Embedded Analytics Market Size, Share, Trends and Forecast by Solution, Analytics Tool, Deployment Mode, Business Function, Organization Size, Industry Vertical, and Region, 2025-2033

Embedded Analytics Market Size and Share:

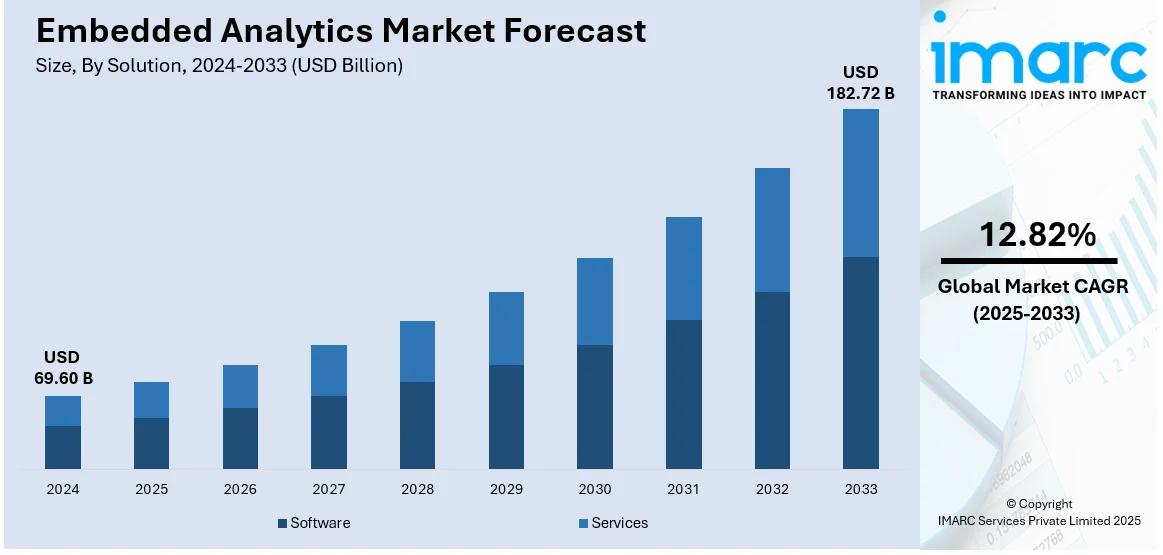

The global embedded analytics market size was valued at USD 69.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 182.72 Billion by 2033, exhibiting a CAGR of 12.82% from 2025-2033. North America currently dominates the market, holding a market share of over 32.6% in 2024. The embedded analytics market share is expanding, driven by the growing incorporation of artificial intelligence (AI) and machine learning (ML) capabilities, rising demand for data security and compliance, and increasing traction of self-service analytics that enables end-users to create their reports and monitor data without relying on information technology (IT) teams.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 69.60 Billion |

|

Market Forecast in 2033

|

USD 182.72 Billion |

| Market Growth Rate (2025-2033) | 12.82% |

As businesses look for smarter ways to use data, the demand for embedded analytics is rising. Companies want real-time insights from their existing software, making decision-making faster and more efficient. With digital transformation on the rise, industries like healthcare, finance, and retail rely on embedded analytics to track performance, detect trends, and improve operations. Besides this, the increasing usage of AI and ML is also enhancing analytics capabilities, making them more predictive and automated. Cloud adoption is another major driver, allowing businesses to integrate analytics seamlessly without heavy IT infrastructure. As user expectations for personalized experiences grow, companies employ embedded analytics to offer tailored services.

