Engineered Wood Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Engineered Wood Market Size and Share:

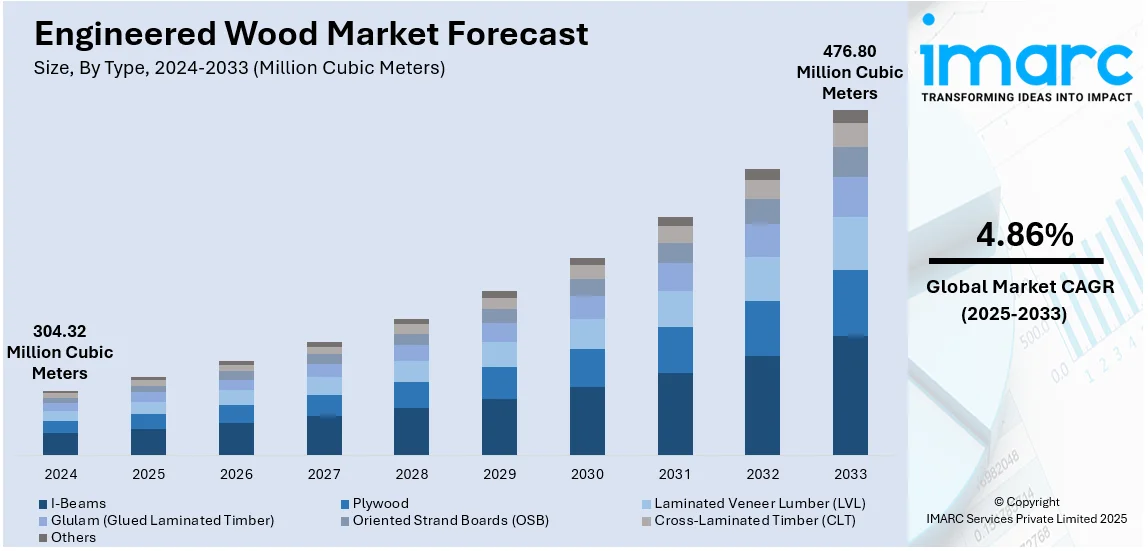

The global engineered wood market size was valued at 304.32 Million Cubic Meters in 2024. Looking forward, IMARC Group estimates the market to reach 476.80 Million Cubic Meters by 2033, exhibiting a CAGR of 4.86% during 2025-2033. Asia-Pacific currently dominates the market, accounting for 36.5% market share in 2024. The market is mainly driven by the increasing popularity of intricate flooring patterns, custom cabinetry, and visually striking structural designs, along with an increase in construction projects such as residential complexes, commercial buildings, and public infrastructure, and the growing need for affordable solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

304.32 Million Cubic Meters |

|

Market Forecast in 2033

|

476.80 Million Cubic Meters |

| Market Growth Rate (2025-2033) | 4.86% |

The global market is primarily driven by the growing demand for sustainable and customized construction materials, supported by technological advancements in wood engineering. Additionally, rising interest in eco-friendly solutions among architects and builders is also contributing to the expansion of the market. Moreover, increasing investments in modern infrastructure projects are also acting as a significant growth-inducing factor for the market. For instance, on May 14, 2024, the World Bank reported that the private sector investment in infrastructure throughout low- and middle-income countries in 2023 was USD 86 Billion. Moreover, the number of countries and projects that received private investment increased, to 68 countries and 322 projects in 2023 from 54 countries and 260 projects in 2022. The rising availability of engineered wood products that are more durable and versatile is increasingly gaining popularity.

The United States stands out as a key regional market, driven by the rising adoption of engineered wood due to its superior strength and durability over traditional materials. In addition to this, the growing demand for affordable housing and rapid urban development is stimulating the expansion of the market. Notably, on March 5, 2024, the U.S. Treasury Department announced initiatives to boost housing supply, including updated guidance for using USD 7.1 Billion of American Rescue Plan funds for affordable housing, clarifications for Emergency Rental Assistance funding (over USD 46 Billion) to support low-income housing, and an extension of Federal Financing Bank support for risk-sharing with HUD, aiming to create or preserve tens of thousands of affordable homes. Additionally, the rising adoption of engineered wood in modular and prefabricated structures is also promoting growth through efficiency and reduced waste. Apart from this, the escalating inflation of conventional wood prices is also driving builders to alternative engineered wood options. Also, the increased adoption of engineered wood by large-scale commercial projects is further supporting market growth.

