Enterprise Key Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End Use Industry, and Region, 2025-2033

Enterprise Key Management Market Size and Share:

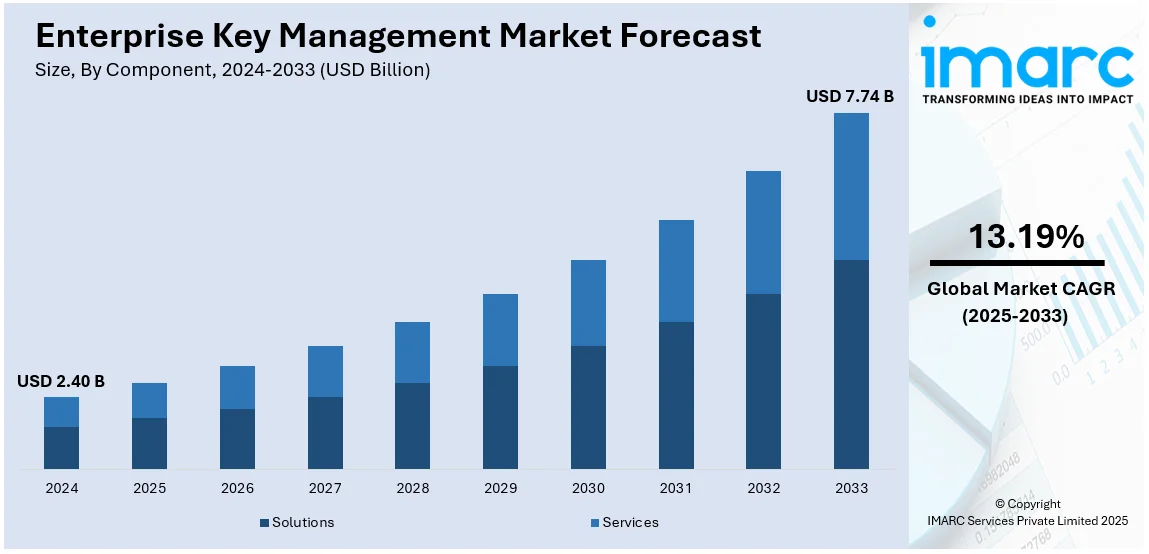

The global enterprise key management market size was valued at USD 2.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.74 Billion by 2033, exhibiting a CAGR of 13.19% from 2025-2033. North America currently dominates the market, holding a market share of over 34.2% in 2024. The enterprise key management market share is expanding, driven by the increasing number of cyberattacks, which create the need for reliable and secure solutions, along with the growing usage of cloud-based platforms that require efficient protection of data.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.40 Billion |

|

Market Forecast in 2033

|

USD 7.74 Billion |

| Market Growth Rate (2025-2033) | 13.19% |

At present, increasing concerns about data security and rising cyberattacks are impelling the market growth. Regulations encourage organizations to adopt safe encryption practices. Besides this, the rising shift towards cloud computing is driving the demand for scalable key management solutions, especially for hybrid and multi-cloud environments. Additionally, rapid digital transformation, including the Internet of Things (IoT) and blockchain usage, creates the need for reliable data encryption. Apart from this, remote work and government policies increase vulnerabilities, requiring strong encryption management. Moreover, businesses invest in cybersecurity to avoid financial and reputational losses. Furthermore, the threat of quantum computing also promotes the utilization of advanced key management solutions. Companies look for centralized and automated systems to handle the high volume of encryption keys efficiently, which is bolstering the enterprise key management market growth.

The United States has emerged as a major region in the enterprise key management market owing to many factors. As organizations face increasing data security challenges and stricter regulatory requirements, the demand for effective key management solutions is growing. Cyberattacks and data breaches also encourage companies to prioritize encryption and reliable key management options. In addition, the rise of cloud adoption in the region promotes the employment of scalable and efficient management systems to protect data across hybrid and multi-cloud environments. Apart from this, digital transformation initiatives, such as artificial intelligence (AI) and big data analytics, catalyze the demand for modern encryption practices. US businesses and government agencies lay a wager on sophisticated cybersecurity technologies to protect sensitive information. As per the information provided on the official website of the Cybersecurity and Infrastructure Security Agency, in September 2024, the Department of Homeland Security (DHS), US declared the availability of US 279.9 Million in grant funds for the Fiscal Year 2024 State and Local Cybersecurity Grant Program (SLCGP). Currently, in its third year, this plan offers financial support to assist SLT governments in improving their abilities to identify, safeguard against, and react to cyber threats.