The United States has emerged as a major region in the embedded analytics market owing to many factors. The rising adoption of data-driven decision-making by businesses is impelling the embedded analytics market growth. Companies want real-time insights within their existing applications to improve efficiency and stay competitive. Besides this, the rise of AI, ML, and automation in the country is making analytics smarter, helping businesses to predict trends and optimize operations. Additionally, industries like healthcare, finance, and retail are employing embedded analytics to enhance customer experiences, detect fraud, and streamline workflows. Apart from this, government initiatives supporting data security and advanced analytics promote the usage of embedded analytics solutions. In December 2024, the US Department of Justice (DOJ) released the Final Rule that put into effect President Biden’s Executive Order from February 28, 2024, titled “Preventing Access to Americans’ Bulk Sensitive Personal Data and United States Government-Related Data by Countries of Concern” (the “EO”). It established a new national security regulatory framework aimed at safeguarding large quantities of US sensitive personal information and government-associated data from nations of interest.

Embedded Analytics Market Trends:

Increasing Demand for Data Security and Compliance

Data security and compliance regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), are becoming paramount. Embedded analytics solutions are designed to ensure data privacy and adherence, which is particularly crucial in industries handling sensitive information like healthcare and finance. This is encouraging the adoption of embedded analytics as a secure means to leverage data insights without compromising integrity. In addition, embedded analytics tools typically employ encryption techniques to safeguard data during transmission and storage. This means that data is transformed into unreadable code that can only be deciphered with the appropriate decryption keys, ensuring that even if intercepted, the data remains secure. According to an industry report, with 60% of global organizations citing compliance as a top priority, industries, such as finance, government, and healthcare, are accelerating the utilization of embedded analytics to maintain data integrity and regulatory adherence.

Rising Traction of Self-Service Analytics

The increasing popularity of self-service analytics is offering a favorable embedded analytics market outlook. Self-service analytics empowers end-users to create their reports and analyze data without relying on IT teams. According to an industrial report, by 2025, 80% of organizations will move away from traditional dashboards in favor of self-service analytics. Embedded analytics often includes self-service features, making it accessible to a broader range of users. This democratization of data analysis is fostering innovations and fueling the market growth. Moreover, users can obtain insights in real-time through self-service analytics, eliminating the need to wait for IT teams to generate reports. This speed is critical for making agile decisions and responding quickly to market changes. Moreover, self-service analytics tools allow users to customize reports and dashboards according to their specific needs and preferences. This flexibility ensures that insights are relevant and tailored to individual business requirements.

Growing Incorporation of AI and ML

Embedded analytics is evolving to incorporate AI and ML capabilities. This enables automated insights, anomaly detection, and predictive analytics within applications, further enhancing its appeal across industries seeking to leverage advanced analytics techniques. According to an industrial report, by 2026, over 75% of enterprises will embed AI-oriented analytics within business applications to enhance decision-making capabilities. AI and ML algorithms can analyze historical data patterns and make predictions about future trends. By inculcating predictive analytics within applications, users can receive proactive insights and recommendations, allowing them to make more informed decisions. Besides this, AI-focused embedded analytics can identify anomalies or irregularities in data, which can be indicative of potential issues or opportunities. Furthermore, AI and ML can monitor vast datasets quickly and comprehensively, providing users with a deeper understanding of complex situations.

Embedded Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global embedded analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, analytics tool, deployment mode, business function, organization size, and industry vertical.

Analysis by Solution:

- Software

- Services

Services held the biggest market share in 2024. Businesses need expert support to implement, customize, and manage analytics solutions. While software provides the tools, companies often lack the in-house expertise to integrate analytics seamlessly into their existing systems. Service providers help with installation, training, and ongoing support, ensuring businesses get the most out of their analytics investments. As more companies move to cloud-based analytics, the demand for consulting and managed services is rising. Customization is another key factor. Every business has unique data needs and service providers aid tailor analytics in fitting with specific goals. Additionally, industries like healthcare and finance require compliance and security support, making professional services essential. With rapid advancements in AI and ML, businesses also rely on service providers to keep their analytics systems up to date. Since data-driven decision-making is critical for growth, companies continue to invest in services to maximize the value of their embedded analytics solutions.

