Elevator and Escalator Market Size, Share, Trends and Forecast by Type, Service, End Use and Region, 2026-2034

Elevator and Escalator Market Size and Share:

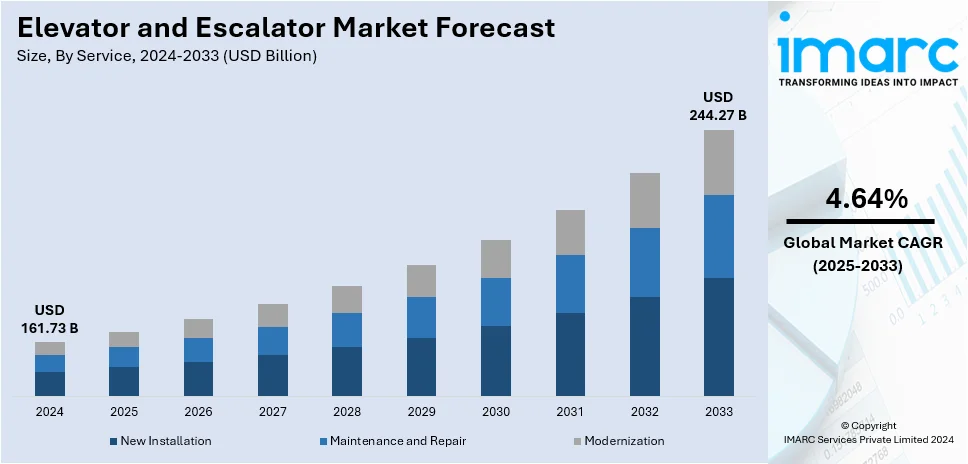

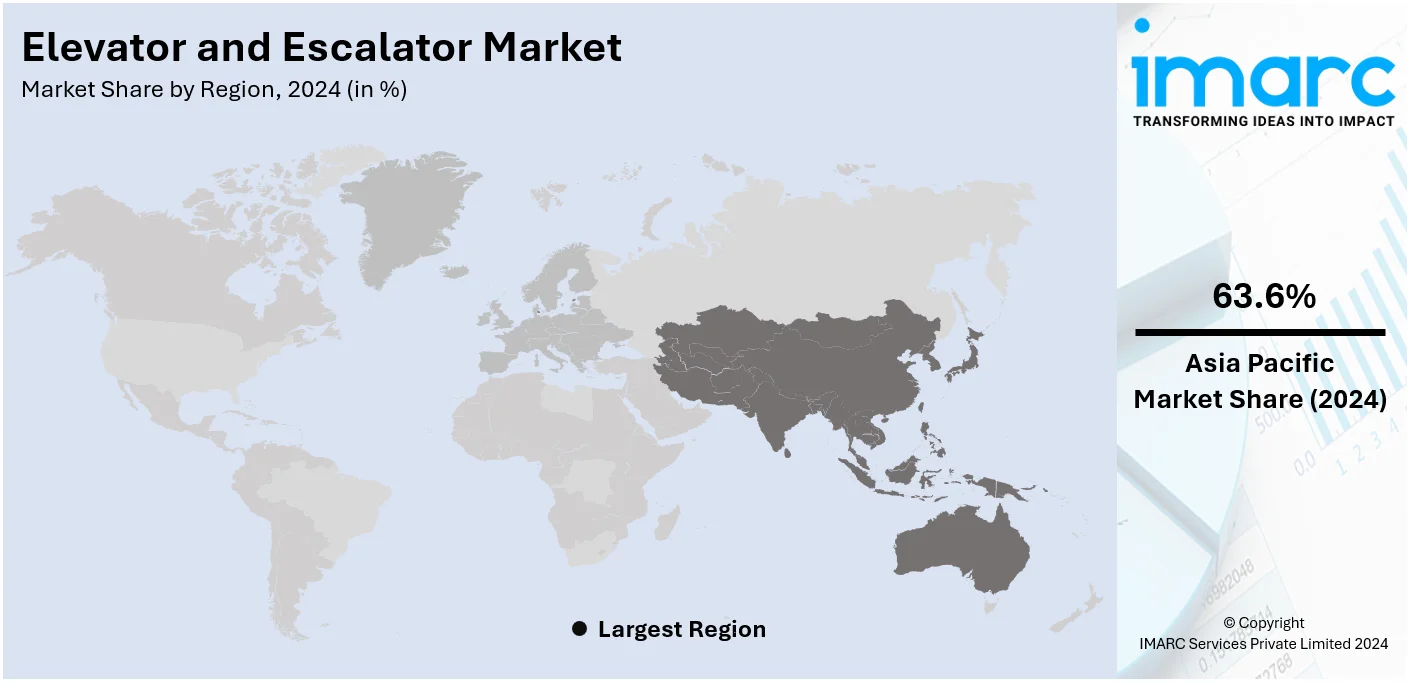

The global elevator and escalator market size was valued at USD 161.73 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 244.27 Billion by 2034, exhibiting a CAGR of 4.64% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 63.6% in 2024. The market is driven by rapid urbanization, increasing construction of high-rise buildings, and a growing demand for advanced mobility solutions in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 161.73 Billion |

| Market Forecast in 2034 | USD 244.27 Billion |

| Market Growth Rate (2026-2034) | 4.64% |

This rapid urbanization across the global sphere has propelled elevators and escalators market growth with a series of skyscrapers and various other residential building developments coming out of these developing markets. The rise in demand for mobility solutions is driving growth in the elevators and escalators market, as these systems are essential for meeting the needs of both disabled individuals and geriatric consumers who rely on these mobility aids for accessibility. Hence, the acceptance of smart elevators installed with Internet of Things (IoT), energy-efficient models, and automation control systems increases in terms of sustainability and convenience. Encouragement for ecofriendly buildings and energy-efficient systems is also creating a drive for elevators and escalators, as these are designed to meet sustainability standards, further boosting demand. Furthermore, infrastructure development is gaining pace in developed and developing countries, which in turn improves the installation and maintenance of vertical transportation systems.

US has a rapidly rising elevator and escalator market share underpinned by a healthy construction sector, predominantly at the commercial and residential levels. The growing focus on enhancing vertical transportation solutions to metropolitan cities accompanied by amplified concentration on public arena accessibility also underpins growth within the market. Technological aspects, such as energy-efficient designs and