Electronic Security Market Size, Share, Trends and Forecast by Product Type, Service Type, End-Use Sector, and Region, 2026-2034

Electronic Security Market Size and Share:

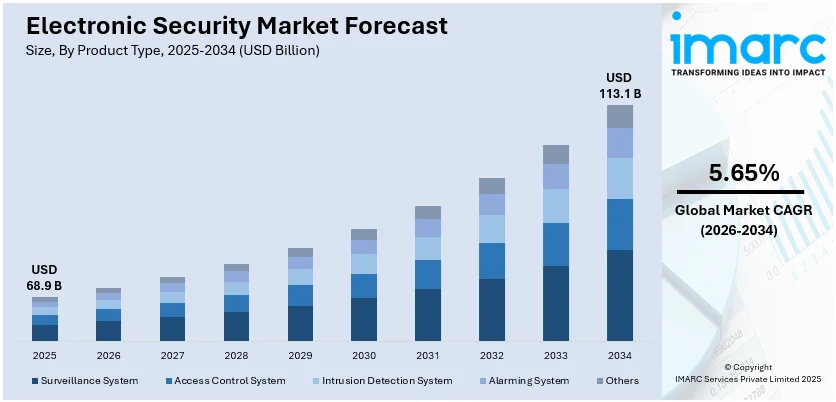

The global electronic security market size was valued at USD 68.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 113.1 Billion by 2034, exhibiting a CAGR of 5.65% during 2026-2034. North America currently dominates the market, holding a market share of over 29.5% in 2025. The electronic security market share is growing due to rising frequency and sophistication of cyber-attacks, escalating concerns regarding safety and surveillance in public and private places, and convergence of electronic security systems with smart home and IoT devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 68.9 Billion |

| Market Forecast in 2034 | USD 113.1 Billion |

| Market Growth Rate (2026-2034) | 5.65% |

The electronic security market growth is driven by the increasing need for security and safety issues in residential, commercial, and industrial sectors. Rising burglaries, thefts, and cybercrimes have increased the level of awareness towards the use of surveillance, access control, and alarm systems. The rising uptake of smart buildings and homes with IoT-based technologies is also resulting in the rise in demand for electronic security equipment like locks, smart cameras, and sensors. Moreover, rapid urbanization and growth of commercial infrastructure, i.e., offices, shopping malls, and transport hubs, are driving the demand for efficient security systems. In addition, government policy and regulations on the deployment of surveillance systems in public spaces are propelling the market. Technological innovation, with the adoption of AI-based surveillance and cloud-based security systems, also plays a significant role in market growth.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, influenced by its sophisticated technological innovations as well as increased demand for advanced security solutions. As a hub of technological innovation, the US has been at the forefront of various innovations in electronic security, including AI-powered surveillance, biometrics, and cloud-based security. The country's high rates of urbanization, with a high demand for residential and commercial security, have required a huge need for sophisticated security devices. Increased awareness of cybersecurity threats and physical security vulnerabilities has also been responsible for the implementation of integrated security systems. US government policies and regulations mandating greater security features in public venues, combined with the increasing popularity of smart homes, also fuel this market growth. The use of IoT in security systems and advances in video analytics are transforming the perception of security by companies and consumers, making the US a worldwide industry disruptor.

Electronic Security Market Trends:

Growing concerns about cybersecurity

The increasing concern about cybersecurity is due to the alarming increase in the number and sophistication of cyberattacks over the past few years. As per an industry report, during Q2 2024, there was a 30% YoY rise in worldwide cyberattacks, with 1,636 attacks per organization on a weekly basis. The sectors most frequently targeted were Education/Research (3,341 attacks/week), Government/Military (2,084 attacks/week), and Healthcare (1,999 attacks/week). Organizations and individuals are under constant attack by malicious activities, from data breaches that expose sensitive data to stealthy ransomware attacks that threaten critical systems. These attacks undermine data integrity and present significant financial and reputational threats. Due to this emerging threat environment, there has been a tremendous growth in investments which are reflected by the electronic security market outlook. Companies from diverse industries are giving top priority to safeguarding their online assets, deploying sophisticated firewalls, intrusion detectors, and encryption techniques. With the world going digital by the minute, there has been an unprecedented demand for stringent electronic protection solutions ever more important to protect sensitive information and maintain the integrity of online transactions. This, in turn, has hastened the use of electronic security for offering the tools and expertise required to address and counter the constantly changing cyber threat environment.