Analysis by Analytics Tool:

- Dashboard and Data Visualization

- Self-service Tools

- Benchmarking

- Reporting

Dashboard and data visualization accounted for the largest market share. Businesses need clear and real-time insights to make quick decisions. Raw data can be overwhelming, so visual dashboards help by presenting complex information in easy-to-understand charts, graphs, and interactive reports. These tools allow users to spot trends, track key metrics, and monitor performance without needing deep technical skills. Industries like healthcare, finance, and retail rely on dashboards for real-time monitoring, fraud detection, and customer insights. As businesses focus on improving user experience, customizable and intuitive visualizations make analytics more accessible for employees at all levels. The rise of AI-oriented dashboards also adds predictive capabilities, helping companies to formulate data-driven decisions faster. Cloud-oriented platforms further enhance accessibility, allowing teams to view analytics on any device. With organizations prioritizing real-time data visualization to stay competitive, dashboards remain the most in-demand analytics tool in the market.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based offers flexibility, scalability, and cost savings for businesses of all sizes. Unlike on-premises solutions that require expensive hardware and maintenance, cloud-based analytics can be accessed from anywhere with minimal setup. This makes it easier for companies to integrate analytics into their existing applications without heavy IT investments. As businesses generate more data, cloud solutions allow them to scale storage and processing power as needed. Security and compliance improvements also make cloud analytics more reliable, especially for industries like healthcare and finance. Another key advantage is automatic updates. Cloud providers continuously enhance features, ensuring businesses always have the latest tools. With remote work and digital transformation on the rise, organizations prefer cloud-based embedded analytics for real-time insights and collaboration. As a result, more companies are moving away from traditional systems and embracing the cloud to stay competitive in a data-driven market.

Analysis by Business Function:

- Finance

- Human Resources (HR)

- Marketing and Sales

- Production

- Others

Marketing and sales dominate the overall market. Businesses depend on data-driven strategies to attract customers and boost revenue. With embedded analytics, companies can track user behavior, measure campaign performance, and optimize sales strategies in real time. Sales teams use these insights to identify high-value leads, predict customer needs, and personalize outreach, leading to higher conversion rates. Marketers benefit from detailed dashboards that show which ads, emails, or social media campaigns are working best. AI-oriented analytics also assist in forecasting trends and automating decision-making, making marketing efforts more efficient. As competition grows, businesses need faster insights to stay ahead, and embedded analytics makes that possible without relying on separate reporting tools. Cloud-based analytics further enhances accessibility, allowing teams to access real-time data from anywhere. With customer experience and revenue growth as top priorities, marketing and sales departments continue to drive demand for embedded analytics solutions.

Analysis by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Small and Medium-sized Enterprises (SMEs) are rapidly adopting embedded analytics to improve decision-making, streamline operations, and enhance customer experiences. Since they often have limited IT resources, cloud-based embedded analytics solutions are particularly popular, offering cost-effective and scalable options without heavy infrastructure investments. SMEs use analytics to oversee sales, observe customer behavior, and optimize marketing plans. With the growing competition, real-time insights help them to stay agile and make data-driven business decisions.

Large enterprises have vast data volumes and complex operational needs. These organizations use advanced analytics to optimize processes, enhance customer engagement, and improve financial planning. Embedded analytics helps large enterprises to automate decision-making, detect fraud, and personalize services across multiple departments. Many firms invest in AI-focused analytics to gain predictive insights and enhance business strategies. With strong IT infrastructure and higher budgets, large enterprises integrate embedded analytics across cloud, on-premises, and hybrid environments, ensuring seamless access to real-time data for better performance and scalability.