IoT applications, are completely transforming the game by ensuring added operational efficiency, sustainability, etc. For instance, in June 2023, Otis Worldwide Corp. launched the Gen3 Core™ Elevator for North America’s growing two-to-six story building segment, offering IoT connectivity, sustainability, and enhanced passenger comfort for low-rise buildings. Moreover, modernization and maintenance services form another significant component of the vertical transportation market because elevators and escalators in buildings more than two decades old require upgrade to the minimum safety and regulatory standards. Awareness of ecofriendly building certifications and rising environmental issues is driving new construction projects that will require energy-efficient vertical transportation solutions. Furthermore, population growth and urbanization in U.S. cities continue to create a significant demand for advanced elevator and escalator systems to ensure efficient movement within high-rise structures.

Elevator and Escalator Market Trends:

Rise in Construction Activities

The crucial role of infrastructure development in propelling the elevator and escalator market cannot be overstated. As cities continue to grow vertically, the essential need for efficient vertical transport systems becomes increasingly pronounced. The construction sector which includes real estate, infrastructures, and industrial buildings, accounts for 13 percent of world GDP, as per world bank. This is particularly evident in fast-developing economies where construction activities are at a peak, driven by both the government and private sectors. Infrastructure projects like airports, railway stations, shopping malls, and even educational institutions require state-of-the-art vertical and horizontal transportation systems to accommodate the heavy footfall and ensure the safety of people. Additionally, new residential complexes aim to provide the best in comfort and convenience, which includes high-speed, secure, and efficient elevators. These extensive construction projects not only reflect the growth of urban spaces but also signify the maturing expectations of the consumers, who now consider such transport systems to be not mere luxuries but essential facets of modern living.

