhesa, ETQ (Hexagon AB), Ideagen, Intelex Technologies, ULC, Pro-Sapien Software, SafetyCulture, SAP SE, Sphera, UL LLC, VelocityEHS, Wolters Kluwer N.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)