Enterprise Key Management Market Trends:

Increasing Cybersecurity Threats

The rise in sophisticated cyber threats, such as data breaches, ransomware attacks, and advanced persistent threats, is fueling the market growth. As organizations face these security challenges, the need for effective solutions to protect sensitive information has become critical. Enterprise Key Management systems help organizations to manage, store, and defend encryption keys, reducing the risk of unauthorized access and safeguarding data privacy. As per the World Economic Forum, the worldwide occurrence of data breaches escalated in 2023, showing a 72% rise in data compromises when compared to 2022. This increase in security incidents underscores the importance of enterprise key management systems, which are essential for ensuring the safety of data from emerging cyber threats. The growing awareness among the masses about these risks also encourages the adoption of key management solutions, making them a crucial element in securing organizational data.

Compliance and Regulatory Requirements

The increase in data protection regulations is offering a favorable enterprise key management market outlook. As organizations face high pressure to comply with stringent data privacy and safety standards enabled by government agencies, there is a growing demand for solutions that ensure secure key storage and proper key lifecycle management. For example, the Texas Data Privacy and Security Act (TDPSA) was passed by the US government, effective from July 1, 2024. This new privacy law pertains to companies with a minimum of USD 25 million in gross income or those managing data of at least 500,000 residents of Texas. It mandates that companies adopt data protection protocols and provides customers with restricted rights like accessing and correcting their data. Enterprise key management systems help organizations to comply with such regulations by making encryption possible, ensuring that data is safeguarded at all times throughout its lifecycle. Companies need to have solid key management practices in place so as not to be on the receiving end of huge penalties for their failure to protect sensitive information. This demand for compliance promotes the usage of enterprise key management solutions, which makes it an essential requirement for organizations in pursuit of standards set by their industries and keeping data private and secure.

Growth of Cloud Adoption

The proliferating adoption of cloud services is supporting the market growth. Because organizations are turning to the cloud for most of their operations, it means there will be an increased requirement for robust security of data and key management systems. These solutions offer centralized control over encryption keys, enabling businesses to effectively manage data security across on-premises, hybrid, and multi-cloud environments. This shift to cloud infrastructure significantly drives the demand for these systems to ensure the protection of sensitive data in complex and distributed environments. According to sector reports, worldwide end-user expenditure on public cloud services is determined to reach USD 723.4 Billion in 2025 from USD 595.7 Billion in 2024. Organizations are further contributing to the market growth, as they accelerate their cloud adoption through the implementation of comprehensive key management solutions.

Enterprise Key Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global enterprise key management market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, enterprise size, application, and end use industry.

Analysis by Component:

- Solutions

- Services

Solutions lead the market with 72.7% of the market share in 2024. They directly handle the core need, which includes managing encryption keys securely. Businesses invest in enterprise key management solutions to protect sensitive data, comply with regulations, and prevent unauthorized access. These solutions offer a range of features like key generation, storage, rotation, and revocation, making them a critical part of modern cybersecurity strategies. Organizations also like how solutions integrate with existing systems like databases, applications, and cloud services, making them easy to adopt. They are designed to work across multiple environments, whether on-premises, cloud, or hybrid, giving companies flexibility as they scale. With the high risk of data breaches and cyberattacks, businesses choose tools that offer automation, centralization, and advanced encryption capabilities. While services like consulting and maintenance are important, solutions remain the foundation because they deliver the technology that businesses depend on to safeguard their most valuable data.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises accounts for 57.0% of the market share. It gives businesses full control over their encryption keys and data security. Many companies prefer keeping sensitive information in-house, especially those in industries like finance and healthcare where strict regulations and compliance are top priorities. With on-premises setups, organizations can customize their key management systems to fit their specific needs and integrate seamlessly with existing information technology (IT) infrastructure. Data privacy concerns also play a big role. Companies feel more confident managing keys themselves rather than depending on third-party providers, particularly when handling highly confidential or critical data. On-premises solutions are considered more reliable for avoiding potential breaches caused by shared environments in the cloud. Additionally, some businesses operate in areas with limited or unreliable internet connectivity, making on-premises a more practical choice. Thus, on-premises remains a popular option for enterprises seeking maximum security, control, and compliance.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with 60.0% of the market share. They deal with massive amounts of sensitive data and face higher risks from cyberattacks. These organizations often operate across multiple regions and industries, requiring robust encryption and key management systems to protect their data and meet strict regulatory requirements. With bigger budgets, large enterprises can spend resources on advanced solutions to handle complex IT environments, including on-premises, cloud, and hybrid setups. They also need scalable and centralized systems to manage thousands of encryption keys efficiently across various departments and locations. Data breaches can be especially costly for large companies, both financially and reputationally, so they prioritize top-tier security solutions. Additionally, in industries like finance, healthcare, and retail where large enterprises dominate, the demand for stringent data safety tools is high. Hence, large enterprises are at the forefront of the market due to their scale, resources, and higher stakes in protecting data.