Rising adoption of IoT devices

The growing use of Internet of Things (IoT) devices in an age of unprecedented connectivity and convenience has created tremendous concerns about cybersecurity. IoT devices, ranging from smart thermostats and cameras to industrial sensors and self-driving cars, have become incredibly popular in homes, enterprises, and industries. Industry reports indicate that connected IoT devices increased by 15% in 2023 to 16.6 billion. The figure was to increase 13% to 18.8 billion by 2024. Their massive deployment, however, also widens the attack surface for future security breaches. The spread of networked devices has brought about vulnerabilities that cybercriminals can leverage to get unauthorized access, breach data integrity, or execute cyberattacks. Consequently, there is an increased need for secure electronic security systems that can protect these IoT environments. Such security systems are intended to monitor, detect, and react to malicious activity in IoT networks to provide protection to sensitive information and ensure the continuity of mission-critical operations. As the IoT environment continues to grow, electronic security demand will be an integral part of preventing the inherent threats and facilitating the secure development of this revolutionary technology.

Increasing regulatory compliance requirements

Regulatory compliance requirements are now an imperative force prompting organizations to move their electronic security protocols up. Stricter data protection laws such as the General Data Protection Regulation (GDPR) in the EU and California Consumer Privacy Act (CCPA) in California have set exacting standards in dealing with people's and sensitive information. CCPA provides consumers of California autonomy over their personal data, allowing rights of access, deletion, and opting-out from sales. It covers for-profit companies with specific requirements, e.g., USD 25 Million of revenue or information on 100,000+ citizens. Failure to comply can incur fines of up to USD 7,500 per offense. To prevent this from happening, companies are spending more money on electronic security products to assist them in complying with the complex tapestry of data protection legislation and privacy mandates. These solutions include data encryption, access control methods, secure storage practices for data, and advanced auditing capabilities. They also provide the ability for organizations to protect sensitive data, track data access, and manage data breaches well. Compliance with these regulations is a matter of law and an indication of a commitment to protecting customers' privacy and data. Therefore, the use of electronic security solutions has become vital for organizations wishing to establish and sustain trust among their customers without incurring the legal and monetary consequences of non-compliance.

Electronic Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electronic security market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, service type, and end-use sector.

Analysis by Product Type:

- Surveillance System

- Access Control System

- Intrusion Detection System

- Alarming System

- Others

Surveillance system stands as the largest component, with a share of 58.4% in 2025. Surveillance systems dominate the electronic security market as they ensure safety and monitoring. These systems encompass CCTV cameras, video recording, and analytics solutions that provide real-time monitoring and evidence collection. Their extensive application spans across various sectors, including commercial, residential, and government, contributing to the segment growth.

Access control systems are integral to electronic security, offering controlled entry and exit points in buildings and facilities. These systems use credentials like keycards, biometrics, and PINs to regulate access. While vital for security, they share prominence with surveillance systems, with their combined use providing comprehensive protection for physical assets.

Intrusion detection systems are designed to identify unauthorized access or security breaches. They play a vital role in security by triggering alarms and alerts when suspicious activities occur. Though crucial, their market presence is slightly overshadowed by surveillance systems, which offer continuous monitoring capabilities.

Alarming systems provide audible and visual alerts in response to security threats or breaches. While they serve as a critical layer of security, they tend to have a more specialized role compared to surveillance systems, access control systems, and intrusion detection systems. Consequently, they have a significant but niche presence in the electronic security market.