Increasing Emphasis on Energy-Efficiency and Sustainability

The boosting emphasis on creating energy-efficient and sustainable elevators and escalators is increasingly becoming a major driving force in market growth. According to industrial reports, the energy use in elevators usually counts for 2–10% of a building's total energy consumption, which means that there is a great potential of saving the energy through innovative technology. Companies are now incorporating smart technologies like regenerative drives that return energy back into the building grid, LED lighting that consumes less electricity, and standby modes that significantly reduce power usage when the systems are not in operation. These innovations not only offer cost-effective solutions by decreasing operational expenses but also appeal to a consumer base that is progressively environmentally conscious. The transition toward green technology aligns with international sustainability targets, thus giving an added incentive for both manufacturers and consumers to move in this direction. As a result, the focus on sustainability is expected to remain a dominant factor steering the market’s trajectory.

The Growing Geriatric Population Requiring Higher Accessibility

The global demographic is experiencing a shift with the steady increase in the geriatric population. According to UN data, the aging population of 65 years or older across the globe is forecasted to more than double, rising from 761 million in 2021 to 1.6 billion in 2050. The growth rate for people aged 80 years or older is even more rapid, accentuating the demand for better accessibility. In this context, the role of elevators and escalators in promoting accessibility in public and private spaces becomes even more pivotal. An older population presents unique challenges, such as reduced mobility and a greater need for safety features. This has led to a specific market demand for elevators and escalators equipped with features like user-friendly interfaces, emergency call buttons, and lower speeds for easy boarding and disembarking. Many countries with a significant aged population have already started implementing these as standard features. This focus on inclusivity is crucial not just from a social perspective but also offers a viable market opportunity for companies to innovate and customize their product offerings. The geriatric population, therefore, not only adds to the immediate demand for accessible systems but also is a significant factor driving technological innovation in this sector.

Innovations in Elevators and Escalators

Innovations in elevators and escalators are greatly driving market expansion by improving safety, accessibility, and energy efficiency. Intelligent functionalities like touch-free controls, AI-driven predictive maintenance, and real-time monitoring enhance operational reliability and decrease downtime. These advancements enhance energy use by integrating regenerative drives and sophisticated sensors, reducing both environmental effects and operational expenses. Additionally, new accessibility innovations, such as voice-controlled operations, automatic entrance systems, and improved cabin layouts, are facilitating navigation for people with mobility challenges, particularly among the elderly. Enhanced safety features, including sophisticated emergency communication systems and slip-resistant escalator steps, provide additional assurance for a safe experience. The integration of these technological innovations is rendering contemporary elevator and escalator solutions more accessible, energy-saving, and sustainable, catering to various demographics and promoting market growth. For instance, in 2024, Otis introduced its Gen3™ connected elevator platform during the recent 'Platform for Possibility' launch event held in Bangkok.

Elevator and Escalator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global elevator and escalator market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, service, and end use.

