Elevator Modernization Market Size, Share, Trends and Forecast by Elevator Type, Modernization Type, Components, End User, and Region 2025-2033

Elevator Modernization Market Size and Share:

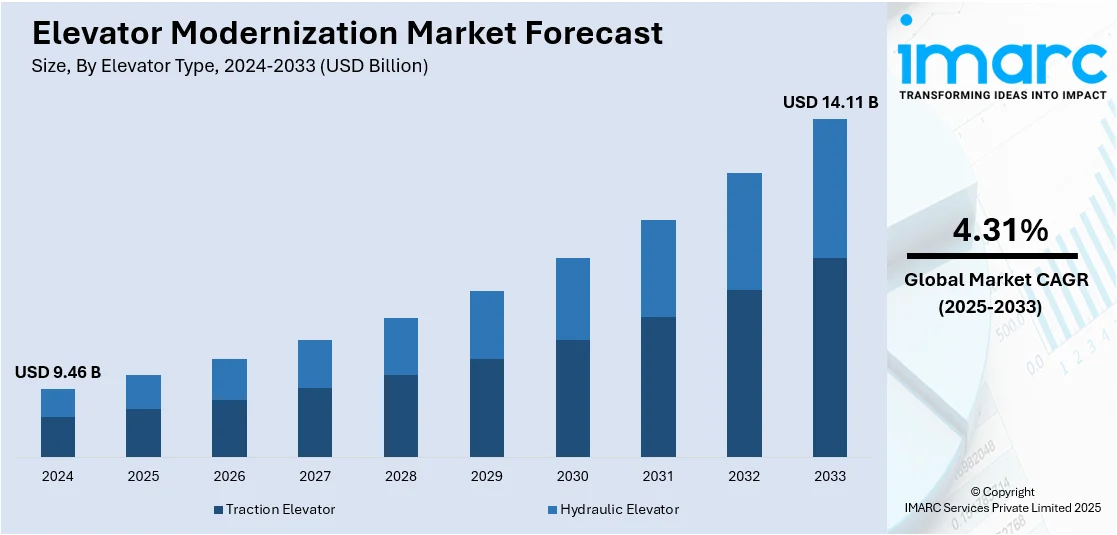

The global elevator modernization market size was valued at USD 9.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.11 Billion by 2033, exhibiting a CAGR of 4.31% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 30.0% in 2024. Aging infrastructure, urbanization, safety regulations, and technological advancements like IoT and AI fuel the elevator modernization market share. Demand for energy efficiency, sustainability, and improved performance fuels growth, alongside rising property values and tenant expectations for modern amenities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.46 Billion |

|

Market Forecast in 2033

|

USD 14.11 Billion |

| Market Growth Rate 2025-2033 | 4.31% |

The elevator modernization market is driven by aging infrastructure, urbanization, and technological advancements. Most buildings maintain elevators that need modernization for safety purposes as well as energy efficiency and operational quality improvements. Modern efficient elevator systems become increasingly necessary because of the growth of urban areas and the increasing number of high-rise developments. Restrictive safety standards together with compliance regulations force property owners to replace their outdated equipment. Technological innovations, such as smart elevators with IoT integration, predictive maintenance, and AI-driven controls, further fuel market growth. Additionally, sustainability concerns drive demand for energy-efficient solutions that reduce power consumption and operational costs. Economic factors, including increasing property values and tenant expectations for modern amenities, further encourage elevator modernization investments, making it a critical market for the construction and real estate industries.

To get more information on this market, Request Sample

Aging infrastructure, stringent safety regulations, and increasing urbanization drive the elevator modernization market in the United States. Many buildings have outdated elevator systems requiring upgrades to meet modern safety codes and efficiency standards. Government regulations, such as the Americans with Disabilities Act (ADA) and energy efficiency mandates, further push modernization efforts. The rise of smart buildings and IoT integration accelerates demand for advanced elevator systems with predictive maintenance and automation. Additionally, sustainability concerns drive the adoption of energy-efficient technologies. Growing tenant expectations, enhanced building values, and increased commercial and residential high-rise developments also contribute to market expansion. For instance, in February 2025, Metro declared that it would modernize elevators at more than a dozen stations. According to Metro, the elevator upgrading project will increase passenger dependability and feature 27 elevators. Crews will replace and improve all important parts, including the passenger cab, controls, motors, and safety devices, throughout the following four years.

