Enteric Disease Testing Market Size, Share, Trends and Forecast by Product Type, Technique, Disease Type, End User, and Region, 2025-2033

Enteric Disease Testing Market Size and Share:

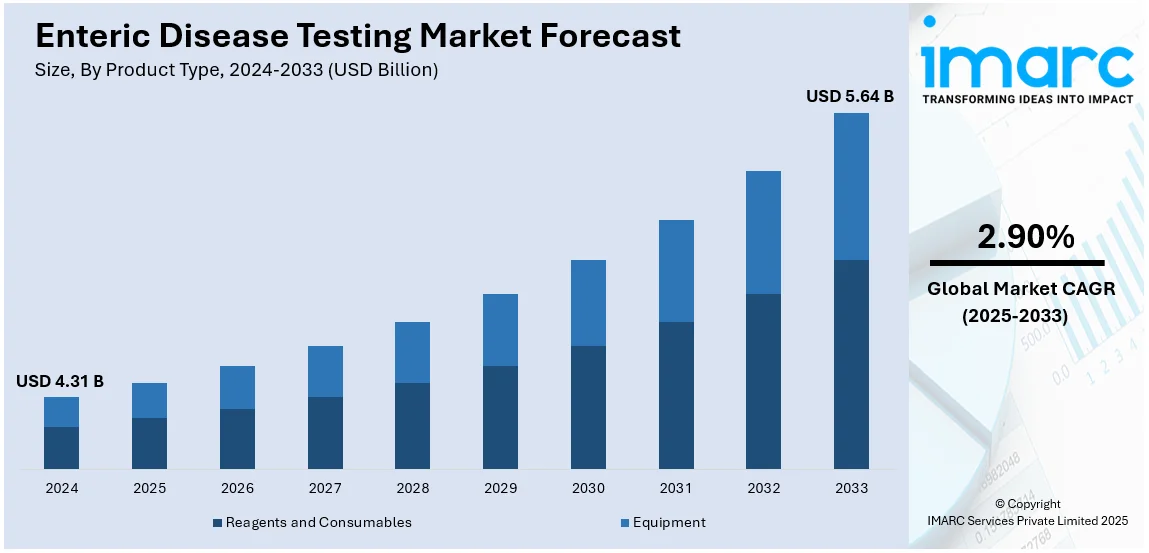

The global enteric disease testing market size was valued at USD 4.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.64 Billion by 2033, exhibiting a CAGR of 2.90% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 38.8% in 2024. The enteric disease testing market share is growing due to the increasing incidence of gastrointestinal infections, growing awareness for early diagnosis, advancement in diagnostic technologies, rising demand for faster and accurate testing methods, and increasing global concern for food and water safety standards.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.31 Billion |

| Market Forecast in 2033 | USD 5.64 Billion |

| Market Growth Rate (2025-2033) | 2.90% |

The enteric disease testing market growth is increasing due to the rise of gastrointestinal infections and foodborne diseases and the development of diagnostic technologies. Enteric diseases, caused by bacteria, viruses, and parasites, affect millions worldwide, thereby causing severe diarrhea, dehydration, and other complications. The growth in demand for rapid, accurate, and cost-effective diagnostic solutions is fueling the expansion of the market. Growing awareness about food safety and government initiatives toward disease surveillance coupled with molecular diagnostics such as PCR and immunoassays propel the demand of diagnostic companies, which have begun to invest heavily in faster, more reliable, and quick test solutions, aided by technological upgradation in the healthcare sector. The drive for automation in the laboratory, together with point-of-care testing kits, propels the market ahead. Furthermore, partnerships between research centers and healthcare institutions are making diagnostic products more accessible and available. In addition, increased demand for early and accurate diagnosis will continue to influence the enteric disease testing market trends, an important factor in controlling and preventing outbreaks.

The United States has emerged as a key regional market for enteric disease testing, driven by the increasing cases of foodborne diseases, awareness about gastrointestinal infections, and advances in diagnostic technologies. Molecular diagnostics, which include PCR and immunoassays, are gaining popularity as they are precise and deliver fast results. Government initiatives, for instance, the FDA's Food Safety Modernization Act (FSMA), are further boosting market demand by emphasizing preventive measures and early detection. Hospitals, diagnostic laboratories, and point-of-care testing facilities are major end-users of efficiency through automation and AI in diagnostics. Leading companies in the US market are making significant R&D investments to launch cutting-edge, reasonably priced testing solutions. The cost of health care and the stringency in food safety standards are also expected to increase the U.S. enteric disease testing market over the next few years.