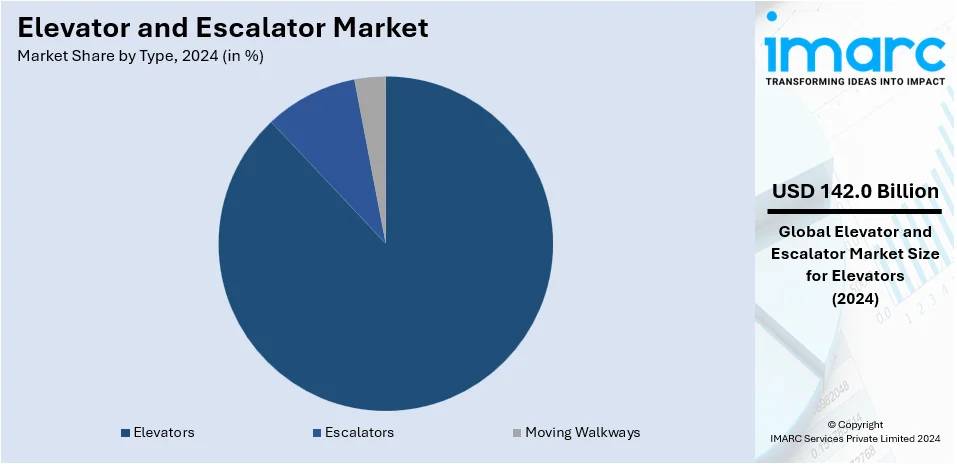

Analysis by Type:

- Elevators

- Escalators

- Moving Walkways

Elevator leads the market with around 87.8% of market share in 2024. Elevators dominate as a major segment, primarily due to continual technological advancements in speed, capacity, and energy efficiency. The introduction of features such as touchless controls and air purification systems in the wake of health crises has also positively impacted demand. Elevators are increasingly being seen as a value addition to commercial and high-end residential spaces, making them indispensable. On the other hand, escalators and moving walkways, form minor but relevant segments of the market that are also expanding. These are primarily used in public spaces like airports, shopping malls, and transit systems. With a focus on reducing the human effort required for mobility, especially over short distances, these systems play a supporting role to elevators. Their importance becomes particularly significant during peak hours, yet the demand is comparatively less than that for elevators.

Analysis by Service:

- New Installation

- Maintenance and Repair

- Modernization

New installation represent as a major segment that is influenced by the expanding urban centers, a surge in skyscraper constructions, and an increased emphasis on making public spaces more accessible. Advances in technology, like gearless and machine-room-less elevators, have made installations more appealing and efficient. Increasing investments in public infrastructure and growing demands for energy-efficient solutions add to the factors driving new installations. Stringent safety regulations are also prompting the replacement of older systems with new installations. On the other hand, maintenance, and repair, combined with modernization, are minor segments, that are still growing. While new installations are essential, the maintenance and modernization of existing systems are mandated by safety regulations. The increasing age of existing installations necessitates upgrades for improved functionality and compliance with modern safety standards. However, the growth here is not as robust as in the new installations and commercial sectors.

Analysis by End Use:

- Residential

- Commercial

- Offices

- Hospitality

- Mixed Block

- Others

The commercial segment is a major driving force owing to rapid infrastructure development, particularly in office buildings, shopping malls, and airports. The integration of smart technologies, such as Internet of Things (IoT) and Artificial Intelligence (AI), has further propelled demand, optimizing energy usage and providing enhanced user experiences. Regulatory standards that require buildings to be more accessible are also contributing factors. The rise in the number of high-rise buildings requiring fast and efficient elevators and escalators to manage people flow efficiently completes the quartet of key drivers in this segment. On the other hand, the residential segment experiences minor growth driven primarily by urbanization and increased multi-story residential projects. The convenience factor of having elevators in residential settings has also contributed to modest increases. The need for elderly and physically challenged individuals to access different floors easily has facilitated this segment's growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 63.6%. The Asia Pacific region has multiple driving factors supporting the growth of the elevator and escalator market. Urbanization is rampant, particularly in countries like China and India, where the expansion of cities necessitates multi-level buildings for both residential and commercial use. The Asia Pacific also leads in technological innovation, often being the first market to adopt new systems. Government initiatives and public-private partnerships in infrastructure development have further fueled growth. The presence of several manufacturing powerhouse countries, such as China and Japan, significantly contributes to both the domestic and global supply chain. Safety regulations are increasingly strict, fostering a healthy market environment. Moreover, the increased standard of living and growing middle-class population in the region have created a demand for more advanced and comfortable elevator and escalator systems. Furthermore, with sustainability being a global concern, the region is seeing a rise in demand for energy-efficient solutions, thereby further driving the market.

