EMI Shielding Market Size, Share, Trends and Forecast by Material, Shielding Method, End-Use Industry, and Region, 2025-2033

EMI Shielding Market Size and Trends:

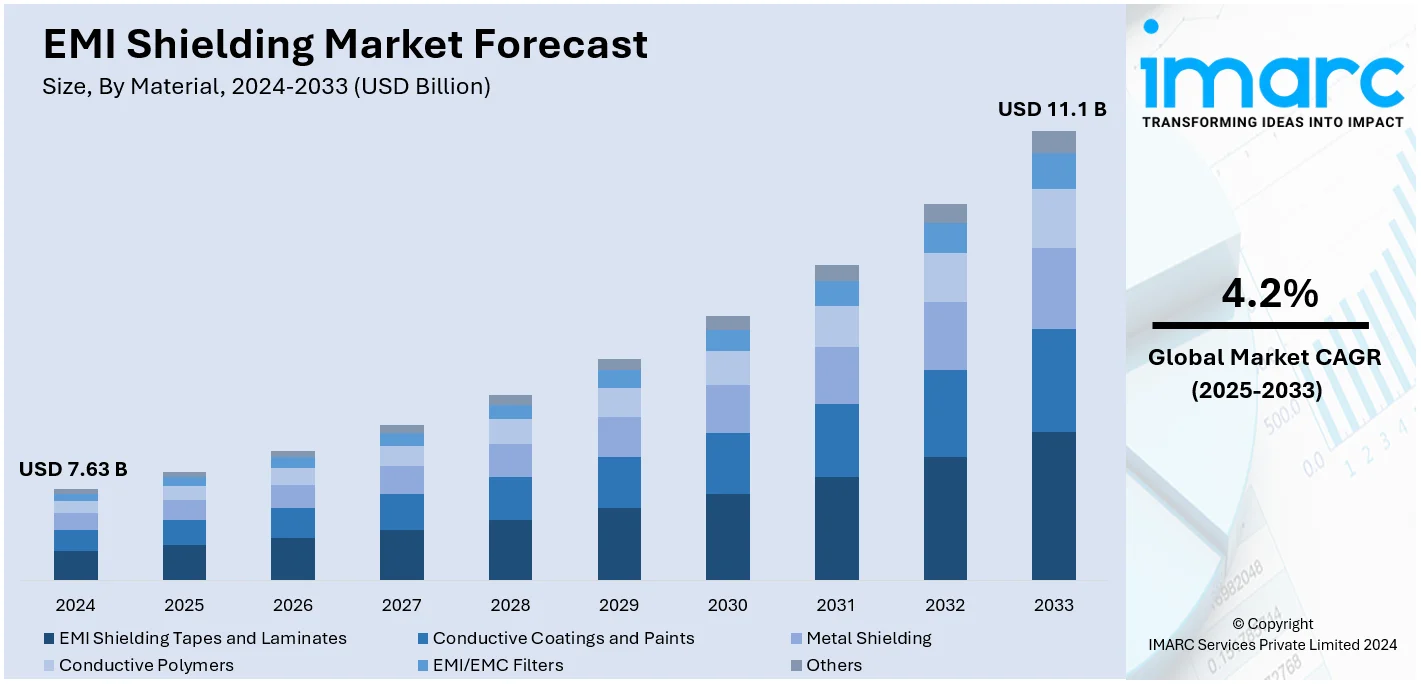

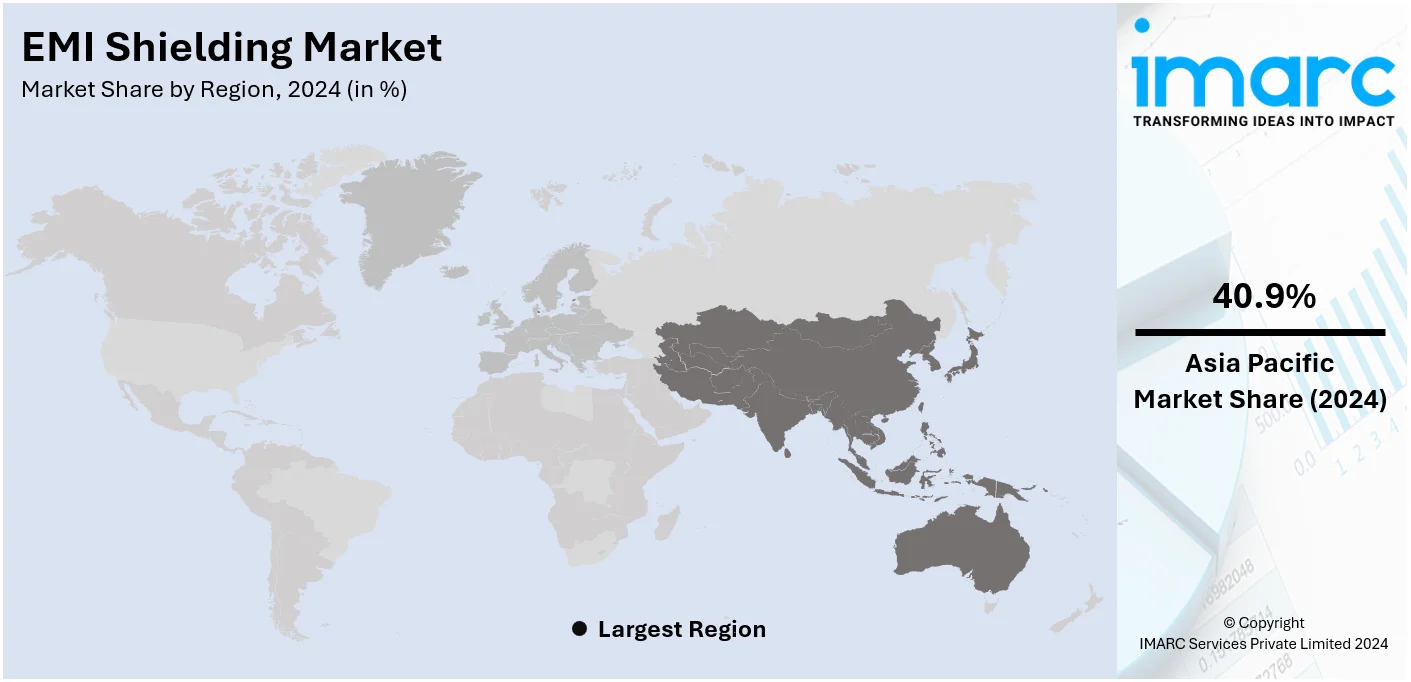

The global EMI shielding market size was valued at USD 7.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.1 Billion by 2033, exhibiting a CAGR of 4.2% during 2025-2033. Asia Pacific currently dominates the market. The growing availability of 5G networks, increasing miniaturization of various electronic devices, and the rapid utilization of various electronic devices in the healthcare industry around the world are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.63 Billion |

|

Market Forecast in 2033

|

USD 11.1 Billion |

| Market Growth Rate (2025-2033) | 4.2% |

The global EMI shielding market is primarily driven by the rising demand for electronic devices and increasing electromagnetic interference in various sectors, including telecommunications, consumer electronics, and automotive industries. The rapid adoption of 5G technology, coupled with the proliferation of Internet of Things (IoT) devices, is increasing the need for effective EMI shielding solutions to ensure device performance and regulatory compliance. Additionally, advancements in materials, such as conductive coatings and metal-based shields, are further enhancing the efficiency of EMI protection, making them indispensable in modern electronics. On 18th April 2024, SiAT, a Taiwanese leader in nanomaterials, partnered with Japan's Zeon Corporation to launch a single-walled carbon nanotube (SWCNT) conductive paste. This innovative material enhances Lithium-ion battery performance with reduced additive requirements, enhancing energy density and charging efficiency. Its versatile applications include transparent films and EMI shielding, showcasing superior conductivity and advanced dispersion technology. Moreover, growing awareness of the importance of electromagnetic compatibility in critical applications, such as aerospace and healthcare equipment, also contributes significantly to EMI shielding market growth.

The United States stands out as a key regional market, primarily driven by the increasing penetration of consumer electronics and the growing complexity of electronic circuits in modern devices. With the rise of smart home technologies and wearable devices across the country, the demand for reliable electromagnetic compatibility solutions is accelerating. Along with this, the military and aerospace sectors also significantly contribute to market growth, driven by the need for secure communication systems and advanced radar technologies. Concurrently, the healthcare industry’s adoption of sophisticated electronic medical equipment, such as imaging and monitoring devices, is creating new opportunities for EMI shielding applications. Furthermore, the ongoing push for sustainable and energy-efficient electronics is also encouraging manufacturers to develop innovative shielding materials and techniques tailored to emerging market needs in the US.

EMI Shielding Market Trends:

Rising Availability of 5G Technology

At present, the proliferation of data-intensive applications, such as video streaming, virtual reality (VR), augmented reality (AR), and the Internet of Things (IoT), is creating a need for faster and more reliable connectivity. 5G technology provides significantly higher data speeds, lower latency, and greater capacity compared to previous generations of wireless networks, which makes it well-suited to meet the demands of these applications. It also offers an improved mobile broadband experience by delivering faster download and upload speeds. This allows users to access and share large files more quickly, stream high-definition content seamlessly, and enjoy enhanced online gaming experiences, which is transforming the EMI shielding market outlook around the world. As of 2023, an estimated 1.9 billion individuals subscribed to fifth-generation or 5G globally. By 2028, that figure will grow to about 8 billion. Such estimates illustrate a greater growth and necessity for the application of 5G technology.

Increasing Miniaturization of Devices

At present, individuals have an increasing demand for portable and mobile electronic devices that can be easily carried and used on the go, which is growing the production of smaller and lightweight devices that are more convenient to carry in pockets, bags, or wearables. Miniaturization also enables the integration of multiple functions and features into a single device as electronic components become smaller and can accommodate more functionality into a compact form factor. It allows for faster processing speeds, higher memory capacities, and improved power efficiency, enabling more powerful and capable devices, which is further propelling the market growth. In fact, global shipments of wearable devices increased 2.6% year over year in the third quarter of 2023 (3Q23), hitting an all-time high of 148.4 million units, according to new data from the International Data Corporation. This increase in wearable device shipments indicates that consumers are increasingly opting for compact, multifunctional devices, which further supports the trend of miniaturization in portable electronics.

Growing Employment of Healthcare Electronics

The continuous advancements in medical technology are leading to the development of sophisticated electronic devices and equipment for healthcare applications. These devices, such as medical imaging systems, patient monitoring devices, diagnostic equipment, and wearable health trackers, play an important part in improving patient care, diagnosis, and treatment outcomes. The increasing adoption of these technologies is driving the employment of healthcare electronics. Apart from this, there is a growing demand for remote patient monitoring solutions, especially in situations wherein patients require continuous monitoring or are unable to visit healthcare facilities regularly. Electronic devices and wearable sensors can monitor vital signs, collect data, and transmit it to healthcare professionals in real time, enabling remote monitoring and timely intervention. This demand for remote patient monitoring solutions is expanding the EMI shielding market size. Additionally, according to the Canadian Institute, healthcare spending in Canada reached USD 331.0 Billion in 2022, compared to USD 328.0 Billion in 2021, which reflects a growing demand for EMI shielding to improve product reliability in the increasing healthcare electronics industry.

EMI Shielding Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global EMI shielding market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, shielding method, and end-use industry.

Analysis by Material:

- EMI Shielding Tapes and Laminates

- Conductive Coatings and Paints

- Metal Shielding

- Conductive Polymers

- EMI/EMC Filters

- Others

Conductive coatings and paints lead the market with Material 34.9% of the share in 2024. Conductive coatings and paints comprise conductive materials, typically metallic particles or carbon-based additives, which provide electrical conductivity to the coated surface. These coatings are designed to offer a range of electrical and functional properties, depending on the specific application requirements. They are used to provide electromagnetic interference (EMI) and radio frequency interference (RFI) shielding. They contain conductive materials that help prevent the leakage or absorption of electromagnetic waves, thereby protecting sensitive electronic components from external interference.

Analysis by Shielding Method:

- Radiation

- Conduction

Radiation leads the market with 88.6% of the market share in 2024 due to its critical role in mitigating electromagnetic interference across various applications. This method is highly effective in environments where sensitive electronic equipment requires protection from radiation-induced performance disruptions, such as in healthcare, aerospace, and military sectors. The increasing use of advanced imaging systems, including CT scanners and MRI machines, further drives demand for radiation shielding solutions. Additionally, the growth of satellite communication systems and nuclear energy projects highlights the need for robust shielding materials to ensure operational efficiency and safety, thereby solidifying radiation shielding as the leading method in the market.

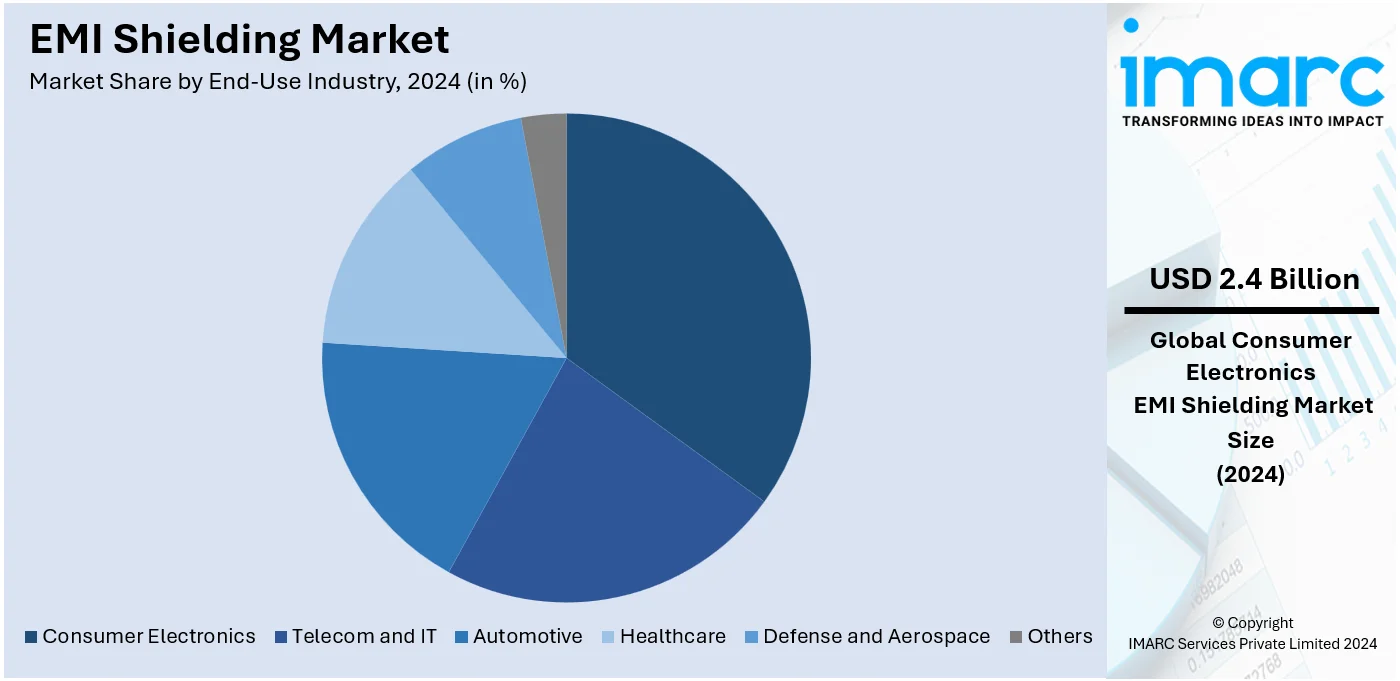

Analysis by End-Use Industry:

- Consumer Electronics

- Smartphones

- Tablets

- Television

- Others

- Telecom and IT

- Automotive

- Healthcare

- Defense and Aerospace

- Others

Consumer electronics lead the market with 31.2% of the share in 2024. Consumer electronics are intended for personal use by individuals in their everyday lives. They comprise a wide range of devices, including smartphones, laptops, televisions, e-books, camcorders, digital cameras, and wearable devices, which help in lifestyle management. These devices are designed to enhance communication, entertainment, productivity, and convenience for consumers. Consumer electronics can range from small handheld gadgets to larger home appliances and entertainment systems. They allow people to stay connected with family, friends, and colleagues through calls, messaging, video chats, and social media platforms. These devices also provide access to the internet, facilitating information sharing, online collaboration, and access to a vast array of digital content.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest regional segment with a market share of 40.9%. The APAC region is experiencing significant industrial and technological advancements. Besides this, the rising purchase of consumer electronics, including televisions (TVs), vacuum cleaners, air-conditioners (ACs), and refrigerators, is propelling the growth of the market. Another contributing aspect is the expansion of telecommunication networks and the deployment of advanced wireless technologies, such as 5G, which require robust EMI shielding solutions to maintain signal integrity, minimize interference, and ensure reliable communication. Additionally, a high concentration of electronics production along with the presence of leading manufacturing hubs are significantly supporting the Asia Pacific EMI shielding market share. The region benefits from cost-effective production capabilities and strong export demand, further solidifying its position as the largest market segment globally.

Key Regional Takeaways:

United States EMI Shielding Market Analysis

In 2024, the US accounted for 86.30% of the total North American EMI shielding market. The market in the United States is growing at a very robust rate, driven by the growth of key industries like aerospace, defense, and automotive. According to the Aerospace Industries Association, the United States aerospace and defense industry recorded a 2.1% revenue growth in 2022 to USD 892 Billion. What this growth does is raise the demand for advanced EMI shielding solutions to ensure protection of sensitive aerospace and defense electronics from electromagnetic interference, thus the assurance of reliable and efficient performance of critical systems.

The automotive industry is also an important contributor to this market growth. The United States is the world's second largest market for both vehicle sales and production. In 2020, light vehicle sales stood at 14.5 million units as reported by the International Trade Administration (ITA). As electric and autonomous vehicles become a new reality for the automotive industry, the demand for EMI shielding has increased dramatically, especially to protect the complicated electronic systems in these vehicles, including electric drivetrains, battery management systems, and advanced driver-assistance systems. The increasing adoption of 5G technology, medical devices, and consumer electronics also enhances the demand for EMI shielding in the U.S. and aids in the positive growth of the market.

Europe EMI Shielding Market Analysis

From 2021 to 2025, industry reports anticipate the generation of new sales amounting to up to EUR 2.0 Trillion (USD 2.08 Trillion) with regard to 5G technology for key industries in the European economy. The increase in sales will generate huge demand for EMI shielding solutions because 5G infrastructure and connected devices are extremely high performance electronic components with no interference. The growing number of devices and the widespread implementation of 5G networks may likely increase demand in all these sectors, such as telecommunications, IT, and consumer electronics, for EMI shielding.

According to an industrial report, the European electric vehicle market is yet another rapidly expanding segment of the automotive business. New electric vehicle registrations almost touched 3.2 million in 2023, a staggering rise of 20% against 2022. The sharp rise in adoption of electric vehicles coupled with the very stringent regulatory standards for automobile electronics is the added encouragement to design EMI shielding to avoid interference with sensitive components for electric drivetrains, battery systems, and autonomous technologies. Europe has more and more sustainable as well as technology-intensive industries. In automotive, telecom, healthcare, and defense, it is going to continuously observe an upsurge in the demand for EMI shielding.

Asia Pacific EMI Shielding Market Analysis

According to an industrial report, the rapidly expanding internet economy in India is predicted to grow to USD 1 Trillion by 2030. E-commerce alone is estimated to reach USD 325 Billion and rank third globally. This explosion of digital connectivity and online transactions is creating a huge demand for EMI shielding in electronic products so that they can be delivered without interference.

The 2023 wearable technology market in India: This experienced a remarkable 34% increase to 134.2 million units annually. International Data Corporation India Monthly Wearable Device Tracker reported improvement within the earwear segment alone. It has increased year on year by 16.9% with 80.4 million units. This represents further increases in the adoption of connected and portable devices within this region that drives demand for EMI shielding to maintain reliability of a device and signal integrity. With the rapid adoption of technology in the Asia-Pacific region, the EMI shielding market will gain from the penetration of electronics across consumer, industrial, and commercial sectors.

Latin America EMI Shielding Market Analysis

The IT and telecom sectors in Latin America are expanding at a remarkable pace even though the economy has been tempered, hence providing good growth opportunities for the EMI shielding market. International Data Corporation projects IT spending in Latin America will surpass the growth of GDP; it was expected to rise by 12.6% in 2023 and over 15% by 2026. This growth is attributed to increased investments in digital transformation, cloud computing, and other next-generation communication technologies like the deployment of 5G. In fact, along with the growing IT and telecom infrastructure, advanced electronic devices, which need to operate in an optimal way while at the same time suffering minimum signal interference, will call for effective EMI shielding solutions. More industries take up smart devices and connected technologies, making strong demands for robust EMI shielding materials and technologies. The Latin America IT and telecom sectors have sustained growth. The growing dependency on electronic systems fuels demand for EMI shielding products and contributes towards the growth of the EMI shielding market in this region.

Middle East and Africa EMI Shielding Market Analysis

The adoption of 5G technology in the Middle East and North Africa (MENA) region is expected to grow significantly from 2025 onwards, with half of the region's population to have access to 5G by the end of the decade, according to a report. According to an industrial report, the GCC countries will dominate the growth of 5G coverage, as 95% of the population in these countries are expected to be covered by 2030. It is also going to be the leader in the MENA region regarding 4G technology. The technology is expected to cover over 50% of total mobile connections till 2027.

The high-speed networks, along with rapid development in telecom infrastructure, are driving the demand for advanced electronic components that require effective EMI shielding. With 5G-enabled devices, telecom equipment, and IoT solutions increasingly spreading across the region, the demand for shielding materials to ensure uninterrupted performance and regulatory compliance will continue to grow, thus propelling the EMI shielding market.

Competitive Landscape:

Key players are investing in research and development (R&D) activities for developing innovative shielding materials and solutions. They are also striving to create products that offer better performance, higher conductivity, improved durability, and reduced weight and thickness. Top market players are concentrating efforts on exploring the opportunity to use these technological advancements to improve the EMI-shielded products developed by them. They have also included recently discovered materials such as conductive polymer, advanced alloy, and nanomaterial for their development. The leading companies are closely cooperating with customers to understand the customers' needs and provide a particularized solution. They are also providing knowledge of design and application engineering for clients to optimize EMI shielding performance, reduce the costs of their products, and increase the reliability of these products.

The report provides a comprehensive analysis of the competitive landscape in the EMI shielding market with detailed profiles of all major companies, including:

- Dow Inc.

- ETS-Lindgren

- HEICO Corporation

- KITAGAWA INDUSTRIES America, Inc

- Laird Technologies, Inc.

- Leader Tech Inc.

- Omega Shielding Products

- Parker Hannifin Corp.

- RTP Company

- Schaffner Holding AG

- Tech Etch, Inc

Latest News and Developments:

- Nov 2024: JLR collaborated with industry partners Dow and Adient to create innovative seat foam for its luxury cars that incorporates closed-loop recycled material, marking a first in the automotive sector.

- Nov 2024: DOW and Guangdong Delian Group Co., Ltd. entered into a memorandum of understanding (MoU) during the 7th China International Import Expo. These two firms will work together to enhance the use of post-consumer recycled (PCR) resins in the automotive sector, aiding the industry's transition towards circularity.

- June 2023: Dow Inc. and For Inspiration and Recognition of Science and Technology (FIRST) declared that they would continue to work together for expanding their robotics competition program.

- June 2023: PPG Industries partnered with ScienceFest (VedaFest), the largest open-air science event in Czechia, which took place in Prague and provided hands-on workshops at the event to inspire young people with interest in science, technology, and engineering.

- In 2022, As an international distributor of vital EMI shielding solutions, Tech-Etch Inc. announced the extension of its long-term distribution agreement with Heilind.

EMI Shielding Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | EMI Shielding Tapes and Laminates, Conductive Coatings and Paints, Metal Shielding, Conductive Polymers, EMI/EMC Filters, Others |

| Shielding Methods Covered | Radiation, Conduction |

| End-Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Dow Inc., ETS-Lindgren, HEICO Corporation, KITAGAWA INDUSTRIES America, Inc, Laird Technologies, Inc., Leader Tech Inc., Omega Shielding Products, Parker Hannifin Corp., RTP Company, Schaffner Holding AG, Tech Etch, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, EMI shielding market forecast, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global EMI shielding market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the EMI shielding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electromagnetic interference (EMI) shielding refers to the process of reducing or blocking electromagnetic radiation or fields emitted by electronic devices. This is crucial to prevent device malfunction, safeguard sensitive electronics, and enhance overall system performance in various applications.

The EMI shielding market was valued at USD 7.63 Billion in 2024.

IMARC estimates the global EMI shielding market to exhibit a CAGR of 4.2% during 2025-2033.

The key drivers of the global EMI shielding market include the proliferation of 5G networks, the miniaturization of electronic devices, the increasing use of electronics in the healthcare sector, and advancements in shielding materials such as conductive coatings and carbon nanotube-based solutions.

Conductive coatings and paints represented the largest segment by material, driven by their ability to offer efficient EMI and RFI shielding for diverse applications.

Radiation leads the market by shielding method due to its effectiveness in protecting sensitive electronics in industries like healthcare, aerospace, and defense.

The consumer electronics segment is the leading segment by end-use industry, driven by the rising adoption of portable and multifunctional devices like smartphones, wearables, and tablets.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global EMI shielding market include Dow Inc., ETS-Lindgren, HEICO Corporation, KITAGAWA INDUSTRIES America, Inc, Laird Technologies, Inc., Leader Tech Inc., Omega Shielding Products, Parker Hannifin Corp., RTP Company, Schaffner Holding AG, and Tech Etch, Inc, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)