Enteric Disease Testing Market Trends:

Rising Incidence of Gastrointestinal Infections

With the increasing incidence of gastrointestinal diseases due to lack of sanitation, contaminated food, and water, and the alarmingly high population density, mostly in developing regions, the enteric disease testing demand is increasing. Bengaluru has witnessed a rise in gastrointestinal diseases due to tainted water sources and inadequate sanitation, according to a 2024 Times of India story. While milk should be avoided during illnesses, ORS is essential for children who are in danger of dehydration from diarrhea. According to the WHO, about 1.5 Million people die worldwide due to diarrheal disease alone. Children less than 5 years old in developing countries are being especially struck with diarrhea, vomiting, deaths, and malnutrition. This is further increasing the value of the enteric disease testing market substantially.

Government and regulatory activities

Increasing public health infrastructure is growing as the government and health organizations are introducing stringent food and water safety standards and investing in public health infrastructure. This is further fueling the requirement for frequent and effective enteric disease testing to prevent outbreaks and safeguard the public, which is further boosting the market. For instance, the Food Safety and Standards Authority of India (FSSAI) launched a massive awareness and sensitization campaign in April 2024, that covered key markets in the national capital, in association with the Food Safety Department, Delhi. Likewise, the NHM is another flagship program under the Modi government, which deals with the development of health infrastructure, essential drugs and diagnostics, and human resource capabilities at the grassroots level. All these have been aimed at reducing the patient's need for expensive treatments outside their localities, which in turn is enhancing the enteric disease testing market forecast over the coming years.

Significant advancements in diagnostic technologies

Enteric infections may now be detected quickly, accurately, and thoroughly due to advancements in molecular diagnostics such as polymerase chain reaction (PCR) and next-generation sequencing (NGS). The market is expanding more quickly. For instance, ArcticZymes Technologies (AZT) unveiled AZtaqTM DNA Polymerase, a novel product, in August 2023. A premium thermostable DNA polymerase that may be used in polymerase chain reaction (PCR) applications is called AZtaqTM. introduced the AZtaqTM, a logical addition to the business's line of molecular instruments. The thermostable DNA polymerase is a crucial enzyme in PCR that makes many molecular diagnostic and research applications possible. This is further driving the enteric disease testing market revenue across the globe.

Enteric Disease Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global enteric disease testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, technique, disease type, and end user.

Analysis by Product Type:

- Reagents and Consumables

- Equipment

The demand for the reagents and consumables was driven by its need for accurately and efficiently operating diagnostic processes. Repeated testings for pathogens in the gut requires constant stock replenishment for high-quality reagents and consumables. More importantly, rising infectious disease levels and advancements in molecular and rapid testing methods lead to the application of specialized consumables. Increasing governmental grants and the establishment of health infrastructures further promote demand for these core testing supplies. Technological upgrades in the machinery of diagnostic systems, for instance, automated PCR systems, as well as platforms for next-generation sequencing, drive further equipment demands in the market report on enteric disease testing. There is a necessity for high-throughput, reliable, and accurate diagnosis, thereby resulting in an acceptance of highly developed equipment. Additional factors of growing demand include extensive investments in the development of healthcare infrastructure, especially in up-and-coming markets, and investments in laboratory modernization. Additionally, improved disease surveillance programs and public health initiatives boost the market for diagnostic equipment.

Analysis by Technique:

- Molecular Diagnostics

- Immunodiagnostics

Molecular diagnostics techniques hold the leading position in the market fueled by their high accuracy, sensitivity, and faster turnaround times. These techniques, for example, PCR and next-generation sequencing, permit the accurate detection of a diverse range of pathogens, thus further enhancing disease control and outbreak response. For example, Roche announced the launching of the LightCycler® PRO System in November 2023, building on the established gold standard technology of the previous LightCycler® Systems. This system is designed to increase performance and usability requirements while connecting translational research with in vitro diagnostics. The LightCycler PRO System further enhances Roche's molecular PCR testing portfolio, which features solutions for different practitioners, from conducting research to testing patients who suffer from cancer, infectious diseases, and many more public health challenges. This is further propelling the demand for enteric disease testing globally.