Engineered Wood Market Trends:

Growing Demand for Sustainable Building Materials

With growing environmental awareness, there is a rapid shift toward the use of sustainable and eco-friendly materials in construction. Engineered wood is gaining popularity as it consumes less wood, has a low carbon footprint, and can be recycled. The material reduces deforestation as it uses smaller trees and wood byproducts, thereby becoming an attractive option for builders and consumers looking to minimize their environmental footprint, which in turn generated huge demand in both the residential and commercial sectors. For instance, as reported by industry reports, 34% of home builders in the United States described more than half of their projects as green in 2023, and 22% of remodelers reported the same. Furthermore, in August 2024, scientists at the University of Maryland have genetically engineered poplar trees to produce high-performance wood without chemicals or energy-intensive processing. This engineered wood has a 12.8% lower lignin content compared to wild-type trees, allowing it to store carbon for longer periods while being more durable. Compared to aluminum alloy 6061, the compressive strength of genetically modified wood is comparable and has possibilities as a replacement for steel and concrete. This innovation was significantly reducing emissions from the construction industry.

Cost-Effectiveness and Versatility

Engineered wood is highly preferred due to the cost-effectiveness it possesses over traditional hardwood. Its layered structure provides it with durability and stability, also resisting warping, making it suitable for application in flooring, furniture, and structural components. With lower costs of production and installation, alongside aesthetic flexibility, engineered wood proves to be a cost-effective substitute for construction projects, thus paving its way to diverse industries like real estate and furniture manufacturing. As recent studies have indicated, green building materials such as engineered wood save energy by 30-40%, limit water consumption by over 20-30%, and decrease CO2 emissions by up to 35%. Green buildings also provide a first-year cost saving of 10.5% and higher asset value of 9%.

Rising Construction Activities Worldwide

The global market is growing due to the increasing number of construction activities, especially in developing economies, as represented by growth in infrastructure, house constructions, and other commercial projects. This indicates that rising demand for durable and sustainable materials fueled the expansion in the market as governments and private sectors are investing in large-scale developments. Another factor contributing to growth in various construction sectors is increasing demand for engineered wood as it develops greater strength and stability than solid wood. Furthermore, as urbanization picks up pace, the demand for versatile materials also continues to increase, which in turn supports the growing trend of using engineered wood everywhere. Notably, in July 2024, according to reports, the U.S. construction spending was recorded at a seasonally adjusted annual rate of USD 2.1627 Trillion, up by 6.7% from USD 2.0274 Trillion in July 2023. Private construction spending was pegged at USD 1.6787 Trillion, with USD 941.6 Billion residential construction and non-residential standing at USD 737.2 Billion. On the other hand, public construction spending was approximately estimated at USD 484.0 Billion. Year-to-date construction spending has totaled USD 1.2375 trillion, marking an 8.8% increase from USD 1.1374 trillion during the same period in 2023.

Engineered Wood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global engineered wood market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- I-Beams

- Plywood

- Laminated Veneer Lumber (LVL)

- Glulam (Glued Laminated Timber)

- Oriented Strand Boards (OSB)

- Cross-Laminated Timber (CLT)

- Others

Plywood stands as the largest component with 43.5% of the share in 2024. Plywood is a crucial component of engineered wood due to its exceptional strength, stability, and versatility. Its unique construction, layering thin wood sheets with alternating grain directions, enhances structural integrity, making it resistant to warping, cracking, and splitting. This durability ensures reliability in various applications, including furniture, cabinetry, flooring, and construction. Additionally, plywood is available in different thicknesses, grades, and sizes, allowing it to meet diverse project requirements. Its adaptability and cost-effectiveness make it an ideal choice for projects that demand a rigid and stable material, reinforcing its essential role in the engineered wood industry.

Analysis by Application:

- Construction

- Furniture

- Flooring

- Packaging

- Others

Furniture leads the market in 2024. Engineered wood plays a crucial role in furniture making due to its cost-effectiveness, durability, and sustainability. It allows manufacturers to produce high-quality furniture at a lower price, making it more accessible to consumers. Unlike solid wood, engineered wood resists warping, cracking, and shrinking, ensuring long-lasting furniture with minimal maintenance. Its eco-friendly nature, often incorporating recycled materials or fast-growing wood species, reduces waste and promotes sustainability. Additionally, some variants use formaldehyde-free adhesives, lowering harmful emissions. These advantages make engineered wood an essential material in modern furniture production, balancing affordability, durability, and environmental responsibility.