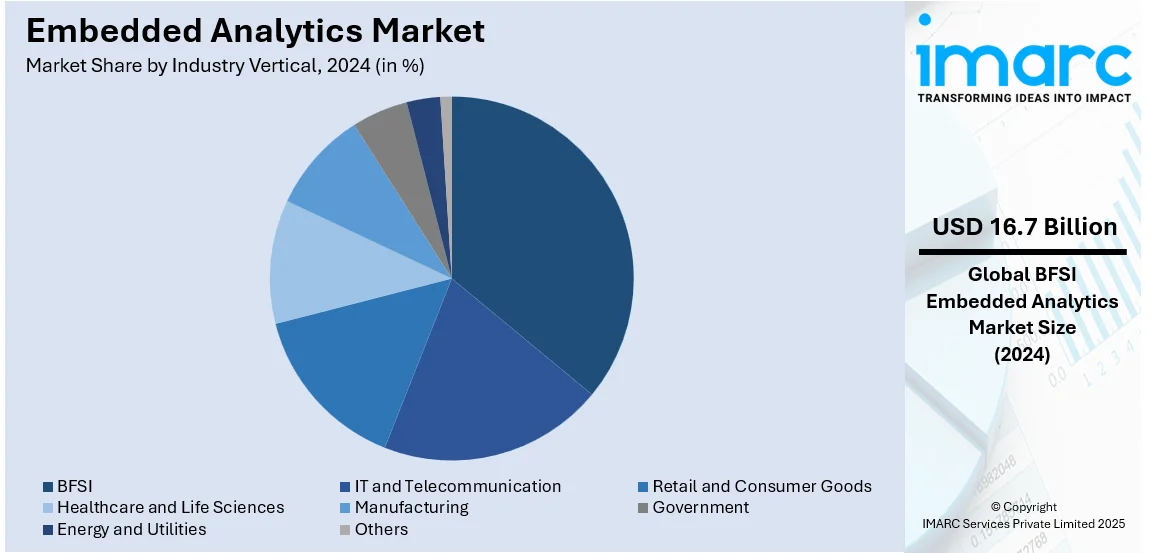

Analysis by Industry Vertical:

- BFSI

- IT and Telecommunication

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Manufacturing

- Government

- Energy and Utilities

- Others

BFSI accounted for 24.0% of the market share. It heavily relies on real-time data to manage risks, detect fraud, and improve user experiences. Financial institutions use embedded analytics to track transactions, analyze spending patterns, and prevent suspicious activities. Banks leverage analytics for personalized banking, offering customers tailored loan options, investment suggestions, and credit card recommendations. Insurance companies employ it to assess risks, streamline claims processing, and enhance user interactions. With increasing digital payments and mobile banking, financial firms need instant insights to stay competitive. Regulatory compliance is another key driver. Embedded analytics helps institutions to monitor and report financial activities accurately. AI-enabled analytics also assist in predicting market trends and optimizing financial strategies. As the BFSI sector continues to embrace digital transformation, the demand for embedded analytics grows, ensuring better decision-making, security, and operational efficiency across the industry.

Regional Analysis:

.webp)

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 32.6%, enjoys the leading position in the market. It has a strong presence of major industries like retail and IT, which rely heavily on data-driven decision-making. Businesses in these sectors employ embedded analytics to improve efficiency, personalize user experiences, and gain a competitive edge. Besides this, government agencies come up with programs to increase the adoption rate of AI, ML, and cloud technologies, which enhance analytics capabilities. In March 2024, the Biden administration’s budget proposal for FY2025 allocated USD 3 Billion to agencies to ethically create, evaluate, acquire, and incorporate revolutionary AI solutions throughout the federal government. The budget spent USD 850 Billion for defense, with an increase of USD 34 billion compared to 2023's approved figures. Discretionary funding outside of defense totaled USD 770 Billion. Apart from this, strict regulatory requirements in industries like healthcare and finance make real-time data monitoring essential, further driving the demand. Additionally, North America is home to leading tech companies that continuously develop and improve embedded analytics solutions.

Key Regional Takeaways:

United States Embedded Analytics Market Analysis

The United States holds 88.60% of the market share in North America. The US market is growing as a result of the rising use of data-driven decision-making and AI-based insights. An industrial report revealed that the US spent around USD 146 Billion on business intelligence and analytics software in 2023, of which embedded analytics is playing a significant part in enterprise functions. Major industries, such as finance and retail, are incorporating analytics into workflows for increased reliability and real-time decision-making. The growth in edge analytics and cloud computing further encourages the employment of embedded analytics. Microsoft, Salesforce, and Tableau, a product of Salesforce, are dominating the market among other leading vendors through solutions crafted for varied business purposes. At the same time, regulatory necessity surrounding data openness and security requirements under HIPAA and GDPR adherence encourage advancements in capabilities on embedded analytics. The US market is extremely competitive, with technology companies developing AI-oriented analytics solutions to stay ahead globally.