Key Regional Takeaways:

North America Elevator and Escalator Market Analysis

The North American elevator and escalator market is showing steady growth because of urbanization, infrastructure development, and technology. Demand for elevators and escalators in residential, commercial, and industrial sectors is on the rise as construction activities increase and there is a need for mobility solutions in high-rise buildings. Growing focus on improving building accessibility, coupled with aging infrastructure in certain regions, is further driving market expansion. In addition, smart technologies like IoT, energy-efficient systems, and automated control solutions transform the market. In fact, the U.S. and Canada are the leading markets for elevator and escalator, and the bulk investment is found there in terms of infrastructure project and modernization. Additionally, their sustenance and green building certifications enhance eco-friendly elevator and escalator solutions. The market is also experiencing consolidation, with significant players investing in maintenance and modernization services for the growing long-term operational efficiency demand.

United States Elevator and Escalator Market Analysis

The United States elevators and escalators market is highly driven by the increasing focus on workplace safety and the growing need to reduce fatalities and injuries in high-rise buildings and large infrastructure projects. According to the U.S. Bureau of Labor Statistics, 5,283 fatal work injuries were reported in 2023, representing a 3.7% decline from 5,486 in 2022. This is proof that the efforts to better improve safety standards are being observed and enhanced, especially in construction, manufacturing, and high-traffic public areas. With the increase in demand for safety features, elevators and escalators play a significant role in reducing workplace injuries in tall buildings and multi-story complexes. Increased concerns towards safer, more efficient workspaces are, therefore, increasing the establishment of modern vertical transport systems, thus enhancing the elevators and escalators market size. This factor will continue since the increase in infrastructure work will be a result of safety and efficient operational requirements.

Europe Elevator and Escalator Market Analysis

The Europe elevators and escalators market is experiencing significant growth, driven by various of factors. Over 75% of Europe's population now lives in urban areas, a trend that is expected to continue as urbanization accelerates. As cities grow, the demand for high-rise buildings increases, fueling the need for efficient vertical transportation systems. Eurostat shows the European construction sector to be on an expansion trend since many enterprises expanded by 4.4%, from 698,034 in 2010 to 728,420 in 2020. There was notable expansion by real estate activities, 47.3% increase and architectural and engineering activities increased by 7.2%. These developments, along with increasing construction and renovation of residential, commercial, and transportation infrastructures, are driving demand for elevators and escalators. Moreover, concern over sustainable and energy-efficient buildings is making the adoption of modern vertical transport solutions encouraging and further the market's growth.

Asia Pacific Elevator and Escalator Market Analysis

The Asia Pacific elevators and escalators market is experiencing strong growth, which is being primarily driven by sizeable government initiatives in the region to enhance infrastructure. As per IBEF, the government has focused on building future-ready infrastructure through initiatives like the USD 1.3 Trillion national master plan for infrastructure, Gati Shakti. This initiative looks to facilitate systemic and effective reforms, which should result in the improvement of transportation, logistics, and urban infrastructures overall. This has led Asia Pacific countries to invest heavily in the construction of high-rise buildings, commercial complexes, transportation hubs, and residential developments that require advanced vertical transportation systems. Rapid urbanization and population growth in major cities fuel the demand for efficient elevators and escalators. The Asia Pacific market for elevators and escalators is going to witness strong growth because of these continued infrastructure development programs and rising interest in upgrading urbanized space.

Latin America Elevator and Escalator Market Analysis

The Latin America elevators and escalators market is growing at a very high rate, propelled by rapid urbanization and increased investments in infrastructure. More than 80 percent of the Latin American population currently lives in urban centers, and this is expected to increase to 90 percent by 2050, making it the most urbanized region in the world, according to industry reports. This urban growth leads to an increase in the construction of high-rise buildings, thus requiring efficient vertical transportation systems. In Mexico, the construction industry is projected to expand in 2023 and 2024, with major public infrastructure investments and an expanding industrial sector driving the growth, ITA said. Further growth in commercial and residential developments along with key countries in Latin America, Brazil and Argentina will increase demand for elevators and escalators as they are needed to comply with energy efficient and safe systems. Investment in public and private sector of urban infrastructure will contribute to increase in demand for elevator and escalators in the Latin America region.