Elevator Modernization Market Trends

Aging Infrastructure

Many buildings, particularly in developed urban areas, have aging elevator systems that require modernization to ensure safety, reliability, and efficiency. For instance, from 2013 to 2023, a total of 270 tall buildings were finished, featuring 121 structures that reached at least 100 meters in height within the Greater London metropolitan area, while an additional 583 tall buildings are planned across numerous opportunity areas. Over time, mechanical wear and outdated technologies lead to frequent breakdowns, higher maintenance costs, and operational inefficiencies. Upgrading these systems with new motors, control panels, and safety features helps improve performance and extend service life. Property owners also modernize elevators to comply with evolving safety codes and meet tenant expectations. The increasing need to replace obsolete components that are no longer supported by manufacturers further drives the demand for elevator modernization in both residential and commercial buildings.

Technological Advancements

Rapid innovations in elevator technology are creating a positive elevator modernization market outlook. Features like destination control systems, IoT-based predictive maintenance, AI-driven optimization, and touchless controls improve efficiency, reduce wait times, and enhance passenger experience. Smart elevators with remote monitoring capabilities help building managers detect issues before they cause failures, minimizing downtime. Additionally, regenerative drive technology enables energy savings by capturing and reusing energy, reducing power consumption. The integration of automation and digital solutions in building management systems encourages property owners to upgrade their elevators for better performance, reliability, and long-term operational cost savings. For instance, in January 2024, Otis Brazil successfully finished the 36-month renovation project on schedule by updating the technology and aesthetics of 13 elevators in São Paulo's famous Birmann 21 building. As the global leader in the production, installation, and upkeep of escalators and elevators, Otis Brazil is a division of Otis Worldwide Corporation.

Sustainability and Energy Efficiency

Energy efficiency is a growing concern in the elevator industry, driving modernization efforts. Traditional elevators consume significant amounts of electricity, while modern systems incorporate energy-saving technologies such as LED lighting, regenerative drives, and standby modes that reduce power usage when idle. Building owners seeking LEED certification or compliance with green building standards invest in modernization to lower carbon footprints and meet sustainability goals. Additionally, eco-friendly materials and lubricants are being used to reduce environmental impact. As energy costs rise and environmental awareness increases, more property owners prioritize elevator upgrades to improve efficiency and support sustainability initiatives. For instance, in June 2024, Fujitec Co., Ltd. supplied 44 elevators to Three Garden Road via its Group company in Hong Kong, FUJITEC (HK) Co. Ltd. (President: Chong Ming Sung). The Three Garden Road comprises two tall office towers in Hong Kong's financial district. The delivered elevators comprise 16 units that function at a speed of 480 meters per minute, the quickest elevators offered by FUJITEC (HK) Co., Ltd. This shipment represents the highest quantity of units supplied by the Fujitec Group for office upgrades.

Elevator Modernization Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global elevator modernization market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on elevator type, modernization type, components, and end user.

Analysis by Elevator Type:

- Traction Elevator

- Hydraulic Elevator

Traction elevator stands as the largest elevator type in 2024, holding around 68.7% of the market. Traction elevators hold the largest share in the market due to their efficiency, speed, and suitability for high-rise buildings. Unlike hydraulic elevators, traction systems use counterweights and motors, reducing energy consumption and operational costs. Their high load capacity and smooth ride quality make them ideal for commercial, residential, and skyscraper applications. Additionally, the modernization of aging traction elevators often involves upgrading control systems, motors, and safety features, ensuring compliance with strict building codes. The rise of smart elevators with IoT-based predictive maintenance and AI-driven traffic management further boosts traction elevator modernization, reinforcing their dominance in the market.