Analysis by Service Type:

- Installation Services

- Managed Services

- Consulting Services

Managed services leads the market, holding a share of 43.5% in 2025. Managed services dominate the electronic security market as they offer continuous monitoring, maintenance, and support for security systems. Managed service providers oversee the operation of security solutions, detect and respond to security incidents, and ensure system reliability. This proactive approach is highly valued by businesses and institutions aiming to enhance their security posture while offloading the day-to-day management of electronic security systems.

Installation services are a fundamental component of the electronic security market, providing expertise in setting up security systems, including surveillance cameras, access control, and alarm systems. These services ensure the proper deployment and functioning of security solutions, catering to the needs of businesses and organizations seeking professional installation to maximize the effectiveness of their security infrastructure.

Consulting services in the electronic security market provide valuable guidance to clients in selecting the most suitable security solutions, conducting risk assessments, and designing comprehensive security strategies. Consultants offer expertise in evaluating security needs, compliance requirements, and technology integration, aiding organizations in making informed decisions to optimize their security investments. While consulting services play a vital advisory role, managed services remain dominant due to their ongoing operational support and security management.

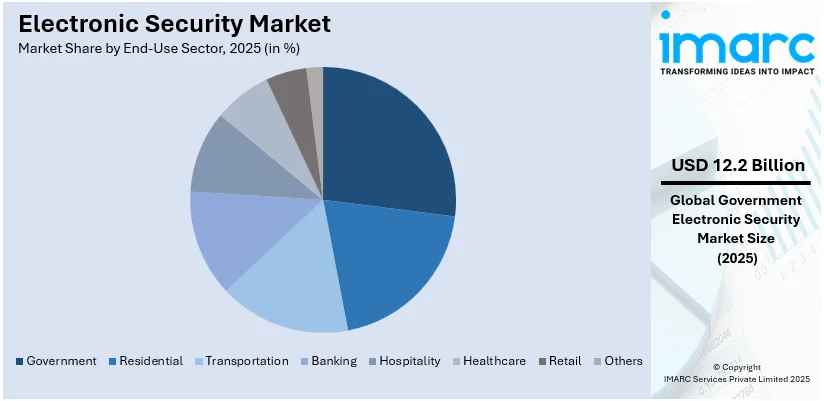

Analysis by End-Use Sector:

Access the comprehensive market breakdown Request Sample

- Government

- Residential

- Transportation

- Banking

- Hospitality

- Healthcare

- Retail

- Others

Government leads the market, with a share 18.7% in 2025. The government sector plays a crucial role in driving the electronic security market demand as governments require robust security systems to protect critical infrastructure, sensitive data, and public safety. The need for surveillance, access control, and cybersecurity solutions is paramount, leading to substantial investments in electronic security technologies to counter evolving threats effectively.

The residential sector contributes significantly to the electronic security market, driven by increasing concerns about home security and personal safety. Smart home technologies, including video doorbells, security cameras, and alarm systems, are in high demand, offering homeowners advanced security features and remote monitoring capabilities.

In the transportation sector, electronic security is crucial for ensuring passenger safety, protecting cargo, and securing critical transit hubs. Surveillance systems, access control, and cybersecurity measures are essential components, driving the adoption of electronic security solutions in airports, ports, railways, and public transportation networks. Electronic security market value increases, driven by increased adoption in transportation for passenger safety and infrastructure protection.

The banking sector heavily relies on electronic security to safeguard financial assets, customer data, and transaction integrity. As cyber threats targeting financial institutions rise, banks invest significantly in cybersecurity, surveillance, and access control systems to ensure data protection and operational continuity.

The hospitality industry incorporates electronic security solutions to enhance guest safety and protect property assets. Surveillance cameras, access control, and alarm systems are deployed in hotels, resorts, and hospitality establishments to maintain a secure environment, boosting customer trust and satisfaction.