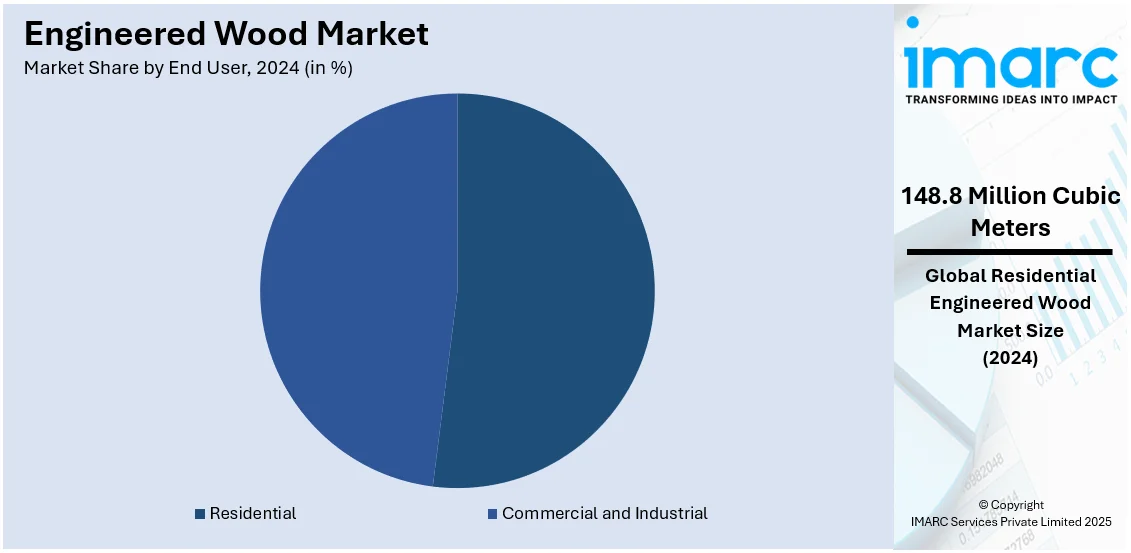

Analysis by End User:

- Residential

- Commercial and Industrial

Residential leads the market with 48.9% of the share in 2024. Engineered wood plays a crucial role in the residential sector due to its versatility, consistency, and efficiency. Available in forms like plywood, OSB, and LVL, it caters to various construction needs, including framing, subflooring, and finishing. Its uniform quality and precise dimensions ensure seamless integration, enhancing structural integrity and aesthetics. Additionally, engineered wood is easy to work with, reducing installation time and labor costs. Its ability to be machined and molded allows for customized designs, making it ideal for modern residential projects that demand both durability and aesthetic appeal. This adaptability makes it an essential material in home construction.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific dominates the market with 36.5% of the share in 2024, due to rapid urbanization and rising population. As more people move to the cities, the demand for housing and infrastructure increases. Notably, India's Smart Cities Mission has aimed at transforming urban life by improving efficient services and infrastructure in 100 cities of India. With a budget of INR 1.6 Lakh Crore, 90% of the 7,244 projects have been completed, accounting for INR 1.45 Lakh Crore. Similarly, the Shenzhen Municipal Government in China plans to build 1 Million affordable homes by 2035, aiming to house 60% of its 18 Million residents. It is targeting to raise affordable housing to 30% of its housing stock, which will cost around 2 Trillion Yuan by 2025. As per the engineered wood market forecast, government policies are expected to improve the demand for engineered wood across the region in the coming years. Engineered wood is the best material for construction as it is cost-effective, versatile, and easy to use, making it a favorite material in fulfilling the demands of urbanization.