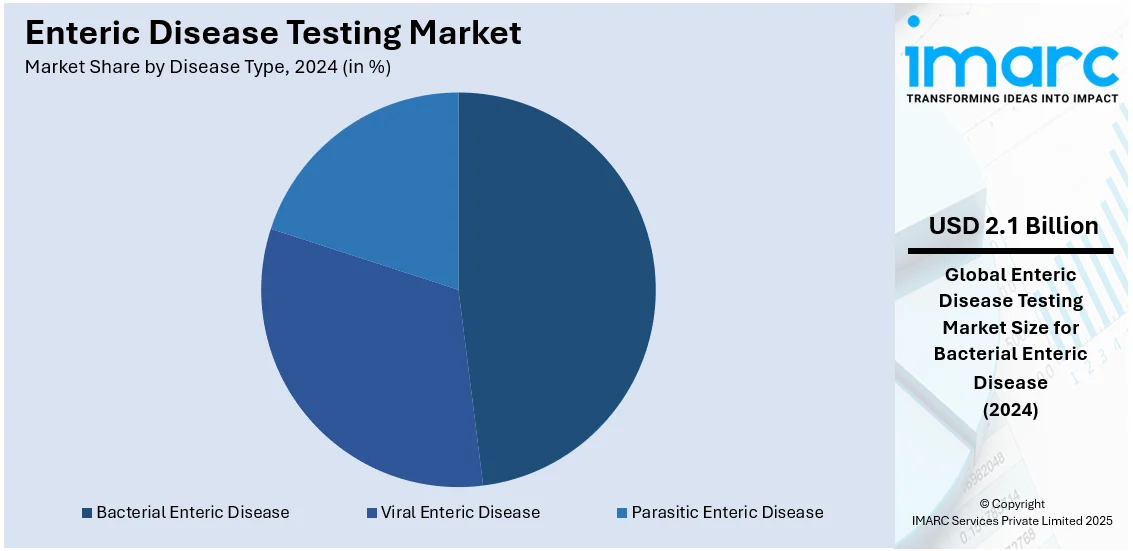

Analysis by Disease Type:

- Bacterial Enteric Disease

- C. Difficile

- Campylobacteriosis

- Cholera

- E. Coli

- H. Pylori

- Salmonellosis

- Shigellosis

- Viral Enteric Disease

- Rotavirus

- Norovirus

- Others

- Parasitic Enteric Disease

- Amebiasis

- Cryptosporidiosis

- Giardiasis

Bacterial enteric diseases represent the largest segment with a share of 48.0%. The high prevalence of infections such as C. difficile, E. coli, and Salmonellosis creates a significant public health risk and drives the demand for enteric disease testing in bacterial types. Rapid, accurate diagnostics are important for effective treatment, outbreak management, and infection control. Testing demand is also fueled by the association of H. pylori with severe gastrointestinal conditions. The increasing foodborne and waterborne outbreaks, stringent food safety regulations, and the need for efficient healthcare interventions further boost the market for bacterial enteric disease testing.

Analysis by End User:

- Hospital Diagnostic Laboratories

- Independent Diagnostic Laboratories

- Academic and Research Institutes

- Others

In the hospital diagnostic laboratory, the need for enteric disease testing arises from the urgent necessity for an accurate diagnosis so that proper patient management and treatment can be assured. High patient volumes and the critical nature of diagnosing gastrointestinal infections require reliable and efficient testing protocols. Independent diagnostic laboratories are in demand due to their specialized services and ability to provide rapid, high-volume testing. They are crucial for routine screening, outbreak management, and offering advanced diagnostic techniques, thus meeting the needs of both healthcare providers and patients. This further creates a positive enteric disease testing market outlook. There is a growing concern in academic and research institutes to study enteric pathogens, develop novel detection techniques, and perform epidemiological research, thereby creating an increased demand. Besides, more funds and grants to infectious disease research organizations increase the demand for high-quality and accurate testing capabilities to support scientific activities and public health.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific accounted for a large share of 38.8% for the enteric disease testing market, driven by the increasing incidence rates of gastrointestinal infections due to poor sanitation and hygiene. Rotavirus, Cryptosporidium spp., enterotoxigenic Escherichia coli (ETEC), and Shigella spp. are the primary causes of diarrheal illnesses and deaths, according to new data from the Global Enteric Multicenter Study (GEMS) on the burden and etiology of diarrhea among children living in developing nations. Moreover, norovirus infections, which equally affect adults and children, are the primary source of foodborne disease outbreaks and are responsible for 20% of diarrheal diseases. Consequently, rising awareness about health problems, increasing government efforts in controlling diseases, and better health infrastructure also spur demand. Improved diagnostics and an increased incidence of food and water-borne diseases fuel the growth of the market further. Rapid urbanization and the expanding middle-class population base, with greater access to healthcare, are contributing to the market growth.