Middle East and Africa Elevator and Escalator Market Analysis

The Middle East and Africa elevators and escalators market is of high development level. There are many large infrastructure projects in the region, and so this would drive the market to a great extent. Of these, one example is given by the Abu Dhabi Projects and Infrastructure Centre, which has already approved 144 projects having a total budget of AED 66 Billion (USD 17.8 Billion). These projects cut across various sectors such as housing, education, tourism, and natural resources, which would require advanced vertical transportation systems to cater to the rising urban population and high-rise developments. The focus of the UAE on enhancing the quality of life and boosting human capital through infrastructure investments further boosts demand for elevators and escalators. Besides this, growing tourism and residential construction sectors in the region require effective, energy-efficient, and modern transportation systems. Increased urbanization and rising construction activities in the UAE, Saudi Arabia, and Egypt would further support the Middle East and Africa elevators and escalators market growth in the near future.

Competitive Landscape:

The key market players are continuously focusing on innovations to improve energy efficiency and safety measures. They are integrating smart technologies, such as IoT and artificial intelligence, to make elevators and escalators more adaptive and responsive to user needs. R&D initiatives are actively aimed at incorporating eco-friendly materials and energy-saving features. The major companies are entering strategic collaborations with real estate developers, thus securing long-term contracts for installation and maintenance services. These enterprises are also establishing manufacturing facilities in emerging economies to capitalize on the growing infrastructure needs in those regions. Additionally, companies are developing enhanced digital marketing strategies, including virtual demonstrations and online customer engagement platforms are being employed to gain a wider customer base. To remain competitive, they are also focusing on modular designs that allow easier upgrades in the future.

The report provides a comprehensive analysis of the competitive landscape in the elevator and escalator market with detailed profiles of all major companies, including:

- Canny Elevator Co. Ltd.

- Electra Elevators

- Fujitec Co. Ltd.

- Gulf Elevators & Escalators Co. Ltd.

- Hitachi Ltd.

- Hyundai Elevator Co. Ltd.

- Johnson Lifts Private Limited

- Kleemann Group

- KONE Corporation

- Mitsubishi Electric Corporation

- Otis Elevator Company (I). Ltd (Otis Worldwide Corporation)

- Schindler Holding Ltd.

- Sigma Elevator Company

- Toshiba Elevator and Building Systems Corporation (Toshiba Corporation)

Latest News and Developments:

- April 2025: Mitsubishi Electric Corporation acquired all shares of Ascension Lifts Limited, an established Irish elevator company, through its subsidiary Motum AB. This strategic move aims to expand Mitsubishi Electric’s elevator maintenance and renewal business in Europe, particularly in Ireland, addressing growing demand driven by aging infrastructure and environmental concerns. Ascension Lifts brings strong multi-brand technical expertise and a robust customer network. The acquisition strengthens Mitsubishi Electric’s presence in the mature European market and supports its global growth strategy in building systems.

- April 2025: Otis announced the acquisition of eight Urban Elevator locations across the US, expanding its service footprint in key metropolitan areas. This strategic move enhances Otis's capacity to provide comprehensive elevator and escalator services, strengthening its presence in urban markets. The acquisition aligns with Otis's growth strategy focused on urban infrastructure and service excellence, supporting its leadership in the elevator industry. This expansion complements Otis’s ongoing innovation, modernization projects, and commitment to sustainable urban mobility solutions.

