Energy Harvesting System Market Report by Technology (Light Energy Harvesting, Vibration Energy Harvesting, Electromagnetic/Radio Frequency (RF) Energy Harvesting, Thermal Energy Harvesting, and Others), Component (Transducers, Power Management IC (PMIC), Storage Unit), Application (Consumer Electronics, Building and Home Automation, Transportation, Healthcare, and Others), and Region 2025-2033

Global Energy Harvesting System Market:

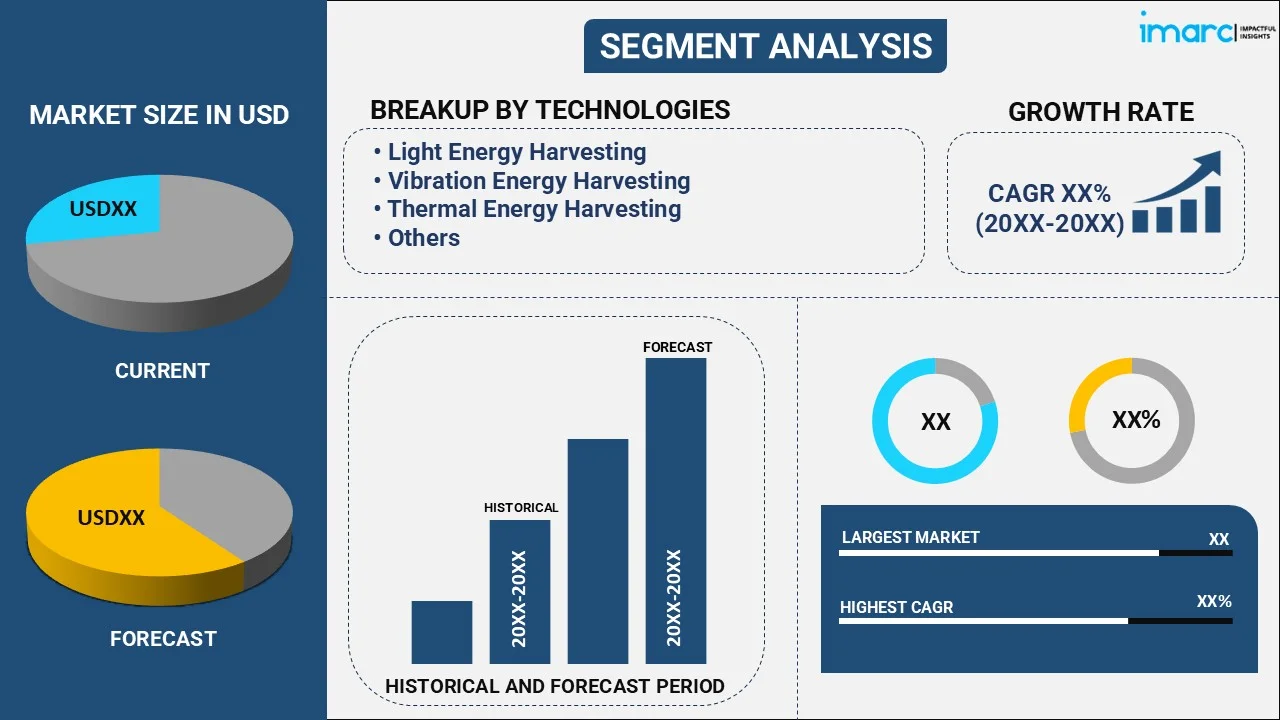

The global energy harvesting system market size reached USD 600.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,536.7 Million by 2033, exhibiting a growth rate (CAGR) of 10.45% during 2025-2033. The increasing emphasis on decreasing greenhouse gas emissions levels is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 600.7 Million |

|

Market Forecast in 2033

|

USD 1,536.7 Million |

|

Market Growth Rate (2025-2033)

|

10.45% |

Energy Harvesting System Market Analysis:

- Major Market Drivers: The rising demand for smart and energy-efficient infrastructures, along with the increasing miniaturization of devices, is stimulating the market.

- Key Market Trends: The launch of supportive government policies and the elevating need to reduce reliance on conventional energy sources are acting as significant growth-inducing factors.

- Competitive Landscape: Some of the major market companies include Analog Devices Inc., Cedrat Technologies, EnOcean GmbH, Kinergizer, Kinetron (Assa Abloy AB), Perpetua Power (Grace Technologies), Powercast Corporation, Silicon Laboratories, STMicroelectronics SA, and Texas Instruments Incorporated, among many others.