The market for North American enteric disease testing is stimulated by strong healthcare infrastructure, advanced diagnostic technologies, and stringent food safety regulations. The CDC and the FDA play a crucial role in disease surveillance and prevention, enforcing strict food and water safety standards. Saliently, the staggering prevalence rates of foodborne illnesses, including Salmonella and Norovirus, drive demand for quick diagnostics. Molecular diagnostics, automation, and AI-based testing are revolutionizing the market. Increased R&D investment along with initiatives of the FDA, such as FSMA, are factors broadening the market's expansion.

The enteric disease testing market in Europe is also expected to grow through stringent food safety laws of the EFSA and rapidly increasing foodborne illness outbreaks. High usage of molecular diagnostics and point-of-care testing is driving the growth of the market. Countries like Germany, the UK, and France are highly investing in diagnostic innovations, improving the efficiency of testing. With the increasing organic and processed food demand, the concern over contamination has increased the demand for rapid and high throughput testing solutions across clinical and food safety sectors.

The Latin American enteric disease testing market is growing due to the rise in foodborne illness cases and the increase in healthcare investments. Poor sanitation conditions and limited water availability are commonly found in numerous regions, increasing the risk for frequent outbreaks due to cholera, E. coli, or rotavirus infection. Governments undertake public health projects, enhance regulatory food safety, and strengthen disease surveillance. Moreover, the growth in private diagnostic laboratory facilities and more affordable rapid-testing kits is creating an opportunity in enteric disease diagnostics, more so in such countries as Brazil, Mexico, and Argentina, as their healthcare is rapidly changing.

In the Middle East and Africa, enteric disease testing demand is increasing due to a high burden of waterborne and foodborne illnesses linked to poor sanitation, contaminated water, and inadequate healthcare access. Diarrheal diseases are a leading cause of mortality, especially in children. Governments and international organizations are focusing on improving disease detection through public health programs and expanded laboratory networks. Growing urbanization, increasing food imports, and significant investments in the healthcare infrastructure further fuel the utilization of modern diagnostic techniques, primarily in Saudi Arabia, South Africa, and the UAE.

Key Regional Takeaways:

United States Enteric Disease Testing Market Analysis

In 2024, the United States held a share of 90.0% of the enteric disease testing market in North America due to emerging outbreaks of foodborne illnesses, a strict regulatory framework, and consumer awareness. According to the Centers for Disease Control and Prevention, millions of infections are produced annually due to foodborne pathogens like Salmonella, E. coli, and Norovirus, and therefore there is a need for sophisticated diagnostic solutions. According to the CDC, each year about 1 in 6 Americans (or 48 Million people) gets sick, 128,000 are hospitalized, and 3,000 die of foodborne diseases. Moreover, the FDA and the USDA have made strict compliance with food safety regulations, and the demand for rapid, accurate testing technologies, including PCR-based and immunoassay methods, is rising. In addition to this, multiplex molecular diagnostics are adopted in increasing numbers with the possibility of detecting more than one pathogen simultaneously at a high specificity. Technology advances, like NGS, improve the identification of pathogens, especially in surveillance and outbreak management. Point-of-care testing is expanding with improvements in early detection in healthcare settings and remote locations. Further, the increasing emergence of antimicrobial-resistant bacteria is motivating more investment in new diagnostic platforms and promoting private-public partnerships between companies, research organizations, and government agencies. Higher healthcare expenditure and insurance coverage for diagnostic testing facilitate early screening and thus contribute to market growth. Additionally, the growing demand for at-home test kits due to e-commerce expansion is shaping the market landscape.