In the healthcare sector, electronic security is essential to safeguard patient records, medical equipment, and healthcare facilities. The need for stringent access control, data privacy compliance, and surveillance systems is accelerating the adoption of electronic security technologies in hospitals and healthcare institutions.

Retailers utilize electronic security solutions to combat theft, shoplifting, and fraud. Video surveillance, electronic article surveillance (EAS) systems, and point-of-sale security measures are integral to maintaining a secure shopping environment, reducing losses, and protecting merchandise. Electronic security market outlook is positive, bolstered by retailers investing in advanced surveillance and fraud prevention systems.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 29.5%. North America held the biggest market share due to its robust cybersecurity infrastructure and a high level of awareness regarding data protection. The region's significant investments in advanced security technologies, stringent regulatory compliance requirements, and a strong presence of cybersecurity companies contribute to its leadership. The continuous evolution of cyber threats drives organizations in North America to adopt cutting-edge electronic security solutions to safeguard their digital assets effectively.

In Europe, the electronic security market significantly benefits from the region's stringent data protection regulations, including GDPR, which mandates stringent security measures. The market is driven by growing concerns about cyber threats, data privacy, and the need for secure access control systems. Additionally, Europe's emphasis on critical infrastructure protection and a heightened focus on research and development (R&D) contribute to the adoption of advanced electronic security technologies.

The Asia Pacific region is a significant driver of the electronic security market, primarily due to its rapid economic growth, expanding industries, and increasing urbanization. As businesses and governments in countries like China and India invest heavily in infrastructure and technology, the demand for electronic security solutions, including surveillance and access control, continues to rise. Moreover, the region's growing awareness of cybersecurity threats fuels the adoption of advanced security measures across various sectors.

In Latin America, the electronic security market is driven by a combination of factors, including the need for crime prevention, safety in public spaces, and protection of assets. The region's urbanization and the growth of industries like banking and retail contribute to the demand for surveillance and access control systems. Additionally, the rising adoption of IoT devices and digital transformation initiatives in Latin America further stimulate the market's growth.

The Middle East and Africa region exhibit growth in the electronic security market owing to a combination of factors, including increasing security concerns in the face of geopolitical tensions, the need to protect critical infrastructure, and the expansion of smart cities. The region's focus on oil and gas industries, tourism, and real estate also fuels the demand for electronic security systems. Additionally, favorable government initiatives to enhance public safety and the adoption of advanced security technologies contribute to electronic security market growth in the Middle East and Africa region.

Key Regional Takeaways:

United States Electronic Security Market Analysis

In 2025, the United States accounted for over 94.00% of the electronic security market in North America. The electronic security market in the United States is significantly driven by the growing demand for both residential and commercial security solutions. Key factors propelling the market’s expansion include the rapid adoption of smart security systems, such as video surveillance, access control, and intrusion detection systems, supported by advancements in IoT and AI technology. These innovations enhance system performance, making security solutions more efficient and reliable. The increasing focus on crime prevention, along with the rise of connected homes, is further strengthening the demand for integrated security systems that can address both physical and digital security needs. In addition, the rising threat of cyberattacks is a significant driver for enhanced security solutions. According to reports, cyberattack costs in the U.S. are expected to surpass USD 452 Billion in 2024, with 75% of companies at risk of a major cyberattack in 2023. States like Colorado, with a 58.7% increase in victim losses since 2017, and California, facing over USD 656 Million in annual losses, highlight the urgency of robust security measures. These trends, coupled with investments in smart city projects, autonomous vehicles, and remote monitoring, ensure the continued growth of the U.S. electronic security market.

