Engine Oil Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Engine Oil Manufacturing Plant Project Report (DPR) Summary:

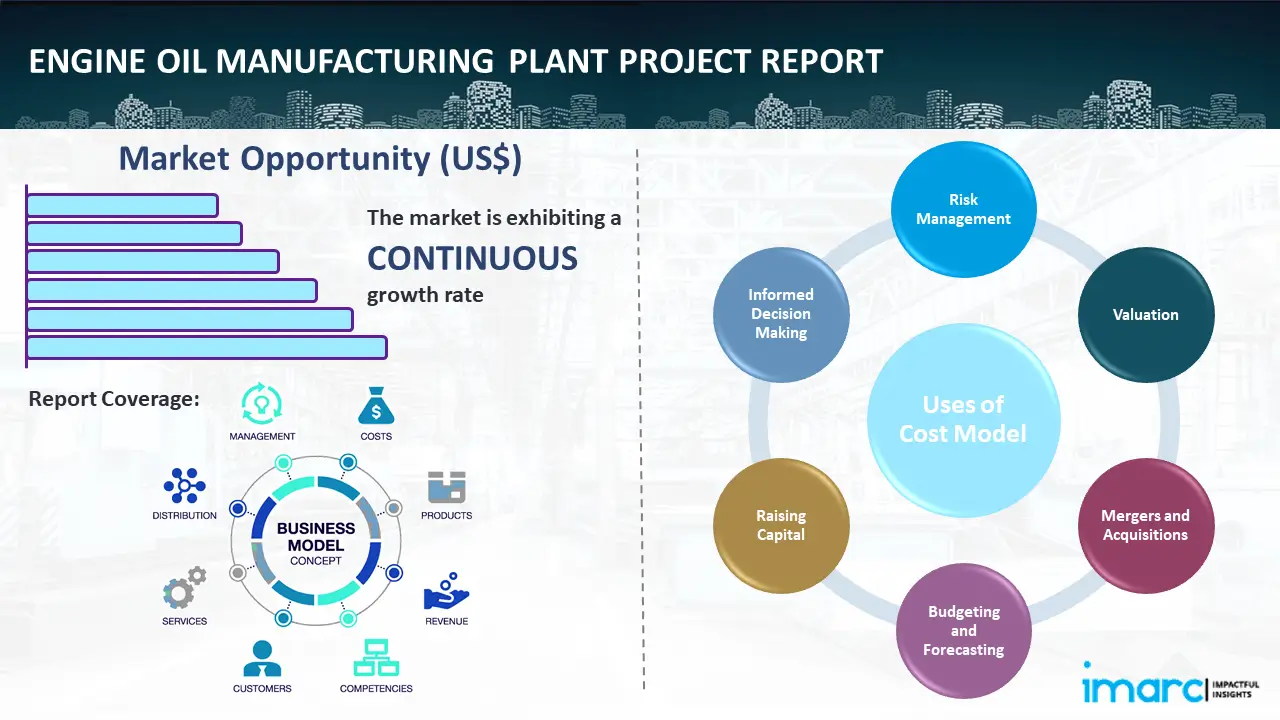

IMARC Group's comprehensive DPR report, titled "Engine Oil Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up an engine oil manufacturing unit. The engine oil market is driven by the growth in the in-use vehicle parc, routine oil-change demand, stricter OEM performance requirements (fuel economy/emissions), and expanding distribution through workshops and retail/e-commerce. The global engine oil market size was volumed at 23.48 Billion liters in 2025. According to IMARC Group estimates, the market is expected to reach 31.86 Billion liters by 2034, exhibiting a CAGR of 3.45% from 2026 to 2034.

Access the Detailed Feasibility Analysis, Request Sample

This feasibility report covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

The engine oil manufacturing plant setup cost is provided in detail covering project economics, capital investments (CapEx), project funding, operating expenses (OpEx), income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

What is Engine Oil?

Engine oils are formulated lubricants that are mainly used in internal combustion engines to handle friction and wear, control deposits, neutralize acids, prevent corrosion, promote sealing, and dissipate heat. The main composition of engine oils may come in different forms: base oils including mineral oils, hydrocracked oils, PAO, and ester oils blended with additive packages in detergents, dispersants, anti-wear additives, antioxidants, viscosity improvisers, and pour-point depressants additives. The additives define the viscosity grade of engine oils indicated by SAE 0W20 and 5W30. There are also other breaks defined by service types like ILSAC and API additives.

Key Investment Highlights

- Process Used: Drawing, annealing, and stranding.

- End-use Industries: Automotive, heavy equipment, power generation, marine, aerospace.