- March 2025: Fujitec Co., Ltd. completed "Wisdom Square," a state-of-the-art elevator and escalator quality evaluation facility at its Hikone, Shiga headquarters. Spanning 1,000 m² with 11 test elevators and one escalator, it enables comprehensive reliability testing, quality verification, and installation method development for global products. The facility promotes cross-divisional collaboration by rotating engineers between development and quality teams, enhancing the Group’s overall quality control.

- February 2025: Alat, a unit of Saudi Arabia’s PIF, and TK Elevator (TKE) formed a €160 million joint venture to manufacture elevators and escalators in Saudi Arabia, marking the first such operation by a global company in the kingdom. Alat will also take a 15% stake in TKE. The partnership aims to support Saudi giga-projects, drive economic diversification, and align with Vision 2030. The JV will include local manufacturing, R&D, training, and regional sales, strengthening urban mobility solutions across MENA.

- January 2025: KONE Australia launched the next-generation High-Rise MiniSpace™ DX elevator, debuting in Melbourne Square’s BLVD tower. This innovative system optimizes space by adding an extra usable floor, increases speed and capacity, and reduces pit depth, headroom, and motor room size. It enhances tenant appeal, energy efficiency (ISO 25745 A class), and sustainability through UltraRope® technology, lowering carbon emissions. With predictive maintenance, it improves uptime and reduces operational costs. The solution accelerates construction timelines and supports green building goals, marking a significant advancement in vertical transportation.

Elevator and Escalator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elevators, Escalators, Moving Walkways |

| Services Covered | New Installation, Maintenance and Repair, Modernization |

| End Uses Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Canny Elevator Co. Ltd., Electra Elevators, Fujitec Co. Ltd., Gulf Elevators & Escalators Co. Ltd., Hitachi Ltd., Hyundai Elevator Co. Ltd., Johnson Lifts Private Limited, Kleemann Group, KONE Corporation, Mitsubishi Electric Corporation, Otis Elevator Company (I). Ltd (Otis Worldwide Corporation), Schindler Holding Ltd., Sigma Elevator Company, Toshiba Elevator and Building Systems Corporation (Toshiba Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the elevator and escalator market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global elevator and escalator market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the elevator and escalator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Elevators and escalators are used in the construction of buildings, transporting both humans and materials within a vertical range. While the elevator refers to an enclosed cabin or platform traveling up a shaft, an escalator is described as a moving staircase that allows movement from one level to another. It remains a key aspect of infrastructure as they serve in convenience, access, and high-traffic locations.

The elevator and escalator market was valued at USD 161.73 Billion in 2024.

IMARC estimates the global elevator and escalator market to exhibit a CAGR of 4.64% during 2025-2033.

Main driving factors of the global elevator and escalator market are rapid urbanization, the increasing demand for high-rise buildings, and development in infrastructure. Moreover, increased modernization and refurbishment of existing buildings coupled with the advanced energy-efficient technologies, smart systems, and sustainability are increasing demand for these systems. Focus on accessibility and safety further supports growth in the market.

In 2024, elevator represented the largest segment by type, driven by driven by increasing construction of high-rise buildings, demand for enhanced mobility solutions, and the need for energy-efficient, high-performance vertical transportation systems.

New installation leads the market by service owing to the growing demand for elevators and escalators in residential and commercial construction projects, as well as the expansion of urban infrastructure and modernization of existing buildings.

Commercial is the leading segment by end use, end use, driven by rapid urbanization, the construction of office buildings, shopping malls, and other public spaces, all requiring efficient and reliable elevator and escalator systems for high traffic handling.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global elevator and escalator market include Canny Elevator Co. Ltd., Electra Elevators, Fujitec Co. Ltd., Gulf Elevators & Escalators Co. Ltd., Hitachi Ltd., Hyundai Elevator Co. Ltd., Johnson Lifts Private Limited, Kleemann Group, KONE Corporation, Mitsubishi Electric Corporation, Otis Elevator Company (I). Ltd (Otis Worldwide Corporation), Schindler Holding Ltd., Sigma Elevator Company, Toshiba Elevator and Building Systems Corporation (Toshiba Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)