Europe Electronic Security Market Analysis

The market in Europe is experiencing rapid growth, propelled by the increasing need for safety in both urban and commercial environments. The rise in cyber threats and terrorist activities, particularly in major metropolitan areas, heightened the demand for advanced security solutions. Around 2,289,599,662 known records have been breached across 556 publicly disclosed incidents in Europe from November 2023 to April 2024. Also, the urban expansion is leading to a rise in demand for video surveillance and biometric security systems, with the UK, France, and Germany being the key drivers. European governments are heavily investing in surveillance infrastructure to enhance national security while balancing privacy concerns. The focus on smart cities and digitalization is further fueling the integration of IoT-enabled cameras, facial recognition, and real-time analytics. Additionally, Europe’s stringent regulatory environment, particularly the GDPR, is shaping the market, compelling businesses to invest in secure, compliant systems. This combination of technological, regulatory, and societal factors makes Europe a critical region for electronic security market growth.

Asia Pacific Electronic Security Market Analysis

The Asia-Pacific electronic security market is rapidly expanding, attributed to the growth of economies like China and India. According to an industry report, As part of the Smart Cities Mission, an investment of USD 23.3 Billion is planned for various projects in India. As cities shift into smart cities, there is rising demand for surveillance, monitoring systems, and automated access control. Security challenges from cyberattacks and terrorism are further supporting the market in countries like Japan, South Korea, and Australia, where advanced video analytics and biometric solutions are in high demand. The rise in e-commerce is also driving the need for enhanced cybersecurity measures to protect digital assets. Additionally, Asia-Pacific's growing industrialization is leading to increased demand for advanced electronic security systems to protect manufacturing and industrial facilities, positioning the region as a key player in global security solutions.

Latin America Electronic Security Market Analysis

The market in Latin America is growing, driven by rising crime rates and the need for better surveillance. Demand for video surveillance, access control, and alarm systems is increasing across commercial and residential sectors. Brazil, Mexico, and Argentina are the key markets, with technological adoption on the rise. Urbanization is accelerating the demand for smart security solutions, with 82% of the population in Latin America living in urban areas, according to UNDP. Governments are investing in infrastructure to improve safety, and businesses are focusing on securing premises to prevent theft and vandalism. However, challenges such as budget constraints and regulatory issues may hinder market growth. Despite these barriers, the need for enhanced safety continues to drive the adoption of electronic security systems in the region.

Middle East and Africa Electronic Security Market Analysis

The electronic security market in the Middle East and Africa (MEA) is growing steadily, due to increased security concerns in both commercial and residential sectors. As per industry reports, cybersecurity incidents in the Middle East have risen to an average of USD 8.07 Million per data breach, surpassing the global average of USD 4.45 Million. Ongoing conflicts and geopolitical tensions have fueled demand for advanced security technologies, with countries like Saudi Arabia, the UAE, and South Africa leading the way in adopting solutions such as video surveillance and access control. Rapid urbanization, large-scale infrastructure projects, and the growth of the oil and gas industries are also driving demand. However, challenges like economic instability and regulatory gaps remain, yet the need for innovative security solutions persists across the region.

Competitive Landscape:

Several key companies in the electronic security market are making significant attempts to drive growth by continuously developing high-end, integrated security systems. Leaders are heavily investing in research and development (R&D) to develop world-class technology such as artificial intelligence (AI), machine learning, and Internet of Things (IoT)-based products in order to optimize security systems in terms of efficiency and effectiveness. All of such technologies provide real-time monitoring, predictive analytics, and remediation automation, and improve security management overall. At the other end, players increasingly invest in building cloud security products, and end-users are being provided remote access, storage capacity, and scalable cloud offerings suited for both individuals and organizations. To access a large number of customers, key players are forming strategic alliances, joint ventures, and acquisitions, thereby having a more robust portfolio of products. There is also a keen emphasis on ease of use interfaces and seamless integration, enabling easy installation and management of security systems. With cyber threats emerging more and more, security companies are incorporating powerful cybersecurity capabilities to their products and providing total physical and cyber security protection. Secondly, consumers are responding to consumers' increasing desire for smart home security systems through offering customizable IoT-enabled devices, which address convenience, efficiency, and safety demands of the consumer today.

The report provides a comprehensive analysis of the competitive landscape in the electronic security market with detailed profiles of all major companies, including:

- Axis Communications (Canon Inc.)