Key Regional Takeaways:

United States Engineered Wood Market Analysis

The market in the United States is propelled by the escalating demand for sustainable and eco-friendly building materials. In recent years, increasing concerns about climate change and deforestation have heightened the demand for engineered wood products such as cross-laminated timber (CLT) and laminated veneer lumber (LVL) due to a lower carbon footprint compared to solid wood. Moreover, ongoing development of green building certifications such as LEED encouraged the use of engineered wood in commercial and residential construction. Population distribution also strongly relates to issues of urbanization. For example, according to the Center for Sustainable Systems at the University of Michigan, where 83% of the U.S. population now resides in cities, as compared to 64% in 1950, it is projected that by 2050, this will increase to 89%. Since engineered wood products is increasingly preferred for their sustainability and cost-effectiveness, this translates into a heightened demand for affordable housing and multi-family residential buildings, where such products are usually preferred. In addition to this, continuous advances in technology and manufacturing have also contributed to improvement in the strength, durability, and aesthetics of engineered wood, thereby these are more appealing for use in a variety of applications. Moreover, government incentives for sustainable building practices as well as the increasing trend of DIY home improvement also supports market growth.

Asia Pacific Engineered Wood Market Analysis

The Asia-Pacific (APAC) region is experiencing significant growth due to the rapid urbanization and a growing construction industry. According to the United Nations Population Fund (UNFPA), the region is home to 60% of the world's population, amounting to around 4.3 billion people, with China and India being the most populous countries. This demographic shift leads to increased demands for residential and commercial properties. This in turn increases the need for cost-effective and sustainable building materials. As engineered wood products are both inexpensive and eco-friendly, they are becoming the first preference, especially for green construction. Moreover, ongoing technological advancements in manufacturing processes have improved the strength and versatility of engineered wood, which makes it more suitable for a wider range of applications. The rising trend of prefabricated and modular construction is further supporting market expansion as engineered wood enables faster and more efficient building. APAC engineered wood market demand is escalating due to the increasing awareness on issues of sustainability as well as awareness among consumers related to their sustainability.

Europe Engineered Wood Market Analysis

The market in Europe is experiencing significant growth due to the sustainability trends and strict environmental regulations. Higher energy efficiency and more environmentally friendly building materials is contributing to the escalating demand for engineered wood products as they can achieve lower carbon emissions than their competitors, such as concrete and steel, in conventional construction. Governments in European countries are promoting the use of sustainable materials in construction through green building regulations and incentives, such as the EU's Climate Strategy and various national initiatives. In 2023, the European construction market reached a size of USD 3.38 Billion, further fueling the demand for innovative and sustainable materials such as engineered wood. Its capability to fulfill such regulations with high performance in construction makes it a preferred option for builders and developers. Moreover, an increased demand for affordable housing in the light of the popularity of urbanization also creates demand for engineered wood in both residential and commercial projects. Moreover, continuous innovation in technology such as the development of cross-laminated timber is making engineered wood products more flexible and stronger and thereby opening their applications. Additionally, the rising trend of refurbishing existing buildings to meet current environmental standards contributes to the market's demand. An enhanced emphasis on local sourcing and reducing transportation costs and supporting domestic production is further contributing to the growth of the market.

Latin America Engineered Wood Market Analysis

In Latin America, the market is driven by the construction sector's need for affordable and sustainable materials. According to BBVA Research, urbanization in the region is now around 80%, which in turn is contributing to the rising demand for residential and commercial buildings, particularly in major cities such as Brazil and Mexico. At present, engineered wood products such as laminated veneer lumber (LVL) are increasing in popularity due to their reduced cost and their environmental benefits particularly in the face of green building initiatives. In addition to this, increased knowledge about sustainable building practices and favorable government policies concerning eco-friendly material usage are increasingly promoting the acceptance of engineered wood in urban developments and housing activities.

Middle East and Africa Engineered Wood Market Analysis

In the Middle East and Africa, the market is driven by the increasing needs of sustainable and cost-effective construction materials along with rapid urbanization. With the UAE construction market projected to reach USD 69.5 Billion in 2024, there is a significant demand for materials that are affordable and environmentally friendly, thereby supporting the industry. Engineered wood products provide an ideal solution with strength that is accompanied with reduced environmental impact. This, in addition to the importance given to green building certifications, supports the use of engineered wood, particularly in home construction and the construction of more commercial buildings with sustainable construction considerations.

Competitive Landscape:

The competitive landscape of the market is dominated by several manufacturers looking to improve the quality of products, sustainability, and innovation. Companies are trying to develop materials that are eco-friendly and durable to cater to the growing demand for sustainable construction solutions. Furthermore, market players are investing in advanced manufacturing technologies to improve the efficiency of production and expand their product portfolios. The industry is becoming highly competitive with growing demand for less expensive alternatives to traditional wood. In addition, strategic partnerships, mergers, and acquisitions are also propelling the industry forward through growth and consolidation of the market.

