Electrophoresis Equipment Market Report by Product Type (Gel Electrophoresis Systems, Capillary Electrophoresis Systems, Electrophoresis Accessories), Type (Vertical Electrophoresis, Horizontal Electrophoresis), End User (Hospitals and Diagnostics Centers, Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, and Others), and Region 2025-2033

Electrophoresis Equipment Market Size:

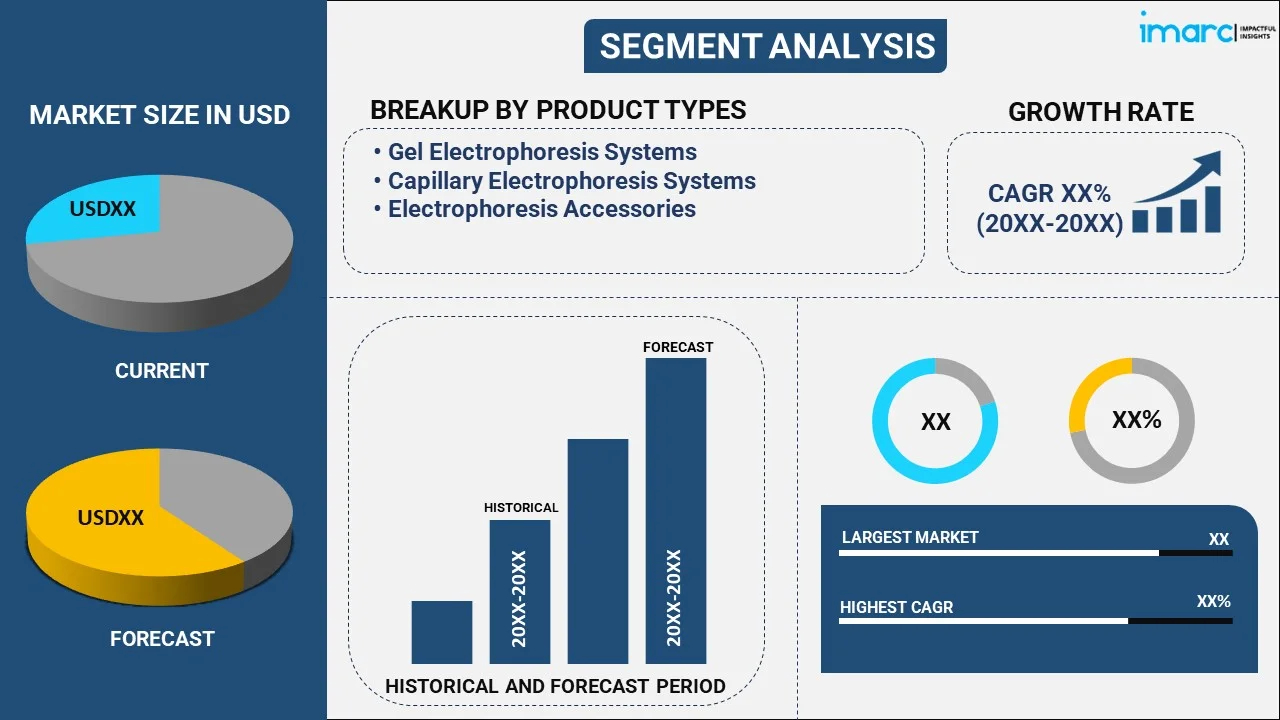

The global electrophoresis equipment market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The ongoing advancements in biotechnology, increased demand for personalized medicine, rising prevalence of genetic disorders, growing research activities, and expanding product applications in pharmaceuticals, diagnostics, and academic research institutions globally are some of the key factors supporting the market trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 4.37% |

Electrophoresis equipment is a laboratory tool used to separate or purify molecules based on charge, size, and binding affinity. It is widely used to analyze large molecules, such as nucleic acids, plasmids, deoxyribonucleic acid (DNA), ribonucleic acid (RNA), proteins, and fragments of these macromolecules by passing an electric current from end to end. Electrophoresis equipment is manufactured using an electrophoretic chamber which consists of a hard plastic box or tank with a cathode at one end and an anode at the opposite end. It is used in various applications, including vaccines, antibody analysis, hemoglobinopathies, and drug quality control. As a result, electrophoresis equipment finds extensive applications in forensic investigation, molecular biology, genetics, and microbiological labs to identify source DNA and manipulate protein molecules.