Analysis by Modernization Type:

- Partial Modernization

- Full Modernization

Partial modernization holds a significant share in the market because it provides a cost-effective solution for upgrading critical components without replacing the entire system. Building owners opt for incremental upgrades to improve safety, performance, and efficiency while minimizing downtime and expenses. Key upgrades include control panels, motors, doors, and safety systems, enhancing reliability and compliance with modern safety regulations. This approach is popular in residential, commercial, and institutional buildings where full replacement is not feasible. Additionally, the rise of IoT-based predictive maintenance and energy-efficient technologies encourages partial upgrades, making it a preferred choice for many property owners.

Full modernization dominates the market due to the need to replace aging infrastructure and meet strict safety, efficiency, and sustainability standards. Older buildings often require a complete elevator overhaul, including new motors, cables, control systems, cabins, and safety devices, ensuring optimal performance and regulatory compliance. Full modernization is especially common in high-rise commercial buildings, hospitals, and public infrastructure, where reliability and speed are crucial. The increasing demand for smart elevators with AI-driven traffic control, IoT-based monitoring, and regenerative drives further drives full modernization. Additionally, full upgrades significantly improve building value, tenant satisfaction, and energy efficiency, making them a long-term investment.

Analysis by Components:

- Controllers

- Door Equipment

- Cabin Enclosures

- Signaling Fixtures

- Power Units

- Others

Controllers hold a significant share in the market because they are the core component responsible for smooth operation, speed regulation, and safety compliance. Older control systems are often inefficient and outdated, leading to frequent breakdowns and high energy consumption. Modern microprocessor-based controllers improve performance, reduce energy usage, and integrate with smart technologies like IoT and AI for predictive maintenance. Upgrading controllers enhances traffic flow optimization, reduces wait times, and ensures compliance with safety regulations. With growing demand for smart buildings and energy-efficient solutions, replacing outdated controllers is a priority in both commercial and residential elevator modernization projects.

Door equipment holds a large share in the market due to its critical role in safety, accessibility, and user convenience. Older door mechanisms wear out over time, causing frequent malfunctions and safety risks. Upgrading to automatic, sensor-based doors improves reliability, speed, and security, reducing downtime and maintenance costs. Modern door systems also comply with strict safety regulations and increase passenger experience. In residential and commercial buildings, property managers prioritize door modernization to prevent accidents, reduce noise, and increase energy efficiency. As safety regulations tighten, upgrading elevator doors remains a key focus in modernization projects.

Cabin enclosures hold a major share due to the demand for aesthetic upgrades, durability, and passenger comfort. Over time, elevator interiors become worn out or outdated, requiring refurbishment to match modern architectural designs and safety standards. Modern stainless steel, glass, and LED-lit cabins enhance visual appeal and user experience. Additionally, advanced fire-resistant materials and antibacterial coatings improve safety and hygiene in high-traffic buildings like hotels, hospitals, and offices. Upgrading cabin enclosures not only boosts aesthetics but also property value, making them a key modernization component for residential, commercial, and public infrastructure projects.