Europe Enteric Disease Testing Market Analysis

Europe's enteric disease testing market is driven by stringent food safety laws, technological advancements, and high public health awareness. The European Food Safety Authority has strict regulations over microbial contamination in food and water, forcing manufacturers and healthcare facilities to employ rapid and reliable diagnostic methods. The increased surveillance of zoonotic diseases and antimicrobial resistance has led to a surge in demand for advanced molecular and immunological testing platforms. Salmonella was the causative agent linked to the highest multi-country foodborne outbreaks reported in the European Union in 2023, at 17 foodborne outbreaks, 81.0% of the total for multi-country foodborne outbreaks, according to the European Union One Health 2023 Zoonoses report. Besides this, the region is experiencing tremendous growth in automated laboratory systems and next-generation sequencing (NGS) techniques, allowing for the accurate identification of enteric pathogens. The increasing number of foodborne infections due to imported food products has enhanced the demand for real-time PCR and multiplex diagnostic assays. Public-private partnerships and European Union-funded projects are promoting research into innovative diagnostic solutions, which in turn is further fueling the growth of the market. Additionally, the growing incidence of traveler's diarrhea, especially due to tourism within and outside the region, is enhancing the demand for portable and rapid testing solutions. In addition, advancing point-of-care diagnostics, integrated with AI-driven data analytics for tracking the disease, also enhances the efficiency of outbreak responses. The market also contributes to the rising integration of diagnostic labs with digital health platforms, improving test access and turnaround time.

Asia Pacific Enteric Disease Testing Market Analysis

Asia Pacific's enteric disease testing market is being propelled by increasing disease burden, rapid urbanization, and improvements in healthcare infrastructure. The region experiences high rates of waterborne and foodborne infections on account of inadequate sanitation and contaminated drinking water. According to studies, an estimated 37.7 Million Indians suffer from waterborne illnesses each year. Salmonella, Vibrio cholerae, rotavirus, and Shigella are still among the major pathogens, and thus, governing agencies are taking measures to strengthen surveillance programs and invest in advanced diagnostic technologies. In addition to this, increasing investments in healthcare, especially in China, India, and Southeast Asian countries, are helping the adoption of automated diagnostic systems for enteric pathogens. The growth rate of the market is being fueled by increasing private laboratories and multinational diagnostic companies, as the PCR-based, ELISA, and microarray platforms are also becoming popular, as they show high accuracy along with rapid results. In addition, technological progress in molecular diagnostics and increased point-of-care testing are making faster and more accurate detection possible. Favorable government initiatives, including India's National Health Mission and China's CDC initiatives, will encourage routine screening. The rising incidence of antimicrobial resistance and emerging zoonotic pathogens are also motivating the development of rapid diagnostic tools, especially in the context of food safety regulations and outbreak response mechanisms.

Latin America Enteric Disease Testing Market Analysis

Latin America's enteric disease testing market is growing owing to frequent waterborne disease outbreaks, improving healthcare infrastructure, and rising government initiatives. Many countries face challenges with unsafe drinking water and inadequate sanitation, leading to high incidence rates of cholera, Shigella, and rotavirus infections. There were around 24,200 suspected cholera cases as of 17 January 2023, as reported in the Latin America & The Caribbean Weekly Situation Update. The region's governing agencies are largely increasing investments in surveillance programs and expanding diagnostic capacities, especially in Brazil, Mexico, and Argentina. In addition, emerging private diagnostic laboratories and collaborations with major global diagnostic firms continue to improve testing availability. Point-of-care and rapid molecular testing technologies are becoming more prevalent, especially in outlying and less privileged regions. Further demand for dependable diagnostic solutions is coming from further strengthened regulations related to food and beverage safety along with increased awareness about antimicrobial resistance. The expansion of public health insurance programs and international funding of infectious disease control are also in support of this market growth.

Middle East and Africa Enteric Disease Testing Market Analysis

The Middle East and Africa's enteric disease testing market is growing due to high disease prevalence, increasing government healthcare spending, and improvements in diagnostic capabilities. Reports indicate that the healthcare expenditure in the Gulf Cooperation Council (GCC) is estimated to be at USD 135.5 Billion by 2027. Water contamination, poor sanitation, and climate-related factors contribute to persistent outbreaks of Cholera, Typhoid fever, and Norovirus. Governments and non-governmental organizations (NGOs) are intensifying efforts to improve water quality and expand disease surveillance programs. Moreover, the adoption of rapid diagnostic kits, particularly in regions with limited laboratory infrastructure, is enhancing early disease detection. Investments in centralized laboratory networks and mobile diagnostic units are improving accessibility in remote areas. In addition to the above, with isothermal amplification-based tests, the advantage of cost and reliability in resource-poor environments is making such technologies more relevant. International partnerships with WHO and UNICEF for infectious diseases are also fueling the need for efficient solutions in enteric disease testing.