Europe Embedded Analytics Market Analysis

The market is experiencing strong growth with digital transformation and regulatory compliance needs. In 2023, 33% of EU businesses conducted data analytics internally or from external sources, as reported by Eurostat. The most impressive adoption rates were seen in Hungary (53%), Croatia (52%), Denmark (50%), and the Netherlands (49%), where regional adoption trends were strong. Germany, France, and the UK are the leaders in demand, with healthcare and financial services being major industries. Germany has been aggressively investing in digital infrastructure and technologies. The nation's "Digital Strategy 2025" targets the provision of gigabit internet access across the country by 2025, which is a major commitment to digital development. The adoption of EU regulations, such as the AI Act and GDPR is driving the demand for explainable and secure analytics solutions. European companies are focusing on AI-oriented insights to streamline processes, with regional innovators like SAP and Sisense leading the charge. Government-sponsored programs in digital infrastructure are fueling the market growth, making Europe a key participant in the expansion.

Asia-Pacific Embedded Analytics Market Analysis

The market is growing at a rapid pace because of rising digital transformation initiatives and data-driven strategies by government agencies. As per official Chinese government data from the National Bureau of Statistics, the core industries of the digital economy added value worth around 12.7555 Trillion Yuan (USD 13.2292 Trillion) in 2023, which represented 9.9% of China's GDP. AI-based solutions and cloud-based analytics from China are leading to acceleration across industries. India is also experiencing healthy demand, with its "Digital India" program promoting data-oriented decision-making in businesses. Regional government agencies are also giving high importance to digital infrastructure, and smart city initiatives and financial sector upgradation are promoting the adoption of embedded analytics. Major technology companies, such as Alibaba Cloud and Infosys, are investing significantly in AI-focused analytics solutions to meet the increasing demand. The rising mobile and internet penetration in the region is also catalyzing the demand for real-time data insights, making Asia Pacific a leading contributor to the market.

Latin America Embedded Analytics Market Analysis

The market is witnessing expansion, as businesses increasingly adopt data-driven decision-making. The Brazilian Information Technology (IT) market was worth USD 45.2 Billion in 2022, as per the International Trade Administration (ITA), which reflected the increasing investments in digital solutions in the region. Brazil, Mexico, and Argentina are leading the adoption of analytics, led by financial services, healthcare, and retail industries. Government investments in digital transformation and cybersecurity are also driving the demand. Cloud analytics platforms are growing, as companies look for scalable and affordable alternatives. TOTVS and Oracle are among the top regional and international companies that are heavily investing in AI-driven analytics software to improve business intelligence. Fintech startups and e-commerce expansion are major drivers, making Latin America an emerging region for embedded analytics solutions.

Middle East and Africa Embedded Analytics Market Analysis

The market is expanding, as businesses and government agencies are making investments in AI-based decision-making and digital transformation. Saudi Arabia plans to create USD 135 Billion of AI revenue by 2030, as per Saudi Vision 2030, indicating the region's focus on advanced data solutions. The UAE and South Africa are also prominent markets. The need for real-time analytics is being created by the financial services, healthcare, and retail industries. Government-sponsored smart city projects and the adoption of AI for public services are further fueling the market growth. SAP and Microsoft are solidifying their position in the region, providing embedded analytics solutions to organizations looking to improve data insights. With advancements in digital infrastructure and companies placing a high emphasis on automation, the region is set to see high growth in the market.