The report provides a comprehensive analysis of the competitive landscape in the engineered wood market with detailed profiles of all major companies, including:

- Boise Cascade Company

- Havwoods Ltd

- Huber Engineered Woods LLC (J.M. Huber Corporation)

- Louisiana-Pacific Corporation

- Mayr-Melnhof Holz Holding AG

- Nordic Structures

- Pacific Woodtech Corporation (Daiken Corporation)

- Roseburg Forest Products Co. (Wilsonart)

- Stora Enso Oyj

- UFP Industries Inc.

- West Fraser Timber Co. Ltd

- Weyerhaeuser Company

Latest News and Developments:

- July 2024: JP Wood Accents announced that it expanded its product offerings by entering the flooring market as a producer of wide plank engineered wood flooring. This move aims to cater to both commercial and residential clients, bringing high-quality, durable wood flooring solutions to the market.

- March 2024: LP Building Solutions introduced LP® SmartSide® Pebbled Stucco Panel Siding, an engineered wood product designed for durability and versatility. Available in 9- and 10-foot lengths with square edge or shiplap options, the panels are primed for paint adhesion and suited for diverse climates. The product offers easier installation than traditional stucco and is ideal for accent walls, full cladding, and renovation projects.

- December 2023: Weyerhaeuser, one of the prominent producers of engineered wood, announced that it is investing USD 96.2 Million to modernize and decarbonize its lumber mill in Winn Parish, Louisiana. The modernization includes installing three Continuous Dry Kilns (CDKs), reducing greenhouse gas emissions, and improving mill productivity. The first two CDKs will be installed by the end of 2024, with additional equipment by mid-2025.

- October 2023: Boise Cascade has successfully finalized its previously announced acquisition of Brockway-Smith Company (BROSCO®), a prominent wholesale distributor specializing in doors and millwork. This strategic acquisition strengthens Boise Cascade’s market position and enhances its product offerings in the building materials sector.

- September 2023: West Fraser Timber Co. Ltd. has entered into an agreement to acquire Spray Lake Sawmills, based in Cochrane, Alberta. This acquisition will enable West Fraser to expand its presence in Southern Alberta, strengthen its Canadian treated wood business, and secure access to a high-quality timber supply, reinforcing its long-term growth strategy.

Engineered Wood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Cubic Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | I-Beams, Plywood, Laminated Veneer Lumber (LVL), Glulam (Glued Laminated Timber), Oriented Strand Boards (OSB), Cross-Laminated Timber (CLT), Others |

| Applications Covered | Construction, Furniture, Flooring, Packaging, Others |

| End Users Covered | Residential, Commercial and Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boise Cascade Company, Havwoods Ltd, Huber Engineered Woods LLC (J.M. Huber Corporation), Louisiana-Pacific Corporation, Mayr-Melnhof Holz Holding AG, Nordic Structures, Pacific Woodtech Corporation (Daiken Corporation), Roseburg Forest Products Co. (Wilsonart), Stora Enso Oyj, Ufp Industries Inc., West Fraser Timber Co. Ltd., Weyerhaeuser Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the engineered wood market from 2019-2033.

- The engineered wood market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the engineered wood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global engineered wood market was valued at 304.32 Million Cubic Meters in 2024.

IMARC estimates the global engineered wood market to exhibit a CAGR of 4.86% during 2025-2033, reaching a value of 476.80 Million Cubic Meters in 2033.

The market is majorly driven by increasing demand for sustainable and eco-friendly materials, urbanization, government initiatives in infrastructure, and rising interest in durable and versatile wood products for residential and commercial applications.

Asia-Pacific currently dominates the market, accounting for 36.5% market share in 2024. The region’s dominance is mainly driven by the increasing popularity of intricate flooring patterns, custom cabinetry, and visually striking structural designs, along with an increase in construction projects such as residential complexes, commercial buildings, and public infrastructure, and the growing need for affordable solutions.

Some of the major players in the global engineered wood market include Boise Cascade Company, Havwoods Ltd, Huber Engineered Woods LLC (J.M. Huber Corporation), Louisiana-Pacific Corporation, Mayr-Melnhof Holz Holding AG, Nordic Structures, Pacific Woodtech Corporation (Daiken Corporation), Roseburg Forest Products Co. (Wilsonart), Stora Enso Oyj, Ufp Industries Inc., West Fraser Timber Co. Ltd., and Weyerhaeuser Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)