- Geographical Trends: North America leads the market, owing to the rising popularity of IoT, the increasing number of smart cities, and the inflating popularity of industrial automation.

- Challenges and Opportunities: Insufficient energy generation is hampering the market. However, improvements in technologies for storing and more efficient energy conversion processes will continue to catalyze the market over the forecast period.

Energy Harvesting System Market Trends:

Increasing Focus on Reducing Carbon Emissions

Energy harvesting systems play an important role in lowering carbon emissions by absorbing and transforming renewable energy from the environment. They reduce dependency on fossil fuels and conventional energy sources, resulting in greener energy use. In September 2024, Honeywell announced its collaboration with Samsung E&A to market solutions aimed at the power plant sector globally. The initiative seeks to reduce carbon emissions and contribute to the fight against climate change. This is increasing the energy harvesting system market growth.

Integration of Wireless Sensor Networks

The growing use of wireless sensor networks (WSNs) in a variety of industries is fueling the market. These networks, which consist of spatially distributed autonomous sensors, are used to monitor physical or environmental variables and transmit their data to a central point. In July 2024, NUS researchers developed new battery-free technology to power electronic devices using ambient radiofrequency signals. This represents the energy harvesting system market outlook.

Advancements in Miniaturization of Devices

The continual trend of miniaturization in electronic gadgets is dramatically increasing the need for energy harvesting systems. As devices shrink, the demand for small and efficient power solutions grows. In April 2024, Vislink Technologies launched DragonFly V, an ultra-compact HEVC HDR COFDM transmitter designed for live video capture from POV cameras, UAVs, and body-worn devices, delivering real-time and high-quality video in a miniature form.

Global Energy Harvesting System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the energy harvesting system market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, component, and application.

Breakup by Technology:

- Light Energy Harvesting

- Vibration Energy Harvesting

- Electromagnetic/Radio Frequency (RF) Energy Harvesting

- Thermal Energy Harvesting

- Others

Among these, light energy harvesting holds the largest share of the market

The report has provided a detailed breakup and analysis of the market based on the technology. This includes light energy harvesting, vibration energy harvesting, electromagnetic/radio frequency (RF) energy harvesting, thermal energy harvesting, and others. According to the report, light energy harvesting represented the largest market segmentation.

Light energy harvesting is gaining popularity since it is the most plentiful and readily available renewable energy source on the planet. Furthermore, the establishment of supportive government policies and incentives to encourage the use of light energy harvesting through subsidies and tax reductions is helping to drive the energy harvesting system market statistics.

Breakup by Component:

- Transducers

- Power Management IC (PMIC)

- Storage Unit

Currently, transducer accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes a transducer, power management IC (PMIC), and storage unit. According to the report, transducer represented the largest market segmentation.

The transducer leads the market due to its critical role in energy harvesting systems. It converts external energy sources such as light, heat, and mechanical vibration into electrical energy. This is boosting the energy harvesting system market revenue.

Breakup by Application:

- Consumer Electronics

- Building and Home Automation

- Transportation

- Healthcare

- Others

Among these, building and home automation hold the largest energy harvesting system market demand

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, building and home automation, transportation, healthcare, and others. According to the report, building and home automation represented the largest market segmentation.

Building and home automation are dominating the market due to the growing worldwide focus on energy efficiency and sustainability in buildings. Energy harvesting devices help to turn renewable energy into usable electricity, considerably lowering energy consumption and carbon footprints.