- Applications: Used for lubrication lines, oil cooler assemblies, turbocharger feeds, hydraulic circuits, and internal engine oil galleries.

Engine Oil Plant Capacity:

The proposed manufacturing facility is designed with an annual production capacity ranging between 50,000 - 100,000 kiloliters, enabling economies of scale while maintaining operational flexibility.

Engine Oil Plant Profit Margins:

The project demonstrates healthy profitability potential under normal operating conditions. Gross profit margins typically range between 20-30%, supported by stable demand and value-added applications.

- Gross Profit: 20-30%

- Net Profit: 8-15%

Engine Oil Plant Cost Analysis:

The operating cost structure of an engine oil manufacturing plant is primarily driven by raw material consumption, particularly base oils, which accounts for approximately 80-85% of total operating expenses (OpEx).

- Raw Materials: 80-85% of OpEx

- Utilities: 5-10% of OpEx

Financial Projection:

The financial projections for the proposed project have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide a comprehensive view of the project’s financial viability, ROI, profitability, and long-term sustainability.

Major Applications:

- Automotive (engine lubrication for passenger vehicles, commercial vehicles, and heavy-duty engines)

- Industrial (lubrication of machinery, generators, compressors, and industrial engines)

- Marine (engine protection for ships, boats, and offshore equipment)

- Power Generation (lubrication of stationary engines and turbines used in power plants)

Why Engine Oil Manufacturing?

✓ Crucial Engine Performance Component: Engine oil is an essential component in combating friction, wear, improving mileage, and extending the life of passenger cars, commercial vehicles, industrial equipment, and marine engines, thereby making it a critical item necessary for smooth operations in the automotive as well as industrial sector.

✓ Moderate but Justifiable Entry Barriers: While requiring capital investment in blending, refining, and quality-testing infrastructure, strict performance standards (viscosity, additive chemistry, OEM approvals) and long-term supplier relationships create entry hurdles that favor experienced manufacturers committed to consistent quality and supply.

✓ Megatrend Alignment: Rising global car parc, industrial automation, renewable energy installations, and heavy machinery are propelling the demand for high-performance engine oils, while the EV and hybrid car segments, as well as emissions regulation, are fueling the demand for high-performance lubricants and synthetics.

✓ Policy & Infrastructure Push: The government initiatives for vehicle electrification, industrial modernization, or the use of renewables, as well as domestic production under programs such as Make in India or Production Linked Incentives, indirectly aid demands for engine oil.

✓ Localization and Dependability in Supply Chains: OEMs, fleet operators, and industrial contractors also continue to increasingly prefer local, dependable suppliers of engine oil to minimize logistics time and stabilize pricing while ensuring consistent quality-a factor that opens a window of opportunity for regional producers with efficient production and distribution networks.

Transforming Vision into Reality:

This report provides the comprehensive blueprint needed to transform your engine oil manufacturing vision into a technologically advanced and highly profitable reality.

Engine Oil Industry Outlook 2026:

The engine oil market is primarily driven by the expanding global vehicle population and the necessity for periodic oil replacement to maintain engine efficiency. As per the Council on Energy, Environment and Water, the total number of vehicles on road will more than double from the 2023 level of 226 million to nearly 494 million by 2050. Stricter emission norms and fuel-efficiency standards are pushing OEMs toward advanced engine designs that require higher-performance lubricants. Growth in commercial transportation, infrastructure development, and off-highway equipment usage further supports demand. Additionally, the transition toward lower-viscosity and synthetic oils to improve fuel economy is influencing product mix and manufacturing practices. While electric vehicle adoption presents long-term substitution risks, the current dominance of internal combustion engines—especially in emerging economies—continues to underpin engine oil consumption.

Leading Engine Oil Manufacturers:

Leading manufacturers in the global engine oil industry include several multinational companies with extensive production capacities and diverse application portfolios. Key players include:

- Shell

- ExxonMobil

- BP (Castrol)

- Chevron

- TotalEnergies

all of which serve end-use sectors such as automotive, heavy equipment, power generation, marine, aerospace.

How to Setup a Engine Oil Manufacturing Plant?

Setting up an engine oil manufacturing plant requires evaluating several key factors, including technological requirements and quality assurance.

Some of the critical considerations include:

- Detailed Process Flow: The manufacturing process is a multi-step operation that involves several unit operations, material handling, and quality checks. Below are the main stages involved in the engine oil manufacturing process flow:

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

- Site Selection: The location must offer easy access to key raw materials such as base oils (Group I-III), additive packages (VI improvers, detergents), and packaging (HDPE cans, drums). Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

- Plant Layout Optimization: The layout should be optimized to enhance workflow efficiency, safety, and minimize material handling. Separate areas for raw material storage, production, quality control, and finished goods storage must be designated. Space for future expansion should be incorporated to accommodate business growth.