Electrophoresis Equipment Market Trends:

Increasing demand for personalized medicine:

The shift towards personalized medicine is significantly impacting the electrophoresis equipment market. Personalized medicine involves tailoring medical treatment to individual characteristics, needs, and preferences. This approach relies heavily on genetic and molecular analyses to determine the best therapeutic options for patients. Electrophoresis plays a critical role in these analyses by allowing for the separation and characterization of nucleic acids and proteins, which are fundamental in understanding genetic variations. As healthcare providers and researchers increasingly adopt genomic technologies to identify specific biomarkers for diseases, the demand for advanced electrophoresis systems is expected to rise, strengthening the market gowth. This demand is particularly pronounced in oncology, where the identification of genetic mutations can lead to targeted therapies, enhancing treatment efficacy.

Technological advancements:

Rapid technological advancements are providing an impetus to the market growth. Innovations in electrophoresis technologies, such as capillary electrophoresis and microfluidic systems, are enhancing the efficiency and accuracy of separations. Capillary electrophoresis, for example, offers high-resolution analysis with minimal sample requirements, making it ideal for applications in pharmacokinetics and drug development. Additionally, significant advancements in automated systems and software solutions for data analysis are streamlining workflows and improving reproducibility in laboratory settings. These technological enhancements not only increase throughput but also enable the handling of complex samples, expanding the applicability of electrophoresis in various fields, including proteomics, genomics, and clinical diagnostics, thereby aiding in market expansion.

Growing research and development (R&D) activities:

Extensive R&D activities across various sectors, including academia, pharmaceuticals, and biotechnology are further bolstering the demand for electrophoresis equipment. Governments and private entities are investing heavily in R&D initiatives aimed at developing novel therapies and diagnostics, particularly in areas such as cancer research, infectious diseases, and genetic disorders. This growing emphasis on R&D is leading to an increased need for sophisticated electrophoresis equipment to support various applications, including protein purification, nucleic acid analysis, and molecular diagnostics. Furthermore, increasing collaborations between research institutions and industry players are fostering innovation and driving market growth, as researchers seek advanced tools to conduct cutting-edge studies.

Electrophoresis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electrophoresis equipment market, along with forecasts at the global, regional, and country level from 2025-2033. Our report has categorized the market based on product type, type and end user.

Product Type Insights:

- Gel Electrophoresis Systems

- Capillary Electrophoresis Systems

- Electrophoresis Accessories

The report has also provided a detailed breakup and analysis of the electrophoresis equipment market based on the product type. This includes gel electrophoresis systems, capillary electrophoresis systems, and electrophoresis accessories. According to the report, gel electrophoresis systems represented the largest segment.

Type Insights:

- Vertical Electrophoresis

- Horizontal Electrophoresis

A detailed breakup and analysis of the electrophoresis equipment market based on the type has also been provided in the report. This includes vertical and horizontal electrophoresis. According to the report, vertical electrophoresis accounted for the largest market share.

End User Insights:

- Hospitals and Diagnostics Centers

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Others

The report has also provided a detailed breakup and analysis of the electrophoresis equipment market based on the end user. This includes hospitals and diagnostics centers, academic and research institutes, pharmaceutical and biotechnology companies, and others. According to the report, pharmaceutical and biotechnology companies represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets that include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and Middle East and Africa. According to the report, North America was the largest market for electrophoresis equipment. Some of the factors driving the North America electrophoresis equipment market growth included its extensive application in the pharmaceutical industry, several product innovations, extensive research and development activities, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global electrophoresis equipment market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Cleaver Scientific Ltd.

- Edvotek Inc.

- Flinn Scientific Inc.

- Hoefer Inc. (Harvard Bioscience Inc.)

- Lonza Group AG

- Lumex Instruments

- Merck KGaA

- Nova-Tech International Inc.

- PerkinElmer Inc.

- Qiagen N.V.

- SERVA Electrophoresis GmbH

- Thermo Fisher Scientific Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Electrophoresis Equipment Market News:

- In September 2020, miniPCR bio launched GELATO™, an integrated DNA analysis system that combines gel electrophoresis and transillumination technology for simultaneous nucleic acid separation and visualization in a compact design. Capable of processing up to 50 samples at once, GELATO™ features a variable voltage power supply and a blue-light transilluminator for safety. Designed for both professionals and educators, its user-friendly interface allows novice users to operate it independently, meeting diverse analytical needs.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Type, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bio-Rad Laboratories Inc., Cleaver Scientific Ltd., Edvotek Inc., Flinn Scientific Inc., Hoefer Inc. (Harvard Bioscience Inc.), Lonza Group AG, Lumex Instruments, Merck KGaA, Nova-Tech International Inc., PerkinElmer Inc., Qiagen N.V., SERVA Electrophoresis GmbH, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global electrophoresis equipment market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global electrophoresis equipment market?

- What are the key regional markets?

- Which countries represent the most attractive electrophoresis equipment markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on end user?

- What is the competitive structure of the global electrophoresis equipment market?

- Who are the key players/companies in the global electrophoresis equipment market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electrophoresis equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electrophoresis equipment market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electrophoresis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)