Analysis by Application:

- Disk Encryption

- File and Folder Encryption

- Database Encryption

- Communication Encryption

- Cloud Encryption

Disk encryption accounts for 36.0% of the market share in 2024. It is one of the most widely used methods for protecting sensitive data. It ensures that all the data stored on a drive is secure, even if the device is lost, stolen, or accessed without authorization. Businesses rely on disk encryption to safeguard laptops, servers, and storage devices, especially as remote work and mobile device use grow. Organizations prefer disk encryption because it provides full-disk protection without requiring users to manually encrypt individual files or folders. This makes it easier to implement and manage at scale, especially in industries like finance, healthcare, and government, where data security is critical. It is also a key tool for regulatory compliance, as standards enabled by government agencies often mandate encryption for sensitive data. As cyber threats increase, businesses prioritize disk encryption to ensure data remains inaccessible to hackers, even in the event of physical theft or breaches.

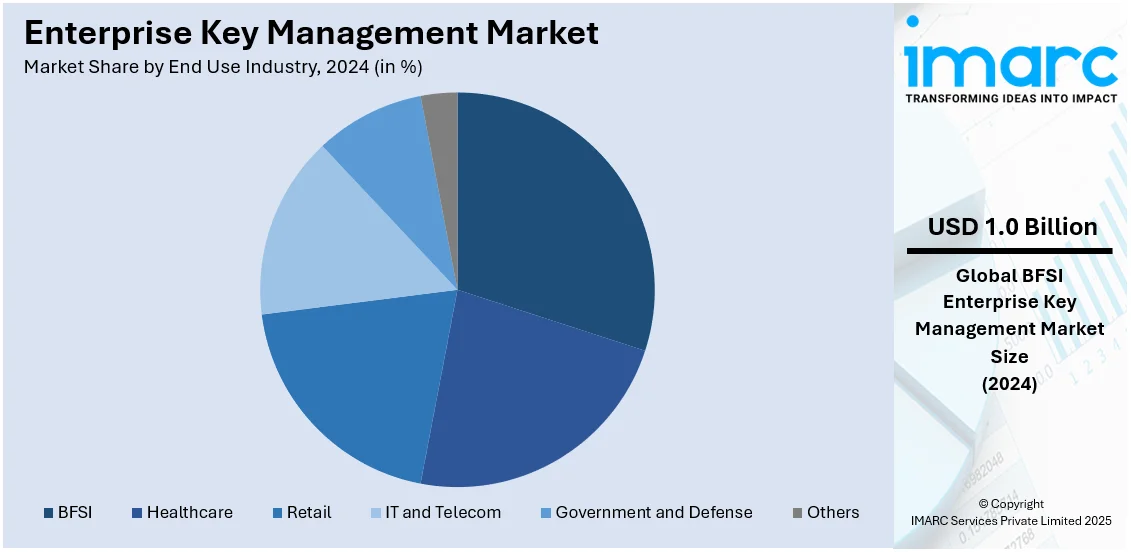

Analysis by End Use Industry:

- BFSI

- Healthcare

- Retail

- IT and Telecom

- Government and Defense

- Others

BFSI leads the market with 29.6% of the market share. It deals with highly sensitive data like customer information, financial transactions, and account details. With cyberattacks and data breaches targeting financial institutions, strong encryption and key management are non-negotiable for ensuring data security. BFSI companies face strict regulatory requirements, which mandate robust encryption practices to safeguard sensitive information. Enterprise key management solutions help these organizations to comply with such regulations while managing encryption keys safely and efficiently. The sector’s heavy reliance on digital transactions, mobile banking, and online services also increases the need for secure data protection. Whether it is securing payment systems, defending customer data, or encrypting communications, enterprise key management solutions play an important role. Additionally, with the high adoption of cloud services and digital wallets in BFSI, encryption and key management have become even more essential.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 34.2%, enjoys the leading position in the market. The region has a strong presence of major technology companies and advanced IT infrastructure. The area faces a high number of cyberattacks, which encourages businesses to invest heavily in data security and encryption. Companies here are quick to adopt new technologies, including robust enterprise key management solutions, to protect sensitive information. Moreover, government agencies wager on advanced technologies like AI and IoT, which play a critical role in key management applications. For instance, in March 2024, the FY2025 budget request from the Biden administration in the US allocated USD 3 Billion for agencies to responsibly develop, test, procure, and integrate transformative AI applications throughout the federal government. Apart from this, strict regulations enable organizations to prioritize encryption and key management to stay compliant. The widespread usage of cloud services, digital payments, and remote work also drives the demand for safe and reliable encryption practices. North America is noted for its well-established key industries like finance, healthcare, and retail, which handle massive amounts of sensitive data and require strong security measures. With access to larger budgets and modern solutions, businesses in this region lead the way in employing enterprise key management systems to safeguard their operations from the growing cybersecurity threats.

Key Regional Takeaways:

United States Enterprise Key Management Market Analysis

The Banking, Financial Services, and Insurance (BFSI) sector in the United States is increasingly being targeted by cyberattacks, highlighting the growing risks to organizations managing sensitive financial data. Recent industry data reveals a sharp rise in data breaches within the financial services sector, increasing from 138 cases in 2020 to 744 in 2023, making it one of the most vulnerable industries to cyber incidents. This significant rise in attacks has created the need for advanced security measures, enabling the adoption of enterprise key management solutions. These systems provide crucial support in managing encryption keys, securing critical financial data, and ensuring compliance with regulatory frameworks like the Gramm-Leach-Bliley Act (GLBA). These solutions have been pivotal in the least risk and best safety of the operations, as cyber threats evolve, which is more likely to continue, thus making sensitive information protection the new priority of financial institutions and so maintaining a trustful position with the customers.

Europe Enterprise Key Management Market Analysis

The European Union (EU) is witnessing a surge in cyber threats, with ransomware among the most common problems. The EU holds that more than 10 terabytes are stolen every month, and phishing is now considered as the main entry point for those attacks. With cybercriminals and the quantities of sensitive data shared, kept, or otherwise floating out there, organizations in the region have never been as vulnerable. These threats require businesses to implement enterprise key management solutions. These systems are an answer to strong encryption key management. They are applied to protect important information against unauthorized access. In such a manner, they are especially efficient for safeguarding against ransomware and phishing, allowing the end-to-end encryption of data and centralized control over keys. In addition, strong data protection policies in the EU, such as the General Data Protection Regulation (GDPR), contribute to the employment of key management solutions to support compliance and reduce risks. This rising dependence on measures for data security places the market for significant growth in Europe.

Asia Pacific Enterprise Key Management Market Analysis

Advanced email-based cyberattacks experienced a significant increase in the APAC region during the latter half of 2024. Such incidents grew by 26.9% year over year, with reports of phishing, ransomware, and other email-driven security breaches rising significantly, as per an industry report. Such attacks often offer avenues for unauthorized access to sensitive organizational data, making data protection strategies more complex and challenging. Enterprise key management solutions have become very important for organizations in the region to ensure secure encrypted data in order to avoid unauthorized exposure of critical information. With the usage of email-based threats and more reliance on cloud-based systems by various industries, the demand for robust key management systems is growing at a rapid rate. This upward trend showcases the importance of such reliable solutions in safeguarding sensitive data, ensuring business continuity, and meeting regulatory compliance requirements within the evolving digital landscape of this area.

Latin America Enterprise Key Management Market Analysis

The Latin America region is amid a high increase in cyberattacks. Indeed, the LATAM CISO 2023 Cybersecurity Report reveals that 71% of cybersecurity leaders have recorded a rise in attacks on their organizations within the last year. There has been a rise in such attacks targeting larger organizations. Sizable enterprises have been more vulnerable to various incident types, including even data breaches and ransomware. This evolving threat environment has created a pressing need for robust data protection strategies, leading to increased adoption of enterprise key management solutions. These systems provide secure encryption key management, safeguarding critical information and mitigating the risks of unauthorized access. As cyber threats grow in complexity and frequency, businesses in the region prioritize these efficient solutions to enhance data security and meet regulatory compliance requirements. The high recognition of cybersecurity challenges and the rising frequency of attacks are significant drivers of the demand for enterprise key management tools across the region.