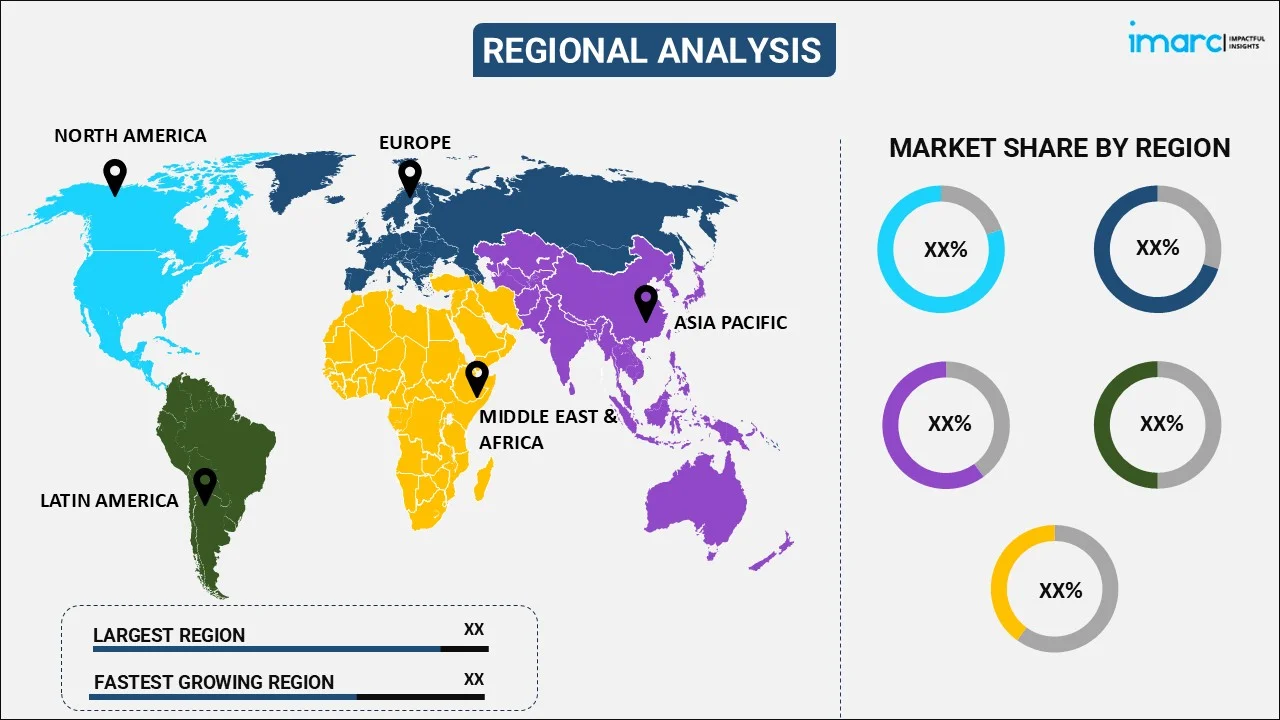

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the market

The energy harvesting system market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America exhibits a clear dominance in the market driven by its robust technological infrastructure. Additionally, the region is home to a large number of leading technology and energy organizations that are actively investing in research and development (R&D) of energy harvesting.

Competitive Landscape:

As per the energy harvesting system market overview, the market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major energy harvesting system market companies have also been provided. Some of the key players in the market include:

- Analog Devices Inc.

- Cedrat Technologies

- EnOcean GmbH

- Kinergizer

- Kinetron (Assa Abloy AB)

- Perpetua Power (Grace Technologies)

- Powercast Corporation

- Silicon Laboratories

- STMicroelectronics SA

- Texas Instruments Incorporated

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Energy Harvesting System Market Recent Developments:

- September 2024: Honeywell announced its collaboration with Samsung E&A to market solutions aimed at the power plant sector globally. The initiative seeks to reduce carbon emissions and contribute to the fight against climate change.

- July 2024: NUS researchers developed new battery-free technology to power electronic devices using ambient radiofrequency signals.

- April 2024: Vislink Technologies launched DragonFly V, an ultra-compact HEVC HDR COFDM transmitter designed for live video capture from POV cameras, UAVs, and body-worn devices, delivering real-time and high-quality video in a miniature form.

Energy Harvesting System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Light Energy Harvesting, Vibration Energy Harvesting, Electromagnetic/Radio Frequency (RF) Energy Harvesting, Thermal Energy Harvesting, Others |

| Components Covered | Transducers, Power Management IC (PMIC), Storage Unit |

| Applications Covered | Consumer Electronics, Building and Home Automation, Transportation, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Cedrat Technologies, EnOcean GmbH, Kinergizer, Kinetron (Assa Abloy AB), Perpetua Power (Grace Technologies), Powercast Corporation, Silicon Laboratories, STMicroelectronics SA, Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

- How has the global energy harvesting system market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global energy harvesting system market?

- What is the impact of each driver, restraint, and opportunity on the global energy harvesting system market?

- What are the key regional markets?

- Which countries represent the most attractive energy harvesting system market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the energy harvesting system market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the energy harvesting system market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the energy harvesting system market?

- What is the competitive structure of the global energy harvesting system market?

- Who are the key players/companies in the global energy harvesting system market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the energy harvesting system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global energy harvesting system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the energy harvesting system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)