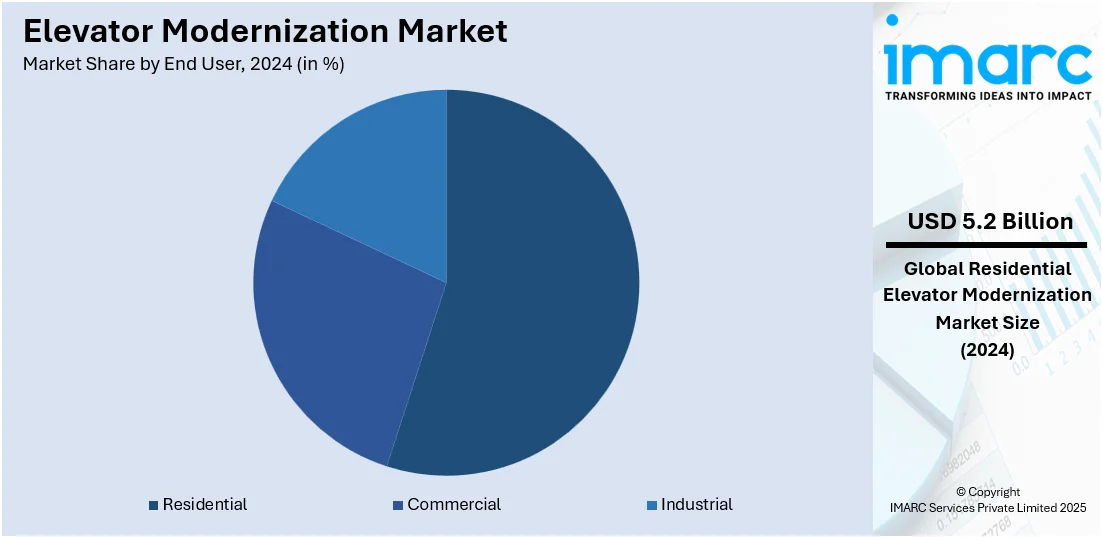

Analysis by End User:

- Residential

- Commercial

- Industrial

Residential leads the market with around 55.0% of market share in 2024. The residential sector holds the largest share of the market due to the high number of aging residential buildings requiring upgrades for safety, efficiency, and reliability. Many apartment complexes and condominiums have old elevator systems that need modernization to comply with updated safety regulations and enhance user experience. Increasing urbanization and high-rise residential developments further drive demand for modern, energy-efficient, and smart elevator solutions. Additionally, homeowners’ associations and property managers prioritize cost-effective partial modernizations to improve elevator performance and longevity. The rising adoption of IoT-based predictive maintenance and sustainability initiatives also contributes to the sector’s market dominance

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 30.0%. Europe experiences rising elevator modernization efforts as the growing expanding working population fuels the need for efficient transportation within office complexes and residential buildings. there were 195,708,000 employed individuals in the EU between the ages of 20 and 64 in 2023, making up 75.3% of the entire population in that age group. The employment rate increased from 70.9% in 2017 to 75.3% in 2023, bringing it closer to the EU objective. With aging infrastructure requiring significant upgrades, modernization solutions focus on enhancing energy efficiency, safety, and performance reliability. Property owners invest in modernization to meet evolving workplace demands, ensuring smooth movement within densely occupied structures. Advanced technologies, such as AI-driven diagnostics and remote monitoring, optimize elevator operations, minimizing downtime and maintenance costs. Sustainability regulations also encourage the adoption of eco-friendly upgrades, reinforcing modernization trends.

Key Regional Takeaways:

North America Elevator Modernization Market Analysis

Age infrastructure, stringent safety regulations, technological advancements, and sustainability initiatives drive the elevator modernization market in North America. Many older buildings, particularly in cities like New York, Chicago, and Toronto, require upgrades to meet modern performance standards and enhance reliability. Regulatory compliance is a key driver, with ASME A17.1 safety codes and ADA accessibility laws pushing property owners to modernize outdated systems. Smart elevator technologies, including IoT-based predictive maintenance, AI-driven traffic control, and energy-efficient systems, are gaining traction. Additionally, sustainability efforts encourage the adoption of energy-efficient motors and regenerative drives. The rise in urbanization, high-rise residential demand, and increasing building renovations further fuel elevator modernization across commercial, residential, and public infrastructure sectors.