Middle East and Africa Enterprise Key Management Market Analysis

The Middle East and Africa region has witnessed a sharp rise in cyber threats, especially ransomware attacks, with a reported 68% increase in 2023, as per reports. These attacks have mainly targeted sectors, such as financial services and real estate, thus highlighting the high cybersecurity risks that organizations face in the region. Due to this, companies have implemented strict data protection measures by embracing enterprise key management solutions that prevent unauthorized access to sensitive data. These systems manage, store, and secure keys to provide organizations with centralized controls on data security in both on-premises and cloud environments. The rising level of cyber attacks, along with the increasing digital transformation activities across the MEA region, catalyzes the demand for reliable key management solutions. The organizations in the area are estimated to enhance the investments in the cybersecurity infrastructure and will significantly fuel the growth of the market in the Middle East and Africa region.

Competitive Landscape:

Key players work to offer new reliable solutions that cater to the high enterprise key management market demand for data security. They develop innovative technologies to simplify encryption key management, such as centralized platforms, cloud-integrated solutions, and hardware security modules. Big companies actively wager on research and development (R&D) activities to improve scalability, automation, and user experience. They also focus on strategic partnerships and integrations with cloud providers, IT systems, and cybersecurity platforms, making it easier for businesses to employ their solutions. By offering training, consulting, and support services, they help organizations to implement and manage encryption effectively. Through awareness campaigns and compliance-focused features, these players educate businesses about the importance of encryption and regulatory requirements. Their competitive efforts, including pricing strategies and customized solutions, further encourage the adoption of enterprise key management tools across industries and regions. For instance, in September 2023, Thales launched the "Hold Your Own Key" (HYOK) feature on CipherTrust Cloud Key Management for Oracle Cloud Infrastructure (OCI), which is accessible in 45 Oracle cloud regions. This aims to enable OCI customers to manage encryption keys under their direct supervision, separated from OCI on either a physical or virtual device. Keeping encryption keys distinct from the data being encoded has rendered this solution feasible for securely transferring sensitive information into Oracle cloud regions.

The report provides a comprehensive analysis of the competitive landscape in the enterprise key management market with detailed profiles of all major companies, including:

- Amazon Web Services Inc. (Amazon.com Inc.)

- Box Inc.

- Broadcom Inc.

- Dell Technologies Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Thales Group

- Townsend Security

- Unbound Security

- WinMagic Inc.

Latest News and Developments:

- September 2024: Nexus Technologies Inc., an IT service management firm located in the Philippines, purchased Enterprise Solutions Providers (ESP), a consulting and IT services company based in the United States. The goal of the acquisition is to improve Nexus Technologies' service capabilities and bolster its standing in the IT service management industry. Nexus Technologies intends to provide more complete IT solutions by combining ESP's expertise and resources.

Enterprise Key Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Disk Encryption, File and Folder Encryption, Database Encryption, Communication Encryption, Cloud Encryption |

| End Use Industries Covered | BFSI, Healthcare, Retail, IT and Telecom, Government and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), Box Inc., Broadcom Inc., Dell Technologies Inc., Google LLC, Hewlett Packard Enterprise Company, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Thales Group, Townsend Security, Unbound Security and WinMagic Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the enterprise key management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global enterprise key management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the enterprise key management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The enterprise key management market was valued at USD 2.40 Billion in 2024.

The enterprise key management market is projected to exhibit a CAGR of 13.19% during 2025-2033, reaching a value of USD 7.74 Billion by 2033.

The rising instances of data breaches and cyberattacks are encouraging organizations to prioritize encryption and secure key management. Besides this, as organizations are shifting to cloud-based environments, the demand for secure and scalable key management solutions is increasing. Moreover, enterprises are allocating more resources to cybersecurity infrastructure, including advanced encryption and key management solutions, which is impelling the market growth.

North America currently dominates the enterprise key management market, accounting for a share of 34.2% in 2024, driven by its strong technology infrastructure, high cybersecurity risks, strict regulations, and the presence of leading tech companies. Businesses in the region prioritize encryption to protect sensitive data and ensure compliance.

Some of the major players in the enterprise key management market include Amazon Web Services Inc. (Amazon.com Inc.), Box Inc., Broadcom Inc., Dell Technologies Inc., Google LLC, Hewlett Packard Enterprise Company, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Thales Group, Townsend Security, Unbound Security, WinMagic Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)