Competitive Landscape:

The competition in the market for enteric disease testing is highly competitive, wherein the key market players are concentrated on technological advances, strategic collaboration, and geographically expanding markets to strengthen market presence. Major companies such as bioMérieux, Thermo Fisher Scientific, BD, and Abbott are investing heavily in molecular diagnostics, automation, and AI-driven solutions to improve test accuracy and efficiency. One of the significant trends is the development of rapid and point-of-care testing kits, which allows quicker diagnosis and treatment, especially in resource-limited settings. Companies are also integrating next-generation sequencing (NGS) and PCR-based diagnostics to enhance detection capabilities. The market is being shaped by strategic mergers and acquisitions, such as partnerships between diagnostic firms and government agencies to improve disease surveillance. Increasing focus on sustainability and affordability is driving innovation in cost-effective diagnostic solutions, making it more accessible in emerging markets. These efforts are creating a positive enteric disease testing market outlook.

The report provides a comprehensive analysis of the competitive landscape in the enteric disease testing market with detailed profiles of all major companies, including:

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- Bio-Rad Laboratories Inc.

- Biomerica Inc.

- Biomérieux SA

- Cepheid Inc. (Danaher Corporation)

- Coris BioConcept

- DiaSorin

- Meridian Bioscience Inc.

- Quest Diagnostics

Latest News and Developments:

- January 2025: Oxford Vaccine Group conducted a new clinical trial, BiVISTA, to assess a novel combination vaccine designed to offer protection against enteric fever, a disease caused by two different kinds of Salmonella bacteria, typhoid and paratyphoid.

- December 2024: Molbio Diagnostics Pvt. Ltd. and the Indian Council of Medical Research inked a technology transfer agreement that licenses the commercialization of EnViro-Q, the country's first multiplex real-time RT-PCR test for enteric virus detection.

- August 2024: MP Biomedicals announced a new generation of in vitro diagnostics tests that feature immunochromatographic technology for the diagnosis of gastrointestinal pathogens. The novel kits are related to Helicobacter pylori, Salmonella typhi, and serogroups of Vibrio cholerae as O1 and O139. These diagnostic technologies are developed to support the rapid, accurate detection capability of healthcare practitioners in the recognition and management of gastrointestinal infections.

- June 2022: Artificial intelligence has identified a new family of enteric bacterial sensing genes that are connected by structure and most likely function, yet unrelated by genetic sequence. Researchers at the Center for Systems Biology of Dendrites at UT Southwestern released their results, which potentially pave the way for novel approaches to combat intestinal bacterial infections and provide a fresh method of determining the function of genes in unrelated species.

Enteric Disease Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Reagents and Consumables, Equipment |

| Techniques Covered | Molecular Diagnostics, Immunodiagnostics |

| Disease Types Covered |

|

| End Users Covered | Hospital Diagnostic Laboratories, Independent Diagnostic Laboratories, Academic and Research Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, BD (Becton, Dickinson and Company), Bio-Rad Laboratories Inc., Biomerica Inc., Biomérieux SA, Cepheid Inc. (Danaher Corporation), Coris BioConcept, DiaSorin, Meridian Bioscience Inc. and Quest Diagnostics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the enteric disease testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global enteric disease testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the enteric disease testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The enteric disease testing market was valued at USD 4.31 Billion in 2024.

The enteric disease testing market is estimated to exhibit a CAGR of 2.90% during 2025-2033.

The enteric disease testing market is driven by the increasing incidence of gastrointestinal infections, growing awareness for early diagnosis, advancement in diagnostic technologies, rising demand for faster and accurate testing methods, and increasing global concern for food and water safety standards.

Asia Pacific currently dominates the market with a share of 38.8%, driven by the increasing incidence rates of gastrointestinal infections due to poor sanitation and hygiene.

Some of the major players in the enteric disease testing market include Abbott Laboratories, BD (Becton, Dickinson and Company), Bio-Rad Laboratories Inc., Biomerica Inc., Biomérieux SA, Cepheid Inc. (Danaher Corporation), Coris BioConcept, DiaSorin, Meridian Bioscience Inc. and Quest Diagnostics, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)