United States Elevator Modernization Market Analysis

In 2024, the United States accounted for over 88.60% of the elevator modernization market in North America. The United States experiences an increasing elevator modernization demand as growing investment in infrastructure enhances the need for efficient vertical transportation. For instance, in a series of bills passed by Congress, over USD 1.2 Trillion will be spent between 2021 and 2030 to modernize aging U.S. infrastructure. The push for revitalizing aging structures, coupled with government initiatives supporting infrastructure development, fosters modernization projects. Developers prioritize safety, energy efficiency, and compliance with updated building codes, driving the replacement of outdated components. Technological advancements, including regenerative drives and predictive maintenance, further accelerate modernization adoption. Additionally, the surge in high-rise construction amplifies the necessity for upgraded elevator systems. With urban expansion and rising commercial developments, property owners seek cost-effective modernization solutions to extend equipment lifespan. As infrastructure funding strengthens, modernization efforts continue to gain momentum, ensuring smoother operations across diverse buildings.

Asia Pacific Elevator Modernization Market Analysis

Asia-Pacific sees a surge in elevator modernization as growing investment in smart cities accelerates the transformation of urban spaces. According to the Ministry of Housing & Urban Affairs India, with 100 cities spearheading the effort, the Smart Cities Mission has achieved substantial strides, finishing 7,380 of 8,075 projects, involving an investment of around USD 17.8 Billion. Governments and private sectors collaborate to integrate intelligent mobility solutions, enhancing vertical transportation efficiency. The adoption of energy-efficient upgrades and digital control systems aligns with sustainability goals, driving modernization across residential and commercial complexes. High-density urbanization increases the demand for advanced elevator technologies, reducing congestion and enhancing passenger experience. Automation, IoT integration, and touchless controls contribute to seamless operations, meeting the evolving expectations of smart infrastructure. Continuous investments in futuristic city planning further boost modernization efforts, reshaping urban landscapes with optimized mobility solutions.

Latin America Elevator Modernization Market Analysis

Latin America experiences an increasing need for elevator modernization due to growing rapid urbanization and industrialization driven by growing disposable income. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Expanding cities demand efficient vertical transportation to accommodate high-rise developments and commercial hubs. Industrial growth necessitates upgraded elevator systems for factories, logistics centres, and production facilities, ensuring seamless operations. With urban dwellers seeking modernized living and working spaces, real estate developers focus on refurbishing existing structures with upgraded elevators. Improved economic conditions allow property owners to invest in energy-efficient and technologically advanced elevator solutions. Enhanced safety regulations further support modernization trends, ensuring compliance with evolving building standards.

Middle East and Africa Elevator Modernization Market Analysis

Middle East and Africa witness increasing elevator modernization initiatives as growing commercial sector and construction projects stimulate the demand for upgraded vertical transportation. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Expanding business hubs require efficient mobility solutions to support high-traffic environments. Large-scale developments, including office towers, shopping malls, and hotels, emphasize modernization to enhance passenger safety and comfort. Rising investments in mixed-use buildings drive the implementation of smart elevator systems with energy-efficient features and advanced automation. Modernization solutions focus on optimizing operational efficiency, reducing maintenance costs, and ensuring compliance with evolving safety standards. As commercial activities flourish, elevator modernization remains a key priority in urban development.

Competitive Landscape:

The elevator modernization market is highly competitive, with key global players focusing on technological advancements, strategic partnerships, and sustainability initiatives to gain market share. Major companies such as Otis Elevator Company Ltd., KONE Corporation, Schindler Group, TK Elevator, and Fujitec Co. Ltd dominate the industry, offering smart elevator solutions, IoT-based predictive maintenance, and energy-efficient technologies. Smaller regional players compete by providing customized modernization services and cost-effective solutions. Increasing urbanization, infrastructure upgrades, and stringent safety regulations drive demand, pushing companies to invest in AI-driven traffic management, automation, and eco-friendly elevator components. Mergers, acquisitions, and R&D investments are shaping the market, with companies focusing on digital transformation and modernization programs to strengthen their competitive position globally.

The report provides a comprehensive analysis of the competitive landscape in the elevator modernization market with detailed profiles of all major companies, including:

- Champion Elevator

- Fujitec Co. Ltd

- Hitachi, Ltd

- Hyundai Elevator Co., Ltd.

- KONE Corporation

- Liberty Elevator

- Mid-American Elevator

- Mitsubishi Electric US, Inc.

- Otis Elevator Company Ltd.