Competitive Landscape:

Key players work on innovating and improving their solutions to meet the high embedded analytics market demand. Tech firms and software providers are integrating AI, ML, and automation to make analytics smarter and more predictive. Cloud-based analytics platforms are making it easier for businesses to adopt embedded solutions without heavy IT investments. Leading companies are also focusing on user-friendly interfaces, helping organizations to implement data-driven decision-making without needing deep technical expertise. Partnerships and acquisitions are common, allowing firms to expand their offerings and reach new industries. With the increasing demand from healthcare, finance, and retail, key players are tailoring their solutions to meet industry-specific requirements. By enhancing security, scalability, and real-time insights, these companies are keeping the market competitive. For instance, in April 2024, Insightsoftware launched Logi AI and Logi SaaS to its Logi Symphony platform, improving embedded analytics through generative AI and a completely managed SaaS offering. Logi AI offered personalized AI-oriented insights, whereas Logi SaaS simplified the deployment process. The update aimed to bolster Logi's standing in embedded BI.

The report provides a comprehensive analysis of the competitive landscape in the embedded analytics market with detailed profiles of all major companies, including:

- Infor (Koch Industries Inc.)

- International Business Machines Corporation

- Logi Analytics Inc. (Insightsoftware Inc.)

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- QlikTech International AB

- SAP SE

- Sisense Inc.

- Tableau Software LLC (Salesforce.com Inc)

- TIBCO Software Inc.

- Yellowfin

Latest News and Developments:

- September 2024: Oracle launched more than 50 AI-driven agents in the Oracle Fusion Cloud Applications Suite, improving finance, HR, supply chain, and customer experience. The advancements in AI aimed to enhance cash forecasting, streamline workflows, and boost decision-making. Included at no additional charge, these features were set to boost productivity, optimize operations, and promote revenue expansion.

- June 2024: SAP aimed to double its embedded AI applications to 100 by the end of the same year, concentrating on fields, such as sourcing, supply chain, customer experience, and sales. CEO Christian Klein highlighted that business AI would set apart their applications, as they featured more than 50 pre-trained AI applications integrated into their services.

Embedded Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Software, Services |

| Analytics Tools Covered | Dashboard and Data Visualization, Self-Service Tools, Benchmarking, Reporting |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Business Functions Covered | Finance, Human Resources (HR), Marketing and Sales, Production, Others |

| Organization Sizes Covered | Small and Medium-Sized Enterprises (SMEs), Large Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecommunication, Retail and Consumer Goods, Healthcare And Life Sciences, Manufacturing, Government, Energy And Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Infor (Koch Industries Inc.), International Business Machines Corporation, Logi Analytics Inc. (Insightsoftware Inc.), Microsoft Corporation, Open Text Corporation, Oracle Corporation, QlikTech International AB, SAP SE, Sisense Inc., Tableau Software LLC (Salesforce.com Inc), TIBCO Software Inc., Yellowfin, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the embedded analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global embedded analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the embedded analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The embedded analytics market was valued at USD 69.60 Billion in 2024.

The embedded analytics market is projected to exhibit a CAGR of 12.82% during 2025-2033, reaching a value of USD 182.72 Billion by 2033.

The rise of AI and ML is making analytics smarter, allowing businesses to predict trends and automate decision-making. Besides this, the high adoption of cloud services enables seamless analytics integration without heavy IT infrastructure. Moreover, industries like healthcare, finance, and retail are using embedded analytics to enhance efficiency, improve user experiences, and detect fraud.

North America currently dominates the embedded analytics market, accounting for a share of 32.6% in 2024, because major industries like BFSI, healthcare, and retail rely on real-time data. High AI adoption, strict regulations, and strong tech presence drive the demand for embedded analytics, helping businesses to improve efficiency, customer experience, and decision-making.

Some of the major players in the embedded analytics market include Infor (Koch Industries Inc.), International Business Machines Corporation, Logi Analytics Inc. (Insightsoftware Inc.), Microsoft Corporation, Open Text Corporation, Oracle Corporation, QlikTech International AB, SAP SE, Sisense Inc., Tableau Software LLC (Salesforce.com Inc), TIBCO Software Inc., Yellowfin, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)