Employee Engagement Software Market by Deployment Mode (Cloud-Based, On-premises), Enterprise Size (Large Enterprises, Small and Medium Enterprises), Function (Onboarding, Training, Collaboration and Interaction, Customer Service, Rewards and Recognitions, and Others), Industry (Retail, BFSI, Government, Healthcare, IT and Telecom, Hospitality, Manufacturing, and Others), and Region 2026-2034

Global Employee Engagement Software Market:

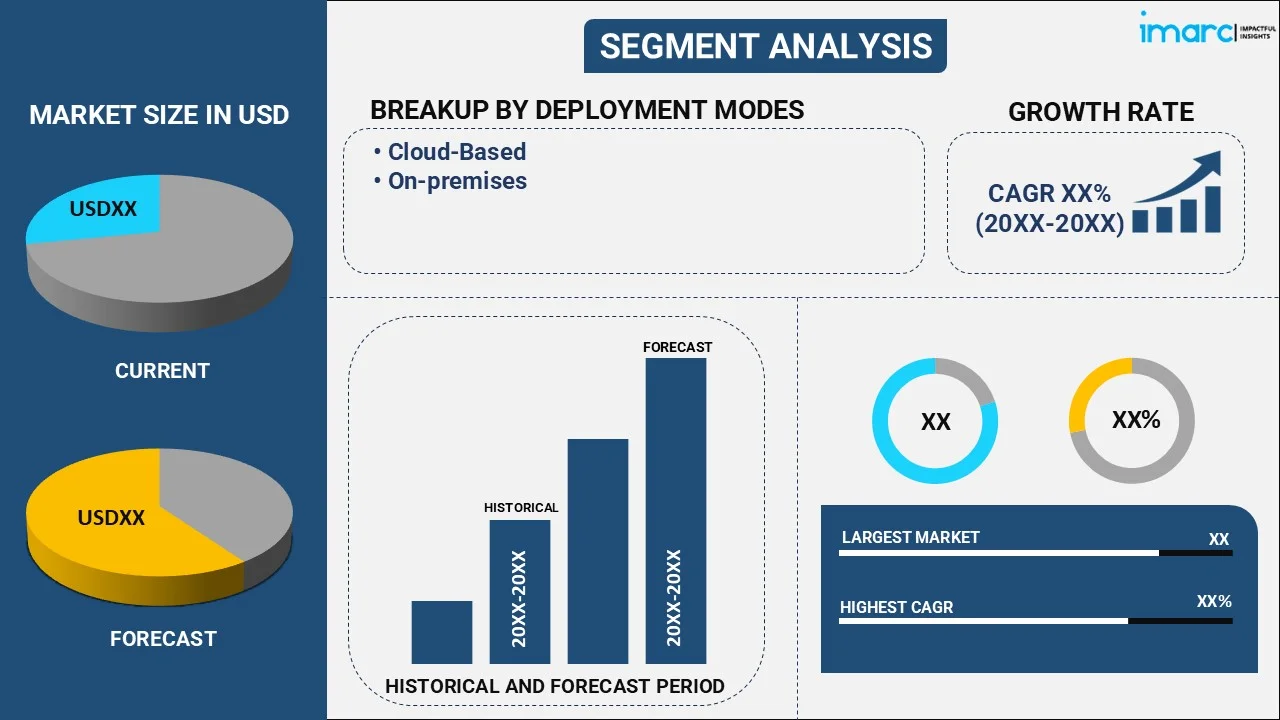

The global employee engagement software market size reached USD 1,195.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,255.9 Million by 2034, exhibiting a growth rate (CAGR) of 11.43% during 2026-2034. The increasing adoption of cloud-based employee engagement software, rapid digital transformation across workplaces, and the rising integration of gamification elements are some of the primary factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,195.1 Million |

| Market Forecast in 2034 | USD 3,255.9 Million |

| Market Growth Rate 2026-2034 | 11.43% |

Employee Engagement Software Market Analysis:

- Major Market Drivers: The increasing demand for highly efficient digital tool that assists in boosting productivity, elevating operational efficiency, streamlining administrations, reducing manual labor, automating several processes, such as survey distribution, data collection, performance evaluations, and recognition programs, etc., is one of the key factors driving the market.

- Key Market Trends: The rising software utilization to facilitate virtual collaboration, communication, and engagement among team members, owing to the emerging work-from-home (WFH) culture, is bolstering the market growth.

- Competitive Landscape: Some of the prominent companies in the global market include 15five Inc., Bitrix24, Culture Amp Pty Ltd., Lattice, Leapsome GmbH, Quantum Workplace, Salesforce Inc., Transcend Engagement LLC, Vantage Circle, Workvivo Limited, and Xoxoday Emplus, among many others.

- Geographical Trends: North America exhibits a clear dominance in the market, owing to the growing focus on employee well-being. Besides this, significant technological advancements are also acting as significant growth-inducing factors.

- Challenges and Opportunities: One of the challenges hindering the market is the difficulty of effectively fostering and measuring genuine engagement among diverse and remote workforces. However, key players are leveraging personalized experiences, advanced analytics, and seamless integration with existing workplace tools to ensure the software meets the unique needs of each organization, which is anticipated to fuel the market over the forecasted period.

To get more information on this market Request Sample

Employee Engagement Software Market Trends:

Growing Remote Working Models

The shifting preferences towards hybrid work models are propelling the market. As companies adopt new working environments, there is an escalating demand for tools that facilitate virtual communication, collaboration, and engagement. For instance, in December 2023, Zoom introduced Zoom Surveys, an engagement tool to maximize employee productivity. Moreover, Zoom Surveys allows users to create and edit polls as well as share them with employees and customers. As a standalone solution, it enhances Zoom's in-meeting and webinar features, thereby opening up more ways for managers and users to engage with employees and customers outside of meetings. Besides this, the rising number of features that promote continuous engagement and feedback is one of the employee engagement software market growth factors. For example, in March 2024, Airspeed, an innovative platform focused on connecting and celebrating employees to drive engagement, launched new AI capabilities across all their applications that enable workers to follow a flexible hybrid schedule. Similarly, in May 2024, VTS unveiled VTS Activate Workplace, which is tailored specifically for companies to create personal, exceptional end-to-end experiences across their offices to activate every team and workplace.

Rising Focus on Personalization

The widespread adoption of data-driven insights is positively influencing the market. In addition, companies are extensively using AI and big data to gain insights into employee preferences, behavior, and engagement levels. In June 2024, Swissport International AG introduced oneApp, which encompasses over 60,000 employees across 44 countries. It also benefits from enhanced engagement tools, seamless access to information, and streamlined work functionalities through both the app and its intranet counterpart, oneNet. Similarly, in April 2024, LMS365, the only AI-powered learning and performance management platform built into Microsoft 365 and Teams, unveiled employee engagement software that offers real-time feedback, daily check-ins, and AI-powered insights. Furthermore, Glint, a part of LinkedIn, utilizes data analytics to provide real-time insights and feedback, thereby helping managers understand their teams better and take proactive measures to enhance engagement. Similarly, Qualtrics offers reporting tools that assist organizations in tailoring their engagement initiatives based on specific employee needs and preferences.

Increasing Integration with Existing Tools

The inflating need for improving usability for daily workflows, minimizing friction, and increasing participation is one of the primary factors bolstering the market. For example, in October 2023, WorkForce Software developed its new prebuilt integration to SAP SuccessFactors Human Experience Management (HXM) Suite. Additionally, in March 2023, Terryberry launched an all-in-one employee engagement platform that offers an easy-to-access platform and app. Besides this, platforms like Kudos and Bonusly, integrate with popular collaboration tools like Slack and Microsoft Teams, thereby making it easier for employees to give and receive recognition in real-time. Moreover, the increasing number of engagement activities is also acting as another significant growth-inducing factor. For instance, in May 2024, Lattice unveiled new AI features for performance management and employee surveying. Apart from this, in March 2023, Glue, one of the leading employee engagement companies formerly known as Mystery, introduced a connection platform that uses network analysis and machine learning to uncover connection opportunities for distributed teams.

Global Employee Engagement Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the deployment mode, enterprise size, function, and industry.

Breakup by Deployment Mode:

To get detailed segment analysis of this market Request Sample

- Cloud-Based

- On-premises

On-premises currently exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises. According to the report, on-premises represented the largest market segmentation.

The on-premises employee engagement software market has seen notable advancements, with recent product launches catering to organizations prioritizing data security and customization. For instance, the release of Oracle HCM Cloud 21B brought significant updates, offering enhanced capabilities for on-premises deployment. This version includes advanced analytics, personalized dashboards, and robust compliance features, ensuring companies can tailor the software to their unique requirements while keeping sensitive data in-house. Another significant launch is SAP SuccessFactors 1H 2023, which introduced new modules specifically designed for on-premises environments, such as enhanced performance management and employee recognition tools that seamlessly integrate with existing IT infrastructures. As per the employee engagement software market insight, these launches reflect a growing trend toward providing secure, flexible, and highly customizable employee engagement solutions for organizations preferring on-premises software.

Breakup by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Currently, large enterprises hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises. According to the report, large enterprises represented the largest market segmentation.

Large enterprises represent the largest segment in the market due to several key factors, including their complex organizational structures, substantial workforce, and significant budgets allocated for employee development and retention. For instance, multinational corporations like IBM and Microsoft use advanced engagement platforms, such as Qualtrics and Workday. These platforms offer extensive features like real-time feedback, pulse surveys, and detailed analytics, which help in understanding employee sentiment across different regions and departments.

Breakup by Function:

- Onboarding

- Training

- Collaboration and Interaction

- Customer Service

- Rewards and Recognitions

- Others

Onboarding accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the function. This includes onboarding, training, collaboration and interaction, customer service, rewards and recognitions, and others. According to the report, onboarding represented the largest market segmentation.

Onboarding represents a critical segmentation in the market because it sets the foundation for long-term employee satisfaction and productivity. Effective onboarding processes ensure that new hires are quickly integrated into the company culture, understand their roles, and feel valued from the start. For example, BambooHR offers a comprehensive onboarding solution that includes automated workflows, e-signatures, and personalized welcome emails, helping new employees navigate their initial days smoothly.

Breakup by Industry:

- Retail

- BFSI

- Government

- Healthcare

- IT and Telecom

- Hospitality

- Manufacturing

- Others

IT and telecom account for the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the industry. This includes retail, BFSI, government, healthcare, IT and telecom, hospitality, manufacturing, and others. According to the report, IT and telecom represented the largest market segmentation.

The IT and telecom sectors represent the largest segmentation in the market due to their fast-paced, highly competitive nature and the critical need to maintain a skilled and motivated workforce. For example, Infosys, a global leader in IT services, utilizes Oracle HCM Cloud to enhance its employee engagement strategies. The platform provides tools for continuous feedback, career development, and wellness programs, which are essential for keeping employees engaged and reducing burnout in a demanding environment. As per the employee engagement software market segmentation analysis, the emphasis on advanced tools in these sectors underscores the importance of fostering a supportive and engaging work culture to drive innovation and maintain a competitive edge.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The market across North America is thriving, driven by the region's high adoption of advanced technologies and the increasing focus on employee satisfaction and retention. Companies across the United States and Canada are leveraging sophisticated engagement tools to enhance their workforce experience. For instance, Salesforce, headquartered in San Francisco, utilizes its own Salesforce Employee Experience platform to boost engagement through personalized communication, feedback mechanisms, and recognition programs. Similarly, Toronto-based Kudos offers a cloud-based employee recognition platform that integrates with popular tools like Slack and Microsoft Teams, fostering a culture of appreciation and engagement. Moreover, Qualtrics, with its robust survey and feedback tools, is widely used by companies in the region to gain real-time insights into employee sentiment and drive data-driven engagement strategies.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- 15five Inc.

- Bitrix24

- Culture Amp Pty Ltd.

- Lattice

- Leapsome GmbH

- Quantum Workplace

- Salesforce Inc.

- Transcend Engagement LLC

- Vantage Circle

- Workvivo Limited

- Xoxoday Emplus

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Employee Engagement Software Market Recent Developments:

- June 2024: Swissport International AG introduced oneApp that benefits from enhanced engagement tools, seamless access to information, and streamlined work functionalities through both the app and its intranet counterpart, oneNet.

- May 2024: Lattice launched new AI features for performance management and employee surveying.

- April 2024: LMS365, the only AI-powered learning and performance management platform built into Microsoft 365 and Teams, unveiled employee engagement software that offers real-time feedback, daily check-ins, and AI-powered insights.

Employee Engagement Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Modes Covered | Cloud-Based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Functions Covered | Onboarding, Training, Collaboration and Interaction, Customer Service, Rewards and Recognitions, Others |

| Industries Covered | Retail, BFSI, Government, Healthcare, IT and Telecom, Hospitality, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 15five Inc., Bitrix24, Culture Amp Pty Ltd., Lattice, Leapsome GmbH, Quantum Workplace, Salesforce Inc., Transcend Engagement LLC, Vantage Circle, Workvivo Limited, Xoxoday Emplus, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the employee engagement software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global employee engagement software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the employee engagement software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The employee engagement software market was valued at USD 1,195.1 Million in 2025.

The employee engagement software market is projected to exhibit a CAGR of 11.43% during 2026-2034, reaching a value of USD 3,255.9 Million by 2034.

The market is driven by the increasing need for businesses to improve productivity, enhance employee experience, and reduce turnover. Advancements in AI, data analytics, and cloud technologies also support the growth of these platforms, while a growing remote workforce demands tools for better engagement and collaboration.

North America currently dominates the employee engagement software market in 2025. The dominance is fueled by the presence of major software providers and widespread adoption of advanced technologies, and a focus on improving workforce productivity. Additionally, businesses in the region are investing heavily in employee retention and satisfaction initiatives.

Some of the major players in the employee engagement software market include 15five Inc., Bitrix24, Culture Amp Pty Ltd., Lattice, Leapsome GmbH, Quantum Workplace, Salesforce Inc., Transcend Engagement LLC, Vantage Circle, Workvivo Limited, and Xoxoday Emplus, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)