- Pincus Elevator Company

- Schindler Group

- Stanley Elevator Company Inc

- TK Elevator

- Toshiba Corporation

Latest News and Developments:

- December 2024: KONE launched the High-Rise MiniSpace™ DX elevator in India, enhancing speed and energy efficiency in tall buildings. Featuring KONE UltraRope® technology, it is 80% lighter than steel ropes and cuts energy use by 15% for a 500m journey. Designed for buildings over 60 floors, it includes sustainable materials and standby solutions. This innovation supports elevator modernization, ensuring seamless and efficient vertical mobility.

- December 2024: Fujitec will launch its new standard elevator model, Ele Glance, in spring 2025, enhancing design, maintenance, and disaster response. As a successor to XIOR, it offers 29 color options and follows the CMF design framework. Improved remote monitoring ensures advanced maintenance, while key equipment relocation minimizes flood risks. This innovation aligns with trends in elevator modernization for safety and aesthetics.

- November 2024: Otis Electric launched the Otis Electric 7000, a smart elevator designed for new construction and modernization at CIIE 2024 in Shanghai. The elevator enhances safety, reliability, and passenger experience with customizable aesthetics and a space-saving design. Otis Electric aims to meet the growing demand for modernized, connected elevators amid China’s urban renewal. The company offers end-to-end project support for building owners and facility managers.

- October 2024: Nippon Otis completed the elevator modernization of 21 elevators and two escalators at Tokyo Metropolitan Bokutoh Hospital. The project, which began in 2014, enhanced earthquake resistance, safety, and accessibility features. Upgrades included handrails, LED lighting, and an optimized management system for smoother mobility. This ensures a safer and more efficient experience for patients and staff.

- October 2024: Hitachi secured an order for 56 elevators and escalators for CRC The Flagship in Noida, India, enhancing commercial infrastructure. The project includes high-speed elevators with advanced safety features like earthquake emergency operation. A destination floor reservation system improves efficiency and user experience. This order reinforces Hitachi’s role in elevator modernization and urban mobility solutions in India.

Elevator Modernization Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Elevator Types Covered | Traction Elevator, Hydraulic Elevator |

| Modernization Types Covered | Partial Modernization, Full Modernization |

| Components Covered | Controllers, Door Equipment, Cabin Enclosures, Signaling Fixtures, Power Units, and Others |

| End Users Covered | Residential, Commercial, Industrial |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Champion Elevator, Fujitec Co. Ltd, Hitachi, Ltd, Hyundai Elevator Co., Ltd., KONE Corporation, Liberty Elevator, Mid-American Elevator, Mitsubishi Electric US, Inc., Otis Elevator Company Ltd., Pincus Elevator Company, Schindler Group, Stanley Elevator Company Inc, TK Elevator, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the elevator modernization market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global elevator modernization market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the elevator modernization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The elevator modernization market was valued at USD 9.46 Billion in 2024.

The elevator modernization market is projected to exhibit a CAGR of 4.31% during 2025-2033, reaching a value of USD 14.11 Billion by 2033.

Aging infrastructure, stringent safety regulations, technological advancements, and sustainability demands drive the elevator modernization market. Older buildings require upgrades for reliability, compliance, and efficiency. Innovations like smart controls, IoT, and AI enhance performance, while energy-efficient solutions support sustainability goals. Urbanization and high-rise developments further boost modernization demand.

Europe currently dominates the elevator modernization market due to aging infrastructure, strict safety regulations, energy efficiency goals, smart technology adoption, and urbanization drive the elevator modernization market in Europe.

Some of the major players in the elevator modernization market include Champion Elevator, Fujitec Co. Ltd, Hitachi, Ltd, Hyundai Elevator Co., Ltd., KONE Corporation, Liberty Elevator, Mid-American Elevator, Mitsubishi Electric US, Inc., Otis Elevator Company Ltd., Pincus Elevator Company, Schindler Group, Stanley Elevator Company Inc, TK Elevator and Toshiba Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)