- ADT Security Services Inc. (Apollo Global Management Inc.)

- Bosch Security Systems Inc.

- FLIR Systems Inc.

- Hitachi Ltd.

- Honeywell International Inc.

- IBM Corporation

- Tyco International (Johnson Controls)

- Lockheed Martin Corporation

- OSI Systems

- Siemens AG

- Thales Group

Latest News and Developments:

- January 2025: Keysight Technologies launched AppFusion, a network visibility partner program integrating third-party security and monitoring solutions into its Vision Series Network Packet Brokers. The program, featuring partners like Forescout, Instrumentix, and Nozomi Networks, streamlines IT and security operations, reduces infrastructure costs, simplifies deployment, and improves real-time threat detection and performance monitoring.

- December 2024: BearCom announced the acquisition of Stone Security, a leading provider of enterprise-level physical security solutions. This acquisition enhances BearCom's capabilities as an end-to-end integrator of voice, security, and data solutions. Stone Security brings expertise in video surveillance and access control, expanding BearCom's reach across North and South America.

- November 2024: HCLTech launched DataTrustShield, a cloud data security solution developed in collaboration with Intel. It uses Intel's Trust Domain Extensions (TDX) and Trust Authority to protect sensitive data during cloud operations. The solution offers secure data sharing, scalability, and enhanced compliance, designed for enterprises requiring high data integrity in collaborative and cloud environments.

- July 2024: Datalec Precision Installations (DPI) announced its industry-leading electronic security partnerships, enhancing data center security and project efficiency. DPI, which added in-house security services in November 2023, partnered with top companies like Avigilon Alta, Axis Communications, and Cisco Meraki. The company is expanding its team and successfully installing integrated security solutions across the UK and EMEA.

- April 2024: Pavion launched Pavion ON-X, a proactive system monitoring service designed to enhance the reliability and performance of electronic security and IoT devices. The service provides continuous monitoring, real-time insights, predictive analytics, and expert support to address system vulnerabilities, ensuring compliance with cybersecurity policies and preventing failures. ON-X aims to optimize security operations for large enterprises and midmarket customers.

Electronic Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surveillance System, Access Control System, Intrusion Detection System, Alarming System, Others |

| Service Types Covered | Installation Services, Managed Services, Consulting Services |

| End-Use Sectors Covered | Government, Residential, Transportation, Banking, Hospitality, Healthcare, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axis Communications (Canon Inc.), ADT Security Services Inc. (Apollo Global Management Inc.), Bosch Security Systems Inc., FLIR Systems Inc., Hitachi Ltd., Honeywell International Inc., IBM Corporation, Tyco International (Johnson Controls), Lockheed Martin Corporation, OSI Systems, Siemens AG, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electronic security market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electronic security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electronic security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electronic security market was valued at USD 68.9 Billion in 2025.

The electronic security market is projected to exhibit a CAGR of 5.65% during 2026-2034, reaching a value of USD 113.1 Billion by 2034.

The electronic security market is driven by increasing safety concerns, rising crime rates, and advancements in technology like AI, IoT, and cloud solutions. Growing demand for smart homes, commercial infrastructure expansion, and regulatory requirements for surveillance also fuel market growth. Enhanced cybersecurity needs further drive the adoption of electronic security systems.

North America currently dominates the electronic security market. The North American electronic security market is driven by increasing concerns over safety, rising cyber threats, and rapid technological advancements. Growing adoption of smart homes, commercial infrastructure expansion, and government regulations mandating surveillance systems also contribute to market growth.

Some of the major players in the electronic security market include Axis Communications (Canon Inc.), ADT Security Services Inc. (Apollo Global Management Inc.), Bosch Security Systems Inc., FLIR Systems Inc., Hitachi Ltd., Honeywell International Inc., IBM Corporation, Tyco International (Johnson Controls), Lockheed Martin Corporation, OSI Systems, Siemens AG, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)