- Equipment Selection: High-quality, corrosion-resistant machinery tailored for engine oil production must be selected. Essential equipment includes blending tanks and reactors, additive dosing systems, high-shear mixers, filtration and dehydration units, quality control laboratories, filling lines, and drum or container packaging machines. All machinery must comply with industry standards for safety, efficiency, and reliability.

- Raw Material Sourcing: Reliable suppliers must be secured for raw materials like base oils (Group I-III), additive packages (VI improvers, detergents), and packaging (HDPE cans, drums) to ensure consistent production quality. Minimizing transportation costs by selecting nearby suppliers is essential. Sustainability and supply chain risks must be assessed, and long-term contracts should be negotiated to stabilize pricing and ensure a steady supply.

- Safety and Environmental Compliance: Safety protocols must be implemented throughout the manufacturing process of engine oil. Advanced monitoring systems should be installed to detect leaks or deviations in the process. Effluent treatment systems are necessary to minimize environmental impact and ensure compliance with emission standards.

- Quality Assurance Systems: A comprehensive quality control system should be established throughout production. Analytical instruments must be used to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Project Economics:

Establishing and operating an engine oil manufacturing plant involves various cost components, including:

- Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

- Equipment Costs: Equipment costs, such as those for blending tanks and reactors, additive dosing systems, high-shear mixers, filtration and dehydration units, quality control laboratories, filling lines, and drum or container packaging machines, represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery.

- Raw Material Expenses: Raw materials, including base oils (Group I-III), additive packages (VI improvers, detergents), and packaging (HDPE cans, drums), are a major part of operating costs. Long-term contracts with reliable suppliers will help mitigate price volatility and ensure a consistent supply of materials.

- Infrastructure and Utilities: Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan.

- Operational Costs: Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. Optimizing processes and providing staff training can help control these operational costs.

- Financial Planning: A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted. This analysis aids in securing funding and formulating a clear financial strategy.

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Machinery costs account for the largest portion of the total capital expenditure. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment. This allocation ensures a solid foundation for safe and efficient plant operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the engine oil manufacturing plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

.webp)

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

To access CapEx Details, Request Sample

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | 80-85% |

| Utility Cost | 5-10% |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Taxes | XX |

| Other Expenses | XX |

To access OpEx Details, Request Sample

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Average |

|---|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX | 20-30% |

| Net Profit | US$ | XX | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX | 8-15% |

To access Financial Analysis, Request Sample

Latest Industry Developments:

- September 2025: Shell Lubricants Egypt (SLE) has signed a significant five-year agreement with Hassan Allam Holding, one of Egypt's biggest engineering, construction, investment, and development companies in the MENA area. As per the agreement, Shell Lubricants Egypt will serve as the exclusive supplier of industrial lubricants for Hassan Allam Holding.

- September 2024: PETRONAS Lubricants International (PLI) and Stellantis N.V. unveiled their latest lubricant line, the co-branded Selenia SUSTAINera engine oils. This cutting-edge product line lowers carbon emissions without compromising exceptional engine performance as it is made from recycled base oils.

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Engine Oil |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. have played a crucial role in constructing, expanding, and optimizing sustainable manufacturing plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start an engine oil manufacturing business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Engine oil production requires base oils, which are derived from crude oil refining or synthesized chemically. These base oils are blended with various additives like detergents, anti-wear agents, antioxidants, and viscosity modifiers to enhance performance and protection.

The engine oil factory typically requires storage tanks, blending vessels, and additive dosing systems for mixing base oils and additives. It also needs filtration units, filling and packaging machines, and quality control lab equipment to ensure product consistency and performance.

The main steps generally include:

-

Sourcing and refining base oils

-

Mixing base oils with additives

-

Blending to the desired consistency and performance levels

-

Filtration and quality control tests

-

Packaging in bottles, cans, or drums

Usually, the timeline can range from 12 to 18 months to start an engine oil manufacturing plant, depending on factors like factory size, equipment procurement, installation, and regulatory approvals. Proper planning and sourcing can help streamline the process.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top engine oil manufactures are:

-

Exxon Mobil Corporation

-

Shell PLC

-

BP p.l.c

-

China Petrochemical Corporation

-

TotalEnergies

-

Lukoil

Profitability depends on several factors including market demand, production efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in an engine oil manufacturing business typically range from 3 to 5 years, depending on production scale, market demand, operating costs, and distribution efficiency. Strong branding and consistent quality can help accelerate profitability.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization