Embedded Software Market Report by Operating System (General Purpose Operating System (GPOS), Real-Time Operating System (RTOS)), Function (Standalone System, Real-Time System, Network System, Mobile System), Application (Automotive, Consumer Electronics, Manufacturing, Healthcare, Military and Defense, IT and Telecom, and Others), and Region 2025-2033

Embedded Software Market Size:

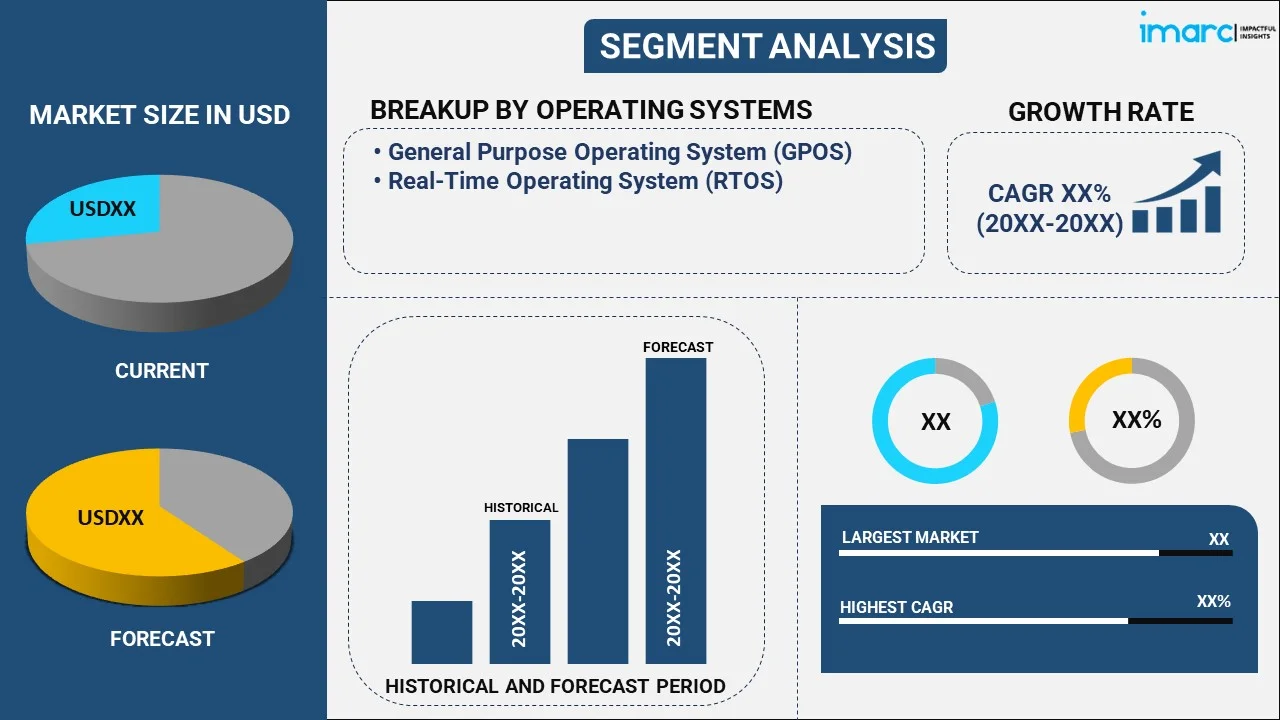

The global embedded software market size reached USD 17,217.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 31,537.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.96% during 2025-2033. The market demand is majorly increasing by the growing incorporation of IoT for real-time data processing, augmenting demand for embedded software in autonomous systems, and heightening focus on cybersecurity, with robust solutions required to ensure safety, performance, and protection across critical applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17,217.7 Million |

| Market Forecast in 2033 | USD 31,537.2 Million |

| Market Growth Rate (2025-2033) | 6.96% |

Embedded software refers to computer programs that are specifically designed to run on embedded systems, which are specialized computer systems that perform specific tasks. These systems are typically found in various devices, such as consumer electronics, medical devices, automotive systems, and industrial machinery. Some of the standard embedded systems include smartphones, automobiles, home appliances, medical devices, industrial equipment, and other electronic devices. Embedded software is responsible for controlling the hardware and enabling the desired functionality of the embedded system. It interacts with sensors, actuators, and other components to gather data, process information, and provide appropriate outputs. In addition to this, embedded software provides numerous advantages, such as customization, resource efficiency, real-time responsiveness, reliability, cost-effectiveness, scalability, connectivity, and faster development.

Embedded Software Market Trends:

Rapid Incorporation of the Internet of Things (IoT)

As more devices become interconnected, embedded software plays a critical role in managing communication, data processing, and device functionality. This trend is particularly evident in sectors such as healthcare, automotive, and manufacturing, where IoT-enabled devices rely on embedded software for real-time data processing and decision-making. The increasing demand for smart devices, coupled with continual advancements in wireless communication technologies, is driving the need for more sophisticated and secure embedded software solutions, with an emphasis on enhancing efficiency, interoperability, and security across a wide range of connected devices. As IoT adoption continues to expand globally, the embedded software market share is expected to grow.

Growing Demand in Autonomous Systems

A significant trend in the market is the rising demand for embedded software in autonomous systems, particularly in the automotive and aerospace industries. The rapid development of self-driving cars, advanced driver assistance systems (ADAS), and autonomous drones requires highly reliable and efficient embedded software to ensure safety, real-time data processing, and decision-making capabilities. This trend is fueled by the continual advancements in artificial intelligence (AI) and machine learning (ML), which are being integrated into embedded systems to enhance their ability to learn, adapt, and perform complex tasks autonomously. As the need for automation and autonomy grows, the embedded software segment is expected to experience significant growth, with an increased focus on software that ensures safety, security, and performance in critical applications.

Growing Emphasis on Cybersecurity

As embedded systems become more connected and integral to critical infrastructure, the risks of cyberattacks have risen, with statistics showing 2,200 attacks per day and one occurring every 39 seconds. By 2024, cybercrime is projected to cost USD 9.5 trillion globally. Sectors such as defense, healthcare, and telecommunications are particularly vulnerable due to their reliance on secure embedded systems. This is fueling the demand for embedded software featuring robust security measures such as encryption, secure boot, and real-time monitoring. Regulatory requirements and industry standards are also facilitating the adoption of these secure solutions. As cybersecurity becomes a top priority, the future of the embedded software market is anticipated to increasingly focus on developing resilient systems that can effectively counter sophisticated cyber threats.

Embedded Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global embedded software market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on operating system, function, and application.

Operating System Insights:

- General Purpose Operating System (GPOS)

- Real-Time Operating System (RTOS)

The report has provided a detailed breakup and analysis of the embedded software market based on the operating system. This includes general purpose operating system (GPOS) and real-time operating system (RTOS). According to the report, general purpose operating system (GPOS) represented the largest segment.

Function Insights:

- Standalone System

- Real-Time System

- Network System

- Mobile System

The report has provided a detailed breakup and analysis of the embedded software market based on the function. This includes standalone, real-time, network, and mobile systems. According to the report, standalone system represented the largest segment.

Application Insights:

- Automotive

- Consumer Electronics

- Manufacturing

- Healthcare

- Military and Defense

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the embedded software market based on the application. This includes automotive, consumer electronics, manufacturing, healthcare, military and defense, IT and telecom, and others. According to the report, IT and telecom represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for embedded software. Some of the factors driving the North America embedded software market included rapid technological advancements, extensive research and development (R&D) activities, and significant growth in the automotive industry.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the embedded software market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Advantech Co. Ltd

- Green Hills Software

- Intel Corporation

- Intellias

- L&T Technology Services Limited (Larsen & Toubro Ltd.)

- Microsoft Corporation

- NXP Semiconductors N.V

- Siemens

- STMicroelectronics N.V

- Xilinx Inc. (Advanced Micro Devices Inc.)

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Embedded Software Market News:

- May 23, 2024: Accenture acquired Teamexpat, a Netherlands-based embedded software specialist, to strengthen its digital engineering capabilities, particularly in the semiconductor sector. Teamexpat’s expertise in software development for lithography systems is anticipated to enhance Accenture’s ability to deliver smart, connected products. This acquisition also aligns with Accenture’s focus on expanding its presence in high-tech industries.

- March 8, 2024: General Motors, Magna, and Wipro Limited are teaming up to launch a digital marketplace called SDVerse for software-defined vehicles. The platform aims to connect buyers and sellers of automotive software, addressing the increasing demand for software in modern vehicles. With the automotive industry transitioning towards software-defined vehicles, this collaboration seeks to provide a solution for acquiring embedded automotive software more efficiently and cost-effectively. The new venture, in which Wipro and Magna will each hold a 27% stake and GM will hold the remaining 46%, is anticipated to benefit vehicle manufacturers by enabling faster adoption of new technologies.

- January 25, 2024: Vector is offering high-availability embedded software for ECUs that complies with ISO 26262 safety standards, exceeding typical market requirements. Designed for autonomous driving and x-by-wire systems, this software is integrated into Vector’s MICROSAR Classic product. It enables the development of safety-related systems capable of fault detection and reliable service execution, essential for fully self-driving vehicles and other mission-critical applications.

Embedded Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Operating Systems Covered | General Purpose Operating System (GPOS), Real-Time Operating System (RTOS) |

| Functions Covered | Standalone System, Real-Time System, Network System, Mobile System |

| Applications Covered | Automotive, Consumer Electronics, Manufacturing, Healthcare, Military and Defense, IT and Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advantech Co. Ltd, Green Hills Software, Intel Corporation, Intellias, L&T Technology Services Limited (Larsen & Toubro Ltd.), Microsoft Corporation, NXP Semiconductors N.V, Siemens, STMicroelectronics N.V, Xilinx Inc. (Advanced Micro Devices Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global embedded software market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global embedded software market?

- What is the impact of each driver, restraint, and opportunity on the global embedded software market?

- What are the key regional markets?

- Which countries represent the most attractive embedded software market?

- What is the breakup of the market based on the operating system?

- Which is the most attractive operating system in the embedded software market?

- What is the breakup of the market based on the function?

- Which is the most attractive function in the embedded software market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the embedded software market?

- What is the competitive structure of the global embedded software market?

- Who are the key players/companies in the global embedded software market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the embedded software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global embedded software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the embedded software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)